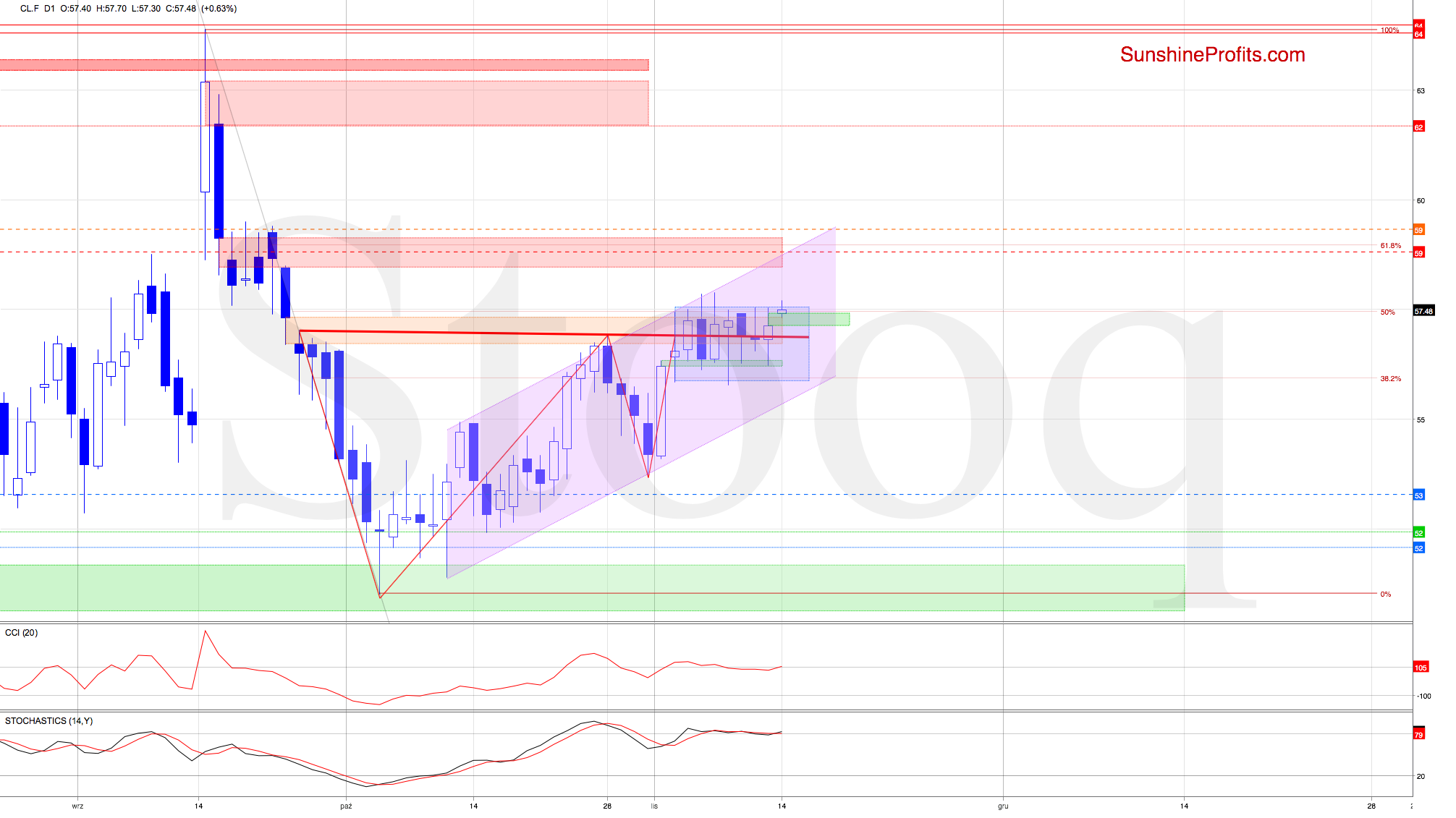

Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $59.32 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Let's take a closer look at the chart below (chart courtesy of www.stooq.com ) and examine what's the likely crude oil price path ahead.

Yesterday's session oil brought us an invalidation of the earlier breakdown below the red line and lower border of the orange gap, but the bulls just couldn't break above the upper border of the blue consolidation.

They've carried on today though, and the oil futures opened with the green gap that serves as an additional support right now. The prices are however still below key resistances, increasing the probability that a reversal is just around the corner.

Summing up, oil reversed higher yesterday, and the bulls are eyeing additions to their gains today. Their opening gap serves as a support right now. The prices however still remain below the key resistances, favoring the chances of an upcoming reversal. The short position remains justified.

Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $59.32 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist