-

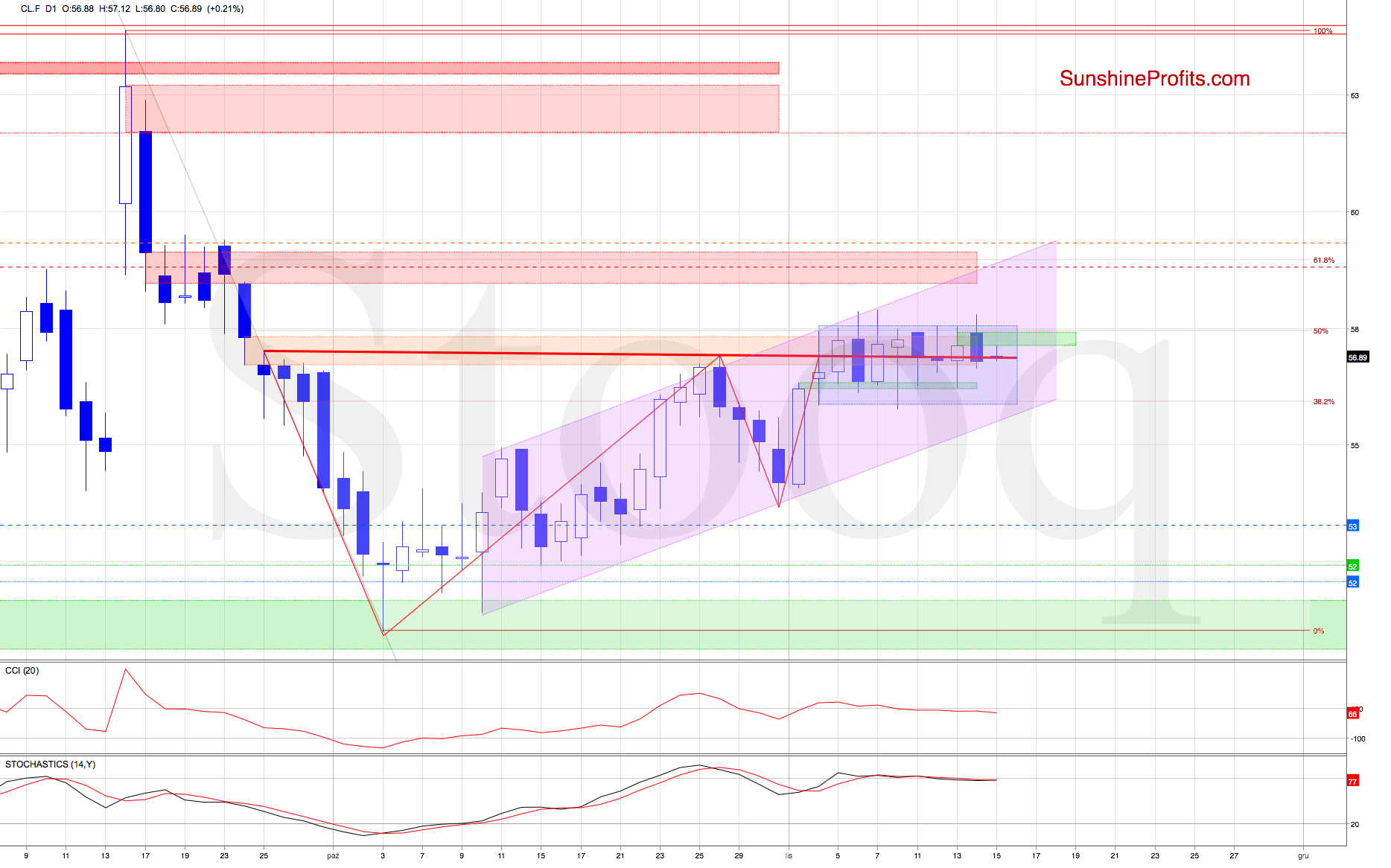

Yesterday's Breakout Attempt Invalidated. Again

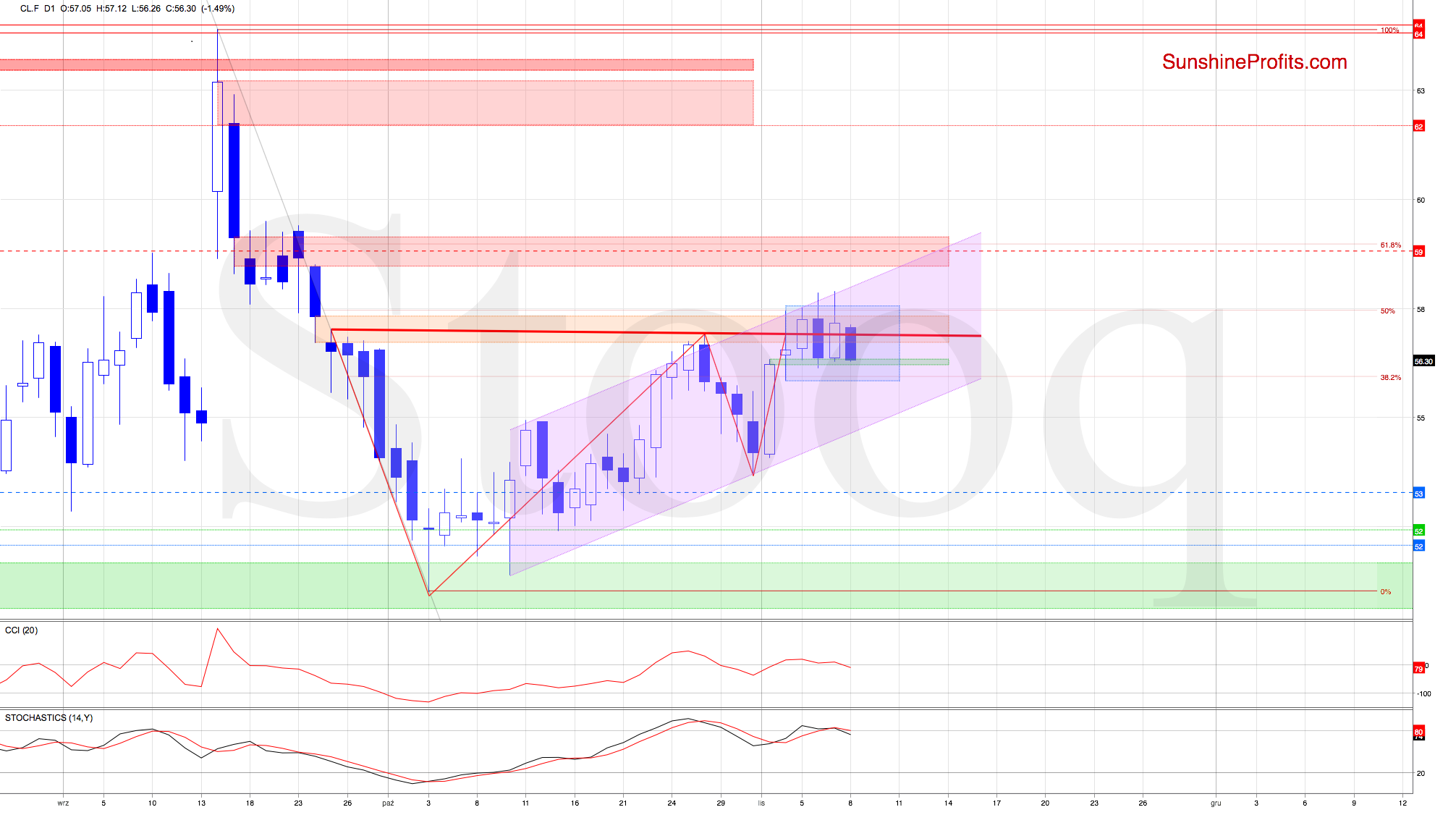

November 15, 2019, 8:36 AMLet's take a closer look at the chart below (chart courtesy of www.stooq.com ) and assess the likely crude oil price path ahead.

Although black gold futures moved higher after our Alert was posted, the bulls couldn't sustain their breakout above the upper border of the blue consolidation and the upper border of the orange gap. That's for the 9th time and counting that they didn't manage to close the day above these major resistances.

This how of weakness triggered further deterioration, and the futures slipped below the yesterday's green gap. The prices closed right there, below this support, which doesn't bode well for further rally. That also marks a close below the red support/resistance line.

Earlier today, the bulls attempted to move higher, but haven't even reached above yesterday's green gap. It hints at their weakness today too.

The CCI and the Stochastic Oscillator generated their sell signals, increasing the probability of further deterioration in the very near future.

Should we see such price action and the futures extend decline from here, the first downside target for the bears will be the lower border of the consolidation followed by the lower border of the rising purple trend channel.

Summing up, the bulls couldn't keep gained ground yesterday, and yesterday's downswing closed the opening bullish gap. The price action reverted back below the key resistances, favoring the chances of an upcoming reversal. The short position remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about our current positions and levels to watch. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

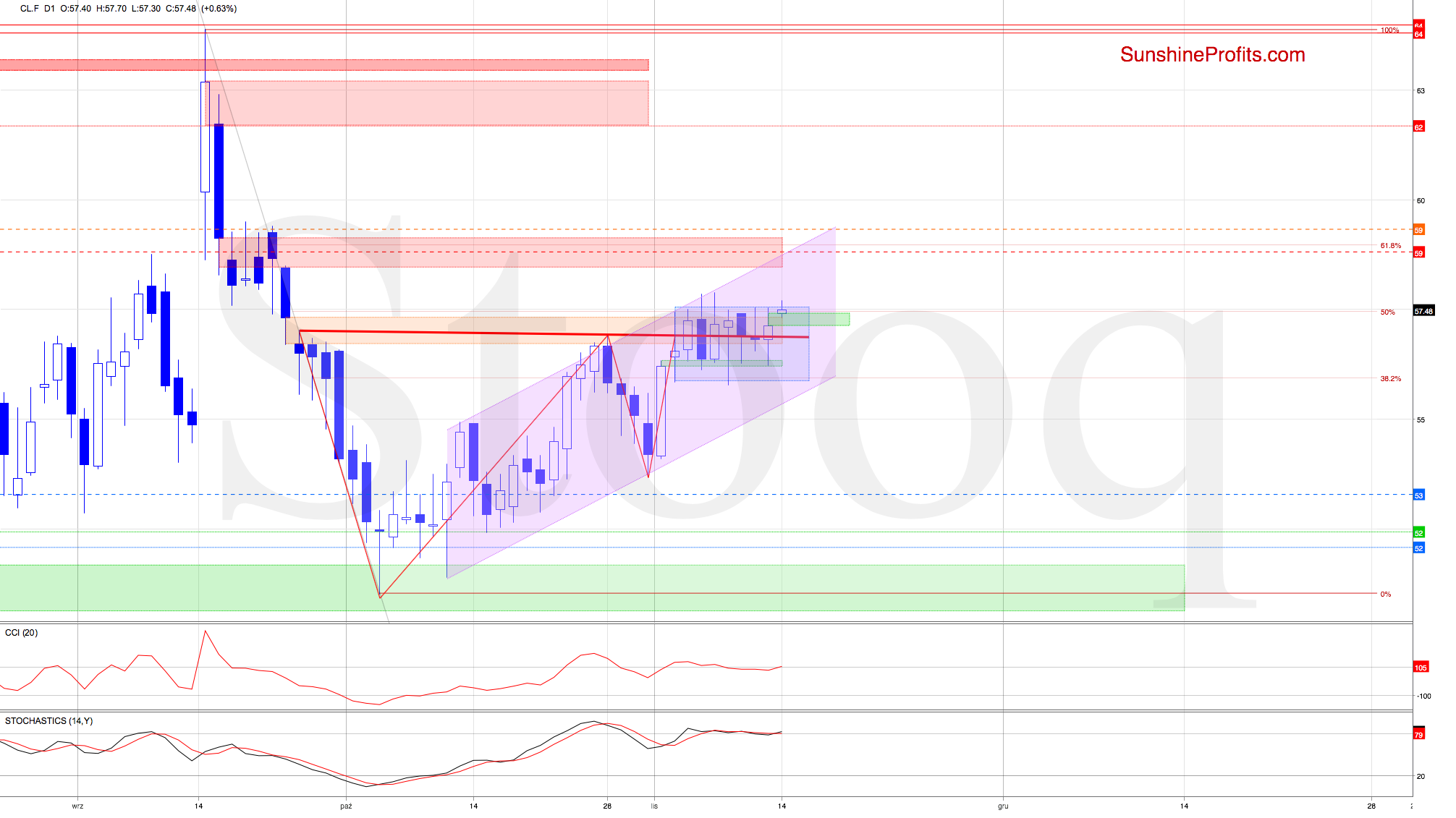

Another Daily Oil Reversal, Yet No Breakout Above the Consolidation

November 14, 2019, 8:16 AMLet's take a closer look at the chart below (chart courtesy of www.stooq.com ) and examine what's the likely crude oil price path ahead.

Yesterday's session oil brought us an invalidation of the earlier breakdown below the red line and lower border of the orange gap, but the bulls just couldn't break above the upper border of the blue consolidation.

They've carried on today though, and the oil futures opened with the green gap that serves as an additional support right now. The prices are however still below key resistances, increasing the probability that a reversal is just around the corner.

Summing up, oil reversed higher yesterday, and the bulls are eyeing additions to their gains today. Their opening gap serves as a support right now. The prices however still remain below the key resistances, favoring the chances of an upcoming reversal. The short position remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about our current positions and levels to watch. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

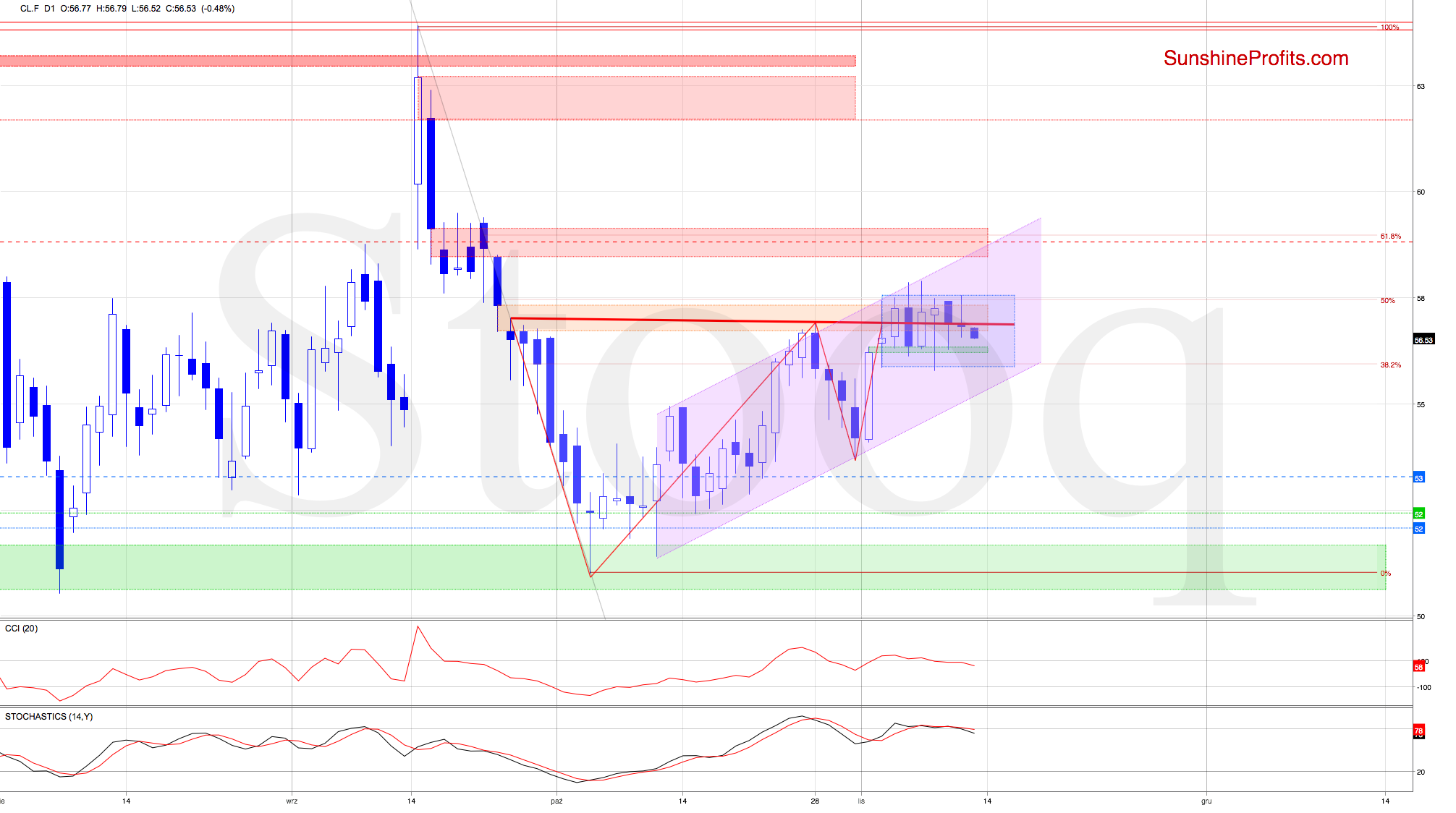

The Unfolding Oil Decline

November 13, 2019, 7:53 AMLet's take a closer look at the chart below (charts courtesy of www.stooq.com and www.stockcharts.com ) and examine what's the likely crude oil price path ahead.

The short-term situation still remains unchanged as black gold keeps trading inside the blue consolidation around the red support/resistance line. Examination of yesterday's price action shows that the bulls failed to break above the upper border of the consolidation or to close the orange gap. As that happened for the 7th time in a row, it doesn't bode well for further rally.

The oil futures closed yesterday below the red line, invalidating yet another earlier breakout attempt. This certainly shows the buyers' weakness, and has already triggered deterioration earlier today. The futures extended losses, increasing the probability of a test of the lower border of the consolidation in the very near future.

Should we see such price action and the breakdown below the lower border of the formation, the next objective for the sellers will be to test of the lower border of the rising purple trend channel.

If they break below this support, the way south targeting at least the late-Oct low would be open.

Let's look at the daily indicators now. Both the CCI and the Stochastic Oscillator generated their sell signals, lending further support to the bears.

Is there a fundamental catalyst on the horizon? In line with our Economic Calendar publication, our eyes are set on the oil inventories to be released tomorrow.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It discusses also the current situation in the NYSE Arca Oil Index (the XOI). The full Alert includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

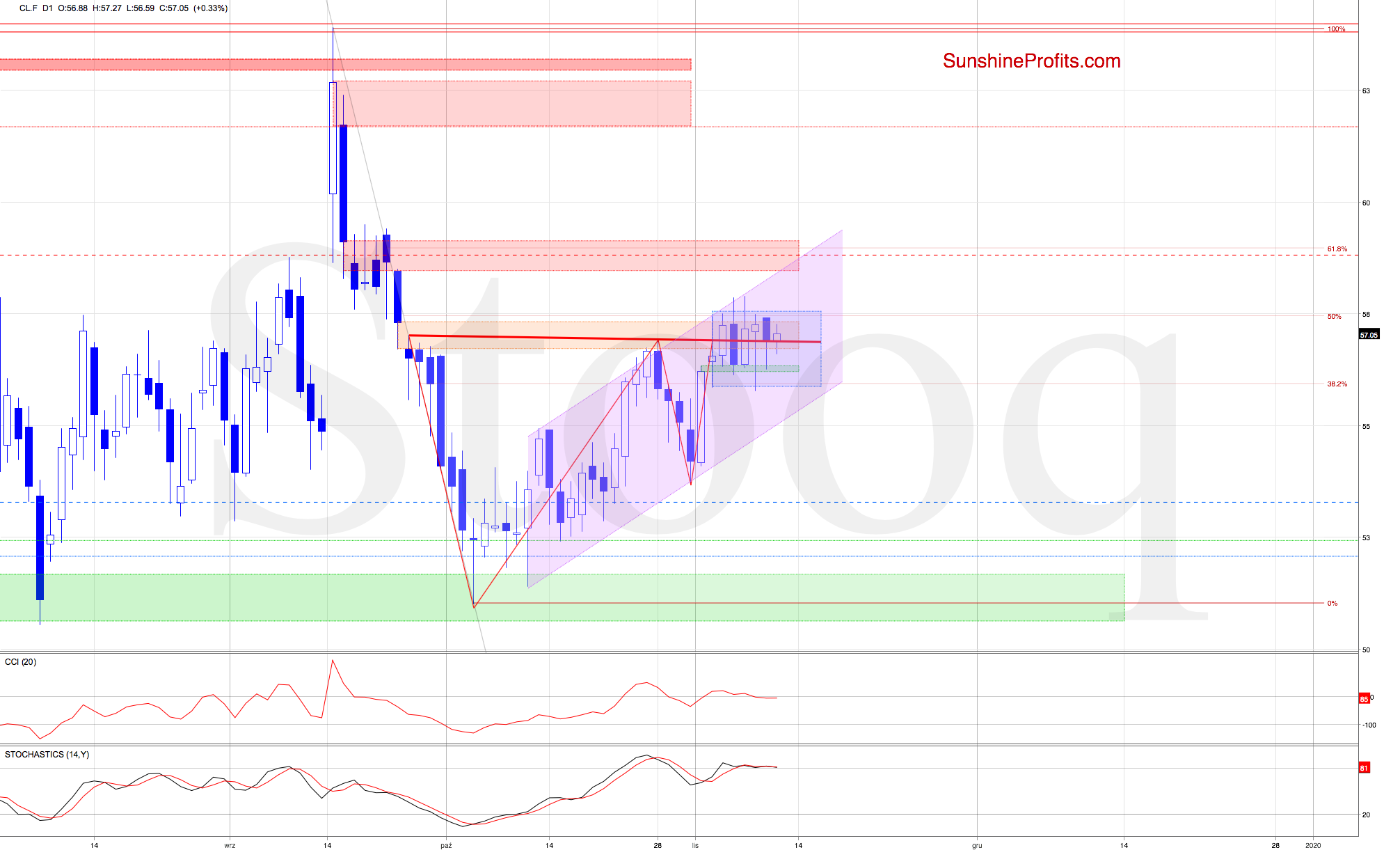

Oil Consolidating and Getting Ready to Move

November 12, 2019, 8:36 AMLet's take a closer look at the chart below (chart courtesy of www.stooq.com ) and examine what's the likely crude oil price path ahead.

In our Friday's analysis, we noted that:

(...) The short-term situation hasn't changed much. Crude oil futures keep trading inside the blue consolidation and around the red support/resistance line and the 50% Fibonacci retracement.

They're also still trading inside the rising purple trend channel below the upper border of the orange gap. Therefore as long as there is no breakout above these resistances another attempt to move lower is likely.

Yesterday's session brought us renewed selling pressure, yet the bears couldn't keep all of their gains till the closing bell. The bulls' response earlier today hasn't been strong exactly (crude oil futures trade at around $56.95 as we speak), and therefore the above observations ring true also today.

Summing up, today's oil upswing seems unable to overcome yesterday's move lower. While the short-term picture remains unchanged, prices keep trading around the orange resistance, the horizontal red line and the 50% Fibonacci retracement. The bears' objectives are closing the green gap and breaking below the lower border of the blue consolidation reinforced by the 38.2% Fibonacci retracement. The short position remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about our current positions and levels to watch. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

The Oil Reversal in Progress

November 8, 2019, 7:51 AMLet's take a closer look at the chart below (chart courtesy of www.stooq.com ) and assess the likely crude oil price path ahead.

We wrote these words yesterday, and they ring true also today:

(...) The short-term situation hasn't changed much. Crude oil futures keep trading inside the blue consolidation and around the red support/resistance line and the 50% Fibonacci retracement.

They're also still trading inside the rising purple trend channel below the upper border of the orange gap. Therefore as long as there is no breakout above these resistances another attempt to move lower is likely.

Yesterday's candle shows that bulls have been rejected at the upper border of the blue consolidation, and the bears keep the initiative today. They're currently working to close the bullish green gap, as black gold is trading below $56.25 as we speak. The daily indicators are supporting the downside move, and the bears' next target would be to break down from the blue consolidation.

Summing up, after yesterday's upswing that partially fizzled out, crude oil is moving lower today. While the short-term picture remains unchanged, prices have backed down from the orange resistance and back below the horizontal red line and the 50% Fibonacci retracement. The bears' objectives are closing the green gap and breaking below the lower border of the blue consolidation reinforced by the 38.2% Fibonacci retracement. The short position remains justified.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about our current positions and levels to watch. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM