Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

After last Thursday’s big decline, we saw another decline on Friday – this time it was in the USD Index. Interestingly, gold didn’t soar back as a result.

This tells us something important, even though the session might appear uninformative or just plain boring. Namely, it tells us that the precious metals market wants to move lower and not higher.

If the latter was the case, gold, silver, and mining stocks would have surely taken advantage of the decline in the USDX and magnified this indication by rallying profoundly. Instead, they just took a breather after Thursday’s decline. That’s bearish. Let’s take a closer look.

As you can see on the above chart, the USD Index declined visibly, so this move shouldn’t have been ignored by the PMs. And yet, it was. So, as I wrote earlier, the implications for PMs are bearish.

Technically, the USDX didn’t invalidate the breakout below the June 2020 low, so there were no bearish implications for the USD Index based on Friday’s session. This, combined with a weak reaction in the precious metals market, makes the situation particularly bearish for the latter.

The USD Index is likely to rally shortly – if not right away, and when that happens, the PMs are likely to respond by declining profoundly. I don’t think that predicting higher gold prices while there is a bullish outlook for the USDX is a good idea.

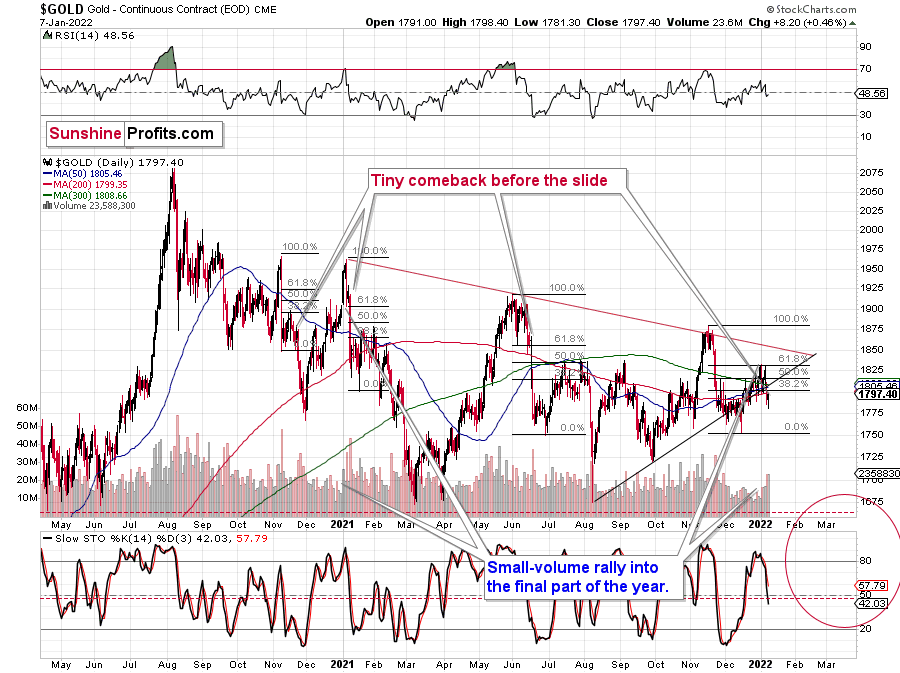

As you can see on the above gold chart, despite the USD’s decline, gold was unable to get back above its previous rising support line. The sell signal from the Stochastic indicator (lower part of the chart) wasn’t invalidated either.

Yes, the shape of Friday’s session makes it look like a reversal hammer candlestick and the volume that accompanied this move was quite high, but it seems to me that the relative performance of gold vs. the USD Index and the fact that gold was unable to rally back above the previously broken support are more important.

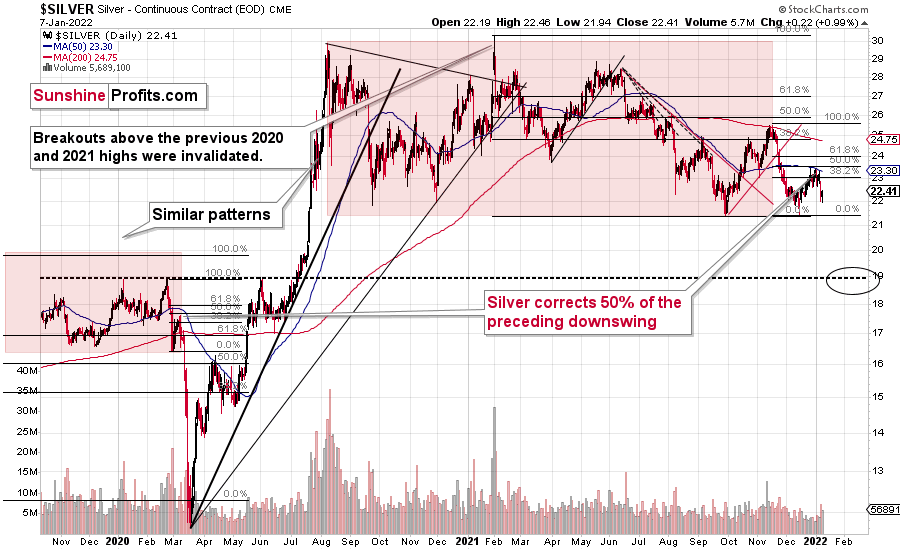

Besides, silver moved only slightly higher as well.

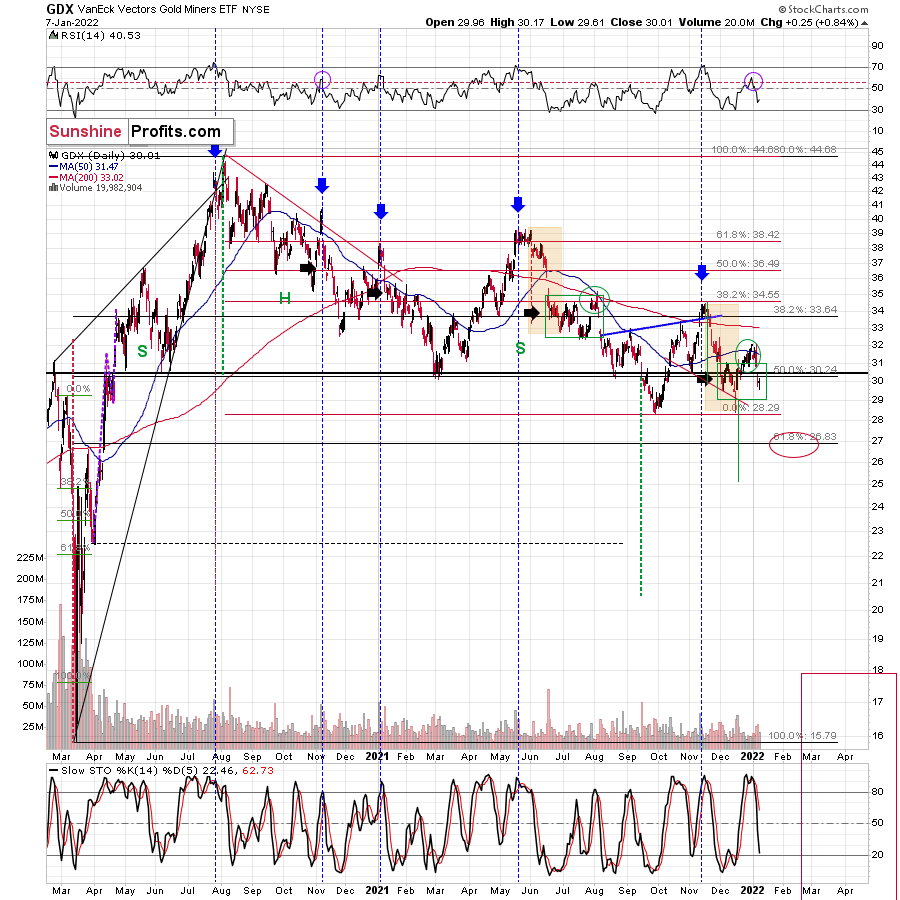

The rally in silver was too small to change anything. And I can say the same thing about the tiny upswing in the mining stocks.

Not only was the price move relatively small, but the volume was not as high as the one that accompanied Thursday’s decline. Consequently, the possible theory about a reversal in gold is not confirmed by what we saw in the mining stocks.

All in all, the situation in the precious metals market continues to look bearish, and it seems to be only a matter of time when we see breakdowns below the 2021 lows. Gold has the flu, and silver and mining stocks appear particularly vulnerable.

Having said that, let’s take a look at the markets from a more fundamental point of view.

The Music Is Still Playing

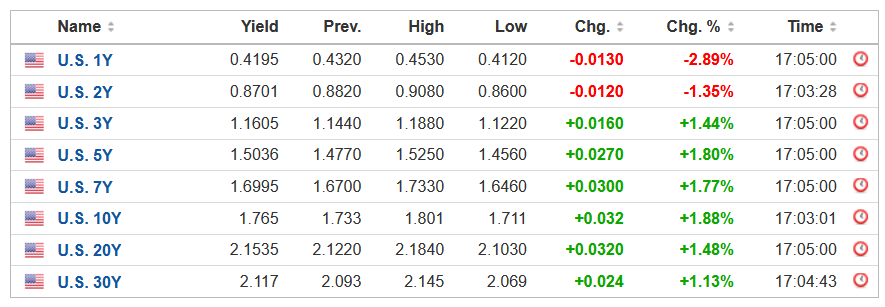

With U.S. Treasury yields resuming their uprising on Jan. 6 and Jan. 7, the fundamental destruction of the PMs continues. For example, the U.S. 5-Year Treasury yield and the U.S. 10-Year Treasury yield ended the Jan. 7 session at their highest levels since January 2020.

Please see below:

And helping to underwrite the pair's ascent, Fed officials provided another hawkish serenade on Jan. 6. Speaking at an Irish central bank virtual event, San Francisco Fed President Mary Daly – a reformed dove – called the U.S. labor market "very strong" and said that high inflation is a "repressive tax" on consumers.

More importantly, though, she echoed the worst-kept secret on Wall Street:

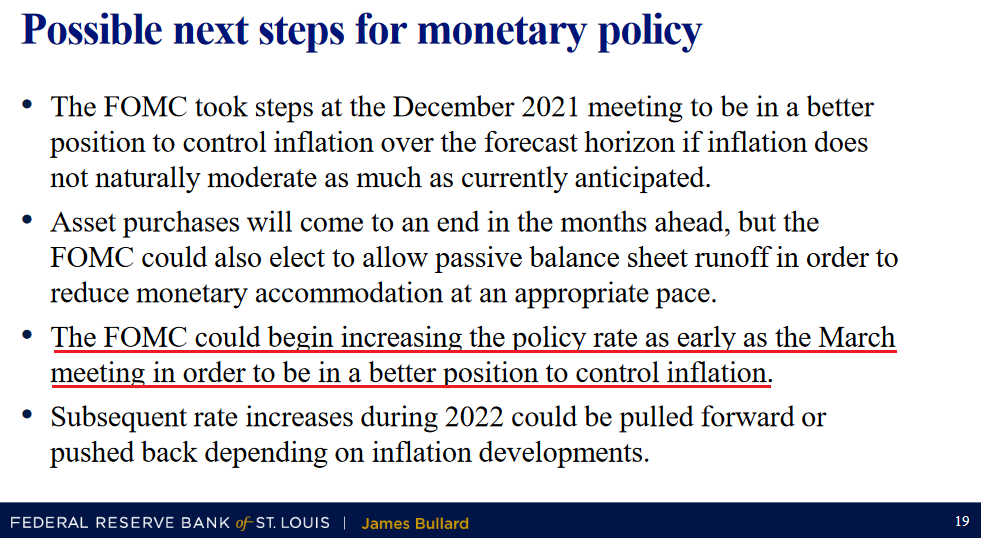

Likewise, St. Louis Fed President James Bullard gave a presentation to the St. Louis CFA Society on Jan. 6. And acknowledging reality, he stated:

“In December 2020, the inflation forecast in the Summary of Economic Projections (SEP) indicated that the median Federal Open Market Committee (FOMC) participant thought 2021 inflation would be 1.8% for both core and headline PCE inflation, below the FOMC’s 2% target.

“Measured from a year ago, headline PCE inflation is currently 5.7%, and core PCE inflation is 4.7% – well in excess of the FOMC’s 2% target.”

However, with 2021’s mistakes now in the rearview, the FOMC has a lot to make up for in 2022:

Speaking of inflation, the Institute for Supply Management (ISM) released its Services PMI on Jan. 6. And while the headline index decreased from 69.1 in November to 62 in December, inflationary pressures increased. The report revealed:

“Prices paid by services organizations for materials and services increased in December for the 55th consecutive month, with the index registering 82.5 percent, 0.2 percentage point higher than November's reading of 82.3 percent. This is the index's third-highest reading; its all-time high is 83.5 percent (September 2005) with the second highest (82.9 percent) occurring two months ago in October. All 18 services industries reported an increase in prices paid during the month of December.”

Also relevant, the ISM report revealed that “employment activity in the services sector grew in December for the sixth consecutive month after contracting in June.” And why is this so noteworthy? Well, with inflation and employment – the Fed’s dual mandate – both moving in a hawkish direction, the Fed should deliver on its promises over the medium term.

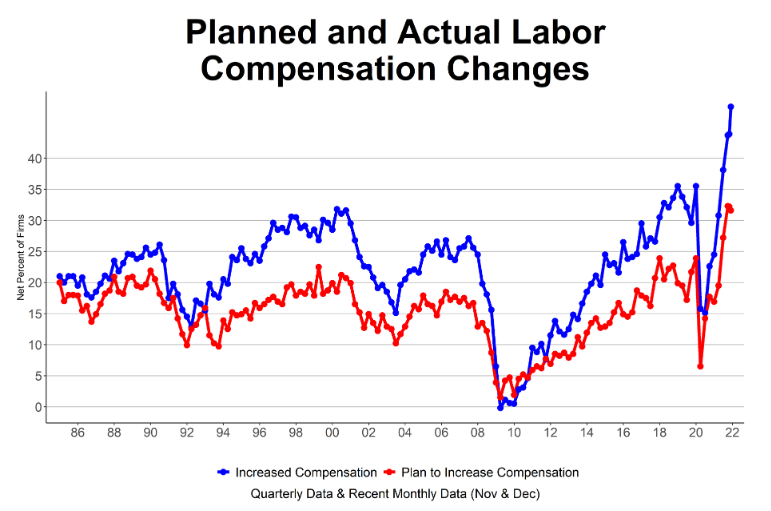

As further evidence, the NFIB released its Small Business Jobs Report on Jan. 6. And citing wage inflation, the report revealed:

“Seasonally adjusted, a net 48% reported raising compensation, up four points from November and a 48-year record high reading. A net 32% of owners plan to raise compensation in the next three months, unchanged from November’s record high reading.”

Please see below:

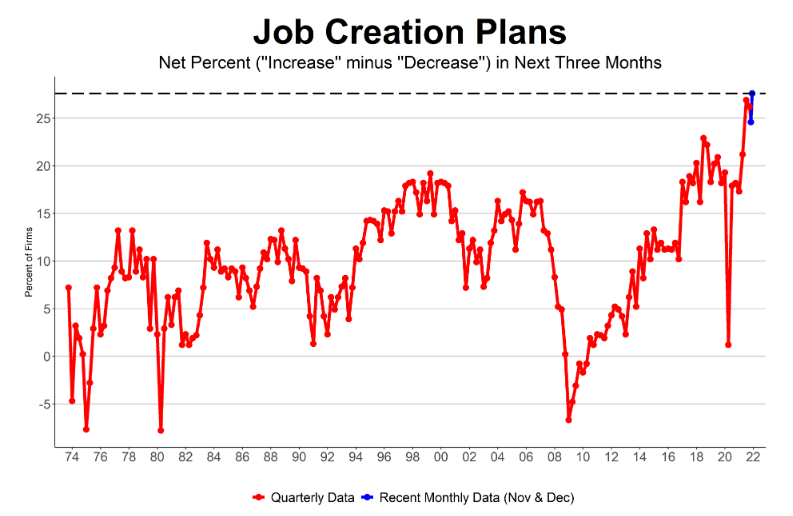

And citing employment, the report revealed:

“Small business owners’ plans to fill open positions remain at record high levels with a seasonally adjusted net 28% planning to create new jobs in the next three months, up three points from November and four points below the highest reading in the 48-year history of the survey set in August.”

Please see below:

As a result, while some investors hold out hope that the Fed will capitulate and perform a dovish pivot, the data suggests otherwise. With inflation, employment and resilient growth underpinning the U.S. economy, the Fed can raise interest rates without crashing the system.

For context, the economic impact of two or three rate hikes is largely immaterial. And while financial markets freak out when the action unfolds, its effect on the real economy is minimal. Conversely, the Fed runs into problems when it presses the gas pedal too hard. For example, three rate hikes can be tolerated. But when the Fed forges ahead with six, seven or eight, the economic scarring starts to show.

Despite that, market participants’ anxiety presents us with opportunities to generate alpha.

To explain, investors’ reaction to the fundamentals is often more important than the fundamentals themselves. And with gold, silver and mining stocks selling off on Jan. 6, the fundamental rationale is that higher interest rates reduce the PMs’ attractiveness. And with more hawkish rhetoric/policy likely to materialize in the coming months, the PMs are likely far from medium-term bottoms.

However, with sentiment known to overshoot and undershoot fundamental reality, investors overpricing of Fed tightening will likely provide us with solid buying opportunities later in 2022.

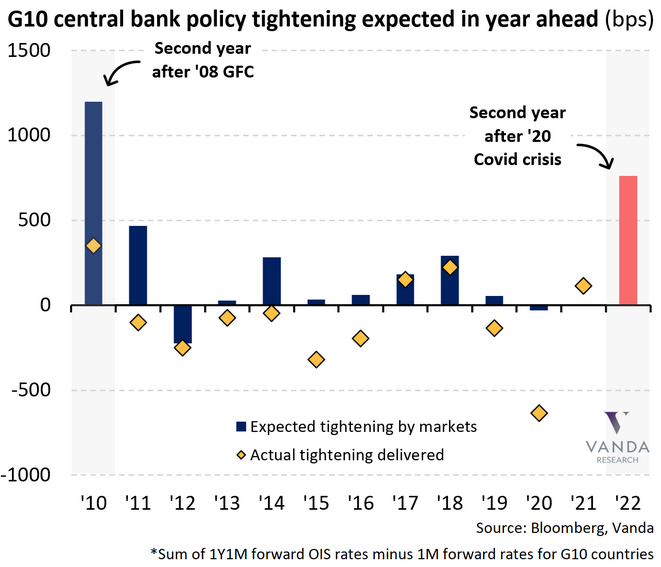

Please see below:

To explain, the various bars above track investors’ global rate hike expectations, while the yellow diamonds above track the rate hikes that actually occurred. If you analyze the blue bar furthest to the left, you can see that investors priced in aggressive tightening in 2010. However, only a third (roughly) of those hawkish expectations materialized.

To that point, if you analyze the pink bar furthest to the right, you can see that investors have ramped up their hawkish expectations once again. And while those bets likely have more room to run – which should untimely help push the PMs to new lows – they will likely overshoot fundamental reality and come down later in 2022. As a result, this fundamental phenomenon will likely align with my technical expectations for when the PMs may bottom.

Finally, while pessimists are eager to throw cold water on the U.S. economy – remember, a bullish U.S. economy is bearish for the PMs – I noted on Dec. 23 that trade data signals a resilient U.S. consumer. I wrote:

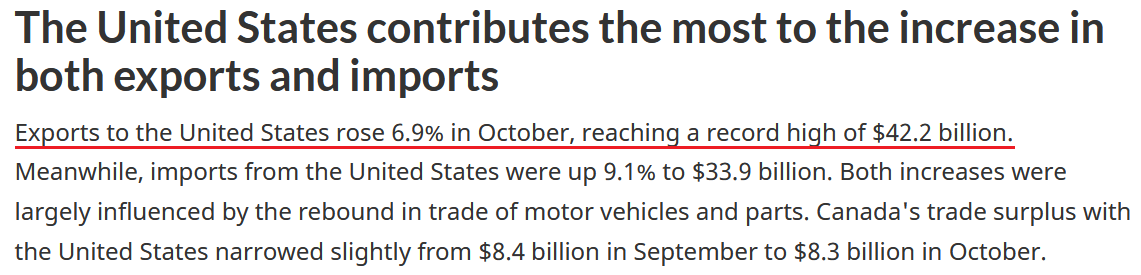

It's important to remember that more than 75% of Canada's exports are sent to the United States. And with the former's exports to the latter hitting an all-time high in October (data released on Dec. 7), it's another indicator that U.S. consumer demand remains resilient.

Moreover, with November’s data released on Jan. 6, Canadian exports to the U.S. hit another all-time high. In addition, Canadian imports from the U.S. also hit an all-time high. Also bullish, the 6.9% increase in October (the first image above) was revised up to 7.5% (the second image below). As a result, the U.S. economy remains on solid footing, and the Fed is unlikely to change its hawkish tone anytime soon.

The bottom line? While the PMs are under heavy fundamental fire, the situation should only worsen over the medium term. With inflation still surging and labor market demand at or near its all-time highs, the Fed should drop the hawkish hammer over the next few months.

Moreover, while some investors expect a dovish pivot, the prospect is much more semblance than substance. For example, hawk talk does nothing to actually calm inflation, and only policy responses will have the desired effect. Likewise, if the Fed performs a dovish 180, inflation will only drift further away from its 2% annual target. As a result, hawkish realities should confront investors in 2022, and those that expect otherwise will likely end the year disappointed.

In conclusion, the PMs suffered a NASDAQ-like sell-off on Jan. 6, with silver and the GDXJ ETF getting smoked. And while lower-than-expected U.S. nonfarm payrolls helped to provide a short-term reprieve on Jan. 7, the PMs’ medium-term paths remain unchanged: the USD Index did much of the heavy lifting in November and U.S. Treasury yields have grabbed the baton in recent days. As a result, the two-headed monster continues to inflict fundamental pain on the PMs, and more of the same will likely occur over the next few months.

Overview of the Upcoming Part of the Decline

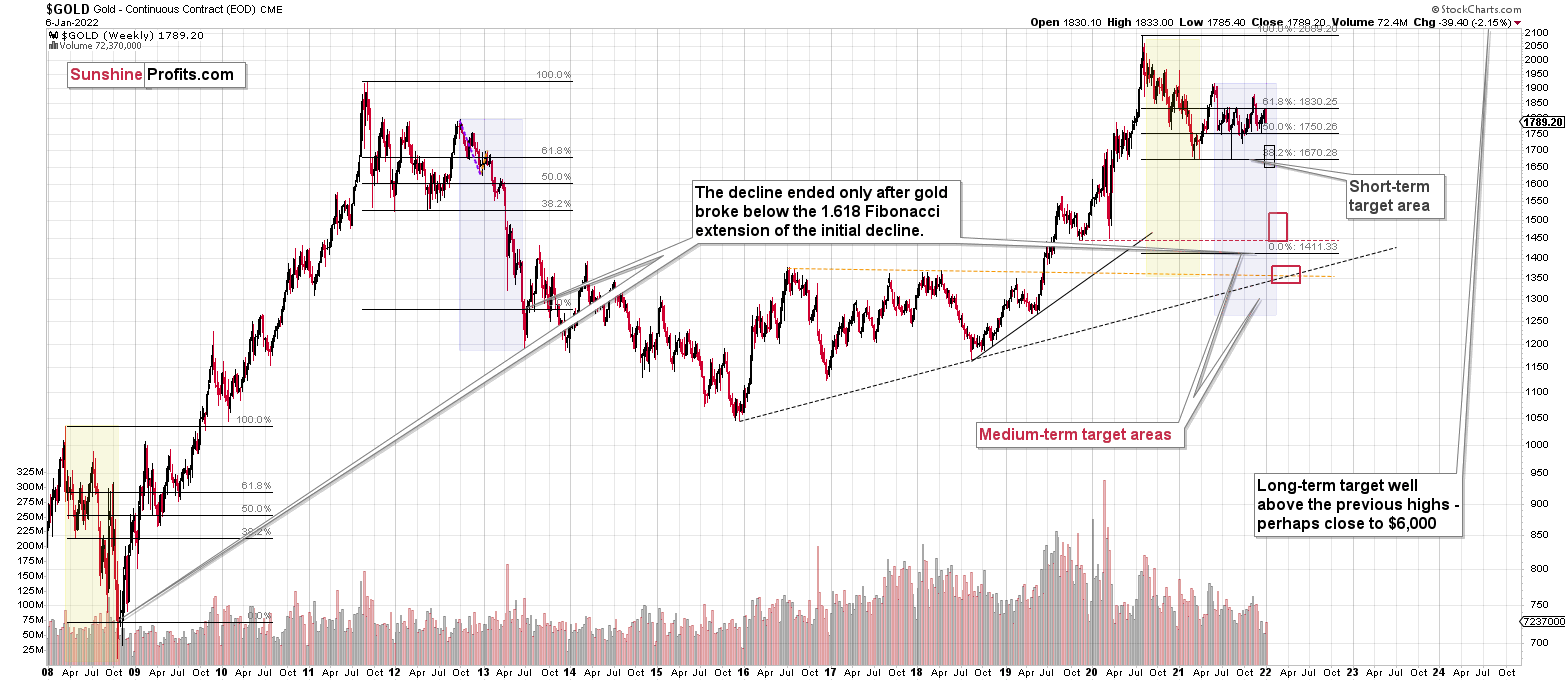

- It seems to me that the corrective upswing is over, and that gold, silver, and mining stocks are now likely to continue their medium-term decline.

- It seems that the first (bigger) stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

Summing up, it seems to me that the corrective upswing is over, and that gold, silver, and mining stocks are now likely to continue their medium-term decline. I continue to think that junior mining stocks are currently likely to decline the most out of all parts of the precious metals sector.

From the medium-term point of view, the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the following months.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $35.73; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $16.18; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $32.08; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $19.12

SLV profit-take exit price: $17.72

ZSL profit-take exit price: $41.38

Gold futures downside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $12.48

HZD.TO – alternative (Canadian) inverse 2x leveraged silver ETF – the upside profit-take exit price: $30.48

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief