Trading position (short-term; our opinion): Short position with a stop-loss order at $57.86 and the initial downside target at $53.28 is justified from the risk/reward perspective.

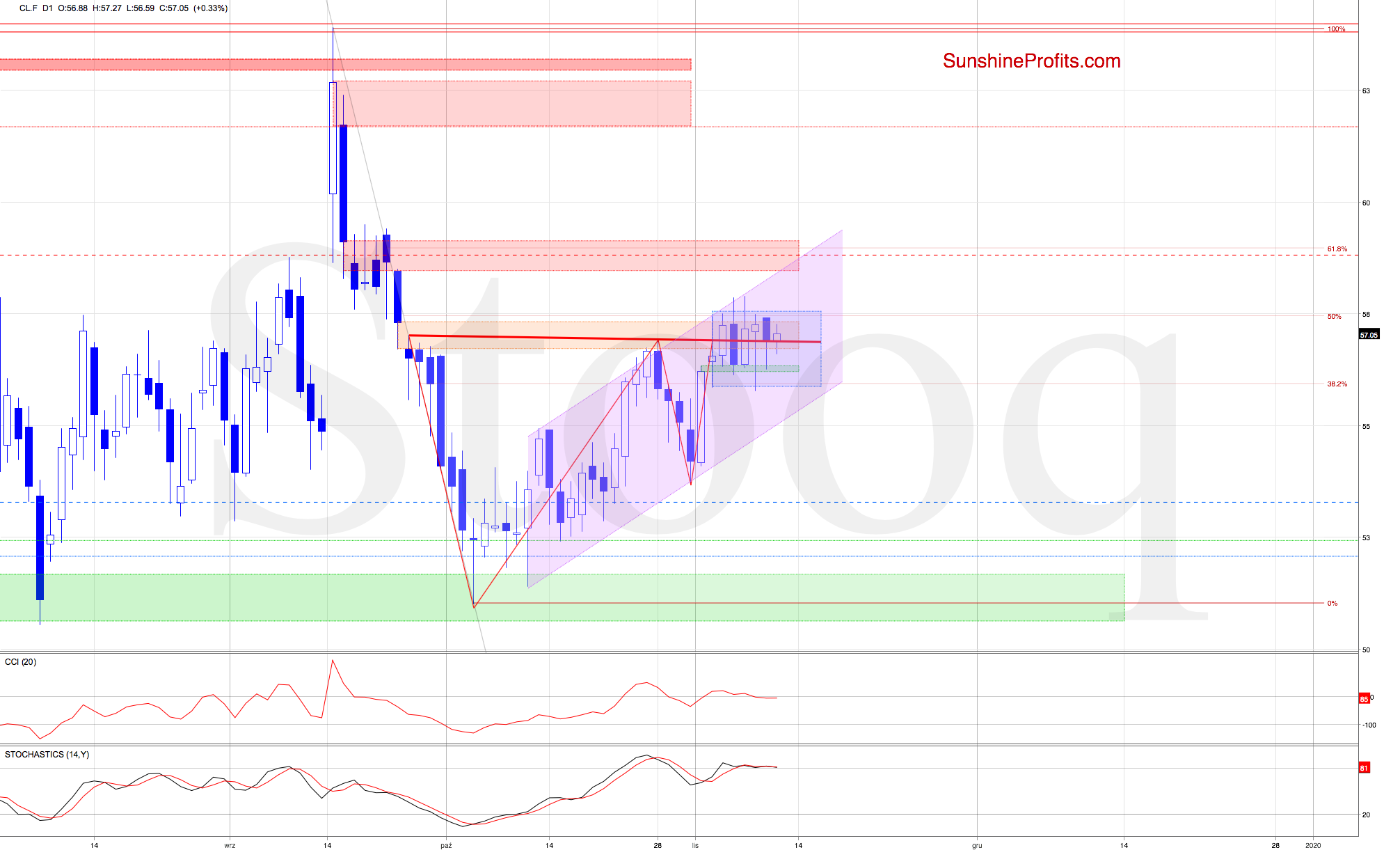

Let's take a closer look at the chart below (chart courtesy of www.stooq.com ) and examine what's the likely crude oil price path ahead.

In our Friday's analysis, we noted that:

(...) The short-term situation hasn't changed much. Crude oil futures keep trading inside the blue consolidation and around the red support/resistance line and the 50% Fibonacci retracement.

They're also still trading inside the rising purple trend channel below the upper border of the orange gap. Therefore as long as there is no breakout above these resistances another attempt to move lower is likely.

Yesterday's session brought us renewed selling pressure, yet the bears couldn't keep all of their gains till the closing bell. The bulls' response earlier today hasn't been strong exactly (crude oil futures trade at around $56.95 as we speak), and therefore the above observations ring true also today.

Summing up, today's oil upswing seems unable to overcome yesterday's move lower. While the short-term picture remains unchanged, prices keep trading around the orange resistance, the horizontal red line and the 50% Fibonacci retracement. The bears' objectives are closing the green gap and breaking below the lower border of the blue consolidation reinforced by the 38.2% Fibonacci retracement. The short position remains justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $57.86 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist