-

Oil At the Next Strong Combination of Resistances

December 13, 2019, 10:10 AM

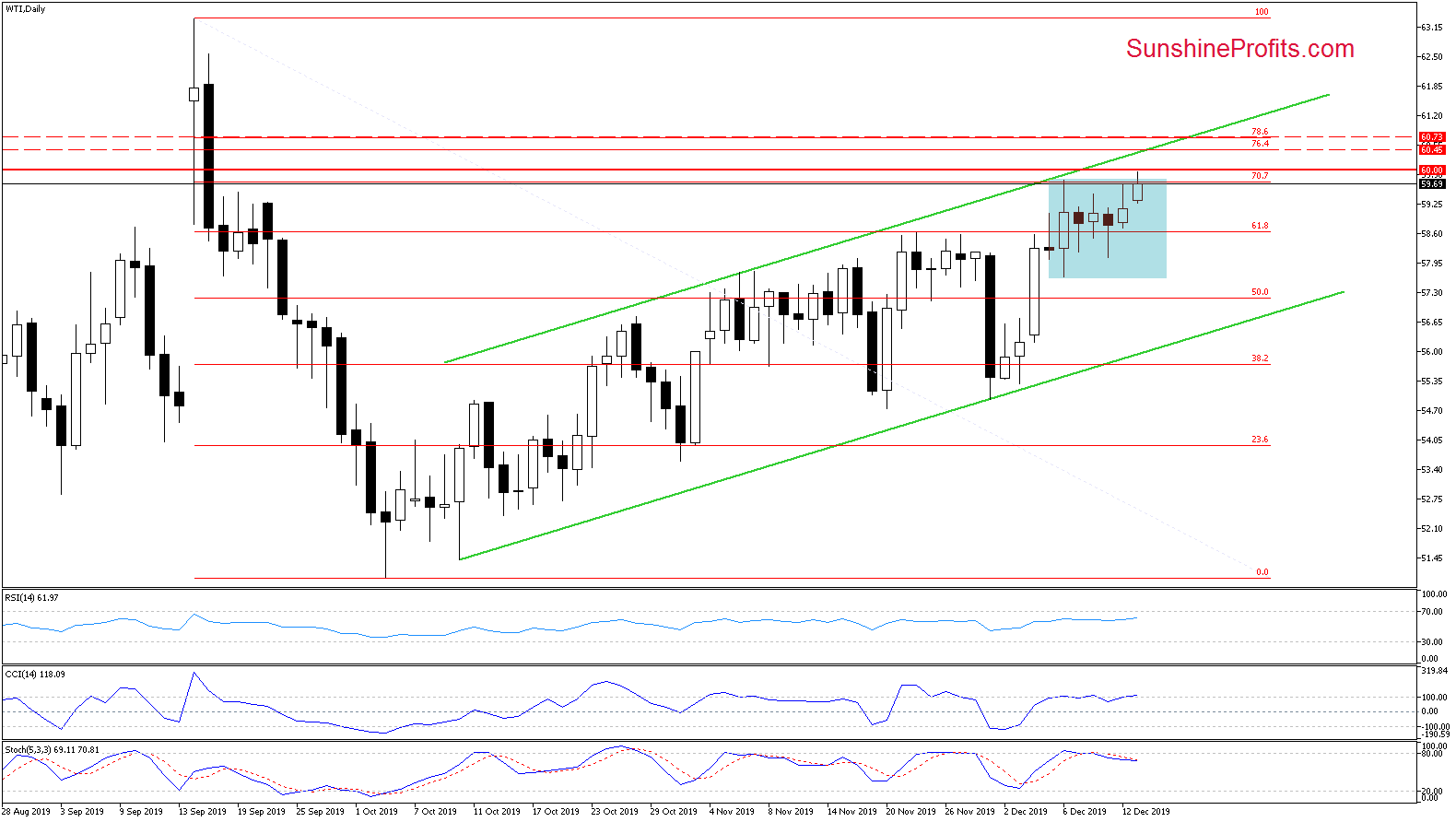

Crude oil futures opened today's trading above yesterday's close, which means that another bullish gap was created. The bulls took the lead and the resulting upswing brought us a short-lived breakout above the upper border of the blue consolidation.

This move took the futures to the psychological barrier of $60, increasing the probability that reversal may be just around the corner. This is especially the case when we factor in the current extended position of the daily indicators and the proximity to the next important resistance zone created by the upper border of the rising green trend channel, the 76.4% and 78.6% Fibonacci retracements.

Let's connect the dots. Should we see reliable signs pointing to the bulls' weakness, we'll consider opening short positions.

Summing up, the bulls opened with another gap today, attempting a breakout above the upper border of the blue consolidation. As the oil futures are approaching the psychologically important level of $60, the probability of a reversal looms large. The extended daily indicators and the proximity of another strong resistance zone (created by the upper border of the rising green trend channel, the 76.4% and 78.6% Fibonacci retracements) would support that. Should we see reliable signs of the bulls' weakness, we'll consider opening short positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

The Prolonged Consolidation After the Quick Oil Upswing

December 12, 2019, 9:06 AM

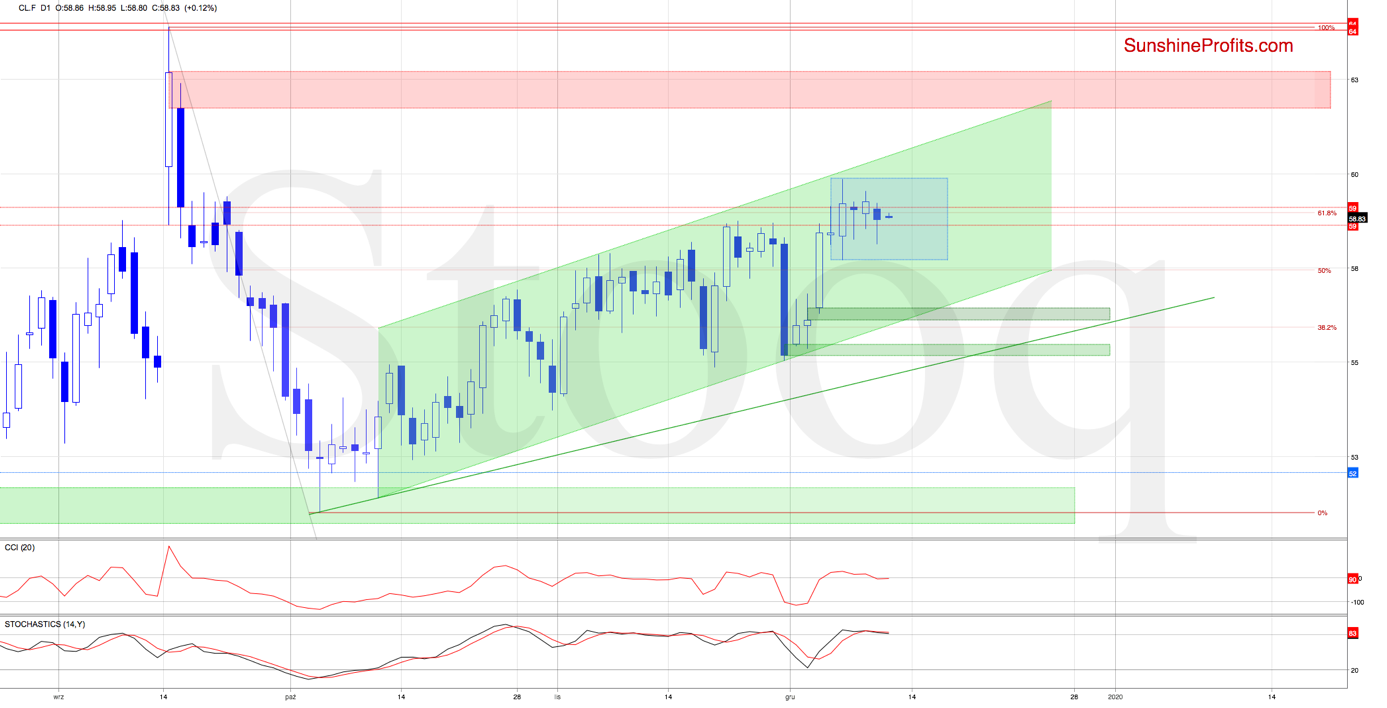

The bulls have overcome the major resistance zone created by three gaps (pink, red and orange ones) and the 61.8% Fibonacci retracement that we wrote about on Friday. Higher oil prices followed, and the futures also closed the gap created in mid-September, reaching the mid-September peaks and approaching the upper border of the rising green trend channel.

Despite these bullish developments, the bulls couldn't make it any higher, and prices became stuck in the blue consolidation. Looking at the extended position of the daily indicators, a reversal just around the corner is indeed probable.

Should we see more signs pointing to the bulls' weakness, we'll consider opening short positions.

Summing up, the recent oil upswing closed the strong combination of resistances, but the bulls couldn't follow through with more buying and higher prices. Oil has consolidated since then, and the daily indicators appear quite extended. Should we see reliable signs of the bulls' weakness, we'll consider opening short positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Oil's Ongoing Struggle at Multiple Resistances. Resolution Just Ahead?

December 6, 2019, 9:08 AM

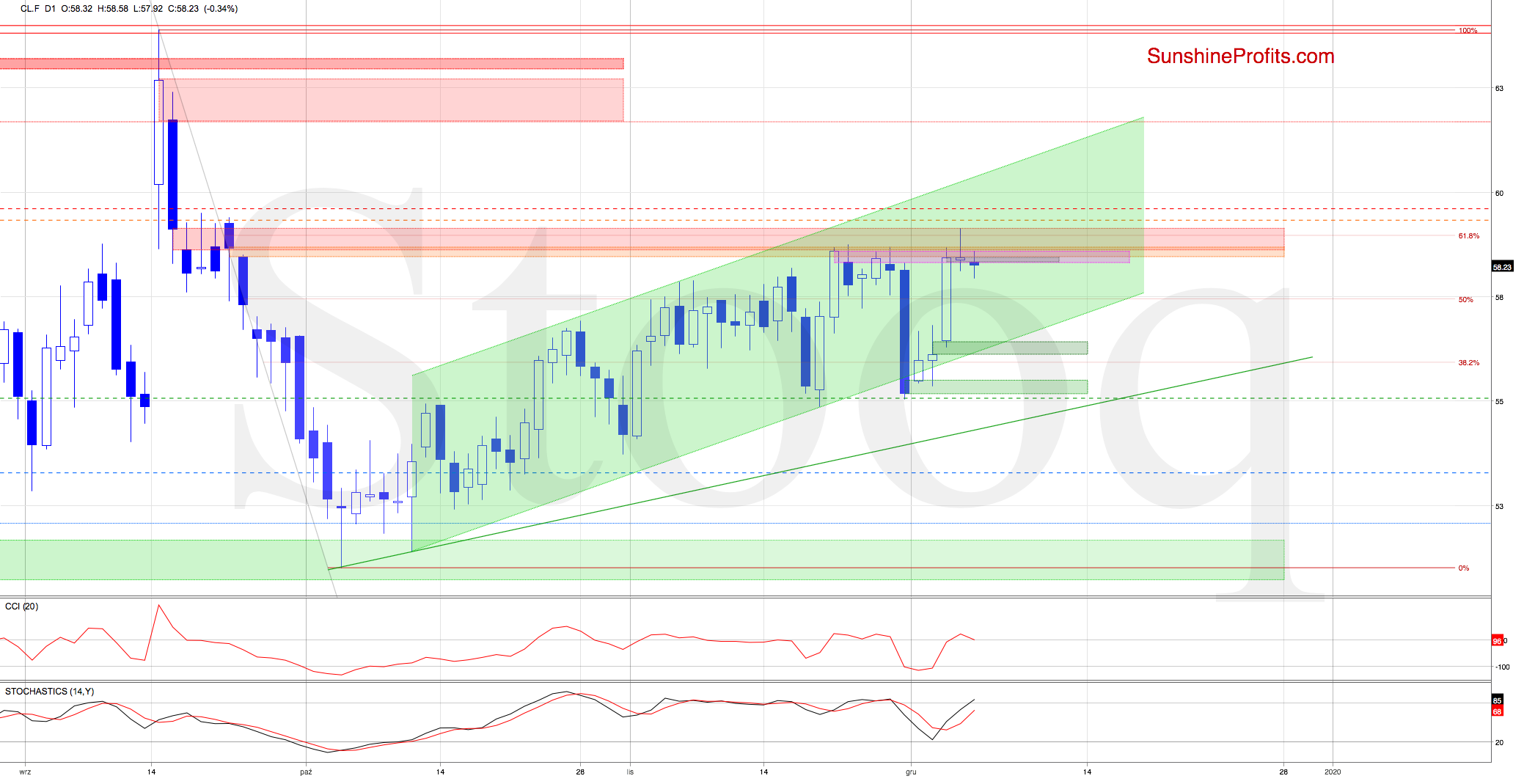

Although crude oil futures moved a bit higher yesterday, the major resistance zone created by three gaps and the 61.8% Fibonacci retracement again stopped the buyers. A pullback followed, and the futures invalidated the earlier breakout above the previous peaks.

Together with the key resistances just above, it suggests that reversal is just around the corner. This is especially so when we factor in yesterday's grey gap - it continues to serve as an additional resistance.

On top of that, the daily chart reveals that crude oil futures opened today with another bearish gap, and that the bulls didn't manage to close it in the following hours.

Therefore, should the sellers push the futures lower from here, the first downside target would be Wednesday's green gap and the lower border of the rising green trend channel. The bears are on the move as black gold changes hands at around $57.80 currently.

Summing up, Wednesday's oil upswing generated no follow-through buying as the bulls haven't yet again overcome the strong combination of resistances ahead. It's the 61.8% Fibonacci retracement, and the three gaps (pink, red and orange ones), now also supported by yesterday's grey gap. They have reliably stopped the bulls several times already, and the short position thus remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Assessing the Bullishness of Yesterday's Oil Upswing

December 5, 2019, 7:34 AM

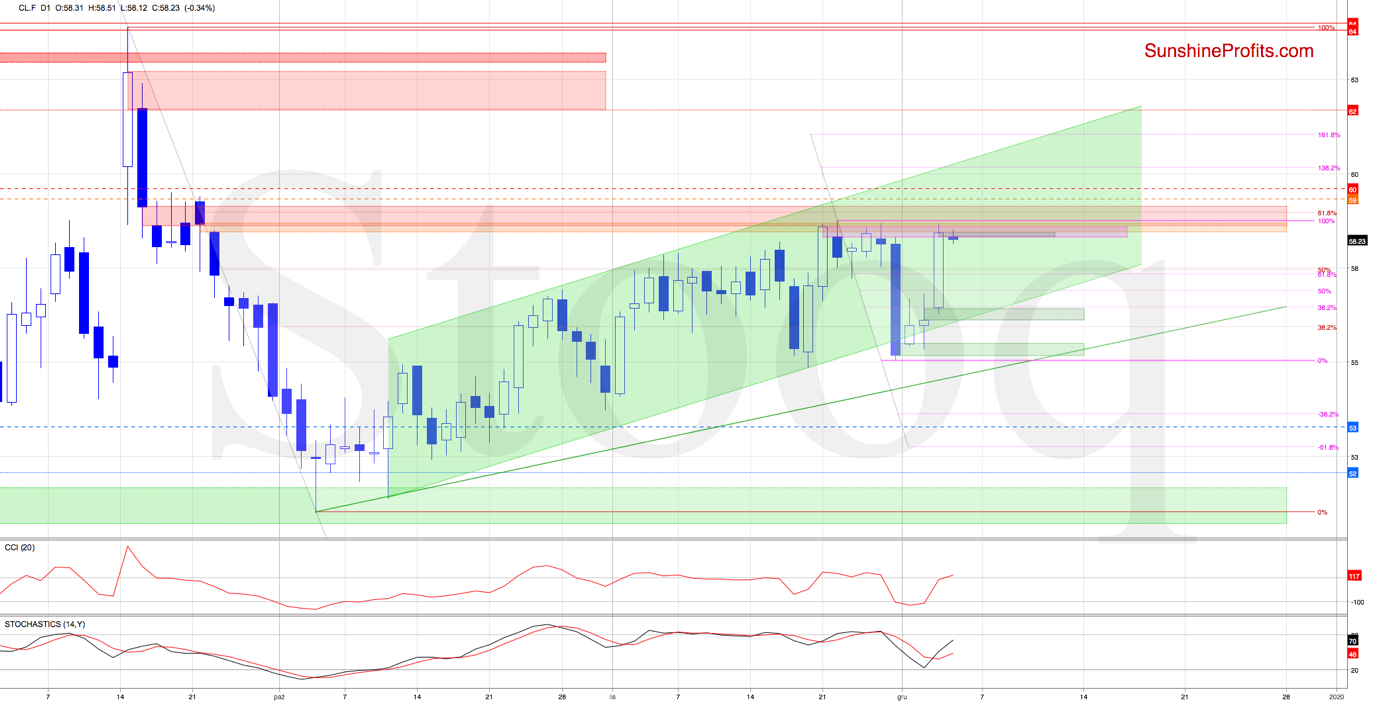

Crude oil futures moved sharply higher yesterday, and erased recent declines in the process. While this is a bullish development, the buyers still haven't overcome the major resistance zone created by three gaps and the 61.8% Fibonacci retracement - for quite a few times in a row.

The futures opened today with yet another gap (marked in grey), which further reinforces the already strong resistance zone.

Taking all the above into account, reversal and lower values of crude oil futures are probably just around the corner. Should we see such price action, and the sellers in action, the first downside target would be yesterday's green gap and the lower border of the rising green trend channel.

Summing up, while yesterday's oil upswing looks and is bullish, don't take it at face value. The bulls haven't overcome for the fifth time in a row the strong combination of resistances ahead: the 61.8% Fibonacci retracement, and the three gaps (pink, red and orange ones). They have reliably stopped the bulls several times already, and the short position thus remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Will Oil's Rebound Stick?

December 4, 2019, 10:18 AM

Despite the buyers struggling initially with overcoming the lower border of the blue consolidation during yesterday's session, oil futures finished the day back inside the rising green trend channel. This means invalidation of the earlier breakdown below the lower border of the formation.

This is certainly a bullish development, and the buyers continued with today's green gap that has translated into further gains in the following hours.

As a result, the futures came back above the previously broken lower border of the blue consolidation, suggesting a test of the red resistance zone created by the late-Nov lows and the 61.8% Fibonacci retracement in the very near future.

As long as the price action is confined inside the large declining Friday's candle, another attempt to move lower is very likely. This is especially so when we factor in the proximity of the major resistance zone created by three gaps and the 61.8% Fibonacci retracement. Combined, they have been strong enough to stop the bulls several times in the previous month already.

Summing up, the bulls have closed yesterday's session back inside the rising trend channel in the end, and upswing continuation rules today. There is however a strong combination of resistances ahead: the 61.8% Fibonacci retracement, and the three gaps (pink, red and orange ones). They have stopped the bulls a few times already, and the short position thus remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products. Subscribe today and stay informed.

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM