-

Crude Oil Keeps Bobbing Around Resistances

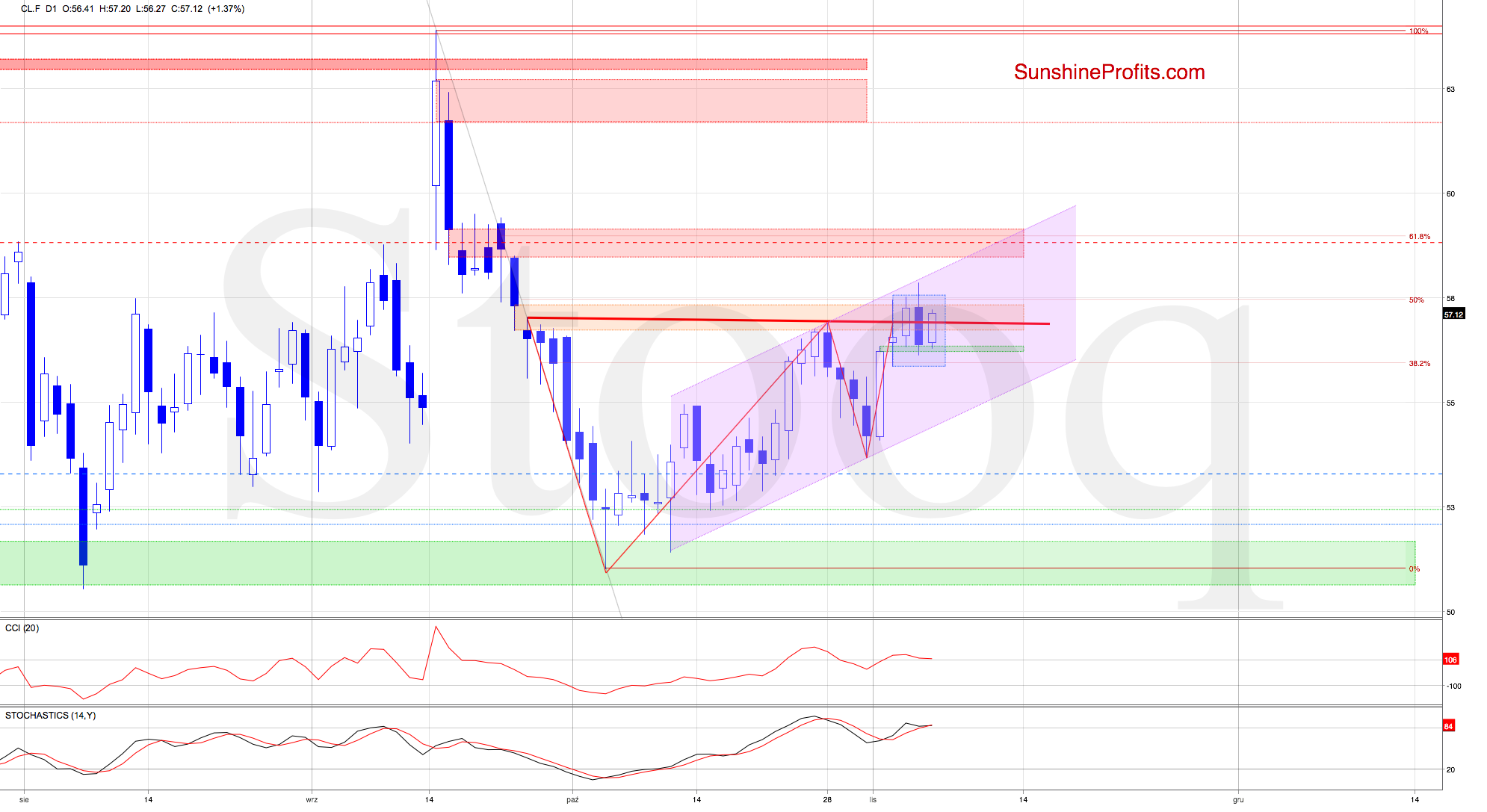

November 7, 2019, 10:35 AMLet's take a closer look at the chart below (chart courtesy of www.stooq.com ) and assess the likely crude oil price path ahead.

The short-term situation hasn't changed much. Crude oil futures keep trading inside the blue consolidation and around the red support/resistance line and the 50% Fibonacci retracement.

They're also still trading inside the purple rising trend channel below the upper border of the orange gap. Therefore as long as there is no breakout above these resistances another attempt to move lower is likely.

Summing up, after yesterday's downswing, crude oil are moving higher today. The short-term picture is unchanged though, as prices are trapped in the blue consolidation and around the horizontal red support/resistance, the 50% Fibonacci retracement and the orange resistance. Unless we see a breakout above these resistances, a reversal lower is likely, and the short position remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to take a look at today's Oil Trading Alert - this analysis' full version. It includes more details about our current positions and levels to watch. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

The Suspicious Hesitation of the Oil Bulls

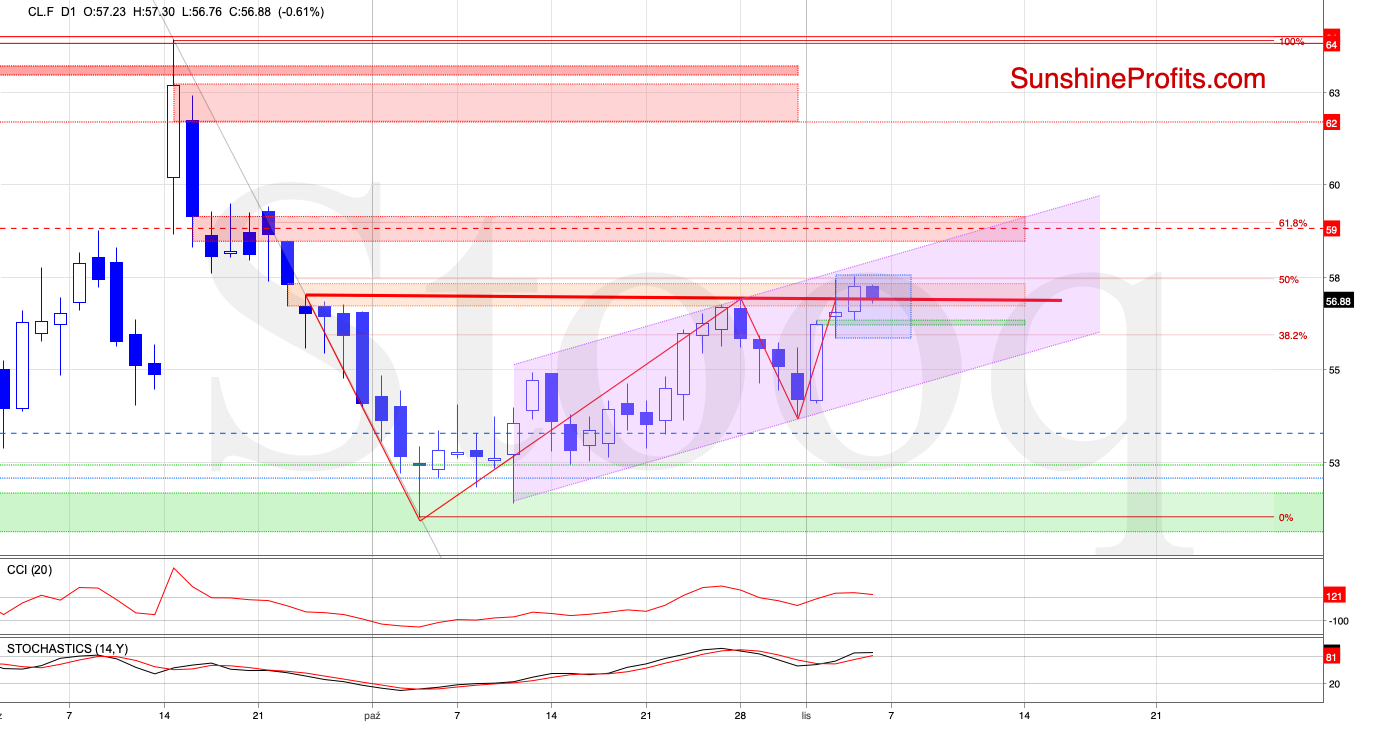

November 6, 2019, 9:08 AMLet's dive right into the chart below (chart courtesy of www.stooq.com ) and assess where crude oil price is most likely to go next.

Yesterday, crude oil futures moved higher, closing the day above the red resistance. That would lend some support to the bulls in their further efforts. However, they haven't managed to close the orange gap for the second time in a row, and they also couldn't overcome the 50% Fibonacci retracement.

That could be interpreted as a sign of weakness. Nearby, there's also the upper border of the rising purple trend channel, serving as an additional resistance. Please note that as the futures hit a fresh peak, we deleted the blue rising wedge and replaced it with the rising purple trend channel.

Earlier today, the sellers triggered a pullback up to the red resistance line. While this can be a verification of yesterday's breakout, it could equally well turn out to be an invalidation of yesterday's breakout, which would open open the way to at least the lower border of the recent blue consolidation.

Taking into account yesterday's data from the American Petroleum Institute showing that U.S. crude inventories tripled the forecast of an increase of 1.5 million barrels, rising by 4.3 million barrels in the week ended Nov. 1 to 440.5 million barrels, it seems that lower values of crude oil are just around the corner. Especially so if today's EIA report shows a bigger than expected increase in crude oil stockpiles.

Connecting the dots, we think that a reversal and lower values of the commodity are still ahead of us, and short position continues to be justified.

Summing up, while crude oil moved higher yesterday, the bulls didn't end up on a high note. They couldn't overcome the orange resistance zone or the 50% Fibonacci retracement. Prices have pulled back earlier today. If today's EIA report shows a bigger than expected stockpiles increase, it could mark a catalyst for renewed downside. Such an outcome would be supported by yesterday's American Petroleum Institute data. Therefore, our short position remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about our current positions and levels to watch. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

After Yesterday's Rejection at Resistances, the Oil Bulls Are Trying Again

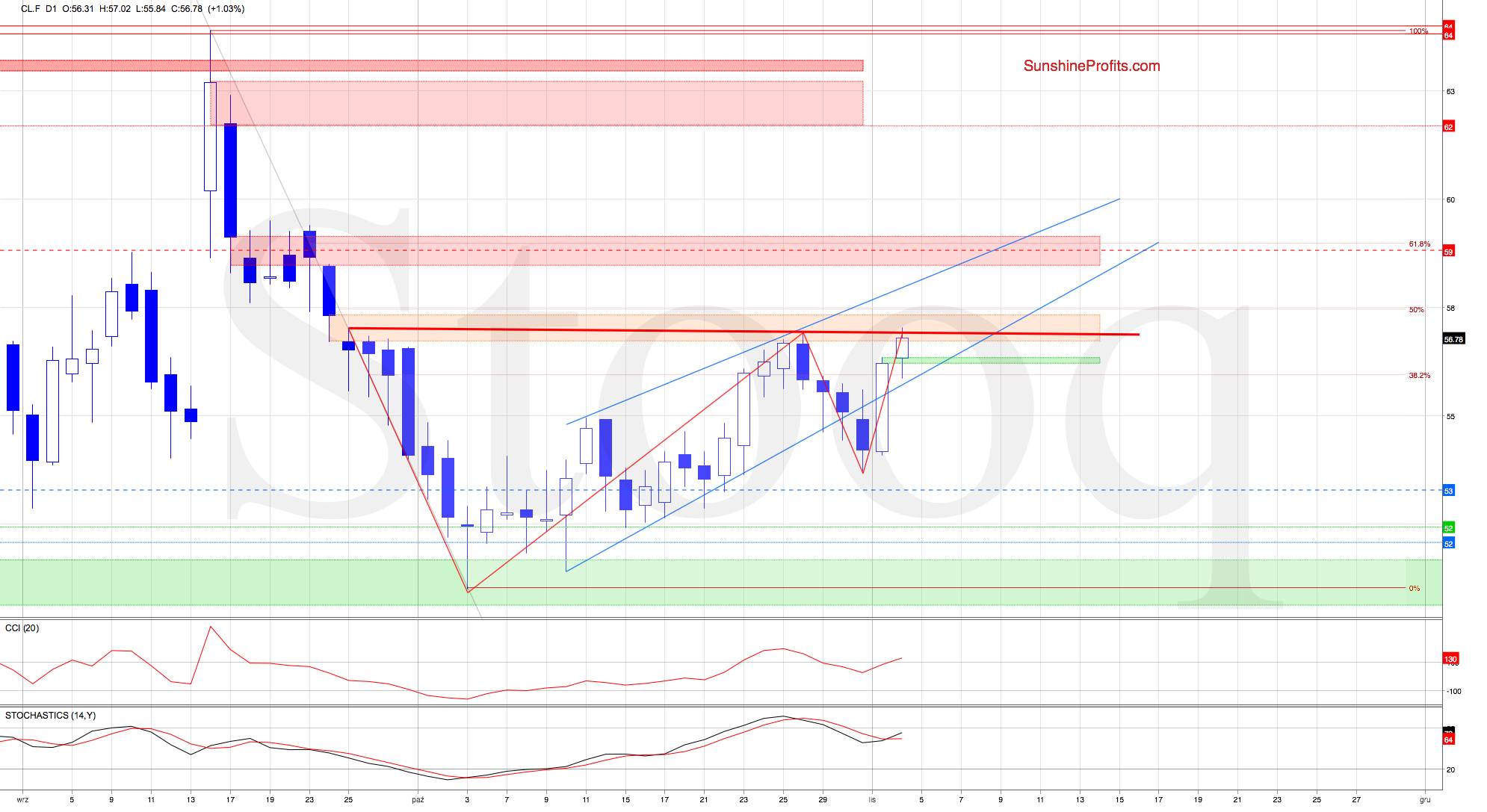

November 5, 2019, 7:27 AMLet's dive right into the chart below (chart courtesy of www.stooq.com ) and assess where crude oil price is headed next.

While crude oil bulls made a strong run yesterday, the futures gave up most of their gains before the closing bell. Black gold closed below both key resistances: the red line and the upper border of the gap. As a result, the late-September gap remains open, continuing to support the sellers.

Of note however, yesterday's green gap is also open, supporting the bulls in turn. And they have moved the oil prices up earlier today. Let's quote our yesterday's observations:

(...) Today's open is marked by the green gap, which has sparked further bulls' gains. Prices have reached the red resistance line based on its previous peaks, and also the orange gap that has been open since the end of September.

Let's take a closer look at the chart: there's a potential cup and handle formation (marked with red lines for your convenience). Should crude oil futures move higher from here and close above the red line, the probability of further improvement would increase. Then, we would consider closing short positions.

Summing up, Friday's oil reversal marks a potential cup and handle formation, and should black gold close above the red line and put the late-September orange gap into jeopardy, we'll consider closing our short positions. For now however, they remain justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about our current positions and levels to watch. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

The Oil Rebound - A Game Changer, Or Not?

November 4, 2019, 10:41 AMLet's get straight into the chart below (chart courtesy of www.stooq.com ) to find out where crude oil price is headed next.

The daily chart shows that crude oil futures reversed sharply to the upside on Friday. Today's open is marked by the green gap, which has sparked further bulls' gains. Prices have reached the red resistance line based on its previous peaks, and also the orange gap that has been open since the end of September.

Let's take a closer look at the chart: there's a potential cup and handle formation (marked with red lines for your convenience). Should crude oil futures move higher from here and close above the red line, the probability of further improvement would increase. Then, we would consider closing short positions.

Connecting the dots, we decided to move our stop-loss order a bit higher. But should we see further improvement and the orange gap likely to be closed, we'll consider closing our short position.

Summing up, Friday's oil reversal marks a potential cup and handle formation, and should black gold close above the red line and put the late-September orange gap into jeopardy, we'll consider closing our short positions. For now however, they remain justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about our current positions and levels to watch. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Oil Doesn't Really Want to Go Higher, It Seems

October 31, 2019, 10:02 AMThe overall situation in the very short term deteriorated after crude oil futures closed Wednesday below the upper border of the short-term trend channel. Earlier today, this show of weakness triggered further deterioration, and futures dropped below $55, making our short positions even more profitable. Taking the above into account and combining it with the sell signals generated by the daily indicators, the probability of further deterioration has increased. Therefore, what we wrote yesterday, is up to date also today.

We hope you enjoyed reading the above free analytical update, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about our current positions and levels to watch. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM