tools spotlight

-

Gold Lost Its Chance Again as the Dollar Ran Out of Fuel

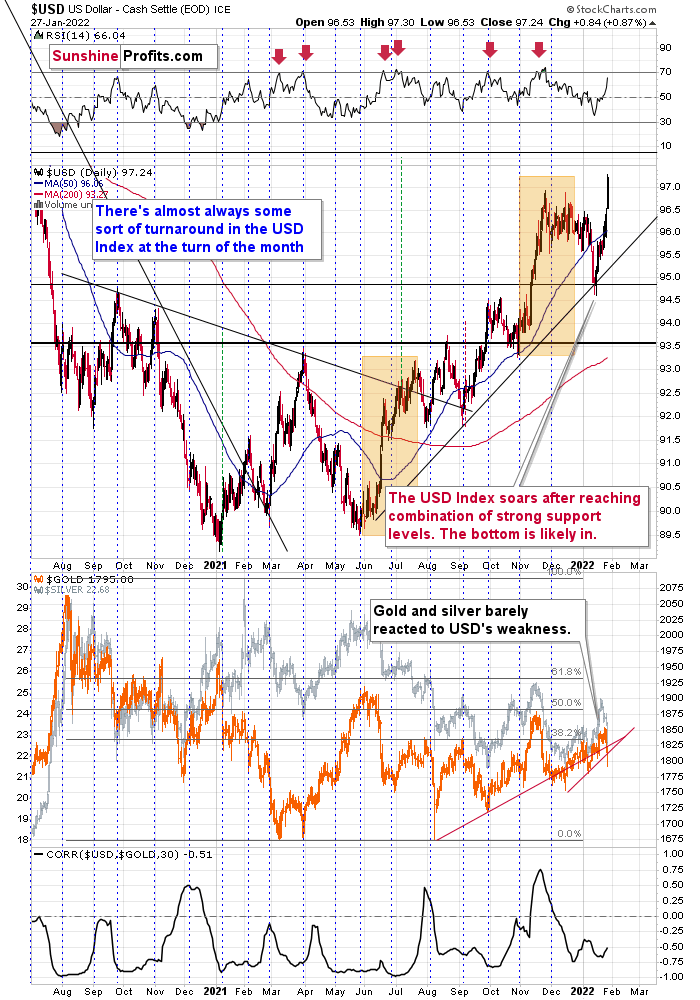

January 31, 2022, 10:11 AMIt was no surprise that both gold and silver suffered a lot last week, since they usually react with a weakening to the dollar's success. As predicted, at the sight of the Fed’s hawk spreading its wings, after Powell announced that the Fed would raise interest rates in March, the precious metals moved lower with their tails between their legs.

Okay, but the dollar’s rally has to end sometime, or at least slow down, and that means an opportunity for gold and silver to win back. Indeed, this was the case just before last weekend. The dollar ran out of fuel for a while, but the precious metals got confused again and instead of making up for the losses, they generated more.

Why did this happen? A similar situation has already taken place this month. On January 13, I wrote:

I’ve been writing this over and over again, and yet I’ll write it once more. Markets don’t move in a straight line up or down, and periodic corrections are natural. However, the way markets interact during those corrections tells us a lot about what’s likely to take place next, at least in the case of some markets.

The USD Index declined quite visibly yesterday and in today’s overnight trading.

The key questions are: so what, and if that was completely unexpected.

Starting with the latter, it wasn’t unexpected. It’s something in tune with gold’s long-term chart.

When the weekly RSI (based on the weekly price changes) for the USD Index hit 70, I wrote the following:

Also, please note that the recent medium-term rally has been calmer than any major upswing witnessed over the last 20 years, where the USD Index’s RSI has hit 70. I marked the recent rally in the RSI with an orange rectangle, and I did the same with the second-least and third-least volatile of the medium-term upswings.

The sharp rallies in 2008 and 2014 were of much larger magnitudes. And in those historical analogies, the USD Index continued its surge for some time without suffering any material corrections.

As a result, the short-term outlook is more of a coin flip.

Consequently, the current decline is not unexpected, it’s rather normal.

Another thing is that after a series of declines, the outlook for gold for the next few days was not too rosy. As rising expectations of US interest rate hikes pushed the dollar to a multi-month high, making gold less attractive to investors, the end of January was supposed to be the yellow metal's worst week since late November.

Meanwhile, gold prices did not change on Monday, breaking a weak trend in the international market. Perhaps my theory that gold's idleness and the way it resists is actually its strength is reaffirmed. Not only did gold not hit its annual lows when the dollar peaked, but it was able to hold a stable position once the bears visualized the crash.

For context, I wrote on Jan. 27:

The U.S. currency just moved above its previous 2022 and 2021 highs, while gold is not at its 2021 lows.

Yet.

I wouldn’t view gold’s performance as true strength against the USD Index at this time just yet. Why? Because of the huge consolidation that gold has been trading in.

The strength that I want to see in gold is its ability not to fall or soar back up despite everything thrown against it, not because it’s stuck in a trading range.

In analogy, you’ve probably seen someone, who’s able to hold their ground, and not give up despite the world throwing every harm and obstacle at them. They show their character. They show their strength. Inaction could represent greater wisdom and/or love and focus on one’s goal that was associated with the lack of action. You probably know someone like that. You might be someone like that.

The above “inaction” is very different from “inaction” resulting from someone not knowing what to do, not having enough energy, or willpower.

However, wasn’t gold strong against the USD Index’s strength in 2021?

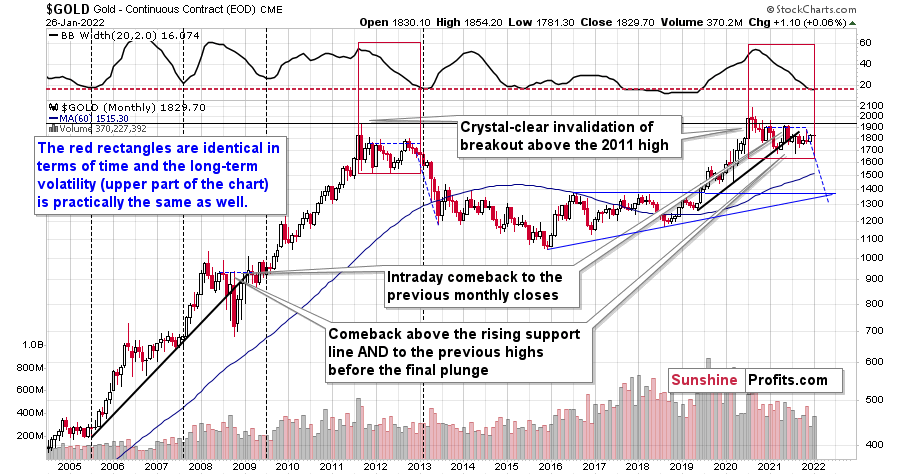

It was, but it was very weak compared to the ridiculous amounts of money that were printed in 2020 and 2021 and given the global pandemic. These are the circumstances, where gold “should be” soaring well above its 2011 highs, not invalidating the breakout above it. The latter, not the former, happened. Besides, the “strength” was present practically only in gold. Silver and miners remain well below their 2011 highs – they are not even close to them and didn’t move close to them at any point in 2020 or 2021.

In the coming days, the greenback will again be the most likely driver of gold prices. In addition, both the dollar and gold are expected to reflect the risk of the conflict between Russia and Ukraine, as I have already mentioned.

Having said that, let’s take a look at the markets from a more fundamental point of view.

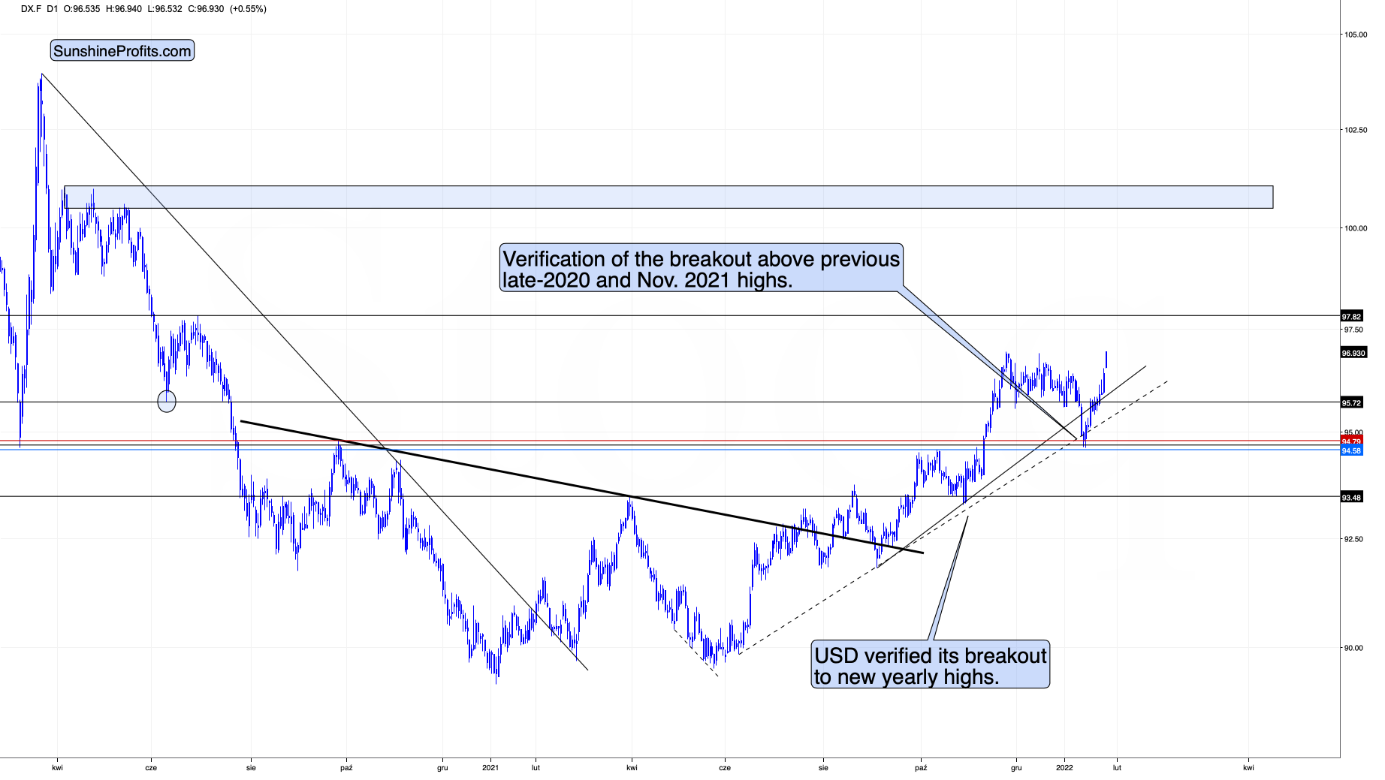

USD: As Expected

After the USD Index surpassed its 2021 high on Jan. 27, my expectations for further dollar strength have materialized. Moreover, with the PMs often moving inversely to the U.S. dollar, they’ve struggled mightily in recent days. However, with a predictable cooling-off period commencing on Jan. 28, I noted that the dollar basket could pause and catch its breath. I wrote:

It’s crucial to avoid speculation and wait for confirmation of breakdowns and breakouts. In its absence, the price action often pulls you in the wrong direction. Remember the supposedly bearish move below 95 when the USD Index moved even below its rising support line? It’s been just 2 weeks since that development.

Fortunately, if you’ve been following my analyses, the recent price moves didn’t catch you by surprise. What’s next? While the USD Index still needs to confirm the recent breakout and some consolidation may ensue, the bullish medium-term thesis remains intact.

That's precisely what we saw on Jan. 28. However, the important development is that gold and silver did not exhibit strength. While the yellow metal could have recouped some losses while the USD Index paused, it declined by 0.47%. Similarly, silver underperformed and declined by 1.65%. As a result, the PMs' inability to muster relief rallies is profoundly bearish.

Furthermore, I've warned on several occasions that the S&P 500 can influence mining stocks. However, while the S&P 500 and the NASDAQ Composite rallied by 2.43% and 3.13%, respectively, on Jan. 28, the GDX ETF declined by 1.28% and the GDXJ ETF fell by 0.88%. Moreover, the GDXJ ETF closed below its 2021 low. As such, the PMs' weakness is visible from many angles.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold & Silver Trading Alert - Heads-up for the Next Week

January 28, 2022, 3:20 PMAvailable to premium subscribers only.

-

The USDX Caught the Wave and Left Hungry Bears on the Shore

January 28, 2022, 8:58 AMDespite death wishes from the doubters, the dollar took to the skies on the Fed’s hawkish wings. Gold and silver can wave from the ground for now.

While Fed Chairman Jerome Powell threw fuel on the fire on Jan. 26, it’s no surprise that the USD Index has rallied to new highs. For example, while dollar bears feasted on false narratives in 2021, I was a lonely bull forecasting higher index values. Likewise, after more doubts emerged in 2022, the death of the dollar narrative resurfaced once again. However, with the charts signaling a bullish outcome for some time, my initial target of 94.5 was surpassed and my next target of 98 is near.

As such, it’s crucial to avoid speculation and wait for confirmation of breakdowns and breakouts. In its absence, the price action often pulls you in the wrong direction.

Remember the supposedly bearish move below 95 when the USD Index moved even below its rising support line? It’s been just 2 weeks since that development.

On Jan. 14, I wrote the following:

In conclusion, 2022 looks a lot like 2021: dollar bears are out in full force and the ‘death of the dollar’ narrative has resurfaced once again. However, with the greenback’s 2021 ascent catching many investors by surprise, another re-enactment will likely materialize in 2022. Moreover, since gold, silver, and mining stocks often move inversely to the U.S. dollar, their 2022 performances may surprise for all of the wrong reasons. As such, while the dollar’s despondence is bullish for the precious metals, a reversal of fortunes will likely occur over the medium term. Given yesterday’s reversal in the USD Index, it’s likely also from the short-term point of view – we could see the reversal and the return of the USD’s rally and PMs’ decline any day or hour now.

Fortunately, if you’ve been following my analyses, the recent price moves didn’t catch you by surprise. What’s next?

While the USD Index still needs to confirm the recent breakout and some consolidation may ensue, the bullish medium-term thesis remains intact.

More importantly, though, the USD Index’s gain has resulted in gold, silver, and mining stocks’ pain. For example, the dollar’s surge helped push gold below its short-and-medium-term rising support lines (the upward sloping red lines on the bottom half of the above chart).

However, since the USD Index hit a new high and gold didn’t hit a new low, is the development bullish for the yellow metal? To answer, I wrote on Jan. 27:

The U.S. currency just moved above its previous 2022 and 2021 highs, while gold is not at its 2021 lows.

Yet.

I wouldn’t view gold’s performance as true strength against the USD Index at this time just yet. Why? Because of the huge consolidation that gold has been trading in.

The strength that I want to see in gold is its ability not to fall or soar back up despite everything thrown against it, not because it’s stuck in a trading range.

In analogy, you’ve probably seen someone, who’s able to hold their ground, and not give up despite the world throwing every harm and obstacle at them. They show their character. They show their strength. Inaction could represent greater wisdom and/or love and focus on one’s goal that was associated with the lack of action. You probably know someone like that. You might be someone like that.

The above “inaction” is very different from “inaction” resulting from someone not knowing what to do, not having enough energy, or willpower.

Since markets are ultimately created by people (or algorithms that were… ultimately still created by people) is it any surprise that markets tend to work in the same way? One inaction doesn’t equal another inaction, and – as always – context matters.

However, wasn’t gold strong against the USD Index’s strength in 2021?

It was, but it was very weak compared to the ridiculous amounts of money that were printed in 2020 and 2021 and given the global pandemic. These are the circumstances, where gold “should be” soaring well above its 2011 highs, not invalidating the breakout above it. The latter, not the former, happened. Besides, the “strength” was present practically only in gold. Silver and miners remain well below their 2011 highs – they are not even close to them and didn’t move close to them at any point in 2020 or 2021.

The Eye in the Sky Doesn’t Lie

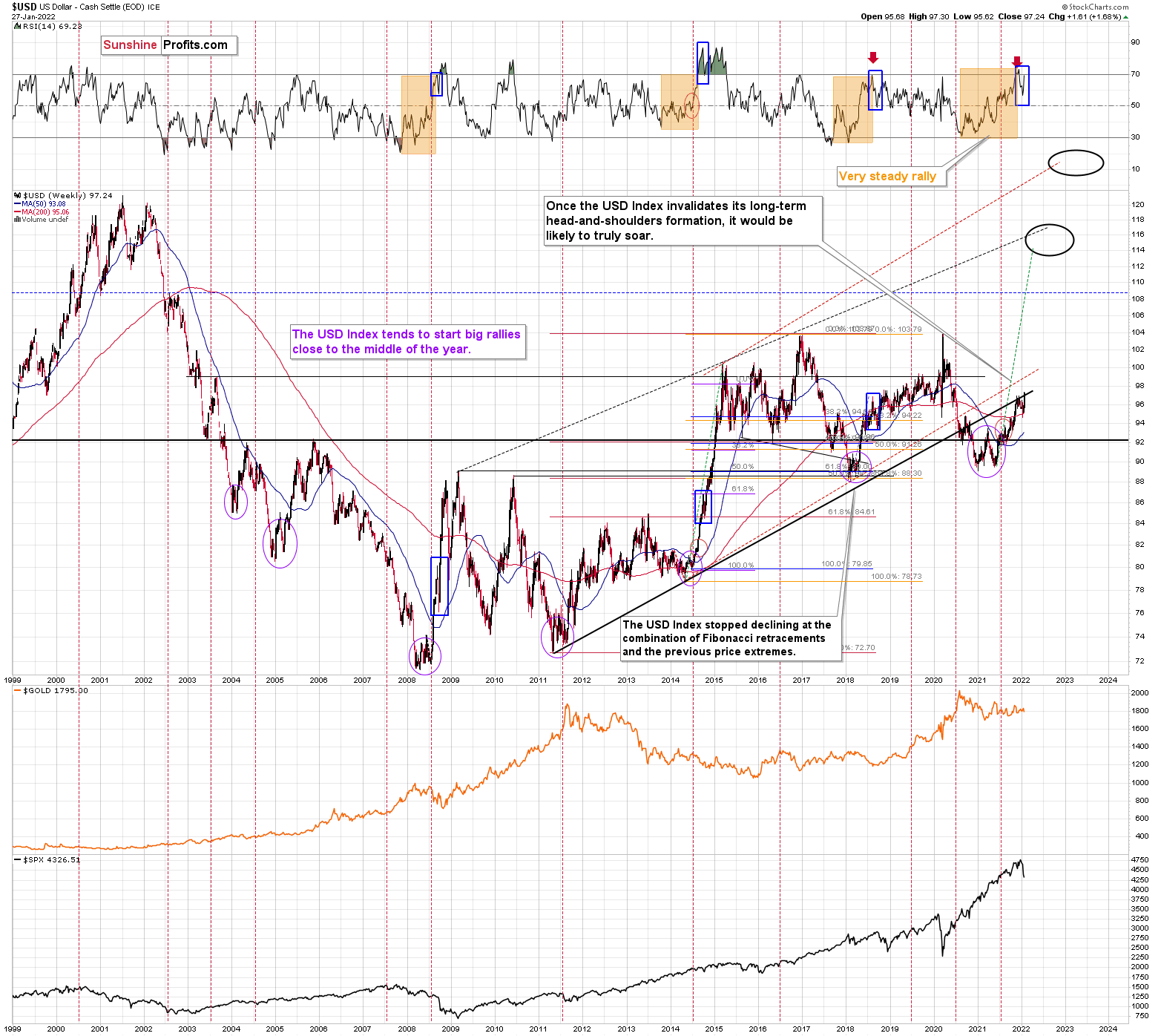

Moreover, if we zoom out and focus our attention on the USD Index’s weekly chart, the price action has unfolded exactly as I expected. For example, while overbought conditions resulted in a short-term breather, the USD Index consolidated for a few weeks. However, history shows that the greenback eventually catches its second wind. To explain, I previously wrote:

I marked additional situations on the chart below with orange rectangles – these were the recent cases when the RSI based on the USD Index moved from very low levels to or above 70. In all three previous cases, there was some corrective downswing after the initial part of the decline, but once it was over – and the RSI declined somewhat – the big rally returned and the USD Index moved to new highs.

Please see below:

Just as the USD Index took a breather before its massive rally in 2014, it seems that we saw the same recently. This means that predicting higher gold prices (or those of silver) here is likely not a good idea.

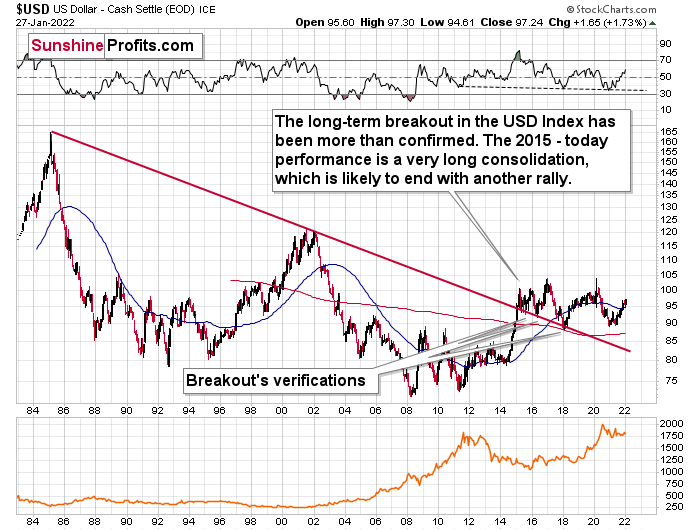

Continuing the theme, the eye in the sky doesn’t lie, and with the USDX’s long-term breakout clearly visible, the wind remains at the dollar’s back. Furthermore, dollar bears often miss the forest through the trees: with the USD Index’s long-term breakout gaining steam, the implications of the chart below are profound. While very few analysts cite the material impact (when was the last time you saw the USDX chart starting in 1985 anywhere else?), the USD Index has been sending bullish signals for years.

Please see below:

The bottom line?

With my initial 2021 target of 94.5 already hit, the ~98-101 target is likely to be reached over the medium term (and perhaps quite soon) Mind, though: we’re not bullish on the greenback because of the U.S.’s absolute outperformance. It’s because the region is fundamentally outperforming the Eurozone. The EUR/USD accounts for nearly 58% of the movement of the USD Index, and the relative performance is what really matters.

In conclusion, the USD Index’s ascent has surprised investors. However, if you’ve been following my analysis, you know that I’ve been expecting these moves for over a year. Moreover, with the rally poised to persist, gold, silver, and mining stocks may struggle before they reach lasting bottoms. However, with long-term buying opportunities likely to materialize later in 2022, the precious metals should soar to new heights in the coming years.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Is Bruised but Can Show Strength – By Doing Nothing

January 27, 2022, 9:35 AMThe Fed finally said it: the rates are going up. The USD Index and gold heard it and reacted. The former is at new yearly highs, while gold slides.

The medium-term outlook for gold is now extremely bearish.

The above might sound like a gloom and doom scenario for precious metals investors, but I view it as particularly favorable. Why? Because:

- This situation allows us to profit on the upcoming decline in the precious metals sector through trading capital.

- This situation allows us to detect a great buying entry point in the future. When gold has everything against it and then it manages to remain strong – it will be exactly the moment to buy it. To be more precise: to buy into the precious metals sector (I plan to focus on purchasing mining stocks first as they tend to be strongest during initial parts of major rallies). At that moment PMs will be strong and the situation will be so bad that it can only improve from there – thus contributing to higher PM prices in the following months.

- Most market participants have not realized the above. “Gold and (especially) silver can only go higher!” is still a common narrative on various forums.

Having said that, let’s take a look at the short-term charts.

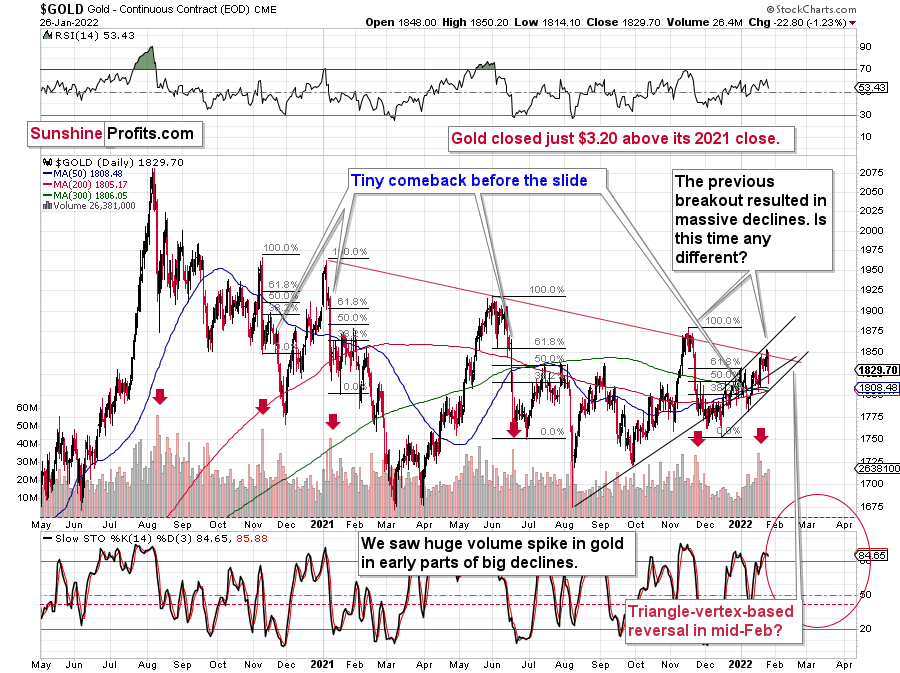

In short, gold declined significantly, and it’s now trading once again below the rising support / resistance line, the declining red resistance line, and back below 2021 closing price (taking also today’s pre-market decline into account).

In other words:

- All important short-term breakouts were just invalidated.

- The 2022 is once again a down year for gold.

Is this as bearish as it gets for gold? Well, there could be some extra bearish things that could happen, but it’s already very, very bearish right now.

For example, gold market could catch-up with its reactions to USD Index’s strength.

The U.S. currency just moved above its previous 2022 and 2021 highs, while gold is not at its 2021 lows.

Yet.

I wouldn’t view gold’s performance as true strength against the USD Index at this time just yet. Why? Because of the huge consolidation that gold has been trading in.

The strength that I want to see in gold is its ability not to fall or soar back up despite everything thrown against it, not because it’s stuck in a trading range.

In analogy, you’ve probably seen someone, who’s able to hold their ground, and not give up despite the world throwing every harm and obstacle at them. They show their character. They show their strength. Inaction could represent greater wisdom and/or love and focus on one’s goal that was associated with the lack of action. You probably know someone like that. You might be someone like that.

The above “inaction” is very different from “inaction” resulting from someone not knowing what to do, not having enough energy, or willpower.

Since markets are ultimately created by people (or algorithms that were… ultimately still created by people) is it any surprise that markets tend to work in the same way? One inaction doesn’t equal another inaction, and – as always – context matters.

However, wasn’t gold strong against the USD Index’s strength in 2021?

It was, but it was very weak compared to the ridiculous amounts of money that were printed in 2020 and 2021 and given the global pandemic. These are the circumstances, where gold “should be” soaring well above its 2011 highs, not invalidating the breakout above it. The latter, not the former, happened. Besides, the “strength” was present practically only in gold. Silver and miners remain well below their 2011 highs – they are not even close to them and didn’t move close to them at any point in 2020 or 2021.

Gold has been consolidating for many months now, just like it’s been the case between 2011 and 2013.

The upper part of the above chart features the width of the Bollinger Bands – I didn’t mark them on the chart to keep it clear, but the important detail is that whenever their width gets very low, it means that the volatility has been very low in the previous months, and that it’s about to change.

I marked those cases with vertical dashed lines when the big declines in the indicator took it to or close to the horizontal, red, dashed line. In particular, the 2011-2013 decline is similar to the current situation.

What does it mean? It means that gold wasn’t really showing strength – it was stuck. Just like 2012 wasn’t a pause before a bigger rally, the 2021 performance of gold shouldn’t be viewed as such.

What happened yesterday showed that gold can and will likely react to hawkish comments from the Fed, that the USD Index is likely to rally and so are the interest rates. The outlook for gold in the medium term is not bullish, but very bearish.

The above is a positive for practically everyone interested in the precious metals market (except for those who sell at the bottom that is), as it will allow one to add to their positions (or start building them) at much lower prices. And some will likely (I can’t guarantee any performance, of course) gain small (or not so small) fortunes by being positioned to take advantage of the upcoming slide.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM