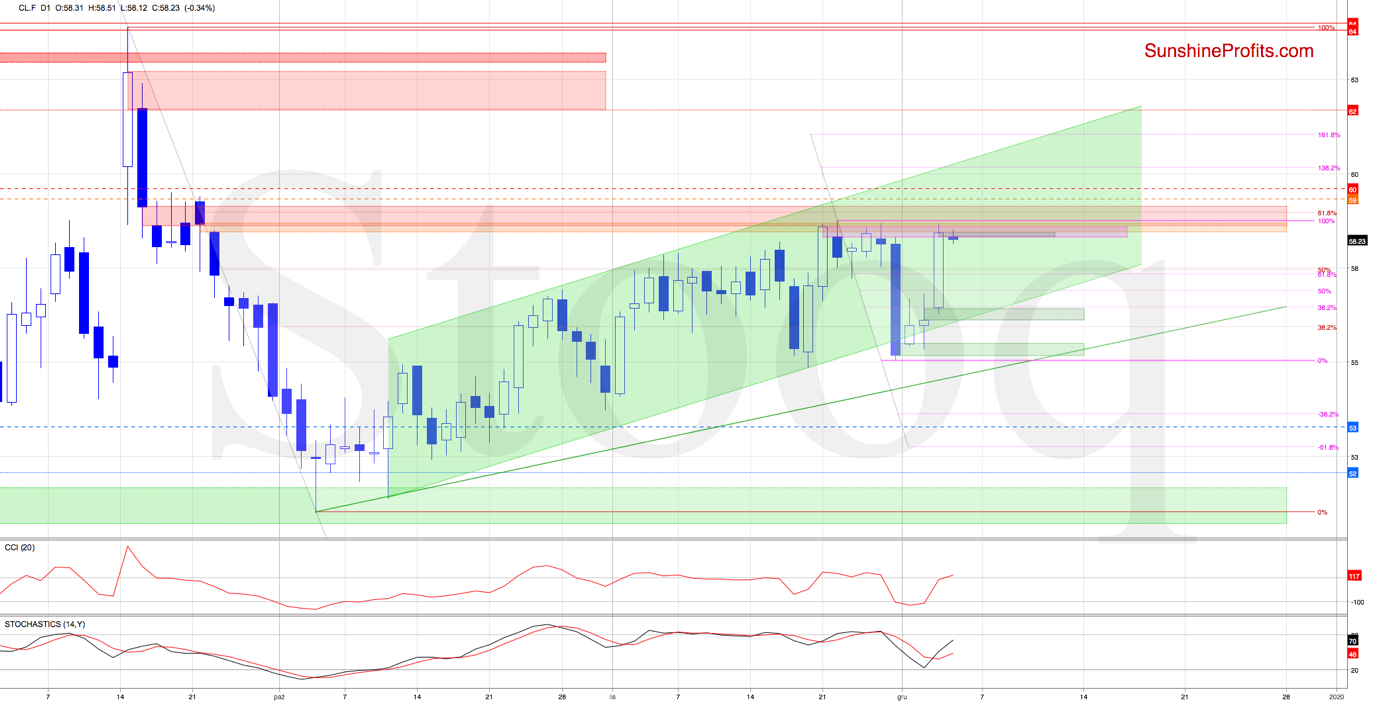

Trading position (short-term; our opinion): Short position with a stop-loss order at $59.60 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Crude oil futures moved sharply higher yesterday, and erased recent declines in the process. While this is a bullish development, the buyers still haven't overcome the major resistance zone created by three gaps and the 61.8% Fibonacci retracement - for quite a few times in a row.

The futures opened today with yet another gap (marked in grey), which further reinforces the already strong resistance zone.

Taking all the above into account, reversal and lower values of crude oil futures are probably just around the corner. Should we see such price action, and the sellers in action, the first downside target would be yesterday's green gap and the lower border of the rising green trend channel.

Summing up, while yesterday's oil upswing looks and is bullish, don't take it at face value. The bulls haven't overcome for the fifth time in a row the strong combination of resistances ahead: the 61.8% Fibonacci retracement, and the three gaps (pink, red and orange ones). They have reliably stopped the bulls several times already, and the short position thus remains justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $59.60 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist