-

Weak Payrolls Saved Gold. For How Long?

January 11, 2022, 8:35 AMJob creation disappointed in December. However, it could not be enough to counterweight rising real interest rates and save gold.

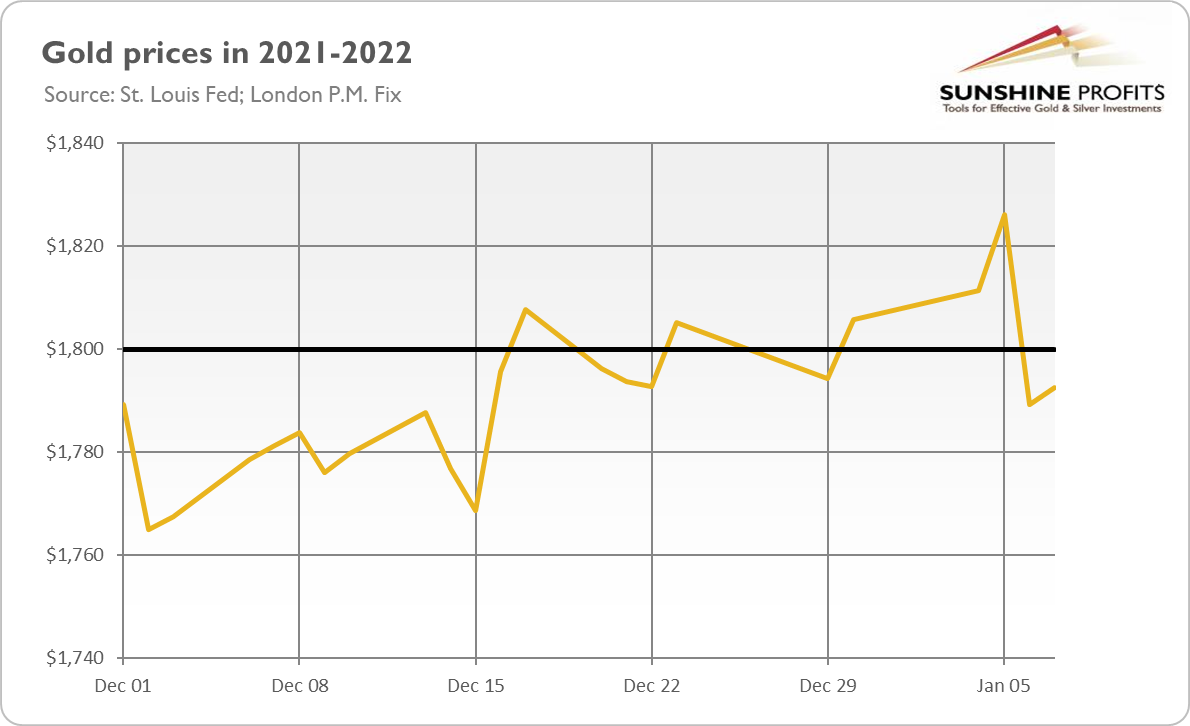

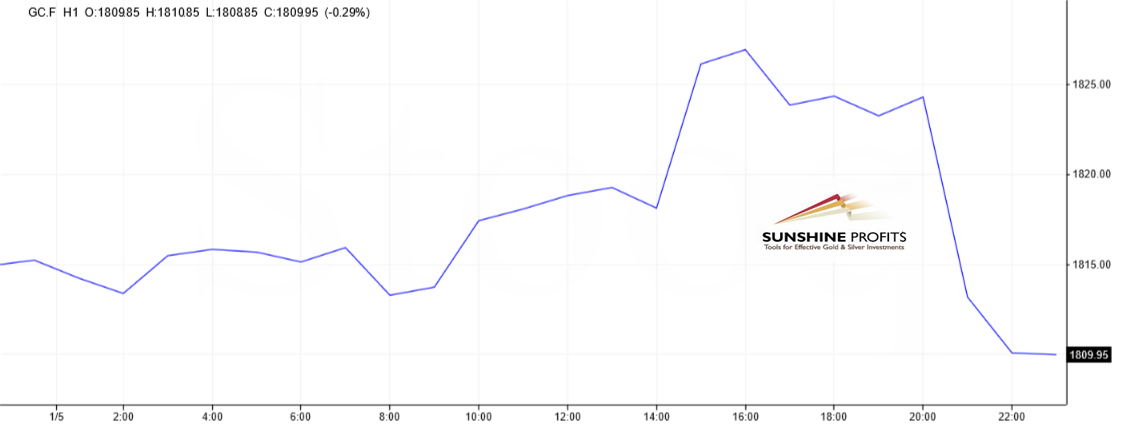

On Thursday (January 6, 2022), I wrote that “the metal may find itself under hawk fire in the upcoming weeks”. Indeed, gold dropped sharply in the aftermath of the publication of the FOMC minutes. As the chart below shows, the hawkish Fed’s signal sent the price of the yellow metal from $1,826 to $1,789.

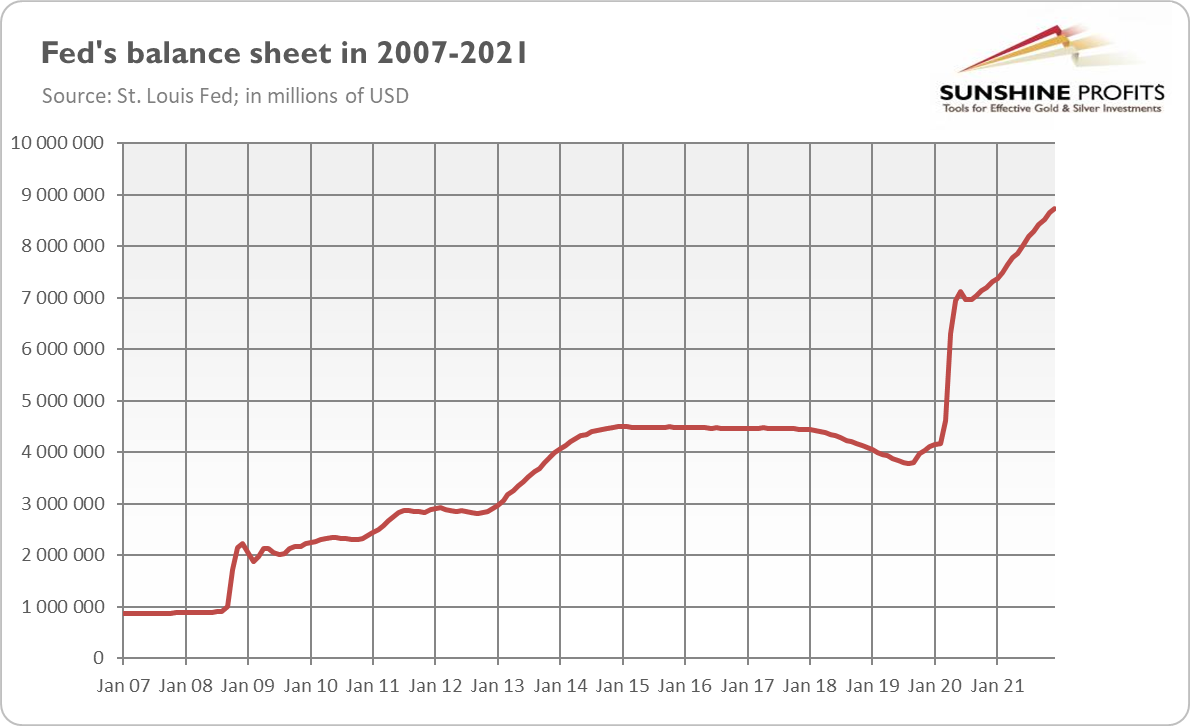

This is because the minutes revealed that the Fed would be ready to cut its mammoth holdings of assets later this year. Previously, the US central bank was talking only about interest rate hikes and the ending of new asset purchases, i.e., quantitative easing. Now, the reverse process, i.e., quantitative tightening, is also on the table.

What is surprising here is not the mere idea of shrinking the Fed’s assets – after all, they have risen to $8.7 trillion (see the chart above) – but its timing. Last time, the central bank started the normalization of its balance sheet only in 2018, nine years after the end of the Great Recession and four years after the completion of tapering. This time, QT may start within a few months after the end of tapering and the first interest rate hikes. It looks like 2022 will be a hot year for US monetary policy – and the gold market.

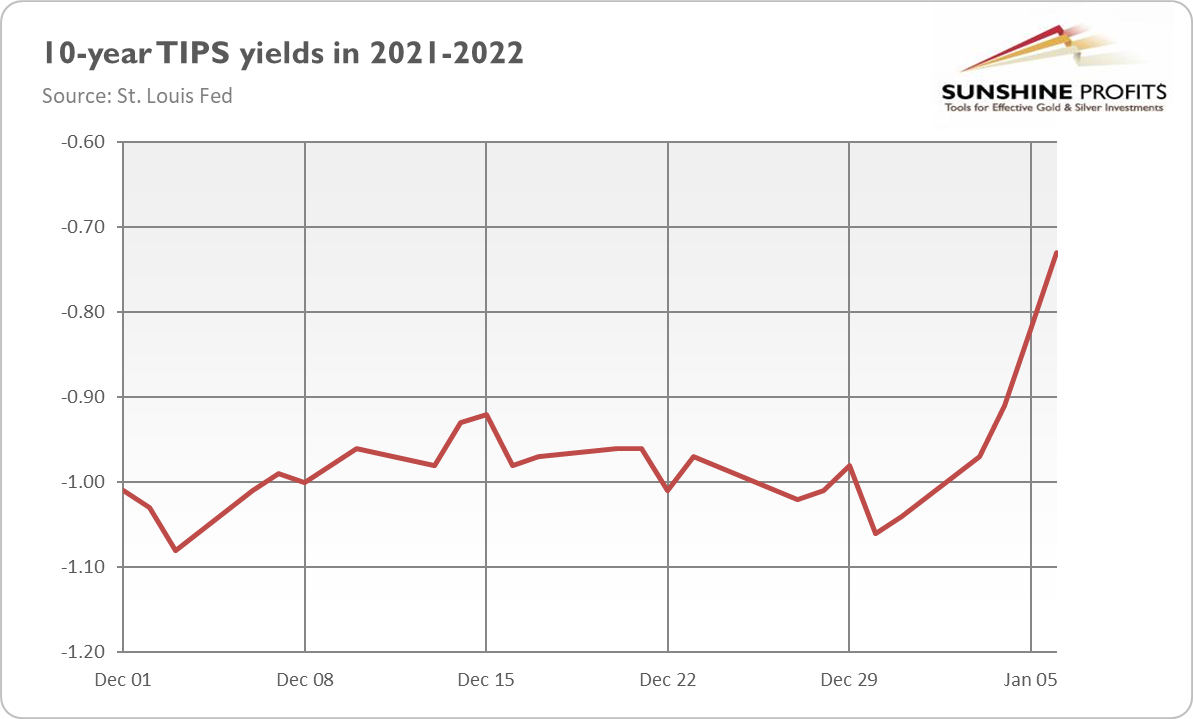

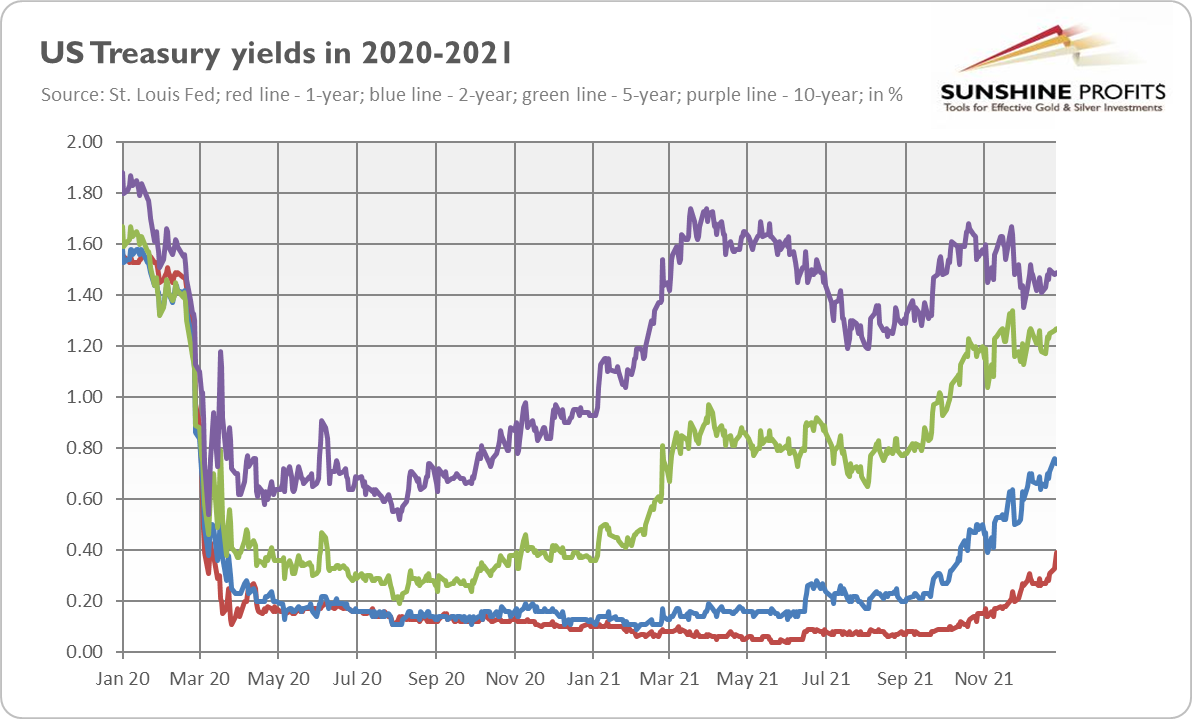

Consequently, markets have been increasingly pricing in a more decisive Fed, which boosted bond yields. As the chart below shows, the long-term real interest rates (10-year TIPS) jumped from -1.06% at the end of 2021 to -0.73 at the end of last week. The upward move in the interest rates is fundamentally negative for gold prices.

Implications for Gold

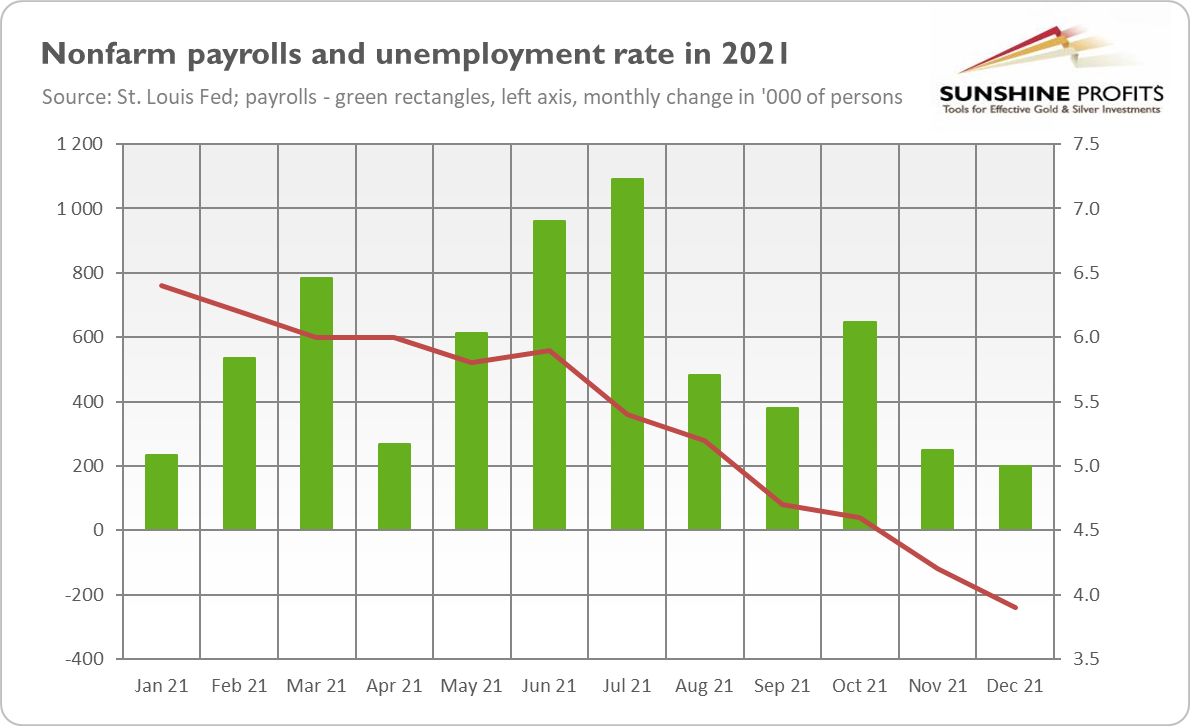

Luckily for the yellow metal, nonfarm payrolls disappointed in December. Last month, the US labor market rose, adding just 199,000 jobs (see the chart below), well short of consensus estimates of 400,000. This negative surprise lifted gold prices slightly on Friday (January 7, 2021). The latest employment report suggests that labor shortages and the spread of the Omicron variant of coronavirus are holding back job creation and the overall economy.

However, gold bulls shouldn’t count on weak job gains to trigger a sustainable rally in the precious metals. This is because the American economy is still approaching full employment. The unemployment rate declined further to 3.9% from 4.2% in November, as the chart below shows.

The drop confirms that the US labor market is very tight, so weak job creation won’t discourage the Fed from hiking the federal funds rate. As a reminder, in December, FOMC members forecasted the unemployment rate to be 4.3% at the end of 2021. What is crucial here is that disappointing job gains reflect labor shortages rather than weak demand. Additionally, wage growth remains pretty fast, despite the decline in the annual rate from 5.1% in November to 4.7% in December.

The key takeaway is that, despite disappointing job creation, the US economy is moving quickly towards full employment. The unemployment rate is at 3.9%, very close to the pre-pandemic low of 3.7%. Hence, the latest employment situation report may only reinforce arguments for the Fed’s tightening cycle. This is fundamentally bad news for gold, as strengthened expectations of the interest rate hikes may boost real interest rates further and put the yellow metal under downward pressure.

Some analysts believe that hawkish sentiment might be at its peak. I’m not so sure about that. I believe that monetary hawks haven’t said the last word yet, and that the normalization of the interest rates is still ahead of us. Anyway, Powell will appear in the Senate today, so we should get more clues about the prospects for monetary policy and gold this year.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Fed Hawks Grow Stronger. Will Gold Stand Its Ground?

January 6, 2022, 10:05 AM2022 may be the year of Fed hawks. After tapering, they may hike rates and then start quantitative tightening. Will they tear gold apart?

During the Battle of the Black Gate in the War of the Ring, Pippin cried out: “The eagles are coming!”. It was a sign of hope for all those fighting with Sauron. Now, I could exclaim that hawks are coming, but that wouldn’t necessarily give hope to anyone fighting the bearish trends in the gold market.

Yesterday (January 5, 2022), the FOMC published the minutes from its last meeting, held in mid-December. Although the publication doesn’t reveal any revolutions in US monetary policy, it strengthens the hawkish rhetoric of the Fed.

Why? First, the FOMC participants acknowledged that inflation readings had been higher, more persistent, and widespread than previously anticipated. For instance, they pointed to the fact that the trimmed mean PCE inflation rate, which trims the most extreme readings and is calculated by the Dallas Fed, had reached 2.81% in November 2021, the highest level since mid-1992, as the chart below shows. It indicates that inflation is not limited to a few categories but has a broad-based character.

The Committee members also noted several factors that could support strong inflationary pressure this year. They mentioned rising housing costs and rents, more widespread wage growth driven by labor shortages, and more prolonged global supply-side frictions, which could be exacerbated by the emergence of the Omicron variant; as well as easier passing on higher costs of labor and material to customers. In particular, supply chain bottlenecks and labor shortages could likely last longer and be more widespread than previously thought, which could limit businesses’ ability to address strong demand.

Second, the FOMC admitted that the US labor market could be tighter than previously thought. They judged that it could reach maximum employment very soon, or that it had largely achieved it, as indicated by near-record rates of quits and job vacancies, labor shortages, and an acceleration in wage growth:

Many participants judged that, if the current pace of improvement continued, labor markets would fast approach maximum employment. Several participants remarked that they viewed labor market conditions as already largely consistent with maximum employment.

The consequence of higher inflation and a tighter labor market would be, of course, a more hawkish monetary policy. Although the central bankers didn’t discuss the appropriate number of interest rate hikes, they agreed that they should raise the federal funds rate sooner or faster:

Participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.

Additionally, Fed officials also discussed quantitative tightening. They generally agreed that – given fast economic growth, a strong labor market, high inflation, and bigger Fed assets – the balance sheet runoff should start closer to the policy rate liftoff and be faster than in the previous normalization episode:

Almost all participants agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate. However, participants judged that the appropriate timing of balance sheet runoff would likely be closer to that of policy rate liftoff than in the Committee's previous experience. They noted that current conditions included a stronger economic outlook, higher inflation, and a larger balance sheet and thus could warrant a potentially faster pace of policy rate normalization.

Implications for Gold

What do the recent FOMC minutes imply for the gold market? Well, referring once more to the Lord of the Rings, they are more like the Nazgûl that wreak despair rather than the Eagles offering hope. They were hawkish – and, thus, negative for gold prices. The minutes revealed that after tapering of quantitative easing, the Fed could also reduce its overall asset holdings to curb high inflation.

In December, the US central bank accelerated the pace of tapering and signaled three interest rate increases in 2022. The minutes went even further, signaling a possibility of an earlier and faster rate hike and outright reduction in the Fed’s balance sheet:

Some participants also noted that it could be appropriate to begin to reduce the size of the Federal Reserve's balance sheet relatively soon after beginning to raise the federal funds rate. Some participants judged that a less accommodative future stance of policy would likely be warranted and that the Committee should convey a strong commitment to address elevated inflation pressures.

Hence, the price of gold responded accordingly to the FOMC minutes and declined from about $1,825 to $1,810, as the chart below shows. Luckily, there is a silver lining: the drop hasn’t been too big, at least so far. It may indicate that a lot of hawkish news has already been priced into gold, and that sentiment is rather bullish.

However, the hawks haven’t probably said the last word yet. Please remember that the composition of the Committee will be more hawkish this year, but also that the mindset is changing among the members. For example, Minneapolis Fed President Neel Kashkari, one of the Committee’s most dovish members, said this week that the U.S. central bank would have to need to raise interest rates two times this year. Previously, he believed that the federal funds rate could stay at zero until at least 2024. Thus, although inflationary risk may provide support for gold, the yellow metal may find itself under hawkish fire in the upcoming weeks. We will see whether it will stand its ground, like the soldiers of Gondor.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Bang and Plunge: 2022 Replays 2021 for Gold

January 4, 2022, 6:23 AMThe start of 2021 wasn’t successful for gold: after a few days of rally, the yellow metal entered a bearish trend. 2022 looks uncomfortably similar.

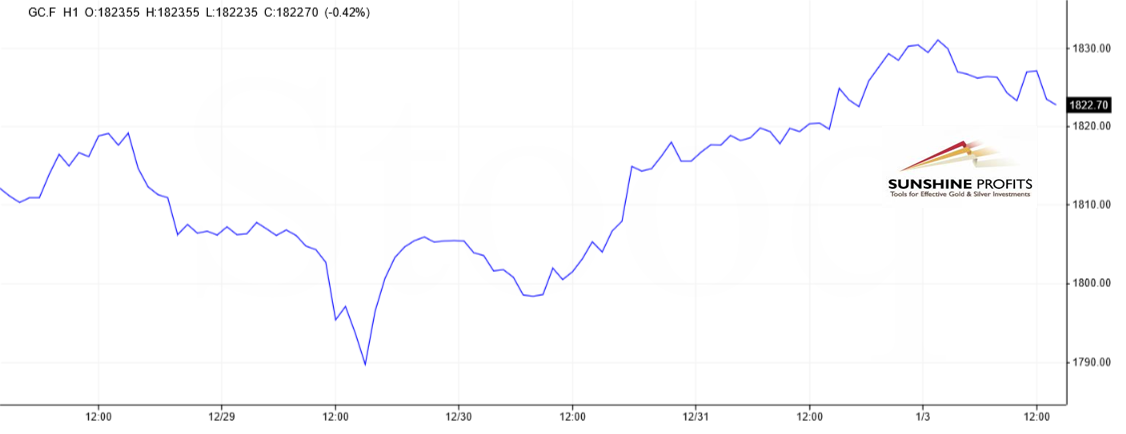

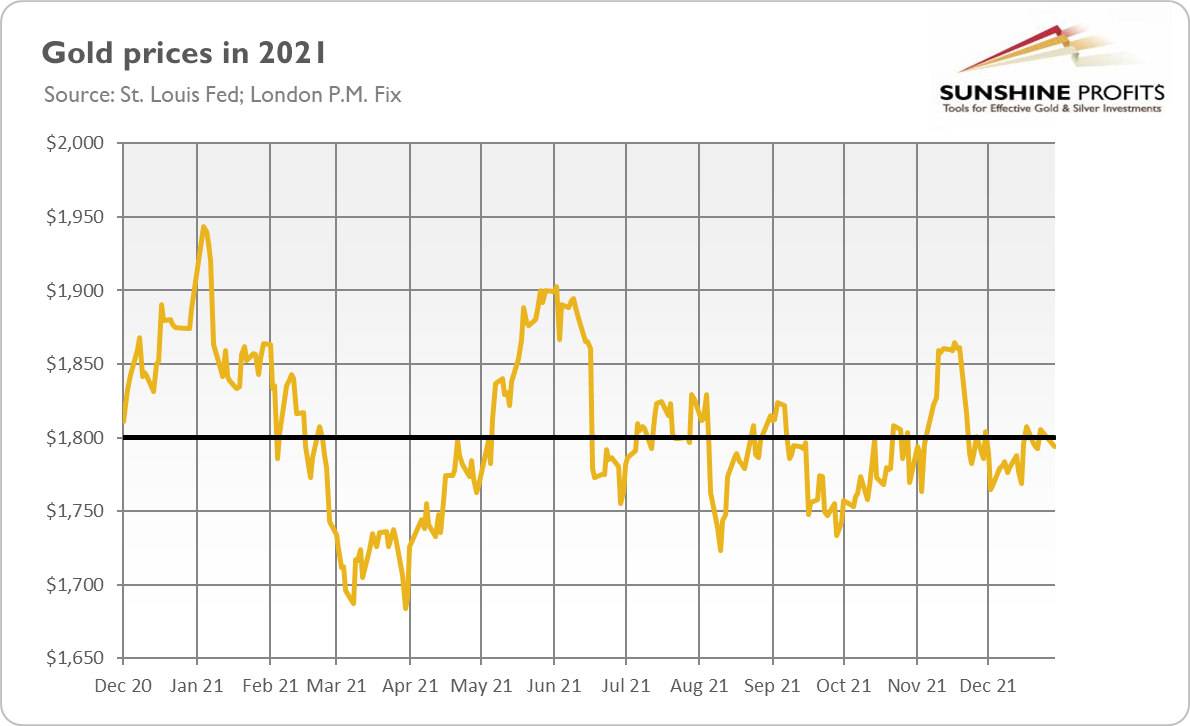

So far, so good – the first three days of 2022 didn’t bring a new catastrophe. It’s probably just the calm before the storm, but the new year started well. Even the price of gold has risen! As the chart below shows, the yellow metal managed to jump above the key level of $1,800 at the very end of 2021, but it still maintains its position (at least as of early January 3, 2022).

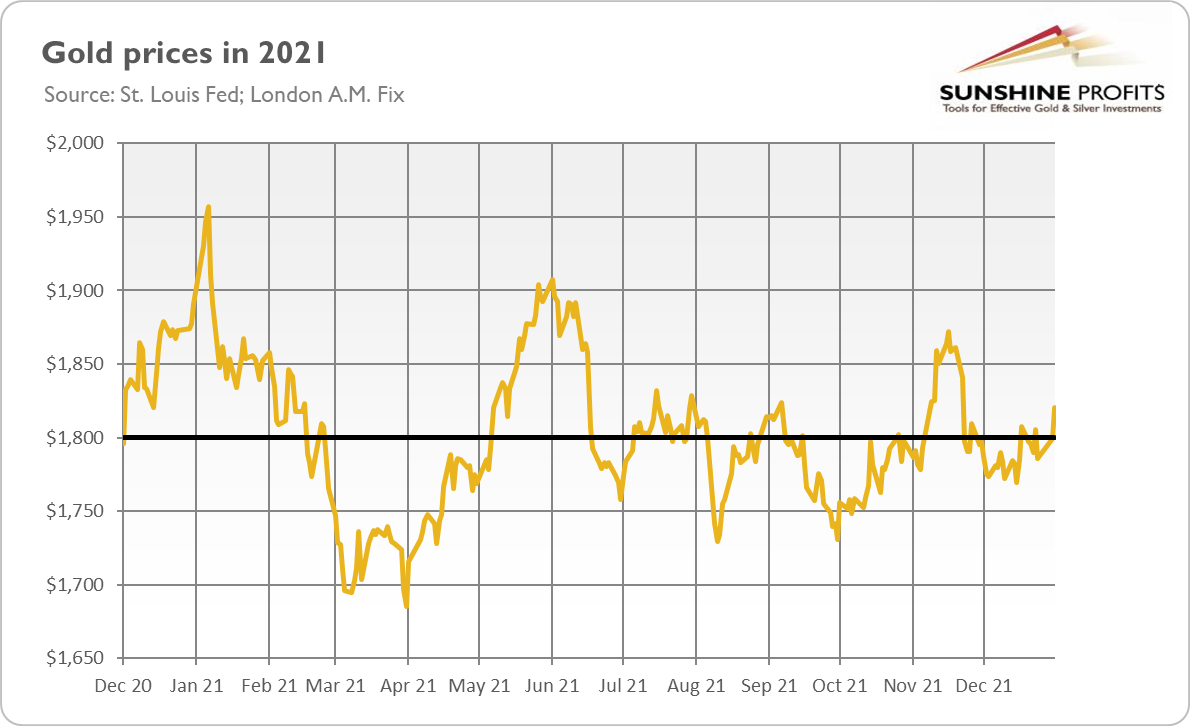

It reminds me of the beginning of 2021. Gold also started last year with a bang, only to plunge later. Its price increased 3.5% during the first week of the year, reaching $1,957, and then began its big downward move. As the chart below shows, the yellow metal plunged below $1,700 at the very end of March.

Hence, although January is historically a good month for gold, it might be too early to celebrate, and investors should exercise caution. However, luckily for gold bulls, there is one significant difference between 2021 and 2022. Last year, there were Georgia runoffs and Democrats took over both the White House and the full Congress (the House and the Senate). That was when the blue wave plunged the yellow metal.

This year should be politically calmer for the US (so, we don’t count the odds of Russia invading Ukraine and China attacking Taiwan), but the major threat to the gold market remains the same: a rise in the real interest rates. In January 2021, it was the blue wave that triggered a rebound in rates, but it may be induced by many more factors in the future. It could be the development of a new cure against coronavirus and the end of the pandemic, a more hawkish Fed, or a decline in inflation.

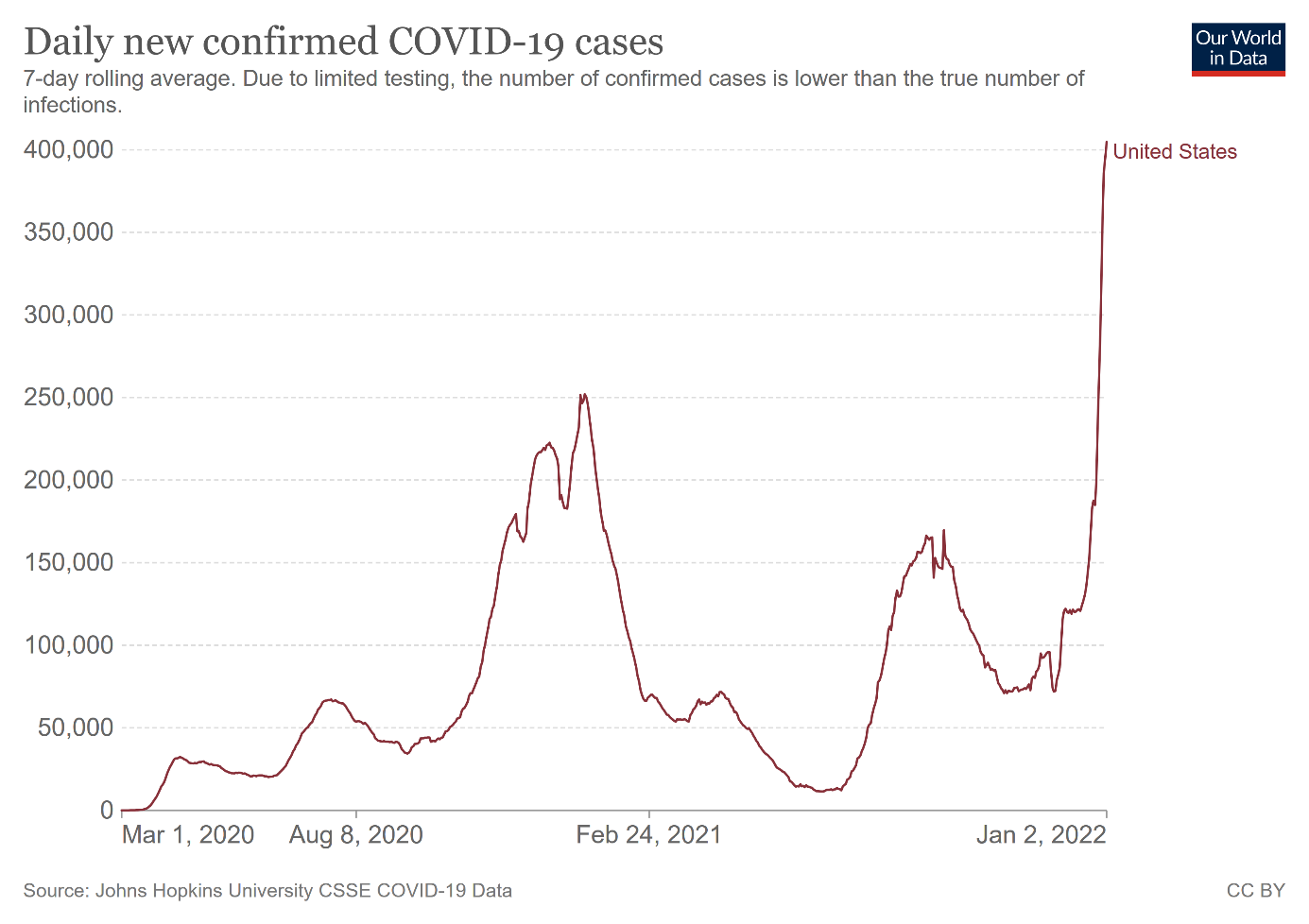

The spread of the Omicron variant keeps worries alive. After all, as the chart below shows, the 7-day rolling average of COVID-19 cases in the United States has hit a record high of about 405,000. When we are completely back to normalcy, risk appetite and bond yields may increase.

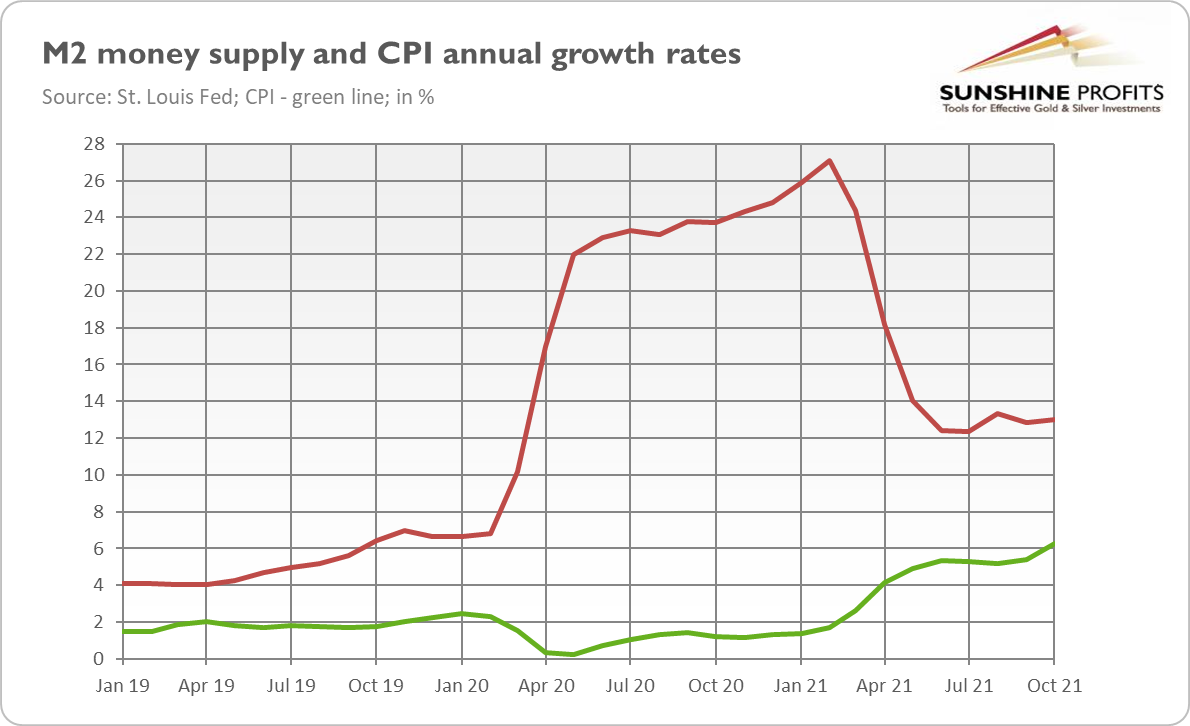

Another risk for gold is the stabilization of inflation and even subsequent disinflation. As the chart below shows, we got a one-off boost in the money supply, so inflation is likely to peak this year. Inflation expectations should ease then, and real interest rates may rebound in such a scenario.

What gives me some comfort here is that the pace of money supply growth hasn’t returned to the pre-pandemic level yet, but it stays at an elevated level (although much below the peak). It should support high inflation this year. Moreover, the Fed is likely to remain behind the curve and the peak in inflation may only strengthen the dovish camp within the FOMC (although investors should remember that the composition of the voting members of the Committee has become more hawkish in 2022).

Implications for Gold

What does it all imply for the gold market? Will the yellow metal resume its long-term bullish trend in 2022? Well, this is what a majority of investors that took part in Kitco News’ annual outlook survey believe. Of nearly 3,000 retail investors, 54% said they see gold prices above $2,000 by the end of the year. This is also in line with Goldman Sachs’ call for gold in 2022.

Other forecasters see gold prices trading in a range between $1,800 and $2,000. It’s certainly a possible scenario. After all, much of the Fed’s tightening cycle has already been priced in; and the last time gold bottomed was in December 2015, just around the first hike in the federal funds rate after the Great Recession.

However, I expect more volatile trading with strong downside potential. As a reminder, my educated guess is that gold may plunge at some point amid a rebound in bond yields, but will rise later as worries about the next economic crisis accumulate.

Indeed, it’s quite funny, but I haven’t even finished this article, and the price of gold has already started to slide amid rising US dollar index and Treasury yields, in line with my warnings from the beginning of this text. This is how I became a prophet. Now I can see that as soon as you finish reading this article you will continue surfing the internet!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will 2022 Be Better for Gold Than 2021?

December 30, 2021, 11:24 AM2021 was bad for gold. Unfortunately, 2022 doesn’t look any better, especially at the beginning. The end, however, gives the yellow metal some hope…

Bye, bye 2021! It definitely wasn’t a year of gold. As the chart below shows, the yellow metal lost 5% of its value over the last twelve months, declining from $1,887.60 on December 30, 2020, to $1,794.25 on December 29, 2021. Thus, the gold bulls won’t miss 2021, I guess.

What about me? Well, I correctly predicted in January that “gold’s performance in 2021 could be worse than last year”. However, I expected more bullish behavior. I thought that rising inflation would be more supportive of gold prices. I’m fully aware that gold is not a perfect inflation hedge, but historical analysis suggests that high and accelerating inflation should be positive for gold prices. After all, inflation lowers the real interest rates, the key fundamental factor in the gold market.

However, rising inflation has prompted the Fed to tighten its monetary policy and speed up the tapering of its quantitative easing. Expectations of hikes in the federal funds rate in 2022 also strengthened. In consequence, as the chart below shows, bond yields rose, especially those short- and medium-term, creating downward pressure on gold prices. Thus, we’ve learned two important lessons in 2021: don’t just count on inflation, and don’t fight with the (hawkish) Fed.

As you can see, bond yields haven’t returned to their pre-pandemic level yet. Although they don’t have to fully recover, they do have room for further increases. The issue here is that when inflation peaks and disinflation starts, inflation expectations could decline, boosting the real interest rates. Actually, market-based inflation expectations already peaked in November, as shown in the chart below. This indicates that worries about inflation had calmed and investors had regained some confidence in the US central bank’s ability to contain upward price pressure.

Implications for Gold

Will 2022 be better for gold than 2021? It’s possible, but I’m not an optimist. I mean here: macroeconomic conditions will turn more bearish for gold. Despite the spreading of Omicron variant of coronavirus, 2022 could mark the end of the global Covid-19 epidemic with a full economic recovery and a return to normal conditions. Fiscal policy will tighten, while the Fed will adopt a more hawkish monetary policy than in 2021. Supply shocks are easing, so inflation may peak, while real interest rates go up further. Moreover, the US dollar may strengthen against the euro, as the ECB is slower with its monetary policy tightening.

On the other hand, there are also some factors that could support gold prices. In 2021, GDP rebounded greatly after the economic crisis of 2020, and financial markets also recovered robustly. 2022 may be more challenging for economic growth and the financial sector, though. One thing is the base effect, while another is central banks’ policy normalization and rising interest rates. With massive public and private debts, the Fed’s tightening cycle could deflate asset and credit bubbles and even trigger a recession, or at least a market correction.

However, there are no signs of market stress yet, so a financial crisis is not in my baseline scenario for the next year. 2023 (or even later) is a more probable timeframe. Hence, I believe that the end of 2022 may be better for gold than the beginning of the year, as mere expectations of the Fed’s tightening cycle could be replaced by worries about the consequences of interest rate hikes.

Anyway, 2021 is (almost) dead. Long live 2022! I wish you a return to normalcy, shining profits and all the golden next year!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

2022 – The Year of (Gold) Inflation?

December 28, 2021, 9:47 AMHigh inflation won’t go away in 2022. Good for gold. However, it is likely to continue to climb and reach its peak. That sounds a bit worse for gold.

If 2021 was tough for you, I don’t recommend reading Nostradamus’ predictions for the next year. This famous French astrologer saw inflation, hunger, and much more coming in 2022:

So high the price of wheat,

That man is stirred

His fellow man to eat in his despair

Yuk! So, life is about to get a little more complicated: we must now avoid becoming infected and being eaten by our fellow citizens! If you are interested in how cannibalism will affect the gold market, I’m afraid that I don’t have adequate data. Anyway, if you end up in the pot together with vegetables and your colleagues, gold’s performance probably won’t be your top priority.

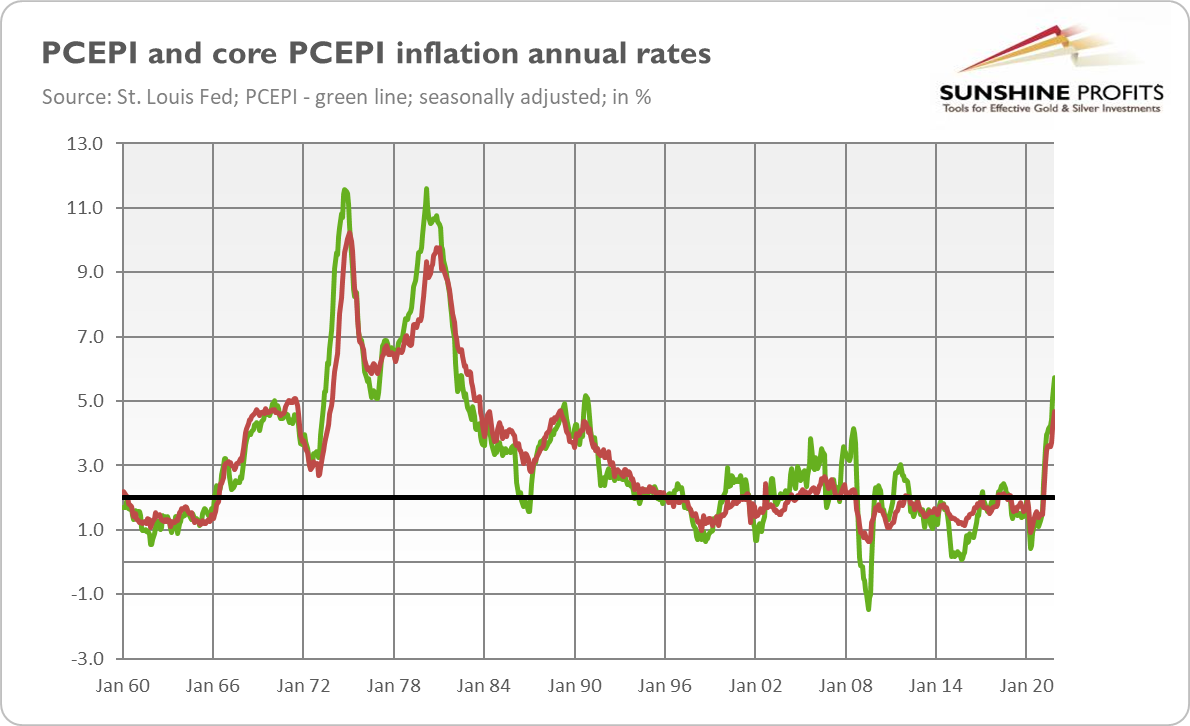

Hence, let’s focus on inflation. Last week, the Bureau of Economic Analysis released the latest data on the Personal Consumption Expenditures Price Index. This measure of inflation surged 5.7% in the 12 months ended in November, which was the fastest increase since July 1982. Meanwhile, as the chart below shows, the core index, which excludes energy and food, rose 4.7%. It was the highest jump since February 1989.

This is very important, as it shows that inflation is not elevated merely by rising energy prices. Instead, it’s more broad-based, which can make inflation more lasting. Indeed, there are strong reasons to expect that high inflation will stay with us in 2022.

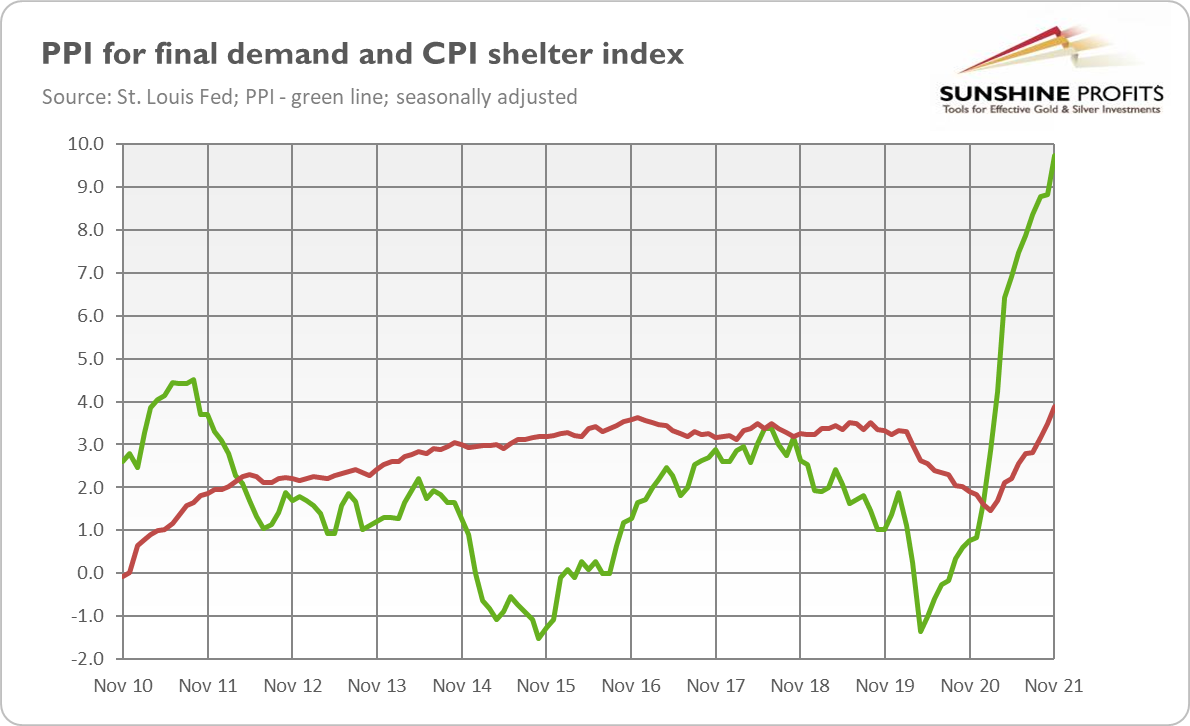

As the chart below shows, the shelter index – the biggest CPI component – has been rising recently, which should move the whole index up. In other words, surging home prices could translate into higher rents, supporting consumer inflation.

Additionally, the Producer Price Index has also been rallying this year. The final demand index rose 9.6% on an annual basis in November, the largest advance since 12-month data was first calculated in late 2010. Moreover, the commodity index surged 23%, and it was the highest jump since November 1974. All this indicates that inflationary pressure remains strong.

Implications for Gold

To be clear, inflation will eventually peak, and this will probably happen in 2022. This is because a one-time helicopter drop (the surge in the money supply) leads to a one-time jump in the price level. However, inflation is like toothpaste. It’s easy to get it out, but it’s difficult to get it back in again.

To use another metaphor, if you wait with your actions until you see the whites of the eyes of a tiger, you can be eaten (sorry for being monothematic today!). This was exactly the Fed’s strategy with the inflationary tiger for most of 2021. Yes, the US central bank accelerated tapering of quantitative easing in December, but it remains behind the curve (or, to continue the metaphor, it’s still holding the tiger by the tail).

What does it all mean for the gold market? High inflation should support gold prices. The expectations of a more hawkish Fed probably prevent a big rally, but ultra-low real interest rates are supportive of the yellow metal.

However, what is one of my biggest worries for the next year (except for the perspective of being eaten by hungry neighbors) is how gold will react to the peak in inflation. Although inflation will stay elevated, it won’t rise indefinitely. When it peaks, real interest rates could go up, negatively affecting the yellow metal.

Of course, one would say that the peak of inflation would be accompanied by a more dovish Fed, so disinflation doesn’t have to hurt gold, just as rising inflation didn’t make it shine. However, this is not so simple, and if inflation stays above 5%, the Fed could still feel obligated to act and bring inflation to its 2% target. Anyway, US monetary policy (together with fiscal policy) will be tighter compared to 2020 and to other major countries, which (together with a likely peak in inflation) creates a rather challenging macroeconomic environment for gold in 2022 (at least until worries about the negative consequences of the Fed’s tightening cycle emerge).

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM