-

Henry Hub Natural Gas: Potential Reversal Trade

December 16, 2022, 9:29 AMAvailable to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

What Is Fueling the New Crude Oil Rebound?

December 13, 2022, 11:11 AMAvailable to premium subscribers only.

-

Crude Oil Drops to a New Year Low – What’s Happening?

December 8, 2022, 1:12 PMHere’s how to make sense of the different figures reported by the Energy Information Administration (EIA).

Macroeconomics

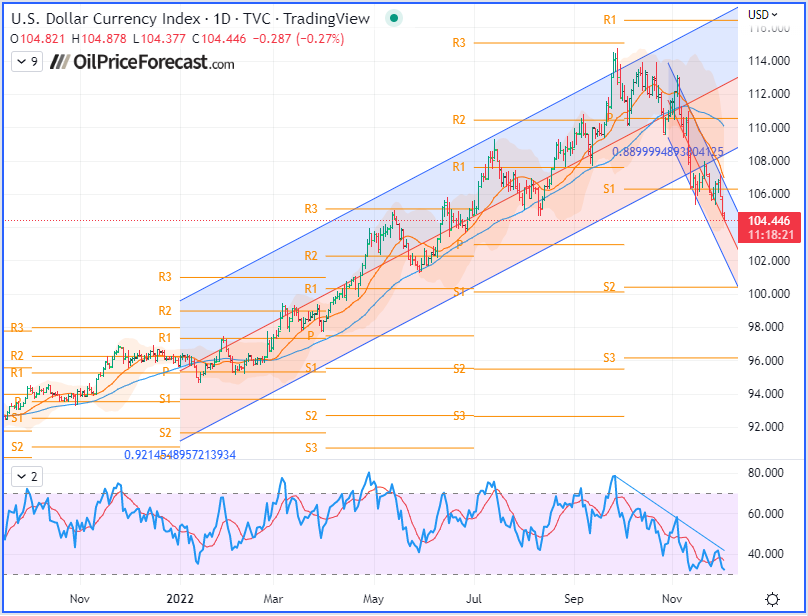

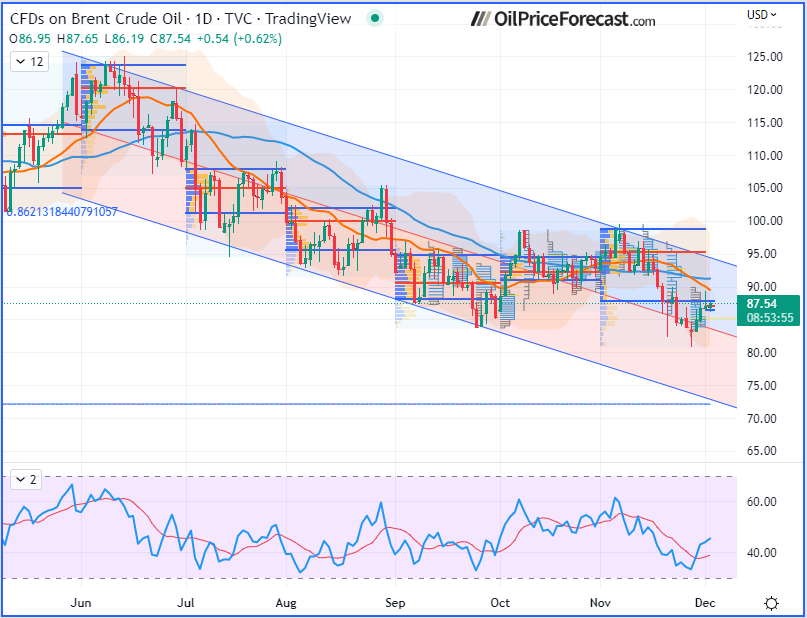

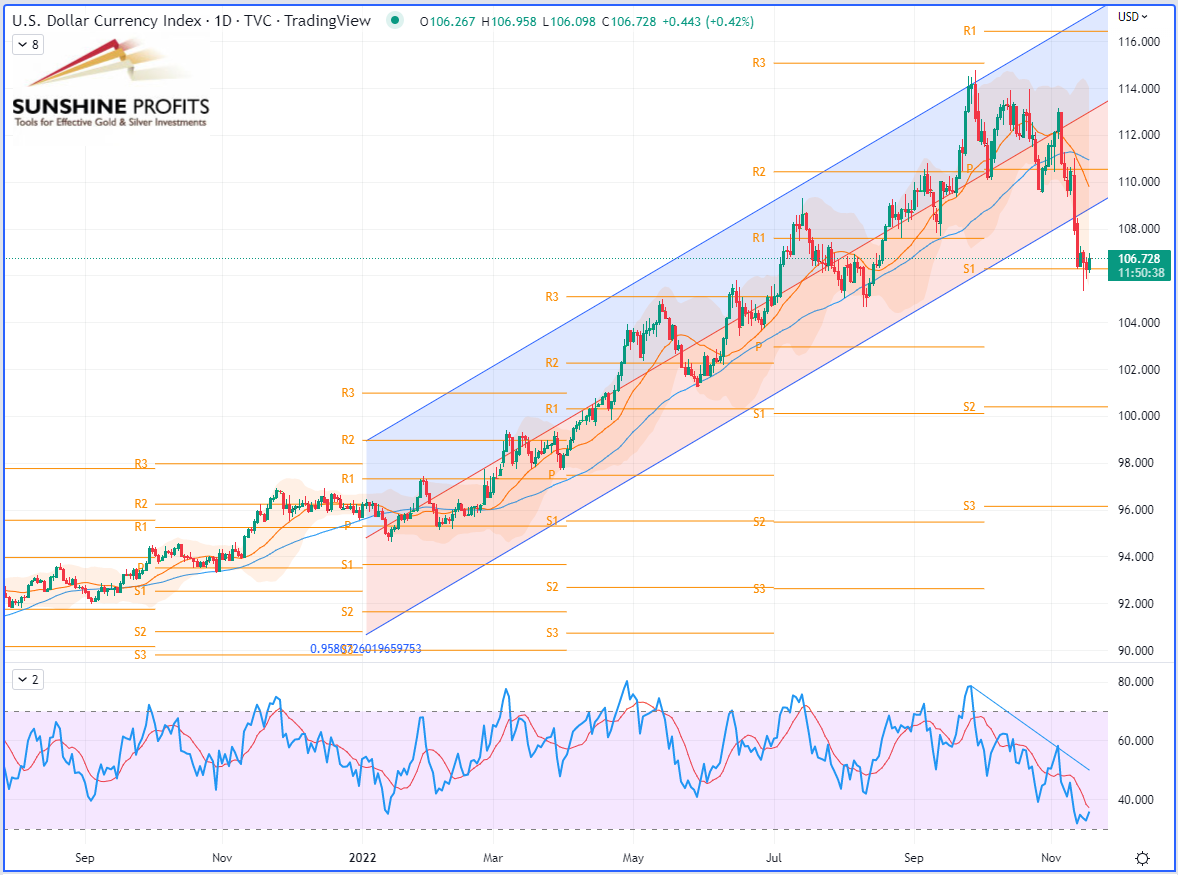

From a macroeconomic point of view, the US dollar index (DXY or USDX) has maintained its downward trend within its recent regression channel, probably still eyeing the next quarterly S2 pivot just located at the $100 mark.

U.S. Dollar Currency Index (DXY), daily chart

As we will see in this article, a certain lack of appetite for petroleum products is fueling the general impression of anemic demand, stifled by hikes in key interest rates by central banks (the Federal Reserve, the European Central Bank, the Bank of England, etc.) around the world combined with the slowing economy.

Geopolitical and Fundamental Analysis

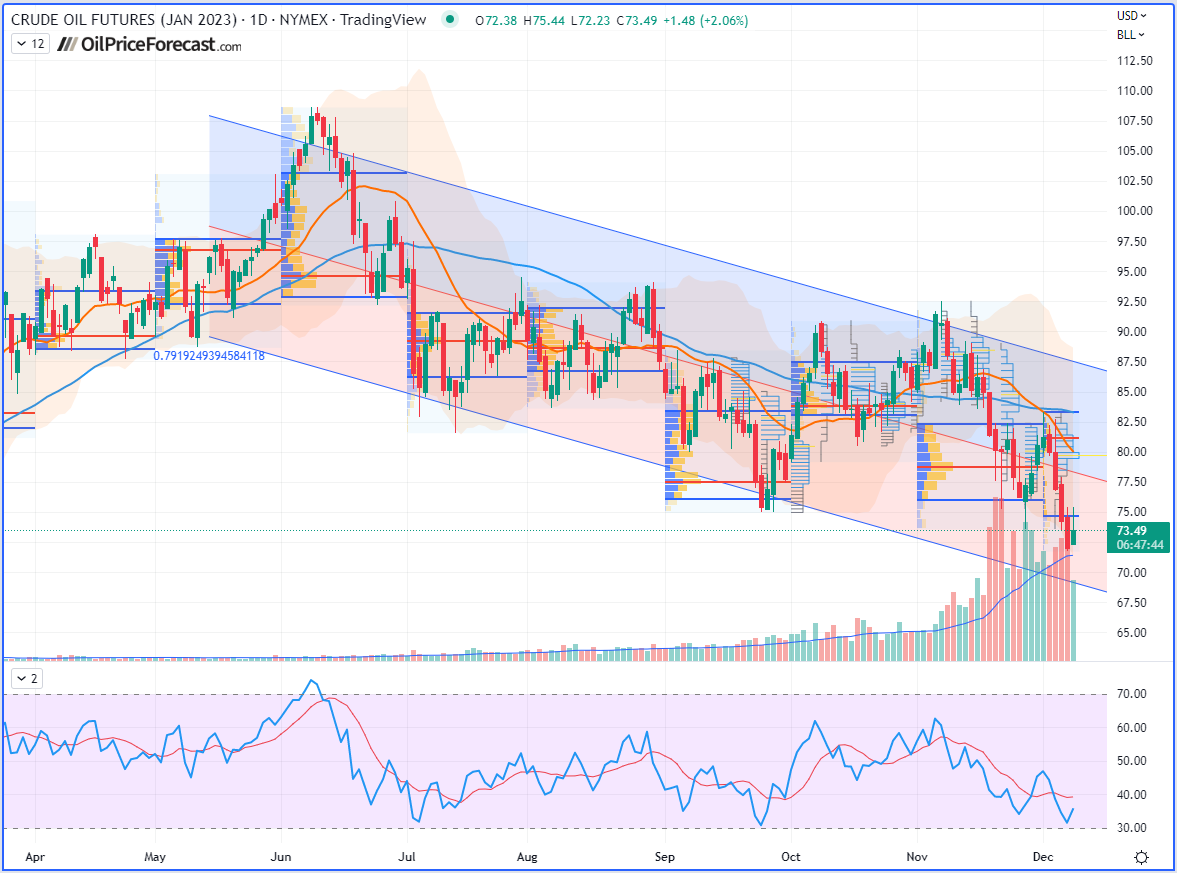

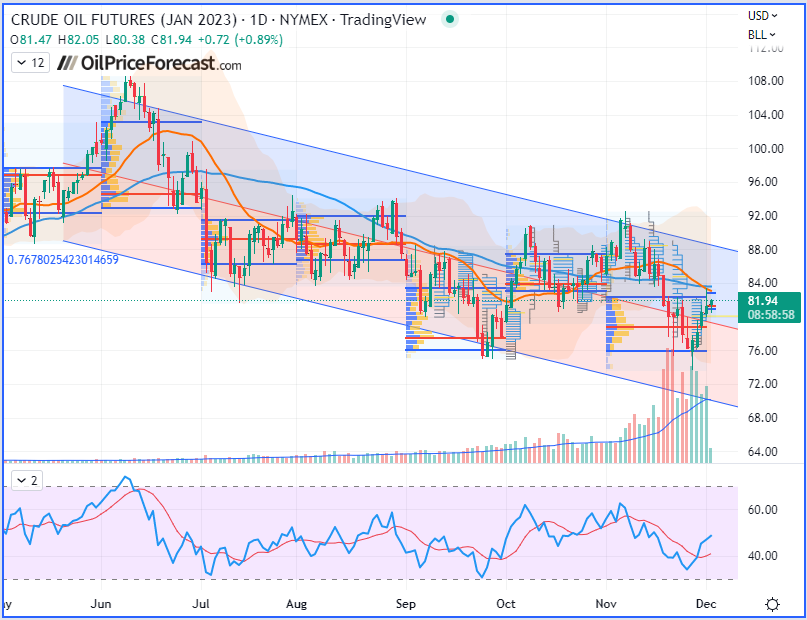

The price of a barrel of West Texas Intermediate (WTI) closed Wednesday down 3% after falling a moment earlier to its lowest level of the year ($71.75 on the January futures contract). As the geopolitical fears were placed in the background, even the EU’s price cap on Russian oil has not really impacted the market, as I mentioned last week, given that Russia has made investments into its own fleet of oil tankers, so they have the option to deliver their Urals crude oil by putting their own conditions or even simply finding other clients eventually.

Already resolutely on the downside for several days as concerns over supply risk are gradually evaporating, the black gold market was encouraged to continue in this downward momentum by the EIA’s weekly report on US crude oil inventories.

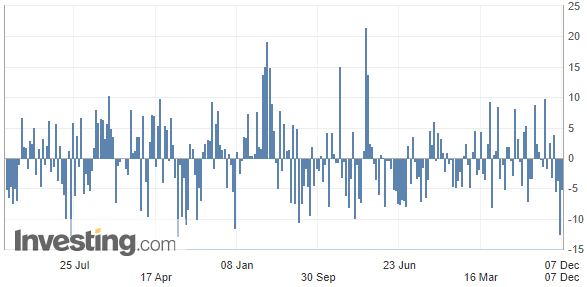

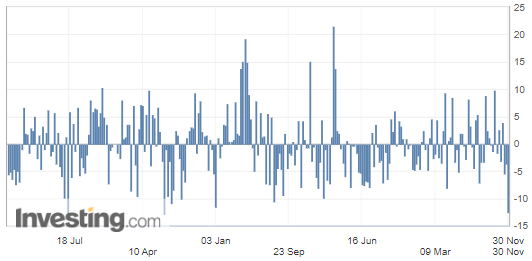

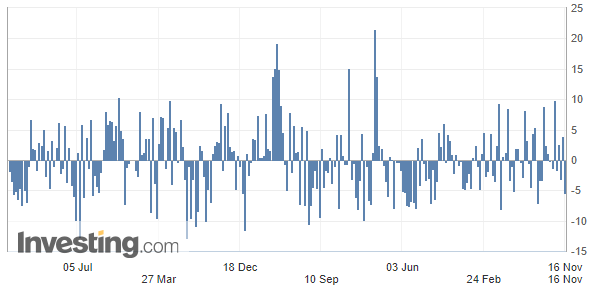

U.S. Crude Oil Inventories

(Source: Investing.com)

Operators ignored the significant contraction of 5.187 million barrels in commercial crude reserves to focus on stocks of refined products to get an overview of US petroleum demand.

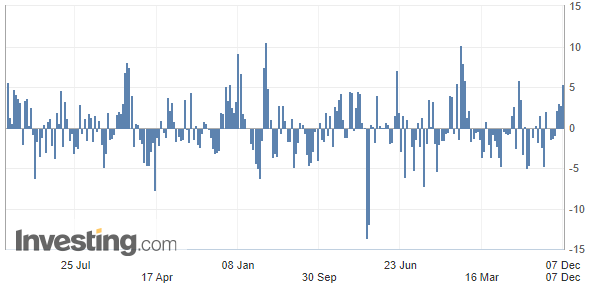

U.S. Gasoline Inventories

(Source: Investing.com)

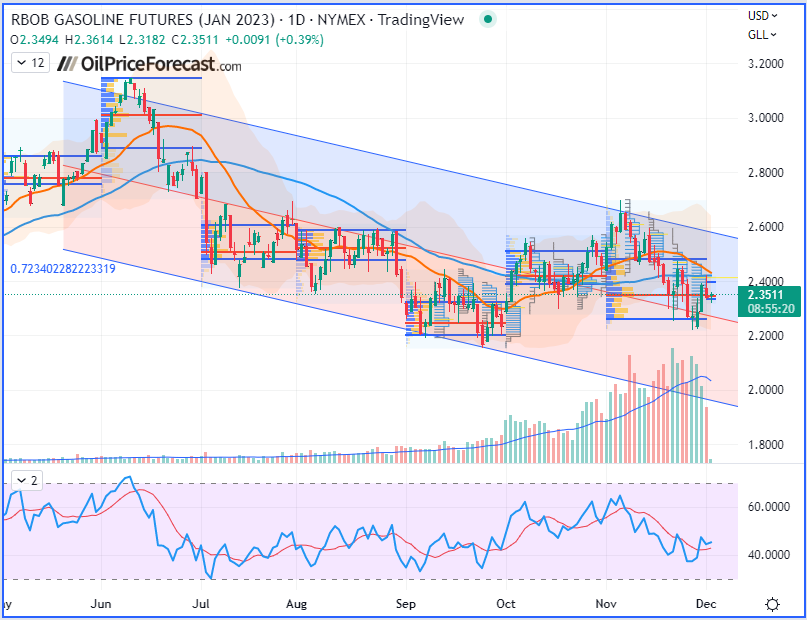

The oil market is sinking due to a significant increase in gasoline stocks, which rose by 5.320

million barrels, nearly doubling expectations (2.7 million barrels).

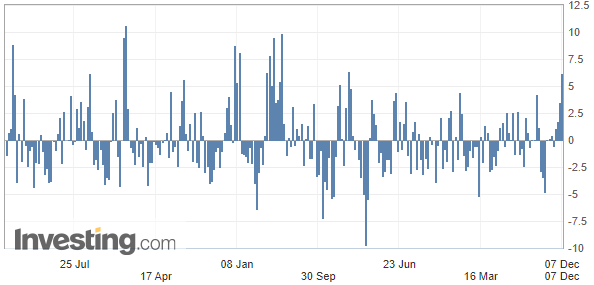

U.S. EIA Weekly Distillates Stocks

Now, regarding the reserves of distilled products – such as diesel, mainly – they also increased significantly, by 6.159 million barrels versus the 2.2 million barrels forecasted.

(Source: Investing.com)

In fact, this figure has to be compared to the demand for refined products in the United States, which remained, last week, below its level of 2021 at the same time, whereas on average over the past four weeks, the demand for gasoline dropped more than 7% lower than a year ago.

Finally, OPEC+’s decision last Sunday (Dec 4th) to maintain their production and not reduce it further, is another bearish factor.

Technical Charts

WTI Crude Oil (CLF23) Futures (January contract, daily chart)

WTI Crude Oil (CLF23) Futures (January contract, 4H chart)

RBOB Gasoline (RBF23) Futures (January contract, daily chart)

Brent Crude Oil (BRNG23) Futures (February contract, daily chart) – Contract for Difference (CFD) UKOIL

That’s all for today, folks! Happy trading!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

What Will Upcoming OPEC+ Mean for Oil Prices?

December 2, 2022, 5:53 PMWhat are the macro-economic, geopolitical, and technical factors driving oil prices this week?

Macroeconomics

On the macroeconomic view, the greenback has kept falling lower against a basket of major currencies – the DXY thus remains further below its yearly regression channel now, while eyeing the next quarterly S2 pivot just located at the $100 mark.

The President of the Federal Reserve (Fed), Jerome Powell, signaled on Wednesday (Nov. 30th) a possible inflection of the monetary policy of the Fed as soon as this month.

U.S. Dollar Currency Index (DXY), daily chart

Geopolitical & Fundamental Analysis

Oil prices ended on a mixed note Thursday (Dec 1st), in the grip of the suspense surrounding the decision, expected this upcoming Sunday, of the Organization of the Petroleum Exporting Countries and their allies (OPEC+) on its production quotas. The cartel meeting will take place on Sunday in a delicate context, marked by the fall in oil prices and the entry into force of new sanctions against Russia. Its members will thus hold a virtual meeting by videoconference, one day before the start of the EU's embargo on imports of Russian crude, which must be accompanied by a price cap. They should vote for a renewal of the previous decision relating to a reduction of 2 million barrels per day, according to an Iranian source, the market being very uncertain with the imminent arrival of a new series of sanctions against Russia.

All members of the European Union, except for Poland (which had pushed for the lowest possible cap), tentatively agreed on Thursday to cap the price of Russian oil transported by sea at $60 a barrel, according to an EU diplomat. This agreement would be accompanied by a readjustment mechanism to maintain the price cap 5% below market price. Following the implementation of such a price cap model, European carriers and insurers will be able to process orders for Russian crude placed by non-EU countries, provided that the latter undertake to pay a price lower than or equal to this cap. However, all this fuss probably won't have much effect on the market since the Russians will simply find other customers to sell their crude oil to.

U.S. Crude Oil Inventories

Commercial crude oil reserves fell sharply last week in the United States, according to figures released Wednesday by the United States Energy Information Agency (EIA), a decline attributed in part to the acceleration of the refinery activity, from below 94% capacity the previous week to 95.2%.

Another element that could explain the significant contraction in commercial stocks is the slowdown in imports (-14%) combined with the acceleration in exports (+16%) of crude oil.

In addition to commercial stocks, strategic reserves also fell last week, by 1.4 million barrels.

Furthermore, last week was both Thanksgiving holiday and Black Friday sales. It's supposed to be a good week for fuel consumption, but it came out down 5% year-on-year.

(Source: Investing.com)

Technical Charts

WTI Crude Oil (CLF23) Futures (January contract, daily chart)

WTI Crude Oil (CLF23) Futures (January contract, 4H chart)

RBOB Gasoline (RBF23) Futures (January contract, daily chart)

Brent Crude Oil (BRNG23) Futures (February contract, daily chart) – Contract for Difference (CFD) UKOIL

That’s all, folks, for today – have a great weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

How Did the Rocket Explosion in Poland Affect the Oil Market?

November 17, 2022, 11:49 AMThe markets were confused after, a.o., speculations about who is responsible for launching missiles that fell near the Polish-Ukrainian border. What about oil?

Macroeconomics

On the macroeconomic view, the greenback explored the lower floor as the DXY fell just below $106 on Nov. 15 – thereby dropping well below (outside) its yearly regression channel with a Pearson’s R (correlation coefficient) near 96 %.

U.S. Dollar Currency Index (DXY), daily chart

Fundamental Analysis

Oil prices fell on Thursday (Nov. 17), with the prospect of a slowing global economy adding to a lower risk of geopolitical escalation as NATO and Washington denied Kiev's accusations that Russia fired missiles against Poland. Now, the oil market is focusing more on the bearish elements, such as poor macroeconomic data in China and low demand.

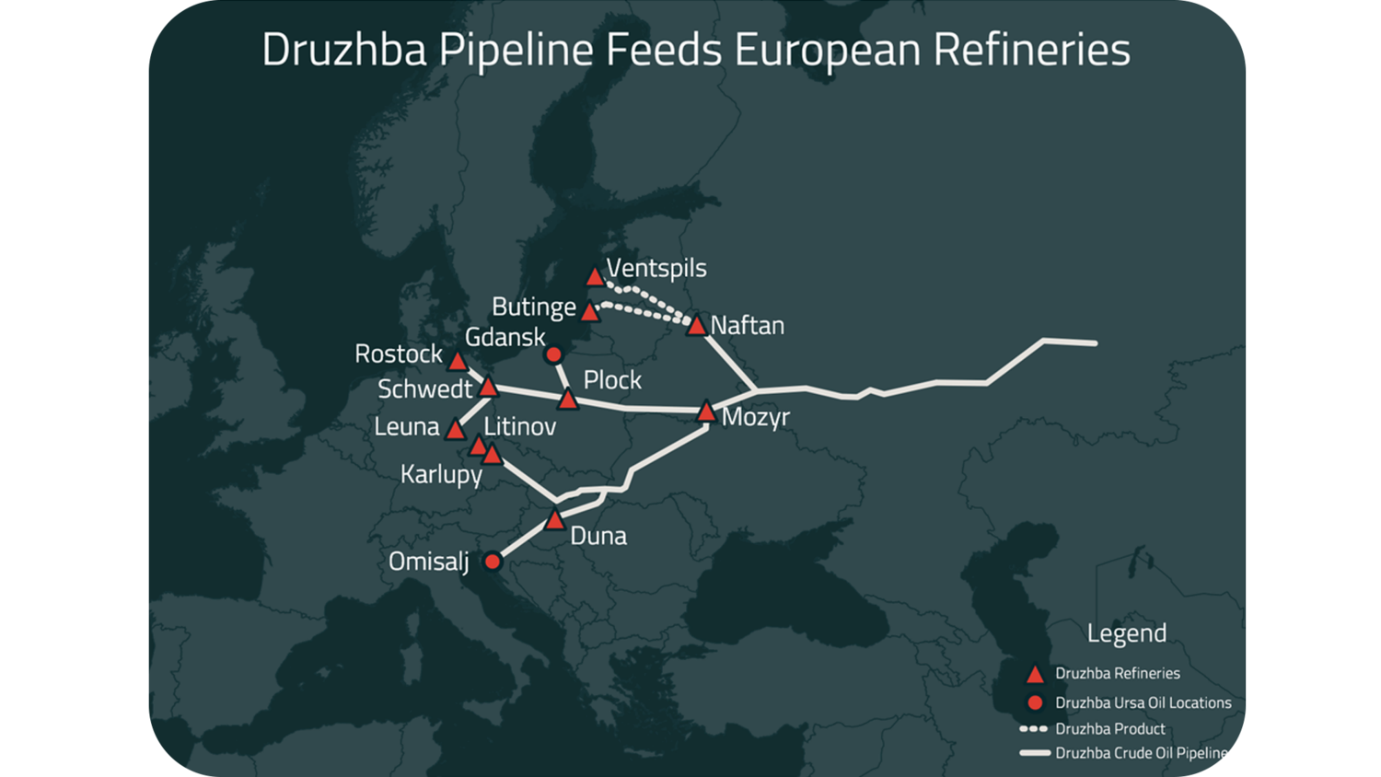

On the supply side, flows in the Druzhba pipeline, which carries Russian oil to Hungary, resumed after a brief blackout that caused a fall in pressure. The supply outlook, however, remains cautious, with the European Union set to impose a ban on Russian crude imports beginning next month and OPEC+ expected to maintain a tight supply..

(Source: Ursa Space)

U.S. Crude Oil Inventories

Commercial crude oil reserves fell sharply last week in the United States, much higher than expected, according to figures released Wednesday by the US Energy Information Agency (EIA). During the week ended November 11, these commercial stocks contracted by 5.4 million barrels, or ten times more than expected. This decline is even more significant given that, at the same time, US strategic crude reserves fell by 4.1 million barrels, which means that inventories fell by almost 10 million barrels in total over the week (or 9.5 million barrels more precisely).

(Source: Investing.com)

Geopolitics

In addition to the news that Russian missiles had fallen into Polish territory, the announcement that an oil tanker had been hit by a projectile attributed to Iran by Washington off the coast of Oman on Tuesday (Nov 15) had slightly pushed prices higher.

After some false press reports that could have led to some worsening escalation in the Black Sea basin these past days, it appears that some mainstream media are correcting their stories following the recent missiles that fell into Poland:

So, it looks like there is no immediate escalation in the conflict from the Russian side, which may temporarily eliminate some short-term crude supply risks, at least globally (in the EU, it is another story).

Technical Analysis

Our members had a successful trade last week, which was liquidated for the most part just before the weekend around the mid-$88s level.

On the daily chart, WTI crude oil (December contract) is moving towards the median of the regression channel (also known as the mean regression line).

WTI Crude Oil (CLV22) Futures (October contract, daily chart)

WTI Crude Oil (CLZ22) Futures (December contract, 4H chart)

RBOB Gasoline (RBV22) Futures (October contract, daily chart)

Brent Crude Oil (BRNZ22) Futures (December contract, daily chart) – Contract for Difference (CFD) UKOIL

A Word on Natural Gas

Following spot gas prices falling into negative territory last week, liquefied natural gas (LNG) is arriving at an unprecedented level by sea routes, but due to a lack of infrastructure capacity (such as regasification-equipped terminal ports) and concerns in that sector, it looks like natural gas is not finding lots of buyers right now.

That’s all, folks, for today. Stay tuned for our next oil trading alert!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM