-

Capitalizing on Plunging Oil as Iran Tensions Subside

January 9, 2020, 6:08 AM

Yesterday, we wrote:

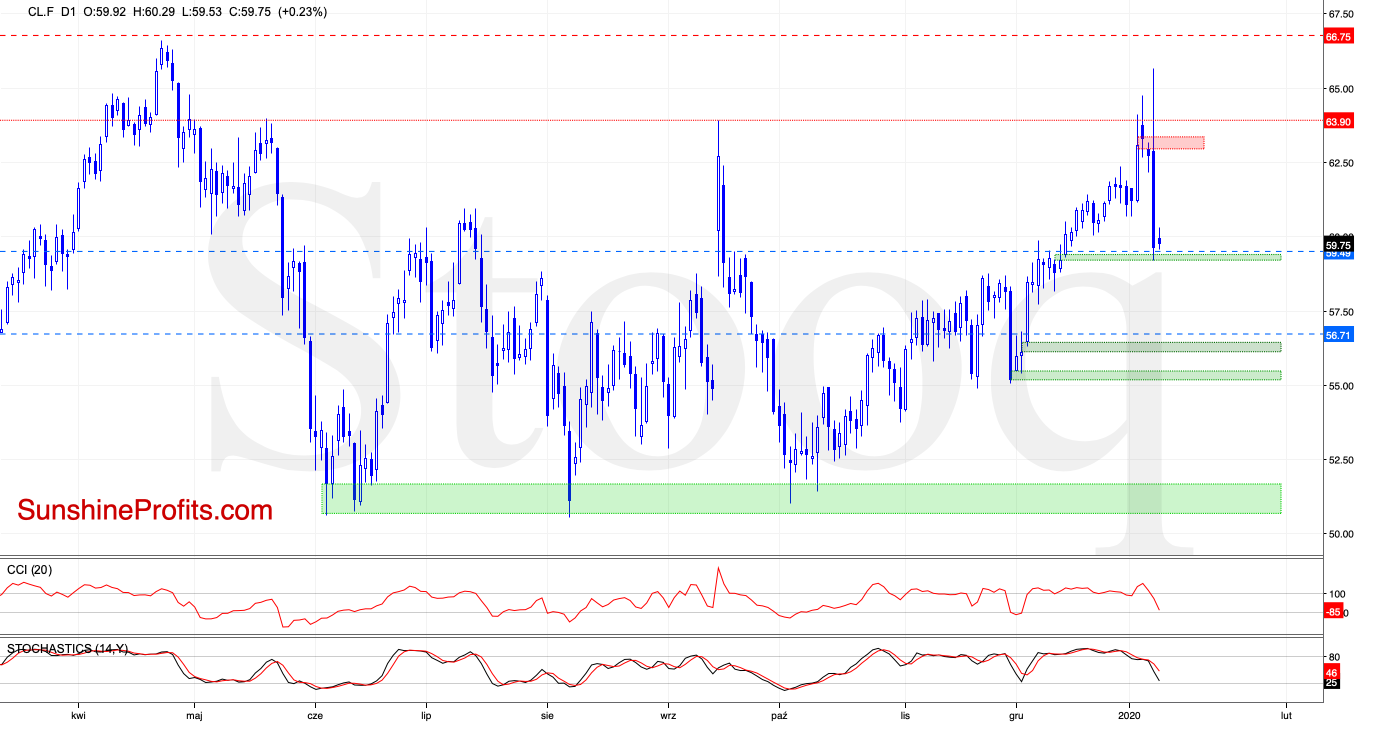

(...) Although crude oil futures moved higher after Wednesday's open and broke above the previous peaks, this improvement was very temporary, and the bears took over in the following hours.

As a result, the futures came back below the lower border of yesterday's red gap, creating a very long upper shadow. This is clearly a bearish sign, suggesting further deterioration.

(...) Should it be the case and the futures extend losses from here, we'll likely see a decline to at least the nearest bullish green gap created in mid-December. This is where also the 38.2% Fibonacci retracement is, which together with the gap serves as the closest short-term support.

The situation indeed developed in tune with the above scenario, and crude oil futures declined sharply during yesterday's session to our downside target, making our short positions profitable.

Despite this drop, the gap remains open and the above-mentioned Fibonacci retracement continues to serve as a support. These suggest that we could see a rebound from here in the very near future. Therefore, closing short positions and taking sizable profits off the table (as a reminder, we opened them when crude oil futures were trading at around $62.80) is justified from the risk/reward perspective.

Nevertheless, should we see a successful drop below these supports, we'll likely reopen short positions. We may even reopen them at higher levels after the futures rebound.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. Apart from the specifics of our brand new position, it includes both the daily perspective and more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

The Oil Spike and Its Just As Fast Reversal

January 8, 2020, 5:50 AM

Although crude oil futures moved higher after Wednesday's open and broke above the previous peaks, this improvement was very temporary, and the bears took over in the following hours.

As a result, the futures came back below the lower border of yesterday's red gap, creating a very long upper shadow. This is clearly a bearish sign, suggesting further deterioration.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. Apart from the specifics of our brand new position, it includes both the daily perspective and more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Can the Oil Bulls Really Move Any Higher?

January 7, 2020, 10:22 AM

Yesterday, we wrote the following:

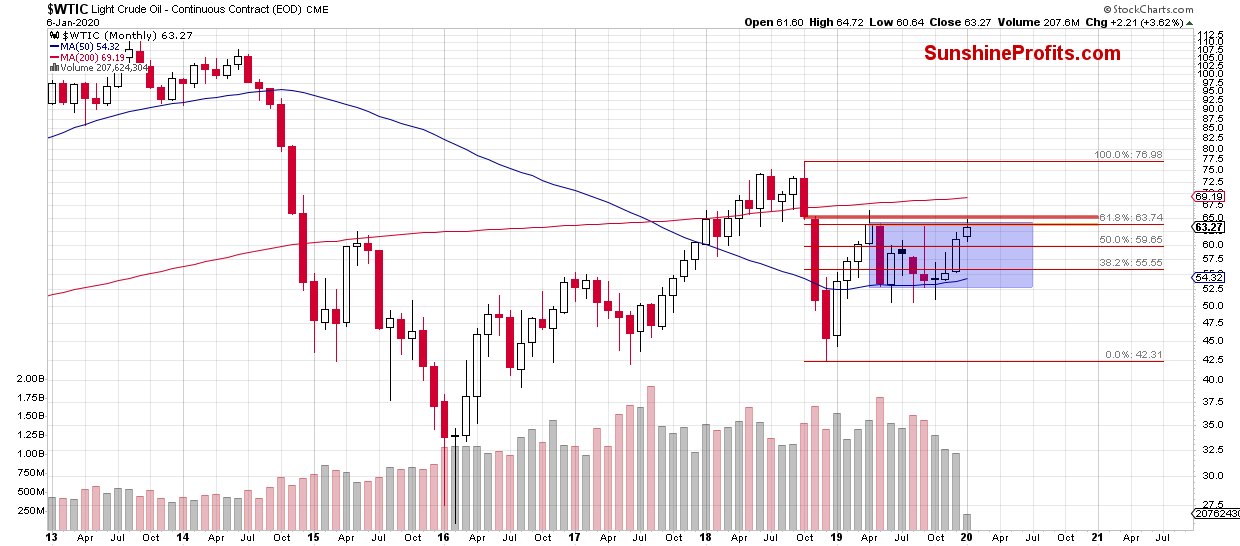

(...) crude oil is still trading inside the blue consolidation below three very important resistances (the red and orange bearish gaps and the 61.8% Fibonacci retracement), which form the key resistance zone for the coming week(s).

Additionally, the volume is decreasing on a monthly basis, which raises the probability of a reversal in the near future. Therefore, as long as there is no successful breakout above the mentioned consolidation and resistances, another move to the downside is very likely.

The above chart shows that recent increases took crude oil slightly above the orange gap and the 61.8% Fibonacci retracement. Despite this improvement, the bulls failed to push prices higher, and a pullback resulting in a drop below the above-mentioned levels followed.

This way, black gold invalidated the earlier tiny breakouts, which together with the proximity to the red gap increases the likelihood of further deterioration in the coming month.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. Apart from the specifics of our brand new position, it includes both the daily perspective and more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

The All-Out View of Oil's Spike

January 6, 2020, 11:30 AM

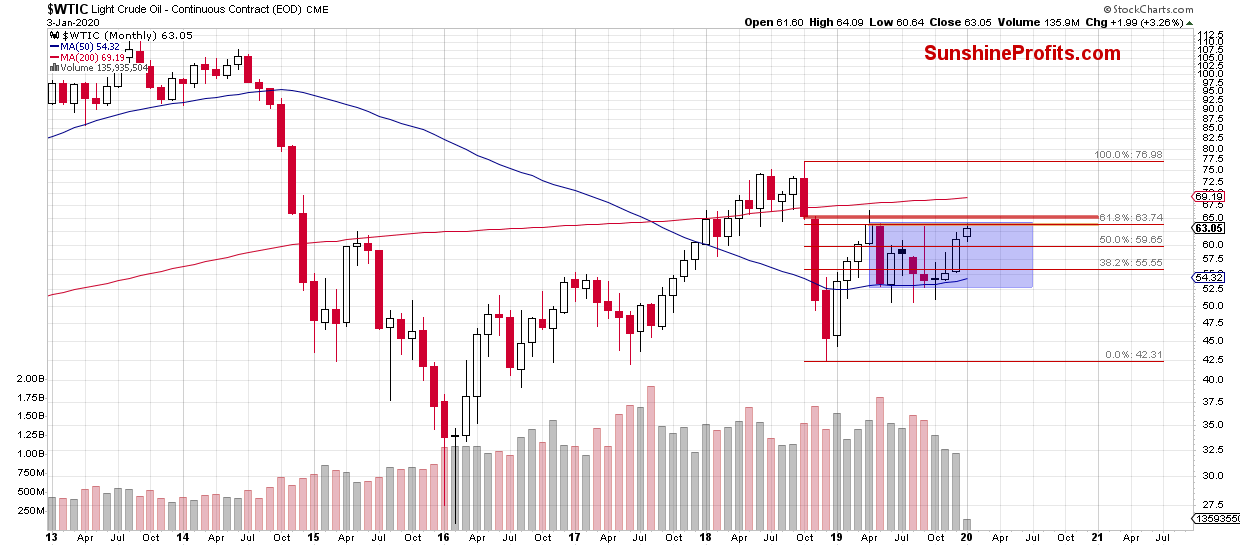

Let's put the geopolitical gyrations in oil into a proper perspective by taking a look at the monthly chart. The overall situation hasn't changed much as crude oil is still trading inside the blue consolidation below three very important resistances (the red and orange bearish gaps and the 61.8% Fibonacci retracement), which form the key resistance zone for the coming week(s).

Additionally, the volume is decreasing on a monthly basis, which raises the probability of a reversal in the near future. Therefore, as long as there is no successful breakout above the mentioned consolidation and resistances, another move to the downside is very likely.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Oil Trading Alert - this analysis' full version. It includes more details about which levels to watch and why. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM