Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $59.32 and the initial downside target at $53.28 is justified from the risk/reward perspective.

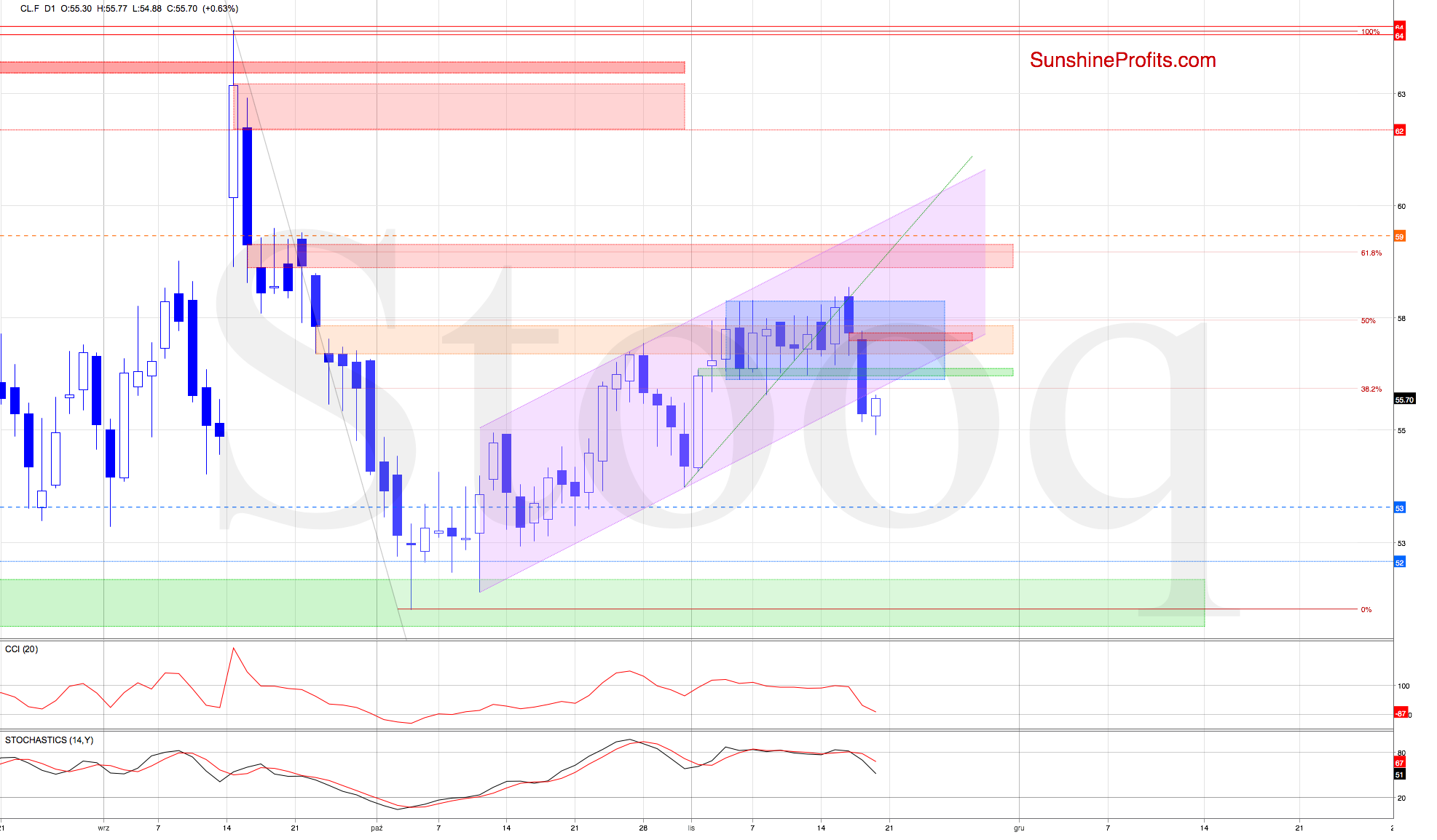

Let's take a closer look at the chart below (chart courtesy of www.stooq.com ) and assess the likely crude oil price path ahead.

Yesterday, we wrote:

(...) Earlier today, the futures opened the day with a bearish red gap, which serves as an additional resistance right now. Additionally, the CCI generated a sell signal while the Stochastic Oscillator is very close to doing the same.

All in all, these signs increase the likelihood of the above-described further decline in the very near future. And indeed, black gold is trading at around $56.00 as we speak.

How low could the bears aim?

(...) the first downside target for the sellers will be the green support gap and then the lower border of the rising purple trend channel.

The situation indeed developed in line with the above, and crude oil futures have since sharply extended losses.

The futures not only slipped below the green gap to close the day below the lower border of the formation, but also moved below the lower border of the rising purple trend channel. As a result, the green gap has been closed, and the futures finished below the rising purple trend channel.

Coupled with the sell signals generated by the daily indicators, it suggests that further deterioration still lies ahead of us.

The futures slightly rebounded compared to the size of yesterday's candlestick earlier today. As long as they remain below the lower border of the trend channel, all upswings would be nothing more than verifications of the earlier breakdown.

What if the situation develops in tune with the above and the crude oil futures decline? The next downside target for the sellers will be around $53.73-$54.13, right at the late October lows.

Summing up, crude oil powerfully reversed lower yesterday, breaking below several important supports. Today's rebound looks like a verification of the earlier breakdown, and further downside remains probable. This is supported by both daily indicators' sell signals. The short position remains justified.

Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $59.32 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist