Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

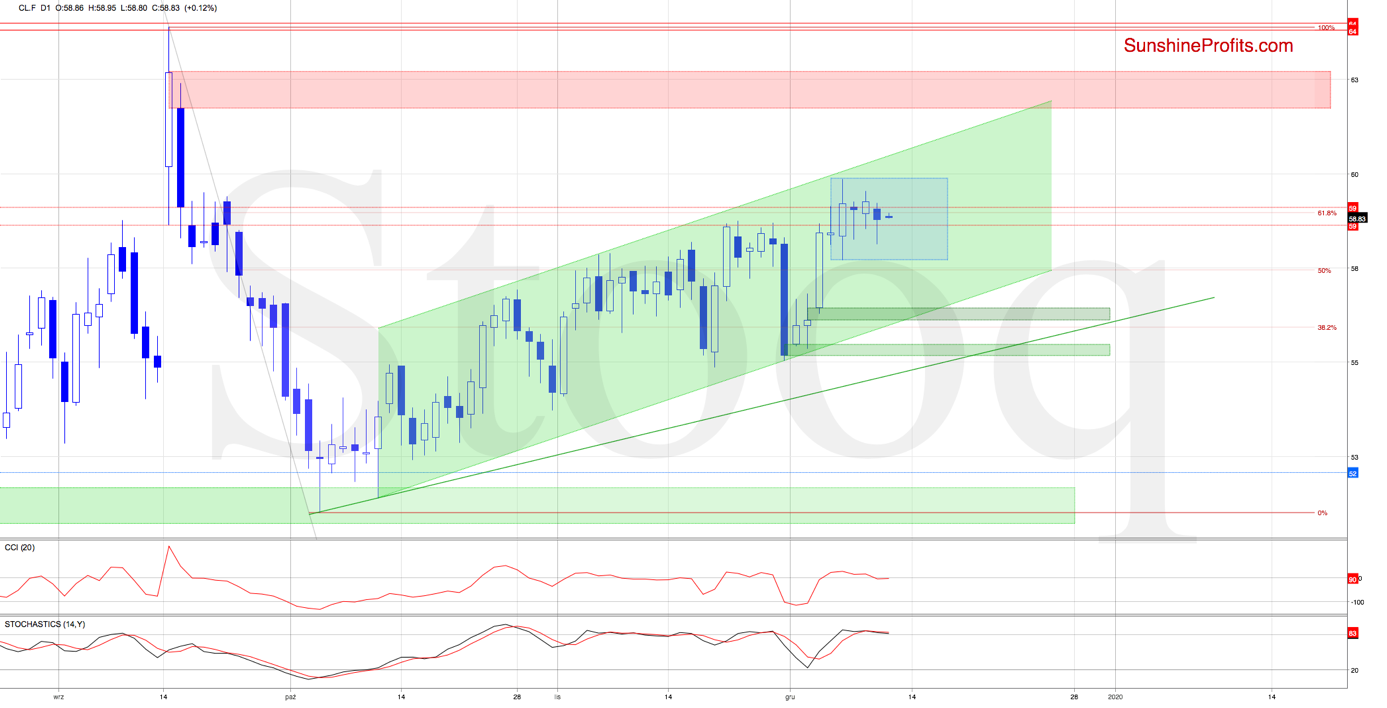

The bulls have overcome the major resistance zone created by three gaps (pink, red and orange ones) and the 61.8% Fibonacci retracement that we wrote about on Friday. Higher oil prices followed, and the futures also closed the gap created in mid-September, reaching the mid-September peaks and approaching the upper border of the rising green trend channel.

Despite these bullish developments, the bulls couldn't make it any higher, and prices became stuck in the blue consolidation. Looking at the extended position of the daily indicators, a reversal just around the corner is indeed probable.

Should we see more signs pointing to the bulls' weakness, we'll consider opening short positions.

Summing up, the recent oil upswing closed the strong combination of resistances, but the bulls couldn't follow through with more buying and higher prices. Oil has consolidated since then, and the daily indicators appear quite extended. Should we see reliable signs of the bulls' weakness, we'll consider opening short positions.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist