Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $59.32 and the initial downside target at $53.28 is justified from the risk/reward perspective.

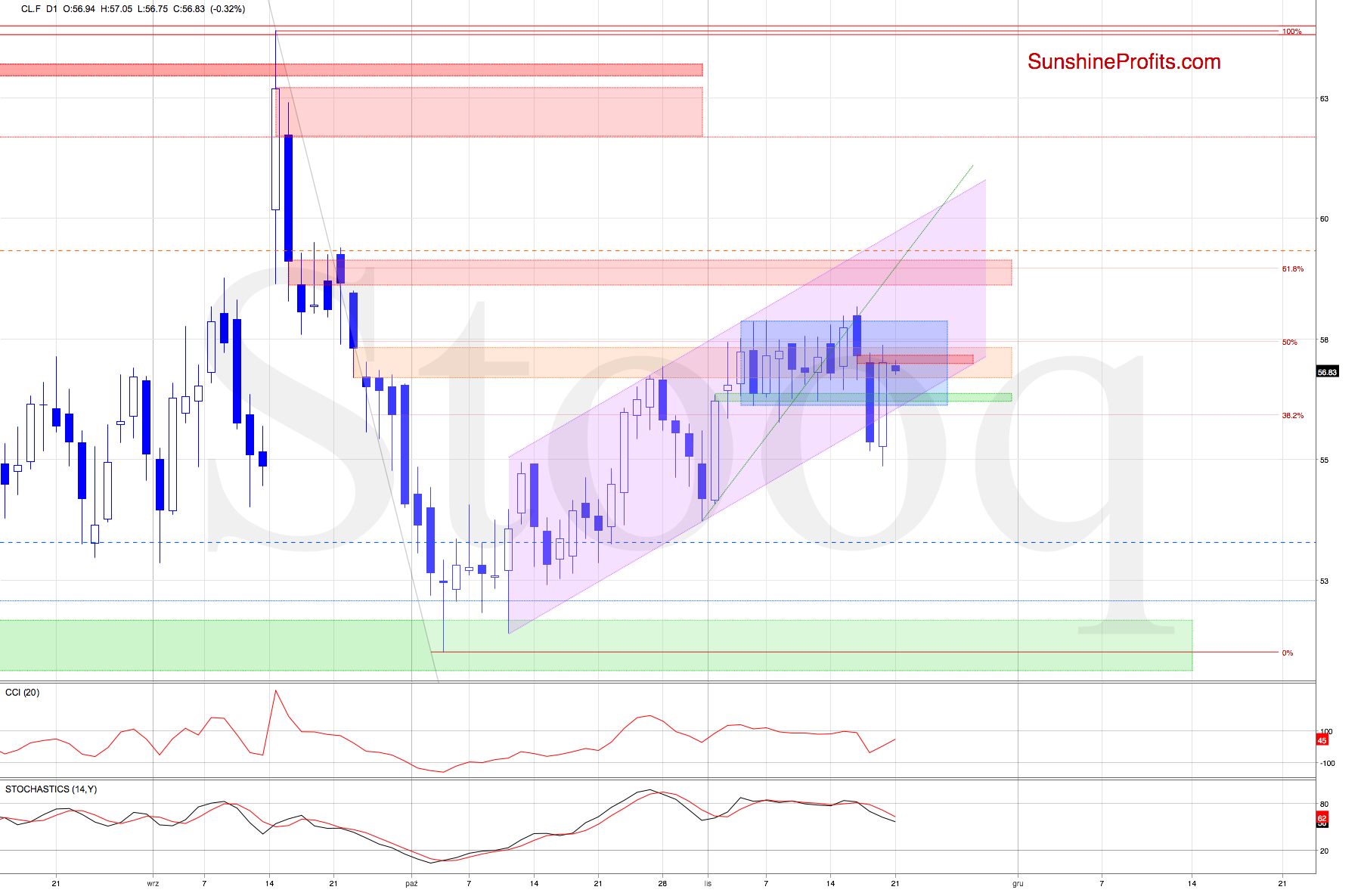

Let's take a closer look at the chart below (chart courtesy of www.stooq.com ) and assess the likely crude oil price path ahead.

While crude oil futures closed below the lower border of the rising purple trend channel and attempted to move even lower yesterday, the bulls made a real comeback on the heels of the Energy Information Administration's report showing a smaller-than-expected build in weekly U.S. crude stockpiles.

As a result, the futures erased Tuesday's decline and returned to trade above $56. The bulls however couldn't close Tuesday's red gap. As long as it remains open, it works to support the bears and acts as resistance to the attempts to move north.

The sell signals of the daily indicators continue to support an upcoming move lower. Should the futures decline, the bears will likely not only test the lower border of the rising purple trend channel, but also yesterday's low in the very near future. If that is broken, the next stop for the sellers will be around $53.73-$54.13, right at the late October lows.

Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $59.32 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist