tools spotlight

-

Powell as a Joker in the Fed’s Deck? Cards Still Unexposed

January 12, 2022, 8:17 AMWhile gamblers returned to the stock market and their optimism helped uplift the PMs, Fed hawks were out in full force on Jan. 11. While market participants ignored their ominous warnings, the harsh realities will likely sink in over the medium term.

To explain, I wrote on Jan. 5:

Investors have gotten so used to a dovish Fed that they assume Chairman Jerome Powell won’t follow through and raise interest rates. However, with rampant inflation, a hot labor market and a resilient U.S. economy still in play, the PMs may find out the hard way that the Fed isn’t bluffing.

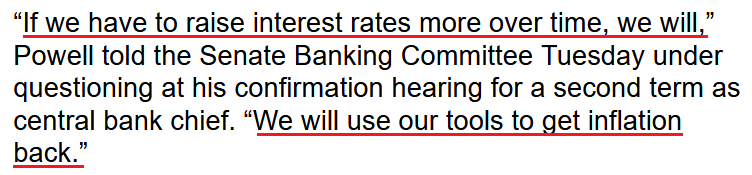

To that point, Powell was questioned about monetary policy by the Senate Banking Committee on Jan. 11. He said:

“To get the kind of very strong labor market we want, with high participation, it is going to take a long expansion. To get a long expansion we are going to need price stability. And so in a way, high inflation is a severe threat to the achievement of maximum employment.”

Moreover, while I’m skeptical that Powell will be able to pull this rabbit out of his hat, he made it clear that quantitative tightening (selling assets and reducing the balance sheet) remains likely in 2022.

“The balance sheet is much bigger and so the runoff can be faster. So I would say sooner and faster – that much is clear,” said Powell.

Thus, while another (likely) short squeeze helped uplift the S&P 500 and the PMs, and hurt the USD Index, the reality is that Powell was more hawkish on Jan. 11 than at any point in 2021.

On top of that, Cleveland Fed President Loretta Mester told Bloomberg on Jan. 11 that she supports a rate hike in March and has penciled in three rate hikes in 2022.

"If the economy in March looks like it does today and the outlook is similar (...), then I would support moving the funds rate up at that meeting and starting to move back from some of the extraordinary accommodation we needed earlier in the pandemic.”

Likewise, she also said that quantitative tightening should be a priority in 2022.

"I'd like to set a path for the balance sheet," Mester said. "That will reduce accommodation and then we'll use our policy tool, the Fed funds rate, as our active tool."

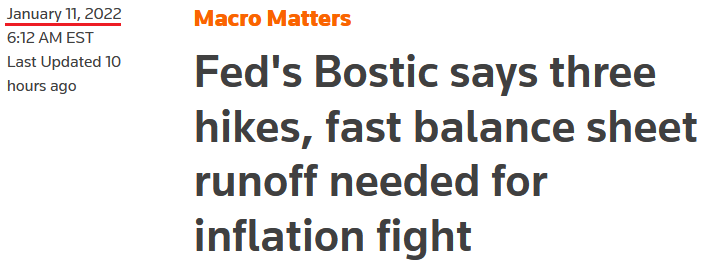

What’s more, Atlanta Fed President Raphael Bostic said on Jan. 11 that he expects three rate hikes in 2022 and a drawdown of the Fed’s balance sheet.

Please see below:

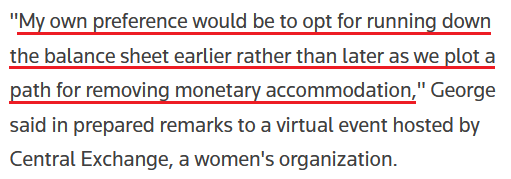

Making four of a kind, Kansas City Fed President Esther George said on Jan. 11 that with inflation mirroring the 1980s and the U.S. labor market in solid shape, the Fed's "very accommodative" policies are no longer needed:

As a result, while the price action on Jan. 11 suggests otherwise, the foursome's remarks are extremely bullish for the USD Index and U.S. Treasury yields and bearish for the PMs. While I warned throughout 2021 that surging inflation would elicit a hawkish shift, Fed officials are making their points loud and clear. Thus, while 'risk-on' sentiment returned to the financial markets on Jan. 11, optimism should evaporate as the tightening process unfolds.

Know When to Hold ‘Em, Know When to Fold ‘Em

To that point, billionaire hedge fund manager Paul Tudor Jones warned on Jan. 11 that he doesn’t “think [Powell] can catch up fast enough to try to deal with the inflation problem he has right now.” He added: “We're getting ready to see a major shift, and it's going to have a lot of consequences for a variety of asset prices."

Moreover, he sees "tough sledding" ahead for stocks as the Fed may end up popping the "financial bubble" and the realization could result in "huge negative economic consequences".

As a result, "the things that performed the best since March of 2020 are going to probably perform the worst in this tightening cycle," said Jones.

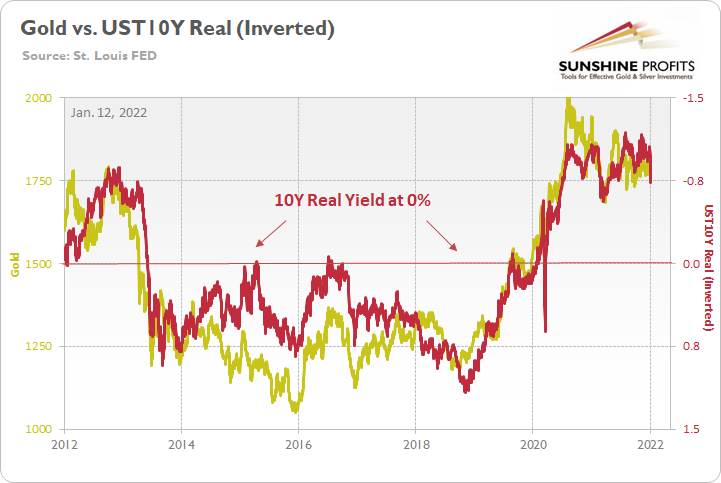

To explain, while he hinted at hyper-growth NASDAQ stocks and speculative assets like cryptocurrencies, the PMs suffer from a similar fundamental affliction. For context, the PMs are less volatile than speculative assets. However, it's important to remember that gold, silver, and mining stocks peaked amid the liquidity-fueled surge in the summer of 2020. Likewise, their uprisings coincided with real interest rates that were at all-time lows at the time.

Conversely, with the Fed's liquidity drain already unfolding and real interest rates poised to rise in the coming months, the PMs should suffer from the likely re-pricings. For example, when the U.S 10-Year real yield was at 0% or higher from June 2013 until October 2018, gold was stuck below $1,400 during that timeframe and actually fell below $1,100. As a result, if the Fed pushes its hawkish chips into the middle, don't be surprised if the PMs fold in 2022.

Finally, with the U.S. Bureau of Labor Statistics (BLS) releasing December’s Consumer Price Index (CPI) today, another hot inflation print should materialize. With pricing pressures unlikely to abate without policy action, the release should support the Fed’s newfound hawkish disposition.

To that point, the NFIB released its Small Business Optimism Index on Jan. 11. While the headline index increased from 98.4 in November to 98.9 in December, NFIB Chief Economist Bill Dunkelberg said:

“Small businesses unfortunately saw a disappointing December jobs report, with staffing issues continuing to impact their ability to be fully productive. Inflation is at the highest level since the 1980s and is having an overwhelming impact on owners’ ability to manage their businesses.”

On top of that, the report revealed:

“Twenty-two percent [of small business owners] report inflation as the single most important problem operating their business, a 20-point increase from the beginning of 2021 and the highest level since Q4 1981.”

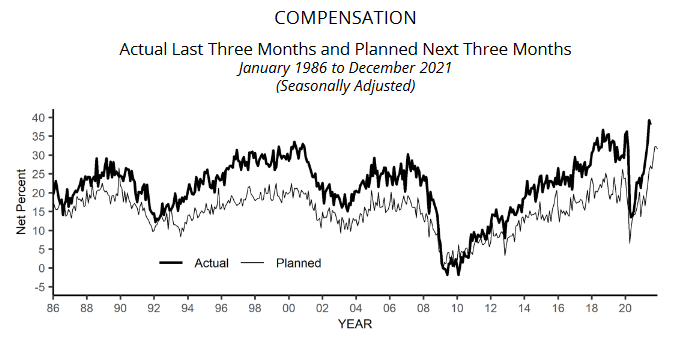

As for wage inflation:

“A net 48 percent reported raising compensation, up 4 points from November and a 48-year record high reading. A net 32 percent plan to raise compensation in the next three months, unchanged from November’s record high reading.”

Please see below:

The bottom line? While the price action on Jan. 11 was contradictory, the fundamentals underpinning the USD Index and U.S. Treasury yields continue to strengthen. As such, the fundamentals underpinning the PMs continue to weaken. While the PMs attempt to call the Fed’s bluff, they’ll likely find out the hard way that the central bank has a really strong hand. With inflation, employment, and consumer demand akin to three of a kind, the cards will likely be unkind to the PMs over the medium term.

In conclusion, the PMs rallied on Jan. 11, as the bulls gored everything in sight. However, with the fundamental outlook contrasting the recent price action, the PMs’ ‘lower highs, lower lows’ story of 2021 should continue in 2022. Moreover, while the U.S. 10-Year Treasury yield consolidates after surpassing its 2021 high, more upside should materialize over the next few months. As a result, the precious metals’ bearish outlooks remain unchanged.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Fed Hawks Circle Over Gold. Will It Become Their Prey?

January 11, 2022, 7:32 AMThe imminent interest rate hike by the Fed is almost certain. Are investors' concerns justified and will it mean trouble for the precious metals?

While the S&P 500 and the NASDAQ Composite recovered from sharp intraday losses on Jan. 10, investors’ mood swings signaled heightened anxiety. With the PMs whipsawing alongside the general stock market, more volatility should materialize in the weeks and months to come.

To explain, with the Fed on a hawkish warpath to fight rampant inflation, JPMorgan CEO Jamie Dimon told CNBC on Jan. 10 that a resilient U.S. economy could prove problematic for the financial markets in 2022.

“The consumer balance sheet has never been in better shape; they’re spending 25% more today than pre-COVID,” said Dimon. “Their debt-service ratio is better than it’s been since we’ve been keeping records for 50 years.”

As for inflation and the Fed:

“It’s possible that inflation is worse than they think and they raise rates more than people think. I personally would be surprised if it’s just four [interest rate] increases [in 2022],” he added.

How would the financial markets react?

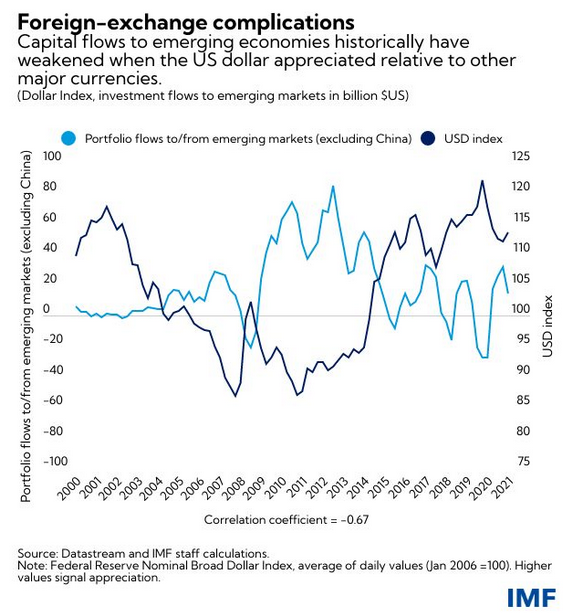

Singing a similar tune, the International Monetary Fund (IMF) warned on Jan. 10 that the Fed’s rate hike cycle could slaughter emerging markets. Its report revealed:

“For most of last year, investors priced in a temporary rise in inflation in the United States given the unsteady economic recovery and a slow unravelling of supply bottlenecks. Now sentiment has shifted. Prices are rising at the fastest pace in almost four decades and the tight labor market has started to feed into wage increases.”

Volatile Days Ahead

While I warned for all of 2021 that inflationary pressures were bullish for the U.S. dollar and U.S. Treasury yields and bearish for the PMs, the IMF stated:

“Faster Fed rate increases in response could rattle financial markets and tighten financial conditions globally. These developments could come with a slowing of US demand and trade and may lead to capital outflows and currency depreciation in emerging markets.”

As a result, even the IMF is anxiously bullish on the USD Index:

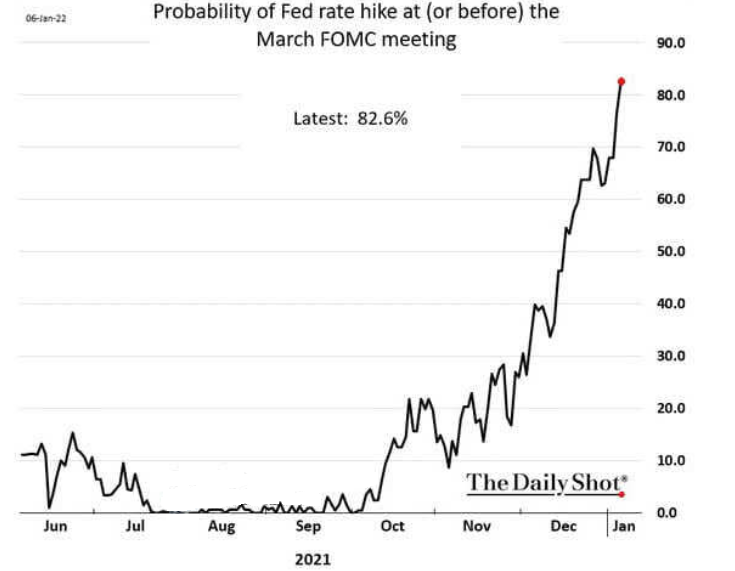

For a good reason. With September, July, June, and May all gone by the wayside, now, the market-implied probability of a Fed rate hike in March has risen to nearly 83%. For context, the probability of a March liftoff was less than 10% in early November.

Please see below:

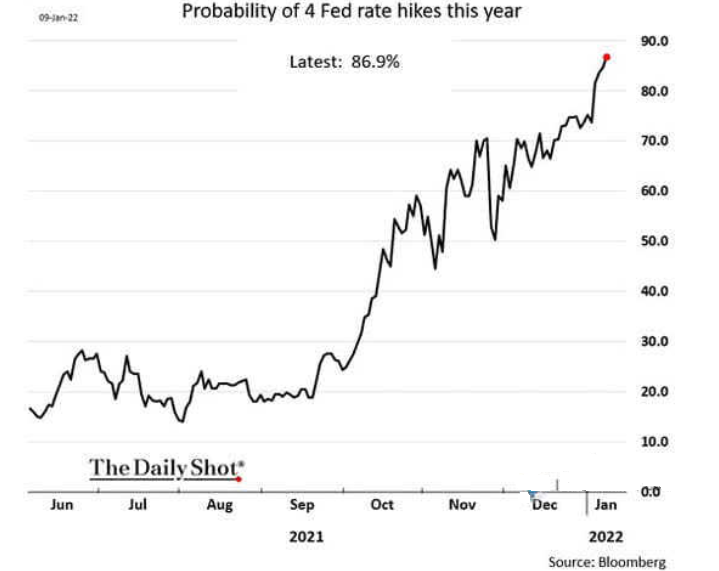

Likewise, the market-implied probability of four rate hikes by the Fed in 2022 has risen to nearly 87%. Again, the probability was less than 50% in early November.

Please see below:

Why the material shift? Well, while I’ve been warning for months that rampant inflation would elicit a hawkish about-face from the Fed, investors are finally coming around to this reality. With inflation still running hot, market participants understand that pricing pressures won’t subside without policy responses from the Fed. As a result, the “transitory” narrative is dead, and investors have lost one of their staunchest allies. This means that predicting silver and gold at higher levels in the medium term might not be the best idea.

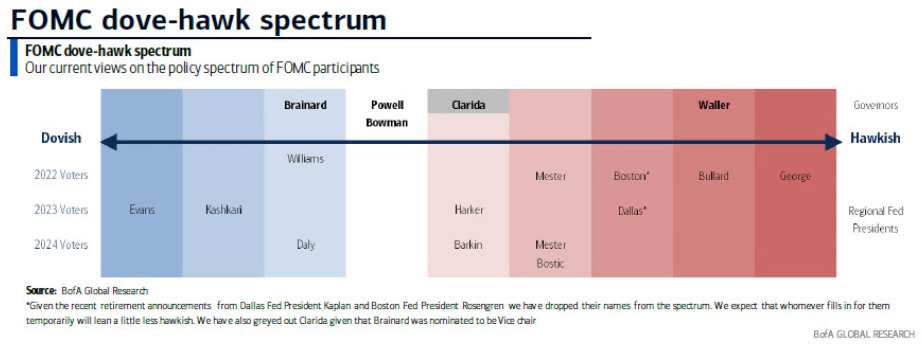

To that point, Bank of America’s dove-hawk spectrum shows that the dovish brigade has lost several soldiers. With the hawks now on the offensive, the officials preaching monetary patience are few and far between.

Please see below:

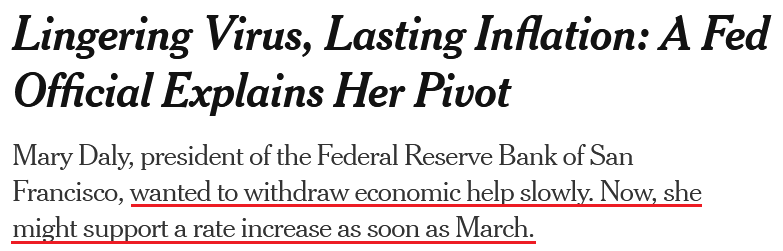

For context, Bank of America still places San Francisco Fed President Mary Daly in the dovish bucket. However, I noted on Dec. 23 that she has materially shifted her stance in recent weeks:

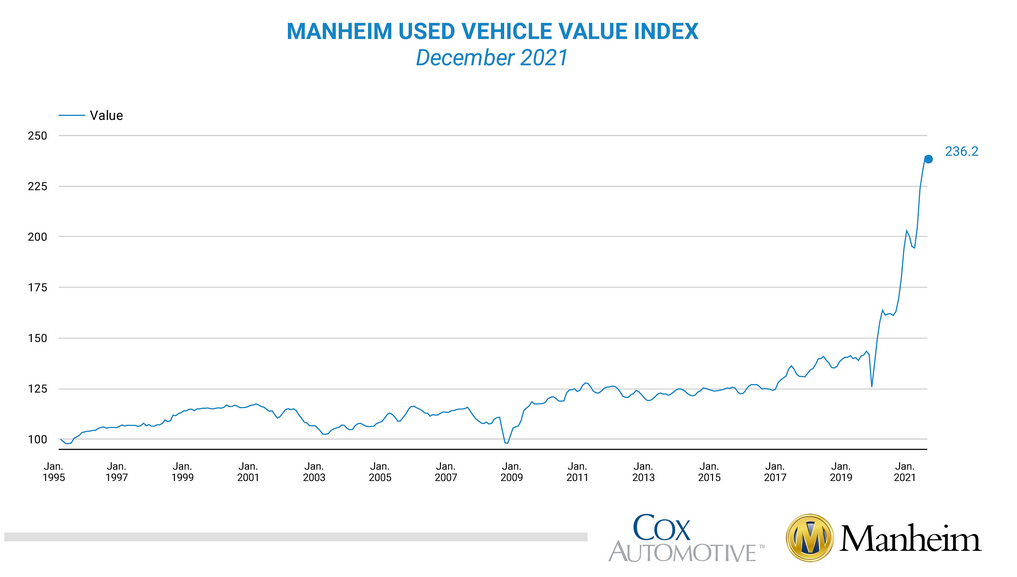

Furthermore, with inflationary pressures still bubbling, the Manheim Used Vehicle Value Index hit another all-time high of 236.2 in December, as “wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 1.6% month-over-month.”

Please see below:

On top of that, the cost of shipping from Shanghai, China, is still increasing. With the U.S. importing more goods from China than any other nation, the inflationary impact on the U.S. economy is material.

Please see below:

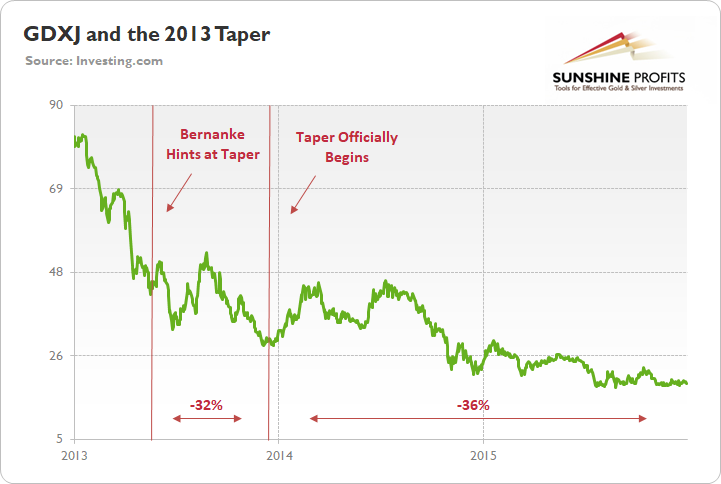

Finally, while the GDXJ ETF benefited from the NASDAQ Composite’s intraday reversal on Jan. 10, I warned on Oct. 26 that monetary policy tightening would eventually upend the junior miners. I wrote:

To explain, the green line above tracks the GDXJ ETF from the beginning of 2013 to the end of 2015. If you analyze the left side of the chart, you can see that when Fed Chairman Ben Bernanke hinted at tapering on May 22, 2013, the GDXJ ETF declined by 32% from May 22 until the taper began on Dec. 18.

Moreover, the onslaught didn’t end there. Once the taper officially began, the GDXJ ETF enjoyed a relief rally (similar to what we’re witnessing now), as long-term interest rates declined and the PMs assumed that the worst was in the rearview.

However, as the liquidity drain caught up to the junior miners over the medium term, the GDXJ ETF declined by another 36% from when the taper was announced on Dec. 18, 2013 until the end of 2015.

To that point, with part one already on the books, the second act will likely unfold once the Fed formally begins its taper in “either mid-November or mid-December.” Thus, history implies that the GDXJ ETF still has plenty of downside left.

While the junior miners' ETF has declined by more than 11% since Oct. 26, Goldman Sachs has come around to our way of thinking.

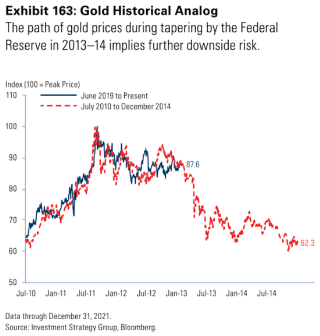

Please see below:

To explain, Goldman Sachs told its clients last week that the yellow metal has been following its ominous path since 2013/2014 (as you may recall, I’ve been writing about the 2013-now analogy for months). For context, the red line above tracks gold’s price action from July 2010 until December 2014, while the blue line above tracks gold’s price action from July 2019 until now.

If you analyze the symmetrical overlay, you can see that the pair have been in sync for some time. Moreover, if you focus your attention on the red line’s plight as time passes, it’s clear why Goldman Sachs is warning its clients about “further downside risk”.

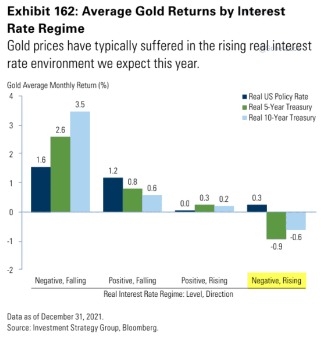

To that point, with the investment bank forecasting a real (inflation-adjusted) interest rate regime change in 2022, gold is poised to suffer along the way.

To explain, the various bars above track gold’s monthly returns when the real U.S. Federal Funds Rate (dark blue), the real U.S. 5-Year Treasury yield (green), and the real U.S. 10-Year Treasury yield (light blue) begin with positive/negative values and then increase/decrease.

If you focus your attention on the bars furthest to the right, you can see that when the real U.S. 5-Year Treasury yield and the real U.S. 10-Year Treasury yield are negative and then rise, gold suffers its worst monthly performances. Moreover, with the current fundamental environment presenting us with precisely that, similar results will likely materialize over the medium term.

The bottom line? While investors desperately bought the dip on Jan. 10, the more than 2% intraday swing in the NASDAQ Composite screamed of monetary policy anxiety. With another hot inflation print poised to hit the wire on Jan. 12, the reprieve will likely be short-lived. Furthermore, with the PMs suffering from a similar fundamental affliction – as both the PMs and technology stocks are extremely allergic to rising interest rates – volatility is likely here to stay. As a result, the Fed should continue to break investors’ hearts over the medium term.

In conclusion, the PMs rallied on Jan. 10, though their fundamental outlooks remain profoundly bearish. With interest rates poised to rise and the USD Index still undervalued, more headwinds should confront gold, silver, and mining stocks in the coming months. As a result, long-term buying opportunities are likely still a ways away.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Has Caught a Cold – Where’s the Medicine?

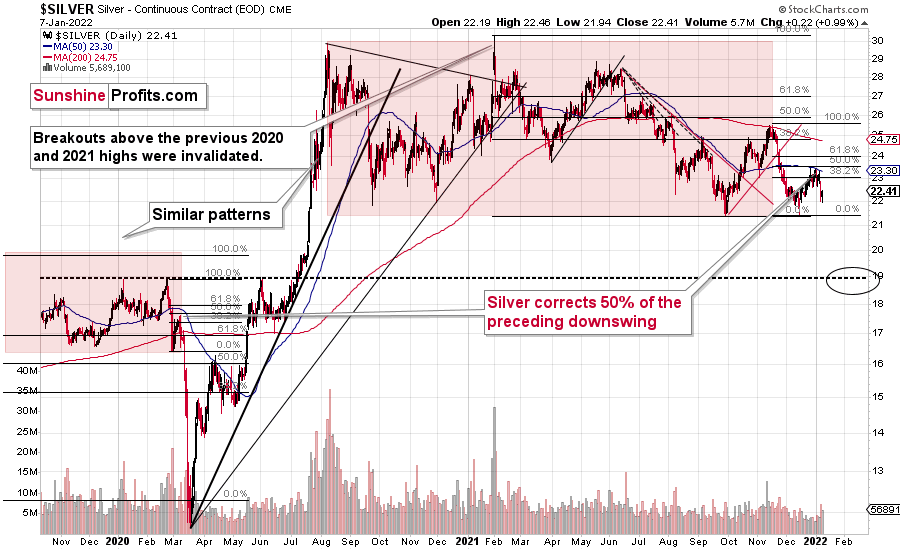

January 10, 2022, 8:43 AMIt’s the second week of January and gold is looking at suffering more than the sniffles. Silver and mining stocks aren’t coming to its defense either.

After last Thursday’s big decline, we saw another decline on Friday – this time it was in the USD Index. Interestingly, gold didn’t soar back as a result.

This tells us something important, even though the session might appear uninformative or just plain boring. Namely, it tells us that the precious metals market wants to move lower and not higher.

If the latter was the case, gold, silver, and mining stocks would have surely taken advantage of the decline in the USDX and magnified this indication by rallying profoundly. Instead, they just took a breather after Thursday’s decline. That’s bearish. Let’s take a closer look.

As you can see on the above chart, the USD Index declined visibly, so this move shouldn’t have been ignored by the PMs. And yet, it was. So, as I wrote earlier, the implications for PMs are bearish.

Technically, the USDX didn’t invalidate the breakout below the June 2020 low, so there were no bearish implications for the USD Index based on Friday’s session. This, combined with a weak reaction in the precious metals market, makes the situation particularly bearish for the latter.

The USD Index is likely to rally shortly – if not right away, and when that happens, the PMs are likely to respond by declining profoundly. I don’t think that predicting higher gold prices while there is a bullish outlook for the USDX is a good idea.

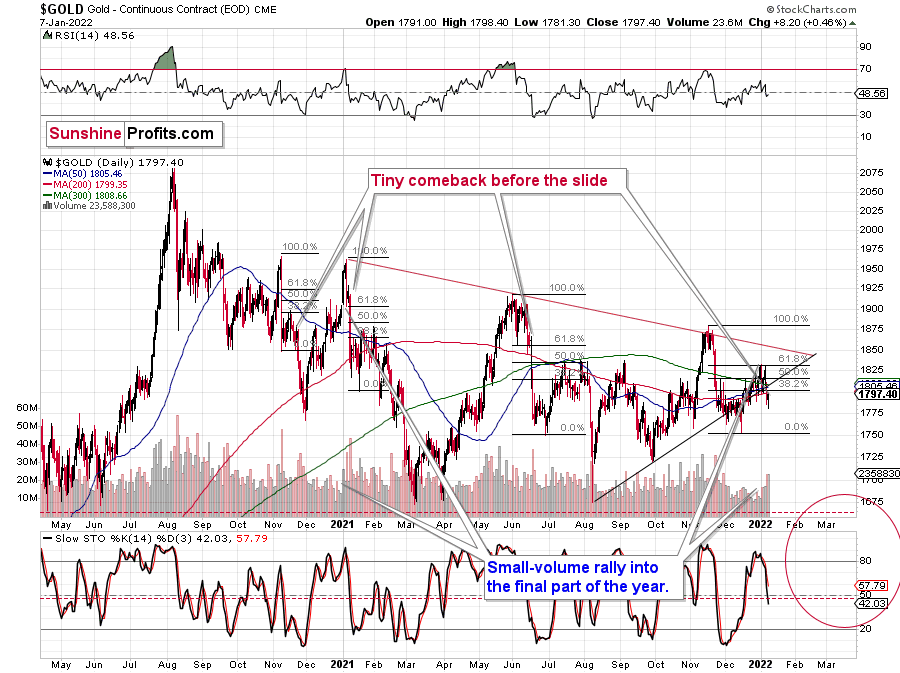

As you can see on the above gold chart, despite the USD’s decline, gold was unable to get back above its previous rising support line. The sell signal from the Stochastic indicator (lower part of the chart) wasn’t invalidated either.

Yes, the shape of Friday’s session makes it look like a reversal hammer candlestick and the volume that accompanied this move was quite high, but it seems to me that the relative performance of gold vs. the USD Index and the fact that gold was unable to rally back above the previously broken support are more important.

Besides, silver moved only slightly higher as well.

The rally in silver was too small to change anything. And I can say the same thing about the tiny upswing in the mining stocks.

Not only was the price move relatively small, but the volume was not as high as the one that accompanied Thursday’s decline. Consequently, the possible theory about a reversal in gold is not confirmed by what we saw in the mining stocks.

All in all, the situation in the precious metals market continues to look bearish, and it seems to be only a matter of time when we see breakdowns below the 2021 lows. Gold has the flu, and silver and mining stocks appear particularly vulnerable.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Miners Should Prepare a Pillow: Gold's Hard Landing Can Hurt

January 7, 2022, 9:24 AMAs in sports, a weak market streak can reverse in the next season. However, the precious metals team looks like it’s about to drop out of the league.

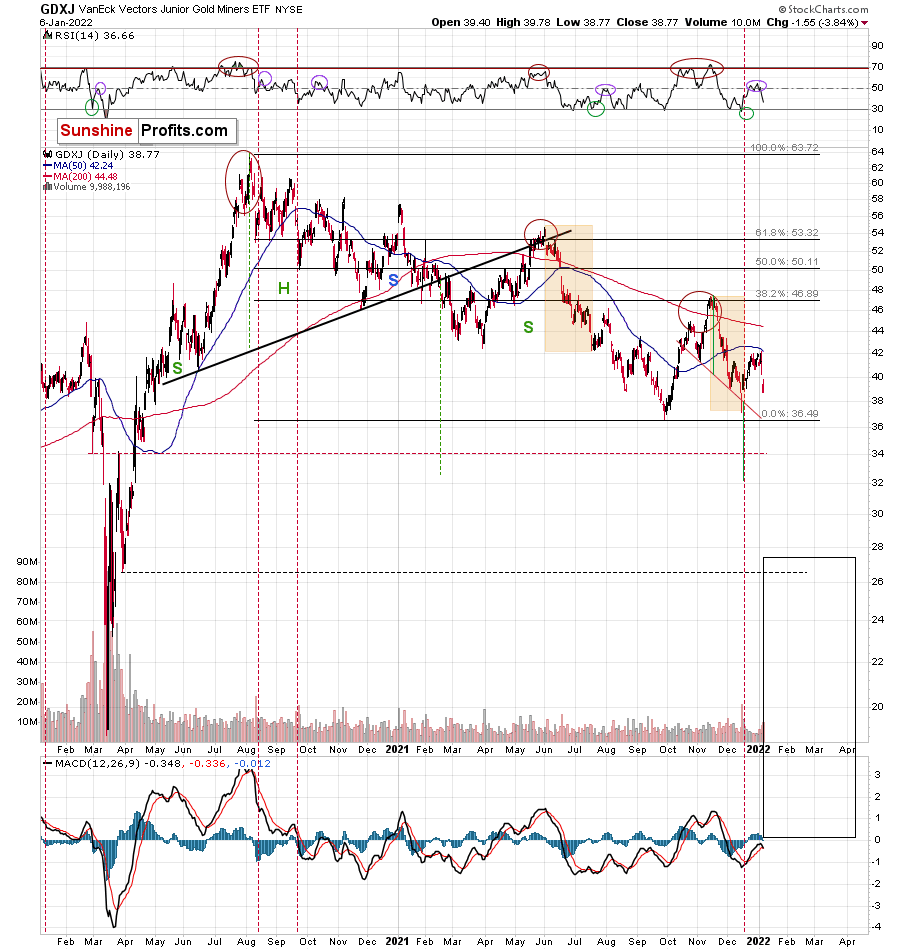

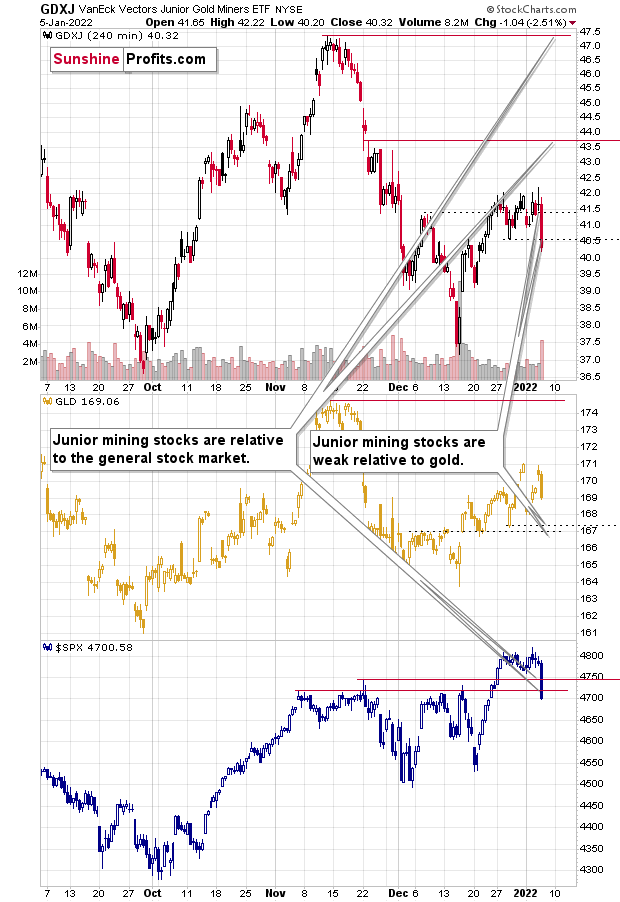

While gold, silver, and mining stocks were in the holiday spirit during the final weeks of 2021, I warned on Jan. 4 that the GDXJ ETF’s sleigh was headed for an epic crash. I wrote:

The GDXJ ETF’s corrective upswing has likely run its course. Interestingly, the junior miners’ current rally mirrors the small correction that materialized in mid-2021 (early August). Back then, the GDXJ ETF rallied on low volume and didn’t recapture its 50-day moving average. With the same tepid strength present today, the drawdown that followed in mid-2021 will likely commence once again.

On top of that, the behavior of the GDXJ ETF’s RSI is also similar – with the indicator moving from roughly 30 to 50. For context, I highlighted the similarities with green and purple ellipses below. Also noteworthy, similar developments occurred in February/March 2020, before the profound plunge unfolded. As a result, the GDXJ ETF looks set for another sharp drawdown over the medium term.

After the junior mining stocks ETF proceeded to decline by more than 6% in two days, my short position rang in the New Year with solid gains. What’s more, with the GDXJ ETF likely to break below its 2021 lows over the medium term, winter woes should materialize before a long-term buying opportunity emerges.

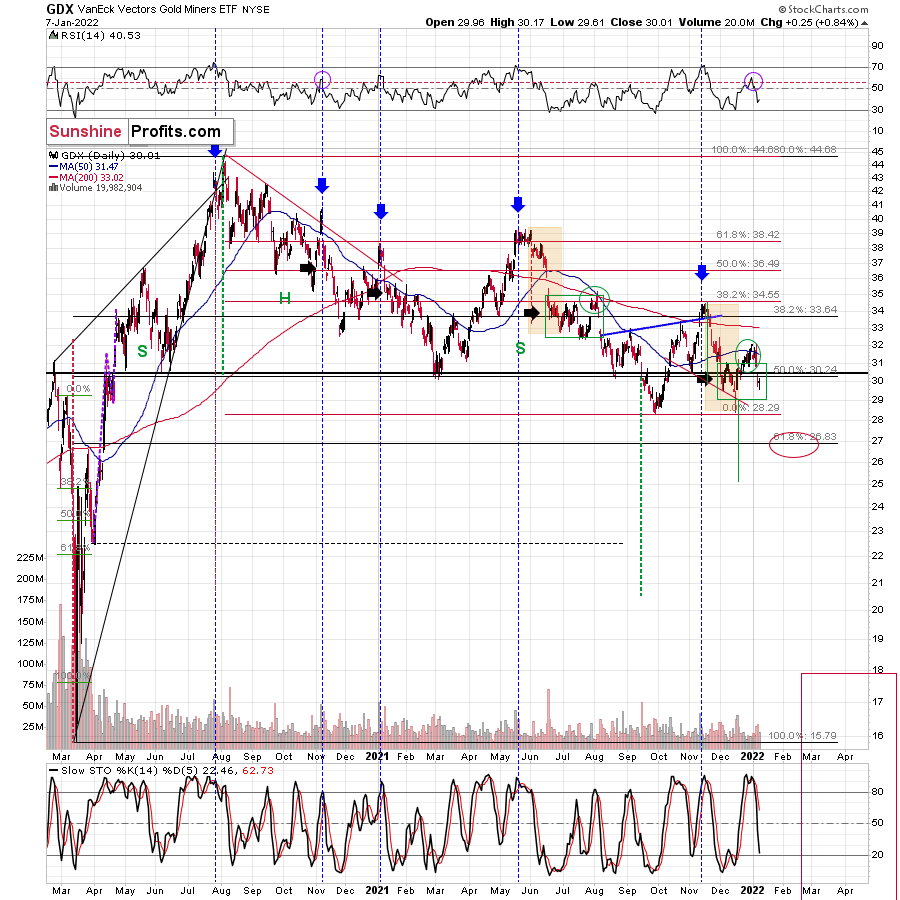

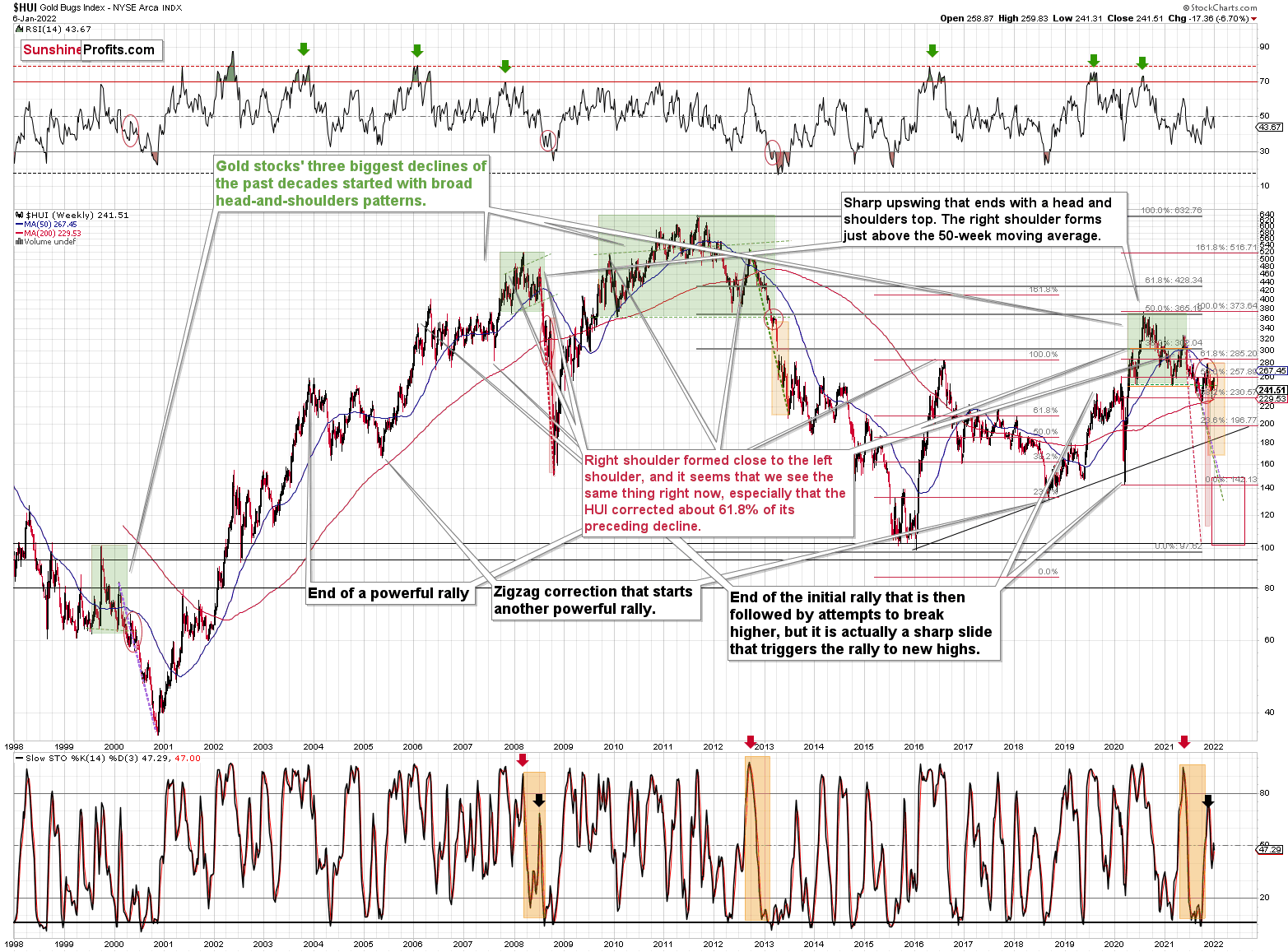

Please see below:

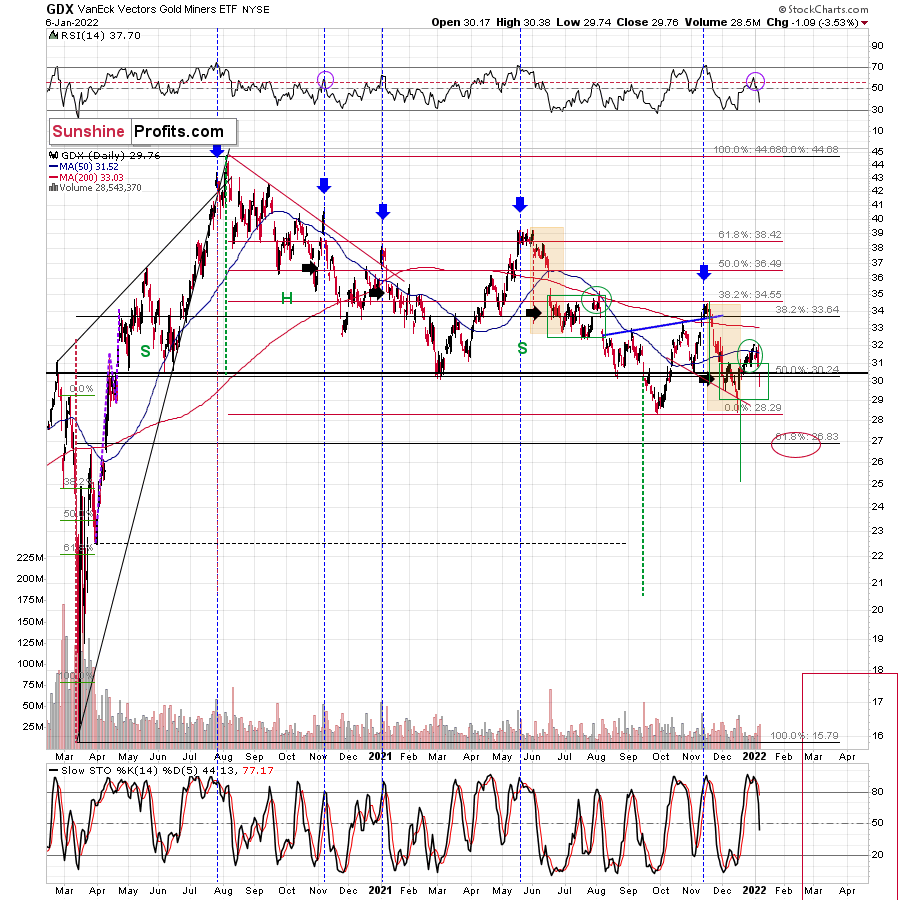

Likewise, with the GDX ETF’s RSI (Relative Strength Index) signaling an ominous outcome for the senior miners, I warned that a sell-off was likely on the horizon. For context, I highlighted the historical similarities with the blue vertical dashed lines below.

Moreover, with the GDX ETF’s weakness accelerating on Jan. 5/6, the senior miners have declined sharply in recent days. In addition, the current price action mirrors the senior miners’ ominous performance in July/August 2021 – just like I’ve been describing it for a few weeks now. As a result, the previous corrective upswing is likely over, and the GDX ETF should confront lower lows sooner rather than later.

For context, a breakdown below the 2021 lows should materialize over the medium term, and the forecast for gold, as well as gold stocks, is bearish for the next several weeks / months. However, the milestone may not occur over the next few days.

Turning to the HUI Index’s long-term chart, the same bearish signals are present. For example, I marked the specific tops with red and black arrows. In the current situation, we saw yet another small move up, but that’s most likely because the price moves are now less volatile. The areas marked with red ellipses remain similar and show back-and-forth movement before the big decline.

As such, while we’ve entered a consolidation phase, this week’s selling pressure has been quite ferocious. Thus, the implications are not bullish but bearish.

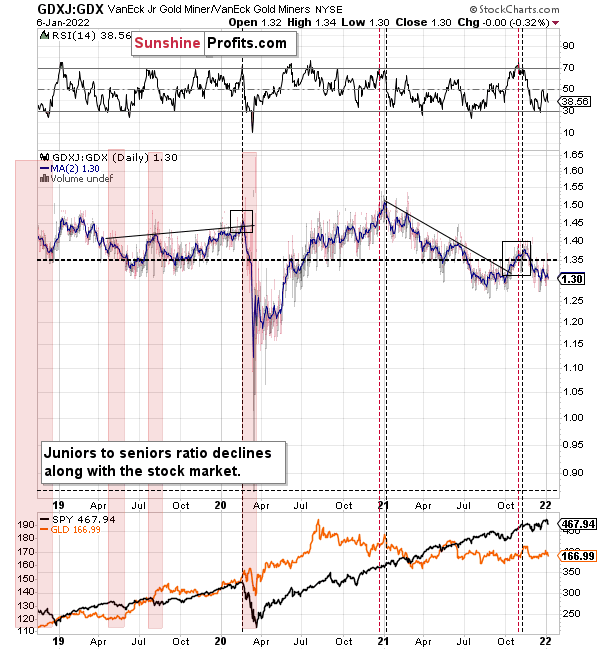

Finally, the GDX/GDXJ ratio continues to perform as expected. For example, I warned throughout 2021 that the ratio was destined for devaluation. ith the metric kicking off 2022 with another decline, the GDXJ ETF continues to underperform the GDX ETF.

For context, I believe that gold, silver, and the GDX ETF are all ripe for sharp re-ratings over the medium term. However, I think that the GDXJ ETF offers the best risk-reward ratio due to its propensity to materially underperform during bear markets. As a result, shorting junior miners offers a great risk to reward trade-off.

In conclusion, gold, silver, and mining stocks began 2022 with the same weakness that plagued them in 2021. While the worst performers one year often become the best performers the next, the charts signal more weakness ahead. As a result, while the precious metals are poised to soar over the long term, lower lows will likely materialize before their secular uptrends resume.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold: No Cheer in the New Year

January 6, 2022, 5:53 AMWhat a way to start a year! Gold just faked its comeback before moving to new yearly lows. That’s a very bearish way for a market to start the year.

Given that miners underperformed gold and silver briefly outperformed it, we have a very bearish storm brewing for the next couple of weeks / months.

On Jan 3, I wrote the following:

The year 2021 is over, 2022 has finally arrived. However, why does the current price action look “sooo last year”? Because the patterns appear to be repeating and the clearest similarity is present in the key precious metal – gold itself.

Gold prices moved higher in late December, and it happened on low volume. The rally caused the stochastic indicator to move above 80 and the RSI above 50. That’s exactly what happened in both: late 2021 and late 2020.

What does it mean? Well, it means that we shouldn’t trust this rally, as it could end abruptly, just like the one that we saw a year ago.

Besides, gold corrected 61.8% of the preceding decline (so it moved to its most classic Fibonacci retracement), which means that – technically – what we saw in the past two weeks was just a correction, not the beginning of a new rally.

And what happened next?

Gold declined, faked its comeback, and then declined again to new yearly lows. 2022 continues to be a down year for gold, and this is particularly revealing, because early January is the time when the buy-backs should – theoretically – happen.

I’m referring to the tendency for investors to exit losing positions (and – in tune with my expectations and against expectations of almost everyone else – 2021 was a down year for gold, silver, and mining stocks, after all) close to the end of the year, in order to harvest the tax loss, and then to get back into the market in early January.

Despite the above tendency, gold is down, silver is down, and mining stocks are down as well.

This shows that the precious metals market is weak (which has been clear since gold invalidated its breakout above the 2011 high in 2020) and is unlikely to soar significantly (in terms of hundreds of dollars) unless it slides first.

Besides, at the beginning of major rallies, gold stocks tend to lead the way up. And right now, it’s exactly the opposite.

The upper part of the above chart features the GDXJ ETF – proxy for junior mining stocks, the middle part features the GLD ETF – proxy for gold, and the bottom part features the S&P 500 Index.

The red lines compare the previous stock market highs to what happened in junior miners, and the dotted lines show what juniors did when gold formed its recent highs and lows.

In short, junior gold mining stocks are underperforming both: gold, and other stocks.

This is as bearish as it can get, given the current situation regarding the USD Index (which is in a medium-term uptrend) and the situation in the interest rates, which are not only about to go up, but the expectations of them going up are becoming more and more hawkish. And that’s no accident either, as it’s in tune with the current political narrative in the U.S. – inflation is currently presented as the major enemy that needs to be dealt with.

In other words, as the situation in interest rates is likely to become even more hawkish and the USD Index is likely to move higher, gold is likely to go down, and so – eventually – will the general stock market. And since junior mining stocks have already proven over and over again that they magnify declines on both markets, they are likely to fall particularly hard, when the above markets decline. We gained quite a lot based on the decline in the juniors in 2021, but it seems that the gains that could be reaped in 2022 (of course, I can’t and I’m not promising any kind of specific performance for any market) based on junior miners’ decline (and then their revival) could be breathtaking – but as always, only if one is positioned correctly for both major moves.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM