-

Gold Investment Update: While Focusing on Details in the GDXJ, Don’t Miss the Great Downturn!

June 10, 2022, 10:10 AMIf history is to repeat itself to some extent, junior miners have a chance to make minor corrections. However, is it worth leaving short positions now?

Let’s take a look at what happened in junior mining stocks.

In last Friday’s (June 3) Gold & Silver Trading Alert, I commented on Thursday’s rally in the following way:

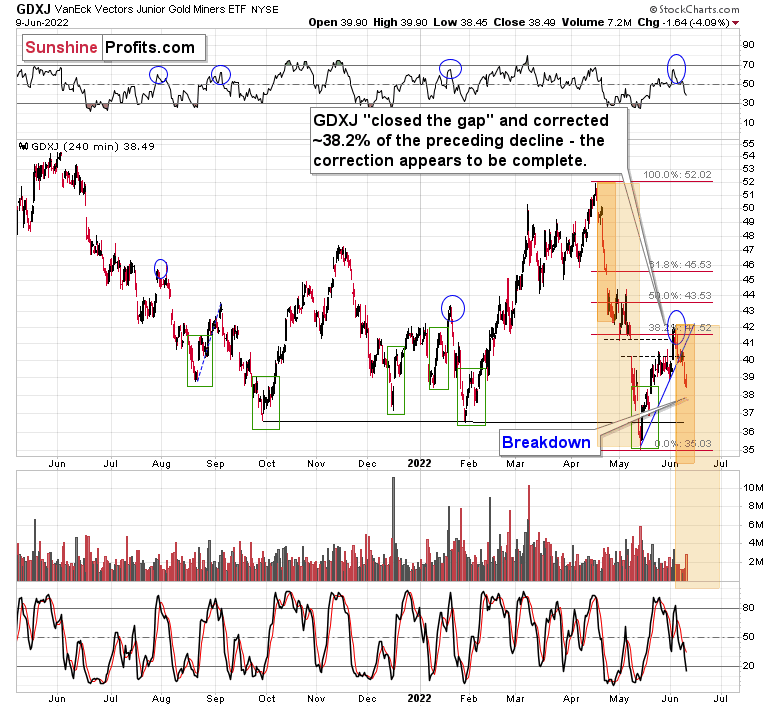

The price of the GDXJ ETF – a proxy for junior miners – moved sharply higher yesterday, and this got many people excited. High volume confirms that. It’s natural for most investors and traders to view rallies as bullish, but let’s keep in mind that most traders tend to lose money… It’s not that simple. After all, the best shorting opportunities are at the tops, which – by definition – can only be formed after a rally.

The particularly interesting thing about high volume readings in the GDXJ ETF is that they quite often mark local tops. Remember the late-April – early-May consolidation? It ended when GDXJ finally rallied on high volume. That was the perfect shorting opportunity, not a moment to panic and exit the short position.

The GDXJ-based RSI indicator is also quite informative right now. It moved well above 50, but it’s not at 70 yet. Why would that be important? Because that’s when many of the previous corrections ended.

When one digs deeper, things get even more interesting. You see, when we consider corrections that started after the RSI was very oversold (after forming a double bottom below 30), it turns out that in all those cases, the tops formed with the RSI between 50 and 70. I marked those situations with blue ellipses on the above chart.

So, while it’s easy to “follow the action,” it’s usually the case that remaining calm and analytical leads to bigger profits in the end.

Also, let’s use yesterday’s move as something useful. If this single-day move higher made you really uncomfortable and almost made you run for the hills, it might be a sign that the size of the position that you have is too big. It’s your capital and you can do with it what you wish, but if the above were the case, it might serve as food for thought.

The big trend (as well as the reasons for it) remains down, which means that the enormous profit potential remains intact.

Last Friday’s and this week’s declines confirm the above. The high-volume rally marked the top – those who got excited at that time likely bought exactly or very close to the top, instead of shorting at that time. Fortunately, you were prepared.

After taking profits off the table and closing short positions on May 12, we immediately entered long positions (it turned out that it happened right at the bottom), and we then took profits from that long position on May 26. Next, we returned to short positions. These positions are already profitable, but it seems that they will be much more profitable soon.

Why?

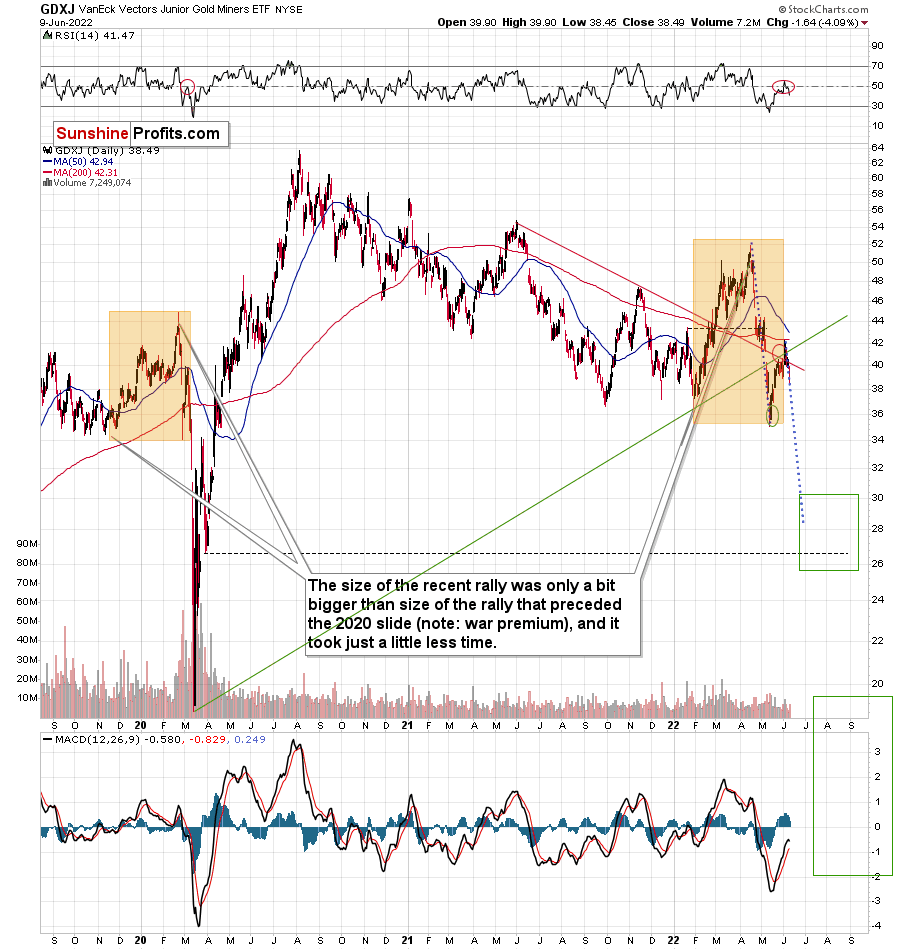

Most importantly, because history rhymes, we’re likely to see a repeat of 2012-2013 or the 2008 decline. So far, the current slide is in tune with the 2008 performance.

However, let’s not dig into the long-term details yet. While we’re close to the short-term chart, let’s focus on what it features. For your convenience, here it is once again.

The recent April-May decline doesn’t have to be repeated to the letter, but we could see something similar nonetheless. After all, that decline is the most recent analogy to what we’re about to see in the GDXJ (a massive decline).

Based on the above, I marked two cases from the precious decline (the initial decline and the entire decline) and I copied them to the current situation, assuming that the recent top is indeed the starting point of the next bid decline (which seems likely in my view).

It turns out that junior miners might need to decline to or slightly below the May lows before we see even a moderate corrective upswing.

Will I want to trade this correction? Probably not. If we see a correction from below $35, it might be small – only a bit over $36, so it might be way too risky to trade this quick rebound. The downside (the bigger orange rectangle) is much bigger than the above, and it would be a much bigger waste to miss this move in order to try to catch a relatively small move.

Besides, there’s also a chance that we won’t see any meaningful correction, just like what happened in 2020.

Back in March 2020, after the corrective upswing, mining stocks fell like a stone in water. While the current price moves are less volatile, they are still somewhat similar (note the marked areas on the above chart).

Moreover, please note that the GDXJ failed to break back above the red and green resistance lines, which by itself is also a bearish indication.

The next short-term upswing is quite likely here, and (while I can’t make any promises with regard to performance), in my opinion, the profits on our short positions are likely to increase tremendously before we exit them.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Investment Update: Keep Calm and Stay on the Short Side of Junior Miners

June 6, 2022, 8:57 AMA price jump on a given day doesn’t mean you should give up your short position. Let’s look at the context by examining what happened in the junior mining stocks.

In Friday’s Gold & Silver Trading Alert, I commented on Thursday’s (June 2) rally in the following way:

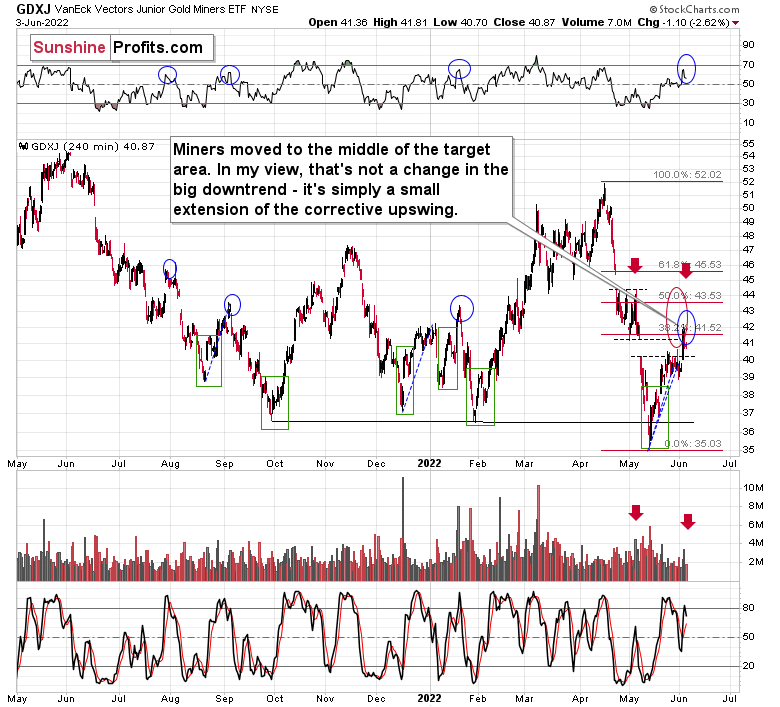

The price of the GDXJ ETF – a proxy for junior miners – moved sharply higher yesterday, and this got many people excited. High volume confirms that. It’s natural for most investors and traders to view rallies as bullish, but let’s keep in mind that most traders tend to lose money… It’s not that simple. After all, the best shorting opportunities are at the tops, which – by definition – can only be formed after a rally.

The particularly interesting thing about high volume readings in the GDXJ ETF is that they quite often mark local tops. Remember the late-April/early-May consolidation? It ended when GDXJ finally rallied on high volume. That was the perfect shorting opportunity, not a moment to panic and exit the short position.

The GDXJ-based RSI indicator is also quite informative right now. It moved well above 50, but it’s not at 70 yet. Why would that be important? Because that’s when many of the previous corrections ended.

When one digs deeper, things get even more interesting. You see, when we consider corrections that started after the RSI was very oversold (after forming a double bottom below 30), it turns out that in all those cases, the tops formed with the RSI between 50 and 70. I marked those situations with blue ellipses on the above chart.

So, while it’s easy to “follow the action,” it’s usually the case that remaining calm and analytical leads to bigger profits in the end.

Also, let’s use yesterday’s move as something useful. If this single-day move higher made you really uncomfortable and almost made you run for the hills, it might be a sign that the size of the position that you have is too big. It’s your capital and you can do with it what you wish, but if the above were the case, it might serve as food for thought.

The big trend (as well as the reasons for it) remains down, which means that the enormous profit potential remains intact.

Friday’s decline confirms the above. While the GDXJ closed above the upper border of the previous price gap on Thursday, it closed back below it on Friday, thus invalidating the small breakout. This is a bearish sign, especially in light of what I wrote above. The top might be already in.

Remember, the strong medium-term downtrend remains intact.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Investment Update: The USD Index Rose, but Gold Didn’t React. What Does That Mean?

June 2, 2022, 12:11 PMPractically nothing changed on the technical side of things in the precious metals market yesterday or in today’s pre-market trading, so everything that I wrote yesterday remains up-to-date.

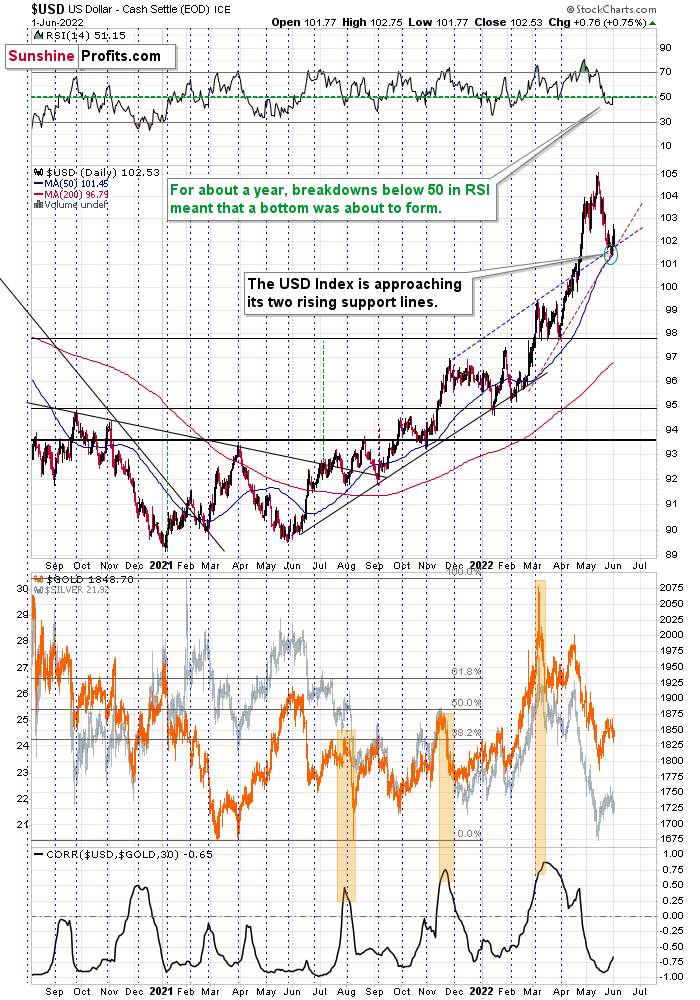

In particular, the USD Index rallied from my previous downside target area.

Gold, however, didn’t respond by declining. Why would that be the case? Does it mean that gold is showing strength here and thus we just got a bullish indication?

No. It’s not that simple.

You see, the USD Index is an… index.

It’s a weighted average of currency exchange rates, and the EUR/USD exchange rate has the biggest (57.6%) weight. The purpose of the USD Index is to isolate the strength of the U.S. currency so that it’s clear what’s going on in it. However, this is not a perfect way to measure it (there is no perfect way to do it, they all have their flaws).

The assumption here is that what happens in all those other monetary areas (Eurozone, Japan, etc.) will average itself out and we’ll be left with the USD’s “value changes”, which is what’s taking place most of the time.

However, not always, and yesterday was one of those “other” days.

I’ll elaborate a bit later, but in short, the Eurozone inflation numbers came in and they were terrible. Inflation once again soared. Greater than expected inflation means that the euros are worth less than they used to be and that their value has declined more than was previously expected. In other words, the “value of the euro” declined.

If the value of the euro declined, what would happen to the EUR/USD exchange rate? Of course, it declines too. How does it impact the USD Index (because it’s definitely going to have an impact, since most of the index is about the EUR/USD)? Of course, the USD Index would be likely to rally based on the above.

So, did gold show strength by not declining yesterday, despite the USD Index’s strength? No, because it was not the U.S. dollar that was strong – it was the euro that was weak. As a consequence, what we saw yesterday was not a bullish sign for the precious metals market.

What does it mean for us and our short position in the junior mining stocks? In short, it means nothing. Yesterday’s session was an “exception” from the rule that usually remains intact, and we don’t have to worry about it.

The medium-term downtrend remains intact. The USD Index is likely to move higher and (most importantly), real interest rates are going higher. It’s likely to be a global phenomenon, but it seems that they are likely to rally faster in the U.S. than in the Eurozone. This is a profoundly bearish combination for the precious metals sector in the medium term.

All in all, it seems that we’re about to see another sizable decline in the prices of junior mining stocks, and while I can’t promise any performance, it seems likely to me that profits on our short positions will increase substantially.

Having said that, let’s take a look at the markets from a more fundamental point of view.

The Canary

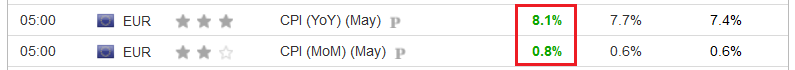

With unanchored inflation still rattling the financial markets, prayers for peaks have gone unanswered in recent weeks. Moreover, with Eurozone inflation hitting another 2022 high on May 31, the timeline for normalization continues to lengthen. For context, the figures in the middle column were economists’ consensus estimates.

Please see below:

However, the more important development came from the Bank of Canada (BoC) on June 1. With 1970s/1980s-like inflation a global phenomenon, I warned on Apr. 14 that the BoC is the canary in the coal mine for future Fed policy. I wrote:

The Bank of Canada (BoC) announced a 50 basis point rate hike on Apr. 13. With the Fed likely to follow suit in May, the domestic fundamental environment confronting the PMs couldn’t be more bearish.

Please see below:

Moreover, BoC Governor Tiff Macklem (Canada's Jerome Powell) said that "We are committed to using our policy interest rate to return inflation to target and will do so forcefully if needed."

Furthermore, while he added that the BoC could "pause our tightening" if inflation subsides, he cautioned that "we may need to take rates modestly above neutral for a period to bring demand and supply back into balance and inflation back to target."

However, with the latter much more likely than the former, the BoC's decision is likely a preview of what the Fed should deliver in the months ahead.

To that point, the Fed hiked interest rates by 50 basis points in May, and the BoC increased its overnight lending rate by another 50 basis points on Jun. 1. As a result, the North American connection should hold firm.

Please see below:

In addition, the BoC release stated:

“With the economy in excess demand, and inflation persisting well above target and expected to move higher in the near term, the Governing Council continues to judge that interest rates will need to rise further. The policy interest rate remains the Bank’s primary monetary policy instrument, with quantitative tightening acting as a complementary tool.”

“The pace of further increases in the policy rate will be guided by the Bank’s ongoing assessment of the economy and inflation, and the Governing Council is prepared to act more forcefully if needed to meet its commitment to achieve the 2% inflation target.”

Thus, with inflationary realities forcing hawkish central bank responses, more pain should confront the financial markets as the drama unfolds.

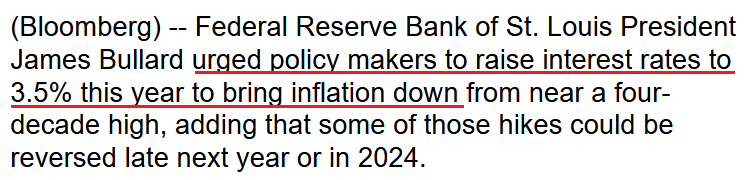

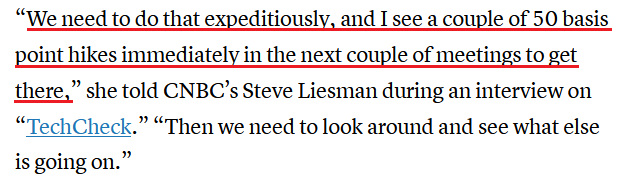

To that point, St. Louis Fed President James Bullard said on Jun. 1: "The current U.S. macroeconomic situation is straining the Fed's credibility with respect to its inflation target." As such, he reiterated his call for a 3.5% U.S. federal funds rate by the end of 2022.

Please see below:

Likewise, San Francisco Fed President Mary Daly said on Jun. 1 that there must be material progress on inflation before the central bank can slow its roll.

“We aren’t really there yet, so we need to see those data on a slowing economy bringing demand and supply back in balance, and I need to see some real progress on inflation,” she said.”

She added:

“I don’t meet anyone, contacts, consumers, anyone, who thinks the economy needs help from the Fed right now. I certainly am comfortable to do what it takes to get inflation trending down to the level we need it to be. I really think these inflation numbers have been going on too long, and consumers, businesses and everyday Americans are depending on us to get inflation back down and bridling it.”

As a result:

Thus, while the Fed remains focused on taming inflation, the reality is that more hawkish drama should unfold over the medium term. For example, the Fed released its latest Beige Book on Jun. 1. For context, the report consolidates the economic data from all of the regional Federal Reserve banks.

The growth outlook was decent:

“All twelve Federal Reserve Districts have reported continued economic growth since the prior Beige Book period, with a majority indicating slight or modest growth; four Districts indicated moderate growth. Four Districts explicitly noted that the pace of growth had slowed since the prior period.”

The labor market outlook was relatively better:

“Most Districts reported that employment rose modestly or moderately in a labor market that all Districts described as tight. One District explicitly reported that the pace of job growth had slowed, but some firms in most of the coastal Districts noted hiring freezes or other signs that market tightness had begun to ease. However, worker shortages continued to force many firms to operate below capacity.”

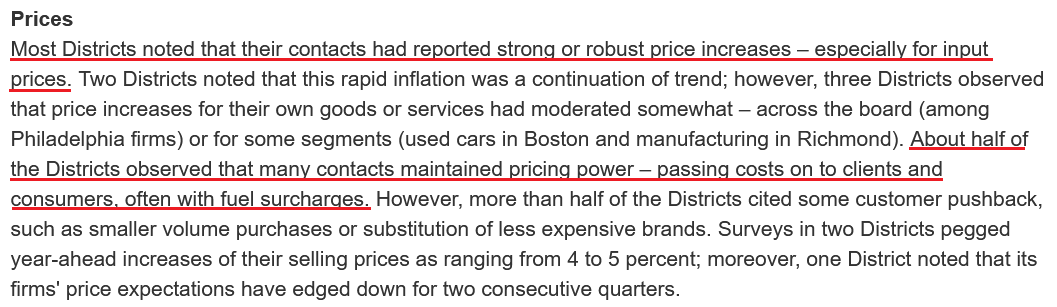

And pricing pressures remain “robust:”

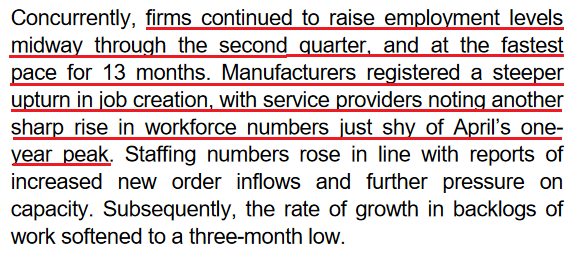

Likewise, S&P Global released its U.S. Manufacturing PMI on Jun. 1. The report revealed:

“New orders rose sharply in May, with higher new sales inflows often attributed to a sustained rise in customer demand and the acquisition of new clients. That said, the pace of growth softened further from March's recent peak and was the slowest seen since January.”

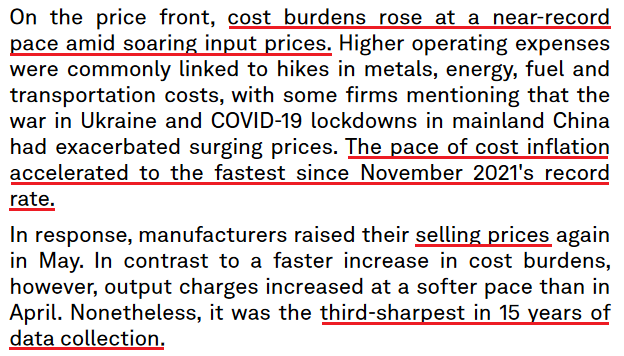

More importantly:

As a result, while some data points show record inflation and others show “robust price increases” with some moderation, the important point is that the Fed’s war with inflation will be one of attrition. To explain, I wrote on May 24:

It’s ironic how the permabears hope for a recession so that the stock market will crash and the permabulls hope for a recession so that the stock market will rally. Confused? Well, the reality is that collapsing inflation allows the Fed to perform a dovish 180 and follow the post-GFC script. Therefore, the ‘bad news is good news’ mantra will likely benefit the bulls.

Conversely, the longer inflation persists, the longer the Fed stays on the sidelines. Thus, simmering inflation and resilient consumer spending should keep the Fed on a hawkish warpath, which is bearish for the S&P 500 and the PMs.

Again, macroeconomic data declining from all-time highs represents normalization, not a crisis. Moreover, what did investors think would happen when the Fed started hiking interest rates? Of course, economic momentum would moderate. However, with a huge gap between 8%+ annualized inflation and the Fed’s 2% goal, more rate hikes are needed to alleviate the pricing pressures.

Therefore, the newest narrative is that a faltering U.S. labor market could provide dovish cover for the Fed. I added on May 24 that the permabull prayer looks like this:

Fundstrat founder Tom Lee said:

"Incoming data could show the labor market weakening... and thus [the] job market could be cooling at a pace faster than implied by tighter financial conditions." Moreover, “layoffs are accelerating, hitting 7,700 so far in May....We expect this to soon go parabolic, based upon anecdotal comments we have heard.”

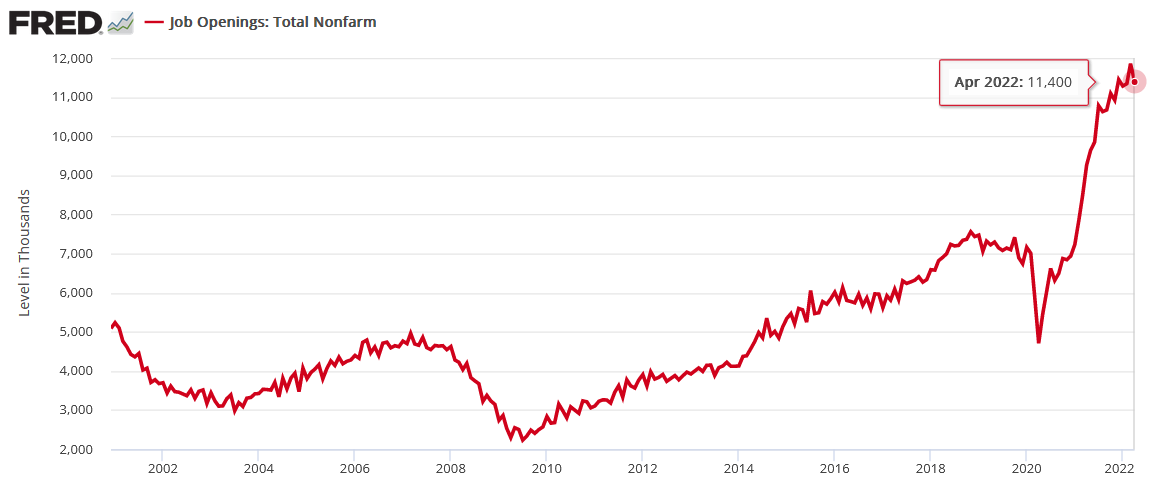

In contrast, the U.S. Bureau of Labor Statistics (BLS) released its JOLTS jobs report on Jun. 1. For the sake of objectivity, U.S. job openings declined from their all-time high of 11.855 million in March to 11.400 million in April. Also, the April data lags by two months, so it’s not real-time.

However, does it look like the U.S. labor market is moderating at a pace that will cool inflation anytime soon?

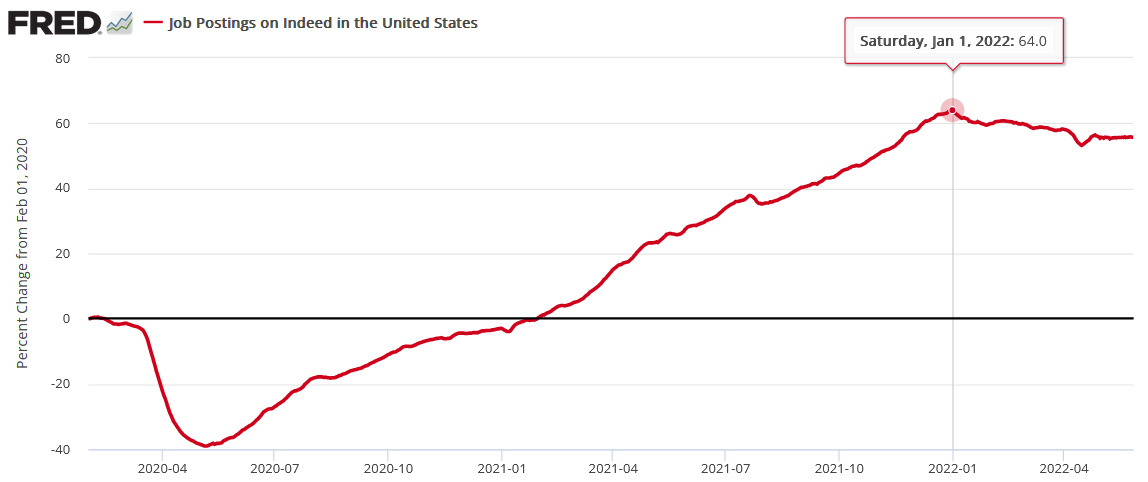

Second, Indeed releases its job openings data weekly, with the latest update on Jun. 1. Moreover, while postings have declined from their all-time high, they remain elevated and have held steady in recent weeks.

Please see below:

Third, the BLS’ JOLTS report stated:

“In April, the number of layoffs and discharges edged down to a series low of 1.2 million (-170,000). The rate was little changed, at 0.8 percent. Layoffs and discharges decreased in professional and business services (-133,000).”

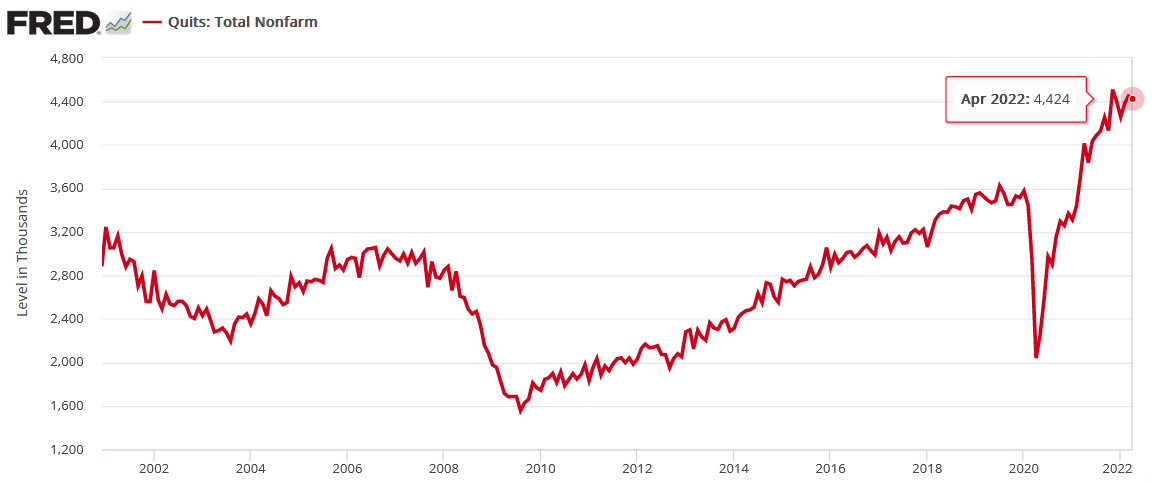

Likewise, Americans are still quitting their jobs at unprecedented rates. For context, the BLS states: “Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs.”

As a result, does it seem like Americans fear unemployment?

Fourth, and most importantly, S&P Global released its U.S. Composite PMI on May 24. For context, the data was collected from May 12-23 and includes responses from “around 800” manufacturing and service sector companies in the U.S. An excerpt stated that they added employees “at the fastest pace for 13 months.”

The bottom line? The Fed remains materially behind the inflation curve, and nearly 70 years of history shows that the U.S. federal funds rate needs to rise above the annualized inflation rate to curb price pressures. Therefore, curing 8%+ inflation with a couple of rate hikes is unrealistic, and investors should learn this lesson the hard way over the medium term. As a result, more downside should confront the S&P 500 and the PMs over the next few months.

In conclusion, the PMs rallied on Jun. 1, as they sidestepped Wall Street’s negativity. However, the thesis remains unchanged: the U.S. 10-year real yield is still at 0.26% and needs to rise to calm inflation. Moreover, a hawkish Fed is bullish for the USD Index, and U.S. Treasury yields are also rallying once again. Therefore, the PMs should feel the fundamental heat this summer.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Investment Update: Here Is Why I’m No Longer Bullish on Gold Miners

May 27, 2022, 9:12 AMThe medium-term outlook for the precious metals is profoundly bearish – and it’s about time to abandon the short-term bullish ship.

To find out why, let’s take a look at what happened in junior mining stocks.

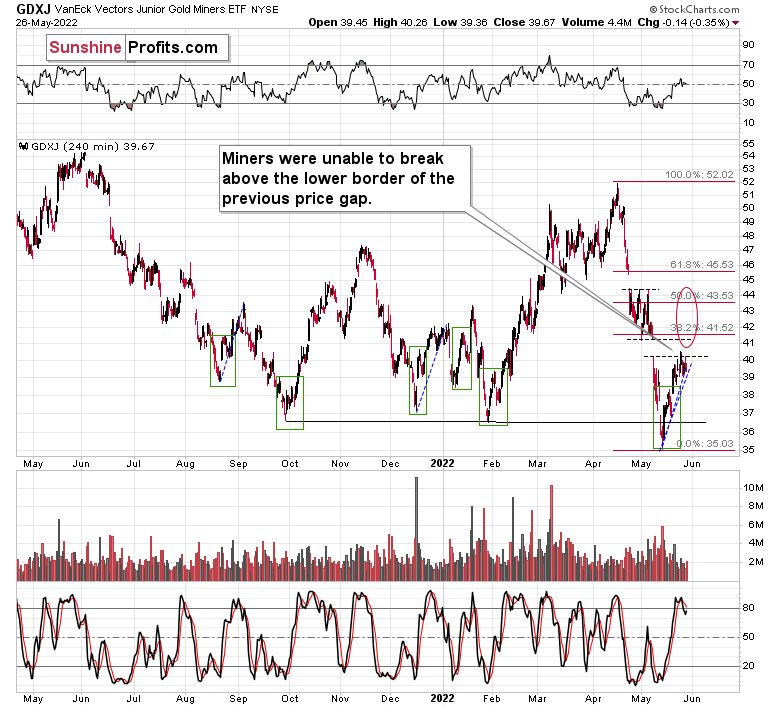

The miners were unable to break above the lower border of the previous price gap despite the rally in the general stock market that continued yesterday. In fact, junior miners ended yesterday’s session lower.

Yes, gold is still the main driver of the juniors’ prices, but given that the S&P 500 moved up by about 2%, at least some strength in the juniors was expected. And we didn’t see it.

If it all didn’t happen so close to GDXJ’s upside target, and if stocks weren’t so close to their own upside target, it wouldn’t matter much. However, the above was the case, and thus it did matter.

Perhaps junior miners will rally more and even manage to “close the gap” by rallying to its upper border, but… so what? That’s only about $1 – $1.5 higher in the GDXJ, and its already after a ~$4 rally, which means that we’ve caught the majority of the move with our previous long position. In fact, we’ve actually caught the “easy part” of the move.

Congratulations to everyone who managed to profit on this rebound!

I called the recent rally “easy” because when sentiment becomes too extreme, it’s very likely that a correction will follow. Thus, trading it was rather easy. After all, no market moves up or down in a straight line.

Anyway, the “easy” part of the rally is definitely over, and now the rally has either ended or we entered the “difficult” part thereof. “Difficult” because it’s no longer very likely that we’ll see further move higher. Yesterday’s lack of positive reaction to stocks’ rally emphasized that. This is why I was quick to take profits here.

Remember, the strong medium-term downtrend remains intact.

While aiming to gain from a rebound (against a powerful medium-term downtrend) when it’s very likely to take place (based on the sentiment being too extreme) is something justified from the risk to reward point of view (risk is relatively low), the situation changes dramatically in the “difficult” part of the rally. In this case, the risk is big (the reversal could take place at higher prices or it could be already after the reversal…) while the profit potential is limited.

Also, in today’s pre-market trading we might be seeing a sell indication. So far it’s not strong, but still…

Silver futures are up by 1.49%, the GDXJ is up by 0.96% in London trading, the GDX is up by only 0.38% in London trading, and gold futures are up by 0.53%.

Silver has just moved to new monthly high, while gold, the GDX and the GDXJ haven’t (the latter is quite close, though). This means that we’re in a situation where silver is outperforming on an immediate-term basis, while miners are underperforming (the GDX in this case) gold. This is often what we see right before declines.

This doesn’t guarantee that the decline will start today or tomorrow, but it does indicate that it’s likely to take place within the next several days.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Investment Update: Gold Miners Still on a Rise – Where Will the Top Be?

May 21, 2022, 1:59 PMTo answer this question, let’s take a look at what happened in junior mining stocks over the last few days. In yesterday’s analysis, I wrote the following:

Of course, there will be some back-and-forth movement on an intraday basis, but it doesn’t change anything. Junior miners are likely to rally this week nonetheless. And perhaps not longer than that, as the next triangle-vertex-based reversal is just around the corner – on Friday/Monday.

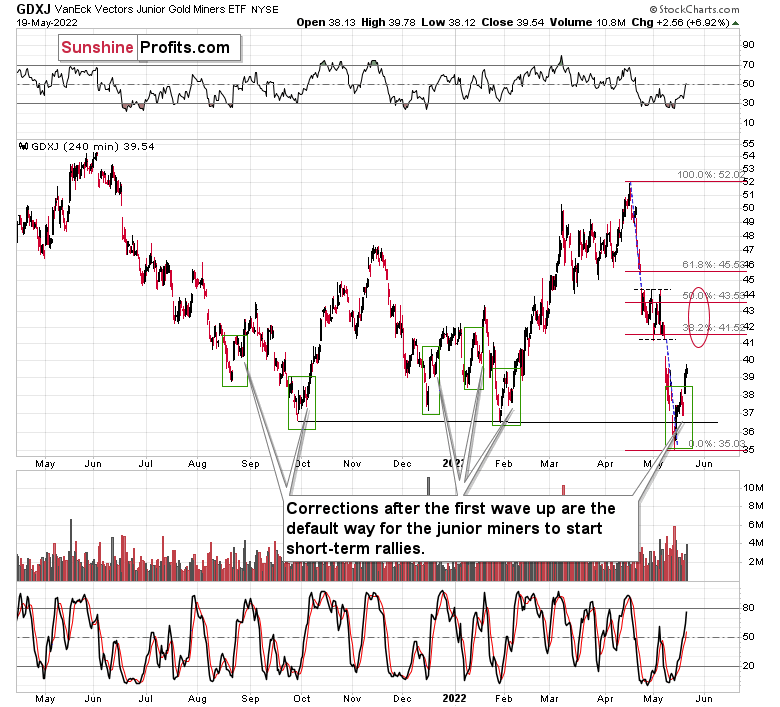

The previous few days were the “forth” and yesterday [May 18] was the “back” movement – so far, my comments remain up-to-date. However, comparing the market action with what I wrote previously isn’t what I meant by analogies to past situations. I meant this:

The areas marked with green rectangles are the starting moments of the previous short-term rallies. Some were bigger than others, and yet they all had one thing in common. They all included a corrective downswing after the initial post-bottom rally.

Consequently, what we saw yesterday [May 18] couldn’t be more normal during a short-term rally. This means that yesterday’s decline is not bearish at all and the profits from our long positions are likely to increase in the following days.

Besides, the general stock market declined by over 4%, while the GDXJ (normally moving more than stocks) ETF – a proxy for junior mining stocks – declined by only about 2%.

Well, that’s exactly what happened. Juniors soared yesterday, and so did profits from our long positions (which we managed to open practically right at the bottom).

I would like to clarify one of the points that I made previously with regard to timing the top. I previously wrote that based on the next triangle-vertex-based reversal, it’s likely that the top will take place today (Friday) or on Monday. However, I re-visited the charts to make sure that I got the date right, and when I applied the same methodology on a bigger chart, it turned out that the vertex that I described was already behind us, and that it simply confirmed the bottom when we switched from short to long positions.

Consequently, it’s not very likely that the final top for the rally will take place today or on Monday. It could be the case based on other reasons, but not based on the triangle-vertex-based reversal.

Since gold and silver are likely to move higher, so are junior miners.

I previously wrote that the target for junior miners is at the 38.2% Fibonacci retracement and the recent short-term low, a bit above $41. However, it could be the case that the next resistance is a bit higher, closer to the upper border of the previous consolidation. This could correspond to the 50% Fibonacci retracement close to the $44 level.

Still, remaining conservative and keeping our chances of exiting the current trade and cashing profits at all, I’m keeping the profit-take level intact.

On a very short-term basis, junior miners could be driven by stock market moves. Meanwhile, the stock market appears to be repeating its very recent consolidation pattern.

After stocks’ initial rebound (late April), they declined once again, and then they rallied back up to their previous high before sliding to new lows.

So far, we’re seeing something similar. The initial rebound was indeed followed by a sharp decline. In fact, even the intraday performance is similar. The daily decline was big and sharp, and it was followed by a daily reversal. What followed then was a small daily rally and then a huge daily rally, which was the final top.

If history rhymes, then perhaps today’s or Monday’s (or Tuesday’s) rallies will be significant and take stocks to the final short-term top. This could correspond to a short-term top in junior miners as well.

The above would fit the scenario in which the miners continue to rally for the next 1-3 days.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM