Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks (GDXJ) are justified from the risk/reward point of view at the moment of publishing this Alert.

We’re moving the stop-loss levels lower, thus decreasing the potential risk of the trade and improving the risk-to-reward ratio.

Some might consider an additional (short) position in the FCX.

So, it happened. The USD Index verified its breakout in a beautiful style. That’s really important for gold price.

This means that pretty much everything that I wrote about it in yesterday’s analysis – and in the previous analyses – remains up-to-date:

On Friday, the USD Index finally closed above its declining resistance line based on the 2023 highs, which was a small, but important bullish development.

The fact that the USD Index continues to move higher today instead of declining back above this line is suggesting that the consolidation is finally over.

Last week, I commented on the above chart in the following way:

“

(…) if we don’t see a breakout here, what I see as likely is consolidation’s continuation and then a successful breakout. This implies a pause in the precious metals market now, and a slide later (in a week or so).

“

That’s exactly what happened. The consolidation continued and we now saw a breakout. I’d like to see also a third consecutive close above the declining resistance line to say that the breakout was confirmed (so, today’s and tomorrow’s closes), but the situation looks promising already today as that the first time when the breakout wasn’t immediate invalidated during the same day.

By “promising” I mean that it’s promising for the USD Index, which is bearish for gold, silver, and mining stocks.

So, the risk to reward continues to strongly favor short positions in junior miners that are likely to slide particularly significantly – due to USD Index’s rally AND the decline on the general stock market. I wrote about all those markets in Friday’s extensive analysis, so I don’t want to go into details also today.

Tuesday’s rally served as a natural confirmation of the breakout and also a follow-up to the symmetric nature of the recent price moves.

I previously wrote that since the price moves surrounding the recent bottom, and the consolidations that I marked with blue rectangles, it’s quite likely that the following rally would be sharp just as the mid-December decline was – this would make both moves symmetric.

So, this week’s sharp rally was neither accidental, nor is it surprising to you. This is a very bearish piece of news for gold, silver, mining stocks, copper, crude oil and other commodities. The stock market could be affected as well.

Stock market once again invalidated its attempt to move above the top that formed two years ago.

The S&P 500 futures are down in today’s pre-market trading, suggesting lower prices ahead.

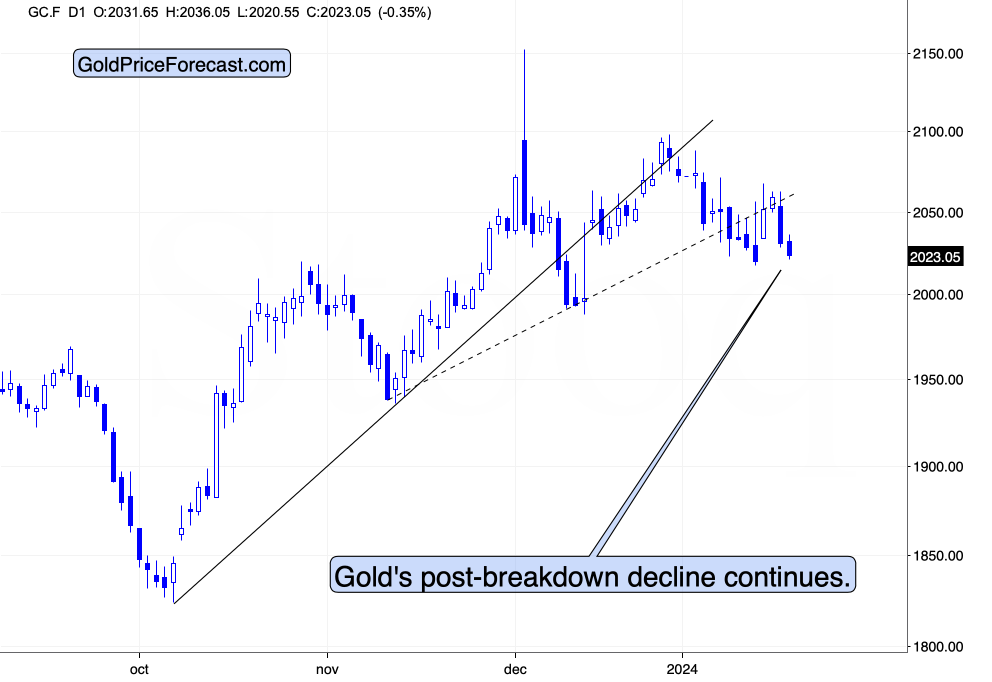

Gold was down yesterday, and it’s down in today’s trading as well.

Gold was after a verified breakdown below its upper rising resistance line, and now it’s also after a verified breakdown below its lower rising resistance line.

This has profoundly bearish implications. Still, most people are not familiar with technical tools, and they will pay attention to whatever mass media provides them with.

The journalists will likely notice that something’s off when gold breaks below $2,000 and declines from there. But before the investment public is able to react to those journalists’ texts, gold might be $100 lower, and miners might be MUCH lower. And it might be time to prepare for a rebound.

Paying attention to the early signs usually has a very good rate of return on invested time.

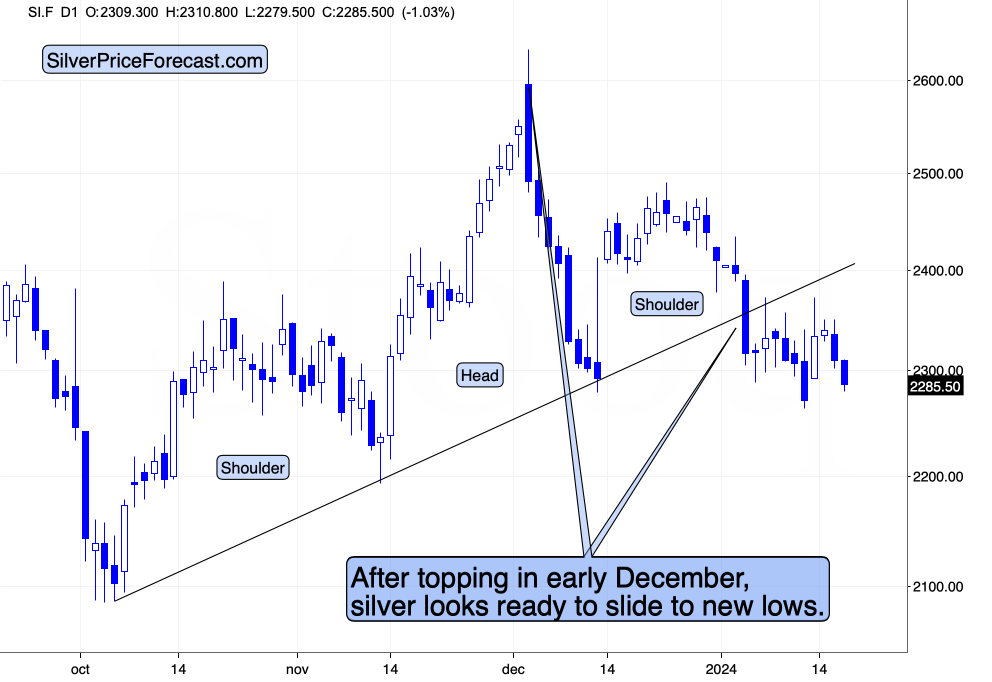

Silver is declining this week as well, proving that last week’s run-up was just a second verification of the breakdown below the head-and-shoulders pattern.

This should not be surprising at all – since the breakdown below this pattern was already verified previously, the implications were bearish all along. Since we knew that the breakdown was verified, it was quite obvious that the very recent rally was a fake move. And indeed – this week’s decline confirms it.

The next big move in silver is likely to be to the downside, and this is also – most definitely – true for junior mining stocks.

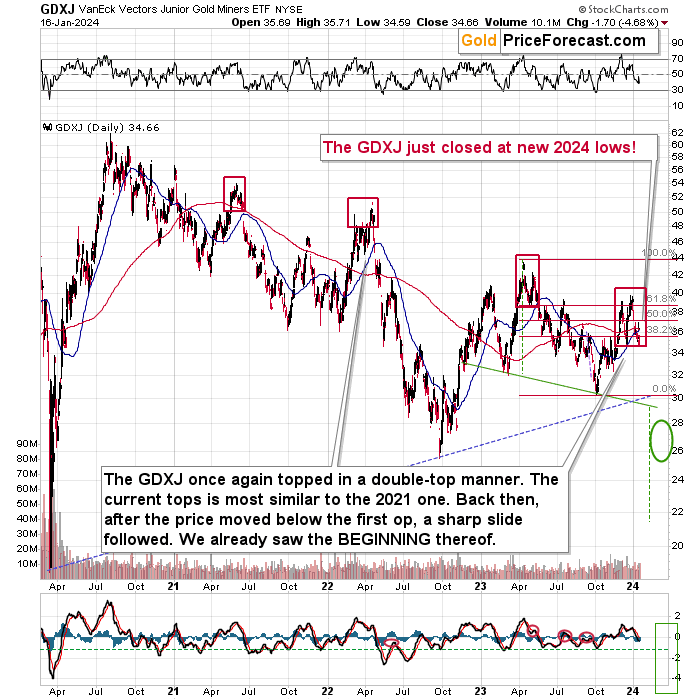

Junior miners just closed at a fresh 2024 low, which serves as yet another bearish confirmation.

The double-top pattern that I’ve been writing about for many days now has worked once again. The medium-term downtrend has now resumed, and another short-term rally is underway.

Now, if the stock market falls substantially (!) here – which I view as likely – the decline in mining stocks is likely to be MUCH bigger than the short-term and medium-term decline that we saw in 2023.

After all, junior miners are already underperforming both markets that impact their prices to the highest extent: gold and the stock market.

Making money on the short-term and medium-term downfall is – in my opinion, of course – the most promising opportunity out there, as this move is supported by the situation in both: the USD Index, and stocks, and they both appear to have big moves ahead of them. Additional benefits could be reaped by shorting other commodities like crude oil and copper (by the way, Anna’s short position in crude oil is getting more profitable as I’m writing these words), but shorting junior mining stocks is still my favorite way to benefit from USD Index’s rally (and stocks’ decline).

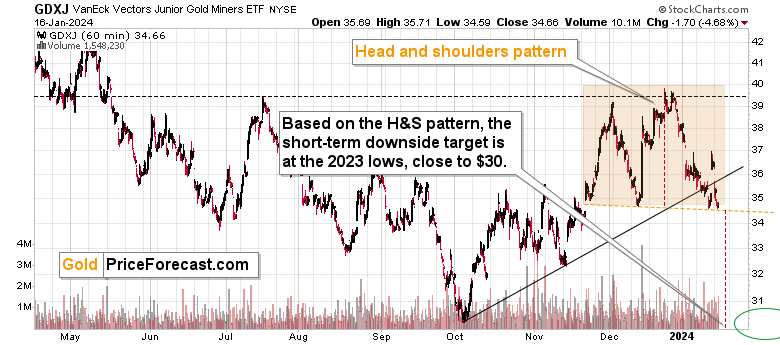

Zooming in allows us to see something new.

Namely, the December-January performance of the GDXJ is a head-and-shoulders pattern that is about to be completed.

Junior miners closed the day at the neckline of the pattern and since gold, silver, and GDXJ itself in pre-market trading are down, it looks like we’re about to see a breakdown and completion of the pattern.

We might then see a small rebound (perhaps only on an intraday basis), but the breakdown here would be likely to lead to a bigger short-term slide.

After breaking below the head-and-shoulders pattern, price tends to fall as much as it moved up and then down when creating the head of the pattern. In other words, by copying the height of the head and then pasting it neck level gets us the downside target. I marked both with red, dashed lines, and this technique currently points to the 2023 low as the target.

This is wonderful piece of news, because that’s the level that I featured as the target, anyway. With this confirmation, this downside target (at about $30 - $31) became even more likely to be reached. This means sizable short-term gains are likely to be reaped for those positioned to gain from this decline.

Our current trading position in the GDXJ remains profitable and it’s likely to become much more profitable in the near future.

Also, given all the confirmations that we saw, view the risk of seeing a corrective rebound as very small, so I’m moving the stop-loss level lower – thus decreasing the trading risk of the position.

As always, we’ll keep you – our subscribers – informed.

GDXJ’s and HGD.TO’s Roadmap

What’s next? While the next 1-3 days are a bit unclear, the entire roadmap that I featured for the GDXJ ETF in my previous Gold Trading Alert remains very much up-to-date.

The markets usually don’t move up or down in a straight line, so some kind of correction is likely to take place in the future, anyway. The question is from what price levels.

My best candidate for the first correction (based on the data that I have available right now) is The $30.5 - $32 range for the GDXJ ($7.50 - $8 in HGD.TO), which is based on the previous lows. I don’t expect a huge rally from those levels, though. Perhaps a move from $30.5 to $32 ($7.50 - $8 in HGD.TO), and then the decline (rally in HGD.TO) would continue.

The next target is more important. After breaking to new 2023 lows, the move to the 2022 low (close to $26; approximately $11 in HGD.TO) becomes a good possibility – I marked this area with a green ellipse.

Once this level is reached, I then expect the GDXJ to correct in a more visible manner. After all, at that point, it will be after important breakdowns:

- Below the rising blue support line

- Below the previous 2023 low

- Below the green support line

Consequently, a verification of those breakdowns by a move back to them, would be quite normal. This means a move back to $29 - $30 ($8 – $8.5 in HGD.TO). Then, after a successful verification of those breakdowns, I’d expect the GDXJ to slide lower – to the 2020 low or close to them – at about $20 (at about $15 in HGD.TO).

There’s also a good possibility of seeing a bottom at about $22 ($13.5 - $14 in HGD.TO), as that’s where we have a downside target based on the head-and-shoulders pattern that is most likely being formed right now. It could also be the case that the GDXJ slides to about $20 (about $15 in HGD.TO) on an intraday basis only to recover and close the day at about $22 (about $13.5 - $14 in HGD.TO). In a way, both targets would be reached in this case.

There are many IFs around the above-mentioned scenario, and the situation might (and it probably will) change as we go. Remaining open-minded and flexible regarding the new information is key, but having a roadmap is very useful, too, as it shows how things could develop on a more-or-less basis. This can help you prepare for those – or similar – price moves.

= = =

If you’d like to become a partner/investor in Golden Meadow, you’ll find more details in the above link.

Overview of the Upcoming Part of the Decline (In Terms of Months)

- It seems that the recent – and probably final – corrective upswing in the precious metals sector is over.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

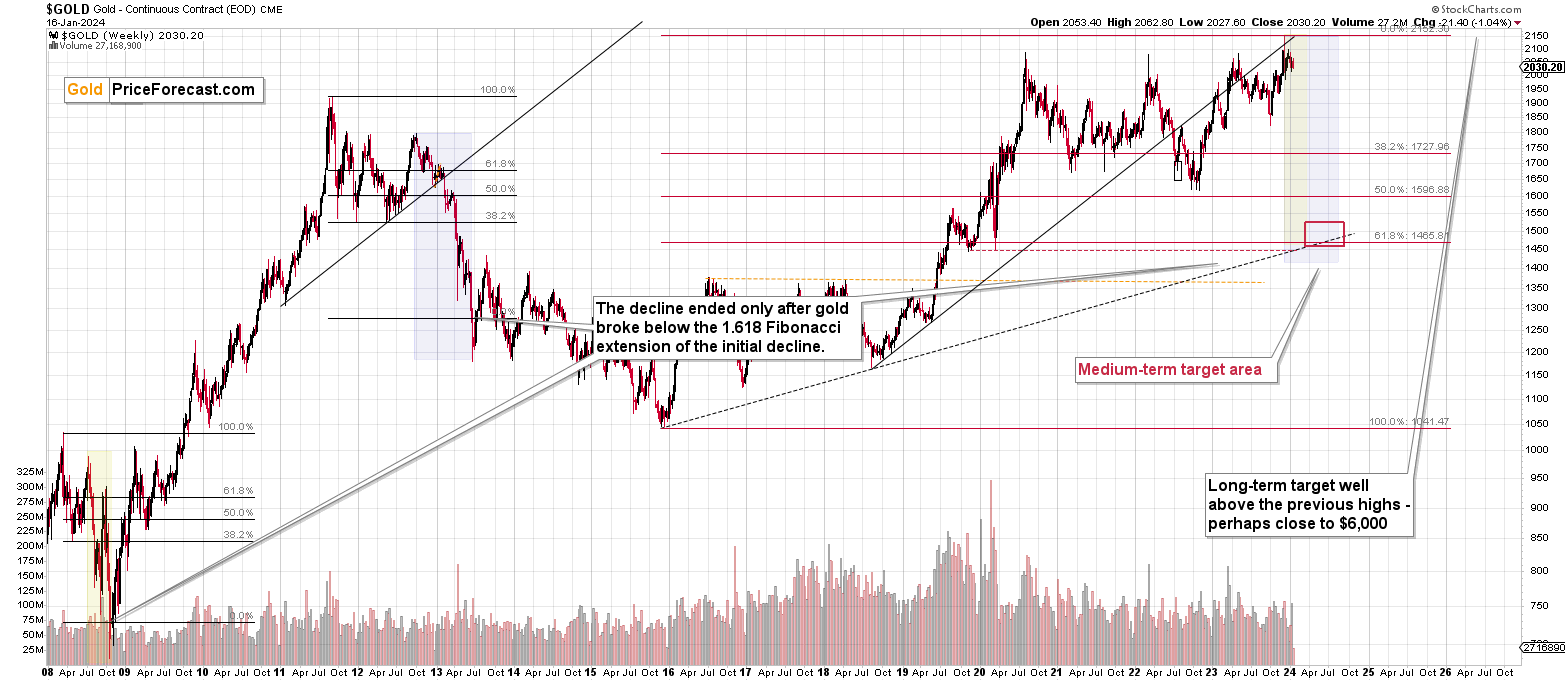

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Depending on the nature and target group of your question, feedback or comment, please use the following means of communication:

- For questions or comments that you’d like to get the Community’s response, please use the Ask the Community space so others can contribute to the reply and also enjoy the answers.

- For questions, comments or feedback that you’d like me to comment on / reply to, please send them to Golden Meadow’s support – some clarifications can be provided directly by our experienced support team, and those that are strictly for me, will be forwarded to me and I’ll then provide replies either individually, or in the “Letters to the Editor” section in the Alerts, depending on the nature of the question/comment.

Administrative Announcement

After keeping our service not only on our current platform (Golden Meadow), but also on our old website (SunshineProfits.com) for many months, we are starting to wind down operations on the old website. While today’s section with analyses is still online, the homepage was already turned down, and starting tomorrow, the new analyses will no longer be posted on SunshineProfits.com – only on GoldenMeadow.eu.

Your access to premium commentary is not affected in any way, but I’m letting you know about this to make sure that you’re using GoldenMeadow.eu to access your premium analyses.

Also, please note that the old website had no mobile notifications, and Golden Meadow supports mobile notifications through an app that is available for both: iPhones (here’s the AppStore link) and Android devices (here’s the analogous link). The app’s name is “Circle”, and once you log in with your Golden Meadow username/password, it will take you to your Golden Meadow account and you can access the analyses and set up notifications there.

Speaking of the notifications, here’s the link to the notifications page on Golden Meadow – you can customize them.

I don’t see a reason why it should be the case, but if for any reason something doesn’t work or you don’t get notifications, please contact our support – our support team will be happy to help.

===

Finally, we currently have a special promotion for new readers (for people, who used our services within a year), which is about providing a free 10-day trial of the service. This trial is also available for Stock- and Oil Trading Alerts. So, if you know that some of your friends or colleagues might be interested gold, silver, mining stocks, USD Index, rare earth minerals, crude oil, oil stocks, copper, natural gas, uranium, stock market futures, tech stocks (like AAPL), please let them know about this offer. If they don’t like the analyses, they can cancel and it won’t cost them a dime.

Of course, if you haven’t subscribed to Oil- or Stock Trading Alerts (you can sign up for both) within the last year, you can also take advantage of this offer. It’s all available here:

https://www.goldenmeadow.eu/c/available-subscriptions/

Summary

To summarize, Friday’s quick run-up in gold, silver, and miners was likely just a bounce within a bigger downtrend and the shape of Friday’s session confirmed that. Gold is after two major weekly reversals, which point to MUCH lower prices in the following weeks. The same goes for silver’s confirmed breakdown below its head and shoulder’s pattern, and USD Index’s breakout above its medium-term declining resistance line, not to mention the peak in interest in “how to buy gold” searches.

The strength in the USD Index, and the likely breakdown in the head and shoulders pattern in the GDXJ only add to the profit potential of our trading position in the GDXJ.

The enormous potential of our trading position in the junior miners remains intact.

Also, given that it’s highly unlikely that we’ll see any major rally here, we’re moving the stop-loss level for the GDXJ lower.

===

As we’re on a streak of 11 profitable (closed, unleveraged) trades, and – just like I wrote today and in the previous days – it looks like we’re going to see much more of them in the near future, I want to provide you with even more great news!

There are even more savings connected with our Diamond Package that includes Gold Trading Alerts, as well as Oil Trading Alerts and Stock Trading Alerts.

There are many reasons due to which the above are interesting, for example, the recent huge profits that Paul took off the table in Stock Trading Alerts, and Anna’s already-profitable (with great short-term potential) trade in crude oil in Oil Trading Alerts.

The prestigious Diamond Package includes a bundle-offer discount, there’s a 10% discount available for purchasing it for more than one year, and on top of that when using the “DIAMOND10” code when going Diamond there’s an additional 10% discount on top of it all.

Additionally, if you’re interested in trying out Oil Trading Alerts and/or Stock Trading Alerts, please note that there’s a 7-day free trial available for both services. You can sign up for the free trials (or go Diamond) using this page.

Please contact our support to upgrade your subscription to ensure that your paid-for days will be properly transferred over to your new subscription.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $30.62; stop-loss: $38.32.

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding exit level for the JDST: $8.16; stop-loss for the JDST: 5.28.

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside exit price: $21.12 (stop-loss: if GDXJ reaches its stop-loss level)

SLV exit price: $19.32 (stop-loss: if GDXJ reaches its stop-loss level)

ZSL exit price: $22.75 (stop-loss: if GDXJ reaches its stop-loss level)

Gold futures / spot gold downside exit price: $1,943 (stop-loss: if GDXJ reaches its stop-loss level)

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the exit price: $7.49 (stop-loss: if GDXJ reaches its stop-loss level)

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the exit price: $17.78 (stop-loss: if GDXJ reaches its stop-loss level)

///

Optional / additional trade idea that I think is justified from the risk to reward point of view:

Short position in the FCX with $27.13 as the short-term profit-take level.

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

===

On a side note, while commenting on analyses, please keep the Pillars of the Community in mind. It’s great to provide points that help others be more objective. However, it’s important to focus on the facts and discuss them in a dignified manner. There is not much of the latter in personal attacks. As more and more people join our community, it is important to keep it friendly. Being yourself, even to the point of swearing, is great, but the point is not to belittle other people or put them in a position of “shame” (whether it works or not). Everyone can make mistakes, and everyone does, in fact, make mistakes. We all here have the same goal: to have a greater understanding of the markets and pick better risk-to-reward situations for our trades. We are on the same side.

On another – and final – side note, the number of messages, comments etc. that I’m receiving is enormous, and while I’m grateful for such engagement and feedback, I’m also starting to realize that there’s no way in which I’m going to be able to provide replies to everyone that I would like to, while keeping any sort of work-life balance and sanity ;) Not to mention peace of mind and calmness required to approach the markets with maximum objectivity and to provide you with the service of the highest quality – and best of my abilities.

Consequently, please keep in mind that I will not be able to react / reply to all messages. It will be my priority to reply to messages/comments that adhere to the Pillars of the Community (I wrote them, by the way) and are based on kindness, compassion and on helping others grow themselves and their capital in the most objective manner possible (and to messages that are supportive in general). I noticed that whatever one puts their attention to – grows, and that’s what I think all communities need more of.

Sometimes, Golden Meadow’s support team forwards me a message from someone, who assumed that I might not be able to see a message on Golden Meadow, but that I would notice it in my e-mail account. However, since it’s the point here to create a supportive community, I will specifically not be providing any replies over email, and I will be providing them over here (to the extent time permits). Everyone’s best option is to communicate here, on Golden Meadow, ideally not in private messages (there are exceptions, of course!) but in specific spaces or below articles, because even if I’m not able to reply, the odds are that there will be someone else with insights on a given matter that might provide helpful details. And since we are all on the same side (aiming to grow ourselves and our capital), a ton of value can be created through this kind of collaboration :).

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief