-

The Crumbling Attempt of the Oil Bulls

December 3, 2019, 9:18 AM

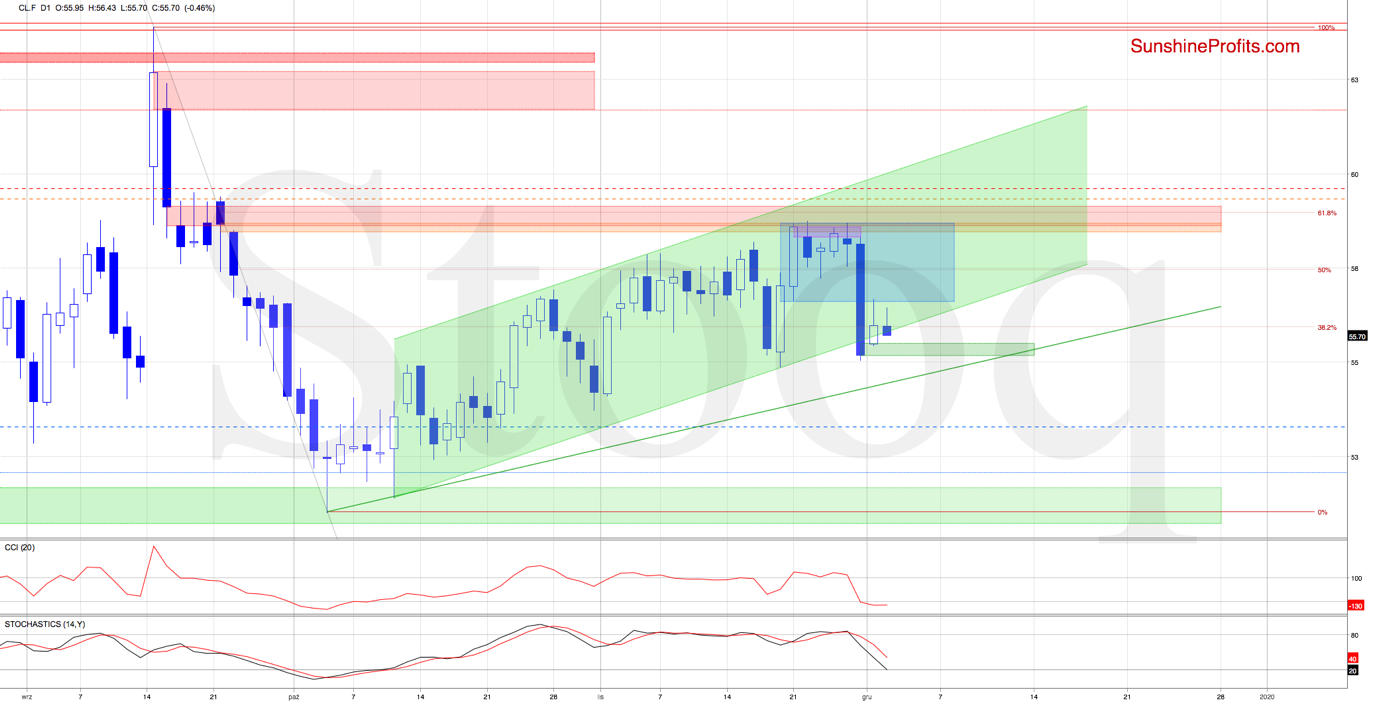

Yesterday, we wrote:

(...) the bulls opened the week with a green gap, which has triggered modest improvement in the following hours. The bulls are fighting to invalidate the earlier breakdown below the green trend channel, and have reached the lower border of the blue consolidation on intraday basis. Prices have pulled back since though, and are currently trading at around $56.00.

Such price action looks like verification of the earlier breakdown. Coupled with the sell signals of the daily indicators, it suggests that lower crude oil prices are just around the corner.

The situation developed in line with the above, and prices closed far away from the previously broken lower border of the blue consolidation.

Earlier today, the bulls attempted to move higher once again, yet failed. Another downswing is unfolding as the commodity is trading at around $55.65. Should we see it stick and move yet lower, where will the bears aim to reach? Let's quote our yesterday's words:

(...) the first target for the sellers will be today's green gap.

Additionally, should the sellers manage to close yesterday's green gap, the way to the green support line based on the October lows would be open.

Summing up, the retracement attempt of Friday's slide mostly fizzled out, and today is bringing us another oil downswing. The downside reversal at the strong combination of resistances: the 61.8% Fibonacci retracement, and the three gaps (pink, red and orange ones) is still in play. The sell signals of the daily indicators support lower prices, and the short position remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products. And besides, you can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. Subscribe today and stay informed at very preferred terms.

-

Oil Sliding Faster Than You Can Blink

December 2, 2019, 11:06 AM

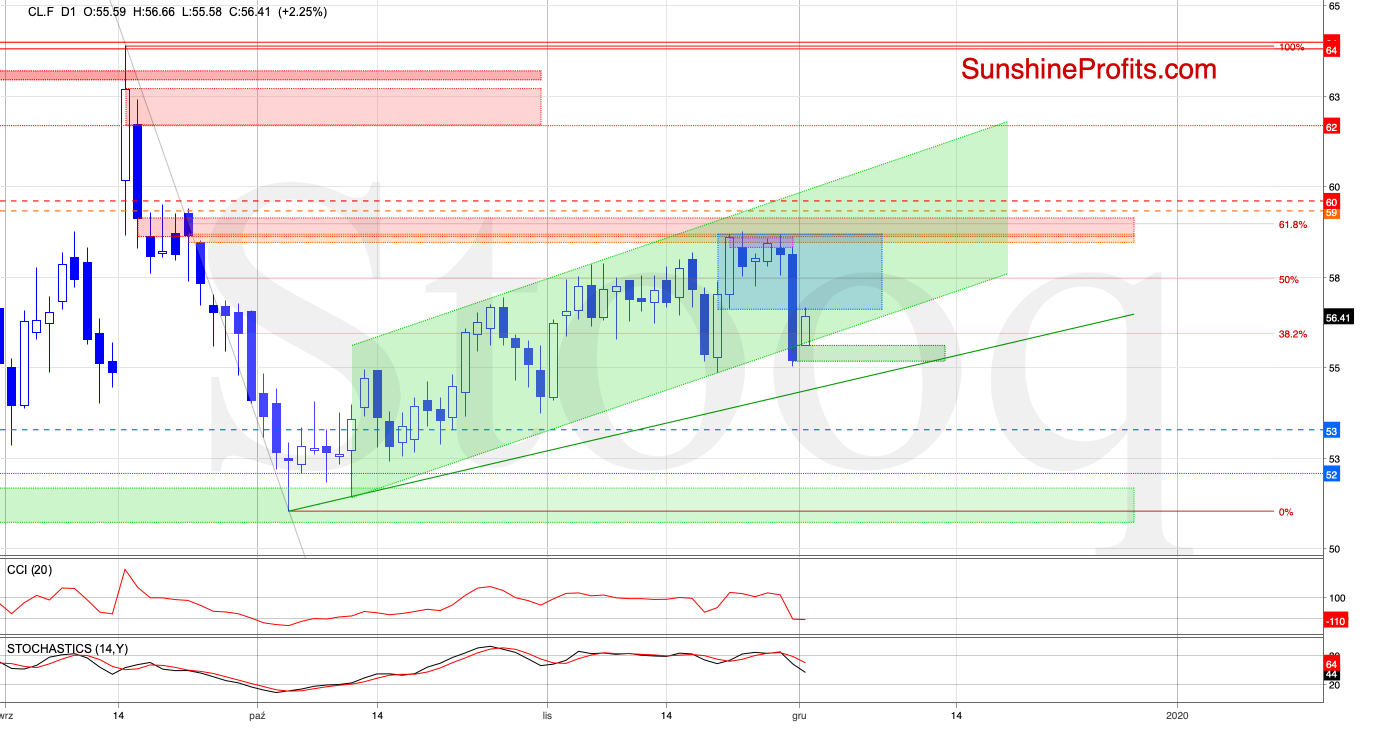

Crude oil futures declined sharply on Friday. The steep slide's result was a breakdown below the lower border of the rising green trend channel. As the prices closed the day below the formation, it's clearly a bearish development.

Despite this setback, the bulls opened the week with a green gap, which has triggered modest improvement in the following hours. The bulls are fighting to invalidate the earlier breakdown below the green trend channel, and have reached the lower border of the blue consolidation on intraday basis. Prices have pulled back since though, and are currently trading at around $56.00.

Such price action looks like verification of the earlier breakdown. Coupled with the sell signals of the daily indicators, it suggests that lower crude oil prices are just around the corner.

Should we see such price action and another downside reversal today, the first target for the sellers will be today's green gap.

Summing up, the bulls' difficulties in overcoming the new set of resistances: the 61.8% Fibonacci retracement, and the three gaps (pink, red and orange ones) were swiftly resolved to the downside on Friday. The steep slide took crude oil below the lower border of the rising green trend channel. Despite today's bullish opening gap, the buyers are having trouble holding onto their gains. The sell signals of the daily indicators suggest upcoming downswing continuation. The short position remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products. And besides, you can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. Subscribe today and stay informed at very preferred terms.

-

Crude Oil Going From Strength to Strength? Far From It

November 27, 2019, 7:12 AM

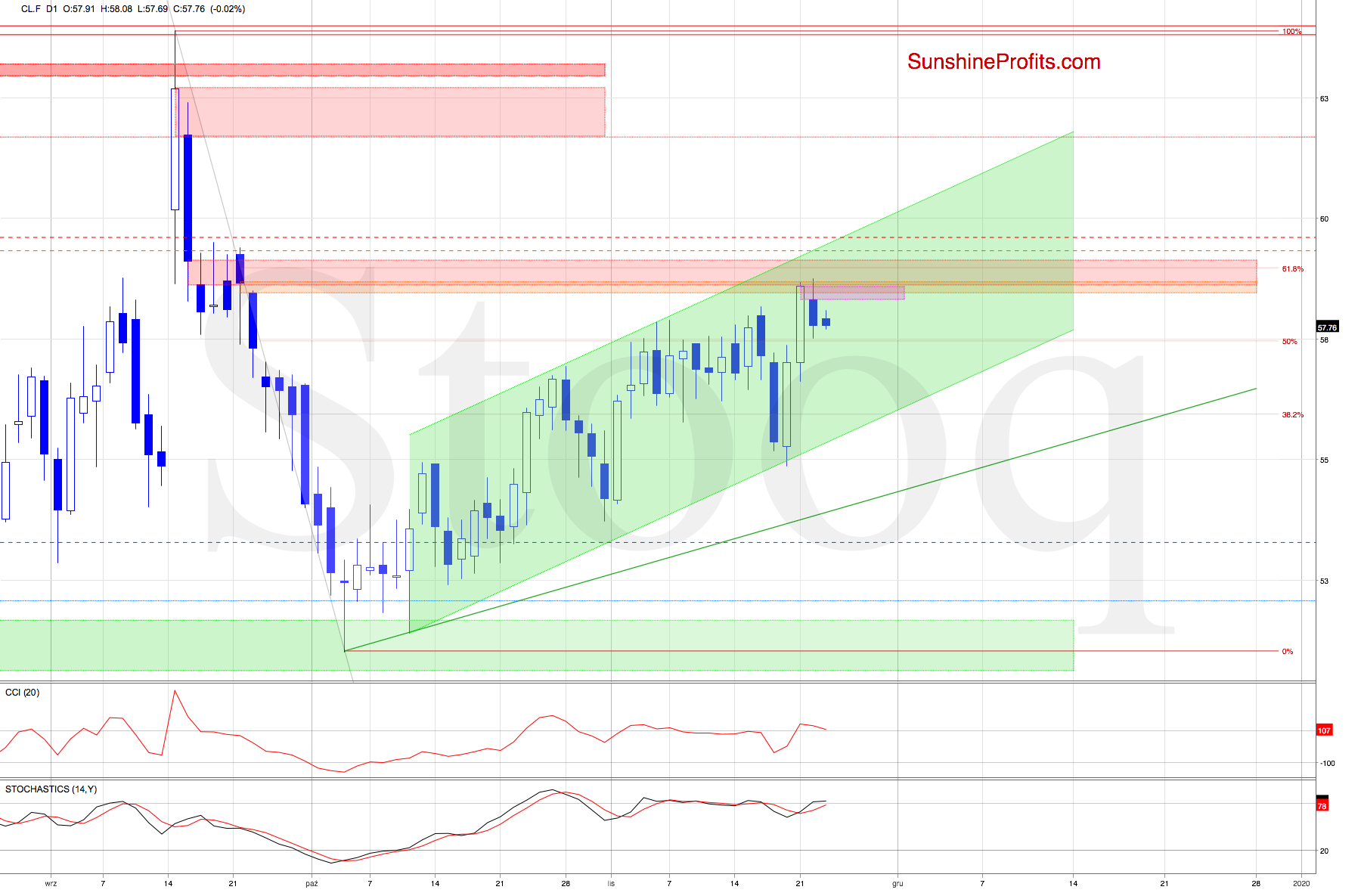

While crude oil futures moved higher yesterday, the bulls had no success closing any of the open three gaps - neither the pink, nor the orange, nor the red one. This relative weakness triggered a pullback and the futures finished the day below the orange gap.

Earlier today, the futures opened with yet another bearish gap, which by itself doesn't bode well for the bulls. This is especially so when we factor in the nearest key resistance area created by the above-mentioned three gaps and the 61.8% Fibonacci retracement.

As long as the gaps keep putting a stop to the bulls' effort, the way higher is blocked and reversal remains just around the corner. Should we see prices decline from here, the lower border of the blue consolidation and the lower border of the rising green trend channel will likely be tested in the coming days.

Summing up, despite yesterday's upswing, the bulls are facing difficulty overcoming the new set of resistances: the 61.8% Fibonacci retracement, and the three gaps (pink, red and orange ones). There's also the upper border of the rising green trend channel and the Sept 18-23 peaks in the proximity. This formidable combination of resistances could trigger a reversal shortly, and the short position is justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products. And besides, you can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. Subscribe today and stay informed at very preferred terms.

-

Oil Is Clinging Below a Powerful Combo of Resistances

November 26, 2019, 9:26 AM

The overall short-term situation hasn't changed much since yesterday. Crude oil futures keep trading in a tight range below a combination of several key resistances. These are the three gaps (marked on the chart with pink, orange and red) and the 61.8% Fibonacci retracement.

As long as the gaps keep putting a stop to the bulls' effort, the way higher is blocked and reversal remains just around the corner. Should we see prices decline from here, the lower border of the rising green trend channel will likely be tested in the coming days.

Summing up, the bulls face ongoing issues overcoming the new set of resistances: the 61.8% Fibonacci retracement, and the three gaps (pink, red and orange ones). There's also the upper border of the rising green trend channel and the Sept 18-23 peaks in the proximity. This formidable combination of resistances could trigger a reversal shortly, and the short position is justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products. And besides, you can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. Subscribe today and stay informed at very preferred terms.

-

Monday Bringing No Breakthrough for the Oil Bulls

November 25, 2019, 9:40 AM

We wrote these words in our Friday's Alert:

(...) Crude oil has broken above its previous peaks, and closed the September gap. While these are certainly bullish developments, the volume of yesterday's upswing declined. This puts a question mark over the sustainability of higher prices.

This is especially the case when we factor in the fact that black gold has climbed to the strong resistance area created by the 61.8% Fibonacci retracement, and the red and orange gaps. This strong combo is further reinforced by the upper border of the rising green trend channel and the Sept 18-23 peaks.

We went on to mention that the Friday's bearish pink gap:

(...) suggests that the above-mentioned mix of resistances could stop the bulls and trigger a reversal in the coming week.

Such a scenario will be more likely and reliable if we see the commodity close below the pink gap later in the day.

The situation developed in line with the above assumptions, and the bears pushed black gold lower on Friday. As the price finished below the pink gap, it increases the likelihood of further deterioration in the coming days.

Should we see such price action, the way to the lower border of the rising green trend channel would be open.

Summing up, the bulls have issues overcoming the new set of resistances: the 61.8% Fibonacci retracement, and the red and orange gaps. There's also the upper border of the rising green trend channel and the Sept 18-23 peaks in the proximity. As Friday's pink gap remained unclosed, the resistances could trigger a reversal shortly. The short position is justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products. And besides, you can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. Subscribe today and stay informed at very preferred terms.

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM