-

Crude Oil Sitting At a Powerful Set of Resistances

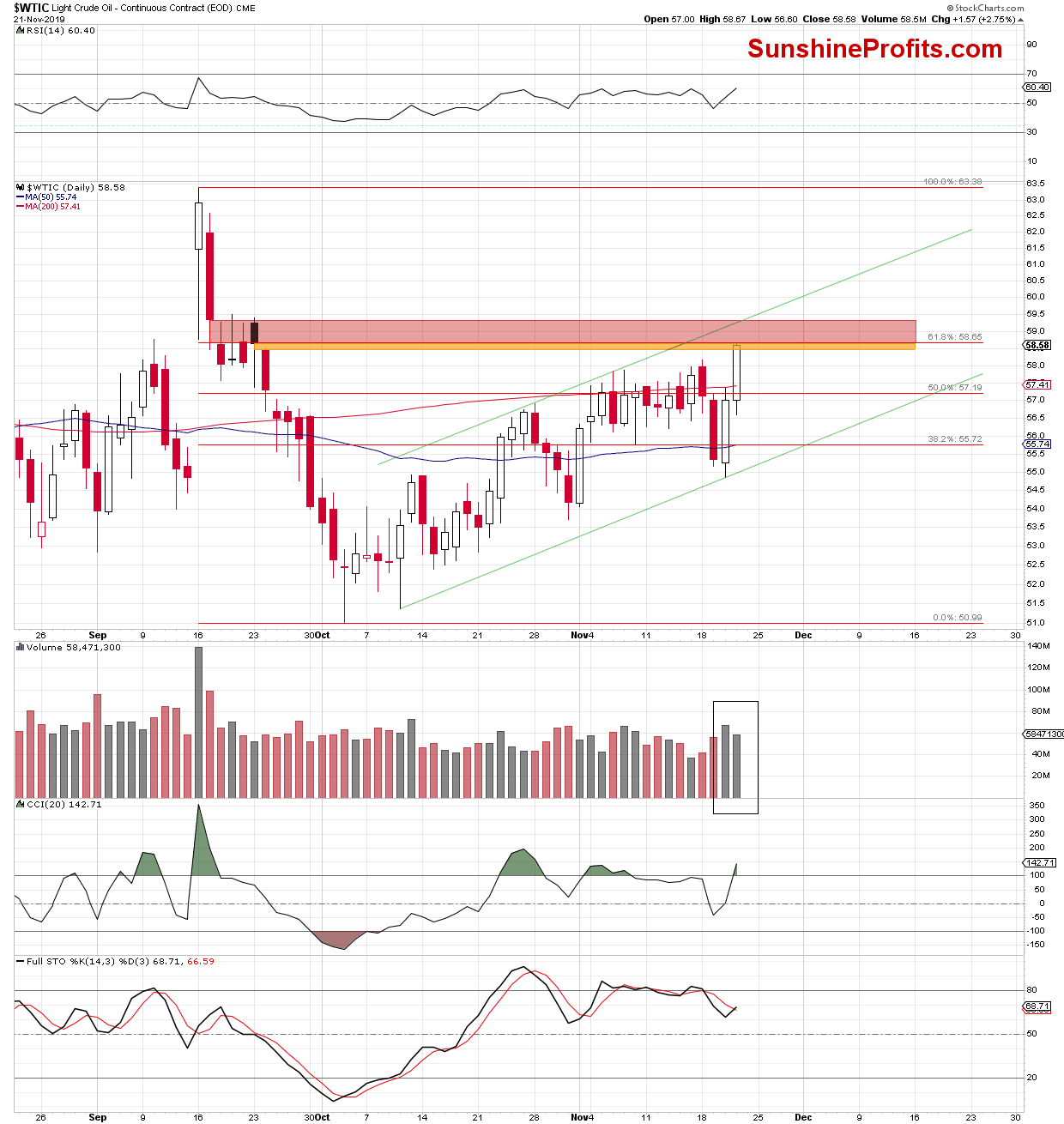

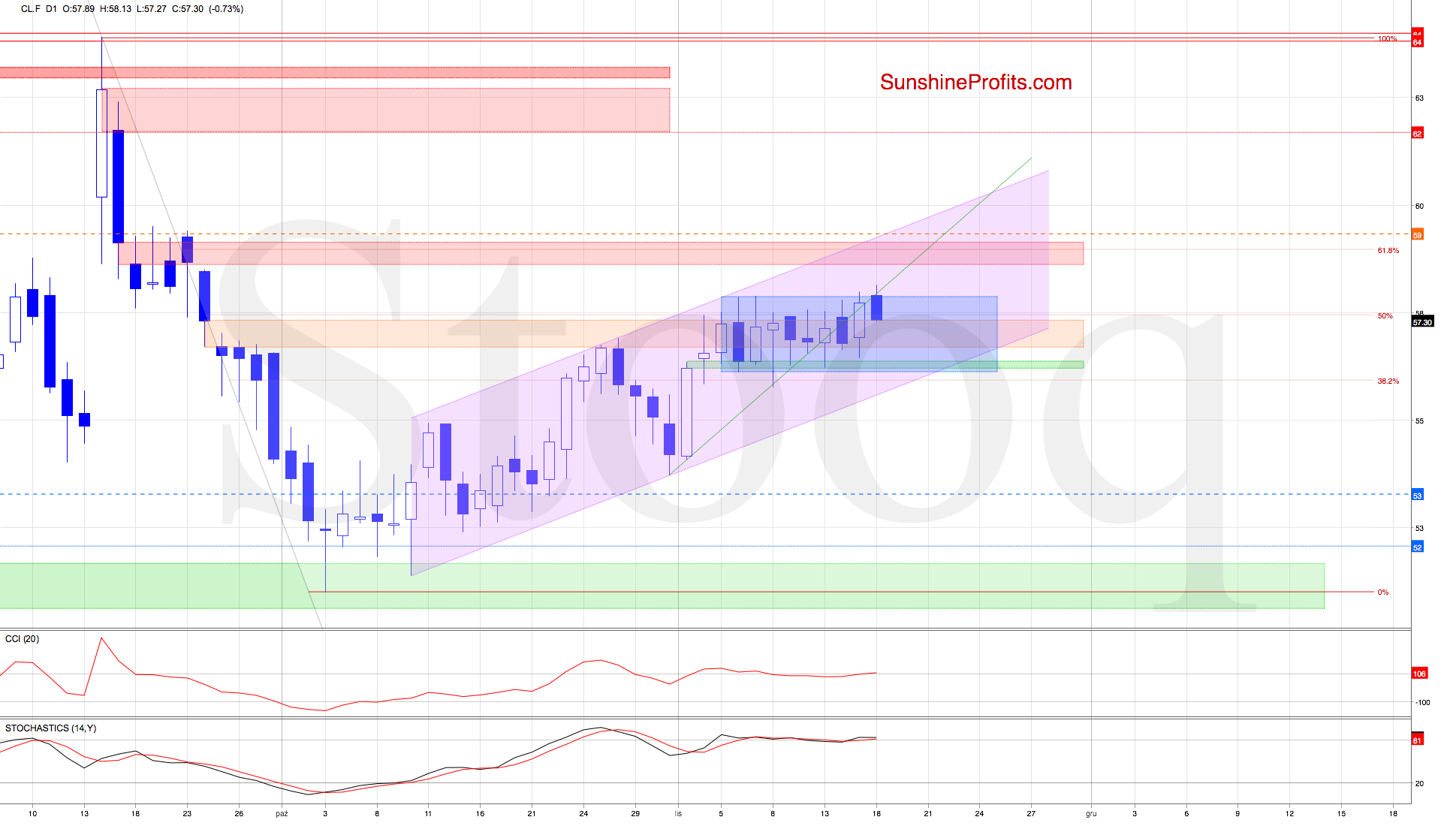

November 22, 2019, 10:01 AMLet's take a closer look at the chart below (chart courtesy of www.stockcharts.com and www.stooq.com ) and assess the likely crude oil price path ahead.

Crude oil has broken above its previous peaks, and closed the September gap. While these are certainly bullish developments, the volume of yesterday's upswing declined. This puts a question mark over the sustainability of higher prices.

This is especially the case when we factor in the fact that black gold has climbed to the strong resistance area created by the 61.8% Fibonacci retracement, and the red and orange gaps. This strong combo is further reinforced by the upper border of the rising green trend channel and the Sept 18-23 peaks.

How did all the above reflect in today's pre-market trading? Let's check the chart below.

Crude oil futures opened today with the bearish pink gap, which suggests that the above-mentioned mix of resistances could stop the bulls and trigger a reversal in the coming week.

Such a scenario will be more likely and reliable if we see the commodity close below the pink gap later in the day.

Summing up, the two-day oil upswing closed the September bearish gap, but it's meeting a new set of resistances: the 61.8% Fibonacci retracement, and the red and orange gaps. There's also the upper border of the rising green trend channel and the Sept 18-23 peaks in the proximity. Combined, they could trigger a reversal, especially if today's pink gap remains unclosed. The short position remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products. And besides, you can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. Subscribe today and stay informed at very preferred terms.

-

Upside Reversal After the Slide, Yet Did the Oil Outlook Change?

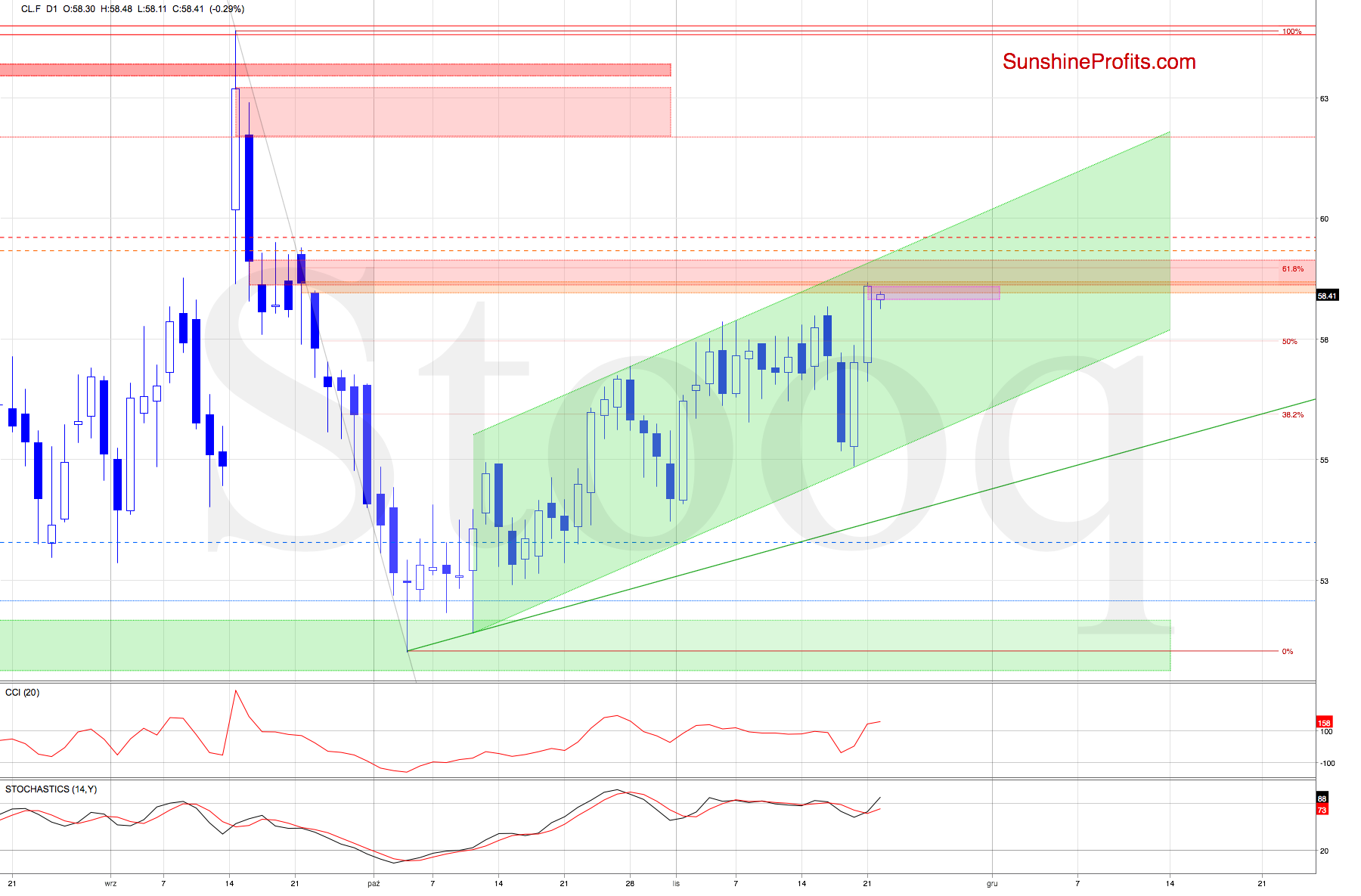

November 21, 2019, 7:18 AMLet's take a closer look at the chart below (chart courtesy of www.stooq.com ) and assess the likely crude oil price path ahead.

While crude oil futures closed below the lower border of the rising purple trend channel and attempted to move even lower yesterday, the bulls made a real comeback on the heels of the Energy Information Administration's report showing a smaller-than-expected build in weekly U.S. crude stockpiles.

As a result, the futures erased Tuesday's decline and returned to trade above $56. The bulls however couldn't close Tuesday's red gap. As long as it remains open, it works to support the bears and acts as resistance to the attempts to move north.

The sell signals of the daily indicators continue to support an upcoming move lower. Should the futures decline, the bears will likely not only test the lower border of the rising purple trend channel, but also yesterday's low in the very near future. If that is broken, the next stop for the sellers will be around $53.73-$54.13, right at the late October lows.

Summing up, spurred by the EIA inventory report, crude oil reversed higher yesterday. While the upswing managed to erase Tuesday's losses, the daily indicators point in the direction of forthcoming deterioration. This would also be supported by the still open Tuesday's bearish gap. The short position remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Retracing Yesterday's Sharp Losses, or Rebounding?

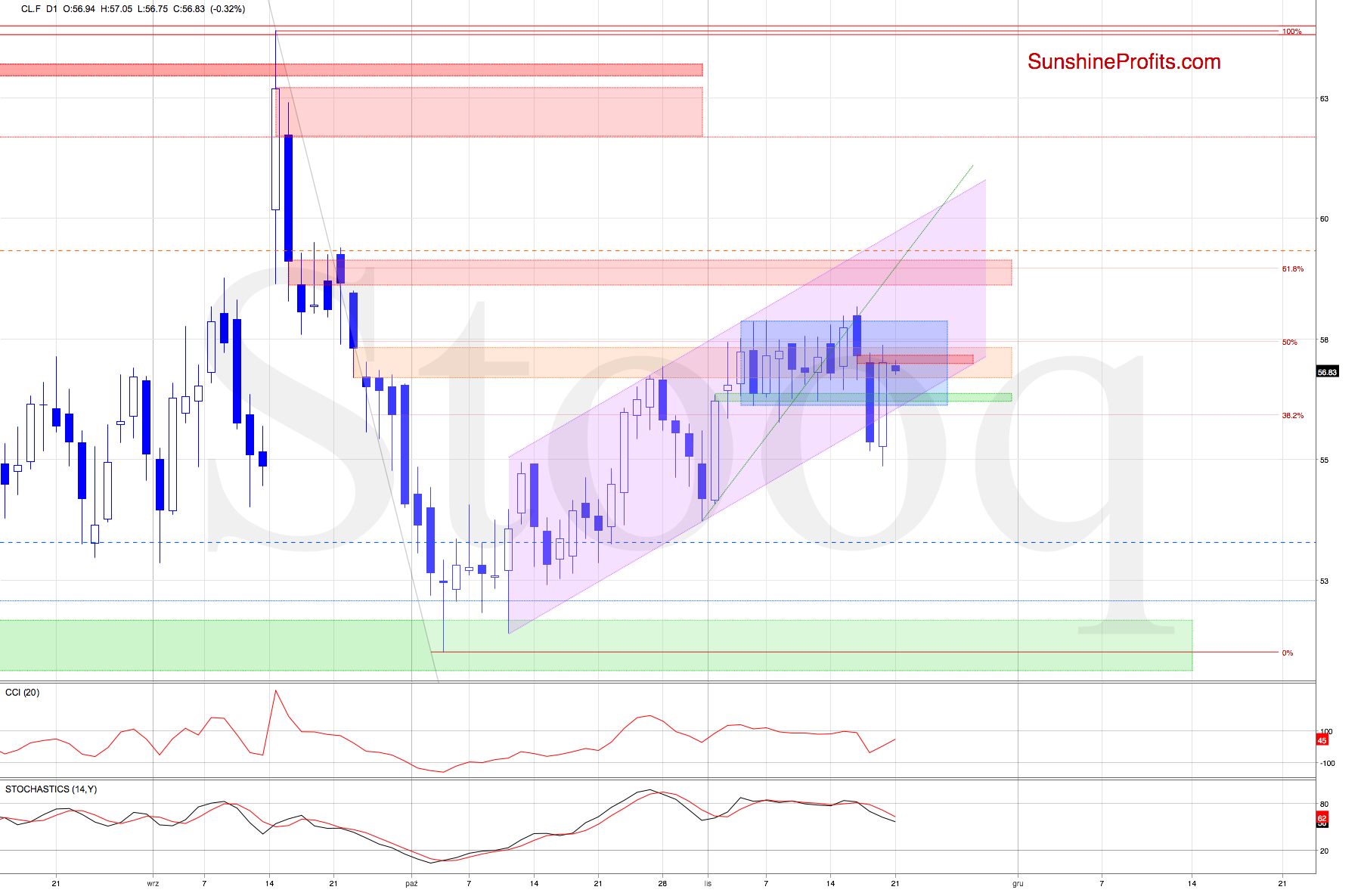

November 20, 2019, 10:56 AMLet's take a closer look at the chart below (chart courtesy of www.stooq.com ) and assess the likely crude oil price path ahead.

Yesterday, we wrote:

(...) Earlier today, the futures opened the day with a bearish red gap, which serves as an additional resistance right now. Additionally, the CCI generated a sell signal while the Stochastic Oscillator is very close to doing the same.

All in all, these signs increase the likelihood of the above-described further decline in the very near future. And indeed, black gold is trading at around $56.00 as we speak.

How low could the bears aim?

(...) the first downside target for the sellers will be the green support gap and then the lower border of the rising purple trend channel.

The situation indeed developed in line with the above, and crude oil futures have since sharply extended losses.

The futures not only slipped below the green gap to close the day below the lower border of the formation, but also moved below the lower border of the rising purple trend channel. As a result, the green gap has been closed, and the futures finished below the rising purple trend channel.

Coupled with the sell signals generated by the daily indicators, it suggests that further deterioration still lies ahead of us.

The futures slightly rebounded compared to the size of yesterday's candlestick earlier today. As long as they remain below the lower border of the trend channel, all upswings would be nothing more than verifications of the earlier breakdown.

What if the situation develops in tune with the above and the crude oil futures decline? The next downside target for the sellers will be around $53.73-$54.13, right at the late October lows.

Summing up, crude oil powerfully reversed lower yesterday, breaking below several important supports. Today's rebound looks like a verification of the earlier breakdown, and further downside remains probable. This is supported by both daily indicators' sell signals. The short position remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

The Expected and Thrilling Resolution of Oil's Consolidation

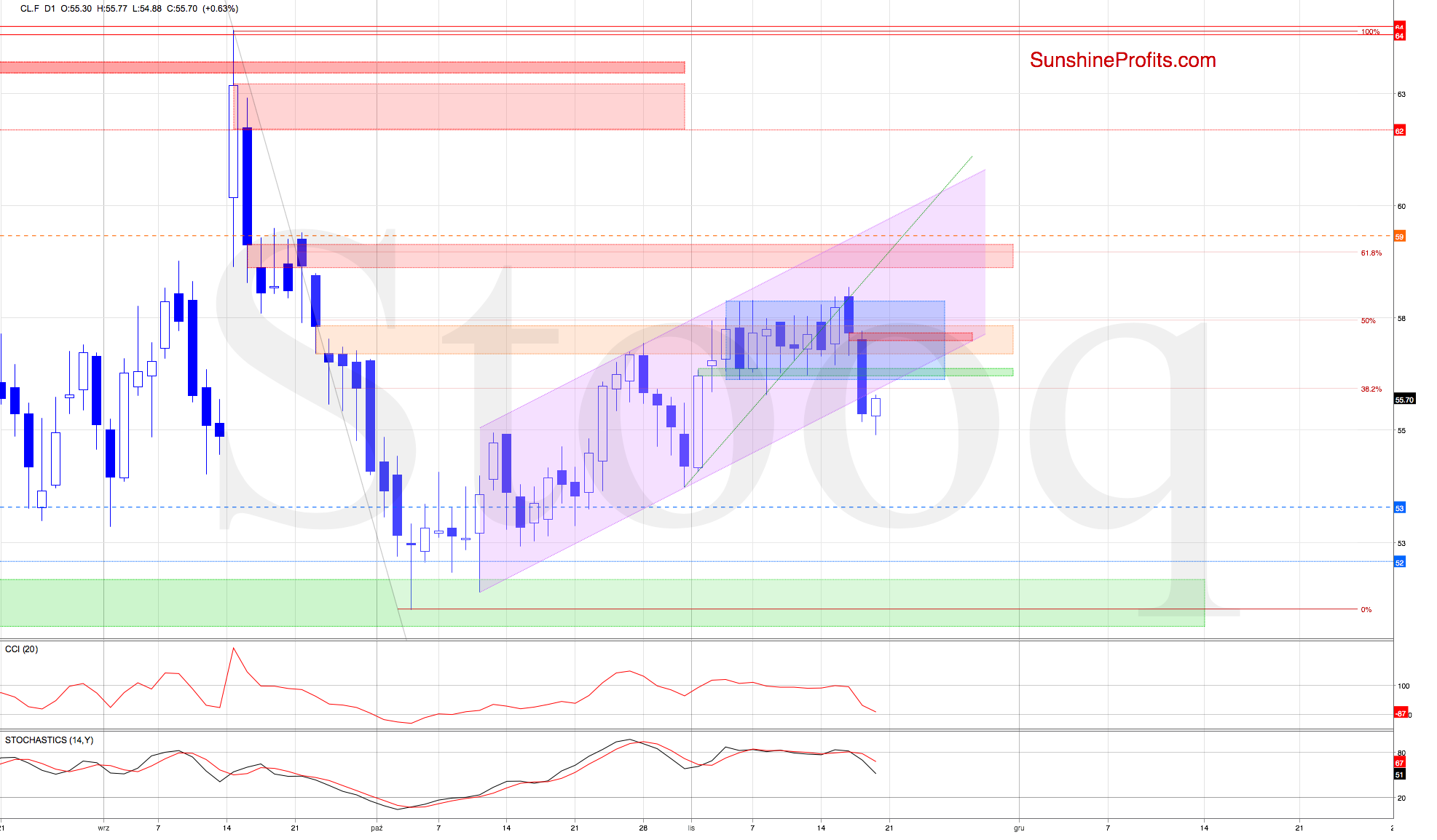

November 19, 2019, 10:05 AMLet's take a closer look at the chart below (chart courtesy of www.stooq.com ) and assess the likely crude oil price path ahead.

Yesterday, we wrote:

(...) On Friday, crude oil futures bounced off the green gap, which brought about quite a sharp move to the upside. The bulls had a reason to celebrate as it closed the orange gap - certainly a bullish development.

Earlier today, the bulls attempted to add to their gains, and broke above the blue consolidation. Their success proved only temporary, as the price reversed and declined to trade at around $57.35 currently. This means invalidation of the intraday breakout attempt.

Due to the extended position of the daily indicators, we have a reason to expect further decline from here.

The situation has indeed developed in tune with the above, and crude oil futures closed yesterday below the upper border of the orange gap. This is a positive development for the bears, hinting that Friday's strength of the bulls was only temporary.

Earlier today, the futures opened the day with a bearish red gap, which serves as an additional resistance right now. Additionally, the CCI generated a sell signal while the Stochastic Oscillator is very close to doing the same.

All in all, these signs increase the likelihood of the above-described further decline in the very near future. And indeed, black gold is trading at around $56.00 as we speak.

How low could the bears aim? Let's again quote our yesterday's Alert:

(...) the first downside target for the sellers will be the green support gap and then the lower border of the rising purple trend channel.

Summing up, yesterday's action shows a downside reversal. The bears opened today with a gap, and keep driving prices lower. The CCI flashed its sell signal, and the Stochastic Oscillator is on the verge of doing the same. Both support lower oil prices ahead, and the short position remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about our current positions and levels to watch. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Yes, Oil Is Higher, But It's Still a Consolidation. An Extended One, At That

November 18, 2019, 10:52 AMLet's take a closer look at the chart below (chart courtesy of www.stooq.com ) and assess the likely crude oil price path ahead.

On Friday, crude oil futures bounced off the green gap, which brought about quite a sharp move to the upside. The bulls had a reason to celebrate as it closed the orange gap - certainly a bullish development.

Earlier today, the bulls attempted to add to their gains, and broke above the blue consolidation. Their success proved only temporary, as the price reversed and declined to trade at around $57.35 currently. This means invalidation of the intraday breakout attempt.

Due to the extended position of the daily indicators, we have a reason to expect further decline from here.

Should we see such price action and crude oil futures going south from current levels, the first downside target for the sellers will be the green support gap and then the lower border of the rising purple trend channel.

Summing up, earlier today, the bulls couldn't add to their Friday's gains. The extended position of the daily indicators supports lower oil prices ahead. The short position remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about our current positions and levels to watch. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM