-

Oil Upswing Attempt Gives Way to Renewed Selling

January 2, 2020, 11:11 AM

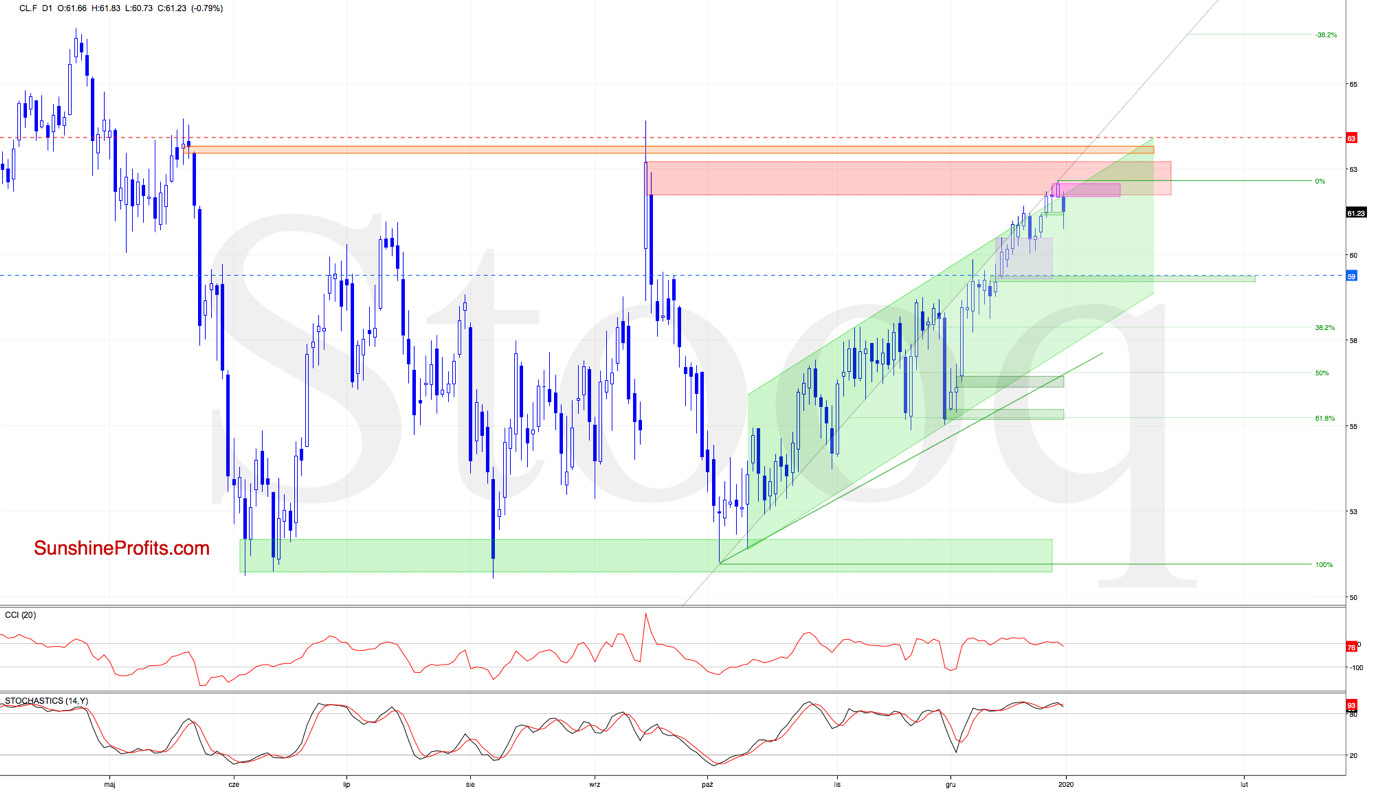

The overall situation in the short term remains almost unchanged as crude oil futures keep trading at around Tuesday's levels. But can we glean more insights from today's opening prices?

Although crude oil futures opened today with a bullish gap, the sellers took over and pushed prices down in the following hours. This suggests a high likelihood of closing the gap in the very near future.

Should we see such price action, the way to the south will be open. The bears can then follow up with a test of the lower border of the purple consolidation and the next green gap, which is where our initial downside target currently is.

Summing up, crude oil ended 2019 with a bearish reversal, with the downswing supported by the extended position of the daily indicators. Regardless of today's bullish gap, the sellers maintain control over today's trading action, suggesting that the gap will likely be closed shortly. Our short position continues being justified from the risk-reward perspective.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes not only the weekly and monthly analysis, but also more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Oil Reverses Lower Faster Than You Can Blink

December 31, 2019, 10:25 AM

Although oil bulls managed to push the futures higher and broke above the upper border of the rising green trend channel during yesterday's session, Monday's upswing turned out only temporary.

Earlier today, crude oil futures opened the day with the bearish pink gap, invalidating yesterday's breakout above the channel. This bearish development triggered further deterioration in the following hours, which means that our yesterday's analysis is up-to-date also today:

(...) the sizable red gap remain in play. It keeps supporting the bears and lower values of the futures in the coming week(s).

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes not only the weekly and monthly analysis, but also more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Oil Keeps Testing a Major Resistance. For How Much Longer?

December 30, 2019, 7:45 AM

Let's recall our Friday's observations:

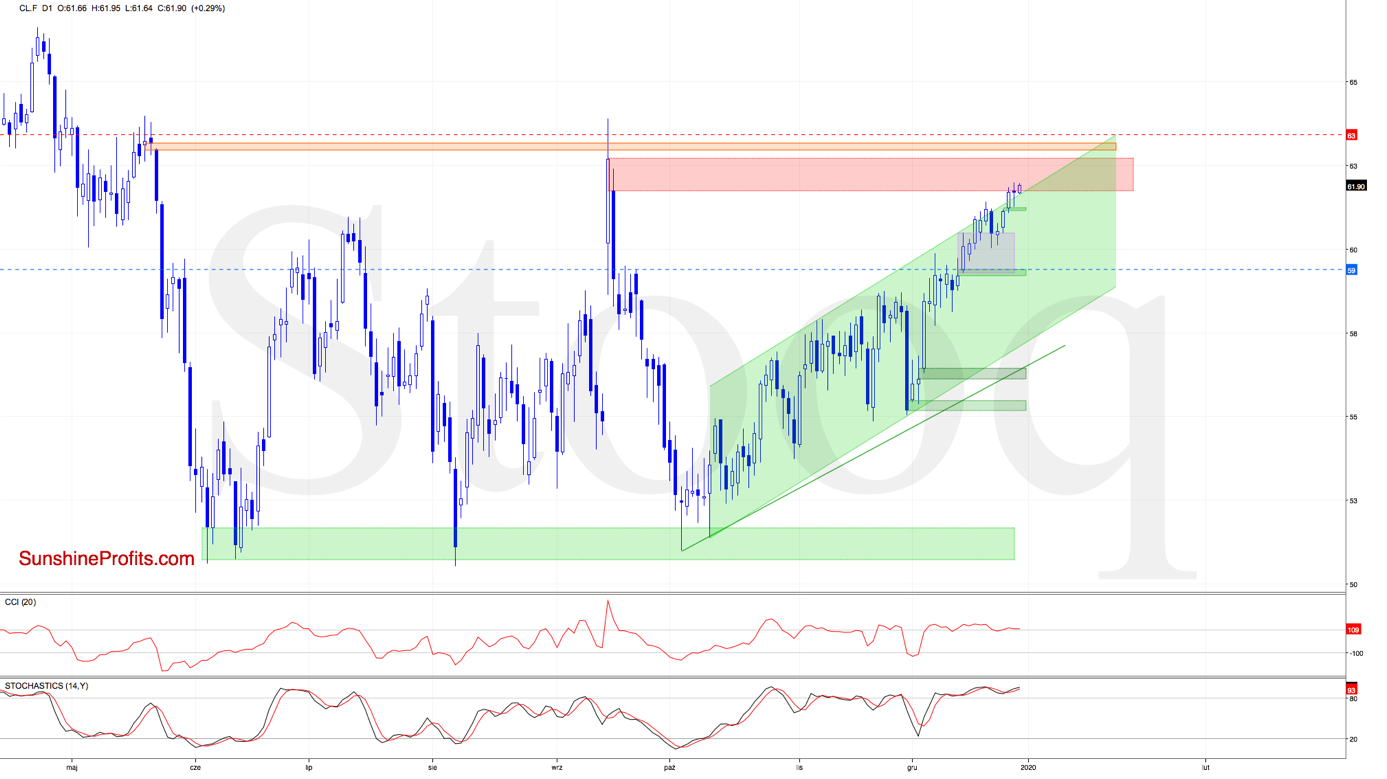

(...) Crude oil futures extended gains, breaking above the upper border of the rising green trend channel during yesterday's session. This upswing took the futures right to the red gap. Let's see how this has reflected upon the daily indicators.

They look quite extended, suggesting that the space for additional gains may be limited and that a reversal is probably just around the corner.

Should it be the case, and the futures move lower from here, the first downside target for the sellers will be yesterday's green gap. If the bears close it, the next target will be the lower border of the purple consolidation and the next green gap, which is where our initial downside target currently is.

The situation has developed in tune with the above, and crude oil futures have indeed pulled back to our first downside target. However, the bears just couldn't close the green gap, and the bulls took advantage, forcing a daily close above the upper border of the rising green trend channel.

This is certainly a bullish development, and the buyers followed through with more upside action. While crude oil futures moved above $61.90, the sizable red gap remain in play. It keeps supporting the bears and lower values of the futures in the coming week(s).

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes not only the weekly and monthly analysis, but also more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Oil Bulls Again Rejected At the Resistance

December 27, 2019, 10:19 AM

Crude oil futures extended gains, breaking above the upper border of the rising green trend channel during yesterday's session. This upswing took the futures right to the red gap. Let's see how this has reflected upon the daily indicators.

They look quite extended, suggesting that the space for additional gains may be limited and that a reversal is probably just around the corner.

Should it be the case, and the futures move lower from here, the first downside target for the sellers will be yesterday's green gap. If the bears close it, the next target will be the lower border of the purple consolidation and the next green gap, which is where our initial downside target currently is.

Summing up, while crude oil futures extended recent gains, the red gap ahead coupled with the extended position of the daily indicators tell about high likelihood of an upcoming reversal lower. And indeed, the futures are trading below $61.50 as we speak. The short position continues being justified from the risk-reward perspective.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

The Expected Oil Reversal

December 23, 2019, 10:17 AM

On Friday, we wrote:

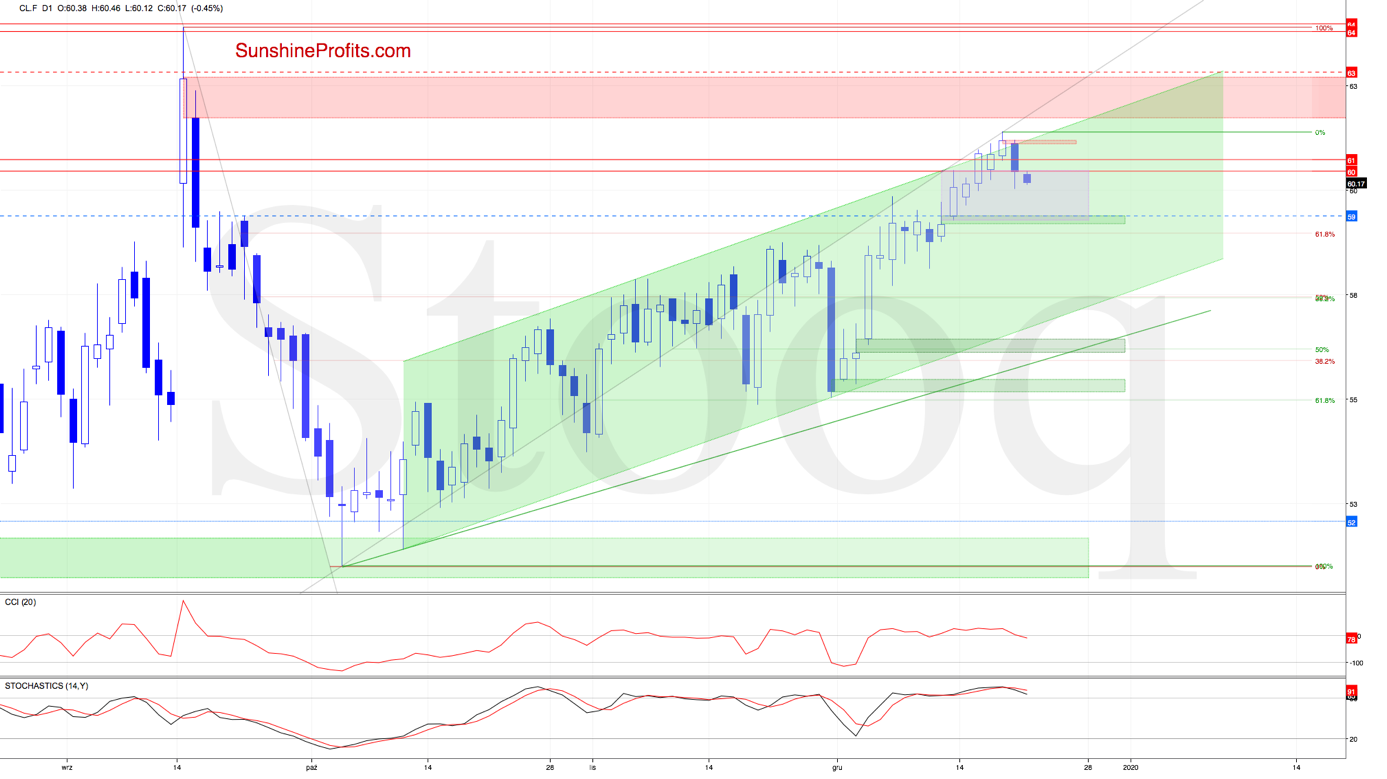

(...) Crude oil futures moved higher once again during yesterday's session, overcoming the upper border of the rising green trend channel for the third time in a row. While the futures finished the day above this resistance, the bulls didn't manage to hold gained ground in full.

Earlier today, the futures opened with the red gap. This bearish development means invalidation of yesterday's breakout, which doesn't bode well for the bulls.

The daily indicators are still very extended, also supporting the likelihood of upcoming resolution to the downside.

The situation indeed developed in tune with the above, and crude oil futures extended losses after our Alert was posted. Friday's drop took black gold slightly below the upper border of the purple consolidation, which means invalidation of the earlier breakout above it. This is an additional bearish development.

Further deterioration followed earlier today, which suggests that lower prices are probably just around the corner. This is especially the case when we factor in the sell signals generated by the daily indicators.

Should it be the case and the futures extended losses from here, the initial downside target for the sellers will be the Friday's green gap.

Summing up, the bulls ran out of steam on Friday, and a reversal lower followed. The result has been invalidation of the breakout above the purple consolidation. Today's bearish gap at the open supports downswing's continuation, and so do the sell signals of the daily indicators. The short position continues being justified from the risk-reward perspective.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM