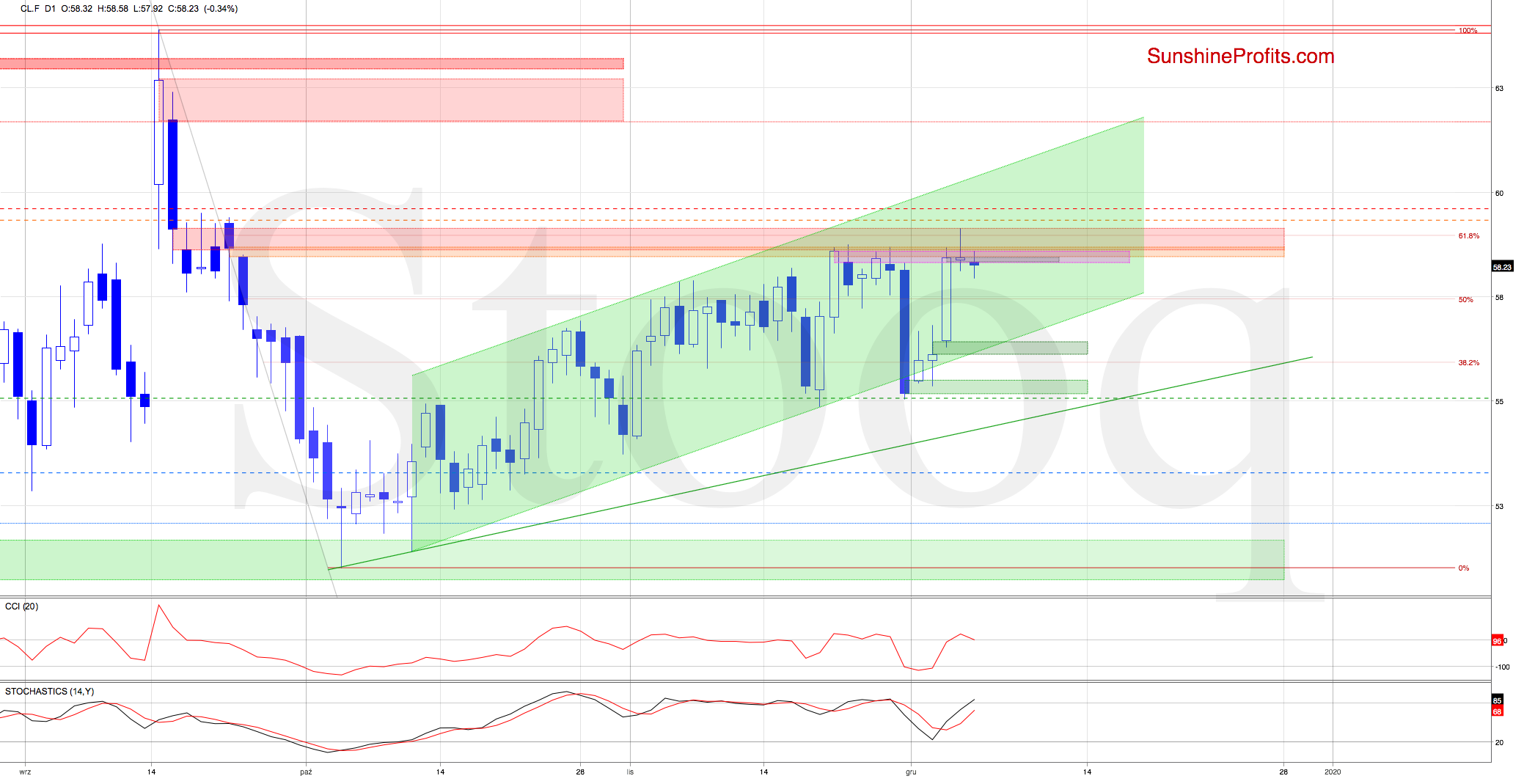

Trading position (short-term; our opinion): Short position with a stop-loss order at $59.60 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Although crude oil futures moved a bit higher yesterday, the major resistance zone created by three gaps and the 61.8% Fibonacci retracement again stopped the buyers. A pullback followed, and the futures invalidated the earlier breakout above the previous peaks.

Together with the key resistances just above, it suggests that reversal is just around the corner. This is especially so when we factor in yesterday's grey gap - it continues to serve as an additional resistance.

On top of that, the daily chart reveals that crude oil futures opened today with another bearish gap, and that the bulls didn't manage to close it in the following hours.

Therefore, should the sellers push the futures lower from here, the first downside target would be Wednesday's green gap and the lower border of the rising green trend channel. The bears are on the move as black gold changes hands at around $57.80 currently.

Summing up, Wednesday's oil upswing generated no follow-through buying as the bulls haven't yet again overcome the strong combination of resistances ahead. It's the 61.8% Fibonacci retracement, and the three gaps (pink, red and orange ones), now also supported by yesterday's grey gap. They have reliably stopped the bulls several times already, and the short position thus remains justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $59.60 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Please note that due to attending additional professional training so beneficial to trading, there won't be any Alert from Mon 9th till Wed 11th December. The Service will resume on Thursday, 12th December.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist