-

Oil Bulls Keep Trying But the Technical Headwinds Are Stiff

December 20, 2019, 9:26 AM

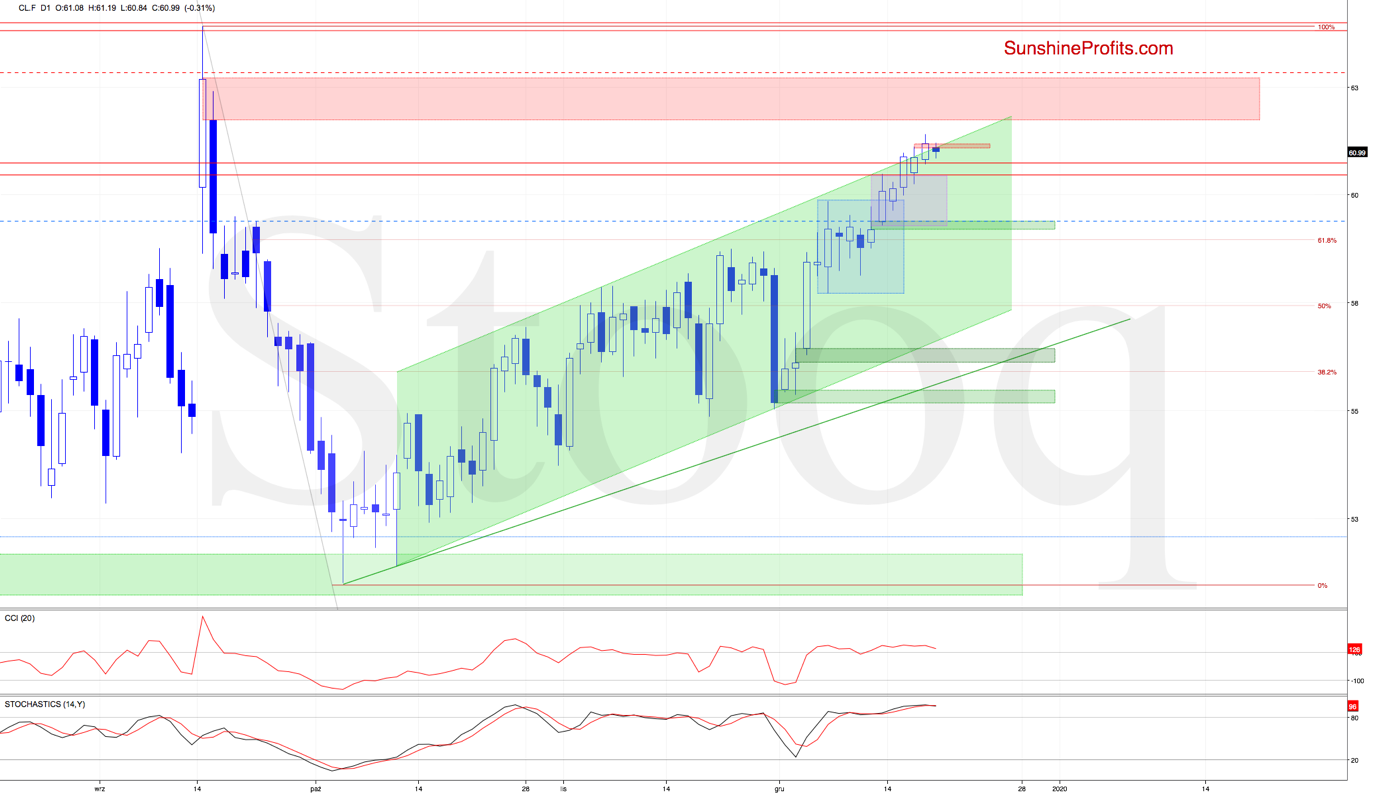

Crude oil futures moved higher once again during yesterday's session, overcoming the upper border of the rising green trend channel for the third time in a row. While the futures finished the day above this resistance, the bulls didn't manage to hold gained ground in full.

Earlier today, the futures opened with the red gap. This bearish development means invalidation of yesterday's breakout, which doesn't bode well for the bulls.

The daily indicators are still very extended, also supporting the likelihood of upcoming resolution to the downside.

Should the futures extend losses from here, the initial downside target for the sellers will be the Friday's green gap.

Summing up, while the bulls broke above the upper border of the rising green trend channel yesterday, today's bearish opening doesn't support a bullish interpretation. The extended daily indicators support a downside reversal too. The short positions continues being justified from the risk-reward perspective.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Unable to Keep Previous Day's Gains, It's a Groundhog Day for the Oil Bulls

December 19, 2019, 9:50 AM

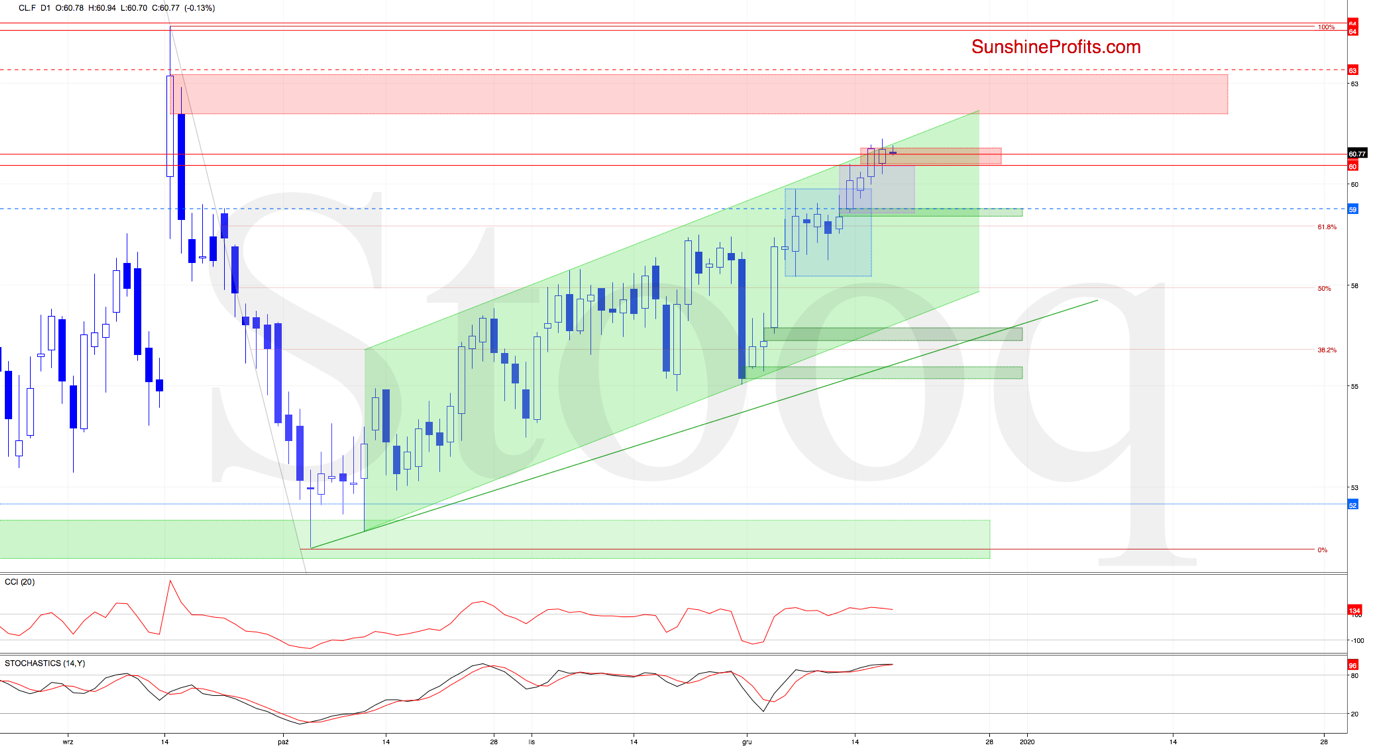

Although crude oil futures again moved higher during yesterday's session, rising above the upper border of the rising green trend channel and 78.6% Fibonacci retracement, the bulls didn't manage to hold gained ground. This very same development characterized action in oil a day earlier too.

Earlier today, the futures opened with another bearish gap, invalidation all yesterday's breakouts. This is certainly a bearish development.

The daily indicators are still very extended, also supporting the likelihood of upcoming resolution to the downside.

Should the futures extend losses from here, the initial downside target for the sellers will be the Friday's green gap.

Summing up, while the bulls appeared to have made a breakthrough on a closing basis yesterday or the day before, the following day's bearish opening speaks differently. The lower border of the red resistance zone continues to keep further gains in check. This zone is marked by the upper border of the rising green trend channel, and the 76.4% and 78.6% Fibonacci retracements. The extended daily indicators support a downside reversal too. The short positions continues being justified from the risk-reward perspective.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Today's Bearish Open Throws Cold Water on the Oil Bulls

December 18, 2019, 6:40 AM

Crude oil futures extended gains yesterday, breaking above the upper border of the purple consolidation, and an attempt on also the key resistance zone followed.

The bulls took the futures above the upper border of the rising green trend channel and the 78.6% Fibonacci retracement. While this is bullish on the surface, the buyers just couldn't gained ground, and today's trading started with the red gap.

That red gap results in invalidation of all yesterday's breakouts, and that is as bearish as it gets. The daily indicators are still very extended, supporting the likelihood of upcoming resolution to the downside.

Taking all the above into account, further deterioration is probably just around the corner and opening short positions is justified from the risk/reward perspective.

Should the futures extend losses from here, the initial downside target for the sellers will be the Friday's green gap.

Summing up, while the bulls appeared to have made a breakthrough on a closing basis yesterday, today's bearish opening appears to have dashed their hopes. The lower border of the red resistance zone continues to keep further gains in check. This zone is marked by the upper border of the rising green trend channel, and the 76.4% and 78.6% Fibonacci retracements. The extended daily indicators support a downside reversal too. As we have seen reliable signs of the bulls' weakness, opening short positions is justified by the risk-reward perspective.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

More of the Same in Crude Oil

December 17, 2019, 9:07 AM

While it's true that crude oil futures have again risen today, the overall situation hasn't changed much. Black gold keeps trading inside the purple consolidation and below the key resistance zone.

Let's bring up our lengthy yesterday's commentary:

(...) Crude oil futures extended gains on Friday, and the bulls succeeded in breaking out of the blue consolidation and closing the day above its upper border.

While this is a bullish development, the buyers were stopped by the lower border of the red resistance zone. This zone is marked by the upper border of the rising green trend channel, and the 76.4% and 78.6% Fibonacci retracements.

A pullback followed, and earlier today, the futures opened with the red gap, which increases the probability of a reversal. Even if the bulls manage to close it in the following hours, we continue to think that the above-mentioned resistance zone will be strong enough to stop the buyers in the following days. This is especially the case when we factor in the extended position of the daily indicators.

Should it be the case and there are reliable signs confirming the bulls' weakness (such as an invalidation of the breakout above the upper border of the blue consolidation and a daily close inside the formation), we'll consider opening short positions.

Summing up, neither on Friday nor yesterday did the buyers manage to overcome the lower border of the red resistance zone. This zone (marked by the upper border of the rising green trend channel, and the 76.4% and 78.6% Fibonacci retracements) just keeps stopping the bulls. The extended daily indicators support such an outcome today too. Should we see reliable signs of the bulls' weakness, we'll consider opening short positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Oil Bulls Continue Struggling At the Strong Resistance

December 16, 2019, 7:46 AM

Crude oil futures extended gains on Friday, and the bulls succeeded in breaking out of the blue consolidation and closing the day above its upper border.

While this is a bullish development, the buyers were stopped by the lower border of the red resistance zone. This zone is marked by the upper border of the rising green trend channel, and the 76.4% and 78.6% Fibonacci retracements.

A pullback followed, and earlier today, the futures opened with the red gap, which increases the probability of a reversal. Even if the bulls manage to close it in the following hours, we continue to think that the above-mentioned resistance zone will be strong enough to stop the buyers in the following days. This is especially the case when we factor in the extended position of the daily indicators.

Should it be the case and there are reliable signs confirming the bulls' weakness (such as an invalidation of the breakout above the upper border of the blue consolidation and a daily close inside the formation), we'll consider opening short positions.

Summing up, while Friday's session was certainly bullish, the buyers were stopped by the lower border of the red resistance zone. Today's bearish gap suggests that this zone (marked by the upper border of the rising green trend channel, and the 76.4% and 78.6% Fibonacci retracements) would stop the buyers again. The extended daily indicators support this scenario. Should we see reliable signs of the bulls' weakness, we'll consider opening short positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM