Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

It looks like the precious metals have finally woken up from their lethargy and noticed that the dollar's troubles may be an opportunity for them to rebound. After all, they recorded an increase on Jan. 31 and reasserted back above the key $1,800 level following the decline in the USDX. The dollar index also slowed down against its currency rivals, which could especially please the euro bulls.

However, we should look a bit deeper - what actually caused the greenback’s loss of form? Although the ECB seems extremely dovish, especially compared to the Fed, and inflation figures remain relatively low, the Eurozone’s currency enthusiasts are counting on some bold moves. The fervor of the euro bulls fazed the greenback, which, interestingly, was also the case in almost all similar situations last year.

Another demotivating factor for the USDX may have been the somewhat shy tone some Fed officials took on Monday about the withdrawal of economic aid in the face of rampant inflation. The general plans of the US federal reserve to raise interest rates in March have not changed though, so it turns out that some investors interpreted the signals in their own way and the optimism regarding both precious metals and the EUR/USD pair is temporary.

NASDAQ vs. S&P 500

While the USD Index suffered on Jan. 31, the consolidation is largely in line with my expectations. Moreover, since asset prices rarely move in a straight line, the daily weakness is likely nothing more than a corrective downswing within a medium-term uptrend.

Conversely, while mining stocks exhibited strength, the general stock market helped uplift their performance. However, with the GDXJ ETF underperforming the NASDAQ Composite, its price action is less bullish than it appears. For example, when assets sell off, the ones that fall the most often rise the most when corrective upswings occur. As a result, with the NASDAQ Composite materially underperforming the S&P 500 during the recent correction, it’s no coincidence that the former has outperformed over the last two days.

However, while the GDXJ ETF (the gold line below) roughly peaked and troughed (for now) with the NASDAQ Composite (the red line below), the former has underperformed over the last two days. As a result, there is less enthusiasm for the GDXJ ETF than other high-beta assets.

Having said that, let's take a look at the situation from a fundamental point of view.

It’s That Time Again

With the ECB holding its next monetary policy meeting on Feb. 3, the EUR/USD is up to its usual shenanigans. Moreover, with the currency pair accounting for nearly 58% of the USD Index’s movement, the sharp rally on Jan. 31 hurt the dollar basket. However, haven’t we seen this movie before? To explain, I wrote on Oct. 29:

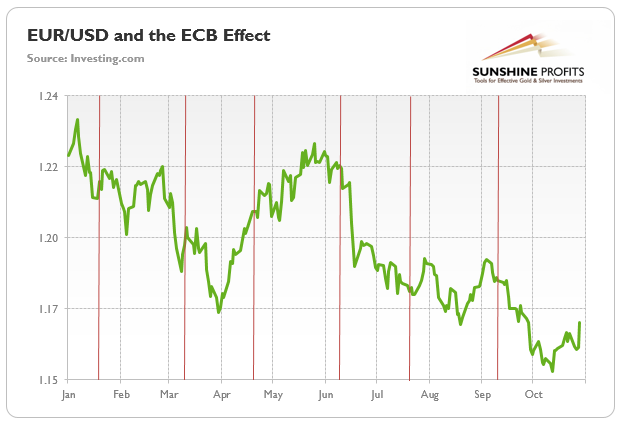

The green line above tracks the EUR/USD’s movement in 2021. If you focus your attention on the vertical red lines, they mark the day before the ECB makes its policy statements. Likewise, if you analyze the performance of the EUR/USD thereafter, you can see that euro bulls often find something to celebrate when Lagarde has her press conferences.

For context, the EUR/USD has recorded rallies after five of the seven ECB policy meetings in 2021 (including on Oct. 28), declined once, and traded roughly flat after another. However, lower lows have still plagued the currency pair throughout its 2021 journey.

Thus, is this time really different?

To that point, while the EUR/USD closed above 1.1680 on Oct. 28, the currency pair has declined materially since; and while euro bulls often buy the EUR/USD in hopes that the ECB will perform a hawkish 180, they’re in front-run mode this time around. However, with disappointment reigning supreme for more than 12 months, another dose of reality should strike sooner rather than later.

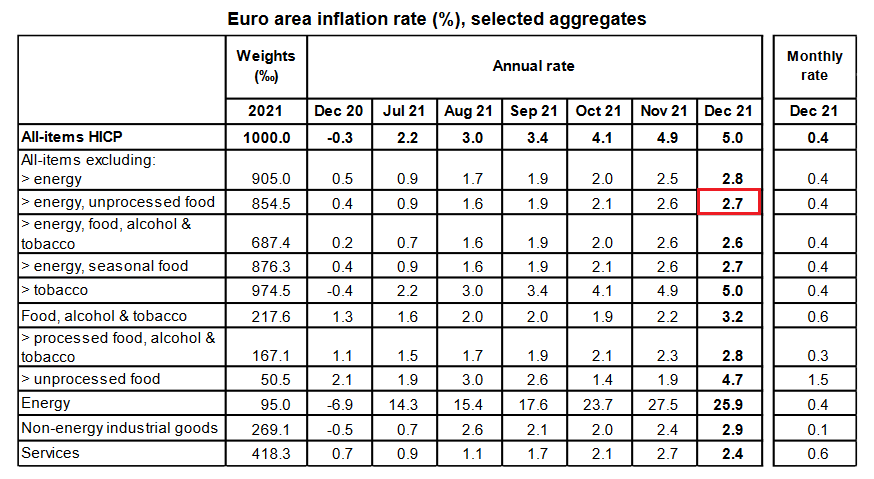

For example, while the Eurozone headline inflation increased by 5% year-over-year (YoY) on Jan. 20, core inflation – which includes the inflationary effects of food and energy prices – only increased by 2.7% YoY (the red box below). As a result, while I’ve highlighted the discrepancy on several occasions, the pricing pressures confronting Europe are mainly a function of oil and gas irregularities. Outside of that, most goods and services are within the ECB’s expected inflation range.

Please see below:

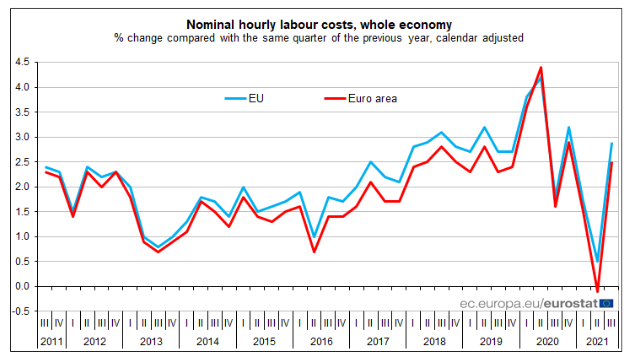

Second, hourly labor costs in the Eurozone rose by 2.5% YoY on Dec. 16 (the latest release). Moreover, the report revealed that “the costs of wages and salaries per hour worked increased by 2.3%, while the non-wage component rose by 3.0% in the third quarter of 2021, compared with the same quarter of the previous year.”

As a result, non-wage labor costs – like insurance, healthcare, unemployment premiums, etc. – did the bulk of the heavy lifting. In contrast, wage and salary inflation are nowhere near the ECB’s danger zone.

Please see below:

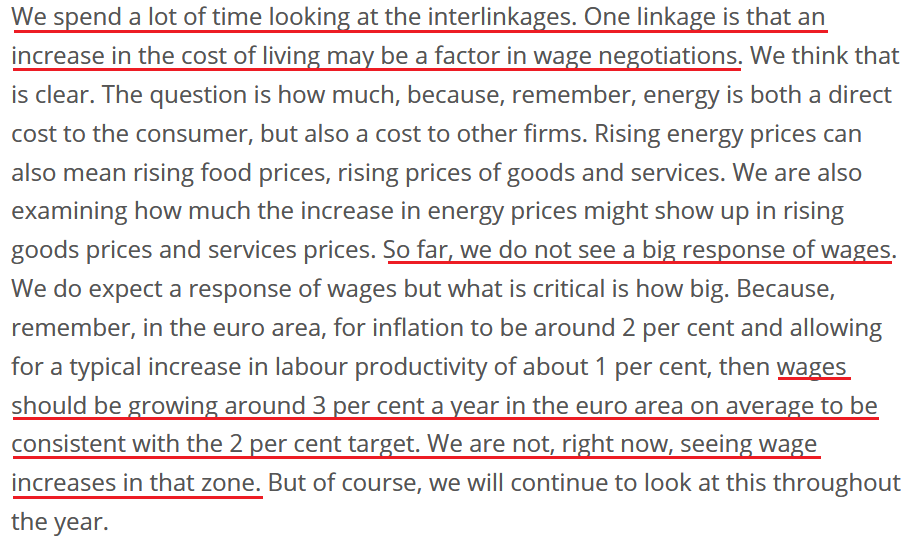

Why is wage inflation so critical? Well, ECB Chief Economist Philip Lane said on Jan. 25:

“We are clear from our December forecast that we expect inflation − in overall terms for this year − to be around 3.2% in the Euro Area, and then to be below 2% in 2023 and 2024 (…). So rather than focus on month by month, we have a clear vision in terms of the overall direction: that the inflation rate will fall later this year.”

More importantly, though:

As a result, when the ECB’s Chief Economist tells you that wage inflation needs to hit 3% YoY to be “consistent” with the ECB’s 2% overall annual inflation target, a wage print of 2.3% YoY is far from troublesome. Thus, while euro bulls hope that the ECB will mirror the Fed and perform a hawkish 180, the data suggests otherwise.

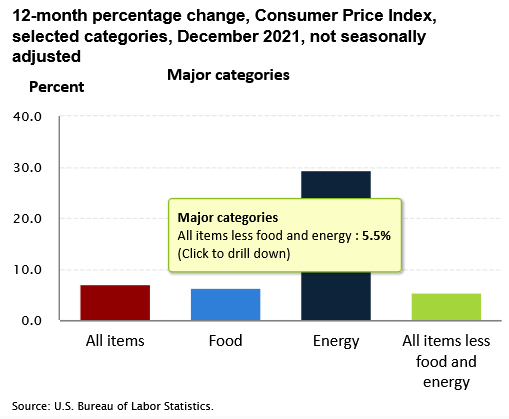

Think about it: why would the ECB raise interest rates when core inflation is at 2.7% YoY and wage inflation is at 2.3% YoY? In stark contrast, U.S. core inflation (the chart below) increased by 5.5% YoY on Jan. 12, and U.S. average hourly earnings increased by 4.7% YoY on Jan. 7. As such, while I’ve stated it on numerous occasions, the Fed and the ECB are worlds apart.

Please see below:

To that point, Giovanni Zanni, Chief Euro Area Economist at NatWest Markets, told clients on Jan. 28: “markets are increasingly worried that the ECB is behind the curve, but we are less concerned. 18bp of rate hikes priced in by Dec-22 looks too much, we think."

Likewise, Derek Halpenny, Head of Research for EMEA Global Markets at MUFG, stated on Jan. 28: “there will certainly be more focus on EUR and GBP next week with the ECB and the BoE meeting. The BoE is widely expected to hike but the ECB remains far off that point. We expect EUR to remain under downward pressure over the coming months."

Conversely, with liftoff at the Fed’s March monetary policy meeting likely a done deal, the dove-hawk divergence between the ECB and the Fed remains material.

For context, this is how it started (Nov. 16):

And this is how it’s going (Jan. 31):

Remember, San Francisco Fed President Mary Daly is a major dove. As a result, she stated on Jan. 31:

"I don't want to predetermine what [the level of interest rates] should be, because I really do see the two-sided risks we're facing, and so I want to be data dependent (...). We have to have our options open, right? And if more is needed, more will be done. If less is needed, less will be done, but we have to have our options open."

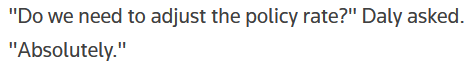

However, when pondering a rate hike in March, Daly said:

The bottom line? While the USD Index may come under pressure this week, it’s the same old story: euro bulls bid up the EUR/USD in hopes that the ECB will say or do something hawkish. In the process, dollar weakness spreads to other currency pairs, and the USD Index suffers. However, once the short-term sentiment highs dissipate, the fundamentals reign supreme. With the Fed all but certain to raise interest rates in March and the ECB poised to disappoint once again, the EUR/USD’s downtrend should continue over the medium term. I wrote before:

With my initial 2021 target of 94.5 already hit, the ~98-101 target is likely to be reached over the medium term (and perhaps quite soon) Mind, though: we’re not bullish on the greenback because of the U.S.’s absolute outperformance. It’s because the region is fundamentally outperforming the Eurozone. The EUR/USD accounts for nearly 58% of the movement of the USD Index, and the relative performance is what really matters.

In conclusion, the PMs rallied on Jan. 31, as the USD Index’s plight helped uplift their performance. Moreover, with U.S. Treasury yields consolidating after their recent run higher, the fundamental all-clear was present. However, with a higher U.S. Federal Funds Rate on the horizon, the USD Index and U.S. Treasury yields should benefit from the FOMC’s rate hikes. As a result, the PMs’ optimism is likely a short-term story, and more downside should materialize in the coming months.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is over or close to being over, and that gold, silver, and mining stocks are now likely to continue their medium-term decline.

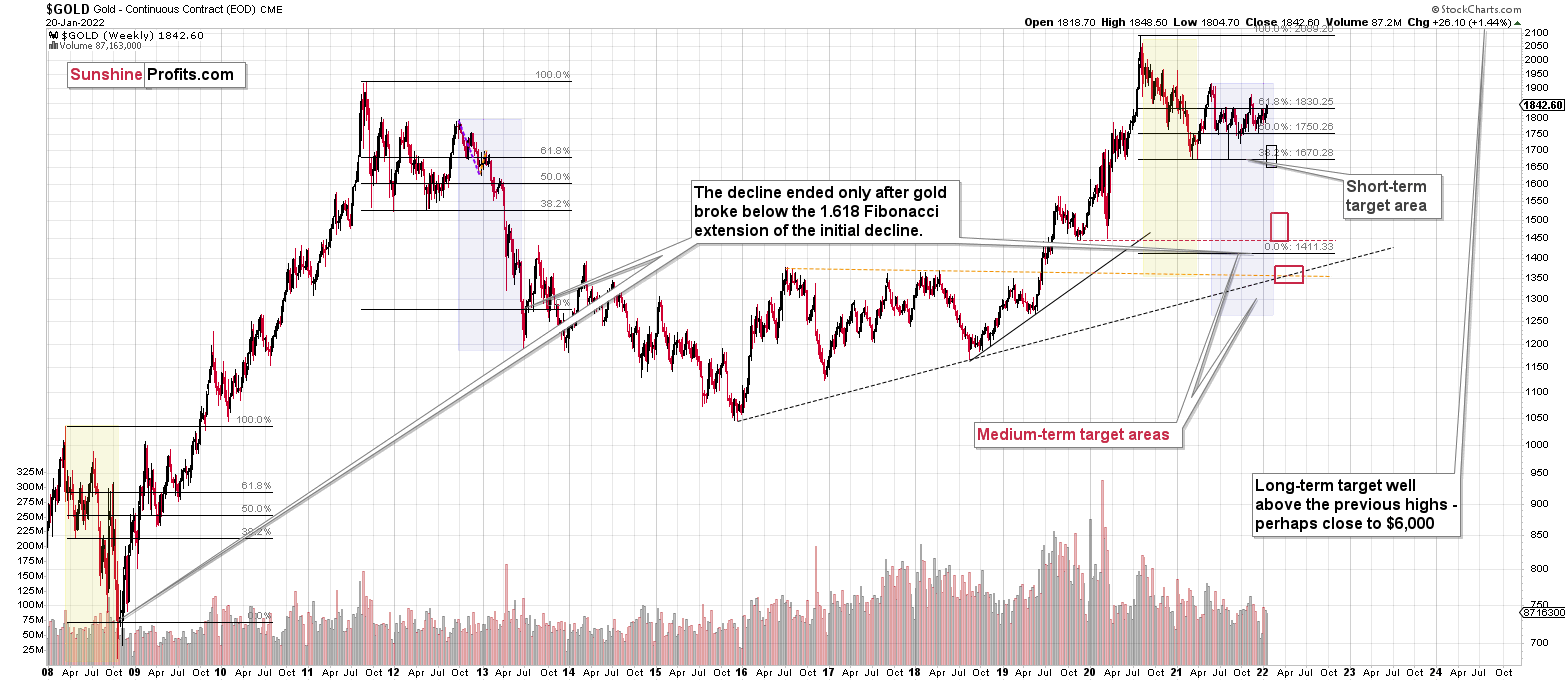

- It seems that the first (bigger) stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

IMPORTANT REMINDER:

Administrative Info for This Week

I – PR – will be traveling this week, which means that the analyses will take a slightly different shape.

Regular analyses will include only the fundamental parts of the analyses, and while the technical details will not be posted regularly, I’ll still be monitoring the markets for most days, and I’ll send you intraday Alerts, if the situation requires it (in particular, if some extra changes are required in the trading or investment positions).

To be precise, the target levels presented in the “Trading capital” part below summary are “binding”, which means that if the price touches a given level, the trade should be executed (in my opinion, that is; it’s your capital, and you can do whatever you want with it) without waiting for my confirmation. I’m usually sending them for additional clarification, anyway, but this likely won’t be the case next week. In other words, if you haven’t placed an exit order on your trades, yet you’d like to apply the above suggestion, it might be a good idea to place those exit orders right away.

By “most days”, I mean that I know that there will be two days when I’ll have no access to any internet / electronics whatsoever, but I don’t know which days those will be. So, conservatively, I’ll provide you with a game-plan for the next week below. This way, my intraday comments are not that important as you’re up-to-date in advance, and if it’s necessary for me to provide you with an intraday update and I have the ability to do so, let’s treat it as an “extra value” that is not necessary (you’ll already be up-to-date because of the below details), but welcome. The gameplan is really an answer to the following question:

What to do next, if the exit levels are reached and the market then moves significantly?

Basically, there could be three scenarios in this case:

- If – after reaching the exit levels – the price moves back up significantly, then it would be a good idea to re-enter the short position in the GDXJ at $35.94 (at 300% of the size of the regular position, so the same size of the position that we have right now).

- If – after reaching the exit levels – the price moves lower significantly (in other words, it doesn’t bottom, but keeps falling), then I think it would be a good idea to re-enter the short position in the GDXJ at $31.47.

- If – after reaching the exit levels – the GDXJ price moves back-and-forth and/or doesn’t move to any of the prices in the previous points, then I think no additional action would be necessary.

The first scenario is positive (we gain more by re-entering short positions at higher prices), and the second scenario is negative (we gain less by re-entering short positions at lower prices). The third scenario is neutral.

The most likely outcome, in my view, is that the GDXJ ETF price will either not manage to get to the $34.63 target next week, or that it will manage to do so, and then it will rebound just a little or trade sideways (third scenario).

After all, let’s keep in mind that mining stocks tend to show strength before gold does, and things are not as volatile as they were in early 2020. This means that the short-term bottom is likely to be rather normal, meaning a situation where miners first show strength by declining just a little while gold declines more, then perhaps rally somewhat while gold doesn’t decline or declines just a little. It takes time for the above to take place.

Consequently, the most likely outcome, in my view, is that next week, the profits on the short position in the junior mining stocks will simply grow while we keep the positions intact.

All in all, you’re already equipped with the strategy for the next week, and the odds are that it won’t be necessary to take action, anyway.

Summary

Summing up, it seems to me that the corrective upswing is over, and that gold, silver, and mining stocks are now likely to continue their medium-term decline.

Please note that if last week’s rally was indeed based on supposedly increased tensions regarding Ukraine, then it’s likely that this rally is not going to be significant, and it might already be over. The “supposedly shocking” news already hit the market, and without any real follow-up (material) action, like Russian troops marching across the border with Ukraine, it seems that there’s nothing additional that markets could rally on. The market already “knows” that the tensions are very high and the chance for military conflict is high, regardless of whether that’s true or not. There’s not much more that can be said to increase that even further – only real action is likely to do it – and seeing such action is very unlikely in my view.

I continue to think that junior mining stocks are currently likely to decline the most out of all parts of the precious metals sector.

From the medium-term point of view, the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the following months.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $34.63; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $14.98; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $25.48; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $19.12

SLV profit-take exit price: $17.72

ZSL profit-take exit price: $38.28

Gold futures downside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $11.79

HZD.TO – alternative (Canadian) inverse 2x leveraged silver ETF – the upside profit-take exit price: $29.48

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief