Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $59.32 and the initial downside target at $53.28 is justified from the risk/reward perspective.

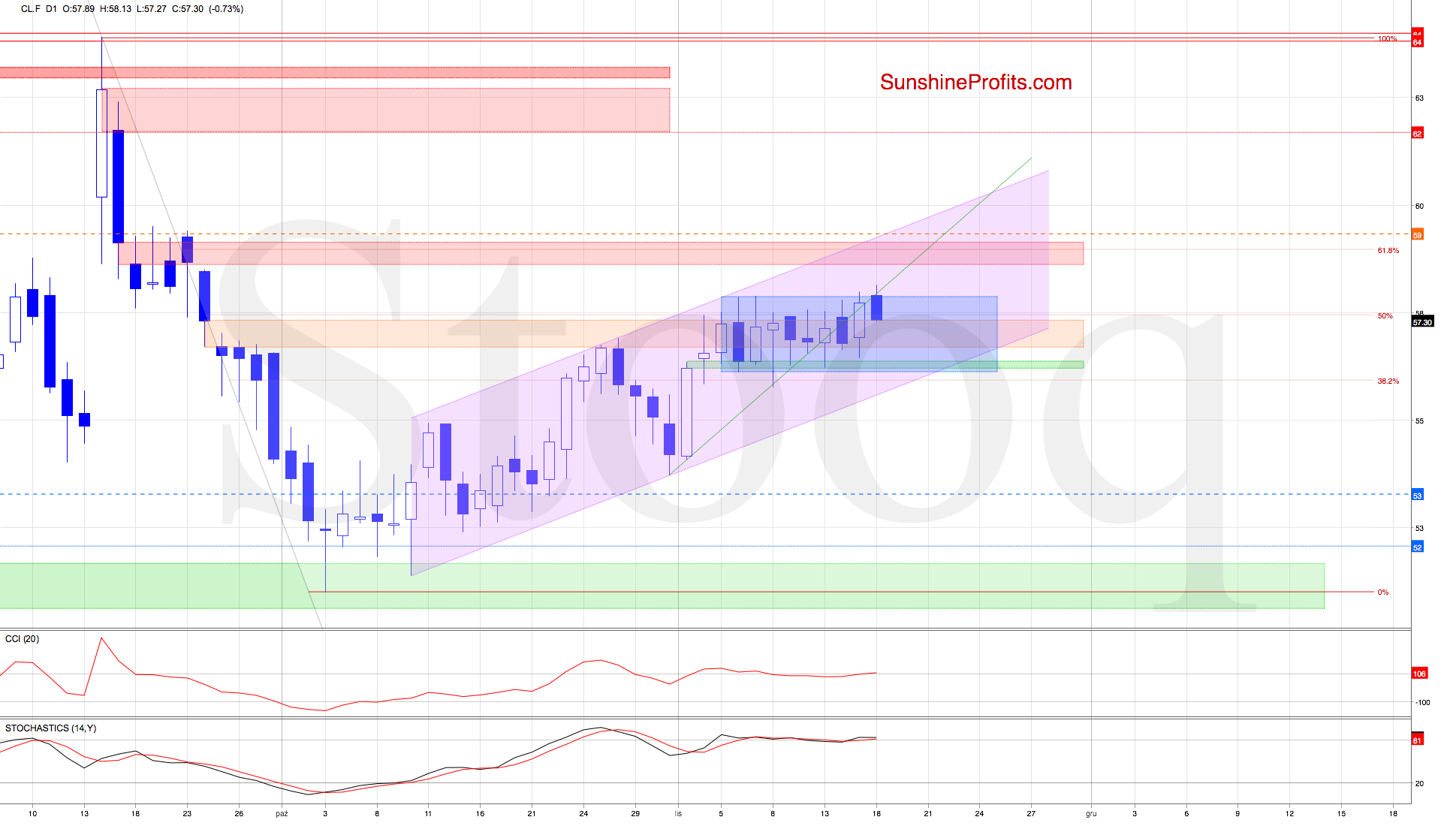

Let's take a closer look at the chart below (chart courtesy of www.stooq.com ) and assess the likely crude oil price path ahead.

On Friday, crude oil futures bounced off the green gap, which brought about quite a sharp move to the upside. The bulls had a reason to celebrate as it closed the orange gap - certainly a bullish development.

Earlier today, the bulls attempted to add to their gains, and broke above the blue consolidation. Their success proved only temporary, as the price reversed and declined to trade at around $57.35 currently. This means invalidation of the intraday breakout attempt.

Due to the extended position of the daily indicators, we have a reason to expect further decline from here.

Should we see such price action and crude oil futures going south from current levels, the first downside target for the sellers will be the green support gap and then the lower border of the rising purple trend channel.

Summing up, earlier today, the bulls couldn't add to their Friday's gains. The extended position of the daily indicators supports lower oil prices ahead. The short position remains justified.

Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $59.32 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist