-

Gold Investment Update: Much to Gold’s Dissatisfaction, the USDX Seems Unstoppable

May 13, 2022, 10:09 AMMiners and silver declined in a truly epic manner, and yes, the same is likely to take place in the following months, as markets wake up to the reality, which is that the USD Index and real interest rates are going up.

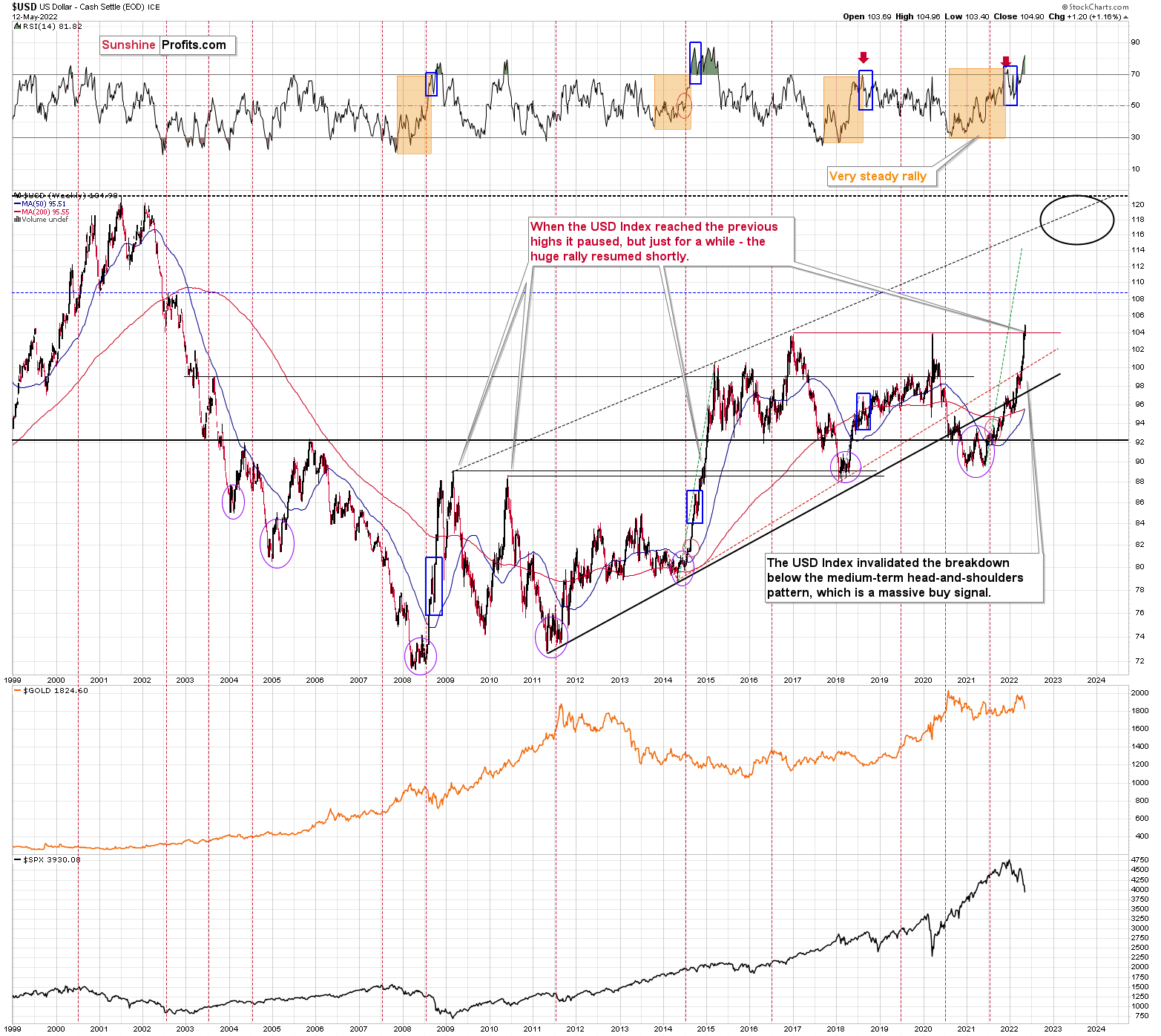

Speaking of the USD Index, after invalidating the breakout below the multi-year head-and-shoulders pattern, the USDX was poised to soar, just like I’ve been expecting it to do for more than a year, and that’s exactly what it did.

The RSI is currently above 70, but since the USDX is in a medium-term rally and is already after a visible correction, it can rally further. Please note that we saw the same thing in 2008 and 2014. I marked the corrections with blue rectangles.

Still, the USD Index is now practically right at its next strong resistance – at about 104.

I previously wrote the following about this target:

It doesn’t mean that the USD Index’s rally is likely to end there. It’s not – but the USDX could take a breather when it reaches 104. Then, after many investors think that the top has been reached as the USDX corrects, the big rally is likely to continue.

The important detail here is that the consolidation close to the 104 level doesn’t have to be really significant (perhaps 1-2 index points of back-and-forth movement?) and it definitely doesn’t have to take long. The interest rates are going higher, and investors appear to have just woken up to this reality – it will take some time before everyone digests what’s going on. Before the late-reality-adopters join in, the USD Index could be trading much, much higher.

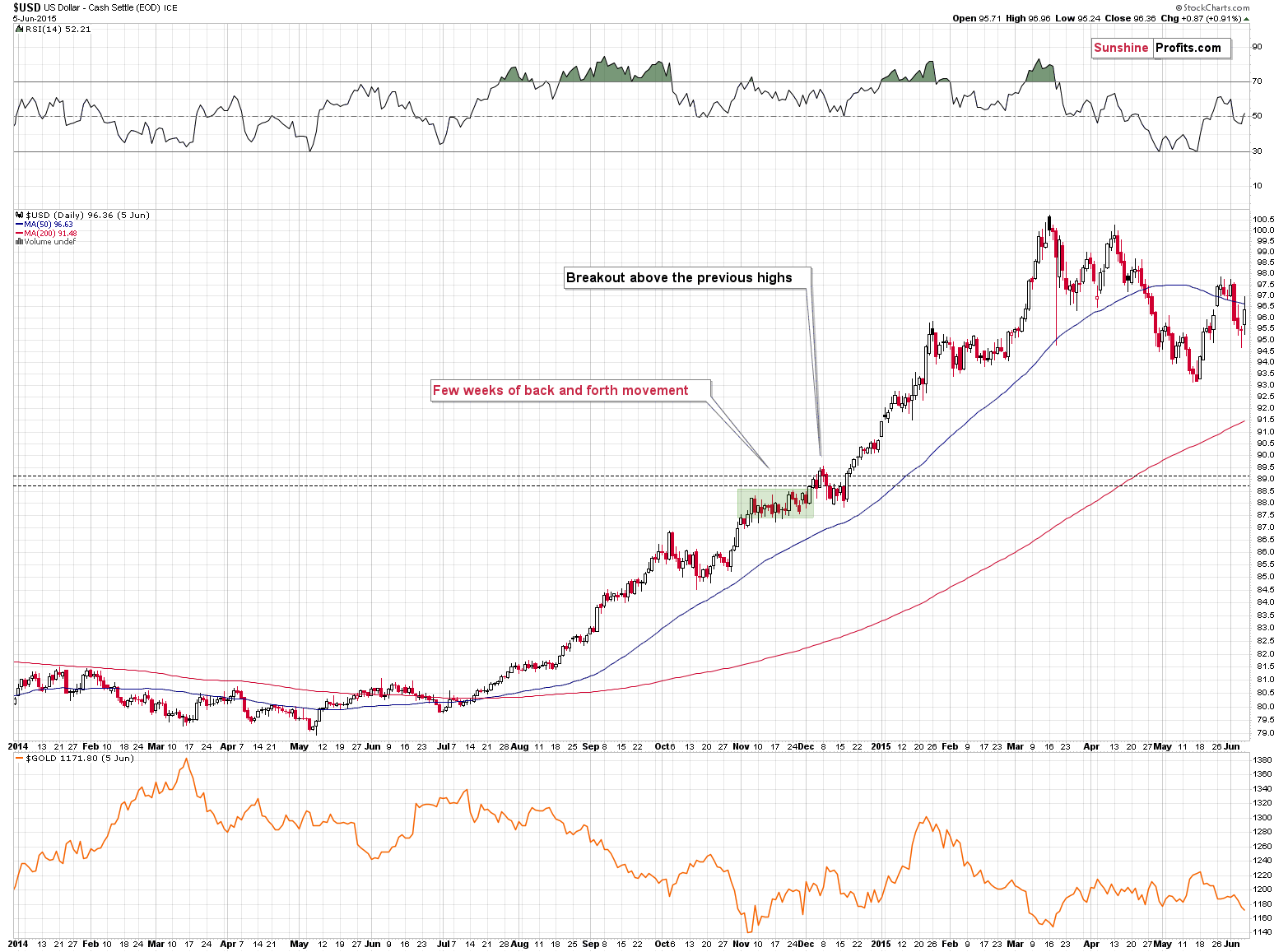

Back in 2014, when the USD Index approached its previous highs (close to 89), it consolidated so quickly that it’s almost not visible on the above chart – it took just a bit more than a week (from Dec. 8, 2014 – 89.56 to Dec. 16, 2014 – 87.83).

I previously wrote the following:

We could see something similar this time – and as the USD Index corrects for about a week, the same thing could take place in other markets as well: stocks and PMs. If junior miners were after a very sharp slide at that time, they would be likely to correct sharply as well.

I would like to add one important detail. Back in 2014, the USD Index didn’t correct after reaching its previous high. It corrected after moving above it. The higher of the highs was the March 2009 high, at 89.11.

The higher of the recent highs is at 103.96 right now, so if the analogy to 2014 is to remain intact, the USD Index could now top at close to 104.5 or even 105.

That’s exactly what happened recently. Yesterday, the USD Index moved to 104.96, which is in perfect tune with what I wrote above. Consequently, it seems that we could now see a move to about 103-103.5, after which USD’s rally could continue.

The opposite is likely to take place in the precious metals sector. Gold, silver, and mining stocks are likely to rally in the near term, and then – after topping at higher levels – their decline would continue.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Investment Update: Will Higher Interest Rates Shake the Gold Market?

May 6, 2022, 10:25 AMThis week was all about earnings, as some of Wall Street’s heavyweights released their quarterly reports. Moreover, while mixed results caused sentiment to swing from one extreme to the other, inflation remains front and center, and the outlook for Fed policy is bullish.

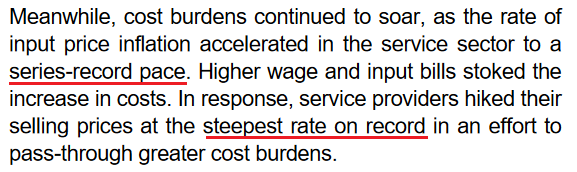

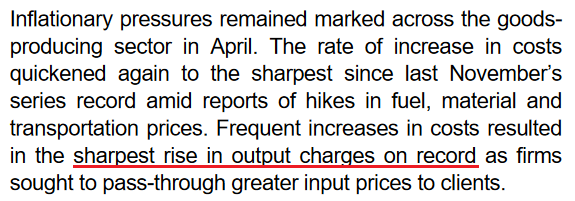

For example, whether it’s PepsiCo, Mondelez, or Whirlpool, companies have warned that inflation remains extremely problematic. Moreover, with American Express and Visa highlighting consumers’ eagerness to spend, the pricing pressures show no signs of slowing down. Likewise, S&P Global released its U.S. Composite PMI on Apr. 22, and I wrote on Apr. 25 that it was another all-time high for inflation.

Isolating services:

Isolating manufacturing:

With growth, employment and inflation supporting several rate hikes over the next several months, there is little in the release that implies a dovish U-turn. To that point, please remember that the survey was conducted from Apr. 11 to Apr. 21. Therefore, while investors hope that decelerating growth and inflation will allow the Fed to back off, the PMI data suggests otherwise. As such, the Fed’s conundrum continues to intensify.

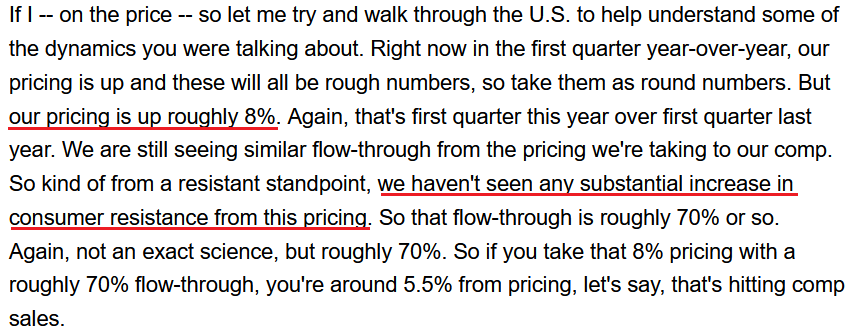

Furthermore, with more appetizing earnings reports released on Apr. 28, the results were even more bullish for Fed policy. Likewise, with the PMs’ force fields wearing off, they should suffer profoundly as rate hike volatility increases. For example, McDonald’s released its first-quarter earnings on Apr. 28. CFO Kevin Ozan said during the Q1 earnings call:

“In the U.S., I think last quarter, I mentioned that we thought commodities were going to be up roughly 8% or so for the U.S. That number is now more like 12% to 14% for the year. So U.S. commodities clearly have risen (…).”

“On the labor side, in the U.S., it's probably over 10% right now. Part of that is because you'll recall that we made adjustments to our wages in our company-owned restaurants mid-year last year, so we haven't lapped that. So part of it is due to that and part of it is due to just continued wage inflation.”

As a result, the Fed is losing control of the inflation situation, and the largest restaurant chain in the world is still sounding the alarm. Therefore, with the pricing pressures unwilling to abate on their own (which I’ve warned about for some time), killing demand is the only way to reduce the wage-price spiral.

Please see below:

Source: McDonald’s/Seeking Alpha

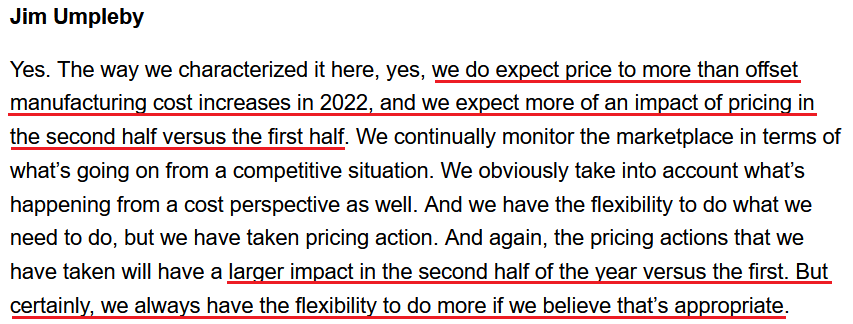

Source: McDonald’s/Seeking AlphaOn top of that, Caterpillar released its first-quarter earnings on Apr. 28. For context, the company is the world's largest construction equipment manufacturer. CFO Andrew Bonfield said during the Q1 earnings call:

“We remain encouraged by the strong demand for our products and services. The first quarter of 2022 marked the fifth consecutive quarter of higher end user demand compared to the prior year. Services remained strong in the quarter. We continue to make progress on our service initiatives, including customer value agreements, e-commerce, connected assets and prioritized service events.”

CEO Jim Umpleby added:

“Absent the supply chain constraints, our top line would have been even stronger. When the supply chain conditions ease, we expect to be well positioned to fully meet demand and gain operating leverage from higher volumes.”

Thus, with each new earnings season, companies note that demand remains resilient. As a result, why not raise prices and capitalize on too much stimulus?

Source: Caterpillar/Seeking Alpha

Source: Caterpillar/Seeking AlphaAs expected, the “transitory” camp waved the white flag in 2022. However, the merry-go-round of input/output inflation was visible from a mile away. For example, remember what I wrote on Mar. 30, 2021?

Didn’t Powell insist that near-term inflation was only “one-time” and “transient”? Well, despite government-issued CPI data failing to capture the effect of the Fed’s liquidity circus, pricing pressures are popping up everywhere. And with corporations’ decision tree left to raising prices or accepting lower margins, which one do you think they’ll choose?

Continuing the theme, Domino's Pizza reported its first-quarter earnings on Apr. 28. For context, the company is the largest pizza chain in the U.S. Moreover, when contrasting the quarterly results of Microsoft and Alphabet on Apr. 28, I wrote that investors fail to realize that some companies have succumbed to the medium-term realities sooner than others. Therefore, Domino's Pizza is another example. CEO Ritch Allison said during the Q1 earnings call:

“Consistent with our communications during our prior earnings call, we faced significant inflationary cost increases across the business in Q1. Those cost pressures combined with the deleveraging from the decline in U.S. same-store sales resulted in earnings falling short of our high expectations for the business (…).”

“We believe that we will continue to face pressure both on the top line for our U.S. business and on our bottom line earnings over the next few quarters. While we remain very optimistic about our ability to drive long-term profitable growth in the near-term 2022 is shaping up to be a challenging year.”

CFO Sandeep Reddy added:

“In addition, we would like to update the guidance we provided in March for 2022. Based on the continuously evolving inflationary environment, we now expect the increase in the store food basket within our U.S. system to range from 10% to 12% as compared to 2021 levels.”

If that wasn’t enough, with unprecedented handouts reducing U.S. citizens’ incentive to work, staffing shortages materially impacted Domino’s Q1 results. Moreover, the development is extremely inflationary and only increases the chances of future interest rate hikes.

Please see below:

Source: Domino’s Pizza/Seeking Alpha

Source: Domino’s Pizza/Seeking AlphaTherefore, while I've warned on numerous occasions that the Fed is in a lose-lose situation, investors still hold out hope for a dovish pivot. However, they fail to understand the consequences. For example, a dovish 180 is extremely unlikely in this environment; but even if officials completely reversed course, the long-term economic damage would be even more paramount.

When companies are saddled with input pressures, even value-oriented chains like Domino's Pizza can only endure margin erosion for so long. Thus, with management searching for new ways to appease investors, Fed officials' patience will only cause an even bigger long-term collapse once inflationary demand destruction unfolds.

Please see below:

Source: Domino’s Pizza/Seeking Alpha

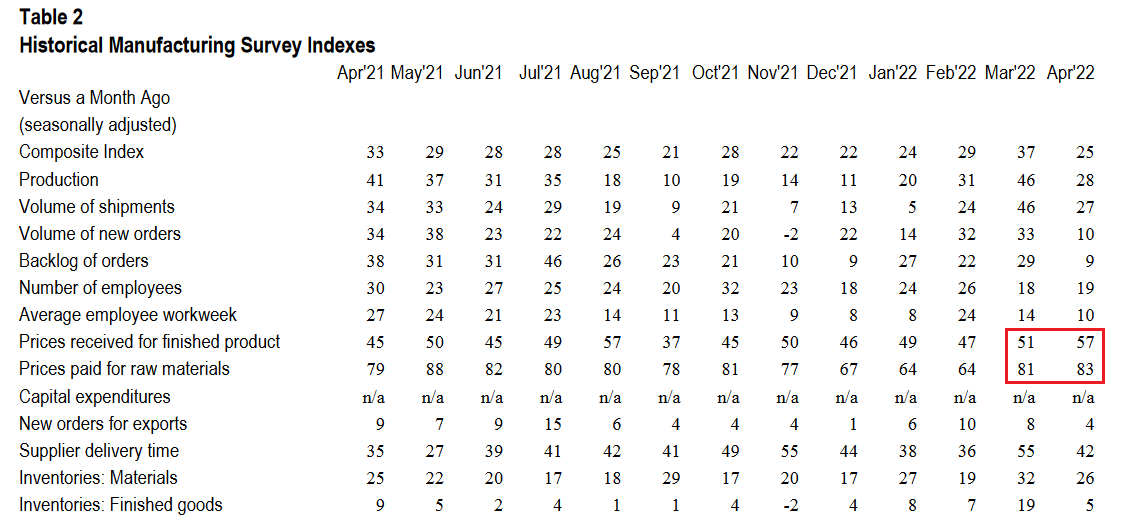

Source: Domino’s Pizza/Seeking AlphaTurning to the macroeconomic front, some interesting data also hit the wire on Apr. 28. For example, the Kansas City Fed released its Tenth District Manufacturing Survey. The headline index declined from 37 in March to 25 in April. Chad Wilkerson, Vice President and Economist at the KC Fed, said:

“The pace of regional factory growth eased somewhat but remained strong. Firms continued to report issues with higher input prices, increased supply chain disruptions, and labor shortages. However, firms were optimistic about future activity and reported little impact from higher interest rates.”

To that point, both the prices paid and received indexes increased month-over-month (MoM).

Please see below:

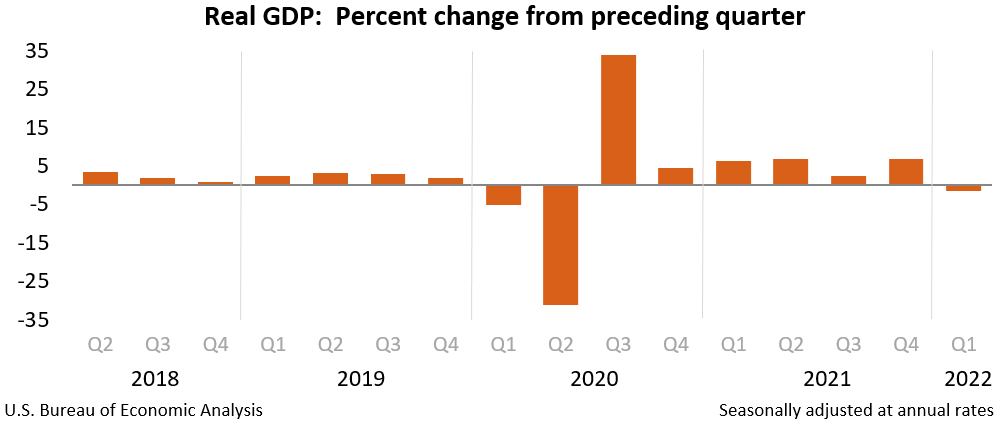

Finally, the major surprise on Apr. 28 was that U.S. real GDP contracted by 1.4% (advance estimate) in Q1. The report stated: “The decrease in real GDP reflected decreases in private inventory investment, exports, federal government spending, and state and local government spending, while imports, which are a subtraction in the calculation of GDP, increased.”

However: “Personal consumption expenditures (PCE), nonresidential fixed investment, and residential fixed investment increased.”

Therefore, with supply chain disruptions leading to import stockpiling (which hurts GDP), net trade was the weak link. However, the dynamic should reverse in Q2 and Q3, and if so, shouldn’t impact the Fed’s rate hike cycle.

The bottom line? The Fed is stuck between a rock and a hard place: deal with inflation now and (likely) push the U.S. into a recession later or ignore inflation and watch an even bigger crisis unfold down the road. As such, the first option is the most likely outcome. Remember, while Fed officials may seem out of touch, they’re not stupid, and history shows the devastating consequences of letting unabated inflation fester. Therefore, interest rate hikes should dominate the headlines over the next several months, and the PMs and the S&P 500 should suffer mightily along the way.

In conclusion, the PMs were mixed on Apr. 28, as silver was the daily underperformer. Moreover, while mining stocks were boosted by the S&P 500, the ‘buy the dip’ crowd is fighting a losing battle. With Amazon and Apple down after the bell on Apr. 28, weak earnings guidance should also dominate the headlines in the months to come. As a result, with the USD Index on fire and real yields poised to continue their ascent, the PMs’ medium-term outlooks are extremely treacherous.

What to Watch for Next Week

With more U.S. economic data releases next week, the most important are as follows:

- May 2: ISM Manufacturing PMI

Like this week’s S&P Global Report, ISM’s report is one of the most important data points because it covers growth, inflation, and employment across the entire U.S. Therefore, the results are more relevant than regional surveys.

- May 3: JOLTS job openings

Since the lagged data covers March’s figures, it’s less relevant than leading data like the PMIs. However, it’s still important to monitor how government-tallied results are shaping up.

- May 4: ADP private payrolls, ISM Services PMI, FOMC statement and press conference

With the FOMC poised to hike interest rates by 50 basis points on May 4, the results and Powell’s comments are the most important fundamental developments of the week. However, ADP’s private payrolls will also provide insight into the health of the U.S. labor market, while the ISM’s Services PMI will have similar implications as the manufacturing PMI. Moreover, both will provide clues about future Fed policy.

- May 5: Challenger jobs cuts

With the data showcasing how many employees were fired in April, it’s another indicator of the health of the U.S. labor market.

- May 6: Nonfarm payrolls, unemployment rate, average hourly earnings

Half of the Fed’s dual mandate is maximum employment, so continued strength in nonfarm payrolls is bullish for Fed policy. In addition, a low unemployment rate is also helpful, while average hourly earnings will showcase the current state of wage inflation.

All in all, economic data releases impact the PMs because they impact monetary policy. Moreover, if we continue to see higher employment and inflation, the Fed should keep its foot on the hawkish accelerator. If that occurs, the outcome is profoundly bearish for the PMs.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Investment Update: What Will the Fed Choose - Recession or an Economic Crisis?

April 29, 2022, 9:44 AMThis week was all about earnings, as some of Wall Street’s heavyweights released their quarterly reports. Moreover, while mixed results caused sentiment to swing from one extreme to the other, inflation remains front and center, and the outlook for Fed policy is bullish.

For example, whether it’s PepsiCo, Mondelez, or Whirlpool, companies have warned that inflation remains extremely problematic. Moreover, with American Express and Visa highlighting consumers’ eagerness to spend, the pricing pressures show no signs of slowing down. Likewise, S&P Global released its U.S. Composite PMI on Apr. 22, and I wrote on Apr. 25 that it was another all-time high for inflation.

Isolating services:

Isolating manufacturing:

With growth, employment and inflation supporting several rate hikes over the next several months, there is little in the release that implies a dovish U-turn. To that point, please remember that the survey was conducted from Apr. 11 to Apr. 21. Therefore, while investors hope that decelerating growth and inflation will allow the Fed to back off, the PMI data suggests otherwise. As such, the Fed’s conundrum continues to intensify.

Furthermore, with more appetizing earnings reports released on Apr. 28, the results were even more bullish for Fed policy. Likewise, with the PMs’ force fields wearing off, they should suffer profoundly as rate hike volatility increases. For example, McDonald’s released its first-quarter earnings on Apr. 28. CFO Kevin Ozan said during the Q1 earnings call:

“In the U.S., I think last quarter, I mentioned that we thought commodities were going to be up roughly 8% or so for the U.S. That number is now more like 12% to 14% for the year. So U.S. commodities clearly have risen (…).”

“On the labor side, in the U.S., it's probably over 10% right now. Part of that is because you'll recall that we made adjustments to our wages in our company-owned restaurants mid-year last year, so we haven't lapped that. So part of it is due to that and part of it is due to just continued wage inflation.”

As a result, the Fed is losing control of the inflation situation, and the largest restaurant chain in the world is still sounding the alarm. Therefore, with the pricing pressures unwilling to abate on their own (which I’ve warned about for some time), killing demand is the only way to reduce the wage-price spiral.

Please see below:

Source: McDonald’s/Seeking Alpha

Source: McDonald’s/Seeking AlphaOn top of that, Caterpillar released its first-quarter earnings on Apr. 28. For context, the company is the world's largest construction equipment manufacturer. CFO Andrew Bonfield said during the Q1 earnings call:

“We remain encouraged by the strong demand for our products and services. The first quarter of 2022 marked the fifth consecutive quarter of higher end user demand compared to the prior year. Services remained strong in the quarter. We continue to make progress on our service initiatives, including customer value agreements, e-commerce, connected assets and prioritized service events.”

CEO Jim Umpleby added:

“Absent the supply chain constraints, our top line would have been even stronger. When the supply chain conditions ease, we expect to be well positioned to fully meet demand and gain operating leverage from higher volumes.”

Thus, with each new earnings season, companies note that demand remains resilient. As a result, why not raise prices and capitalize on too much stimulus?

Source: Caterpillar/Seeking Alpha

Source: Caterpillar/Seeking AlphaAs expected, the “transitory” camp waved the white flag in 2022. However, the merry-go-round of input/output inflation was visible from a mile away. For example, remember what I wrote on Mar. 30, 2021?

Didn’t Powell insist that near-term inflation was only “one-time” and “transient”? Well, despite government-issued CPI data failing to capture the effect of the Fed’s liquidity circus, pricing pressures are popping up everywhere. And with corporations’ decision tree left to raising prices or accepting lower margins, which one do you think they’ll choose?

Continuing the theme, Domino's Pizza reported its first-quarter earnings on Apr. 28. For context, the company is the largest pizza chain in the U.S. Moreover, when contrasting the quarterly results of Microsoft and Alphabet on Apr. 28, I wrote that investors fail to realize that some companies have succumbed to the medium-term realities sooner than others. Therefore, Domino's Pizza is another example. CEO Ritch Allison said during the Q1 earnings call:

“Consistent with our communications during our prior earnings call, we faced significant inflationary cost increases across the business in Q1. Those cost pressures combined with the deleveraging from the decline in U.S. same-store sales resulted in earnings falling short of our high expectations for the business (…).”

“We believe that we will continue to face pressure both on the top line for our U.S. business and on our bottom line earnings over the next few quarters. While we remain very optimistic about our ability to drive long-term profitable growth in the near-term 2022 is shaping up to be a challenging year.”

CFO Sandeep Reddy added:

“In addition, we would like to update the guidance we provided in March for 2022. Based on the continuously evolving inflationary environment, we now expect the increase in the store food basket within our U.S. system to range from 10% to 12% as compared to 2021 levels.”

If that wasn’t enough, with unprecedented handouts reducing U.S. citizens’ incentive to work, staffing shortages materially impacted Domino’s Q1 results. Moreover, the development is extremely inflationary and only increases the chances of future interest rate hikes.

Please see below:

Source: Domino’s Pizza/Seeking Alpha

Source: Domino’s Pizza/Seeking AlphaTherefore, while I've warned on numerous occasions that the Fed is in a lose-lose situation, investors still hold out hope for a dovish pivot. However, they fail to understand the consequences. For example, a dovish 180 is extremely unlikely in this environment; but even if officials completely reversed course, the long-term economic damage would be even more paramount.

When companies are saddled with input pressures, even value-oriented chains like Domino's Pizza can only endure margin erosion for so long. Thus, with management searching for new ways to appease investors, Fed officials' patience will only cause an even bigger long-term collapse once inflationary demand destruction unfolds.

Please see below:

Source: Domino’s Pizza/Seeking Alpha

Source: Domino’s Pizza/Seeking AlphaTurning to the macroeconomic front, some interesting data also hit the wire on Apr. 28. For example, the Kansas City Fed released its Tenth District Manufacturing Survey. The headline index declined from 37 in March to 25 in April. Chad Wilkerson, Vice President and Economist at the KC Fed, said:

“The pace of regional factory growth eased somewhat but remained strong. Firms continued to report issues with higher input prices, increased supply chain disruptions, and labor shortages. However, firms were optimistic about future activity and reported little impact from higher interest rates.”

To that point, both the prices paid and received indexes increased month-over-month (MoM).

Please see below:

Finally, the major surprise on Apr. 28 was that U.S. real GDP contracted by 1.4% (advance estimate) in Q1. The report stated: “The decrease in real GDP reflected decreases in private inventory investment, exports, federal government spending, and state and local government spending, while imports, which are a subtraction in the calculation of GDP, increased.”

However: “Personal consumption expenditures (PCE), nonresidential fixed investment, and residential fixed investment increased.”

Therefore, with supply chain disruptions leading to import stockpiling (which hurts GDP), net trade was the weak link. However, the dynamic should reverse in Q2 and Q3, and if so, shouldn’t impact the Fed’s rate hike cycle.

The bottom line? The Fed is stuck between a rock and a hard place: deal with inflation now and (likely) push the U.S. into a recession later or ignore inflation and watch an even bigger crisis unfold down the road. As such, the first option is the most likely outcome. Remember, while Fed officials may seem out of touch, they’re not stupid, and history shows the devastating consequences of letting unabated inflation fester. Therefore, interest rate hikes should dominate the headlines over the next several months, and the PMs and the S&P 500 should suffer mightily along the way.

In conclusion, the PMs were mixed on Apr. 28, as silver was the daily underperformer. Moreover, while mining stocks were boosted by the S&P 500, the ‘buy the dip’ crowd is fighting a losing battle. With Amazon and Apple down after the bell on Apr. 28, weak earnings guidance should also dominate the headlines in the months to come. As a result, with the USD Index on fire and real yields poised to continue their ascent, the PMs’ medium-term outlooks are extremely treacherous.

What to Watch for Next Week

With more U.S. economic data releases next week, the most important are as follows:

- May 2: ISM Manufacturing PMI

Like this week’s S&P Global Report, ISM’s report is one of the most important data points because it covers growth, inflation, and employment across the entire U.S. Therefore, the results are more relevant than regional surveys.

- May 3: JOLTS job openings

Since the lagged data covers March’s figures, it’s less relevant than leading data like the PMIs. However, it’s still important to monitor how government-tallied results are shaping up.

- May 4: ADP private payrolls, ISM Services PMI, FOMC statement and press conference

With the FOMC poised to hike interest rates by 50 basis points on May 4, the results and Powell’s comments are the most important fundamental developments of the week. However, ADP’s private payrolls will also provide insight into the health of the U.S. labor market, while the ISM’s Services PMI will have similar implications as the manufacturing PMI. Moreover, both will provide clues about future Fed policy.

- May 5: Challenger jobs cuts

With the data showcasing how many employees were fired in April, it’s another indicator of the health of the U.S. labor market.

- May 6: Nonfarm payrolls, unemployment rate, average hourly earnings

Half of the Fed’s dual mandate is maximum employment, so continued strength in nonfarm payrolls is bullish for Fed policy. In addition, a low unemployment rate is also helpful, while average hourly earnings will showcase the current state of wage inflation.

All in all, economic data releases impact the PMs because they impact monetary policy. Moreover, if we continue to see higher employment and inflation, the Fed should keep its foot on the hawkish accelerator. If that occurs, the outcome is profoundly bearish for the PMs.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Investment Update: Is War the Only Factor Buffering Gold Right Now?

April 21, 2022, 8:02 AMDespite the fact that the financial markets were closed for the Easter holiday, there was still plenty of drama. For example, the U.S. 10-Year real yield hit 0% and briefly turned positive for the first time since 2020, the USD Index topped 101, and Fed officials warned of several rate hikes in the coming months.

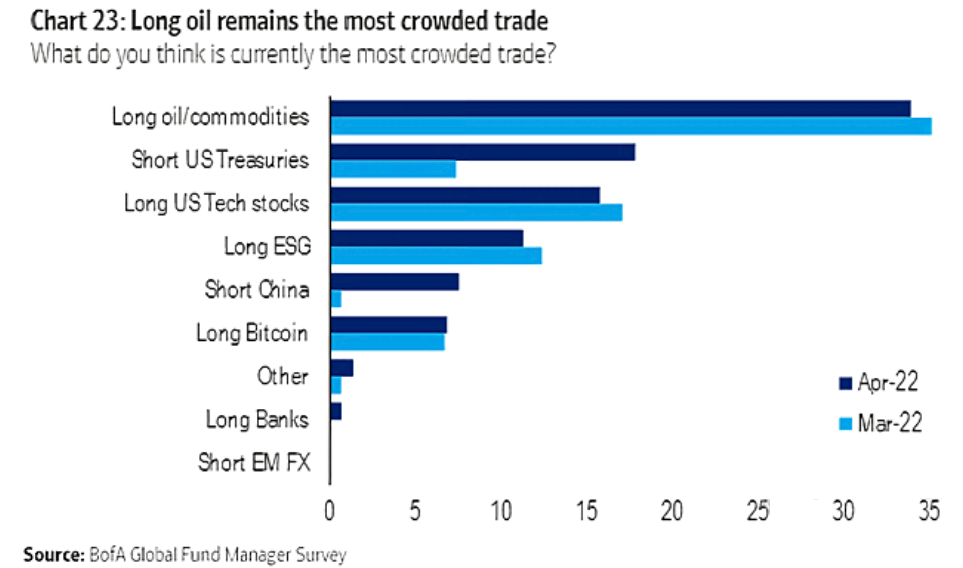

However, while all of these developments are fundamentally bearish for the PMs, the most crowded trade on Wall Street has the commodities complex sitting pretty.

Please see below:

While Netflix's drubbing on Apr. 20 should be a cautionary tale of the consequences of deteriorating fundamentals, the PMs remain uplifted, but with the medium term likely to elicit a material shift in sentiment, don't be surprised if investors' wrath is eventually thrust upon them.

To explain, the devil is in the details, and when you watch for subtle clues, the puzzle pieces come together. For example, I warned on Apr. 13 that Fed officials' messaging couldn't be clearer. I wrote:

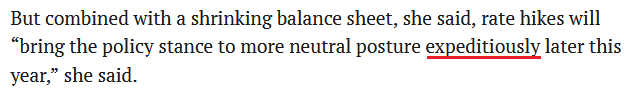

Fed Governor Lael Brainard said on Apr. 12: “Inflation is too high, and getting inflation down is going to be our most important task.”

More importantly, notice her use of that all-important buzzword.

And:

Moreover, where do you think she got it?

Likewise, St. Louis Fed President James Bullard said on Apr. 18 that inflation is “far too high” and that a rapid rise to neutral is the most likely outcome. For context, he wants to increase the U.S. federal funds rate to 3.5% by the end of 2022. Moreover, there is that word again:

Continuing the theme, San Francisco Fed President Mary Daly said on Apr. 20 that a 50 basis point rate hike in May is "complete" and "solid." As a result, it's like Fed officials have morphed into those toys that repeat the same message when you pull the string.

Please see below:

As further evidence, can you guess what Chicago Fed President Charles Evans said on Apr. 11?

Therefore, do you think it’s a coincidence that Fed officials are repeating the same message? Of course not. After the FOMC’s December monetary policy meeting, I warned that Chairman Jerome Powell uses his deputies to deliver remarks on his behalf. I wrote on Dec. 16:

As one of the most important quotes of the press conference, [Powell] admitted:

“My colleagues were out talking about a faster taper, and that doesn’t happen by accident. They were out talking about a faster taper before the president made his decision. So it’s a decision that effectively was more than entrained.”

While Powell sounded a little rattled during the exchange, his slip highlights the importance of Fed officials’ hawkish rhetoric. Essentially, when Clarida, Waller, Bostic, Bullard, etc., are making the hawkish rounds, “that doesn’t happen by accident.” As such, it’s an admission that his understudies serve as messengers for pre-determined policy decisions.

To that point, Evans added on Apr. 19: “On the way to December, you’d be looking for any confirmation of the storyline. It could be that short-term neutral is actually lower, and that by the time we get to 2.5%, it’s actually contractionary for a variety of reasons. It could go the other way too.”

However, given the state of inflation, he realistically said: “Probably we are going beyond neutral. That’s my expectation.” As a result, more than one 50 basis point rate hike is on the table.

Please see below:

Also noteworthy, Atlanta Fed President Raphael Bostic was the most dovish of the crew this week. He said:

“I really have us looking at one and three-quarters by the end of the year, but [inflation] could be slower depending on how the economy evolves and we do see greater weakening than I’m seeing in my baseline model. This is one reason why I’m reluctant to really declare that we want to go a long way beyond our neutral place, because that may be more hikes than are warranted given sort of the economic environment.”

However, stating that the neutral U.S. federal funds rate could range from 2% to 2.5% or be as low as 1.75%, he remains aligned with the FOMC's median projection of six more rate hikes (seven in total) in 2022. Also, there is that word again.

As a result, it’s funny how obvious Fed officials’ messaging has become. In a nutshell: Powell sets the tone, and his deputies recite his message in hopes that investors will react accordingly. However, with investors in denial and/or unable to see the forest through the trees, they’re not heeding the warnings.

Ironically, the U.S. technology sector has been decimated in recent months, while commodities remain uplifted. However, seven to 12 rate hikes over nine months will heavily impact demand and are materially bearish for commodities’ fundamentals. Therefore, one could argue that commodities have more to lose in the coming months than technology stocks.

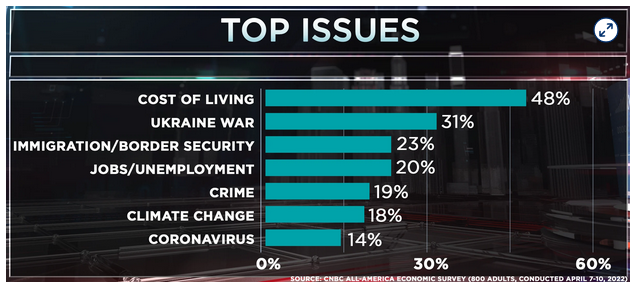

In any event, investors seem to believe that either inflation will subside on its own or the Fed will back off. However, neither outcome is realistic. I’ve mentioned on numerous occasions that political ramifications should keep the pressure on the Fed. As a result, as long as inflation persists, the prospect of a dovish 180 is slim to none. To explain, I wrote on Apr. 20:

CNBC released its All-America Economic Survey on Apr. 13. The report revealed that “47% of the public say the economy is ‘poor,’ the highest number in that category since 2012. Only 17% rank the economy as excellent or good, the lowest since 2014.”

Please see below:

Likewise, I’ve also noted on numerous occasions that U.S. President Joe Biden’s approval rating is inversely correlated with inflation.

As a result, while investors assume that the Fed will bow down to the financial markets, the reality is that the game has changed. Previously, the Fed could support asset prices without the general public noticing. Now, inflation is front-page news and is hurting middle-class and poor Americans. Therefore, the Fed has to deal with the issue, and political pressure should force officials’ hands, whether they like it or not.

To that point, the inflation data continues to sizzle. For example, the Fed released its Beige Book on Apr. 20. The report revealed:

As for wage inflation:

“Employment increased at a moderate pace. Demand for workers continued to be strong across most Districts and industry sectors. But hiring was held back by the overall lack of available workers, though several Districts reported signs of modest improvement in worker availability. Many firms reported significant turnover as workers left for higher wages and more flexible job schedules.”

“Persistent labor demand continued to fuel strong wage growth, particularly for footloose workers willing to change jobs. Firms reported that inflationary pressures were also contributing to higher wages, and that higher wages were doing little to alleviate widespread job vacancies. But some contacts reported early signs that the strong pace of wage growth had begun to slow.”

As a result, with inflation and employment still holding firm, this is bullish for Fed policy and bearish for the PMs.

Furthermore, Procter & Gamble (P&G) released its third-quarter earnings on Apr. 20. For context, the company sells various consumer staples and household products. CFO Andre Schulten said during the Q3 earnings call:

“We said each quarter that we will undoubtedly experience more volatility as we move through the fiscal year. We've seen another step in cost pressures, and foreign exchange rates have moved further against us. Transportation and labor markets remain tight. Availability of materials remains stretched in some categories and markets. Inflationary cost pressures are broad-based and continue to increase with little sign of near-term relief and have resulted in consumer price increases across CPG categories and beyond.”

Thus, Schulten noted that ~5% price hikes in Q3 will look more like ~6% in Q4.

Please see below:

For your reference, favorable price elasticities mean that when P&G raises prices, the company is not seeing a drop-off in demand. Moreover, P&G is no small fry. In fact, the company ranked second on Consumer Goods Technology's (CGT) 2021 Top 100 Consumer Goods Companies list. Therefore, it's more fuel for the hawkish fire.

The bottom line? While the answers are hiding in plain sight, investors do what they usually do: they ignore the fundamentals until something breaks. Then, it’s a rush for the exits and the financial media does a post-mortem about why everyone should have seen it coming. However, it’s simply the nature of investor psychology.

Therefore, no matter how many times Fed officials say “expeditious-ly” or how much the inflation data supports even more hawkish policy, investors usually don’t get the message until it’s too late. However, when reality re-emerges, there will likely be a long way down before the PMs’ prices get to the oversold territory, from which another powerful rally could emerge.

In conclusion, the PMs were mixed on Apr. 20, as momentum still remains elevated. However, with real yields and the USD Index rising, the only things holding up the PMs are the Russia-Ukraine conflict and sentiment. Therefore, when the latter two wane and the former two remain, gold, silver, and mining stocks should suffer profound drawdowns.

What to Watch for Next Week

With more U.S. economic data releases next week, the most important ones are as follows:

- Apr. 26: Confidence Board consumer confidence, Richmond and Dallas Fed’s manufacturing and services indexes, S&P/Case-Shiller home price index.

With consumer confidence providing insight into employment and inflation sentiment, the data highlights how “anchored,” or lack thereof, consumers’ medium-term expectations are with the Fed’s mandate. Likewise, the Richmond and Dallas Fed indexes are leading indicators of inflation and employment, while the S&P/Case-Shiller home price index offers a lagged look at housing inflation (which often leads to rent inflation).

- Apr. 28: Q1 GDP and Kansas City Fed manufacturing index.

GDP is lagged data, and investors are forward-looking. However, it's still important to monitor. Moreover, it will be interesting to see if the Kansas City Fed's data aligns with the Richmond and Dallas Fed's results.

All in all, economic data releases impact the PMs because they impact monetary policy. Moreover, if we continue to see higher employment and inflation, the Fed should keep its foot on the hawkish accelerator. If that occurs, the outcome is profoundly bearish for the PMs.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Investment Update: Russian Invasion and the Hawkish Fed - A Killer Combo for Gold?

April 7, 2022, 10:23 AMThis week belonged to the Fed, as officials finally knocked some sense into overzealous investors. For example, it began with Brainard, George, Daly, and Williams sounding the hawkish alarm, and ended with the FOMC minutes that shook the financial markets. Moreover, while the bearish fundamental implications of the Fed’s rate hike cycle are slowly being grasped by investors, I’ve been warning for weeks that a reality check would unfold. To explain, I wrote on Mar. 22:

While the PMs seem to think that the Fed’s inflation fight won’t impact their medium-term prospects, the reality is that higher real interest rates are needed to reduce inflation. And with commodity investors failing to comply, the merry-go-round of higher input prices leading to higher output prices will continue. As a result, the downside risk confronting the PMs is enormous at this point.

Remember, the Fed can only slow inflation by slowing the U.S. economy. That's why Powell keeps referencing a "soft landing" when describing the tradeoff between calming inflation and maintaining growth. However, with continued inflation of 8%+ likely to push the U.S. into recession, Powell knows that doing nothing is as bad as doing too much. As a result, investors should eventually learn that Powell's dovish days are over.

To that point, while the S&P 500 and the NASDAQ Composite have gotten the memo in recent days, the PMs still remain relatively elevated. However, while the Russia-Ukraine conflict keeps the PMs’ hopes alive for now, their medium-term fundamentals are growing more bearish by the day.

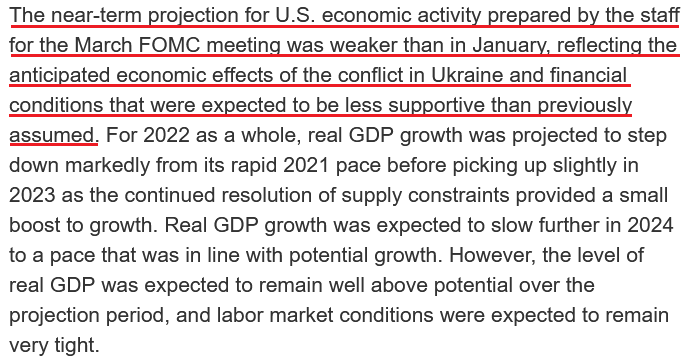

For example, the Fed released the minutes from its Mar. 15/16 policy meeting on Apr. 6. The report revealed:

“Many participants noted that – with inflation well above the Committee's objective, inflationary risks to the upside, and the federal funds rate well below participants' estimates of its longer-run level – they would have preferred a 50 basis point increase in the target range for the federal funds rate at this meeting.

“A number of these participants indicated, however, that, in light of greater near-term uncertainty associated with Russia's invasion of Ukraine, they judged that a 25 basis point increase would be appropriate at this meeting.”

However, while the Fed initially balked at a 50 basis point rate hike, the policy initiatives that should materialize over the next several months are even more bearish. For example, the report added:

“Many participants noted that one or more 50 basis point increases in the target range could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified. A number of participants noted that the Committee's previous communications had already contributed to a tightening of financial conditions, as evident in the notable increase in longer-term interest rates over recent months.”

If that wasn’t enough, the FOMC made it clear that selling assets on the balance sheet will occur at “a more rapid pace” than in 2017-2019, with a combined ~$95 billion of U.S. Treasuries and agency mortgage-backed securities (MBS) set to hit the open market each month.

Please see below:

In addition:

The Mid-Week Fundamental Roundup

As a result, there are those buzzwords again. With Fed officials repeating the terms “rapid” and “expeditiously” recently, investors ignored the warnings at their own peril. However, while the minutes moved markets on Apr. 6, the release didn’t include anything materially different from what Fed officials have already said over the last few weeks.

Moreover, remember what I wrote on Dec. 16 about Chairman Jerome Powell’s press conference?

As one of the most important quotes of the press conference, he admitted:

“My colleagues were out talking about a faster taper, and that doesn’t happen by accident. They were out talking about a faster taper before the president made his decision. So it’s a decision that effectively was more than entrained.”

While Powell sounded a little rattled during the exchange, his slip highlights the importance of Fed officials’ hawkish rhetoric. Essentially, when Clarida, Waller, Bostic, Bullard, etc., are making the hawkish rounds, “that doesn’t happen by accident.” As such, it’s an admission that his understudies serve as messengers for pre-determined policy decisions.

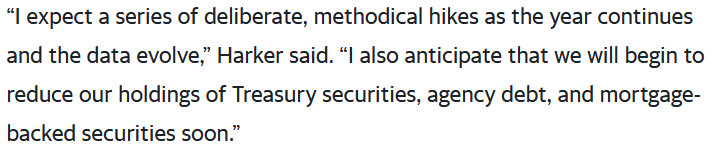

However, while investors were in la la land, the dynamic was on full display. With more than 10 Fed officials making the hawkish rounds recently, they made it clear that inflation was Public Enemy No. 1. Furthermore, Philadelphia Fed President Patrick Harker reiterated the message on Apr. 6. He said:

“Inflation is running far too high, and I am acutely concerned about this. Russia’s invasion of Ukraine will add to inflation pressure, not only hiking oil and gas prices but other commodities, like wheat and fertilizer, as well.”

As a result, he used two sentences to sum up the Fed minutes and what every other Fed official has said over the last month.

Please see below:

In addition, while the S&P 500 and the NASDAQ Composite suffered on Apr. 6, they still remain materially overvalued. Moreover, the PMs have somewhat side-stepped the volatility and also remain in denial of what’s likely to unfold over the medium term. However, I warned on Apr. 6 that Fed officials should continue to pound away at the financial markets until investors finally fulfill their hawkish wishes. I wrote:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. As that occurs, investors should suffer a severe crisis of confidence.

Thus, while negativity reigned supreme on Apr. 6, we’re likely in the early innings of this thesis. For more context, I wrote on Apr. 5:

To explain, the orange line above tracks the number of rate hikes priced in by the futures market, while the blue line above tracks Goldman Sachs’ Financial Conditions Index (FCI). If you analyze the movement of the former, futures traders expect roughly nine rate hikes by the Fed in 2022.

However, if you focus your attention on the right side of the chart, you can see that the FCI has declined materially from its highs. Therefore, financial conditions are easier now than they were before the March FOMC meeting.

Please remember that loose financial conditions impair the Fed’s ability to achieve its inflation goal. As such, we should expect tighter financial conditions over the medium term, and the FOMC made that point clear in the minutes.

Please see below:

Therefore, please remember that loose financial conditions are bullish for the PMs, while tighter financial conditions are bearish. With Fed officials actively trying to push the blue line above higher, several asset classes should suffer from the Fed’s hawkish disposition. In a nutshell: lower stock and commodity prices and a stronger U.S. dollar help the Fed achieve its inflation goal. The opposite does not.

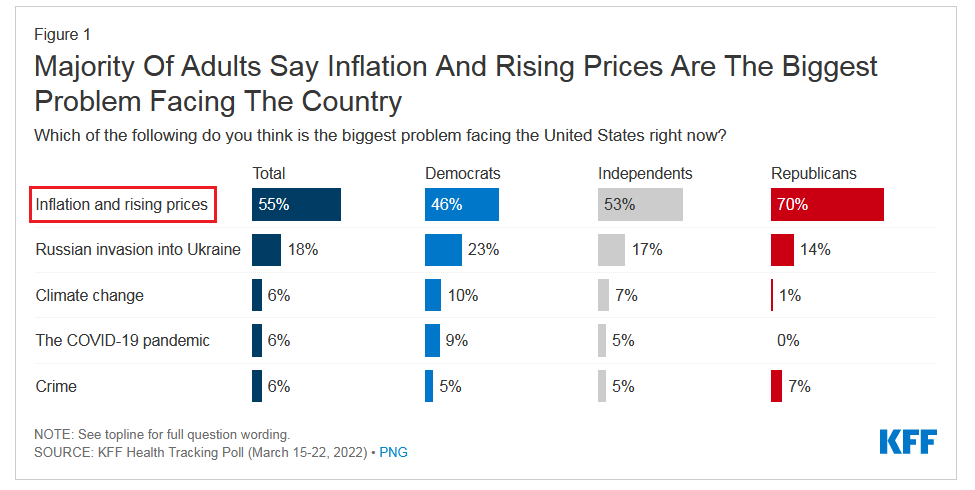

Also noteworthy, with inflation a political liability for the Biden Administration (which I’ve noted on several occasions), the chances of a dovish pivot are slim to none. Thus, is it wise to fight the Fed?

Please see below:

To explain, the Kaiser Family Foundation’s (KFF) poll released on Mar. 31 stated that “more than half of the public (55%) say inflation and rising prices is the biggest problem facing the U.S. right now, more than three times the share who say the same about any other issue included in the survey.”

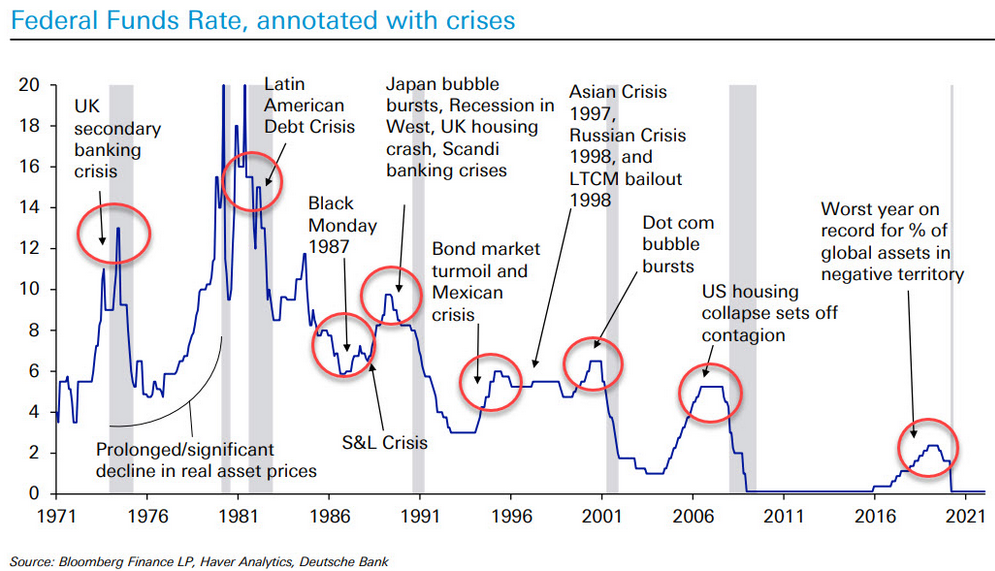

As a result, the Fed has the political authority to reduce inflation by any means necessary. If history is any indication, the power struggle should light plenty of fireworks over the medium term. To explain, I wrote on Mar. 23:

When Fed officials dial up the hawkish rhetoric, their “messaging” is supposed to shift investors’ expectations. As such, the threat of raising interest rates is often as impactful as actually doing it. However, when investors don’t listen, the Fed has to turn the hawkish dial up even more. If history is any indication, a calamity will eventually unfold.

Please see below:

To explain, the blue line above tracks the U.S. federal funds rate, while the various circles and notations above track the global crises that erupted during the Fed’s rate hike cycles. As a result, standard tightening periods often result in immense volatility.

However, with investors refusing to let asset prices fall, they’re forcing the Fed to accelerate its rate hikes to achieve its desired outcome (calm inflation). As such, the next several months could be a rate hike cycle on steroids.

In addition, while I noted that we’re likely in the early innings of this thesis, a slow shift is already unfolding. Moreover, once the PMs realize that they are as vulnerable as the S&P 500, investors’ sentiment should follow.

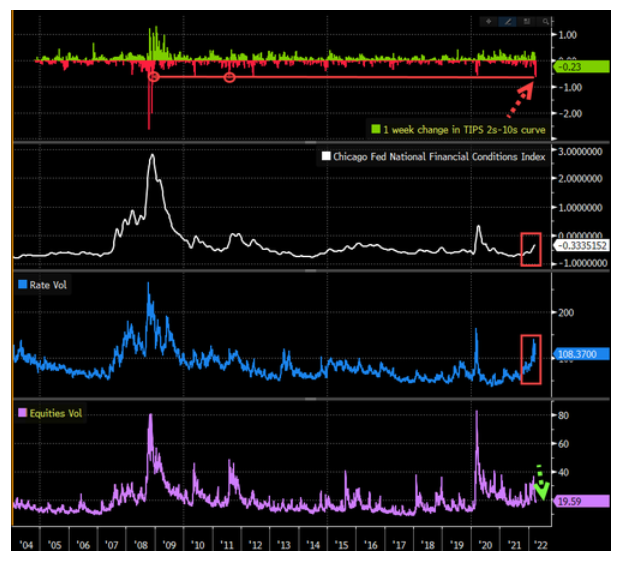

Please see below:

To explain, the four charts above depict various shifts in financial conditions. Whether its inflation expectation spreads, the Chicago Fed’s National Financial Conditions Index, or bond market volatility, the Fed’s message is slowly seeping in. However, with equity volatility (the purple line) quite muted relative to bond volatility (the blue line), the former should crack as the Fed continues its hawkish stampede.

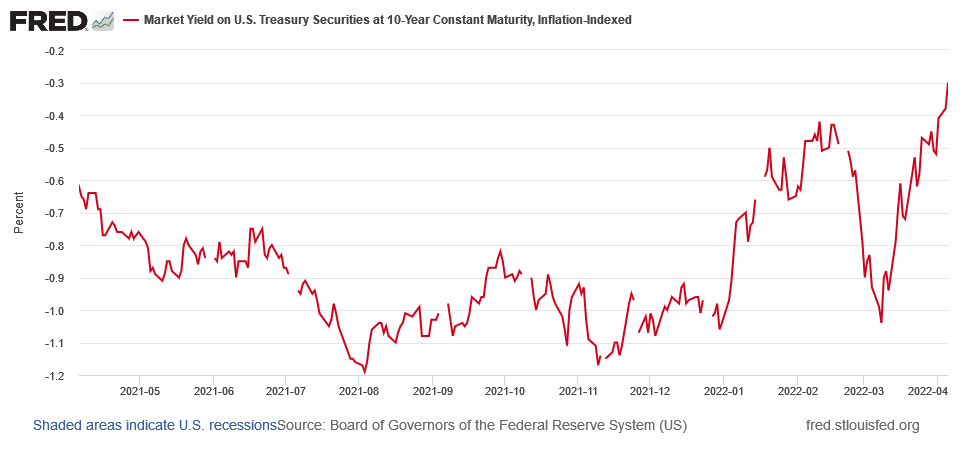

Finally, please note that the PMs often move inversely to U.S. real yields, and with the U.S. 10-Year real yield hitting another 2022 high of -0.30%, the Fed’s “rapid” liquidity drain should lift the metric toward 0% over the medium term.

The bottom line? While the Fed’s hawkish disposition aligns perfectly with my expectations, investors’ denial of the fundamental ramifications has delayed the PMs’ likely drawdowns. However, as the financial market impact of the Russia-Ukraine conflict subsides and the Fed’s rate hike cycle takes its toll on the U.S. economy, commodities’ fervor should dissipate. Moreover, the fundamental constraints confronting the PMs now are even worse than they were at the end of 2021.

In conclusion, the PMs declined on Apr. 6, as a sea of red flooded Wall Street. However, with rising real yields and a stronger USD Index akin to fundamental Kryptonite, gold, silver, and mining stocks face many economic headwinds. As such, while the short term remains uncertain, the bearish medium-term thesis is becoming clearer by the day.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM