Trading position (short-term; our opinion): Short position with a stop-loss order at $59.60 and the initial downside target at $53.28 is justified from the risk/reward perspective.

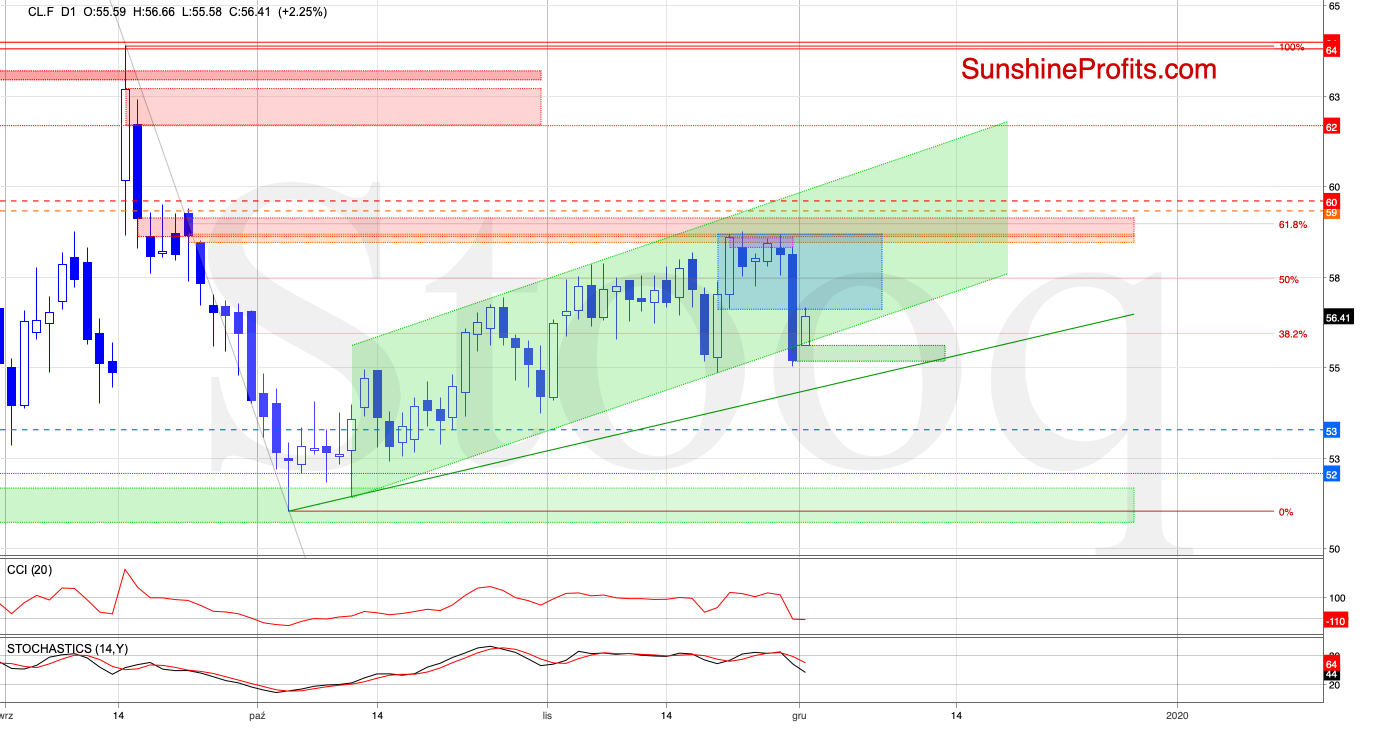

Crude oil futures declined sharply on Friday. The steep slide's result was a breakdown below the lower border of the rising green trend channel. As the prices closed the day below the formation, it's clearly a bearish development.

Despite this setback, the bulls opened the week with a green gap, which has triggered modest improvement in the following hours. The bulls are fighting to invalidate the earlier breakdown below the green trend channel, and have reached the lower border of the blue consolidation on intraday basis. Prices have pulled back since though, and are currently trading at around $56.00.

Such price action looks like verification of the earlier breakdown. Coupled with the sell signals of the daily indicators, it suggests that lower crude oil prices are just around the corner.

Should we see such price action and another downside reversal today, the first target for the sellers will be today's green gap.

Summing up, the bulls' difficulties in overcoming the new set of resistances: the 61.8% Fibonacci retracement, and the three gaps (pink, red and orange ones) were swiftly resolved to the downside on Friday. The steep slide took crude oil below the lower border of the rising green trend channel. Despite today's bullish opening gap, the buyers are having trouble holding onto their gains. The sell signals of the daily indicators suggest upcoming downswing continuation. The short position remains justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $59.60 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist