Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

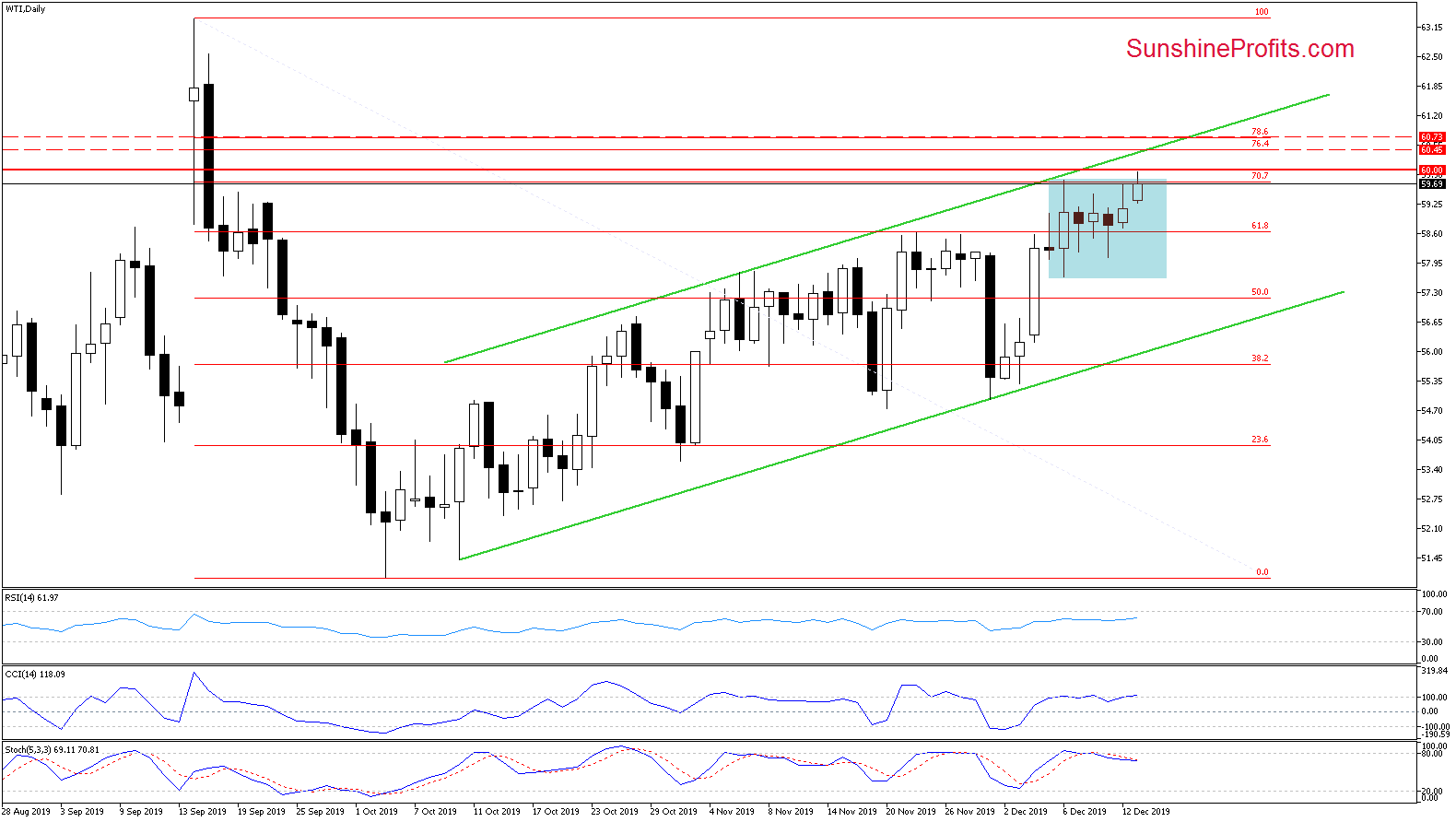

Crude oil futures opened today's trading above yesterday's close, which means that another bullish gap was created. The bulls took the lead and the resulting upswing brought us a short-lived breakout above the upper border of the blue consolidation.

This move took the futures to the psychological barrier of $60, increasing the probability that reversal may be just around the corner. This is especially the case when we factor in the current extended position of the daily indicators and the proximity to the next important resistance zone created by the upper border of the rising green trend channel, the 76.4% and 78.6% Fibonacci retracements.

Let's connect the dots. Should we see reliable signs pointing to the bulls' weakness, we'll consider opening short positions.

Summing up, the bulls opened with another gap today, attempting a breakout above the upper border of the blue consolidation. As the oil futures are approaching the psychologically important level of $60, the probability of a reversal looms large. The extended daily indicators and the proximity of another strong resistance zone (created by the upper border of the rising green trend channel, the 76.4% and 78.6% Fibonacci retracements) would support that. Should we see reliable signs of the bulls' weakness, we'll consider opening short positions.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist