Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $59.32 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Let's take a closer look at the chart below (chart courtesy of www.stooq.com ) and assess the likely crude oil price path ahead.

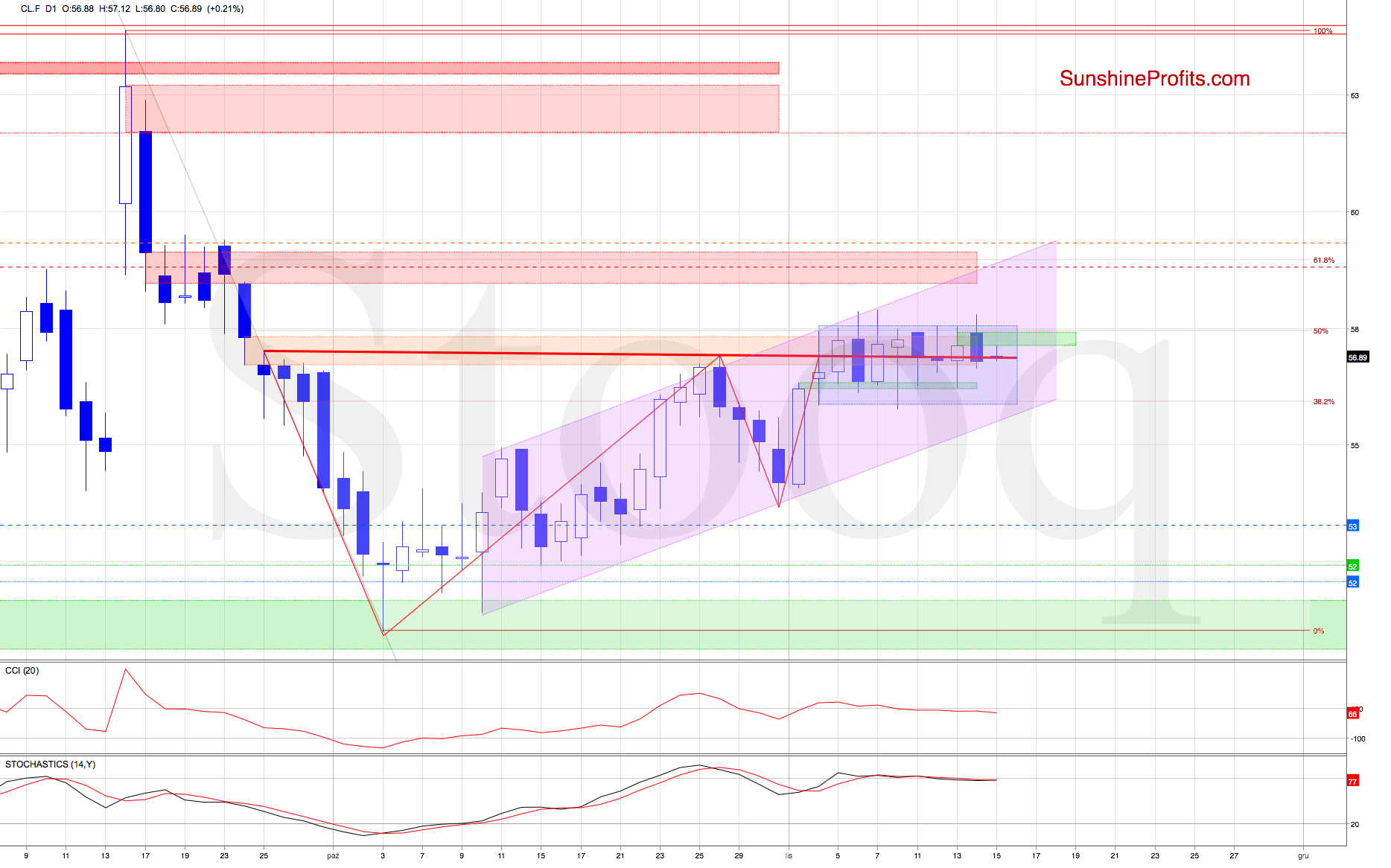

Although black gold futures moved higher after our Alert was posted, the bulls couldn't sustain their breakout above the upper border of the blue consolidation and the upper border of the orange gap. That's for the 9th time and counting that they didn't manage to close the day above these major resistances.

This how of weakness triggered further deterioration, and the futures slipped below the yesterday's green gap. The prices closed right there, below this support, which doesn't bode well for further rally. That also marks a close below the red support/resistance line.

Earlier today, the bulls attempted to move higher, but haven't even reached above yesterday's green gap. It hints at their weakness today too.

The CCI and the Stochastic Oscillator generated their sell signals, increasing the probability of further deterioration in the very near future.

Should we see such price action and the futures extend decline from here, the first downside target for the bears will be the lower border of the consolidation followed by the lower border of the rising purple trend channel.

Summing up, the bulls couldn't keep gained ground yesterday, and yesterday's downswing closed the opening bullish gap. The price action reverted back below the key resistances, favoring the chances of an upcoming reversal. The short position remains justified.

Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $59.32 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist