Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite the USD Index’s continuous strength will likely be the signal confirming that the bottom is in.

Welcome to this week's Gold Investment Update. Predicated on last week’s price moves, our most recently featured outlook remains the same as the price moves align with our expectations. On that account, there are parts of the previous analysis that didn’t change at all in the earlier days, which will be written in italics.

The biggest practical news of the

previous week (which GSTA subscribers already know) is that we took profits from our short-term long positions and re-entered

the medium-term short ones.

Let’s start today’s analysis with a recap of what recently happened on the fundamental front.

The Weekly Fundamental Roundup

This week was all about false narratives, as the perma-investors promote outcomes that don’t reflect fundamental reality. For context, I expect the U.S. to sink into recession, as the prospect of a “soft landing” is extremely unrealistic. However, the timing and the pathway are important; and with consumer spending still resilient, the Fed’s war with inflation should be the culprit, not premature demand destruction.

To explain, I wrote on May 23:

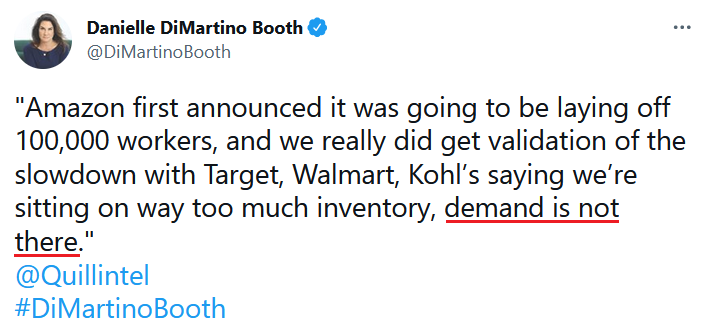

With the new narrative on Wall Street proclaiming that a destitute U.S. consumer is all tapped out and a recession looms, investors have succumbed to the same pitfalls that led them astray in 2021. To that point, with the same merry-go-round on full display now, the permabears and the media are running in circles once again.

Please see below:

Likewise, Bloomberg published an article on May 21 that stated:

“The retailers now find themselves flush with clothes, televisions and other discretionary items that customers aren’t buying as they channel more spending into basic needs and services. As a result, the companies took markdowns that eroded profits.”

Please see below:

While narratives move markets, the doom-and-gloom crowd is cherry-picking data to support their conclusion. Moreover, I don’t care if/when the U.S. falls into recession. I’m simply presenting an objective analysis. Also, I’ve noted on numerous occasions that investors underestimated the demand side of the inflation equation.

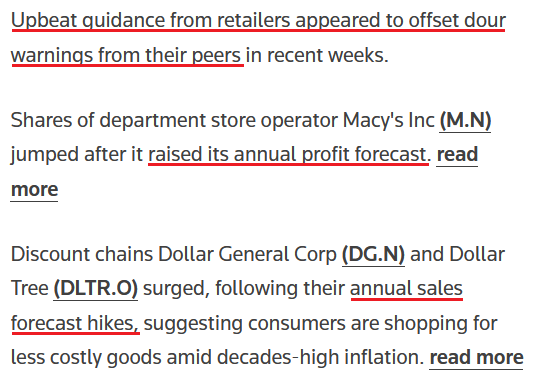

Thus, with "upbeat retail guidance" shifting the narrative from a penniless consumer to all is well on Wall Street on May 26, the fundamental reality is that we're far from the demand destruction that will alleviate inflation.

Please see below:

To that point:

As a result, please avoid buying into investors and the media’s uninformed analysis. Yes, some companies will struggle with high inflation and a lack of pricing power. However, the majority passes through higher input costs with little pushback from consumers. Remember, though, this is not bullish. With resilient consumer spending intensifying inflation, it increases the ferocity of the Fed’s hawkish crusade.

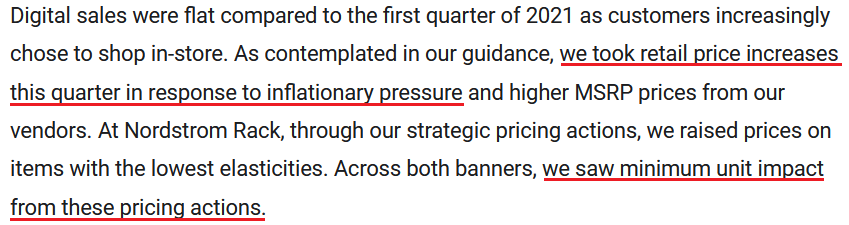

For example, Nordstrom released its earnings on May 24. For context, the fashion retailer is home to brands like Gucci, Nike and Dolce & Gabbana. CFO Anne Bramman said:

“This quarter, our sales growth was supported by pricing actions, favorable mix shift, and transaction growth. At this point, we have not seen inflationary cost pressures adversely impact customer spending, which we believe is due to the higher income profile and resiliency of our customer base. This quarter, both customer counts and spend per customer increased versus the prior year.”

President Pete Nordstrom added:

“Men's apparel was our strongest category this quarter. More broadly, both men's and women's apparel had double-digit growth over last year and sales that exceeded pre-pandemic levels…..

“We also saw robust demand for wardrobe refreshes, especially for the spring and summer seasons. Shoes had a strong double-digit growth with increased demand across formal, casual, and athletic styles. Our designer offering across all categories continued to perform very well, also posting strong double-digit growth and sales significantly above pre-pandemic levels.”

As a result, with “robust demand” culminating with higher prices, the inflationary circus is still touring the U.S.

Please see below:

Source: Nordstrom/The Motely Fool

Source: Nordstrom/The Motely Fool

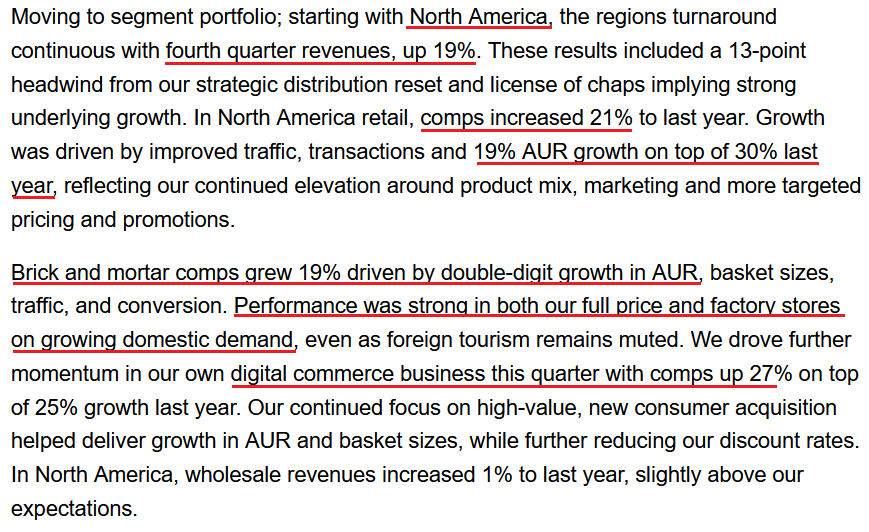

Second, Ralph Lauren – another fashion retailer – released its earnings on May 24. CFO Jane Nielsen said:

“We are encouraged as we look ahead. And let me give you a few reasons why. First, our consumers are resilient. They're at the higher end of income demographics, and they've proven, through COVID that their desire for the brand has increased and that they've come back repeatedly.

“Second, our value perception, our quality score, and our purchase intent have strengthened through the pandemic, even with the backdrop of us taking pricing up 50% over the last two years. So, quality, value, and purchase intent all up in the face of that kind of pricing; that gives us tremendous confidence.”

As a result, where is the demand destruction at Ralph Lauren?

Source: Ralph Lauren/Seeking Alpha

Source: Ralph Lauren/Seeking Alpha

For context, “AUR” refers to average unit retail, and it calculates the average selling price of Ralph Lauren’s products. Therefore, with “19% AUR growth” in Q4, the retailer’s prices materially outperform inflation. Moreover, with revenue and comparable sales (comps) up roughly 20% across the board, North American consumers continue to splurge despite the higher prices.

Furthermore, investors’ supply-side focus led them to miscalculate the demand side of the inflation equation. Yet, the same ill-fated logic that missed inflation’s rise is now used to predict inflation’s fall. For context, inflation should decelerate somewhat in the coming months. However, the Fed has plenty of work to do. To explain, I wrote on May 26:

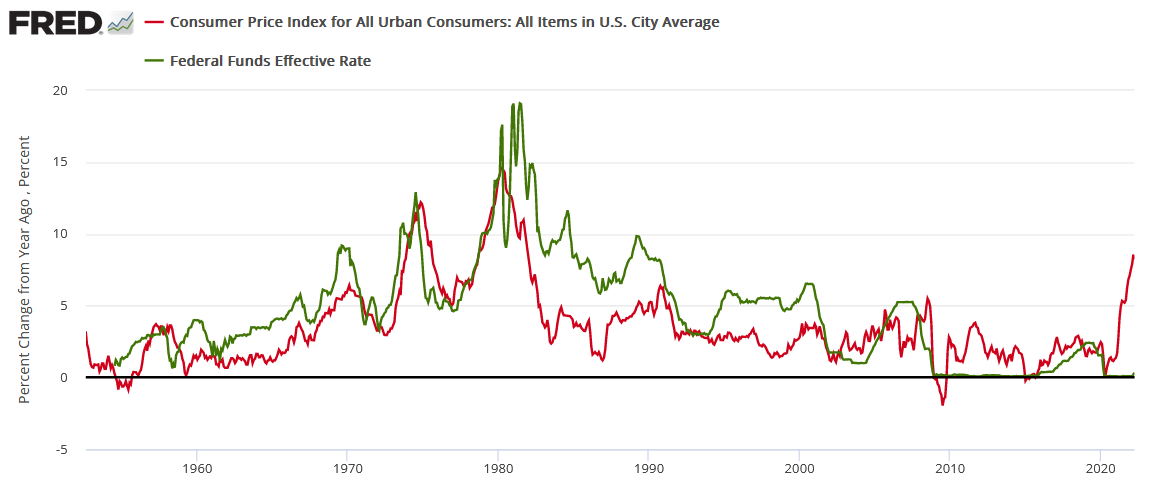

While 50 basis point rate hikes are likely done deals in June and July, a realization will only put the U.S. federal funds rate at 1.83%. With annualized inflation at 8%+, calming the price pressures with such little action is completely unrealistic. In fact, it’s never happened.

If you analyze the chart below, you can see that the U.S. federal funds rate (the green line) nearly always rises above the year-over-year (YoY) percentage change in the headline Consumer Price Index (the red line) to curb inflation. Therefore, investors are kidding themselves if they think the Fed is about to re-write history.

In addition, investors assume that rising oil prices are a function of restricted supply. Yes, OPEC+ has not restored its pre-pandemic output, so the argument has some merit. However, even as supply increases, prices are still going higher. As a result, demand is more resilient than market participants realize.

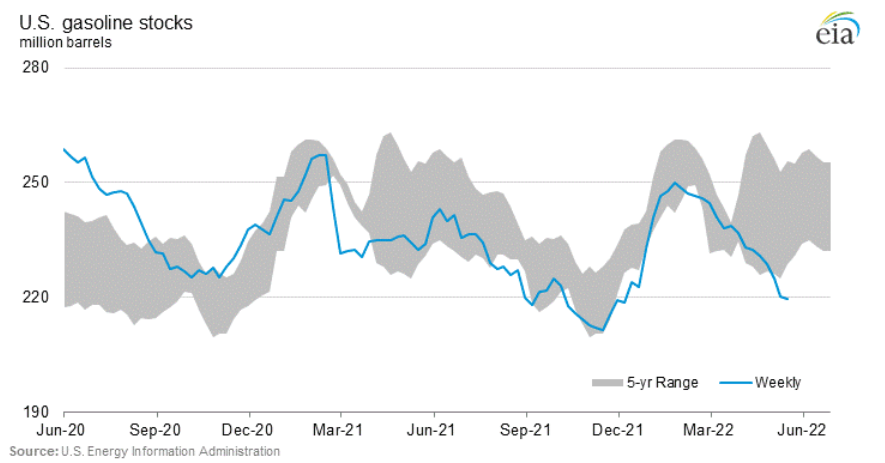

For example, the U.S. Energy Information Administration (EIA) released its Weekly Petroleum Status Report on May 25. An excerpt read:

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.0 million barrels from the previous week. At 419.8 million barrels, U.S. crude oil inventories are about 14% below the five year average for this time of year. Total motor gasoline inventories decreased by 0.5 million barrels last week and are about 8% below the five

year average for this time of year.”

As a result, gasoline inventories (stocks) remain in decline.

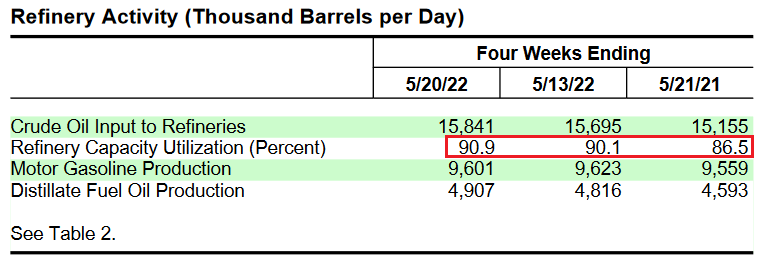

Please see below:

To explain, the blue line above tracks gasoline inventories, while the gray shaded area above reflects the five-year range. If you analyze the right side of the chart, you can see that stocks have fallen below the lower band. Therefore, who is burning all of this gasoline? Many Americans are still working from home, so they're not commuting to and from work. Therefore, the only logical explanation is that citizens are out doing things, which highlights inflationary demand.

To that point, the weak supply-side argument ignores the fact that refinery capacity utilization is at 90.9%, which is more than 4% higher than May 2021.

As such, supply has increased and U.S. refiners still don’t have enough gasoline to meet demand. Thus, it’s no surprise that prices are at all-time highs.

Please see below:

Again, inflation is simple to deduce. If consumers stop purchasing items, the lack of demand reverberates throughout the supply chain and prices decline. However, when refiners are producing more gasoline and inventories are still declining, it shows that record prices aren’t crimping demand.

Finally, Apple announced on May 25 that it will raise the starting wage for its U.S. retail employees from $20 per hour to $22 per hour. That’s a 10% increase that outpaces inflation. Therefore, if one of the largest corporations in the world has to increase wages to retain employees, what should other companies expect?

In conclusion, the PMs were mixed on May 26, and we exited our long positions in the GDXJ ETF with a solid gain. Thus, while investors still can’t decide whether to root for a recession or a “soft landing,” troublesome inflation should lead to the former over the medium term. As such, investors may learn the hard way that normalizing the metric only occurs with much higher interest rates or a profound sell-off of financial assets.

What to Watch for Next Week

With more U.S. economic data releases next week, the most important are as follows:

- May 31: Dallas Fed manufacturing index, The Confidence Board consumer confidence

Data from the Dallas Fed will highlight the inflationary pressures, or lack thereof, in Texas. Likewise, The Confidence Board’s consumer confidence report will provide insights into how Americans are dealing with the macroeconomic environment.

- June 1: ISM manufacturing PMI, JOLTS job openings, Fed Beige Book, Dallas Fed services index

Like the data from S&P Global this week, the ISM’s results are more relevant than regional surveys (like the Dallas Fed) because they cover the entire U.S. Therefore, it will be interesting to see if the ISM’s data matches the all-time high inflation readings from the S&P Global. In addition, the Fed’s Beige Book should provide similar context, as it consolidates the results from all of the regional Fed banks.

Also, while JOLTS data is lagged, it will still provide clues into the health of the U.S. labor market. Likewise, the Dallas Fed’s services index will build on the results from its manufacturing index.

- June 2: Challenger job cuts

On the flip side of job openings, the job cuts data will showcase how many employees were laid off in May.

- June 3: U.S. nonfarm payrolls, average hourly earnings, S&P Global and ISM services PMIs

The payrolls data will show how many jobs were added in May, while average hourly earnings will attempt to capture the extent of wage inflation. In addition, the S&P Global and ISM services PMIs will build on the results from their manufacturing PMIs.

All in all, economic data releases impact the PMs because they impact monetary policy. Moreover, if we continue to see higher employment and inflation, the Fed should keep its foot on the hawkish accelerator. If that occurs, the outcome is profoundly bearish for the PMs.

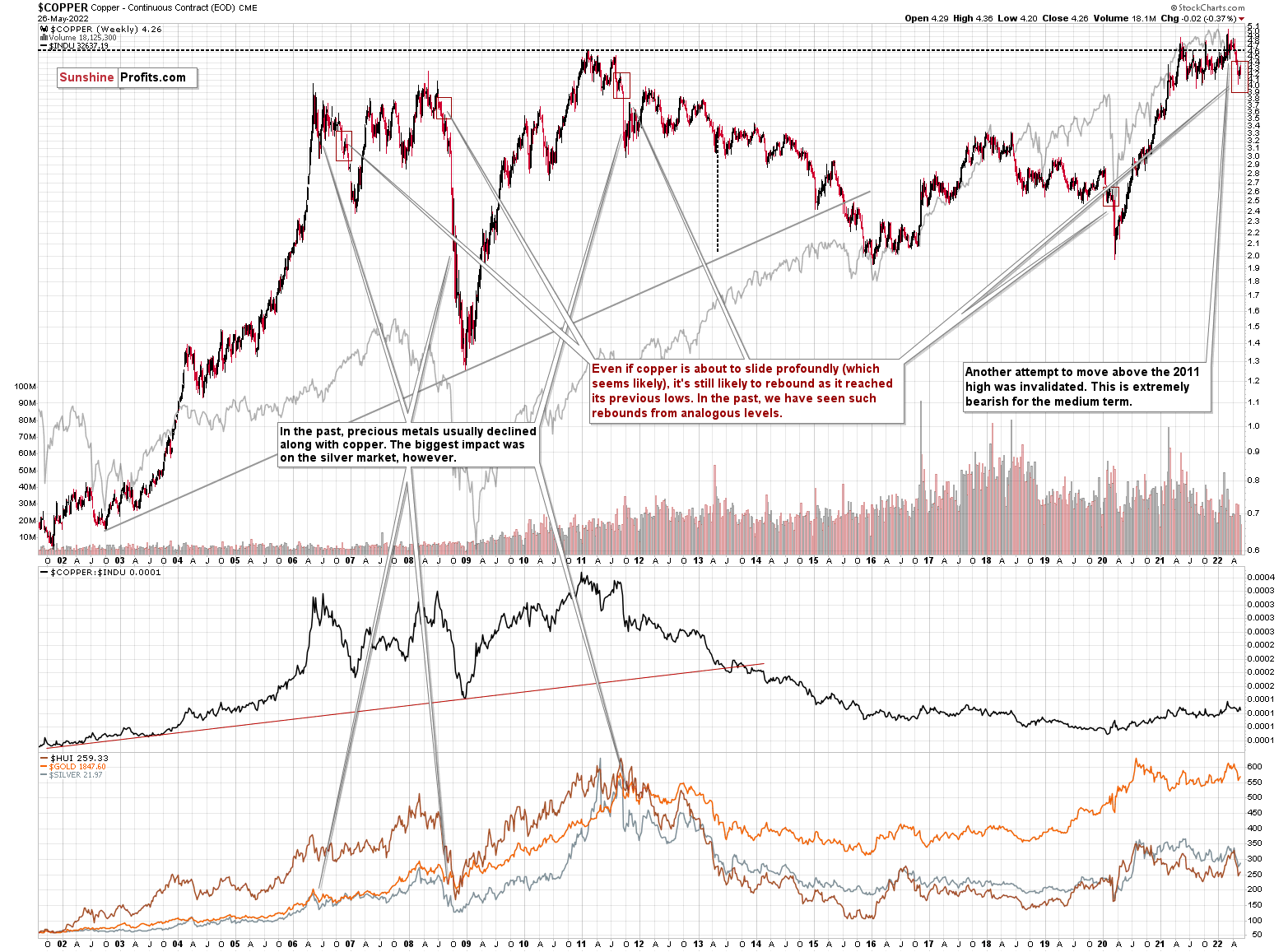

Let’s start today’s technical discussion with a quick check on copper prices.

Practically, everything that I wrote about it last week remains up-to-date:

Copper recently CLEARLY invalidated another attempt to move above its 2011 high. This is a very strong technical sign that copper (one of the most popular commodities) is heading lower in the medium term.

The interest rates are going up, just like they did before the 2008 slide. What did copper do before the 2008 slide? It failed to break above the previous (2006) high, and it was the failure of the second attempt to break higher that triggered the powerful decline. What happened then? Gold declined, but silver and mining stocks truly plunged. The GDXJ was not trading at the time, so we’ll have to use a different proxy to see what this part of the mining stock sector did.

However, the situation looks different from the short-term point of view.

Even if copper is about to slide profoundly (which seems likely), it’s still likely to rebound as it reached its previous lows. In the past, we have seen such rebounds from analogous levels. I marked those situations with red rectangles.

Since PMs quite often align their short-term price moves with copper, a short-term correction here would be quite likely.

The only thing I would like to add is that it could be the case that the corrective upswing is about to end or it could have already ended. The size of the recent quick run-up is similar to what we previously saw in analogous situations (as marked with rectangles).

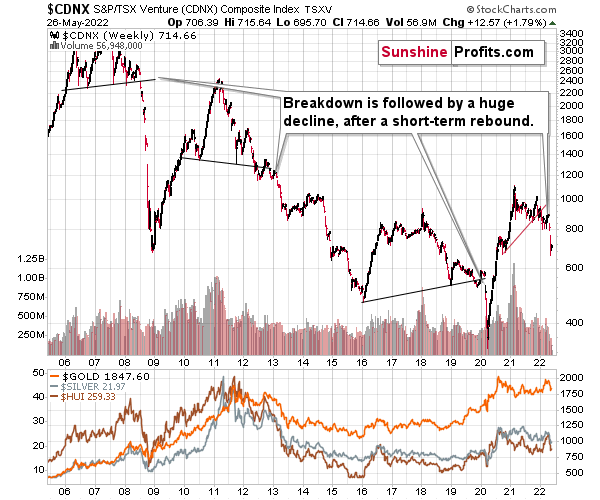

Now, let’s move back to the big picture.

I previously commented on the above chart in the following way:

The Toronto Stock Exchange Venture Index includes multiple junior mining stocks. It also includes other companies, but juniors are a large part of it, and they truly plunged in 2008.

In fact, they plunged in a major way after breaking below their medium-term support lines and after an initial corrective upswing. Guess what – this index is after a major medium-term breakdown and a short-term corrective upswing. It’s likely ready to fall – and to fall hard.

So, what’s likely to happen? We’re about to see a huge slide, even if we don’t see it within the next few days.

And indeed, we did see a slide in the index. It’s down over 13%, even though the week is not yet over. The medium-term outlook remains extremely bearish, even though the above chart doesn’t have any specific short-term indications.

The index corrected, just like the PMs, but it didn’t change anything with regard to the medium term.

What has happened recently?

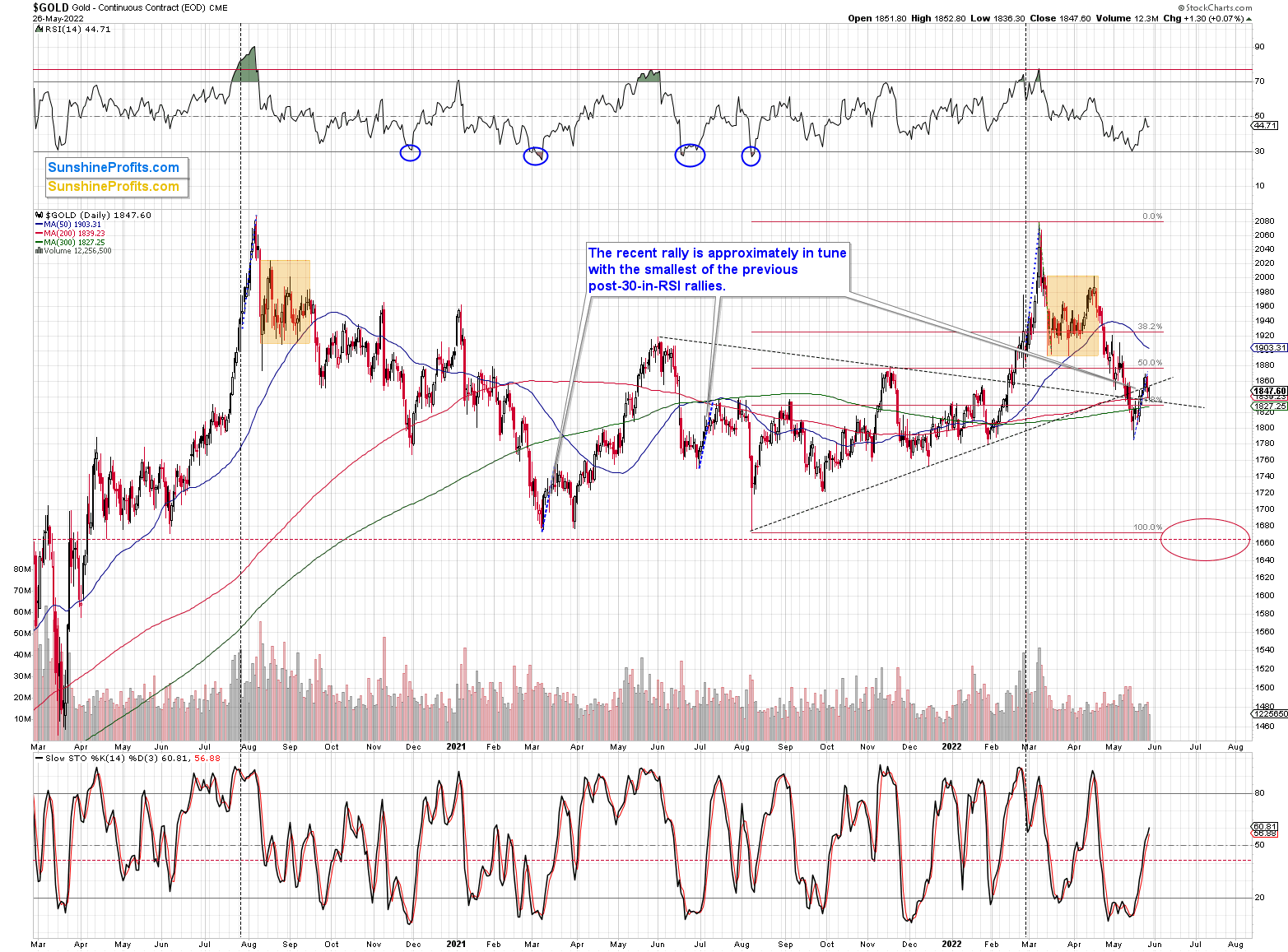

Gold erased almost the entire war-tension-based rally, and it’s now correcting this decline.

The RSI based on gold’s daily price changes was close to 30, which was a classic short-term buy signal.

However, based on how much gold usually rallied after this signal in the past, it might be the case that it has already rallied enough.

Yes, it could rally further, but that’s no longer very likely or likely.

I marked the smallest rallies that followed an analogous signal with blue, dashed lines, and I copied them to the current situation. That’s more or less how much gold rallied recently.

Before continuing with the analysis of the recent events – since the war-tension-based rally is over - I would like to quote what I wrote about war and gold’s “imminent” price rise at the end of February, when titles like “gold to $3000!” were common on various media sides.

Here's what I wrote on February 28, 2022, in the Gold & Silver Trading Alert entitled “Since There is a War, Gold Will Rise, Right? Wrong.”:

Let’s keep in mind that for gold to decline, the war doesn’t have to end, it doesn’t have to be won by either side. The only thing that matters with regard to it, is how big the uncertainty and concern is. And the peak uncertainty/concern might be today, as everything is new, and the situation is dramatically changing the geopolitical environment in Europe.

For comparison, remember Covid-19 cases, deaths in early 2020? That was just a tiny fraction of what we saw later. However, it was new and unknown. People were particularly scared then, and the markets moved particularly significantly then – not based on additional millions of cases and thousands of deaths next year.

Investing and trading are difficult. If it was easy, most people would be making money – and they’re not. Right now, it’s most difficult to ignore the urge to “run for cover” if you physically don’t have to. The markets move on rumor and sell the fact. This repeats over and over again in many (all?) markets, and we have direct analogies to similar situations in gold itself. And junior miners are likely to decline the most, also based on the massive declines that are likely to take place (in fact, it already started) in the stock markets.

That wasn’t the peak uncertainty - it peaked about a week later, but that’s not crucial. What is crucial is that the war is still taking place (months later), so it seems that one could say that the above proved correct.

Since junior miners just moved to new 2022 lows, it was also profitable not to chase the “emotional stampede”, but rather focus on the analogies to the previous situations from the past. Based on how the situation has developed in the markets so far, it seems that the clearest analogy is to how the gold market performed in 2001, based on the U.S.-Afghanistan war. I provided the chart in my Feb. 28, 2022, analysis, but here it is again:

The decline had been big and sharp, but please note when it ended. Gold formed an initial, and then final, short-term bottom, very close to the price levels at which the rally started before the outbreak of the war.

So, gold corrected, and then it did what it was likely to do based on the previous trends.

That’s exactly what we’re seeing right now. Gold has either completed its correction, or it’s still correcting, however, given the strength of the medium-term downtrend, I wouldn’t expect gold to rally much further or for this rally to take particularly long.

When gold is done correcting, it’s likely to return to its previous trend. This time, the medium-term trend is down.

The major takeaway from this situation is that when things get hot, it’s absolutely necessary to check what happened previously given similar situations before acting based on emotions.

Before looking at mining stocks, let’s take a look at gold from a broader point of view.

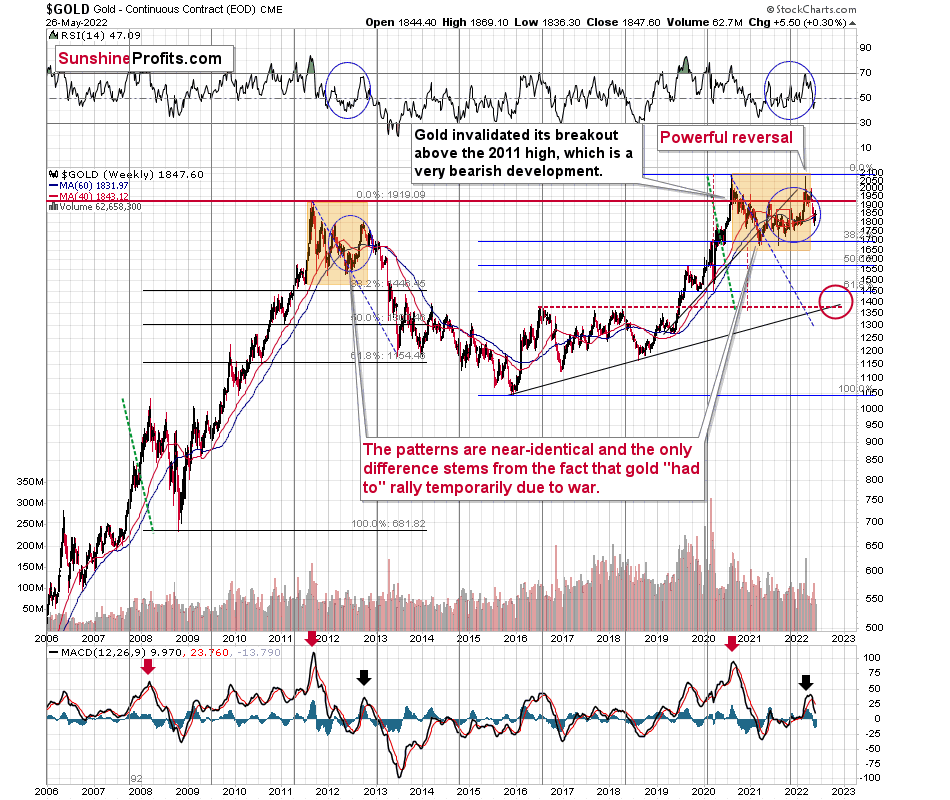

Let’s keep in mind that between 2020 and now, quite a lot happened, quite a lot of money was printed, and we saw a war breaking out in Europe. Yet, gold failed to rally to new highs.

In fact, it’s trading very close to its 2011 high, which tells you something about the strength of this market. It’s almost absent.

Truth be told, what we see in gold is quite in tune with what we saw after the 2011 top, and in particular, shortly after the 2012 top. The long-term gold price chart below provides details.

It seems that if it weren’t for the war in Europe, gold wouldn’t have been able to move above $2,000 and instead it would have topped close to its previous highs, which provided strong resistance.

The extraordinary thing about that is that that’s exactly what happened in 2012. Gold moved higher but only until it reached its previous highs, which happened in the second half of 2012.

This time the RSI was a bit higher, but it was close to 70, just like what we saw in 2012.

Yes, this time gold moved back to the previous high, but:

- This happened based on a geopolitical event (war in Europe) and geopolitically-driven rallies are generally unsustainable;

- When gold reached its previous highs, it also formed a profound weekly reversal, which formed on huge volume, and that’s very bearish.

So, the current medium-term outlook for gold is very bearish.

There are also very interesting short-term takeaways from the above chart.

If the 2012-2013 is currently being replayed (at least to a significant extent), then let’s not forget that this decline initially took the shape of a back-and-forth decline with lower lows and lower highs (but there were notable short-term rallies within the decline).

One of those counter-trend rallies took place when gold touched its 40- and 60-week moving averages (marked with blue and red) in late 2012. The RSI was trading at about 50 at that time, and that’s more or less when we saw the clear sell signal from the MACD indicator (lower part of the above chart).

Let’s see how this applies to the current situation.

Basically, we saw the same thing, gold has corrected – just like it did in 2012. However, the correction didn’t last very long (it’s just a correction, after all).

Back then, it had ended a bit above the 40- and 60-week moving averages after the RSI moved back close to the 50 level (I mean the second rebound, not the first one). We’re seeing the same thing.

The difference now is that gold declined more in the short term before correcting, and back in 2012, it corrected twice. However, let’s not forget that this time the preceding rally was bigger (war tensions), so it’s no wonder that gold had more to correct in shorter time. Consequently, it seems that the current correction is taking place “instead of” two 2012 corrections.

Anyway, after the correction was over, gold plunged and the next rebound started once gold moved close to its previous medium-term lows. The analogous lows right now are the 2021 bottoms, which are below $1,700. That’s where I think gold is headed next.

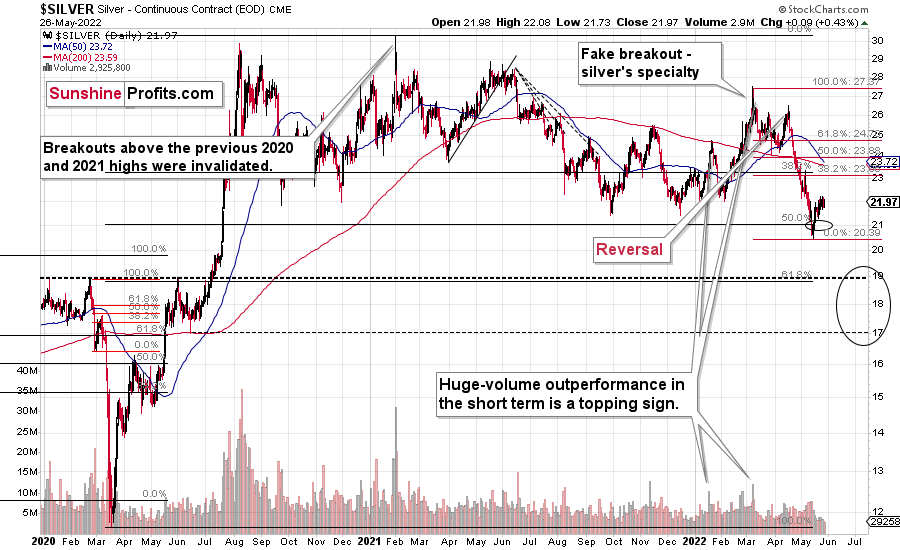

Let’s take a look at the silver market.

Just like gold, silver hit my target area and then moved slightly below it. Then it rallied, but it could be the case that the rally is already over. In fact, it seems quite likely.

Silver didn’t correct significantly, somewhat in line with what we saw in early 2020. No wonder – the silver market is more correlated with the general stock market, and the latter hasn’t been the top performer recently.

Why would silver be more aligned with stocks than gold is? Because it has more industrial applications than gold. And therefore, the demand for the white metal is more aligned with how the economy is performing.

How low will silver slide now? Ultimately, I wouldn’t rule out a move to or below the 2020 low, but as far as the next short-term downswing is concerned, the $17 - $19 area becomes the likely target. Yes, it’s quite wide, but it really is unclear how silver will perform now.

The support provided by the 2020 highs and the 61.8% Fibonacci retracement based on the entire 2020-2021 rally is very strong. However, this support is not that much below the current price levels. And if gold and miners are about to more or less repeat their recent declines (and stocks decline too), then silver could also repeat its previous decline. In this case, it would be likely to fall below the above-mentioned support.

The next support is provided by the mid-June 2020 low (~$17).

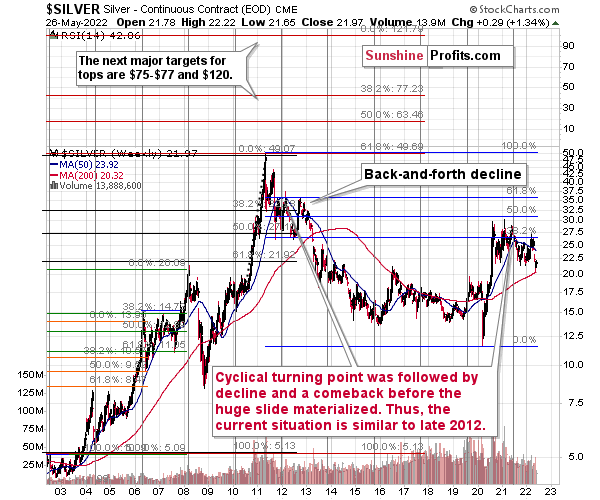

Let’s not forget that gold is not the only precious metal that is repeating its 2012 performance right now, and you can see more details on silver’s long-term chart.

As you can see on the above chart, silver corrected about 50% of the previous downswing, and this correction ended at about $30, a long time ago. Ever since, silver has been declining, and even the outbreak of war in Europe didn’t make silver rally above that level.

On the above chart, you can see how silver first topped in 2011, then declined and formed another top at the cyclical turning point. Next, it declined once again – to the previous lows. After that, silver rallied (in 2012 and 2022), and it topped between its 50-week moving average (marked in blue) and the previous top. Now silver is declining in a back-and-forth manner (you can see it more clearly on the previous short-term silver chart).

Back in 2012, these were just the early days of a gargantuan decline, and the same appears likely to be the case this time. Interest rates are going up after all, and the Fed is determined to quench inflation.

Let’s not forget that rising interest rates are likely to negatively impact not just commodities, but practically all industries. This will likely cause silver’s price to decline profoundly, as silver’s industrial demand could be negatively impacted by lower economic growth (or a decline in economic activity).

Besides, please note that silver didn’t even manage to rally as much as copper (which tried to move to new highs recently) or most other commodities, thus being rather weak.

Consequently, it seems that silver will need to decline profoundly before it rallies (to new all-time highs) once again.

Having said that, let’s take a look at what happened in junior mining stocks.

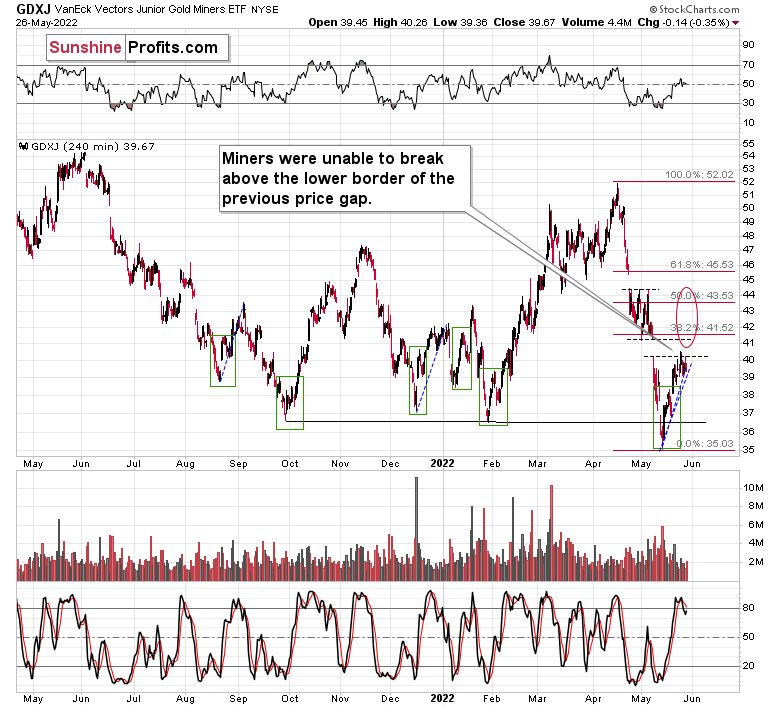

The miners were unable to break above the lower border of the previous price gap despite the rally in the general stock market that continued yesterday. In fact, junior miners ended yesterday’s session lower.

Yes, gold is still the main driver of the juniors’ prices, but given that the S&P 500 moved up by about 2%, at least some strength in the juniors was expected. And we didn’t see it.

If it all didn’t happen so close to GDXJ’s upside target, and if stocks weren’t so close to their own upside target, it wouldn’t matter much. However, the above was the case, and thus it did matter.

Perhaps junior miners will rally more and even manage to “close the gap” by rallying to its upper border, but… so what? That’s only about $1 – $1.5 higher in the GDXJ, and its already after a ~$4 rally, which means that we’ve caught the majority of the move with our previous long position. In fact, we’ve actually caught the “easy part” of the move.

Congratulations to everyone who managed to profit on this rebound!

I called the recent rally “easy” because when sentiment becomes too extreme, it’s very likely that a correction will follow. Thus, trading it was rather easy. After all, no market moves up or down in a straight line.

Anyway, the “easy” part of the rally is definitely over, and now the rally has either ended or we entered the “difficult” part thereof. “Difficult” because it’s no longer very likely that we’ll see further move higher. Yesterday’s lack of positive reaction to stocks’ rally emphasized that. This is why I was quick to take profits here.

Remember, the strong medium-term downtrend remains intact.

While aiming to gain from a rebound (against a powerful medium-term downtrend) when it’s very likely to take place (based on the sentiment being too extreme) is something justified from the risk to reward point of view (risk is relatively low), the situation changes dramatically in the “difficult” part of the rally. In this case, the risk is big (the reversal could take place at higher prices or it could be already after the reversal…) while the profit potential is limited.

Also, in today’s pre-market trading we might be seeing a sell indication. So far it’s not strong, but still…

Silver futures are up by 1.49%, the GDXJ is up by 0.96% in London trading, the GDX is up by only 0.38% in London trading, and gold futures are up by 0.53%.

Silver has just moved to new monthly high, while gold, the GDX and the GDXJ haven’t (the latter is quite close, though). This means that we’re in a situation where silver is outperforming on an immediate-term basis, while miners are underperforming (the GDX in this case) gold. This is often what we see right before declines.

This doesn’t guarantee that the decline will start today or tomorrow, but it does indicate that it’s likely to take place within the next several days.

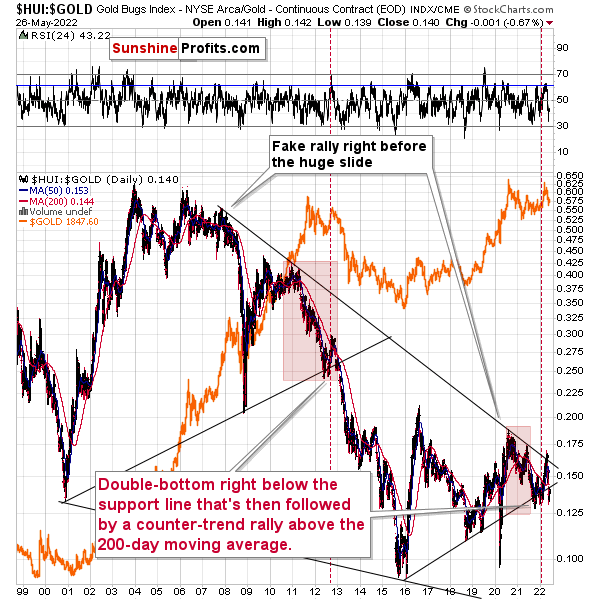

Also, let’s not forget about the forest while looking at individual trees. By that, I mean looking at how gold stocks perform relative to gold. That’s one of the major indications that the current situation is just like what we saw at the 2012 top.

I previously wrote the following:

Gold stocks (GDX, GDXJ, and HUI Index) have recently been quite strong relative to gold. OK, but is this necessarily bullish? It might be, until one considers the fact that we saw the same thing at the 2012 top! This changes everything, and it does so, because the links between now and that top are almost everywhere: in gold, in silver, in gold stocks, and even in their ratios.

As it turns out, the gold stocks to gold ratio is behaving almost identically as it was behaving at the 2012 top in the precious metals sector.

In both cases, the ratio moved below the rising medium-term support line, then formed a double-bottom below the line, and invalidated the breakdown, which resulted in a counter-trend rally. The rally ended shortly after the ratio moved above its 200-day moving average (marked in red). That’s what happened recently. What happened next in 2012? The decline not only continued – it accelerated!

Consequently, the recent action in the ratio is not really bullish. In other words, the fact that gold stocks were recently (in the short run only) strong relative to gold doesn’t make the medium-term outlook for the precious metals sector bullish. However, it remains bearish.

Interestingly, the ratio itself moved to its declining resistance line (and it even moved slightly above it, but the move was too small to be viewed as reliable), indicating that the corrective upswing might already be over or almost over. We get the same indication from the RSI indicator. It’s not above 70, but in the case of most local tops, the RSI didn’t have to move above 70. It just moved to more or less the same levels – I marked it with a horizontal blue line.

The above is actually a confirmation of the analogy that is visible directly in all three key components of the precious metals sector: gold, silver, and mining stocks.

Indeed, the HUI to gold ratio moved lower recently, clearly invalidating the breakout above its declining resistance line – in line with my previous expectations.

The decline didn’t stop there. The ratio actually managed to decline below its rising support line, likely surprising those who didn’t see the analogy to 2012-2013 (but if you’ve been reading my analyses for some time – you did).

The implications are extremely bearish, as it appears that the 2012-2013 decline will now be repeated to a considerable extent. Still, given this similarity, it seems that we might see a short-term correction, just like the one that we did in the early part of the 2012 decline.

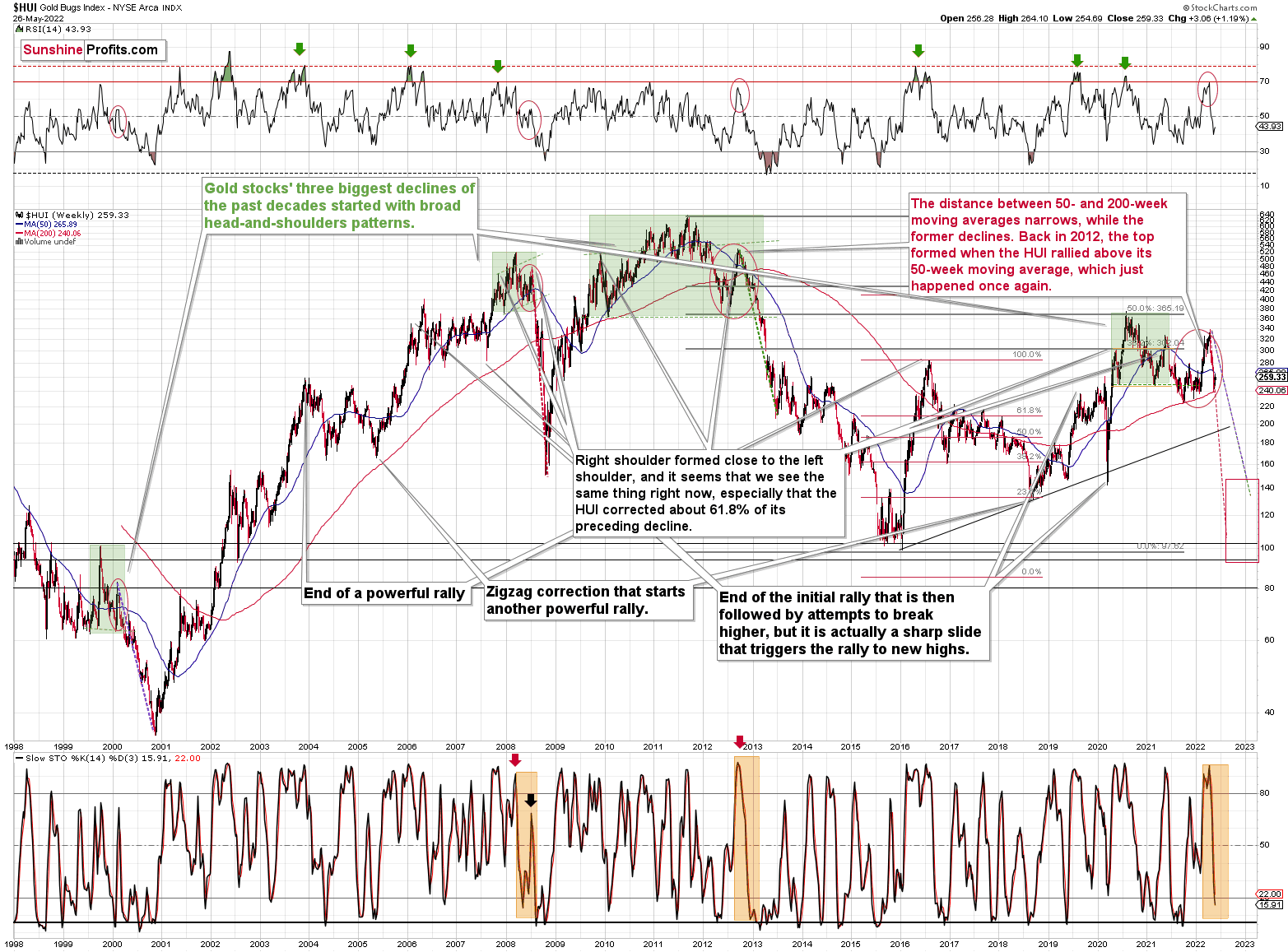

I already discussed the analogies to 2012-2013 in gold and silver, so let’s take a look at the analogy in the HUI Index – a proxy for gold stocks.

If you look at the areas marked with red circles (especially now, 2012/2013, and 2008), you’ll notice that they are very similar. These are the sizable short-term rallies that we saw after / in the final parts of the broad head-and-shoulders patterns.

The moves were quite sizable – the 2012 rally was even bigger than the current one, even though there was no war in Europe at that time.

Based on how broad the pattern is and the self-similarity present in gold, it seems that the analogy to what happened in 2012 is most important right now.

Looking at the moving averages, we see that the 50-week moving average (blue) and 200-week moving average (red) performed quite specifically in late 2012, and we see the same thing this year.

The distance between 50- and 200-week moving averages is currently narrowing, while the former is declining. Back in 2012, the top formed when the HUI rallied above its 50-week moving average, which just happened once again.

The RSI indicator (above the price chart), based on the HUI Index’s weekly chart, provides us with another confirmation of the analogy, and the same goes for the stochastic indicator (below the price chart). The former was just close to the 70 level – exactly what we saw at the 2012 top, and the latter was above 90 – again, something that we saw at the 2012 top.

As history tends to rhyme, gold stocks are likely to slide, similarly to how they declined in 2012 and 2013.

Still, if the general stock market slides, and that appears likely for the following weeks and months, then we might have a decline that’s actually similar to what happened in 2008. Back then, gold stocks declined profoundly, and they have done so very quickly.

Please note that the sharpness of the recent decline in miners was even bigger than the one that we saw in 2008!

The dashed lines that start from the recent prices are copy-paste versions of the previous declines that started from the final medium-term tops. If the decline is as sharp and as big as what we saw in 2008, gold stocks would be likely to decline sharply, approximately to their 2016 low. If the decline is more moderate, then they could decline “only” to 120-150 or so. Either way, the implications are very, very, very bearish for the following weeks.

Also, we saw a fresh sell signal from the weekly stochastic indicator, which (unlike its 4-hour version) is quite efficient. This is a very bearish development for the medium term. After all, the last two times we saw this signal were at the 2021 and 2020 tops.

Let’s take a brief look at the stock market indices.

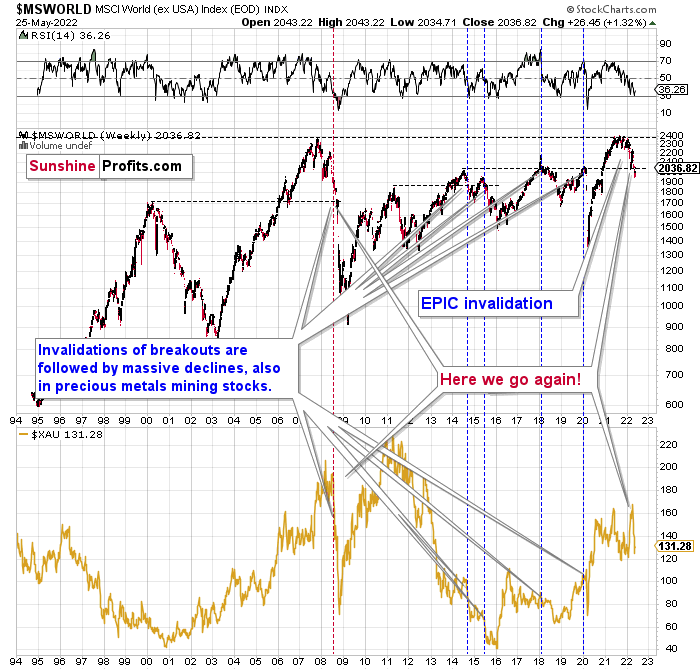

The technical picture in the case of world stocks remains extremely bearish, and my previous comments on it were just confirmed. Here’s what I’ve been writing about the above chart for quite a few weeks now:

World stocks have already begun their decline, and based on the analogy to the previous invalidations, the decline is not likely to be small. In fact, it’s likely to be huge.

For context, I explained the ominous implications on Nov. 30. I wrote:

Something truly epic is happening in this chart. Namely, world stocks tried to soar above their 2007 high, they managed to do so, and… they failed to hold the ground. Despite a few attempts, the breakout was invalidated. Given that there were a few attempts and that the previous high was the all-time high (so it doesn’t get more important than that), the invalidation is a truly critical development.

It's a strong sell signal for the medium - and quite possibly for the long term.

From our – precious metals investors’ and traders’ – point of view, this is also of critical importance. All previous important invalidations of breakouts in world stocks were followed by massive declines in mining stocks (represented by the XAU Index).

Two of the four similar cases are the 2008 and 2020 declines. In all cases, the declines were huge, and the only reason why they appear “moderate” in the lower part of the above chart is that it has a “linear” and not a “logarithmic” scale. You probably still remember how significant and painful (if you were long, that is) the decline at the beginning of 2020 was.

Now, all those invalidations triggered big declines in the mining stocks, and we have “the mother of all stock market invalidations” at the moment, so the implications are not only bearish, but extremely bearish.

World stocks have declined below their recent highs, and when something similar happened in 2008, it meant that both stocks and gold and silver mining stocks (lower part of the chart) were about to slide much further.

The medium-term implications for mining stocks are extremely bearish.

Let’s take a look at the U.S. stock market.

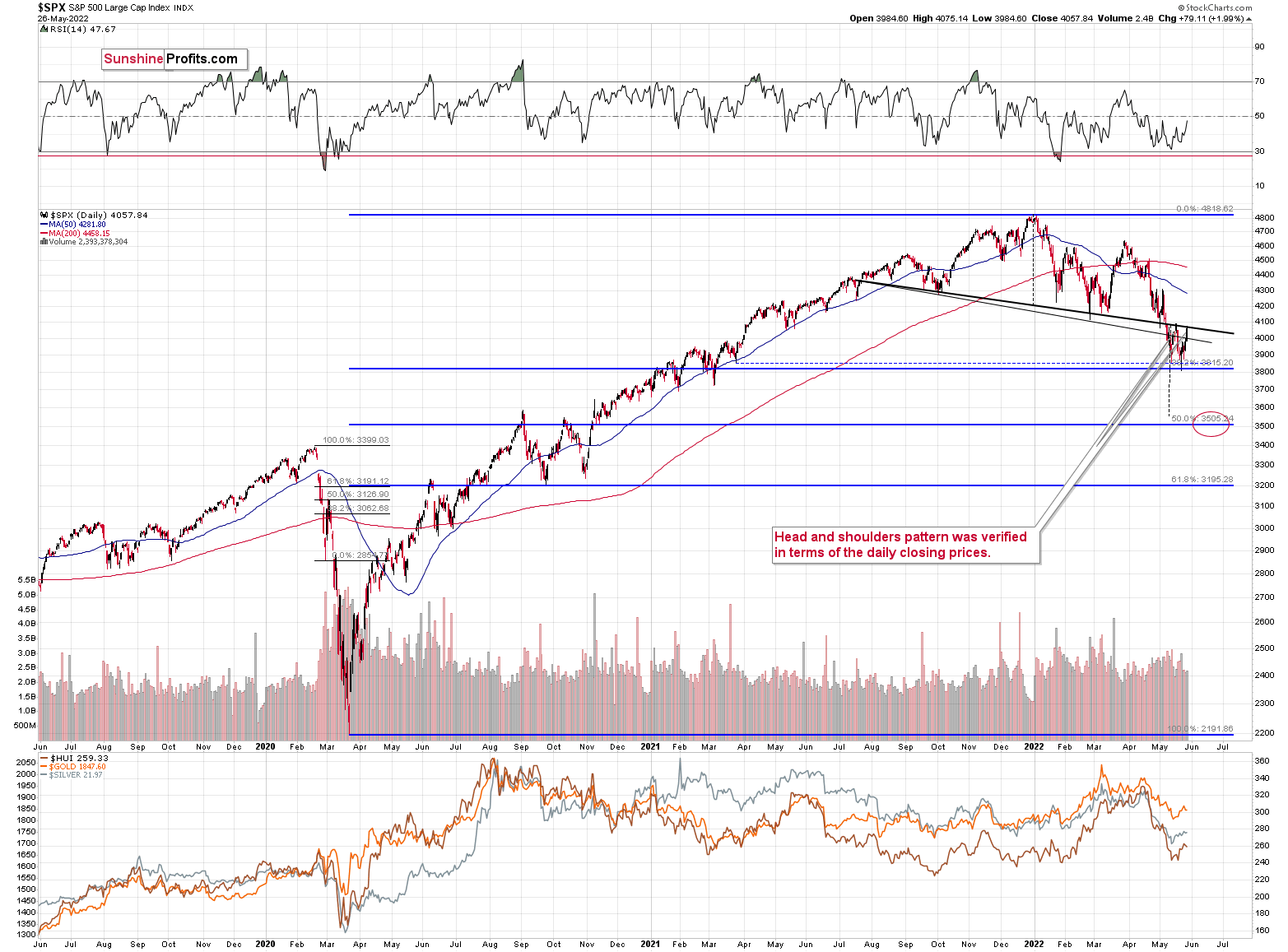

In yesterday’s analysis, I commented on the S&P 500 in the following way:

The S&P 500 has moved slightly higher recently, but a really strong resistance is still a bit higher. Namely, it’s the neck level of the previously broken head and shoulders pattern in terms of the daily closing prices. This resistance line already stopped a previous small rally, and it could be the case that it will be verified one last time – just like what we saw in the final part of the early-May consolidation.

This way, the very recent history (the above-mentioned early-May consolidation) would be repeated to a considerable extent, and that’s what the markets do very often – they rhyme.

If stocks are “almost there” and the USD Index is “almost there”, it’s quite natural for mining stocks to be “almost there” too.

That’s exactly what happened yesterday. Stocks moved back up to the previously broken neck level of the head-and-shoulders pattern. This means that the rally could be over at this very moment or about to end.

The implications for the precious metals market, especially for silver and mining stocks, are bearish.

From a broader point of view, let’s keep in mind what happened in the previous cases when stocks declined profoundly – in early 2020 and in 2008. Miners and silver declined in a truly epic manner, and yes, the same is likely to take place in the following months, as markets wake up to the reality, which is that the USD Index and real interest rates are going up.

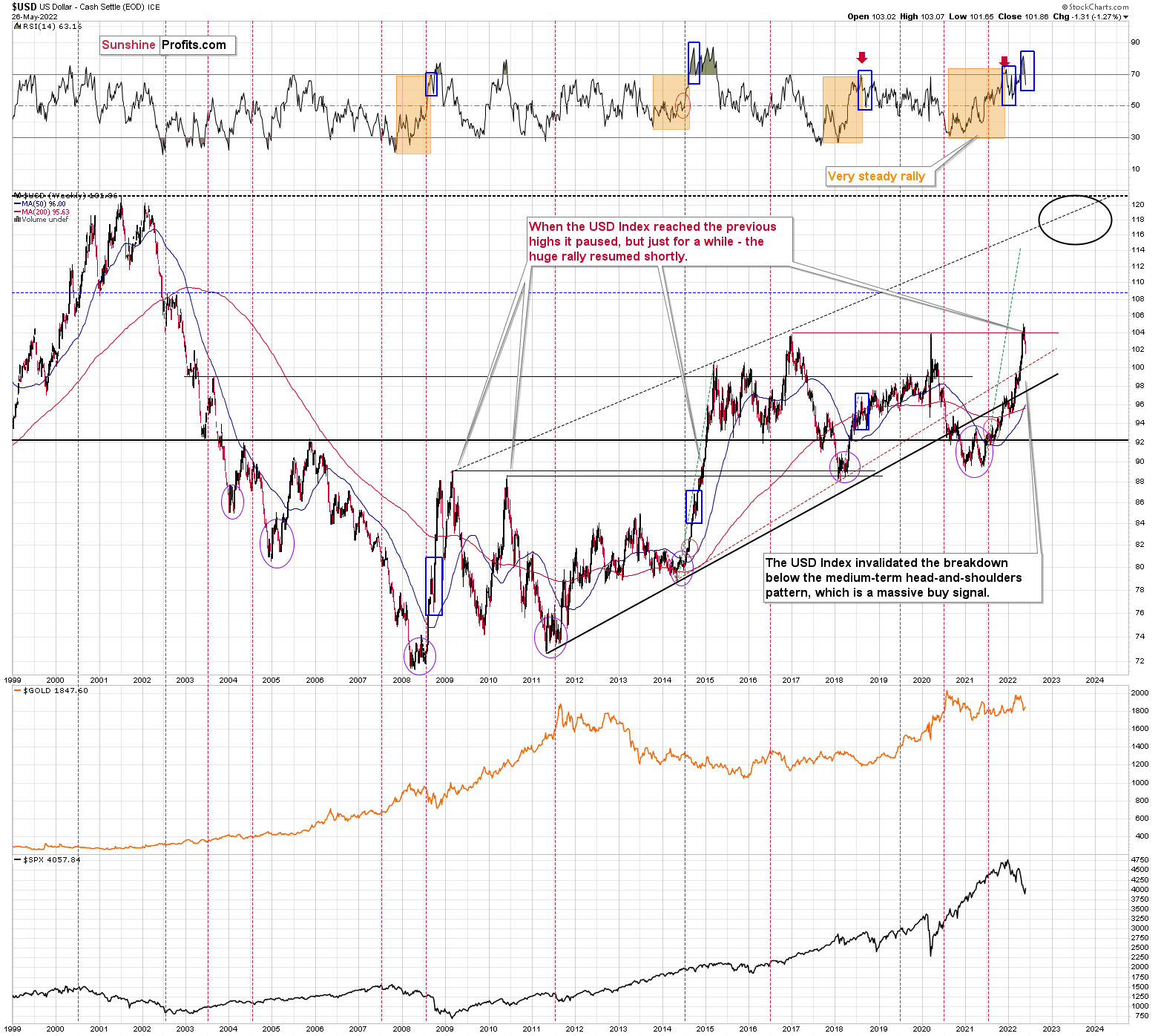

Speaking of the USD Index, after invalidating the breakout below the multi-year head-and-shoulders pattern, the USDX was poised to soar, just like I’ve been expecting it to do for more than a year, and that’s exactly what it did.

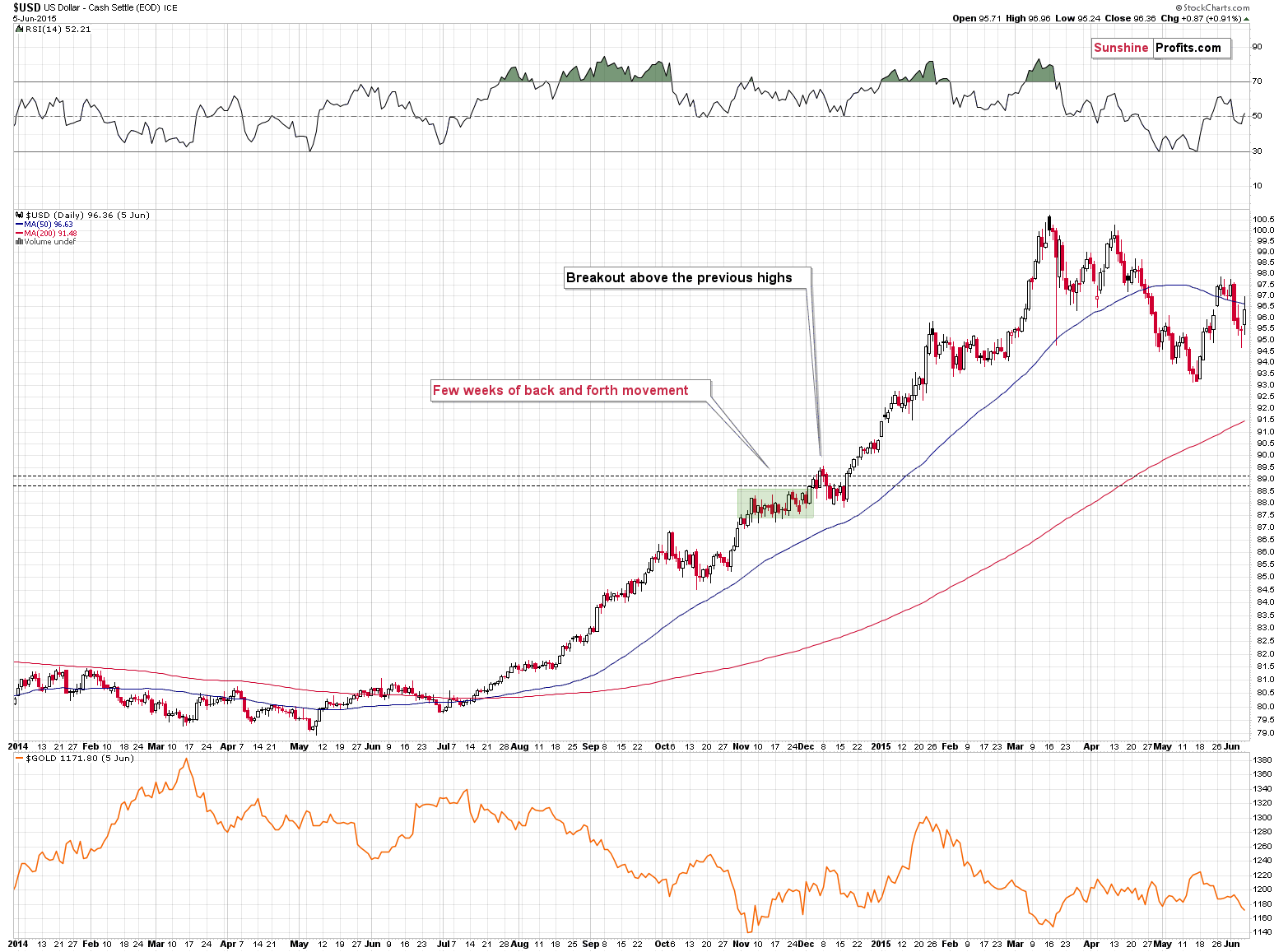

The RSI is currently slightly below 70, but since the USDX is in a medium-term rally and is already after a visible correction, it can rally further. Please note that we saw the same thing in 2008 and 2014. I marked the corrections with blue rectangles.

Back in 2014, the USD Index invalidated the breakout above the previous major highs, but then it soared once again, ignoring the invalidation. Consequently, I’m not taking the recent invalidation at its face value.

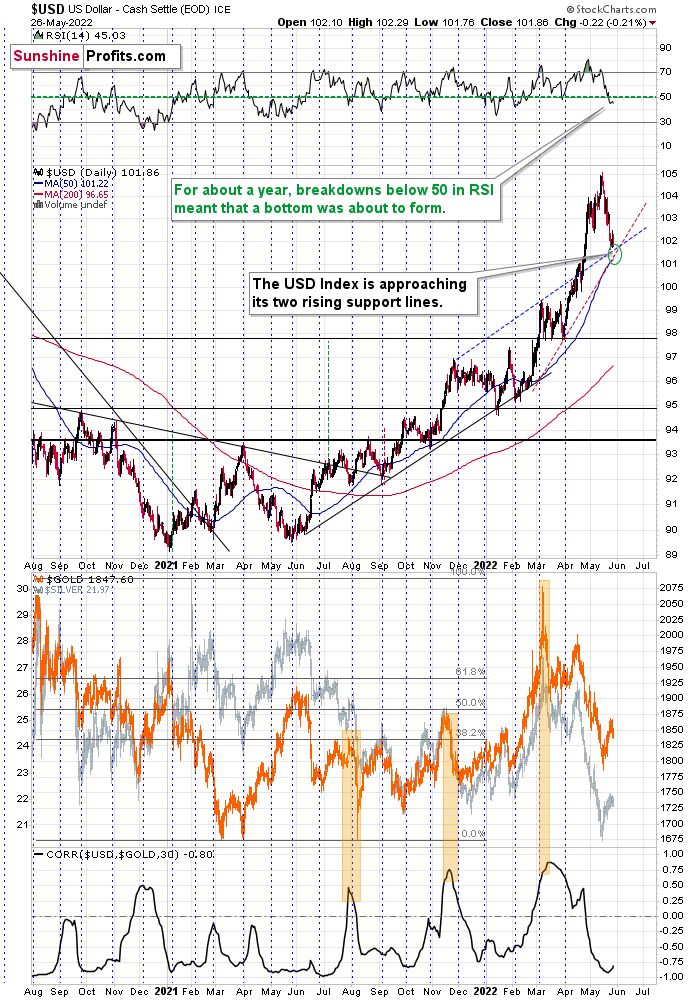

While the USD Index hasn’t reached its combination of support levels just yet, it’s very close to them, so they could be reached any day or hour now.

The RSI is below 50, and while this is not a classic buy signal, it’s something that (recently) often meant that the pullback was over or about to be over.

Even if the USD Index moves slightly lower here, it’s likely to rally significantly in the following weeks and months.

The opposite is likely to take place in the precious metals sector. Gold, silver, and mining stocks are likely to decline profoundly in the following months, even if they move slightly higher here.

Consequently, in my view, the risk to reward ratio strongly favors short positions in junior mining stocks at this time.

Naturally, as always, I’ll keep you – my subscribers – informed.

Overview of the Upcoming Part of the Decline

- It seems to me that the short-term rally in the precious metals market is either over or very close to being over. It’s so close to being over that I think it’s already a good idea to be shorting junior mining stocks.

- We’re likely to (if not immediately, then soon) see another big slide, perhaps close to the 2021 lows ($1,650 - $1,700).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

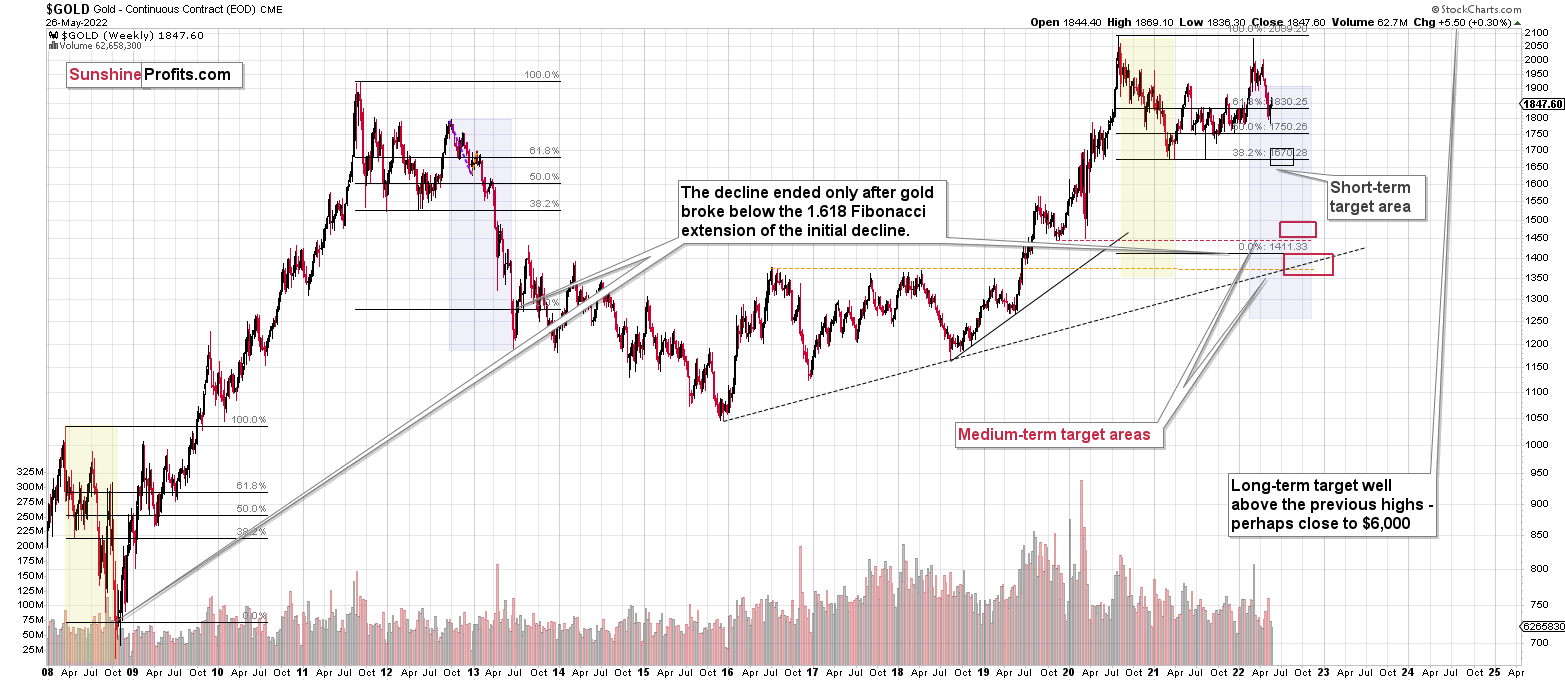

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

Summing up, it seems to me that the short-term rally in the precious metals market is either over or close to being over. In fact, it’s so close to being over that I think it’s already a good idea to be shorting junior mining stocks.

I previously wrote that the profits from the previous long position (congratulations once again) were likely to further enhance the profits on this huge decline, and that’s exactly what happened. The profit potential with regard to the upcoming gargantuan decline remains huge.

As investors are starting to wake up to reality, the precious metals sector (particularly junior mining stocks) is declining sharply. Here are the key aspects of the reality that market participants have ignored:

- rising real interest rates,

- rising USD Index values.

Both of the aforementioned are the two most important fundamental drivers of the gold price. Since neither the USD Index nor real interest rates are likely to stop rising anytime soon (especially now that inflation has become highly political), the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Friday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief