tools spotlight

-

Are You Thinking the Dollar Will Collapse? That’s False Hope

February 7, 2022, 9:20 AMGold’s latest feats increased investors’ appetite. The outlook for the dollar, however, remains healthy. That can only mean one thing.

As volatility erupts across the financial markets, gold and silver prices are being pulled in conflicting directions. For example, with the USD Index suffering a short-term decline, the outcome is fundamentally bullish for the precious metals. However, with U.S. Treasury yields rallying, the outcome is fundamentally bearish for gold and silver prices. Then, with panic selling and panic buying confronting the general stock market, the PMs are dealing with those crosscurrents.

However, with QE on its deathbed and the Fed poised to raise the Federal Funds Rate in the coming months, the common denominator is rising real interest rates. To explain, the euro’s recent popularity has impacted the USD Index. For context, the EUR/USD accounts for nearly 58% of the dollar basket’s movement. Thus, if real interest rates rise and the U.S. dollar falls, what will happen to the PMs?

Well, the reality is that rising real interest rates are bullish for the USD Index, and the euro’s recent ECB-induced rally is far from a surprise. With investors often buying the EUR/USD in anticipation of a hawkish shift from the ECB, another ‘hopeful’ upswing occurred. However, the central bank disappointed investors time and time again in 2021, and the currency pair continued to make new lows. As a result, we expect the downtrend to resume over the medium term.

Supporting our expectations, I wrote the following about financial conditions and the USD Index on Feb. 2:

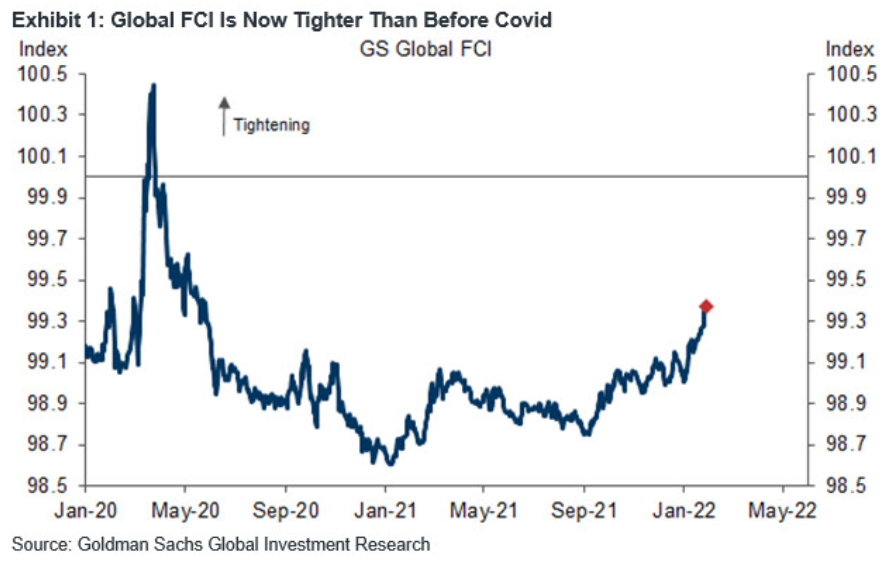

To explain, the blue line above tracks Goldman Sachs' Financial Conditions Index (FCI). For context, the index is calculated as a "weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, with weights that correspond to the direct impact of each variable on GDP." In a nutshell: when interest rates increase alongside credit spreads, it's more expensive to borrow money and financial conditions tighten.

To that point, if you analyze the right side of the chart, you can see that the FCI has surpassed its pre-COVID-19 high (January 2020). Moreover, the FCI bottomed in January 2021 and has been seeking higher ground ever since. In the process, it's no coincidence that the PMs have suffered mightily since January 2021. To that point, with the Fed poised to raise interest rates at its March monetary policy meeting, the FCI should continue its ascent. As a result, the PMs' relief rallies should fall flat like in 2021.

Likewise, while the USD Index has come down from its recent high, it's no coincidence that the dollar basket bottomed with the FCI in January 2021 and hit a new high with the FCI in January 2022. Thus, while the recent consolidation may seem troubling, the medium-term fundamentals supporting the greenback remain robust.

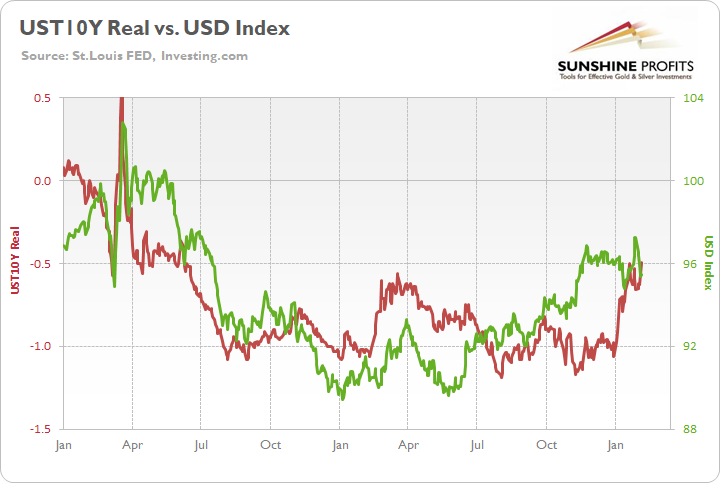

Furthermore, tighter financial conditions are often a function of rising real interest rates. As mentioned, the USD Index bottomed with the FCI and surged to new highs with the FCI. As a result, the fundamentals support a stronger, not weaker USD Index. As evidence, the U.S. 10-Year real yield, the FCI, and the USD Index have traveled similar paths since January 2020.

Please see below:

To explain, the green line above tracks the USD Index since January 2020, while the red line above tracks the U.S. 10-Year real yield. While the latter didn’t bottom in January 2021 like the USD Index and the FCI (though it was close), all three surged in late 2021 and hit new highs in 2022. Moreover, the U.S. 10-Year Treasury nominal and real yields hit new 2022 highs on Feb. 4.

In addition, if you compare the two charts, you can see that all three metrics spiked higher when the coronavirus crisis struck in March 2020. As such, the trio often follows in each other’s footsteps. Furthermore, with the Fed likely to raise interest rates at its March monetary policy meeting, this realization supports a higher U.S. 10-Year real yield, and a higher FCI. As a result, the fundamentals underpinning the USD Index remain robust, and short-term sentiment is likely to be responsible for the recent weakness.

Likewise, as the Omicron variant slows U.S. economic activity, the ‘bad news is good news’ camp has renewed hopes for a dovish Fed. However, the latest strain is unlikely to affect the Fed’s reaction function. A case in point: after ADP’s private payrolls declined by 301,000 in January (data released on Feb. 2), concern spread across Wall Street. However, after U.S. nonfarm payrolls (government data) came in at 467,000 versus 150,000 expected on Feb. 4, the U.S. labor market remains extremely healthy.

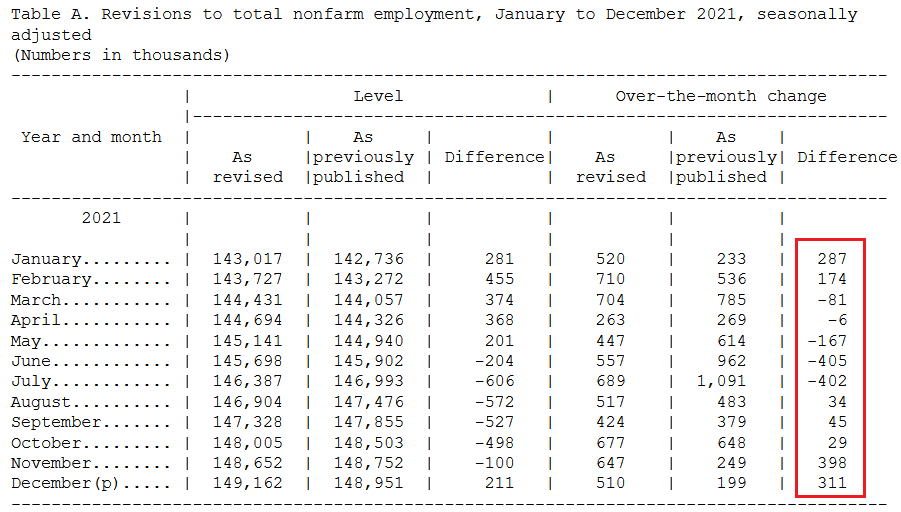

Please see below:

Source: U.S. Bureau of Labor Statistics (BLS)

Source: U.S. Bureau of Labor Statistics (BLS)On top of that, the BLS revealed that “the over-the-month employment change for November and December 2021 combined is 709,000 higher than previously reported, while the over-the-month employment change for June and July 2021 combined is 807,000 lower. Overall, the 2021 over-the-year change is 217,000 higher than previously reported.”

Thus, the U.S. added more than 700,000 combined jobs in November and December than previously reported, and the net gain in 2021 was more than 200,000.

Please see below:

As for wage inflation, the BLS also revealed:

“In January, average hourly earnings for all employees on private nonfarm payrolls increased by 23 cents to $31.63. Over the past 12 months, average hourly earnings have increased by 5.7 percent.”

As a reminder, while investors speculate on the prospect of a hawkish ECB, the latest release out of Europe shows that wage inflation is much weaker than in the U.S. To explain, I wrote on Feb. 1:

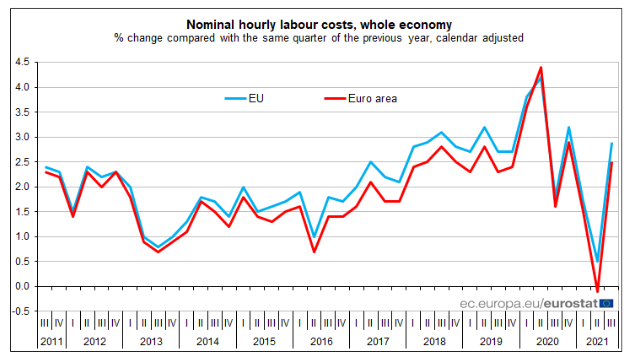

Eurozone hourly labor costs rose by 2.5% YoY on Dec. 16 (the latest release). Moreover, the report revealed that “the costs of wages & salaries per hour worked increased by 2.3%, while the non-wage component rose by 3.0% in the third quarter of 2021, compared with the same quarter of the previous year.”

As a result, non-wage labor costs – like insurance, healthcare, unemployment premiums, etc. – did the bulk of the heavy lifting. In contrast, wage and salary inflation are nowhere near the ECB’s danger zone.

Please see below:

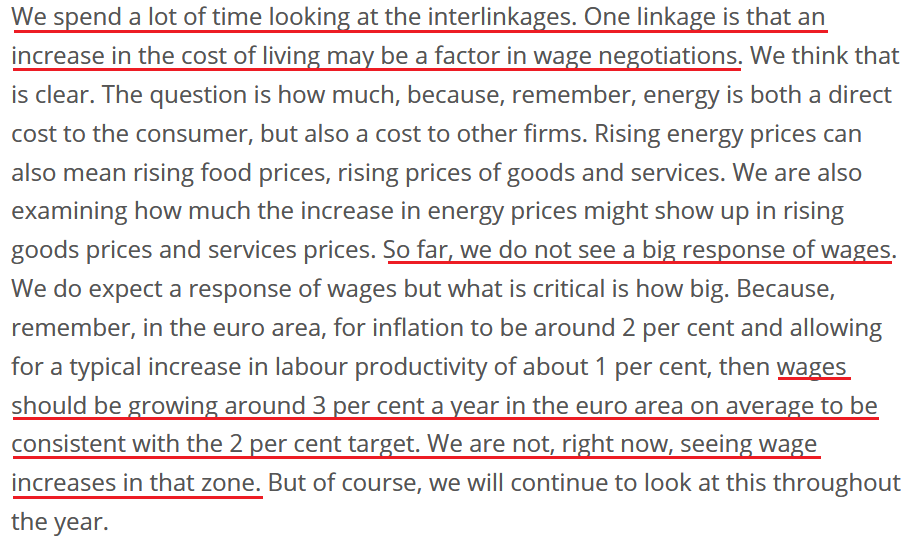

And why is wage inflation so critical? Well, ECB Chief Economist Philip Lane said on Jan. 25:

As a result, when the ECB’s Chief Economist tells you that wage inflation needs to hit 3% YoY to be “consistent” with the ECB’s 2% overall annual inflation target, a wage print of 2.3% YoY is far from troublesome. Thus, while euro bulls hope that the ECB will mirror the Fed and perform a hawkish 180, the data suggests otherwise.

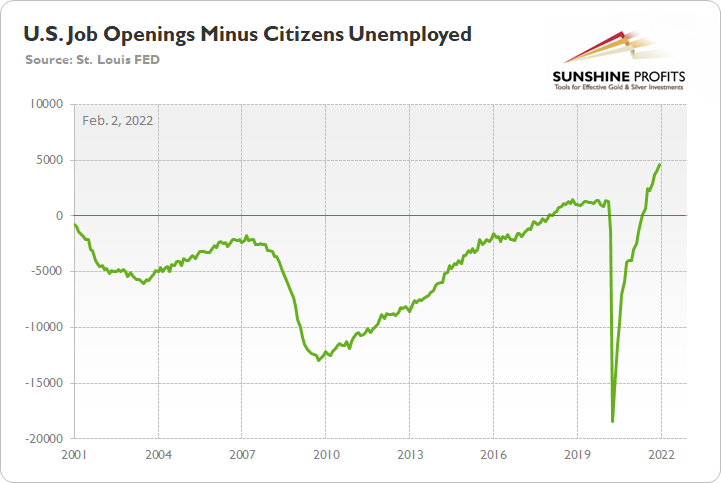

In addition, while U.S. nonfarm payrolls materially outperformed on Feb. 4, I noted on Feb. 2 that there are now 4.606 million more job openings in the U.S. than citizens unemployed.

Please see below:

To explain, the green line above subtracts the number of unemployed U.S. citizens from the number of U.S. job openings. If you analyze the right side of the chart, you can see that the epic collapse has completely reversed and the green line is now at an all-time high. Thus, with more jobs available than people looking for work, the economic environment supports normalization by the Fed.

Thus, if we piece the puzzle together, the U.S. labor market remains healthy and U.S. inflation is materially outperforming the Eurozone. As a result, the Fed should stay ahead of the ECB, and the hawkish outperformance supports a weaker EUR/USD and a stronger USD Index. Moreover, the dynamic also supports a higher FCI and a higher U.S. 10-Year real yield. As we’ve seen since January 2021, these fundamental outcomes are extremely unkind to the PMs.

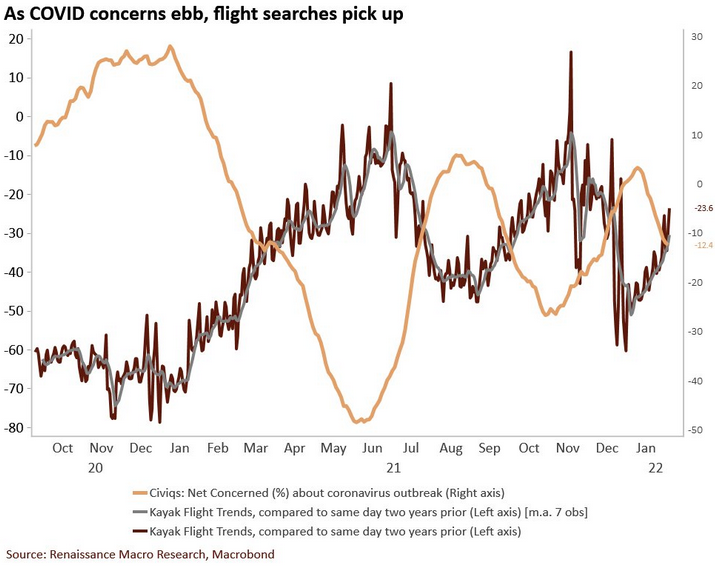

Finally, while the Omicron variant has depressed economic sentiment, I noted previously that the disruptions should be short-lived. For example, with Americans’ anxiety about COVID-19 decelerating, renewed economic strength should keep the pressure on the Fed.

Please see below:

To explain, the light brown line above tracks the net percentage of Americans concerned about COVID-19, while the dark brown line above tracks the change in flight search trends on Kayak. In a nutshell: the more concern over COVID-19 (a high light brown line), the more Americans hunker down and avoid travel (a low dark brown line).

However, if you analyze the right side of the chart, you can see that the light brown line has rolled over and the dark brown line has materially risen. Moreover, with the trend poised to persist as the warmer weather arrives, increased mobility should uplift sentiment, support economic growth, and keep the Fed’s rate hike cycle on schedule.

The bottom line? The USD Index’s fundamentals remain extremely healthy, and while short-term sentiment has been unkind, rising real yields and a hawkish Fed should remain supportive over the medium term. Moreover, with the PMs often moving inversely to the U.S. dollar, more downside should confront gold, silver, and mining stocks over the next few months.

In conclusion, the PMs rallied on Feb. 4, despite the spike in U.S. Treasury yields. However, with so much volatility confronting the general stock market recently, sentiment has pulled the PMs in many directions. However, the important point is that the medium-term thesis remains intact: the USD Index and U.S. Treasury yields should seek higher ground, and the realization is profoundly bearish for the precious metals sector.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

The USDX Is Still King: Don’t Jump the Gun Like Euro Bulls

February 4, 2022, 10:11 AMThe USD Index has declined in recent days, but it doesn’t mean it lost its crown. With the EUR/USD rallying hard, the USDX suffered in the process – but in reality, the ECB hasn’t really done anything to support the euro.

Wall Street woke up to excessive pessimism on Feb. 3, with the NASDAQ Composite sinking by 3.74%. Moreover, with gold and silver also declining by 0.34% and 1.46% respectively, the volatility was unkind to the PMs.

More importantly, though, the GDXJ ETF declined by 2.43% and was easily the worst performer of the bunch. Actually, when you consider what I warned about previously, the price action was far from a surprise:

Once one realizes that the GDXJ is more correlated with the general stock market than the GDX is, the GDXJ should be showing strength here. If stocks don’t decline, the GDXJ is likely to underperform by just a bit, but when (not if) stocks slide, the GDXJ is likely to plunge visibly more than the GDX.

To that point, with the GDX ETF only declining by 1.24%, it’s another example of why shorting the GDXJ ETF offers the best risk-reward ratio. Moreover, while the USD Index remains under short-term pressure, a greenback comeback should add to the PMs’ troubles over the medium term.

Having said that, let's take a look at the situation from a fundamental point of view.

Hear What They Want to Hear: Part 2

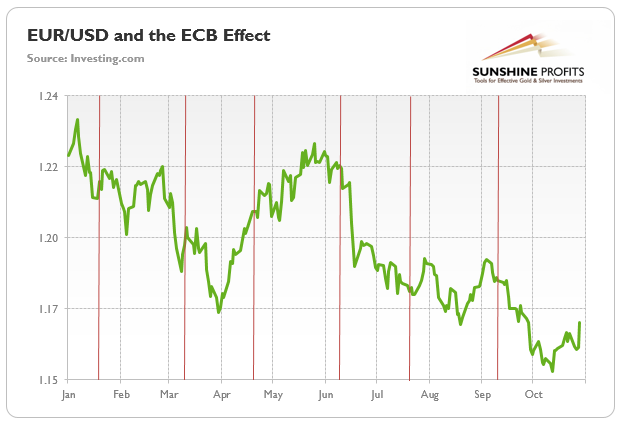

With another ECB monetary policy meeting resulting in another bullish reaction from the EUR/USD, investors followed the same misguided script that I outlined on Oct. 29. To explain, I wrote:

With the EUR/USD rallying sharply on Oct. 28, the ECB must have accelerated the hawkish rhetoric, right? Well, in reality, the ECB maintained its dovish stance and the fundamental outlook for the EUR/USD remains unchanged.

However, because investors ‘hear what they want to hear,’ and speculators do what speculators do, the EUR/USD rallied on the news. I mean, why not speculate on a euro that’s been one of the worst-performing developed market currencies versus the U.S. dollar YTD? Couldn’t it catch fire and revert to the mean?

Well, with the same merry-go-round spinning for months, I warned on May 4 that euro celebrations often end in disappointment. I wrote:

With the EUR/USD rising on hope and falling on reality, history has shown that the latter is likely to reign supreme over the medium term.

To that point, with the medium-term extremely unkind to the EUR/USD, short-term bursts of optimism faded when reality re-emerged. As a result, is this time really different?

To explain, the green line above tracks the EUR/USD. If you analyze the misguided optimism present on May 4 and Oct. 28, you can see that we’ve been down this road before. Moreover, with the EUR/USD rallying six times following the last eight ECB monetary policy meetings, the price action is par for the course. However, the short-term surges haven’t stopped the EUR/USD from making lower lows in the following months.

To that point, what happened that got euro bulls so fired up? Well, as we witnessed throughout 2021, nothing. In reality, the ECB maintained its dovish stance, and monetary policy was left unchanged. The committee’s statement read:

“Monthly net purchases under the APP will amount to €40 billion in the second quarter of 2022 and €30 billion in the third quarter. From October onwards, the Governing Council will maintain net asset purchases under the APP at a monthly pace of €20 billion for as long as necessary to reinforce the accommodative impact of its policy rates. The Governing Council expects net purchases to end shortly before it starts raising the key ECB interest rates.”

As a result, while the Fed will end its bond-buying program and should raise interest rates at its March monetary policy meeting, the ECB still plans to continue QE from "October [2022] onwards." Thus, while currency traders attempt to time the bottom again, the fundamentals that led to a weaker euro in 2021 remain unchanged.

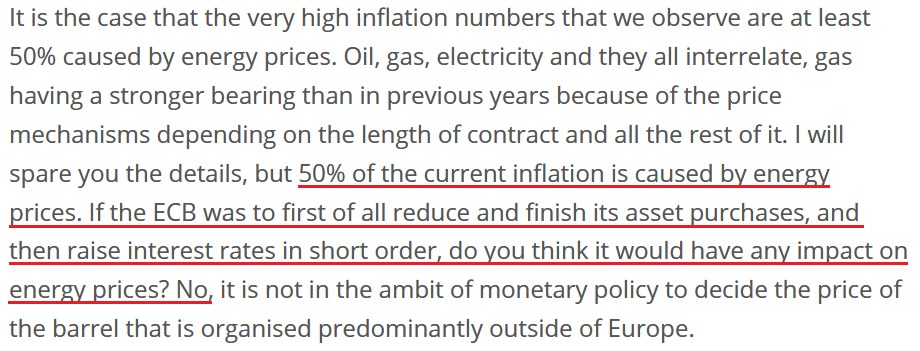

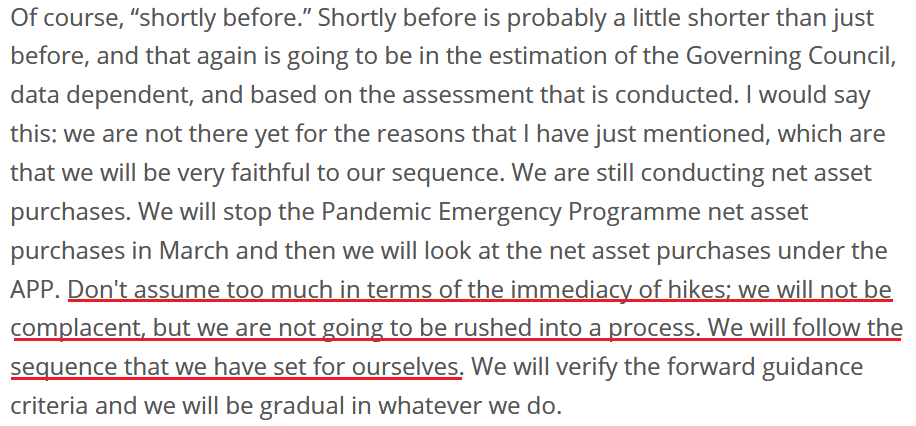

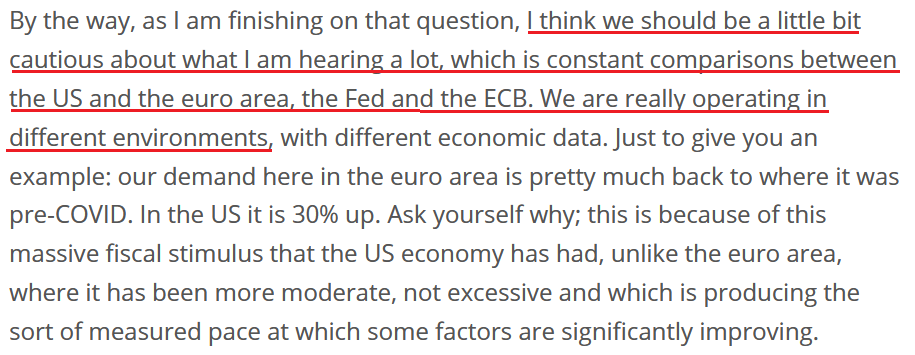

Moreover, during ECB President Christine Lagarde's press conference on Feb. 3, she said the following about inflation:

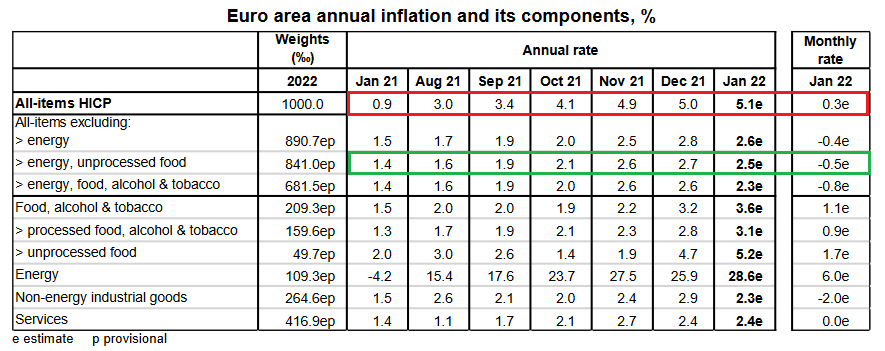

“Inflation increased to 5.1 per cent in January, from 5.0 per cent in December 2021. It is likely to remain high in the near term. Energy prices continue to be the main reason for the elevated rate of inflation. Their direct impact accounted for over half of headline inflation in January and energy costs are also pushing up prices across many sectors.”

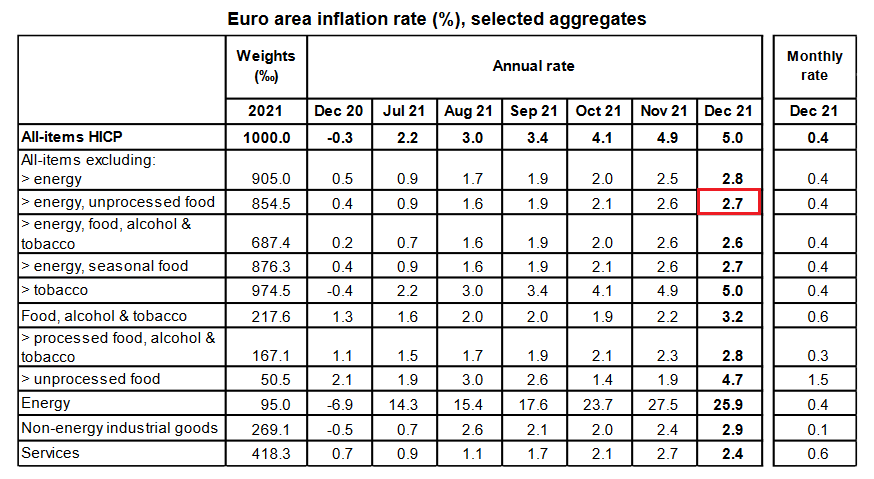

To that point, I noted on Feb. 1 that while energy remains an issue, the majority of goods and services in the Eurozone are far from the danger zone. I wrote:

While I’ve highlighted the discrepancy on several occasions, the pricing pressures confronting Europe are mainly a function of oil & gas irregularities. Outside of that, most goods and services are within the ECB’s expected inflation range.

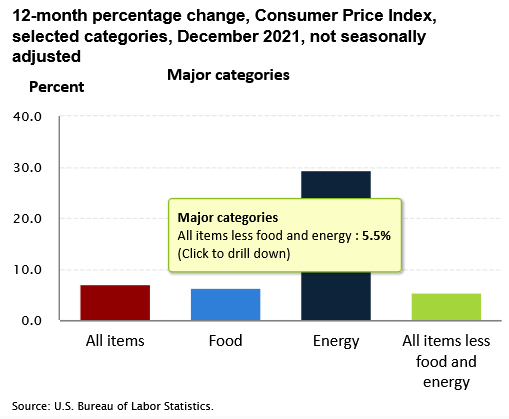

Think about it: why would the ECB raise interest rates when core inflation is at 2.7% YoY and wage inflation is at 2.3% YoY? In stark contrast, U.S. core inflation increased by 5.5% YoY on Jan. 12, and U.S. average hourly earnings increased by 4.7% YoY on Jan. 7. As such, while I’ve stated it on numerous occasions, the Fed and the ECB are worlds apart.

Furthermore, Eurostat – the statistical office of the European Union – released its latest inflation report on Feb. 2. And while headline inflation increased by 0.30% month-over-month (MoM), core inflation decreased by 0.5% MoM.

Please See below:

To explain, follow the trajectory of the red rectangle above. As you can see, headline inflation (which includes food and energy) went from a 0.9% year-over-year (YoY) increase in January 2021 to a 5.1% YoY increase in January 2022. Pretty troublesome, huh?

However, if you focus your attention on the green rectangle, you can see that Eurozone core inflation (which excludes food and energy) declined from 2.7% YoY in December 2021 to 2.5% YoY in January 2022. As a result, while investors assume that abnormally high headline inflation will elicit a hawkish response from the ECB, the reality is that oil & gas remain the region’s only problem.

Conversely, with core inflation falling MoM and moving closer to the ECB’s 2% annual target, the data supports the central bank’s dovish stance. Moreover, Lagarde made my point during her press conference.

Please see below:

On top of that, when asked about potential interest rate hikes, Lagarde responded:

“How do you hike interest rates? By hiking interest rates. And clearly, we will have a very sophisticated determined approach and analysis to doing that. We will only do that in the sequence that we have fixed for ourselves, and which has been agreed, which is that we will look at net asset purchases first, gradually, on a data-dependent basis. Then we will look at interest rates.”

Thus, with the ECB’s monetary policy statement reading that “from October onwards, the Governing Council will maintain net asset purchases under the APP at a monthly pace of €20 billion for as long as necessary to reinforce the accommodative impact of its policy rates,” how can the ECB raise interest rates if it still plans to purchase bonds past October 2022? Think about it: Lagarde said that “we will look at net asset purchases first.” And if ending QE is the first step in the process, then the ECB is nowhere near the second step.

To that point, Lagarde reminded everyone:

And finally:

The bottom line? While it’s no surprise that investors ‘hear what they want to hear,’ the reality is that the ECB didn’t do anything hawkish on Feb. 3. And with the EUR/USD rallying hard, the USD Index suffered in the process. However, since the price action on Feb. 3 was likely another example of short-term hope overpowering medium-term reality, the EUR/USD should resume its downtrend in the coming months. And with the Fed well ahead of the ECB, euro bulls should learn the same hard lessons they learned in 2021.

In conclusion, the PMs declined on Feb. 3, as Meta Platforms’ (Facebook’s) weak Q4 earnings print ignited another NASDAQ Composite sell-off. And with the GDXJ ETF falling hard, the junior miners continued their underperformance. Moreover, while the USD Index also declined, the dollar basket should recover those losses and over the medium term. As a result, the fundamental outlook for the PMs remains profoundly bearish.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Won a Battle, but it Will Lose the Medium-Term War

February 3, 2022, 9:36 AMOmicron gave gold a boost, but business confidence remains high for the next twelve months, which means the USD’s prospects look good, and precious metals will have to find new low ground.

Despite the USD Index’s recent pullback, the PMs’ performance on Feb. 2 was rather pedestrian. For example, gold and silver rallied by 0.49% and 0.50%, respectively, while the GDX ETF rose by 0.33%. However, the GDXJ ETF declined by 0.41% and hasn’t been able to gain any real traction. Moreover, when we consider the USD Index’s recent decline, the PMs should have rallied more. And since they didn’t, it signals investors’ heightened anxiety. As a result, it’s likely another case of corrective upswings within medium-term downtrends.

Having said that, let's take a look at the situation from a fundamental point of view.

Inflated Optimism

As the PMs attempt to recover their post-Fed losses, their misguided confidence could result in hard landings. Similarly, with investors assuming that the USD Index's best days are in the rearview, it's like it's 2021 all over again.

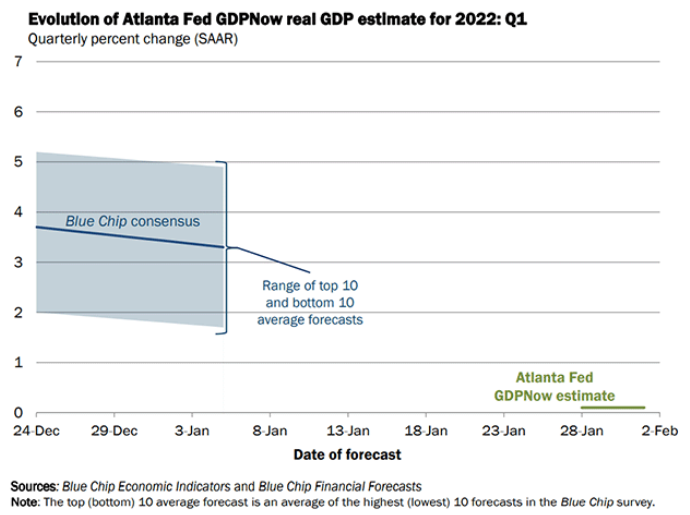

To explain, with the Omicron variant depressing U.S. economic activity, the 'bad news is good news' narrative has spread across Wall Street. For context, the phrase assumes that weak economic data will lead to a more dovish Fed. And with the Atlanta Fed predicting Q1 real GDP growth of only 0.1%, investors believe that potential Fed patience means a weaker USD Index and higher precious metals prices.

Please see below:

To explain, the blue line above tracks the Blue Chip (large investment firms') consensus Q1 GDP growth estimate, while the green line above tracks the Atlanta Fed's Q1 GDP growth estimate. If you analyze the near-flatline, you can see that the Atlanta Fed predicts next to no growth in Q1.

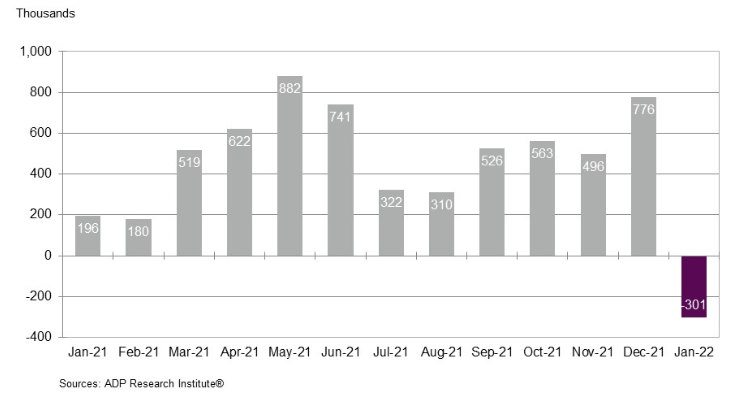

Second, ADP released its National Employment Report on Feb. 2. And with private payrolls declining by 301,000 in January (the purple bar on the right side of the chart below), ADP Chief Economist Nela Richardson said that "the labor market recovery took a step back at the start of 2022 due to the effect of the Omicron variant and its significant, though likely temporary, impact to job growth."

In addition, "leisure and hospitality saw the largest setback after substantial gains in fourth quarter 2021, while small businesses were hit hardest by losses, erasing most of the job gains made in December 2021." As a result, with economically sensitive sectors suffering the brunt of the Omicron variant's wrath, the 'bad news is good news' narrative has investors positioning for a more dovish Fed.

Please see below:

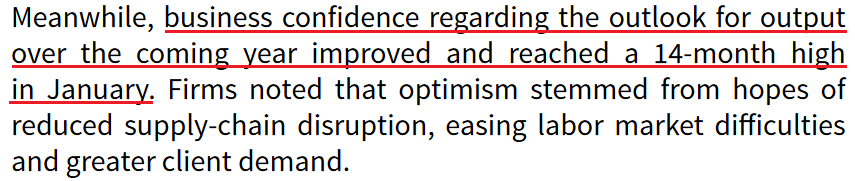

However, the short-term setback doesn’t change the medium-term implications. For example, IHS Markit released its U.S. Manufacturing PMI on Feb. 1. And after the headline index declined from 57.7 in December to 55.5 in January, Chris Williamson, Chief Business Economist at IHS Markit, said:

“The Omicron outbreak has hit manufacturing hard, exacerbating existing headwinds by subduing demand, creating further supply chain issues and causing widespread staff shortages, often through absenteeism due to the surge in COVID-19 infections.”

Despite that, though, business confidence regarding the 12-month outlook hit its highest level in more than a year. As such, Williamson opined that "the current downturn may prove short-lived."

Please see below:

Thus, while weak short-term data helps the PMs and hurts the USD Index, the Omicron variant's economic impact should decelerate when the warmer weather arrives. Likewise, with roughly 800 of the largest U.S. manufacturers sharing this sentiment, the 2021/2022 theme of 'USD Index up, the PMs’ should be down over the medium term.

On top of that, with inflation still an issue, one-half of the Fed's dual mandate is in the danger zone. For example, the Institute for Supply Management (ISM) released its Manufacturing PMI on Feb. 1. And while the headline index decreased from 58.8 in December to 57.6 in January, the report revealed:

“The ISM Prices Index registered 76.1 percent, an increase of 7.9 percentage points compared to the December reading of 68.2 percent, indicating raw materials prices increased for the 20th consecutive month, at a faster rate in January. This is the 17th month in a row that the index has been above 60 percent…. In January, 17 industries reported paying increased prices for raw materials.”

In addition, McDonald’s – the world's largest fast-food restaurant chain – released its fourth-quarter earnings on Jan. 27. CFO Kevin Ozan said during the Q4 conference call:

“In 2022, we anticipate our operating margin percent will continue to be in the low to mid-40s range as strong top line momentum and minimal other operating income will be hampered by significant commodity and labor inflation in the near term.”

Moreover, Ozan said that McDonald’s input costs may “double” in 2022.

Source: McDonald’s/Seeking Alpha

Source: McDonald’s/Seeking AlphaIf that wasn’t enough, Stanley Black & Decker released its fourth-quarter earnings on Feb. 1. For context, the Fortune 500 company manufacturers hand, power, and industrial tools, and provides security services.

Moreover, CFO Don Allan said during the Q4 conference call that “the operating margin rate for the [tools & storage] segment was 11.4%, down versus last year as pricing benefits were more than offset by inflation, higher supply chain costs, growth investments in volume.” However, looking to avoid a repeat performance in 2022, management stated:

Source: Stanley Black & Decker/Seeking Alpha

Source: Stanley Black & Decker/Seeking AlphaAs a result, while investors assume that weak short-term economic data handcuffs the Fed, the medium-term issues are far from resolved. And with major U.S. corporations still sounding the inflationary alarm, price hikes should continue until their input costs come down. As a result, the ‘bad news is good news’ narrative is much more semblance than substance.

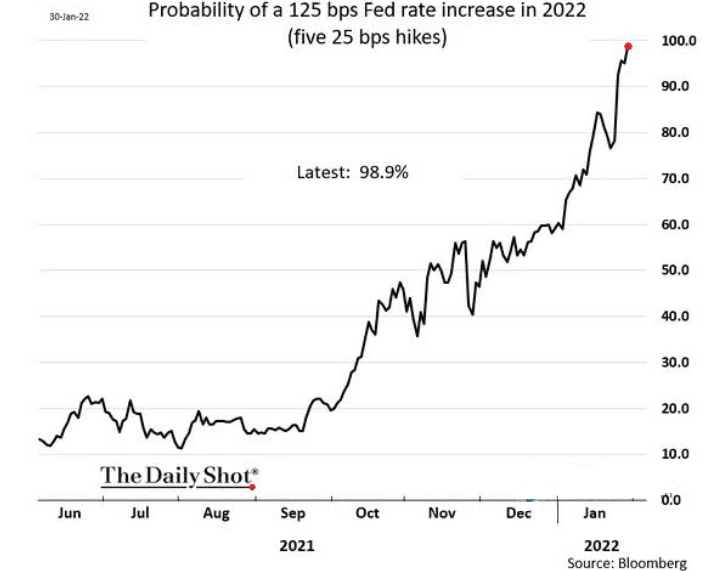

Finally, while investors hope the Fed will perform a dovish 180, the futures market isn’t buying the hype. And with the probability of five rate hikes by the Fed in 2022 hitting nearly 99% on Jan. 30, the short-term narratives impacting the PMs and the USD Index should reverse sharply over the medium term.

The bottom line? While the USD Index has suffered recently, the greenback’s fundamentals remain robust. Moreover, with investors’ upside-down narrative akin to a short-term reprieve, the medium-term implications remain unchanged. To that point, after the Delta variant’s July/August outbreak led to weak U.S. nonfarm payrolls in September, I wrote the following on Sep. 8:

With U.S. nonfarm payrolls coming in at 235,000 vs. 720,000 expected on Sep. 3 (though, the weakness was largely expected due to the disruptions from the Delta variant), the USD Index and the U.S. 10-Year Treasury yield should have suffered the brunt of investors’ wrath.

Weak economic data often elongates the Fed’s taper timeline. And with that, bullish bets on the U.S. dollar and U.S. Treasury yields often unwind when Fed tightening is perceived as delayed. However, whether the taper is officially announced in September, November or December (which is largely immaterial), investors realize that a one or two month wait doesn’t derail an investment thesis.

As a result, we find ourselves in the same situation now. However, despite the short-term implications that materialized in September, the USD Index is higher now, and the GDXJ ETF is lower now. Thus, similar outcomes should emerge this time around.

In conclusion, the PMs were mixed on Feb. 2, and the GDXJ ETF was the lone member in the red. And while the USD Index remains under pressure, it’s likely another rerun of 2021. As a result, while the PMs may win the short-term battle, the USD Index should win the medium-term war.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

The Hesitant Fed and Putin’s Threats Helped Gold Rise

February 2, 2022, 10:11 AMMany times in your life, you have probably observed or experienced the accuracy of the saying that while two dogs are fighting for a bone, a third runs away with it. It can be said that gold is taking advantage of a similar situation, and while the market, economy, and world of politics are slightly in turmoil, the yellow metal is slowly climbing.

As the dollar continued its consolidation on February 1, gold proudly hovered above the $1,800 mark. As you know, as long as the precious metals don’t space out, they can use the falling USDX to improve their performance. It so happened that, thanks to mixed signals from European and US financial authorities, which investors interpreted in their own way, the dollar basket suffered some losses. Yesterday I wrote:

Although the ECB seems extremely dovish, especially compared to the Fed, and inflation figures remain relatively low, the Eurozone’s currency enthusiasts are counting on some bold moves. The fervor of the euro bulls fazed the greenback, which, interestingly, was also the case in almost all similar situations last year.

Another demotivating factor for the USDX may have been the somewhat shy tone some Fed officials took on Monday about the withdrawal of economic aid in the face of rampant inflation. The general plans of the US federal reserve to raise interest rates in March have not changed though, so it turns out that some investors interpreted the signals in their own way and the optimism regarding both precious metals and the EUR/USD pair is temporary.

In fact, while the ECB will still have a chance to comment, so far, despite its dovish approach, the bank did not have to say or do anything special to strengthen the European currency in the EUR/USD pair, because the Fed got it covered. To the delight of the euro – and probably gold – bulls, the Federal Reserve’s officials did not speak in unison on Monday, when commenting on monetary policy plans.

Of course, it is known that the Fed continues its hawkish tactic and intends to fight inflation with a heavy weapon, which will be raising interest rates. The fact that the first step in a monetary tightening will be taken in March is already taken for granted. However, when the Federal Reserve announced a week ago that it was planning to raise interest rates earlier – and possibly more aggressively – than expected just several months ago, now the choir began to sing unevenly.

Some of the Fed’s members suggested that future rate hikes were likely to be data-driven and not necessarily automatic. In addition, apart from the fact that it is not known how much the first raise will be, the pursuit of neutrality was mentioned. Some views on what the Fed should do after the initial rate hike, shared on Monday, became a source of volatility. Among other things, the interpretation of such uncertain statements helped raise the price of gold.

In addition to the above, there is another factor supporting yellow metal stocks.

Russia Breaks the Silence

After several weeks of absence from public life, during which fears were mounting in Western capitals that Russia was preparing an invasion of Ukraine, President Vladimir Putin broke his silence. During a press conference in the Kremlin, Putin told reporters that he was not satisfied with the US response to Russian demands. Previously, Russia demanded that NATO withdraw its troops and infrastructure from Eastern Europe, claiming that the alliance would never accept Ukraine. He also presented a potential scenario suggesting that if Ukraine is admitted to NATO, there may be a conflict over the Crimea.

In his first public comments on the crisis in Ukraine that has worsened since December, the Russian leader accused the US of ignoring Russian security proposals and of using Ukraine as a tool to obstruct Russia's actions.

Although Putin has said he is ready to enter into dialogue with the West, at the same time, Russia continues to deploy thousands of troops and weapons on the border with Ukraine, according to the world's media. Both President Joe Biden and US Secretary of State Antony Blinken consider Putin to be unpredictable. As Blinken told the press, the authorities are not sure whether the Russian leader has already made a decision about his next move and what it is, so they must be prepared for different results.

Ukraine does not remain indebted. The country has announced that it intends to increase its armed forces, as many European leaders have pledged to support it in the current stalemate with Russia. According to the media, tensions between Ukraine and Russia have not subsided.

The improvement in gold's position was due to similar news in mid-January. However, at the time, I wrote that such rallies were insignificant, and that it was specific military actions, rather than rumors of tension and deterioration in the geopolitical situation, that could lead to a real breakthrough in the market.

Later in the text, I will also explain other reasons why the optimism of precious metals is likely to turn out to be temporary and turn into pessimism in the medium term.

A Value Trap

While the USD Index declined again on Feb. 1, the pullback is more of a corrective downswing within a medium-term uptrend. For example, stock market optimism often results in bids for 'risk-on' currencies. With the dollar outperforming in recent weeks, investors' see 'value' in currencies like the euro and the CAD.

However, they're more of a value trap. The USD Index remains in an uptrend, and the dollar basket also rallied after approaching its 50-day moving average on Feb. 1. As a result, the recent consolidation is a normal occurrence, and there isn't much cause for concern.

Similarly, while mining stocks attempt to retrace some of their recent losses, the general stock market has helped uplift their performance. However, their idiosyncratic technical and fundamental outlooks remain bearish. As such, the short-term support from the S&P 500 should dissipate sooner rather than later. For context, I wrote previously:

Once one realizes that GDXJ is more correlated with the general stock market than GDX is, GDXJ should be showing strength here. If stocks don’t decline, GDXJ is likely to underperform by just a bit, but when (not if) stocks slide, GDXJ is likely to plunge visibly more than GDX.

Having said that, let's take a look at the situation from a fundamental point of view.

Digging a Deeper Hole

While the PMs remain relatively upbeat, their fundamental outlooks continue to worsen. For example, with the Fed now fighting inflation, rate hikes should commence in the coming months. However, in the meantime, the ground is already shifting beneath the PMs’ feet.

Please see below:

To explain, the blue line above tracks Goldman Sachs' Financial Conditions Index (FCI). For context, the index is calculated as a "weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, with weights that correspond to the direct impact of each variable on GDP." In a nutshell: when interest rates increase alongside credit spreads, it's more expensive to borrow money and financial conditions tighten.

To that point, if you analyze the right side of the chart, you can see that the FCI has surpassed its pre-COVID-19 high (January 2020). Moreover, the FCI bottomed in January 2021 and has been seeking higher ground ever since. In the process, it's no coincidence that the PMs have suffered mightily since January 2021. To that point, with the Fed poised to raise interest rates at its March monetary policy meeting, the FCI should continue its ascent. As a result, the PMs' relief rallies should fall flat, like in 2021.

Likewise, while the USD Index has come down from its recent high, it's no coincidence that the dollar basket bottomed with the FCI in January 2021 and hit a new high with the FCI in January 2022. Thus, while the recent consolidation may seem troubling, the medium-term fundamentals supporting the greenback remain robust.

Furthermore, Fed hawks remain focused on inflation, and while investors' positioning may seem contradictory, Fed officials' transition from hawkish rhetoric to hawkish policy should help the USD Index surpass 98 in the coming months.

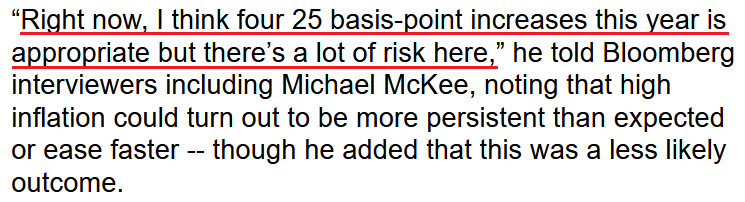

To explain, Philadelphia Fed President Patrick Harker told Bloomberg on Feb. 1 that a 50 basis point rate hike in March shouldn't be expected. For context, the prospect was always unrealistic. However, investors seemed to buy into the notion for a short time. He said:

“I would be supportive of a 25 basis-point increase in March. Could we do 50? Yeah. Should we? Well, I’m a little less convinced of that right now. But we’ll see how the data turn out in the next couple of weeks.”

However, Harker still expects four rate hikes for 2022, as long as inflation remains elevated.

Please see below:

Moreover, it’s important to remember that Fed Chairman Jerome Powell uses his deputies to deliver monetary messages. For example, during his Dec. 15 press conference, Powell was asked if he postponed his “hawkish policy stance” until after he was reappointed for a second term. I wrote about his response on Dec. 16:

As one of the most important quotes of the press conference, Powell admitted:

“My colleagues were out talking about a faster taper and that doesn’t happen by accident. They were out talking about a faster taper before the president made his decision. So it’s a decision that effectively was more than entrained.”

And while Powell sounded a little rattled during the exchange, his slip highlights the importance of Fed officials’ hawkish rhetoric. Essentially, when Clarida, Waller, Bostic, Bullard, etc., are making the hawkish rounds, “that doesn’t happen by accident.” As such, it’s an admission that his understudies serve as messengers for pre-determined policy decisions.

To that point, a chorus of Fed officials reiterated their hawkish expectations over the last two days, and, as Powell said, “that doesn’t happen by accident.”

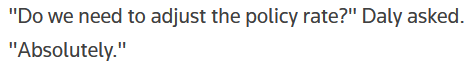

San Francisco Fed President Mary Daly said:

“We definitely are poised for a March increase. But after that, I want to see what the data brings us.”

Richmond Fed President Thomas Barkin said:

“I'd like us to be better positioned. Better positioned is somewhere closer to neutral, certainly, than we are now and I think the pace of that just depends on the pace of inflation."

Atlanta Fed President Raphael Bostic said:

“When I started looking at this year, I had three moves or three rate increases in mind. And March increasingly was looking like it's the right time to do that.”

Kansas City Fed President Esther George said:

“It is in no one's interest to try to upset the economy with unexpected adjustments. I do think the Federal Reserve is going to have to move deliberately in its decisions to begin to withdraw accommodation."

St. Louis Fed President James Bullard said:

“We are cognizant of the inflation issue, we’re moving on the policy rate, but we’re also going to move on the balance sheet so we’re not that far from reaching neutral if you are willing to consider both of those.”

Thus, it’s clear that the Fed is on autopilot. In contrast, the ECB hasn’t achieved its rate hike criteria. Thus, while the EUR/USD’s recent rally hurts the USD Index, should we be concerned? To explain, I wrote on Feb. 1:

While the USD Index may come under pressure this week, it’s the same old story: euro bulls bid up the EUR/USD in hopes that the ECB will say or do something hawkish. And in the process, dollar weakness spreads to other currency pairs, and the USD Index suffers. However, once the short-term sentiment highs dissipate, the fundamentals reign supreme. And with the Fed all but certain to raise interest rates in March and the ECB poised to disappoint once again, the EUR/USD’s downtrend should continue over the medium term.

All in all, it’s important not to overreact to short-term fluctuations. While it seems like the USD Index has fallen out of favor and the PMs are back in investors’ good graces, the reality is that other currencies bounced off of relatively oversold levels, and positioning shifts occurred. However, the USD Index suffered several countertrend declines in 2021. As a result, the recent weakness is far from a regime change, and its robust fundamentals should rule the day over the medium term.

Finally, since Fed officials’ hawkish forecasts depend on the direction of inflation and the U.S. economy, the outlook for both remains resilient. For context, the Omicron variant will likely depress Q1 GDP growth. However, I noted on Jan. 31 that warmer weather should shift the narrative. I wrote:

The U.S. economy is growing well ahead of its pre-pandemic trend. Moreover, while disruptions from the Omicron variant will likely slow growth in Q1, the outbreak should calm down when warmer weather arrives. With the season also allowing for patio dining, camping trips, and other outdoor activities that support economic growth, Q1’s weakness should be short-lived.

Supporting the thesis, the U.S. Bureau of Labor Statistics (BLS) revealed on Feb. 1 that U.S. job openings came in at 10.925 million, well ahead of the 10.300 million expected. Moreover, there are now 4.606 million more job openings in the U.S. than unemployed citizens.

Please see below:

To explain, the green line above subtracts the number of unemployed U.S. citizens from the number of U.S. job openings. If you analyze the right side of the chart, you can see that the epic collapse has completely reversed and the green line is now at an all-time high. Thus, with more jobs available than people looking for work, the economic environment supports normalization by the Fed.

The bottom line? While short-term price moves may seem material, false narratives are built on foundations of sand. While several castles crumbled in 2021, prophecies of the dollar’s demise have risen once again. However, with the fundamentals signaling more dollar strength over the medium term, it’s likely only a matter of time before the USD Index’s bullish ascent continues.

In conclusion, the PMs rallied on Feb. 1 and the USD Index continued its consolidation. However, with financial conditions already tight and poised to tighten further, the pullback lacks fundamental credibility. Moreover, with the U.S. economy still on solid ground, the Fed has little reason to perform a dovish 180. As a result, the PMs’ optimism should turn to pessimism over the medium term.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Hawkish Eurozone Expectations Push the USD Into the Shadow

February 1, 2022, 9:46 AMWith the ECB holding its next monetary policy meeting on Feb. 3, the EUR/USD is up to its usual shenanigans. Moreover, with the currency pair accounting for nearly 58% of the USD Index’s movement, the sharp rally on Jan. 31 hurt the dollar basket. However, haven’t we seen this movie before? To explain, I wrote on Oct. 29:

The green line above tracks the EUR/USD’s movement in 2021. If you focus your attention on the vertical red lines, they mark the day before the ECB makes its policy statements. Likewise, if you analyze the performance of the EUR/USD thereafter, you can see that euro bulls often find something to celebrate when Lagarde has her press conferences.

For context, the EUR/USD has recorded rallies after five of the seven ECB policy meetings in 2021 (including on Oct. 28), declined once, and traded roughly flat after another. However, lower lows have still plagued the currency pair throughout its 2021 journey.

Thus, is this time really different?

To that point, while the EUR/USD closed above 1.1680 on Oct. 28, the currency pair has declined materially since; and while euro bulls often buy the EUR/USD in hopes that the ECB will perform a hawkish 180, they’re in front-run mode this time around. However, with disappointment reigning supreme for more than 12 months, another dose of reality should strike sooner rather than later.

For example, while the Eurozone headline inflation increased by 5% year-over-year (YoY) on Jan. 20, core inflation – which includes the inflationary effects of food and energy prices – only increased by 2.7% YoY (the red box below). As a result, while I’ve highlighted the discrepancy on several occasions, the pricing pressures confronting Europe are mainly a function of oil and gas irregularities. Outside of that, most goods and services are within the ECB’s expected inflation range.

Please see below:

Second, hourly labor costs in the Eurozone rose by 2.5% YoY on Dec. 16 (the latest release). Moreover, the report revealed that “the costs of wages and salaries per hour worked increased by 2.3%, while the non-wage component rose by 3.0% in the third quarter of 2021, compared with the same quarter of the previous year.”

As a result, non-wage labor costs – like insurance, healthcare, unemployment premiums, etc. – did the bulk of the heavy lifting. In contrast, wage and salary inflation are nowhere near the ECB’s danger zone.

Please see below:

Why is wage inflation so critical? Well, ECB Chief Economist Philip Lane said on Jan. 25:

“We are clear from our December forecast that we expect inflation − in overall terms for this year − to be around 3.2% in the Euro Area, and then to be below 2% in 2023 and 2024 (…). So rather than focus on month by month, we have a clear vision in terms of the overall direction: that the inflation rate will fall later this year.”

More importantly, though:

As a result, when the ECB’s Chief Economist tells you that wage inflation needs to hit 3% YoY to be “consistent” with the ECB’s 2% overall annual inflation target, a wage print of 2.3% YoY is far from troublesome. Thus, while euro bulls hope that the ECB will mirror the Fed and perform a hawkish 180, the data suggests otherwise.

Think about it: why would the ECB raise interest rates when core inflation is at 2.7% YoY and wage inflation is at 2.3% YoY? In stark contrast, U.S. core inflation (the chart below) increased by 5.5% YoY on Jan. 12, and U.S. average hourly earnings increased by 4.7% YoY on Jan. 7. As such, while I’ve stated it on numerous occasions, the Fed and the ECB are worlds apart.

Please see below:

To that point, Giovanni Zanni, Chief Euro Area Economist at NatWest Markets, told clients on Jan. 28: “markets are increasingly worried that the ECB is behind the curve, but we are less concerned. 18bp of rate hikes priced in by Dec-22 looks too much, we think."

Likewise, Derek Halpenny, Head of Research for EMEA Global Markets at MUFG, stated on Jan. 28: “there will certainly be more focus on EUR and GBP next week with the ECB and the BoE meeting. The BoE is widely expected to hike but the ECB remains far off that point. We expect EUR to remain under downward pressure over the coming months."

Conversely, with liftoff at the Fed’s March monetary policy meeting likely a done deal, the dove-hawk divergence between the ECB and the Fed remains material.

For context, this is how it started (Nov. 16):

And this is how it’s going (Jan. 31):

Remember, San Francisco Fed President Mary Daly is a major dove. As a result, she stated on Jan. 31:

"I don't want to predetermine what [the level of interest rates] should be, because I really do see the two-sided risks we're facing, and so I want to be data dependent (...). We have to have our options open, right? And if more is needed, more will be done. If less is needed, less will be done, but we have to have our options open."

However, when pondering a rate hike in March, Daly said:

The bottom line? While the USD Index may come under pressure this week, it’s the same old story: euro bulls bid up the EUR/USD in hopes that the ECB will say or do something hawkish. In the process, dollar weakness spreads to other currency pairs, and the USD Index suffers. However, once the short-term sentiment highs dissipate, the fundamentals reign supreme. With the Fed all but certain to raise interest rates in March and the ECB poised to disappoint once again, the EUR/USD’s downtrend should continue over the medium term.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM