-

Gold Investment Update: Silver’s Breakdown, Miners Reversal, and Profits – Lots of Profits

March 16, 2020, 2:58 PMWow, what a move we just saw in silver... Without further ado, let's dive into the chart.

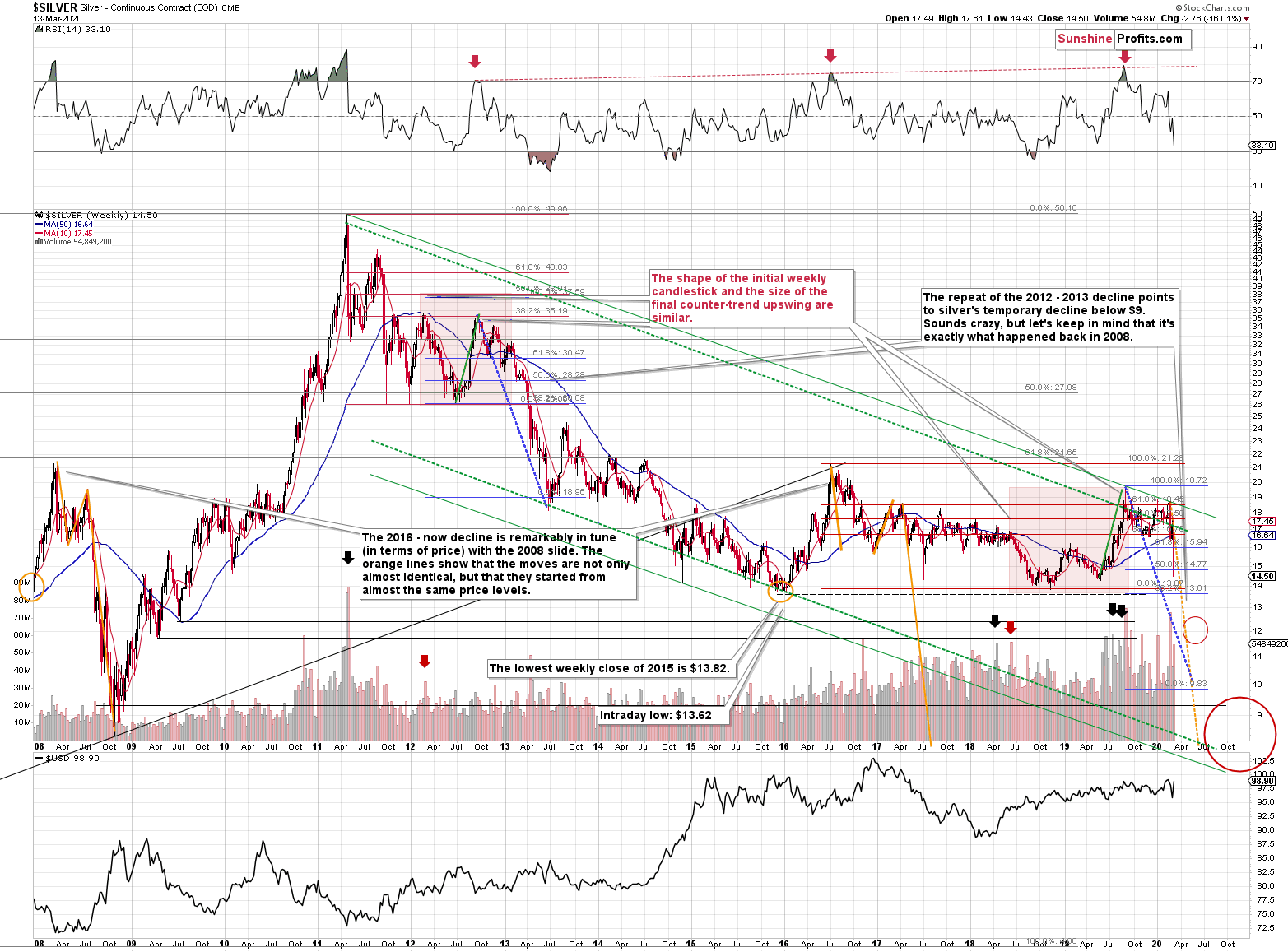

Silver just plunged to our initial target level and reversed shortly after doing so. It was for many months that we've been featuring the above silver chart along with the analogy to the 2008 slide. People were laughing at us when we told them that silver was likely to slide below $10.

Well, today's low of $11.80 proves that we were not out of our minds after all. Our initial target was reached, and as we had explained earlier today, the entire panic-driven plunge has only begun.

Those who were laughing the loudest will prefer not to notice that silver reversed its course at a very similar price level at which it had reversed initially in 2008. It was $12.40 back then, but silver started the decline from about 50 cent higher level, so these moves are very similar.

This means that the key analogy in silver (in addition to the situation being similar to mid-90s) remains intact.

It also means that silver is very likely to decline AT LEAST to $9. At this point we can't rule out a scenario in which silver drops even to its all-time lows around $4-$5.

Crazy, right? Well, silver was trading at about $19 less than a month ago. These are crazy times, and crazy prices might be quite realistic after all. The worst is yet to come.

Let's quote what the 2008-now analogy is all about in case of silver.

There is no meaningful link in case of time, or shape of the price moves, but if we consider the starting and ending points of the price moves that we saw in both cases, the link becomes obvious and very important. And as we explained in the opening part of today's analysis, price patterns tend to repeat themselves to a considerable extent. Sometimes directly, and sometimes proportionately.

The rallies that led to the 2008 and 2016 tops started at about $14 and we marked them both with orange ellipses. Then both rallies ended at about $21. Then they both declined to about $16. Then they both rallied by about $3. The 2008 top was a bit higher as it started from a bit higher level. And it was from these tops (the mid-2008 top and the early 2017 top) that silver started its final decline.

In 2008, silver kept on declining until it moved below $9. Right now, silver's medium-term downtrend is still underway. If it's not clear that silver remains in a downtrend, please note that the bottoms that are analogous to bottoms that gold recently reached, are the ones from late 2011 - at about $27. Silver topped close to $20.

The white metal hasn't completed the decline below $9 yet, and at the same time it didn't move above $19 - $21, which would invalidate the analogy. This means that the decline below $10, perhaps even below $9 is still underway.

Naturally, the implications for the following months are bearish.

Let's consider one more similarity in the case of silver. The 2012 and the 2018 - today performance are relatively similar, and we marked them with red rectangles. They both started with a clear reversal and a steady decline. Then silver bottomed in a multi-bottom fashion, and rallied. This time, silver moved above its initial high, but the size of the rally that took it to the local top (green line) was practically identical as the one that we saw in the second half of 2012.

The decline that silver started in late 2012 was the biggest decline in many years, but in its early part it was not clear that it's a decline at all. Similarly to what we see now, silver moved back and forth with lower highs and lower lows, but people were quite optimistic overall, especially that they had previously seen silver at much higher prices (at about $50 and at about $20, respectively).

Also, if you didn't profit on the recent decline in silver, don't despair - this decline seems to be far from over and there will be plenty of room for profits, especially that silver seems to be starting a corrective upswing now. Just like it did in the 2008. Back then, it corrected to about $14 before moving lower and this might be a realistic target also this time. This would serve as a verification of the breakdown below the 2015 low, and it would open the way for even lower silver prices.

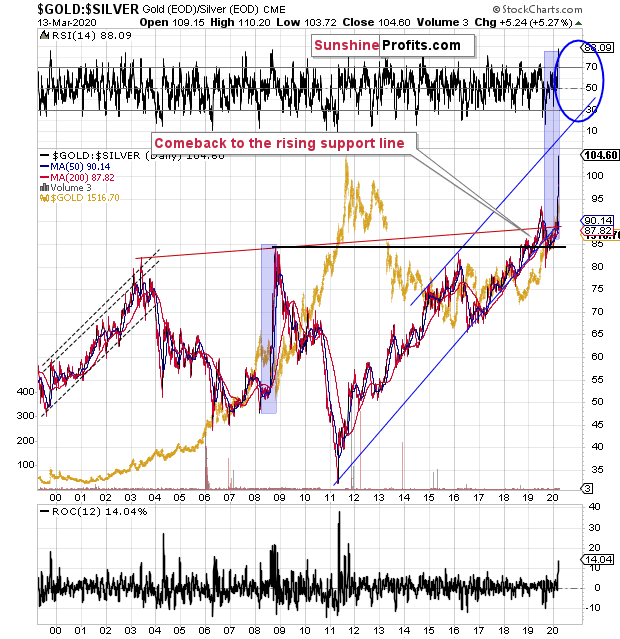

Meanwhile, silver's relationship with gold continues to support medium-term downtrend in the precious metals sector.

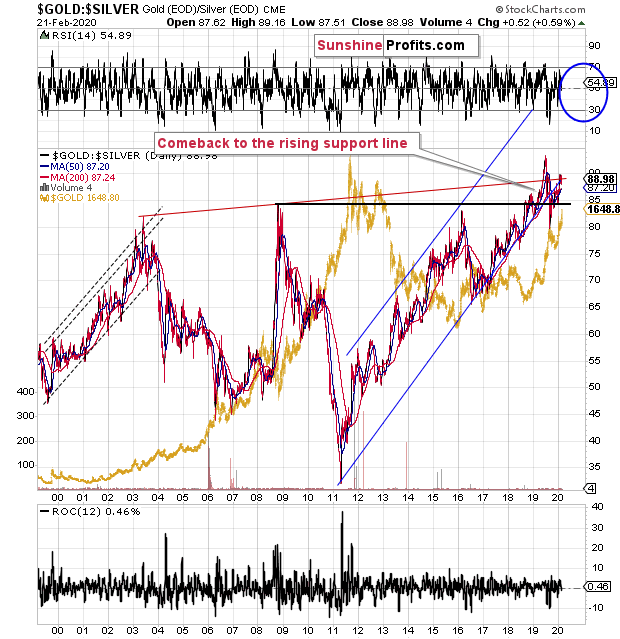

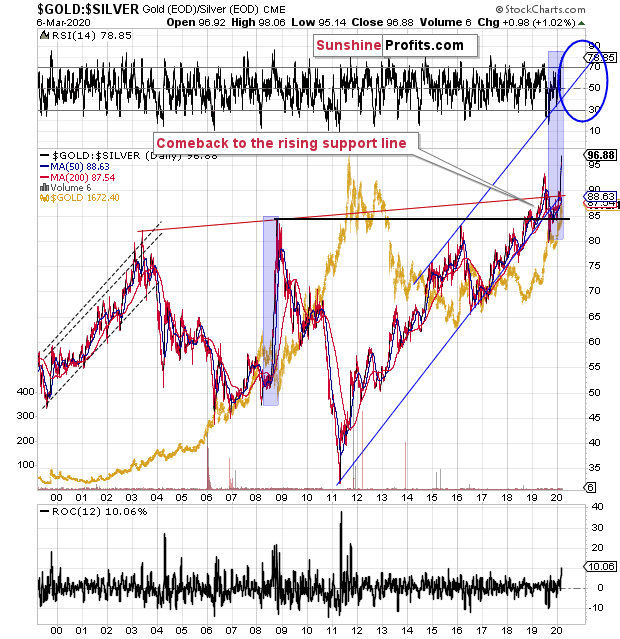

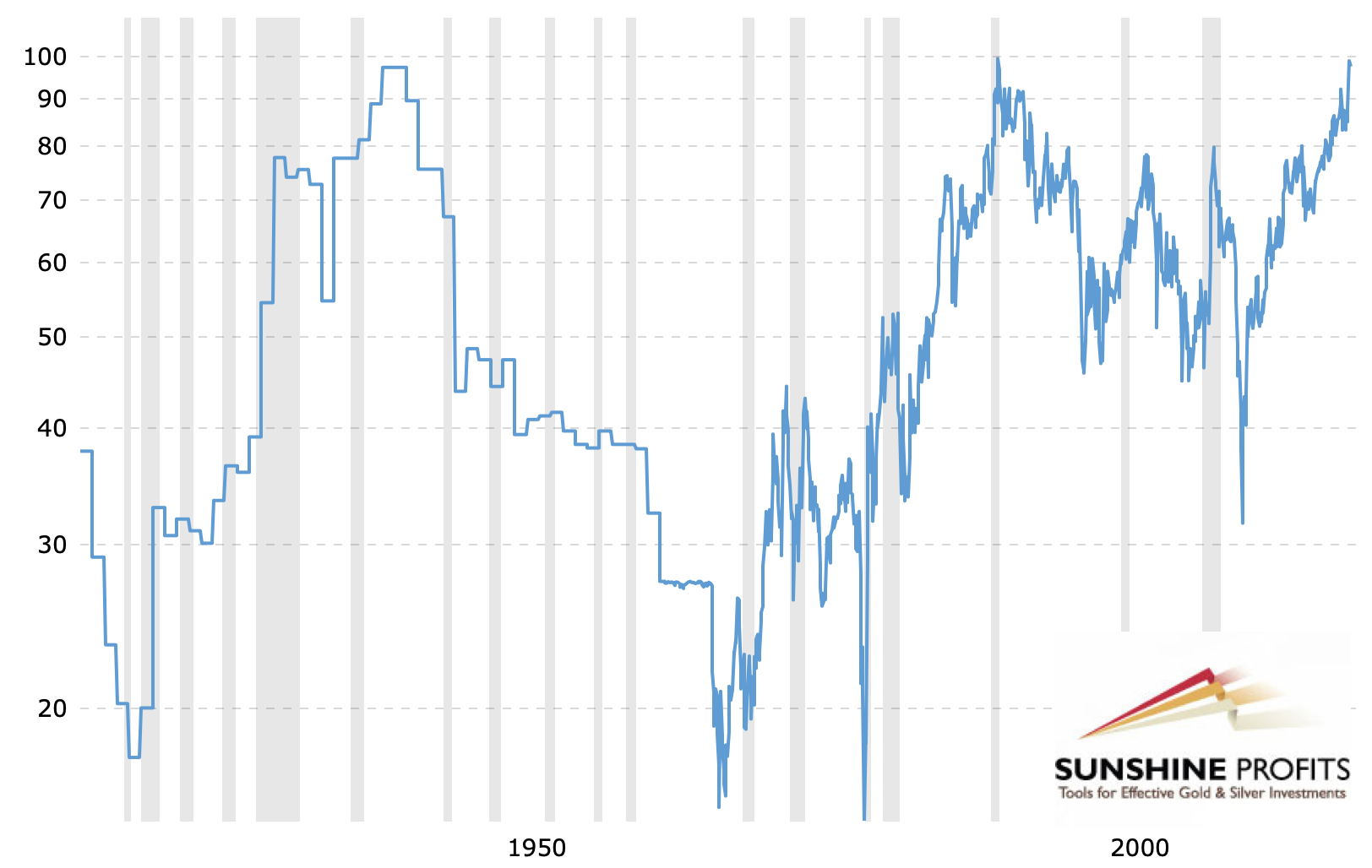

Remember the time, when the gold to silver ratio moved to 80 and practically everyone (well, we didn't) told you to buy silver? We told you that the real long-term resistance was at the 100 level, and that the gold to silver ratio broke above the previous highs, it was likely to shoot up. That's exactly what happened.

Last week we wrote about the move to the 100 level in the following way:

We've been writing the above for weeks, despite numerous calls for a lower gold to silver ratio. And our target of 100 was just hit today. It was only hit on an intraday basis, not in terms of the daily closing prices, but it's still notable.

We had been expecting the gold to silver ratio to hit this extreme close or at the very bottom and the end of the medium-term decline in the precious metals sector - similarly to what happened in 2008. Obviously, that's not what happened.

Instead, the ratio moved to 100 in the situation where gold rallied, likely based on its safe-haven status, and silver plunged based on its industrial uses.

Despite numerous similarities to 2008, the ratio didn't rally as much as it did back then. If the decline in the PMs is just starting - and that does appear to be the case - then the very strong long-term resistance of 100 might not be able to trigger a rebound.

It might also be the case that for some time gold declines faster than silver, which would make the ratio move back down from the 100 level. The 100 level could then be re-tested at the final bottom.

Or... which seems more realistic, silver and mining stocks could slide to the level that we originally expected them to while gold ultimately bottoms higher than at $890. Perhaps even higher than $1,000. With gold at $1,100 or so, and silver at about $9, the gold to silver ratio would be a bit over 120.

If the rally in the gold to silver ratio is similar to the one that we saw in 2008, the 118 level or so could really be in the cards. This means that the combination of the above-mentioned price levels would not be out of the question.

At this time it's too early to say what combination of price levels will be seen at the final bottom, but we can say that the way gold reacted recently and how it relates to everything else in the world, makes gold likely to decline in the following months. Silver is likely to fall as well and its unlikely that a local top in the gold to silver ratio will prevent further declines.

Indeed, gold to silver ratio didn't stop the decline and it's unlikely to stop it anytime soon. The reason is that the ratio broke above the 100 level and today, it soared above it even more. At the moment of writing these words, the gold to silver ratio is trading at about 120.

Breakout above the resistance level as extremely important is very likely to be followed by at least a pullback. A comeback to this level (100) and then another move up seems to be the most likely outcome.

This means that silver would be likely to recover - and it would be likely to recover more than gold.

-

Gold Investment Update: So Many Bullish Factors... That Gold is Ignoring

March 9, 2020, 10:25 AMGold is testing its previous 2020 highs, but silver plunged anyway, which created a very special situation. Namely, the gold to silver ratio just jumped to the 100 level.

This may not seem like a big deal, because ultimately people buy metals, not their ratio, but it actually is a huge deal. This ratio is observed by investors and traders alike, as it tends to peak at the market extremes. Moving to the 100 level might indicate that we are at a price extreme. But what kind of extreme would that be if silver is declining while gold moved up?

Let's take a closer look at the gold to silver ratio chart for details.

In early July 2019, the gold to silver ratio topped after breaking above the previous highs and now it's after the verification of this breakout. Despite the sharp pullback, the ratio moved back below the 2008 high only very briefly. It stabilized above the 2008 high shortly thereafter and now it's moving up once again.

It previously moved up relatively slowly, but it jumped to new highs last week and today.

Anything after a breakout is vulnerable to a quick correction to the previously broken levels. On the other hand, anything after a breakout that was already confirmed, is ready to move higher and the risk of another corrective decline is much lower.

The most important thing about the gold and silver ratio chart to keep in mind is that it's after a breakout above the 2008 high and this breakout was already verified. This means that the ratio is likely to rally further. It's not likely to decline based on being "high" relative to its historical average. That's not how breakouts work.

The breakout above the previous highs was verified by a pullback to them and now the ratio moved even higher, just as we've been expecting it to.

The true, long-term resistance in the gold to silver ratio is at about 100 level. This level was not yet reached, which means that as long as the trend remains intact (and it does remain intact), the 100 level will continue to be the likely target.

We've been writing the above for weeks (hence we formatted it with italics), despite numerous calls for a lower gold to silver ratio from many of our colleagues. And our target of 100 was just hit today. It was only hit on an intraday basis, not in terms of the daily closing prices, but it's still notable.

We had been expecting the gold to silver ratio to hit this extreme close or at the very bottom and the end of the medium-term decline in the precious metals sector - similarly to what happened in 2008. Obviously, that's not what happened.

Instead, the ratio moved to 100 in the situation where gold rallied, likely based on its safe-haven status, and silver plunged based on its industrial uses.

Despite numerous similarities to 2008, the ratio didn't rally as much as it did back then. If the decline in the PMs is just starting - and that does appear to be the case - then the very strong long-term resistance of 100 might not be able to trigger a rebound.

It might also be the case that for some time gold declines faster than silver, which would make the ratio move back down from the 100 level. The 100 level could then be re-tested at the final bottom.

Or... which seems more realistic, silver and mining stocks could slide to the level that we originally expected them to while gold ultimately bottoms higher than at $890. Perhaps even higher than $1,000. With gold at $1,100 or so, and silver at about $9, the gold to silver ratio would be a bit over 120.

If the rally in the gold to silver ratio is similar to the one that we saw in 2008, the 118 level or so could really be in the cards. This means that the combination of the above-mentioned price levels would not be out of the question.

At this time it's too early to say what combination of price levels will be seen at the final bottom, but we can say that the way gold reacted recently and how it relates to everything else in the world, makes gold likely to decline in the following months. Silver is likely to fall as well and its unlikely that a local top in the gold to silver ratio will prevent further declines.

Thank you for reading today's free analysis. If you'd like to supplement the above with details regarding the details of our current trading positions (and the upcoming ones), we encourage you to subscribe to our Gold & Silver Trading Alerts. You might also be interested in our new service - weekly Gold Investment Updates, which we have recently introduced, and which we provide at promotional terms. Try them out today.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

Gold Investment Update: The 2020 Top in Gold Is In

March 2, 2020, 6:33 AMAvailable to premium subscribers only.

-

Gold Investment Update: Capitalizing on Gold's and USD's Reversals

February 24, 2020, 6:17 AMBriefly: the outlook for the precious metals market is very bearish for the following months and weeks

Welcome to this week's Gold Investment Update.

The most important analogies and long-term trends didn't change during the previous week and most of our previous extensive comments remain up-to-date. In fact, precious metals' huge decline confirmed many of the points that we've been making. It also made our short positions (opened on February 21st) very profitable. Of course, in today's analysis, we will update whatever needs to be updated or added. The parts that we didn't change (or changed only insignificantly) since last week will be put in italics.

Let's start today's analysis with the factor that's been getting the most media coverage - the coronavirus scare.

Coronavirus and Gold Prices

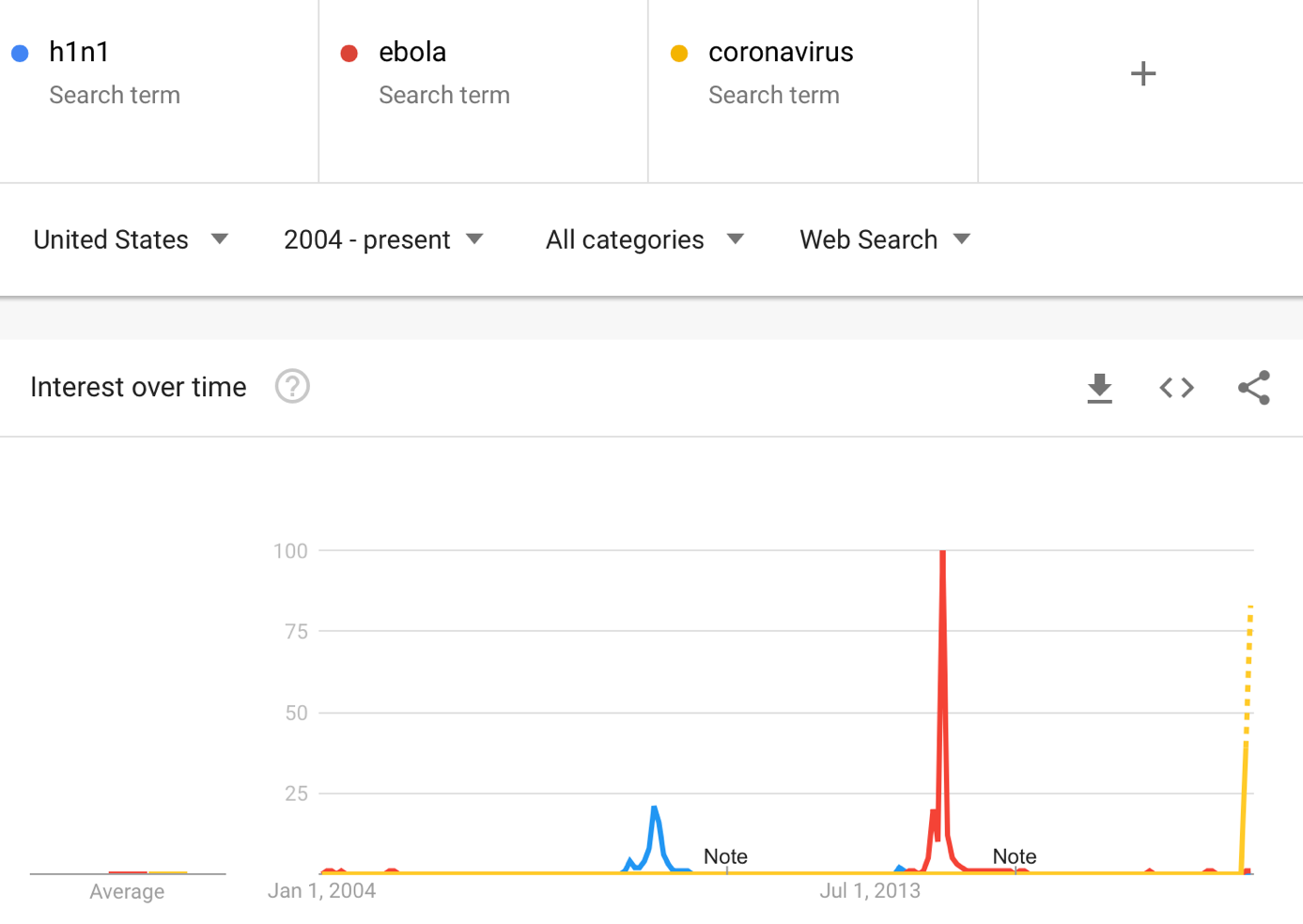

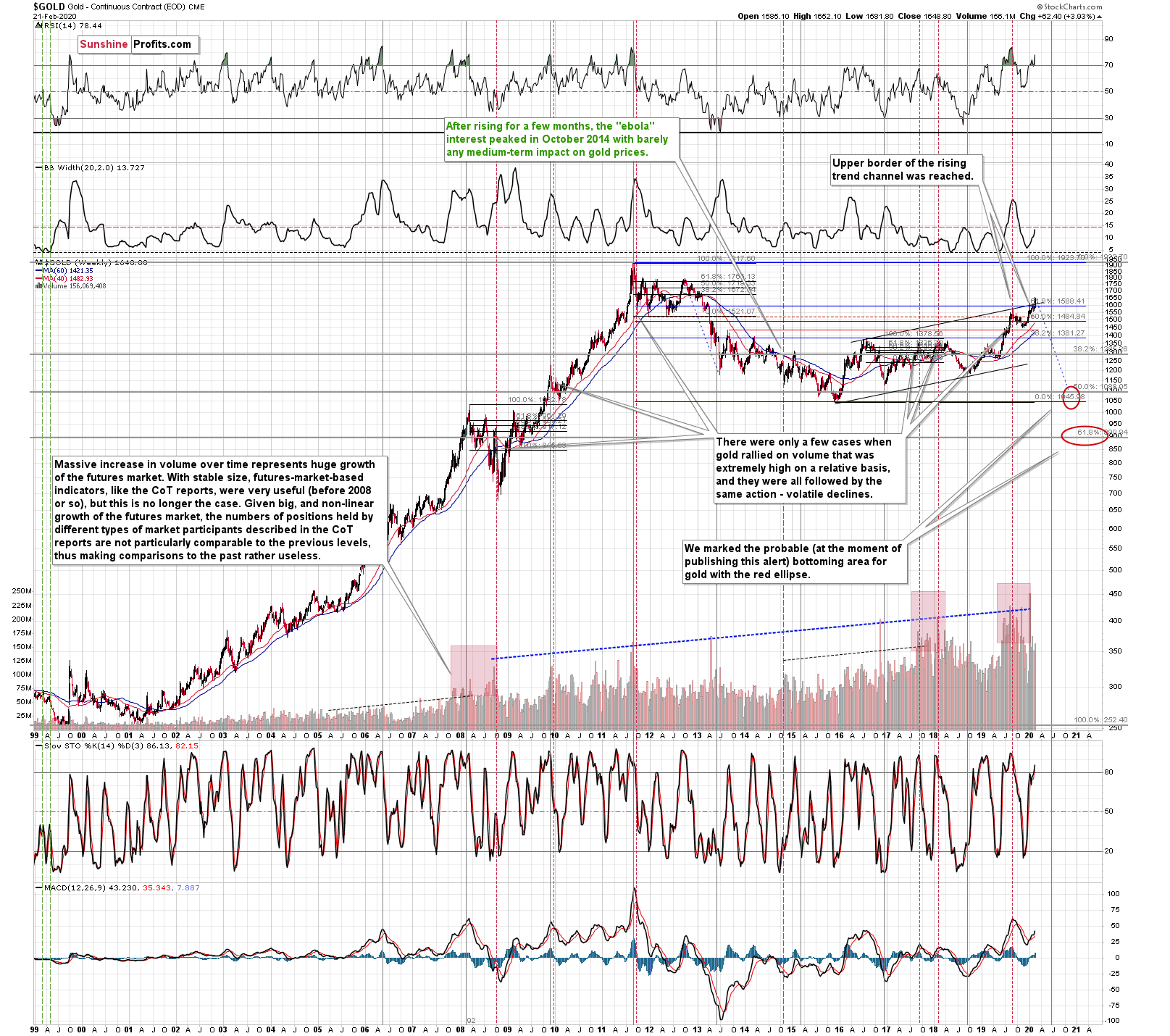

In our previous analyses, we analyzed the interest in the Google searches for "coronavirus" which we used as a proxy for fear thereof. In the previous weeks we featured the chart below (courtesy of Google Trends) and we described it in the following way:

(...) at the 2014 peak, people were searching for ebola more than they are searching for coronavirus right now. It seems that people were more scared of ebola in 2014 than they are scared of the coronavirus right now.

Or - which is more likely true - the fear has not yet peaked this time.

Why would this be more likely? Because we should also take into account the increased usage of Internet worldwide as well as increased use of social media in general. It's becoming increasingly easier to share content, reactions, and emotions online. That's quite likely why the spike interest in ebola of 2014 is so much bigger than the spike in interest in h1n1 that we saw in 2008. Consequently, we can expect the coronavirus interest to peak at levels greater than those at which the ebola interest peaked in 2014.

And what's happening right now?

The projected search numbers for February are now much bigger than the ebola searches of 2014, just as we had indicated. This might be the peak, or we might still be ahead of it.

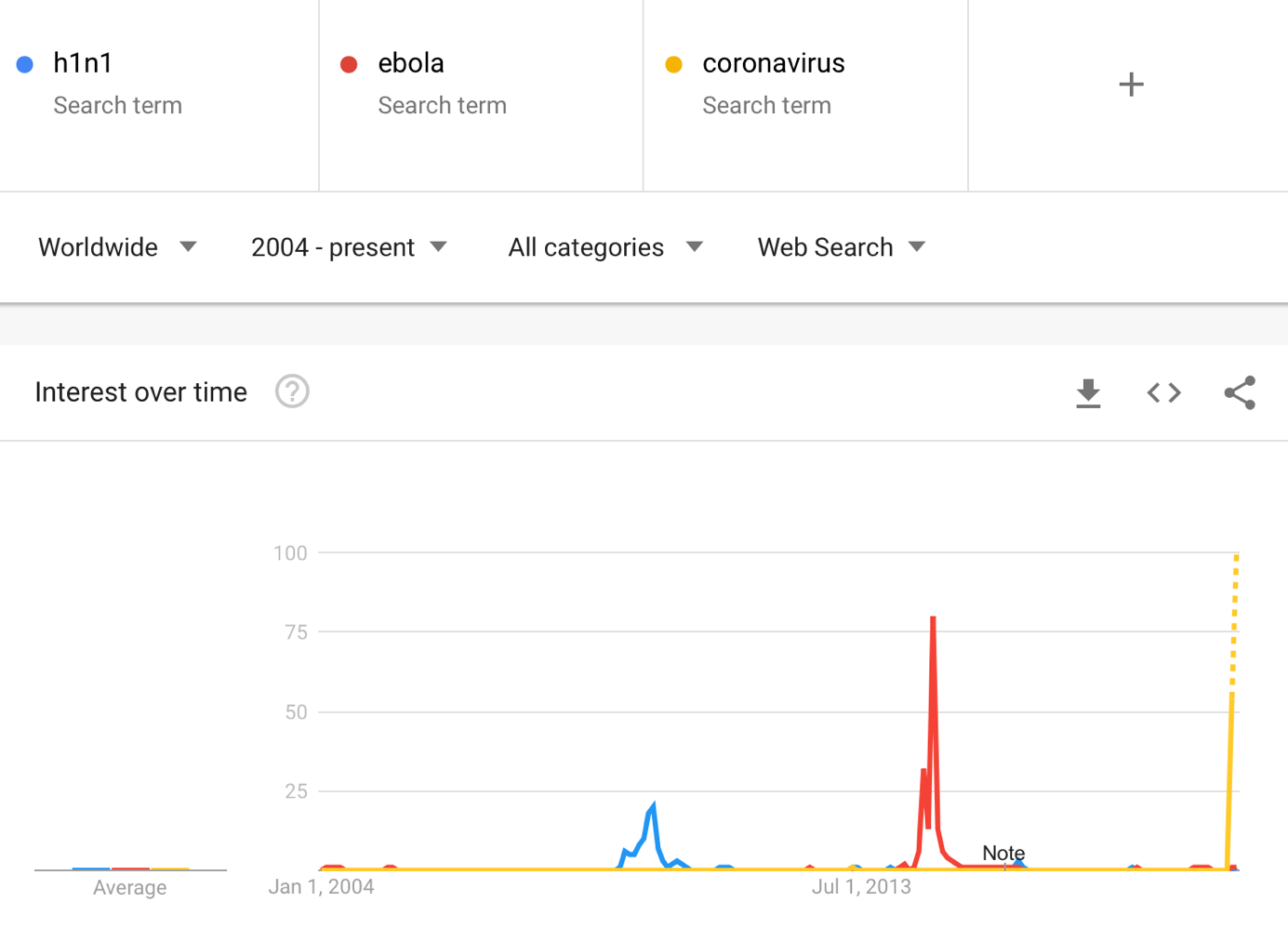

While the viruses are different, the fear of viruses is similar and the way people react to it, is also relatively similar - at least in case of capital markets. So, we can estimate how people might react right now, based on how they reacted to the ebola scare of 2014.

And how did gold react when the ebola scare was getting more serious, and what happened once the fear subsided? What did stocks and the USD Index do?

Gold price actually declined throughout most of the scare and only rallied during the final part of the scare - when the search interest for ebola peaked. There was also one small corrective upswing at the beginning of August.

The USD Index did the opposite - it was rallying for most of the time and only corrected in the final part of the scare.

The stock market, however, was very sensitive to the changes in ebola interest. Stock declined visibly, reacting clearly and strongly to both increases in ebola interest. During the peak interest, stocks declined about 10% from their previous 2014 high. So far, stocks have declined only about 3.3% from their recent high. And they rallied to new highs after the initial downswing.

Gold moved higher by about 6% in the final corrective upswing and it took about 2 weeks.

Fast forward to the current situation. Gold moved up by 7.53%, the stock market declined about 1.9% from its recent peak and USD Index corrected about 0.67%.

Based on the analogy to ebola, it could be the case that the peak-interest and peak-concern was already reached, but it doesn't have to be the case. This means that at this time, it's unclear if the markets are going to move further based on how the coronavirus scare is developing. Consequently, we have to rely on other techniques to guide us. We'll cover many of them in the following part of today's analysis.

Please note that the above analogy makes sense only if the coronavirus is contained and doesn't translate into a full-blown world crisis. This is a very likely outcome in our view - practically all other similarly scary threats were contained without real market impact in the past decades. The damages (in monetary terms) done by hurricanes, floods and similar natural disasters have been much greater historically and they didn't cause changes in long-term market trends. That's unlikely to happen this time.

Rhodium Update

Moving on to the technical part of today's analysis, let's take a look at rhodium. Practically everything we wrote on it last week remains up-to-date, but it's worth keeping it in mind as rhodium is still testing its 2007 high and the very round number of 10,000. It just closed the week at 11,100.

Many people never heard of it and it's hardly a surprise. You know that palladium and platinum markets are tiny compared to silver, which in turn, is small compared to gold's market. Well, rhodium's market is about a tenth of the size of palladium or platinum. Rhodium isn't traded on exchanges and the market for coins and bars is very, very small. Rhodium is mined as a byproduct of platinum and nickel and its mainly used in autocatalysts. There are other applications as well (Swarovski jewelry is often rhodium-plated for instance).

The most interesting thing about rhodium is how much it rallied recently.

This month, without a major shift in its supply or demand, rhodium soared to its new all-time high above $10,000, greatly outperforming other precious metals and almost every other asset. It's not very far above its July 2008 high, so rhodium prices are very vulnerable to a sudden selloff. The situation will become bearish only after the breakout to new highs is invalidated, but given the parabolic nature of rhodium's rally, the move higher looks very unsustainable.

The drop that followed the 2008 top was extremely sharp so everyone invested in rhodium right now might want to consider moving their capital somewhere else.

The demand coming from Asia is big, but this doesn't justify the near-vertical price rally. This demand wasn't absent just a year ago and yet rhodium was not skyrocketing as it is right now. Rhodium seems to be in a price bubble that's likely to pop.

There are very interesting implications for the precious metals market in general as well. You see, the tiny and most volatile parts of a given market tend to behave very specifically. Juniors, for instance, tend to outperform senior mining stocks in the final parts of upswings. Rhodium, being the tiny part of the PM market, could be showing us that what we see in the precious metals marker right now, is a medium-term top.

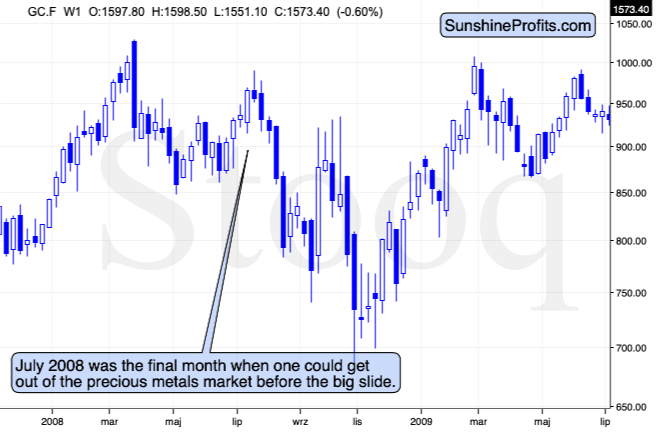

That's the theory, but did this theory work in 2008, when rhodium topped?

You bet it did.

Rhodium topped in July, 2008 and that was when gold formed the final high before one of the sharpest and biggest plunges of the past decades. In case of silver and mining stocks, it was the beginning of THE sharpest decline of the recent decades.

There are very few analogies that could be more bearish than the one that rhodium is now featuring.

Actually, given the fact that volume on which the 2008 top formed and volume on which gold topped recently are relatively similar (gold volume spiked in both cases), the above analogy is confirmed. Additional confirmation comes from the fact that in both: 2008 and 2020, gold tried to rally to the previous highs, and failed to reach them. In 2008, rhodium soared during this second attempt, and this is exactly the case right now. The analogy is clear and extremely bearish.

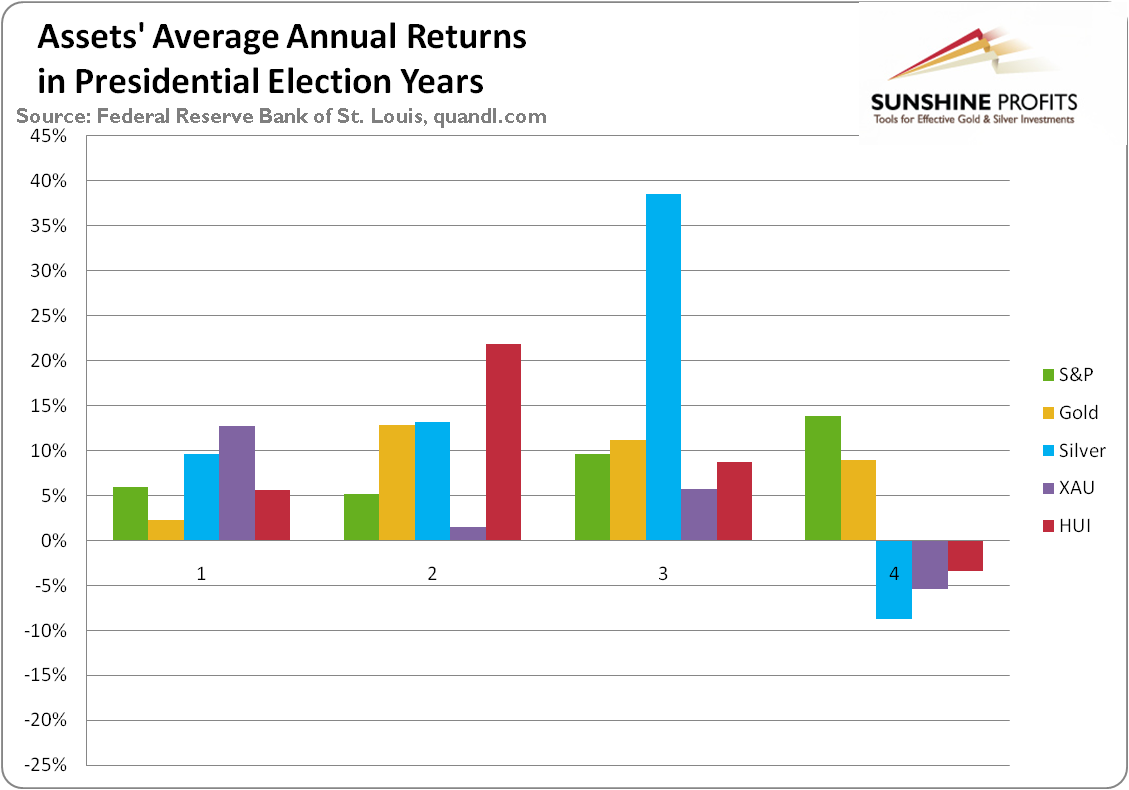

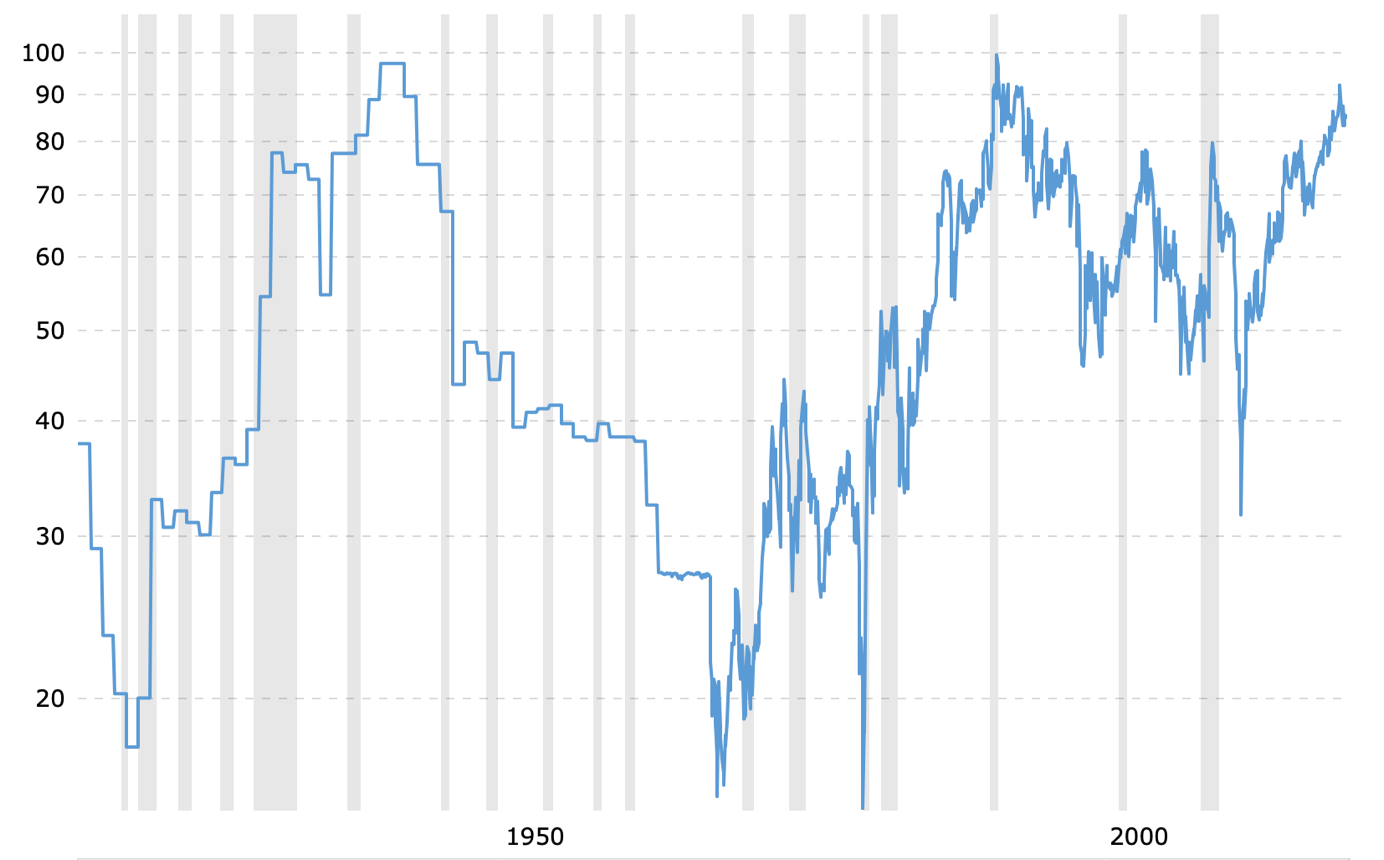

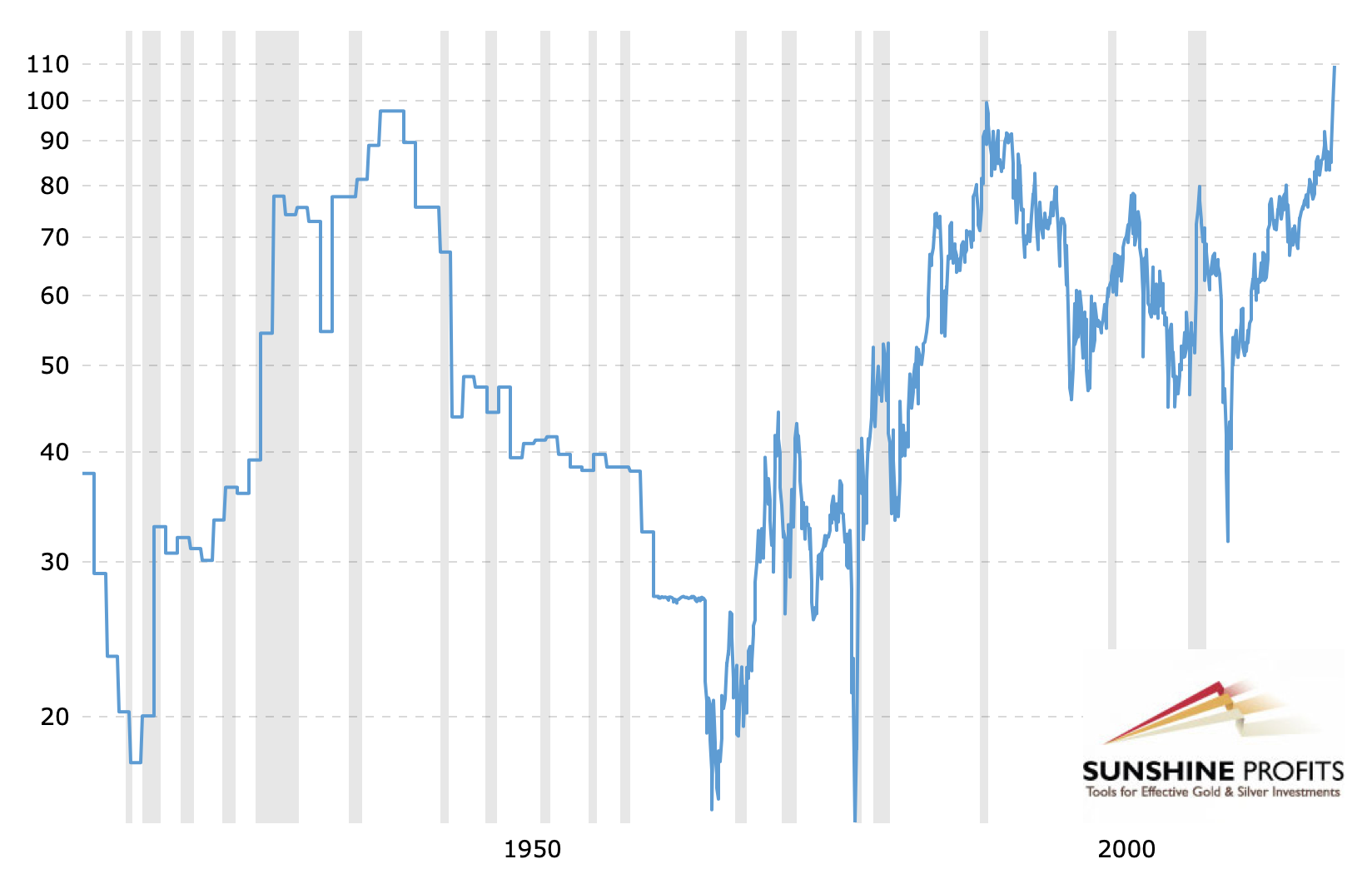

Before moving to technical price charts, we would like to remind you that this year is the final year of the U.S. Presidential cycle and that's the weakest year for silver and mining stocks. This doesn't change anything regarding the short-term price moves, but it is something that will likely have an impact throughout the year.

Assets' Returns and Presidential Cycle

Average annual return of S&P (1948-2015, green line), gold (London P.M. Fix, 1972-2015, yellow line), silver (London Fix, 1972-2015, blue line), XAU Index (1984-2015, purple line) and HUI Index (1997-2015, red line) in presidential election cycles.

Gold's performance is more or less average in the election year, but in case of silver and mining stocks, we see something very different. Namely, the election year is the only year when - on average - they all decline.

So, does it mean that gold won't be affected by this specific cyclicality, but silver and miners will be? Not really. It seems that the above chart shows that silver and miners - on average - lead gold lower. They perform worst in the election year and the yellow metal is the worst choice in the following year - the first year of presidency.

Silver and miners have already been performing very poorly relative to gold if we look at the long-term charts. Did silver or miners exceed their 2016 highs? They are not even close, especially silver. So, it seems that the pattern that we should be seeing at this time of the U.S. Presidential cycle, is already here and it started a bit earlier.

This means two things: even more weakness in silver and miners that we saw, and gold catching up with the decline.

The fundamental background is one thing, but the technical details are another. They provide details and insights that are impossible to get by just analyzing the news. Let's see how much the recent strength in gold changed the technical picture, and what's going on in the most important - long-term - charts featuring gold and the related markets.

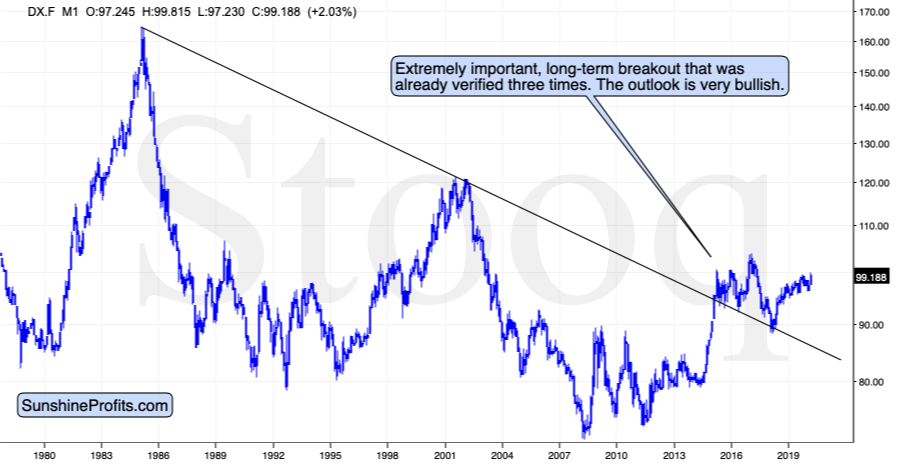

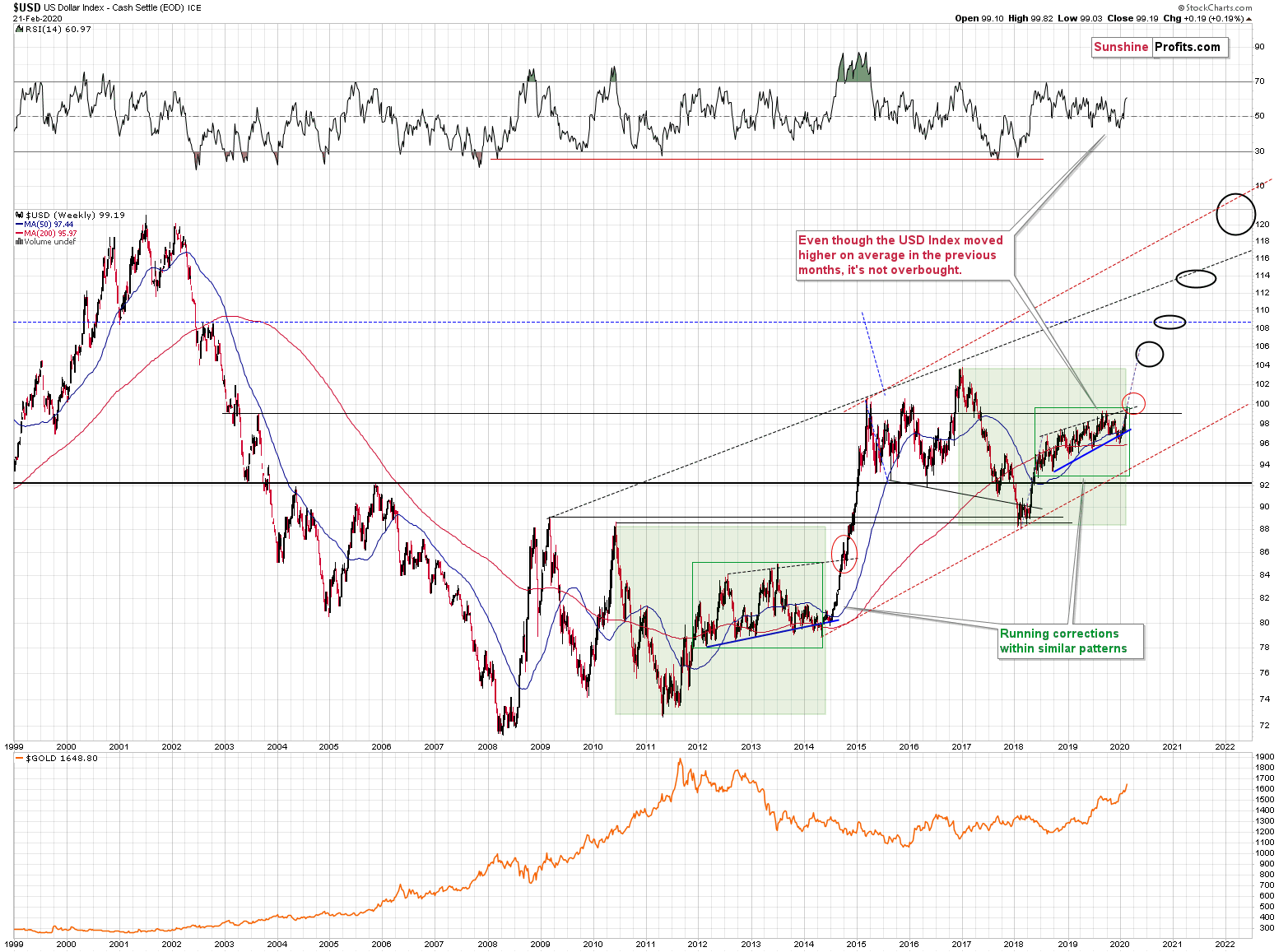

The most important point that remains intact (and unaffected by what happened in the past week) is that the USD Index is after a massive breakout that was already verified more than once. The connection with the gold market remains intact as well.

The Big Picture View of the USD Index

(please click on the charts to enlarge them)

The 2014-2015 rally caused the USD Index to break above the declining very-long-term resistance line, which was verified as support three times. This is a textbook example of a breakout and we can't stress enough how important it is.

The most notable verification was the final one that we saw in 2018. Since the 2018 bottom, the USD Index is moving higher and the consolidation that it's been in for about a year now is just a pause after the very initial part of the likely massive rally that's coming.

If even the Fed and the U.S. President can't make the USD Index decline for long, just imagine how powerful the bulls really are here. The rally is likely to be huge and the short-term (here: several-month long) consolidation may already be over.

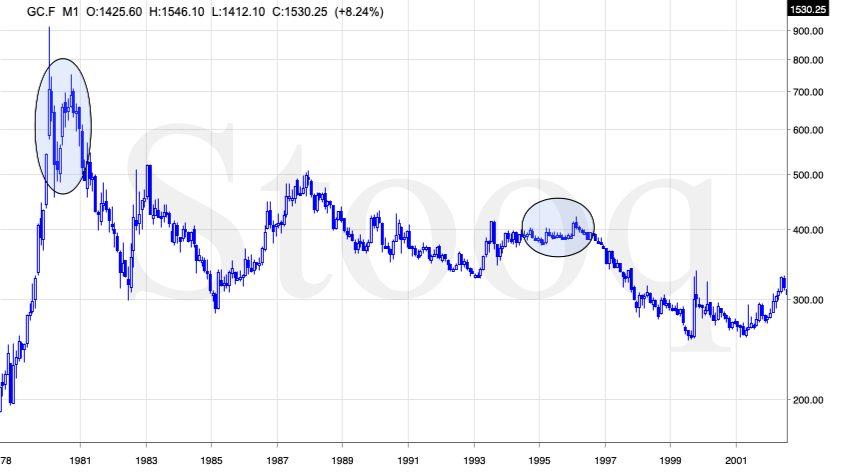

There are two cases on the above chart when the USD Index was just starting its massive rallies: in the early 1980s and in mid-90s. What happened in gold at that time?

Gold Performance When the USD Index Soars

These were the starting points of gold's most important declines of the past decades. The second example is much more in tune with the current situation as that's when gold was after years of prolonged consolidation. The early 1980s better compare to what happened after the 2011 top.

Please note that just as what we saw earlier this year, gold initially showed some strength - in February 1996 - by rallying a bit above the previous highs. The USD Index bottomed in April 1995, so there was almost a yearly delay in gold's reaction. But in the end, the USD - gold relationship worked as expected anyway.

The USD's most recent long-term bottom formed in February 2018 and gold seems to have topped right now. This time, it's a bit more than a year of delay, but it's unreasonable to expect just one situation to be repeated to the letter given different economic and geopolitical environments. The situations are not likely to be identical, but they are likely to be similar - and they indeed are.

What happened after the February 1995 top? Gold declined and kept on declining until reaching the final bottom. Only after this bottom was reached, a new powerful bull market started.

Please note that the pace at which gold declined initially after the top - in the first few months - was nothing to call home about. However, after the initial few months, gold's decline visibly accelerated.

Let's compare the sizes of the rallies in the USDX and declines in gold. In the early 80s, the USDX has almost doubled in value, while gold's value was divided by the factor of 3. In the mid-90s, the USDX rallied by about 50% from its lows, while gold's value was divided by almost 1.7. Gold magnified what happened in the USD Index in both cases, if we take into account the starting and ending points of the price moves.

However, one can't forget that the price moves in USD and in gold started at different times - especially in the mid-90s! The USDX bottomed sooner, which means that when gold was topping, the USDX was already after a part of its rally. Consequently, when gold actually declined, it declined based on only part of the slide in the USDX.

So, in order to estimate the real leverage, it would be more appropriate to calculate it in the following way:

- Gold's weekly close at the first week of February 1996: $417.70

- USDX's weekly close at the first week of February 1996: 86.97

- Gold's weekly close at the third week of July 1999: $254.50

- USDX's weekly close at the third week of July 1999: 103.88

The USD Index gained 19.44%

Gold lost 39.07% (which means that it would need to gain 64.13% to get back to the $417.70).

Depending on how one looks at it, gold actually multiplied USD's moves 2-3 times during the mid-90 decline.

And in the early 1980s?

- Gold's weekly close at the third week of January 1980: $845

- USDX's weekly close at the third week of January 1980: 85.45

- Gold's weekly close at the third week of June 1982: $308.50

- USDX's weekly close at the third week of June 1982: 119.01

The USD Index gained 39.27%

Gold lost 63.49% (which means that it would need to gain 173.91% to get back to $845).

Depending on how one looks at it, gold actually multiplied USD's moves by 1.6 - 4.4 times during the early-80 decline.

This means that just because one is not using U.S. dollars as their primary currency, it doesn't result in being safe from gold's declines that are accompanied by USD's big upswings.

In other words, the USD Index is likely to soar, but - during its decline - gold is likely to drop even more than the USD is going to rally, thus falling in terms of many currencies, not just the U.S. dollar.

Please note that there were wars, conflicts and tensions between 1980 and 2000. And the key rule still applied. Huge rallies in the USD Index mean huge declines in gold. If not immediately, then eventually.

Having covered the most important factor for the USD Index and gold, let's take a look at the other - also important - factors influencing both of these markets.

More on the USD Index and Gold

The USD Index is moving up in a rising trend channel (all medium-term highs are higher than the preceding ones) that formed after the index ended a very sharp rally. This means that the price movement within the rising trend channel is actually a running correction, which is the most bullish type of correction out there. If a market declines a lot after rallying, it means that the bears are strong. If it declines a little, it means that bears are only moderately strong. If the price moves sideways instead of declining, it means that the bears are weak. And the USD Index didn't even manage to move sideways. The bears are so weak, and the bulls are so strong that the only thing that the USD Index managed to do despite Fed's very dovish turn and Trump's calls for lower USD, is to still rally, but at a slower pace.

The temporary breakdown below the rising blue support line was invalidated. That's a technical sign that a medium-term bottom is already in.

Interestingly, that's not the only medium-term running correction that we saw. What's particularly interesting is that this pattern took place between 2012 and 2014 and it was preceded by the same kind of decline and initial rebound as the current running correction.

The 2010 - 2011 slide was very big and sharp, and it included one big corrective upswing - the same was the case with the 2017 - 2018 decline. They also both took about a year. The initial rebound (late 2011 and mid-2018) was sharp in both cases and then the USD Index started to move back and forth with higher short-term highs and higher short-term lows. In other words, it entered a running correction.

The blue support lines are based on short-term lows and since these lows were formed at higher levels, the lines are ascending. We recently saw a small breakdown below this line that was just invalidated. And the same thing happened in early 2014. The small breakdown below the rising support line was invalidated.

Since there were so many similarities between these two cases, the odds are that the follow-up action will also be similar. And back in 2014, we saw the biggest short-term rally of the past 20+ years. Yes, it was bigger even than the 2008 rally. The USD Index soared by about 21 index points from the fakedown low.

The USDX formed the recent fakedown low at about 96. If it repeated its 2014 performance, it would rally to about 117 in less than a year. Before shrugging it off as impossible, please note that this is based on a real analogy - it already happened in the past.

Based on what we wrote previously in today's analysis, you already know that big rallies in the USD Index are likely to correspond to big declines in gold. The implications are, therefore, extremely bearish for the precious metals market in the following months.

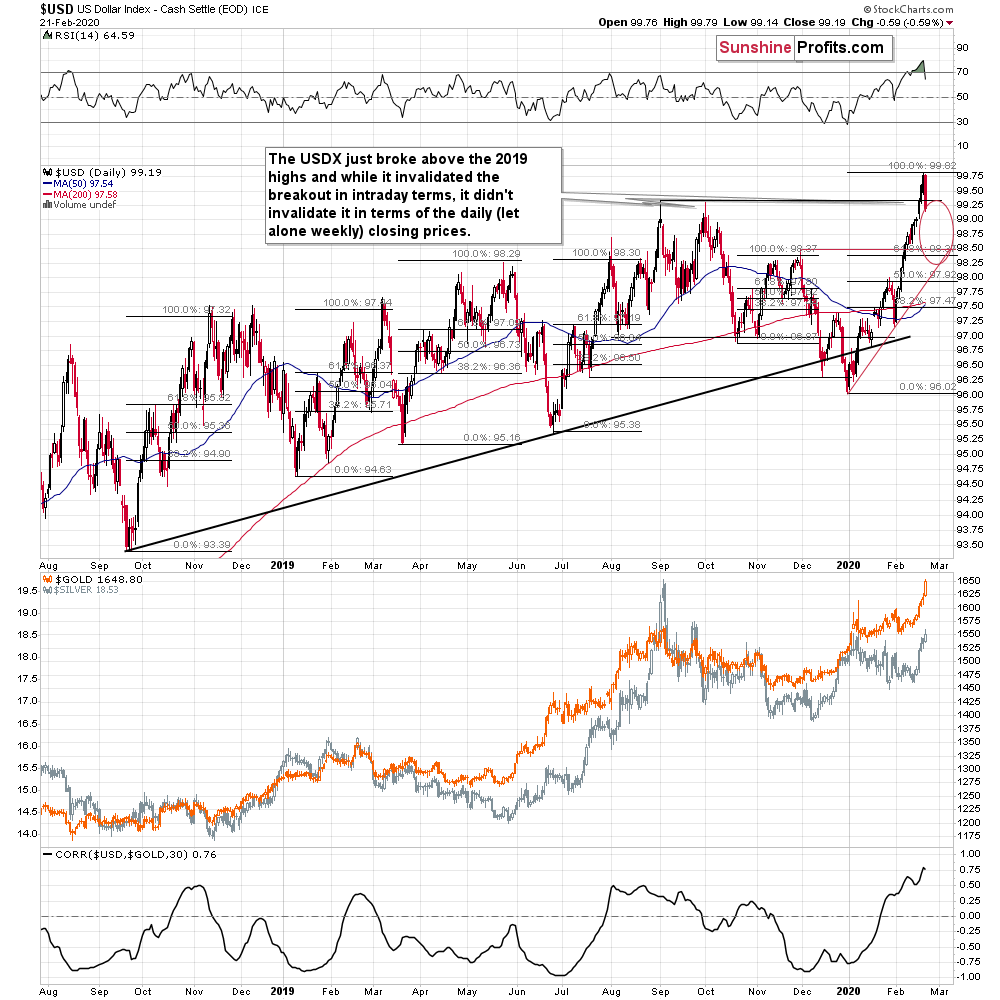

On a short-term basis, the USD Index was likely to correct as no market can move in a straight line indefinitely... And it might be the case that the short-term correction is already over, or relatively close to being over.

The USD Index soared above the 2019 highs, almost touched the 100 level and then it declined. The decline took it back below the 2019 highs in intraday terms, but as far as the daily and weekly closing prices are concerned, we have a major breakout that is currently being verified.

The RSI that's based on the daily prices just moved back below 70, which could be viewed as a sell sign, but let's keep in mind that the RSI based on the weekly prices (previous chart) is not suggesting overbought conditions. Moreover, if the 2010 - 2015 price move continues to repeat itself to a considerable degree, we might not be able to use RSI at all, as it stayed above 70 for months, before the top was really in.

The target area for this decline is relatively wide. On one hand, the USD Index might decline all the way down to the rising red support line or to the 38.2% Fibonacci retracement based on this year's rally. On the other hand, however, the highest closing prices of 2019 (99.02) and the recent price gap (its lower border is at 99.00) are very close to Friday's closing price, which means that they are quite likely to stop the decline.

So, it could be the case that the short-term bottom in the USD Index is at hand. But, there's something else that caught our attention on Friday. In Friday's intraday Gold & Silver Trading Alert, we wrote the following:

What is also very important is that gold soared mostly before the USD Index declined. When the USDX was still trading at about 99.60 - 99.65, gold was already trading at about $1,645. At the moment of writing these words, the USDX is trading at 99.20, while gold is at $1,648. This means that gold seems to have rallied on the expectation of a pullback in the USDX and now, when the pullback is indeed taking place, it's not really willing to react much more.

This might seem similar to what happened in silver quite a few years ago. Back in 2006, silver soared on the expectations that the SLV ETF will be launched and that this will allow many new investors to invest in silver and thus cause silver price to soar. And what did silver do right after the SLV ETF was indeed launched? It moved up for about 2 weeks and then it plunged, erasing more than one third of its value.

In case of the USDX pullback and gold's reaction, the scale is much smaller, so the reaction is likely to be much smaller as well. What happened days back in 2006 in case of silver, could take hours now with regard to USD and gold. And it seems that we see something similar right now.

This means that even if the USD Index declines more here, the gold price is unlikely to rally significantly higher. This, in turn, creates a good risk/reward opportunity for entering short positions.

You can see the details on the charts below.

We marked the analogous times with ellipses. While the USDX was still at about 99.6, right before the biggest slide of Friday's session, gold was already at about $1,645. It closed the session very close to these levels, even though the USD Index moved much lower.

That's an intraday move that is usually useful in case of day trading, but it can be very helpful also for bigger trades. In this case, we can see a very noticeable change in the way gold and the USD Index moved relative to each other.

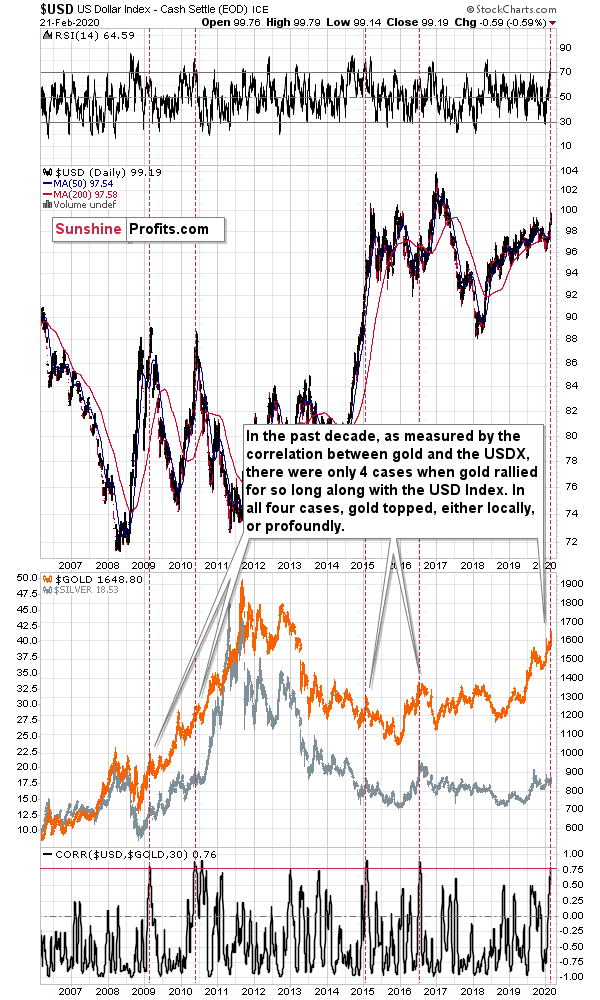

After all, gold used to rally along with the US dollar for most of this year. This might seem like a major bullish sign, but... It's actually something that we saw 4 times in the past decade and in all 4 cases, it fooled people who believed in the bullish implications. Don't get us wrong, when gold rallies without declines in the USDX, it usually is a sign of strength. But, as all things in excess tend to become their opposites, there can be too much of a good thing here as well.

The four previous cases were when the 30-day correlation between gold and the USD Index soared above 0.75 while gold was already after a sizable rally. In all 4 cases, gold topped at that time. In the two most recent cases (2015 and 2016 tops), we saw very important - yearly tops at that time.

The implications are very bearish for the medium term, but not necessarily for the very short term.

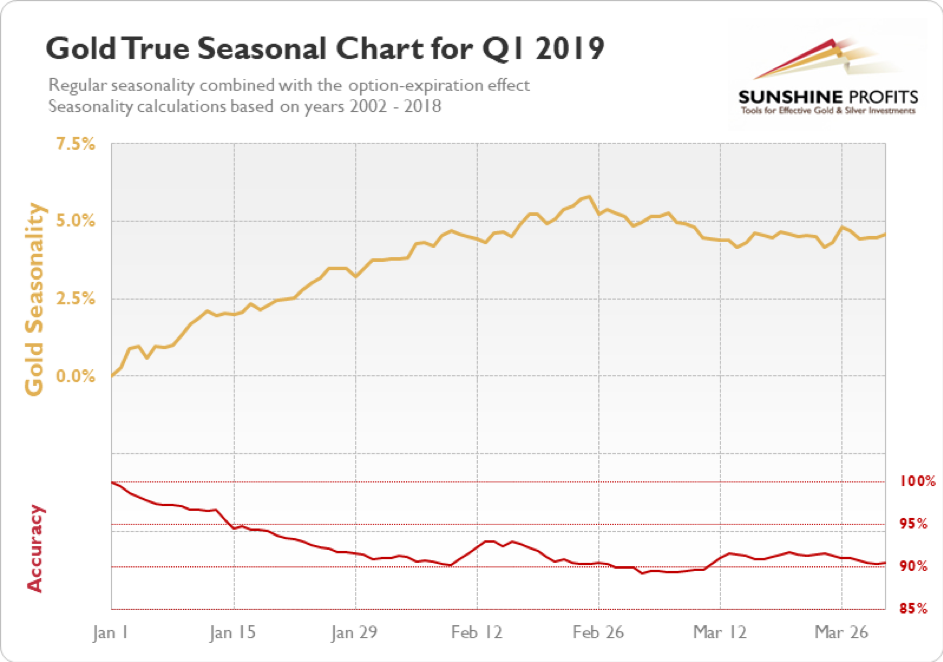

Gold Seasonality Lessons

Having said that, let's take a look at the current seasonality in gold. In short, it's positive at face value, and it's neutral once one considers the likelihood of USD Index's upswing.

As a reminder, our True Seasonal gold charts are an improved version of the regular seasonality, as they additionally estimate also the Accuracy and they are based not only on the plain seasonality, but also on the way gold price tends to move around the options expiration dates (they don't take place at exactly the same day each month, so the regular seasonality ignores this effect).

The option expiration effect is not huge in case of the yellow metal; it's more significant in case of silver. Also, this effect is not very visible in case of yearly charts, such as the one that we present below, but it becomes more useful in case of the quarterly charts that we also feature from time to time (and which you can access on your own over here). You can read more details about this effect in this report (note: the pdf file is quite heavy, so it may take a while to load).

Last week, we wrote that we had only several additional days in which gold was likely to show strength based on what it used to do in the previous years. Precisely said, since it became clear that the gold's bull market started - since 2002.

Gold has indeed rallied and it has just reached its seasonal tipping point. That's yet another reason to think that gold's short-term trend is about to reverse, or that it already has reversed.

Retracements, Reversals and Gold

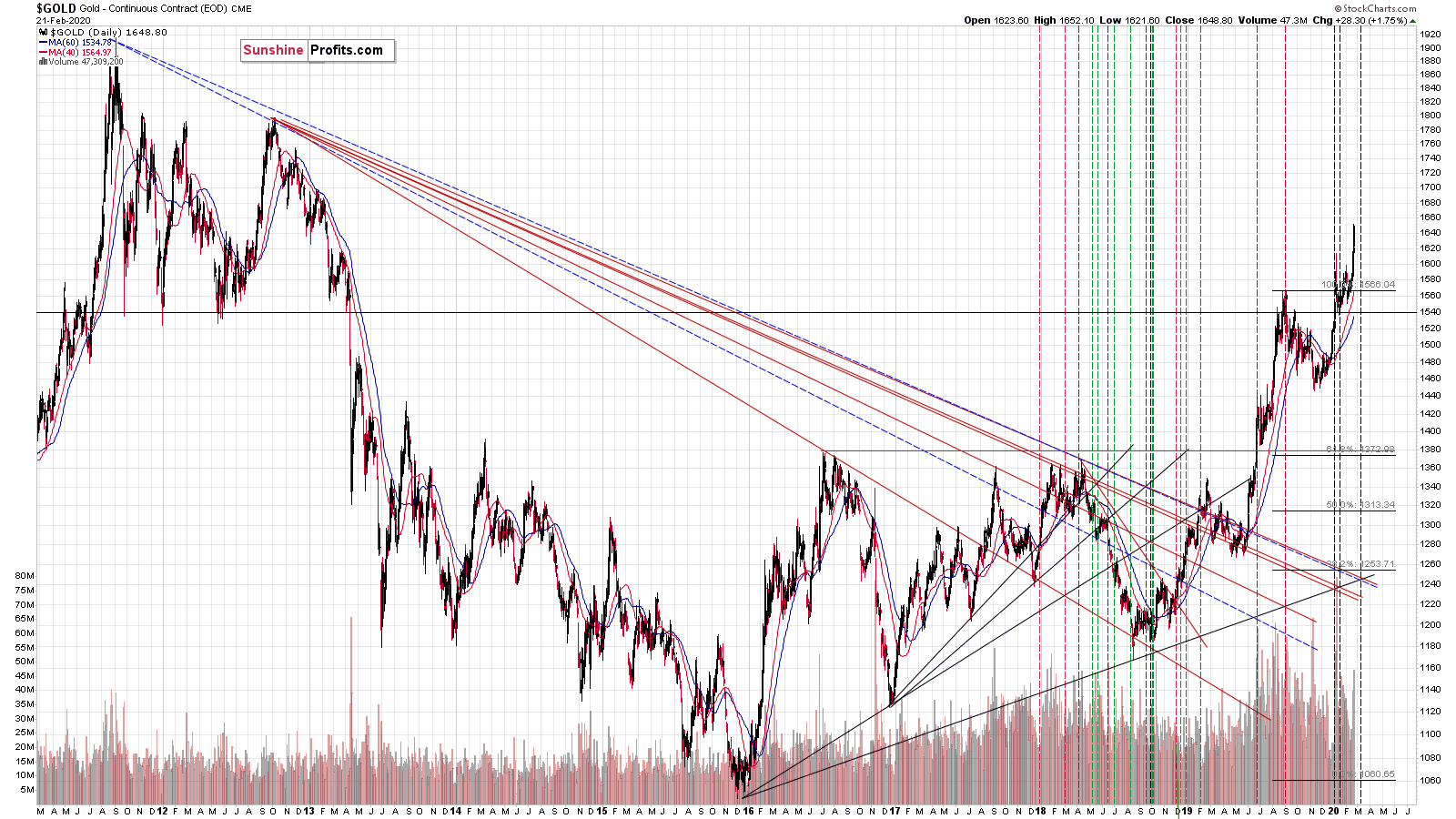

There are many other things that need to be taken into account while analyzing the market other than just the USD Index and gold's seasonality. For instance, the analogy in terms of the previous long-term retracements within big declines. In particular, the declines that we saw in 2008 (please keep the rhodium analogy in mind) and between 2011 and 2015.

The markets have fractal nature, meaning that the price patterns that we see in one timeframe, can also apply on a different scale, with proportionate implications. For instance, silver's tendency to outperform gold at the end of a bigger move higher - it takes place on a small scale in case of local rallies, and it's more visible in case of more medium-term moves.

In case of gold's long-term chart, the Fibonacci retracements are the thing that likely applies on a different scale right now. In today's second fundamental point, we explained why certain patterns repeat themselves despite taking place at entirely different times and under different circumstances. The Fibonacci retracements are one of the patterns that keeps on emerging in many markets, including gold. The 61.8% Fibonacci retracement is the most classic one.

In both previous cases (the 2011-2015 and 2008 declines), gold declined initially after the top (March 17, 2008, September 6, 2011) and then corrected a bit more than 61.8% of the decline before forming the final short-term top (July 15, 2008, October 5, 2012) from which the biggest declines started. The 2016 decline was also preceded by a sharp rally and it was also characterized by a temporary move back up - slightly above the 61.8% Fibonacci retracement - before the main part of the slide.

Now gold also moved a bit (from the very long-term point of view it was indeed a bit) above the 61.8% Fibonacci retracement level but to one of much bigger meaning.

The 61.8% Fibonacci retracement that's based on the entire 2011 - 2015 decline is $1,588. That was the initial high in gold. It was the high that gold failed to break above once, and that it broken very recently, but not (again, from the very long-term point of view) significantly.

Many people - especially those selling gold - will want to tell you that gold has been in a huge rally since late 2015. In reality, however, gold remains in a corrective mode after declining from 2011. And if you don't want to trust gold's classic retracement tool or self-similar patterns, maybe you'll trust silver or gold stocks.

Silver less than $5 above its 2015 bottom. That's over $30 below the 2011 high. Big rally in the precious metals sector? What big rally? It's only gold that's been showing significant strength and taking a closer look reveals that it just corrected (!) 61.8% of the previous decline. It's relatively common for markets to retrace this amount before the previous trend resumes.

And gold miners? The HUI Index is about 400 index points below its 2011 high and only about 150 index points above the 2016 low.

That's a correction, not a new powerful rally. We will see one, but this is not the real deal just yet.

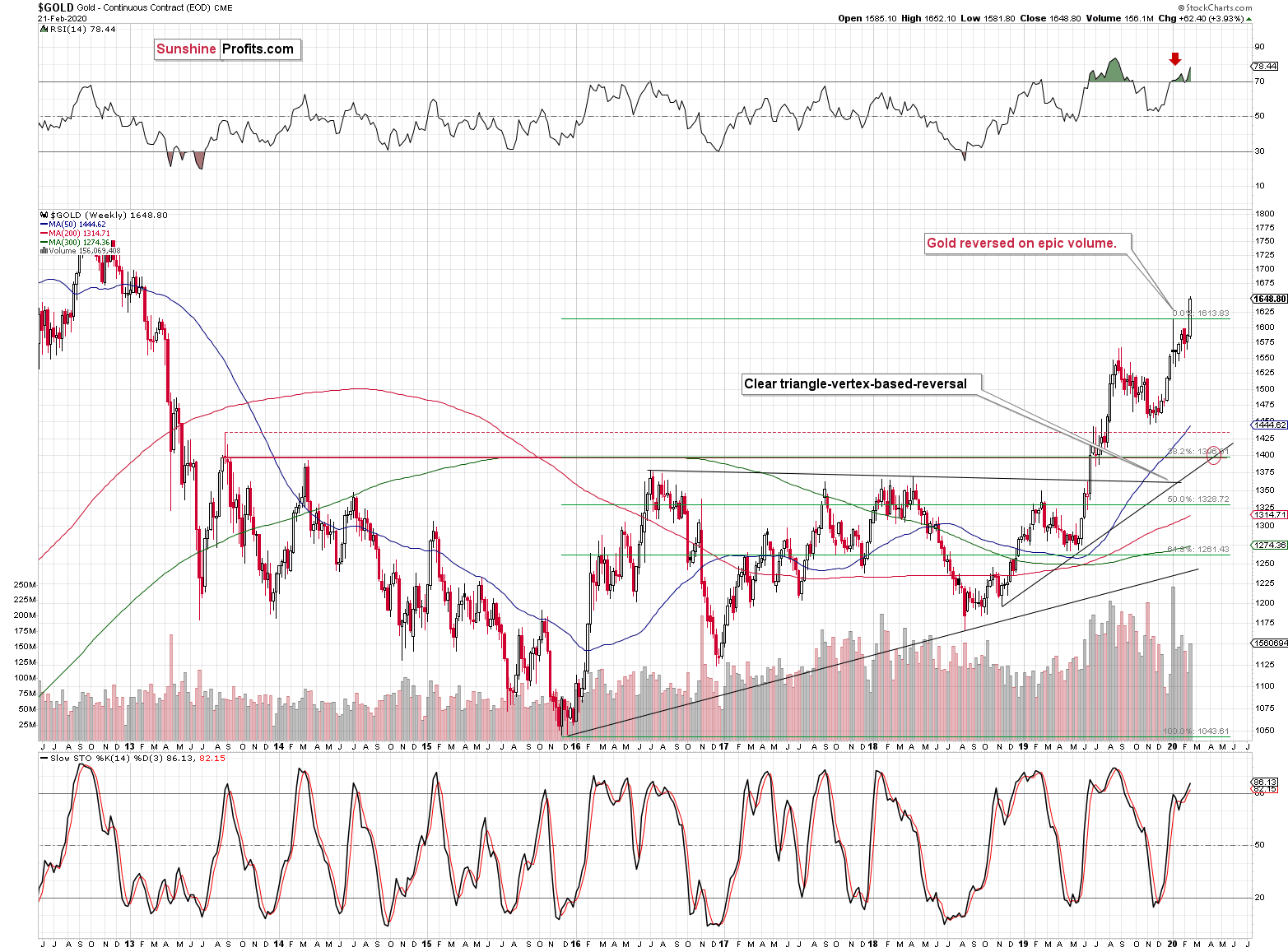

And speaking of major gold moves, please note how perfectly the long-term triangle-vertex-based reversals in gold worked.

Gold was very likely to reverse, and it did exactly that, just like we had written earlier.

Reversals should be confirmed by big volume, and the volume, on which gold reversed was truly epic, and that's a perfectly bearish confirmation. It was the biggest weekly gold volume EVER.

We already wrote a lot today about gold and we will write even more, also about silver and miners. We will cover multiple signs that point to lower precious metals prices in the following weeks and months (not days, though). But, the record-breaking-volume reversal is alone enough to make the outlook bearish. That's how significant this reversal-volume combination is.

In addition to the above, the above chart shows the next medium-term target for gold - at about $1,400 level. This target is based on the mid-2013 high in weekly closing prices, the 38.2% Fibonacci retracement based on the 2015 - 2019 upswing, and the rising medium-term support line. Of course, that's just the initial target, gold is likely to decline more after pausing close to $1,400.

Since the triangle-vertex-based reversal technique worked so well recently, let's check what else it can tell us. The below charts feature the reversal points based on the very long-term triangles.

Gold seems to have reversed (a short-term bottom) close to its reversal date and the next one is at the beginning of March.

This could be a top, or it could be the case at which the next short-term bottom takes place after gold already starts to decline.

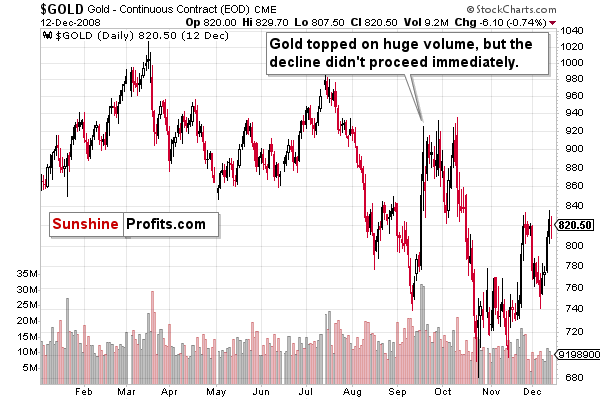

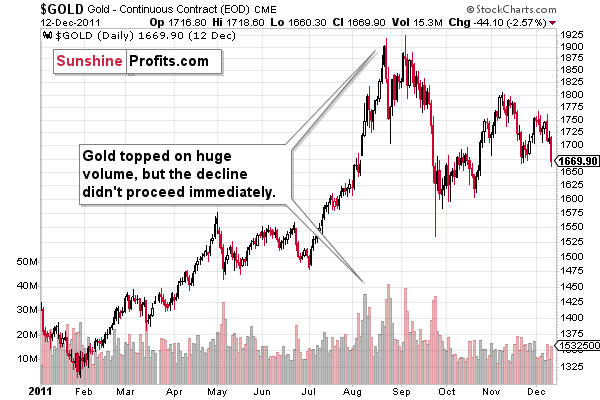

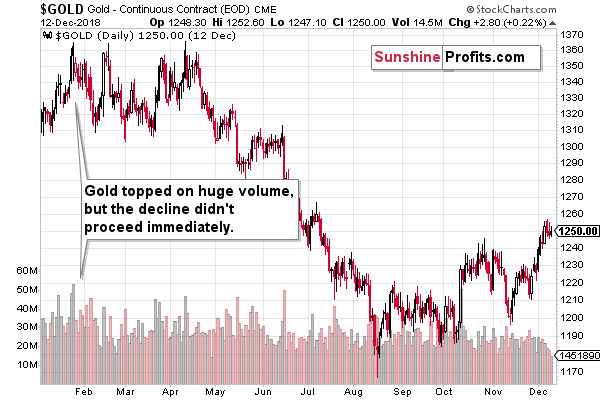

Let's keep in mind that the current rally slightly above the previous yearly high is in perfect tune with how gold behaved after previous tops that formed on huge volume.

The three very similar cases volume-wise and volatility-wise are the September 2008 top, the 2011 top, and the early 2018 top. How did gold perform immediately after the tops?

In all three cases, gold topped on huge volume, but the decline didn't proceed immediately. There was a delay in all cases and a re-test of the previous high. The delay took between several days and a few months.

Since a similar pattern followed the huge-volume tops, it seems that we might see a re-test of the recent high in the near future. Don't get us wrong - the true rally has most likely ended, but we might see a move close to the January high, a move to it, or even a move that takes gold very insignificantly above it. That's when people bought gold at the top in 2008, 2011, and 2018, and we don't want you to fall for this market trick. Knowing what happened then - huge declines in the price of gold - should prevent you from buying on hope for a breakout to new highs. Oh, and by huge declines, we mean the ones where gold declined by hundreds of dollars.

On a short-term note, gold is moving higher today and it's not that strange - the rest of the world is reacting to what happened to the USD Index on Friday. The Asian markets were already closed when gold rallied and USDX plunged on Friday, so it seems they are catching up now. Please note that gold soared the most within the first 30 minutes of trading in the classic sudden-catch-up mode.

It seems that the top in gold is in (given today's pre-market rally to $1,681.50) or at hand.

Let's take a look at gold's sister metal - silver. There are no upcoming long-term reversals for silver based on the triangle-vertex technique for silver, but there are other points worth keeping on one's mind.

Silver Shares Its Two Cents

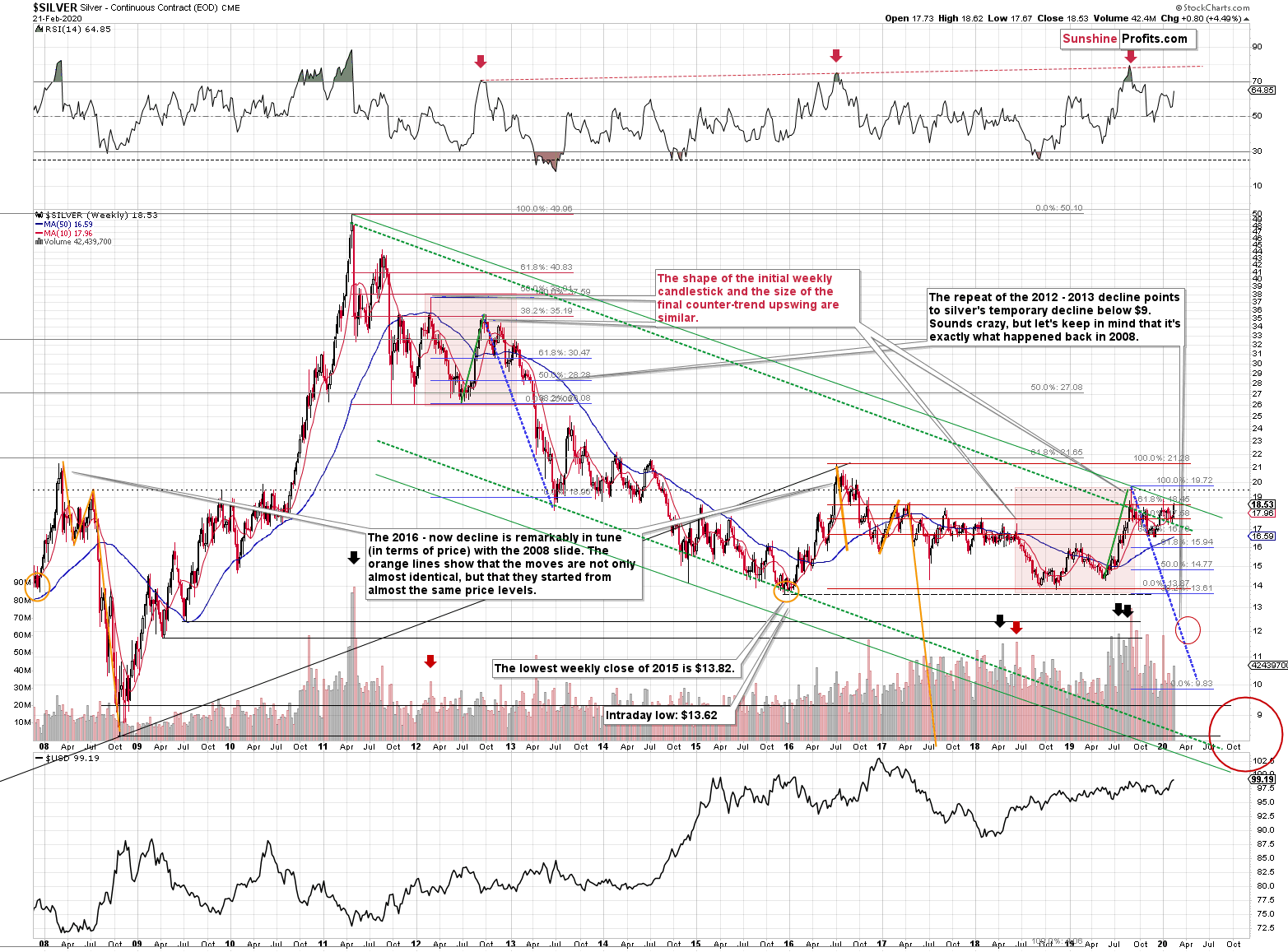

The key analogy in silver (in addition to the situation being similar to mid-90s) continues to be the one between 2008 and the 2016 - now periods.

There is no meaningful link in case of time, or shape of the price moves, but if we consider the starting and ending points of the price moves that we saw in both cases, the link becomes obvious and very important. And as we explained in the opening part of today's analysis, price patterns tend to repeat themselves to a considerable extent. Sometimes directly, and sometimes proportionately.

The rallies that led to the 2008 and 2016 tops started at about $14 and we marked them both with orange ellipses. Then both rallies ended at about $21. Then they both declined to about $16. Then they both rallied by about $3. The 2008 top was a bit higher as it started from a bit higher level. And it was from these tops (the mid-2008 top and the early 2017 top) that silver started its final decline.

In 2008, silver kept on declining until it moved below $9. Right now, silver's medium-term downtrend is still underway. If it's not clear that silver remains in a downtrend, please note that the bottoms that are analogous to bottoms that gold recently reached, are the ones from late 2011 - at about $27. Silver topped close to $20.

The white metal hasn't completed the decline below $9 yet, and at the same time it didn't move above $19 - $21, which would invalidate the analogy. This means that the decline below $10, perhaps even below $9 is still underway.

Naturally, the implications for the following months are bearish.

Let's consider one more similarity in the case of silver. The 2012 and the 2018 - today performance are relatively similar, and we marked them with red rectangles. They both started with a clear reversal and a steady decline. Then silver bottomed in a multi-bottom fashion, and rallied. This time, silver moved above its initial high, but the size of the rally that took it to the local top (green line) was practically identical as the one that we saw in the second half of 2012.

The decline that silver started in late 2012 was the biggest decline in many years, but in its early part it was not clear that it's a decline at all. Similarly to what we see now, silver moved back and forth with lower highs and lower lows, but people were quite optimistic overall, especially that they had previously seen silver at much higher prices (at about $50 and at about $20, respectively).

The 2012 corrective upswings were actually the final chances to exit long positions and enter short ones. It wasn't easy to do it back then just as it's not easy to do so right now. But the size of the decline that followed speaks for itself. In investing and trading, what's pleasant and what's profitable is rarely the same thing.

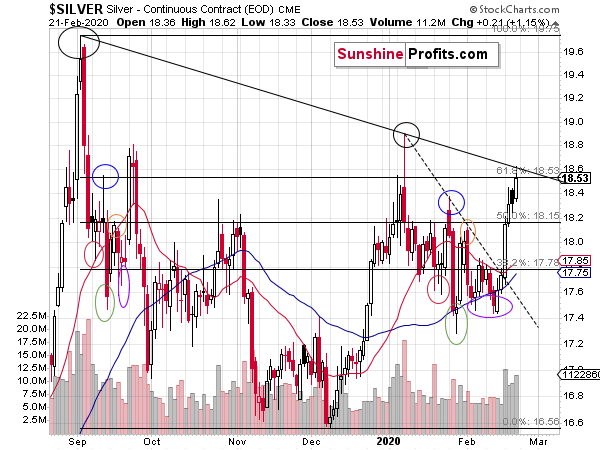

On a short-term basis, it seems that the self-similar pattern in silver was just completed, just like we had indicated previously (when silver was well below $18).

Based on how silver performed previously (analogous price extremes are marked with analogous colors), silver rallied slightly above the previous (marked with blue) high and above the $18.50 level. That's when it topped in September 2019, so it might have also topped right now.

The additional factor supporting the bearish case here is that silver moved to the declining resistance line created by connecting the September and January highs. Still, since silver is known for fake breakouts (especially at the end of the rally) we are not ruling out a situation in which it still moves a bit higher shortly, but then plunges profoundly.

Meanwhile, silver's relationship with gold continues to support medium-term downtrend in the precious metals sector.

In early July 2019, the gold to silver ratio topped after breaking above the previous highs and now it's after the verification of this breakout. Despite the sharp pullback, the ratio moved back below the 2008 high only very briefly. It stabilized above the 2008 high shortly thereafter and now it's moving slowly up once again. Well, slowly if you take the day-to-day price movement into account. In case of the long-term point of view, the strong uptrend simply resumed after a quick breather.

Anything after a breakout is vulnerable to a quick correction to the previously broken levels. On the other hand, anything after a breakout that was already confirmed, is ready to move higher and the risk of another corrective decline is much lower.

The most important thing about the gold and silver ratio chart to keep in mind is that it's after a breakout above the 2008 high and this breakout was already verified. This means that the ratio is likely to rally further. It's not likely to decline based on being "high" relative to its historical average. That's not how breakouts work.

Besides, the true, long-term resistance in the gold to silver ratio is at about 100 level. This level was not yet reached, which means that as long as the trend remains intact (and it does remain intact), the 100 level will continue to be the likely target.

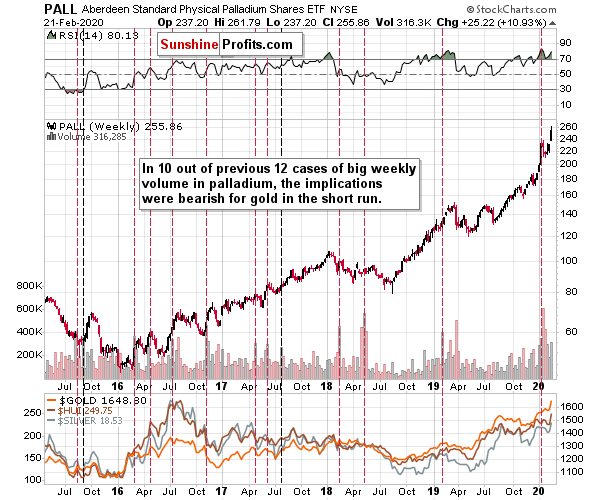

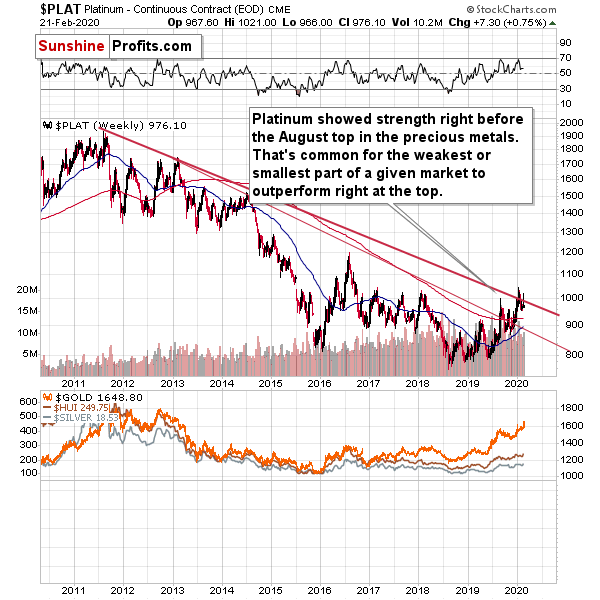

Before moving to mining stocks, let's take a look at the little metals (the market sizes are really tiny) that made many headlines recently - platinum and palladium.

A Few Words on Palladium and Platinum

Previously, we provided you with extended analysis of palladium and platinum, and while we don't want to repeat our fundamental analysis of these markets each week, we will provide you with a technical update.

Let's look more into palladium's and platinum's technical situation.

Palladium soared recently and the weekly volume that accompanied these moves was exceptional. While the price move itself might or might not indicate anything special for the major parts of the precious metals market: gold, silver, and mining stocks, the volume reading does.

In 10 out of 12 previous cases when palladium rallied on a weekly basis and it happened on big volume, the implications were bearish for gold in the short run (not necessarily in the immediate term).

Given the pace at which palladium has been moving higher, RSI well above 70 and the big volume, the current situation is similar to what we saw in early 2019. Gold, silver, and mining stocks declined after the huge-volume week in palladium. After the daily volume spike in palladium, gold moved higher on the next day and then it started a short-term decline.

The problem here is that the volume was really "once again" huge. The problem stems from the sharpness of the recent rally and its parabolic nature. In these movements, it's easy to tell that the situation is extreme, but it's hard to tell when the move is really ending. The valuations are already ridiculous from the very short-term point of view and the volume was already extreme. However, how can one know that the valuations won't get more extreme in the next few days, or the volume doesn't become even bigger?

So, while palladium seems to be topping here, it's unclear if it has indeed topped or that it will soar some more before finally sliding. The top is very likely close in terms of time, but it's not that clear in terms of price.

(Please note that since we first wrote the above, palladium declined significantly. But then it moved up to new highs - just like we warned.)

The implications here are bearish for the next week or two, but they are rather neutral for today and tomorrow.

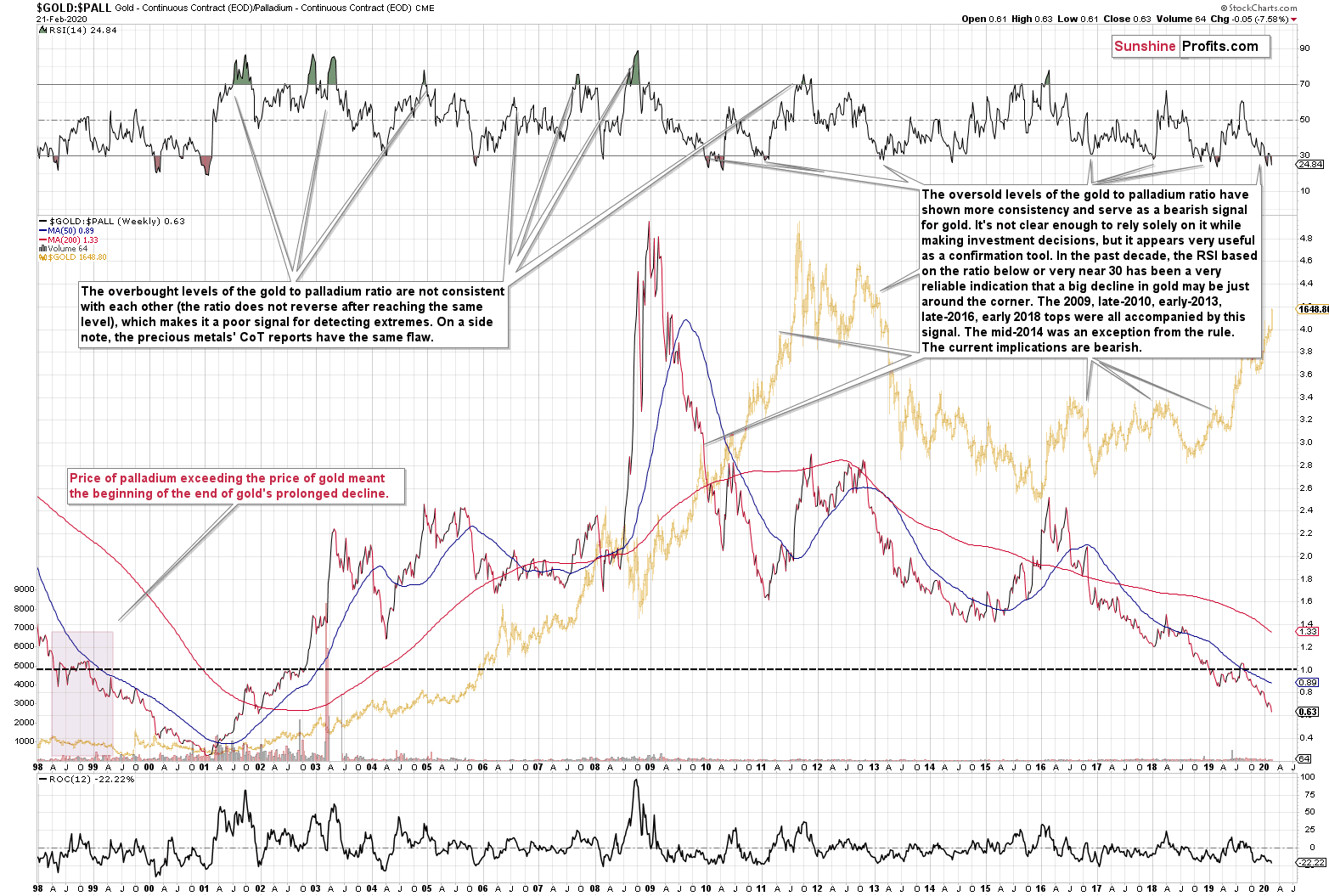

And what can palladium's performance tell us if we compare it to the one of gold?

There was only one situation when palladium became more expensive than gold and the gold to palladium ratio fell below 1. Once that happened, the ratio then corrected for a few months and then declined to new lows. The same thing happened in the past months. The previous time when we saw that was... early 1999.

The oversold status of the ratio - with RSI below 30 - suggests weakness in gold in the medium term. We marked similar cases on the above chart. And yes - the late-2012 top was also confirmed by this indication.

Having said that, let's move to platinum.

Platinum invalidated the breakout above its short-term declining resistance line, which is a bearish sign for the short term.

It just attempted to break above this declining resistance line once again and... It once again failed.

This also tells us that the medium-term top in gold is quite likely in, or that it will not be breached significantly. The reason is that platinum often outperforms close to the tops. No wonder, its market is not as small as the one of rhodium, but it's still very small compared to gold's market. The invalidation of previous breakout suggests that the outperformance - and the rally in the precious metals sector - are over.

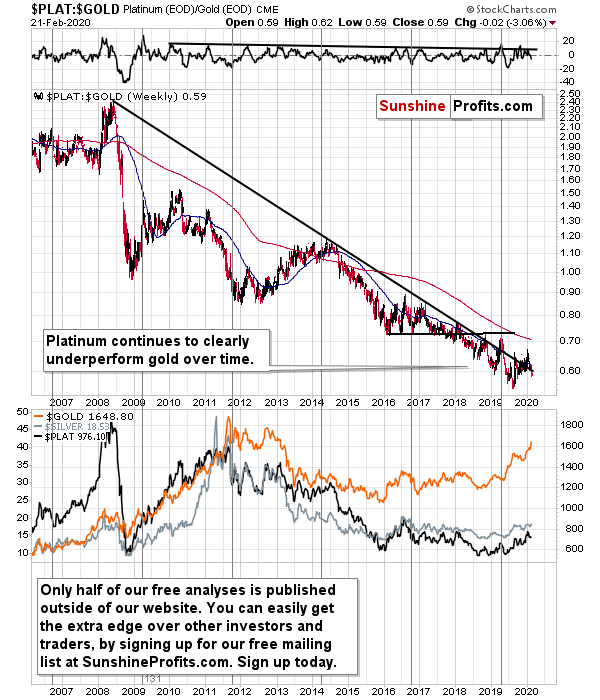

Speaking of platinum's relative strength, let's see how the platinum to gold ratio is performing.

We previously wrote that:

There have been a few unsuccessful attempts to break above the long-term downtrend, and since they all failed, it doesn't seem that this year's attempt would be any different.

The breakout wasn't any different. The history repeated itself and the breakout was invalidated. The top in the precious metals market seems to be in or at hand (depending on which part of the PM market one looks at).

Having said that, let's take a look at the situation in the mining stocks, starting with miners' flagship analogy.

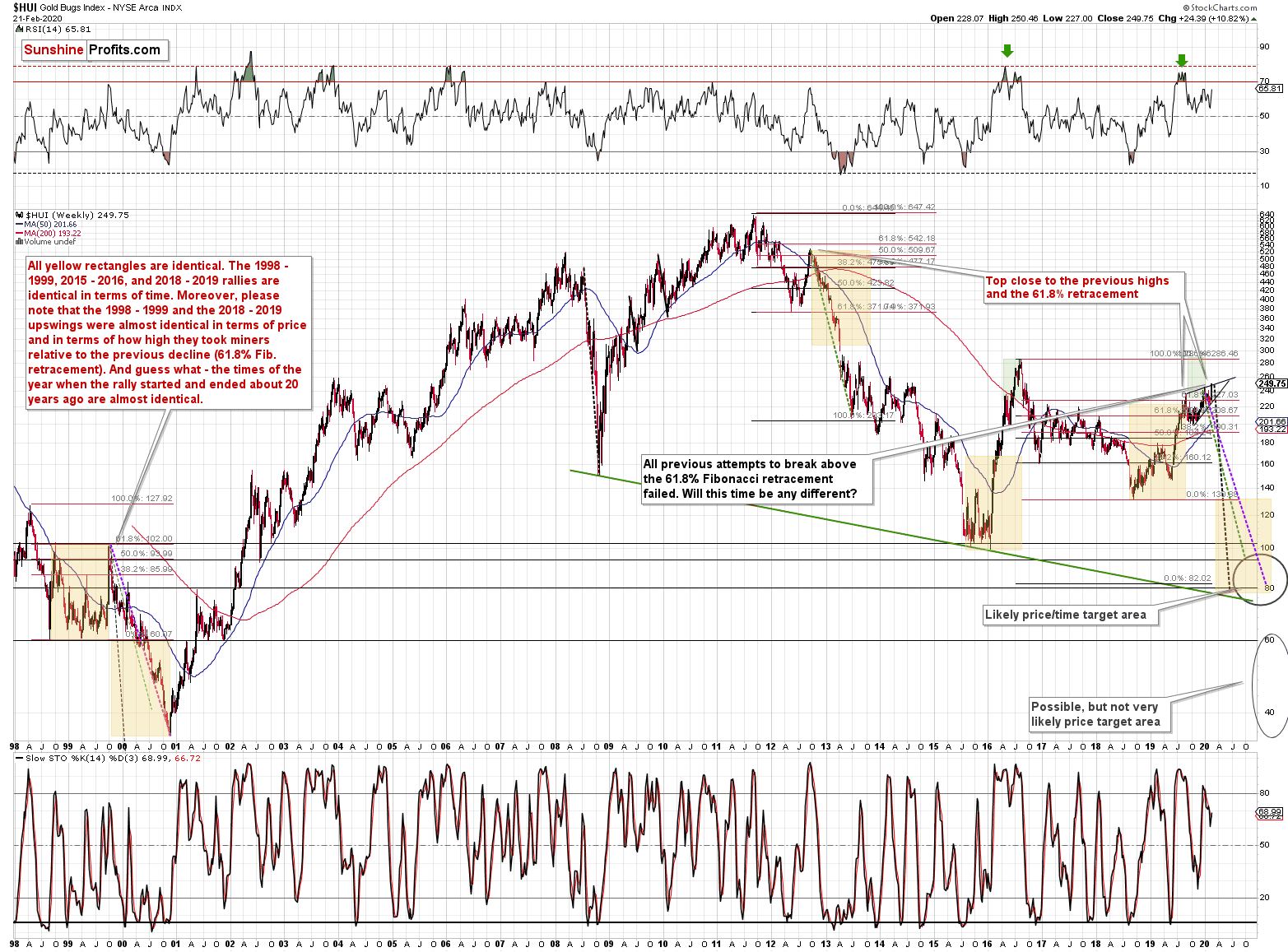

Turning to Gold Miners

In case of gold stocks, we see that history is repeating with an almost exact 20-year delay. This might sound crazy... Until you see the chart revealing how precise it is, and how well it fits to what happened now and in 2012 as well.

(as a reminder, clicking on the chart will expand it)

Let's start with something relatively more familiar - the Fibonacci retracements. Back in 2012, the HUI Index retraced almost 61.8% of the preceding rally before the decline continued. That was one of the reasons that we thought that the 2019 rally won't get much above this retracement, if at all. Indeed, the August breakout above this retracement was very short-lived. The current move higher took the HUI just a little above the August high and this move was already invalidated as gold miners declined this year. Right now miners are trying to stay above the 61.8% Fibonacci retracement once again.

All previous attempts to break above the 61.8% Fibonacci retracement failed. Will this time be any different?

"This time it's different" are usually very costly phrases in investing and trading in general.

The important thing is that this is not the only time when this retracement stopped a sizable, yet counter-trend rally before a big decline.

The 1999 top formed almost exactly at the 61.8% Fibonacci retracement. That's one similarity between what happened recently and in 2012.

The second similarity is what's so exciting about this discovery. The length of the rally. All yellow rectangles on the above chart are identical. The 1998 - 1999, 2015 - 2016, and 2018 - 2019 rallies are identical in terms of time. Most importantly, the 1998 - 1999 and the 2018 - August 2019 upswings were almost identical in terms of both: time and price. And that's in addition to both rallies ending at the same Fibonacci retracement.

Let's re-state it again. Both rallies took practically the same amount of time, and the rallies were almost alike in terms of size - percentagewise.

The current move up is just a little above the August high and the breakout is not confirmed, which is why we don't yet view the current prices as the end of the rally. It's more of a double-top at this time. The rally seems to have ended in August and the only thing we see right now is a re-test of the same Fibonacci retracement.

The times of the year when the rally started and ended about 20 years ago are almost identical as well. The 1998 rally started right after the middle of the year and the same thing happened in 2018. The rally ended in the second part of 1999 and the same was / is the case right now. The month is not the same, but it's close nonetheless.

Based on the way in which the previous bear market in gold stocks ended, it seems that we have about a year of lower prices ahead of us and the HUI Index will decline at or a bit below the 80 level. That's in perfect tune with the upper one of the price target areas that we've been featuring on the above chart for some time now. The key of the additional trading techniques pointing to the 80 level or its proximity as the downside target are the early 1999, and 2011 tops as well as the early 2002 bottom, and the long-term declining support line based on the 2008 and 2016 lows.

The implications extend beyond just the final target - the analogy can tell us something important about the likely corrective upswings that we'll see along the way. Some of them will be relatively small, but there will also be those that are visible even from the long-term point of view, such as the one that we saw in early 2000.

How to detect them? Let's get back to the basics. When does a price rally, even though it remains in a downtrend? When it gets too low, too soon - at least in many cases. The key follow-up question is "too low compared to what?". And that's where the analogy to the 1999 - 2000 decline comes into play.

The purple line is the line that connects the start and the end of the 1999 - 2000 decline. The green line marks the start and the end of the 2012 - 2013 decline and the black one is based on the 2008 decline. There are two rules that we can detect based on these analogies.

First, the time after which we saw corrections during longer declines is similar to the times when the quicker decline ended. The end of the black line (early 2000) is also when we - approximately - saw the first big corrective upswing during the decline. Applying the same technique to the current top (of course, assuming that the top is being formed right now) provides us with early April 2020 as the likely bottoming target date. Naturally, it's likely to be just a short-term bottom that would be followed by a corrective upswing and then even lower prices.

Second, the chance of a corrective upswing and the chance that such upswing would be significant increases dramatically when price moves visibly below the dashed line. There are 3 dashed lines to choose from - each based on a different decline - so the question is which one should be used. It seems that the middle one is appropriate as it was most useful in 2000. The 2012-2013 decline took place mostly above the dashed line that connected its starting and ending point and it didn't have profound corrective upswings until it ended. What we saw 20 years ago, however, was very different. The price declined sharply initially, but then corrected a few times and the more price moved below the declining green dashed line, the bigger the corrective upswing was.

So, if the HUI moves visibly below the declining green dashed line, it will suggest that the miners got too low too fast and are likely to bounce back up sooner rather than later.

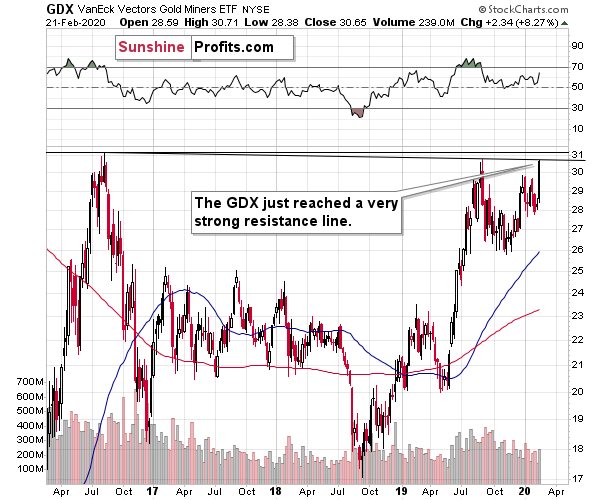

As far as the short term is concerned, the HUI Index has slightly broken above the rising wedge pattern, but we don't trust this breakout for two reasons. First, the HUI Index didn't verify this breakout. Second, the GDX ETF - another important proxy for the precious metals mining stocks - paints an entirely different picture.

The GDX ETF rallied visibly, but the volume didn't confirm the very bullish nature of this move. GDX stopped at the declining resistance line created by the 2016 and 2019 highs. This resistance - being based on major highs - is strong, so it's likely that it will remain unbroken, or that any breakout will be only temporary.

Silver Stocks in Focus

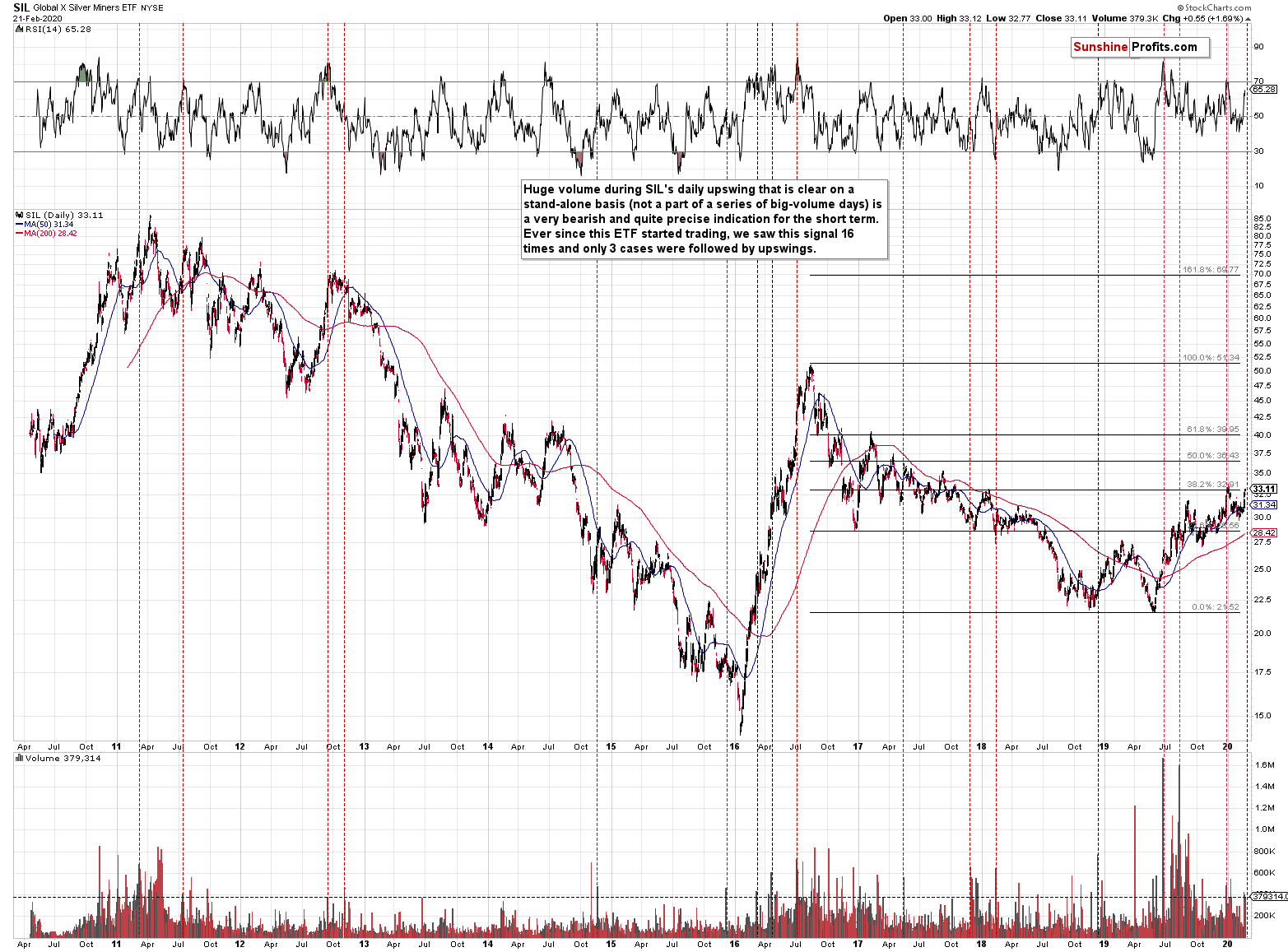

"Silver stocks reached their new yearly high on relatively strong volume" sounded very bullish, didn't it?

The problem was - as we had explained in the previous Alerts - that reaching the new yearly high meant that silver miners were barely able to correct 38.2% of the decline from the 2016 high. And that's compared to the decline alone. Comparing the recent rally to the one that we saw in 2016, we see that this year's upswing is barely one fifth of the previous upswing (about 50% vs about 250%). That's very weak performance - silver miners don't really want to move higher, they are forced to move higher as gold and silver are increasing, but the size of the move emphasizes that it's not the "true" direction in which the market is really moving.

The volume is also not as bullish as it seems to be at the first sight. Conversely, huge volume during SIL's (ETF for silver stocks) daily upswing that is clear on a stand-alone basis (not a part of a series of big-volume days) is a very bearish and quite precise indication for the short term. Ever since this ETF started trading, we saw this signal 16 times and only 3 cases were followed by upswings.

The volume-based sell signal already worked once this year, and we just saw it again as the volume spiked during last week's rally.

Yes, the silver stocks moved sharply higher on a very short-term basis, but please note that they had moved sharply lower on a very short-term basis in early 2016. The opposite of the recent price action was what preceded the biggest and most volatile rally of the recent years. If we see a reversal and invalidation of the breakout to new 2019 highs, we'll have almost exactly the opposite situation and the implications will be even more bearish.

At this time silver stocks provide indications with regard to both medium- and short-term. And they are bearish in both cases.

Summary

Summing up, the precious metals rallied recently, just like we had indicated, but it seems that the time for this rally is up or almost up. The medium-term outlook has been very bearish based on multiple indications for quite some time, but now, based on what we saw last week, it became bearish also for the short term. We might seem a bit more strength in the very short term (the next 1-3 days or so), but it doesn't seem likely that this strength would persist. Even today's profound rally in gold is not likely to be anything sustainable.

The downside potential is much bigger than the upside potential in case of the precious metals market, so it seems that short trading positions are now justified from the risk to reward point of view.

As always, we'll keep you - our subscribers - informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 2 months): Bearish

Medium-term outlook for the precious metals sector (our opinion on the period between 2 and 6 months from now): Very bearish

Long-term outlook for the precious metals sector (our opinion on the period between 6 and 24 months from now): Very bearish in the first half of the period, then neutral to bullish

Very long-term outlook for the precious metals sector (our opinion on the period starting 2 years from now): Bullish

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can't promise that it will be the case each week.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM