-

Houston, We Have a Stagflation Problem. Now It’s Time for Gold!

June 9, 2022, 10:29 AMExperts from the World Bank finally admitted that the risk of stagflation is getting bigger and more real. For gold, however, that's pretty good news.

Better Late Than Never

First they ignore you, then they laugh at you, then they fight you, and finally you win. Indeed, several months ago, pundits were dismissing the possibility of stagflation. The possibility that I was emphasizing almost from the very beginning of the pandemic-related economic crisis and the subsequent jump in inflation. In the summary of the Gold Market Overview for April 2021, I wrote:

The US economy is likely to shift from an economic recovery to stagflation in the upcoming months. Even the Fed itself admits that inflation will jump this year. Of course, the central banks are trying to convince us that inflation will be only transitory, but it’s possible that they underestimate the inflationary risk and overestimate their ability to deal with it.

This is exactly where we are right now. After months of saying inflation was temporary and laughing at warnings of stagflation, this time is different! In its latest report, Global Economic Prospects, the World Bank admitted that “stagflation risks are rising amid a sharp slowdown in growth.” The institution reduced its global growth forecast from 5.7 percent in 2021 to 2.9 percent in 2022, which is significantly lower than the 4.1 percent that was predicted in January. What’s really disturbing is that between 2021 and 2024, global growth is projected to have slowed by 2.7 percentage points—more than twice the deceleration between 1976 and 1979.

Oops! Houston, we have a problem! Indeed, as World Bank President David Malpass said in the foreword to the report, the risk of stagflation is likely now:

Amid the war in Ukraine, surging inflation, and rising interest rates, global economic growth is expected to slump in 2022. Several years of above-average inflation and below-average growth are now likely, with potentially destabilizing consequences for low- and middle-income economies. It’s a phenomenon—stagflation—that the world has not seen since the 1970s (…).

The danger of stagflation is considerable today (…). Subdued growth will likely persist throughout the decade because of weak investment in most of the world. With inflation now running at multidecade highs in many countries and supply expected to grow slowly, there is a risk that inflation will remain higher for longer than currently anticipated.

Treasury Secretary Janet Yellen also admitted this month that she was wrong a year ago when she said she anticipated inflation would be “a small risk,” “manageable” and “not a problem.” In an interview for CNN, she said:

I was wrong about the path inflation would take. As I mentioned, there have been unanticipated and large shocks to the economy that have boosted energy and food prices. And supply bottlenecks that affected our economy so badly that I didn’t, at the time, fully understand.

Rumors have it that Yellen has educated herself a bit recently.

Implications for Gold

What does it all mean for the economy and the gold market? Well, policymakers usually don’t admit that they were wrong. If they do, it’s only because they know how bad it’s about to get. The fact that the World Bank openly predicts stagflation is another indication that the economic situation is turning sour.

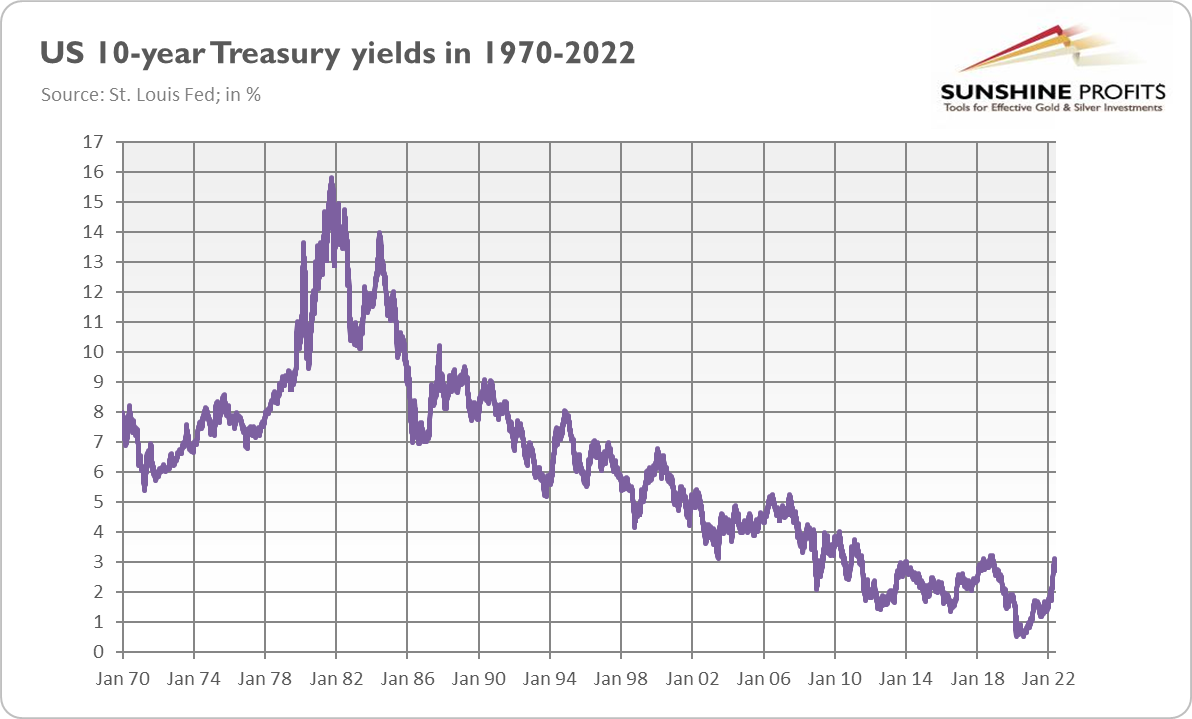

You see, to combat high inflation in the 1970s, the Fed was forced to hike interest rates so steeply that it triggered a global recession. As the chart below shows, the nominal 10-year Treasury yields have just briefly surpassed 3%, which is a relatively high level in recent times, but it’s nothing similar to the levels seen in the 1970s and 1980s. What’s particularly disturbing here is that the debt levels are much higher today than during the Great Stagflation, so the Fed’s tightening cycle could be potentially even more harmful now.

Stagflation should be positive for the gold bulls. The sample is small because there has only been one stagflation in the past, which overlapped with the end of the gold standard and the liberalization of the gold market, but still, a recession should make gold rally. The danger for gold is rising real interest rates, but the current path of monetary tightening is probably already priced in well by the markets, so only a more aggressive stance than the markets expect right now could harm the yellow metal.

As the chart above shows, gold prices continue to trade around the $1,850 level, and it seems that gold is waiting for something to decide which path to take. Next week’s Fed monetary policy meeting may provide a needed catalyst – we’ll see!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Despite Ultra-Hawkish Fed’s Meeting, Gold Jumps

March 17, 2022, 11:58 AMThe FOMC finally raised interest rates and signaled six more hikes this year. Despite the very hawkish dot plot, gold went up in initial reaction.

There has been no breakthrough in Ukraine. Russian invasion has largely stalled on almost all fronts, so the troops are focusing on attacking civilian infrastructure. However, according to some reports, there is a slow but gradual advance in the south. Hence, although Russia is not likely to conquer Kyiv, not saying anything about Western Ukraine, it may take some southern territory under control, connecting Crimea with Donbas. The negotiations are ongoing, but it will be a long time before any agreement is reached.

Let’s move to yesterday’s FOMC meeting. As widely expected, the Fed raised the federal funds rate. Finally! Although one Committee member (James Bullard) opted for a bolder move, the US central bank lifted the target range for its key policy rate only by 25 basis points, from 0-0.25% to 0.25-0.50%. It was the first hike since the end of 2018. The move also marks the start of the Fed’s tightening cycle after two years of ultra-easy monetary policy implemented in a response to the pandemic-related recession.

In support of these goals, the Committee decided to raise the target range for the federal funds rate from 1/4 to 1/2 percent and anticipates that ongoing increases in the target range will be appropriate.

It was, of course, the most important part of the FOMC statement. However, the central bankers also announced the beginning of quantitative tightening, i.e., the reduction of the enormous Fed’s balance sheet, at the next monetary policy meeting in May.

In addition, the Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting.

It’s also worth mentioning that the Fed deleted all references to the pandemic from the statement. Instead, it added a paragraph related to the war in Ukraine, pointing out that its exact implications for the U.S. economy are not yet known, except for the general upward pressure on inflation and downward pressure on GDP growth:

The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain, but in the near term the invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity.

These changes in the statement were widely expected, so their impact on the gold market should be limited.

Dot Plot and Gold

The statement was accompanied by the latest economic projections conducted by the FOMC members. So, how do they look at the economy right now? As the table below shows, the central bankers expect the same unemployment rate and much slower economic growth this year compared to last December. This is a bit strange, as slower GDP growth should be accompanied by higher unemployment, but it’s a positive change for the gold market.

What’s more, the FOMC participants see inflation now as even more persistent because they expect 4.3% PCE inflation at the end of 2022 instead of 2.6%. Inflation is forecasted to decline in the following years, but only to 2.7% in 2023 and 2.3% in 2024, instead of the 2.3% and 2.1% seen in December. Slower economic growth accompanied by more stubborn inflation makes the economy look more like stagflation, which should be positive for gold prices.

Last but not least, a more aggressive tightening cycle is coming. Brace yourselves! According to the fresh dot plot, the FOMC members see seven hikes in interest rates this year as appropriate. That’s a huge hawkish turn compared to December, when they perceived only three interest rate hikes as desired. The central bankers expect another four hikes in 2024 instead of just the three painted in the previous dot plot. Hence, the whole forecasted path of the federal fund rate has become steeper as it’s expected to reach 1.9% this year and 2.8% next year, compared to the 0.9% and 1.6% seen earlier.

Wow, that’s a huge change that is very bearish for gold prices! The Fed signaled the fastest tightening since 2004-2006, which indicates that it has become really worried about inflation. It’s also possible that the war in Ukraine helped the US central bank adopt a more hawkish stance, as if monetary tightening leads to recession, there is an easy scapegoat to blame.

Implications for Gold

What does the recent FOMC meeting mean for the gold market? Well, the Fed hiked interest rates and announced quantitative tightening. These hawkish actions are theoretically negative for the yellow metal, but they were probably already priced in. The new dot plot is certainly more surprising. It shows higher inflation and slower economic growth this year, which should be bullish for gold. However, the newest economic projections also forecast a much steeper path of interest rates, which should, theoretically, prove to be negative for the price of gold.

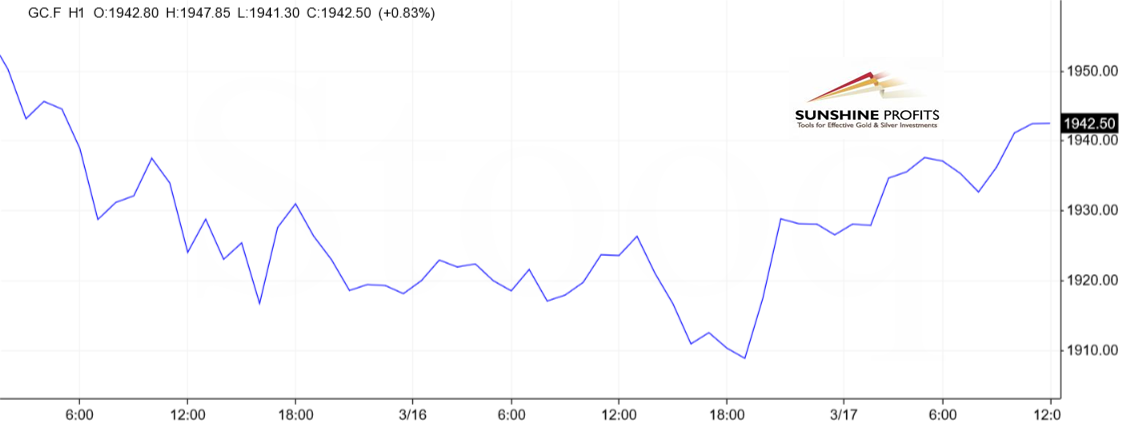

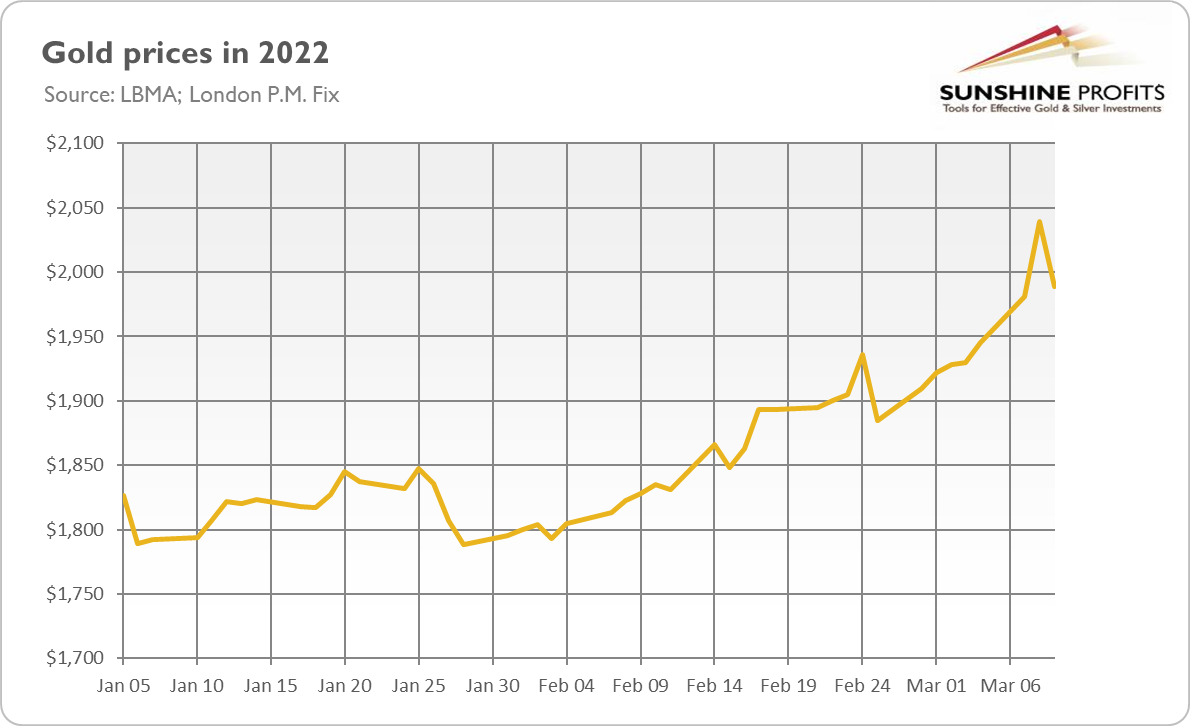

How did gold perform? Well, it has been sliding recently in anticipation of the FOMC meeting. As the chart below shows, the price of the yellow metal plunged from $2,039 last week to $1,913 yesterday.

However, the immediate reaction of gold to the FOMC meeting was positive. As the chart below shows, the price of the yellow metal rebounded, jumping above $1,940. Of course, we shouldn’t draw too many conclusions from the short-term moves, but gold’s resilience in the face of the ultra-hawkish FOMC statement is a bullish sign.

Although it remains to be seen whether the upward move will prove to be sustainable, I wouldn’t be surprised if it will. This is what history actually suggests: when the Fed started its previous tightening cycle in December 2015, the price of gold bottomed out. Of course, history never repeats itself to the letter, but there is another important factor. The newest FOMC statement was very hawkish – probably too hawkish. I don’t believe that the Fed will hike interest rates to 1.9% this year. And you? It means that we have probably reached the peak of the Fed’s hawkishness and that it will rather soften its stance from then on. If I’m right, a lot of the downward pressure that constrained gold should be gone now.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Prices Fall Despite Ongoing War and Surging Inflation

March 15, 2022, 8:44 AMIt seems that the stalemate in Ukraine has slowed down gold's bold movements. Will the Fed's decision on interest rates revive them again?

The tragedy continues. As United Nations Secretary-General António Guterres said yesterday, “Ukraine is on fire and being decimated before the eyes of the world.” There have already been 1,663 civilian casualties since the Russian invasion began. What is comforting in this situation is that Russian troops have made almost no advance in recent days (although there has been some progress in southern Ukraine). They are attempting to envelop Ukrainian forces in the east of the country as they advance from the direction of Kharkiv in the north and Mariupol in the south, but the Ukrainian Armed Forces continue to offer staunch resistance across the country.

So, it seems that there is a kind of stalemate. The Russians don’t have enough forces to break decisively through the Ukrainian defense, while Ukraine’s army doesn’t have enough troops to launch an effective counteroffensive and get rid of the occupiers. Now, the key question is: in whose favor is time working? On the one hand, Russia is mobilizing fighters from its large country, but also from Syria and Nagorno-Karabakh. The invaders continue indiscriminate shelling and air attacks that cause widespread destruction among civilian population as well. On the other hand, each day Russian army suffers heavy losses, while Ukraine is getting new weapons from the West.

Implications for Gold

How is gold performing during the war? As the chart below shows, the recent stabilization of the military situation in Ukraine has been negative for the yellow metal. The price of gold slid from its early March peak of $2,039 to $1,954 one week later (and today, the price is further declining). However, please note that gold makes higher highs and higher lows, so the outlook remains rather positive, although corrections are possible. On the other hand, gold’s slide despite the ongoing war and a surge in inflation could be a little disturbing.

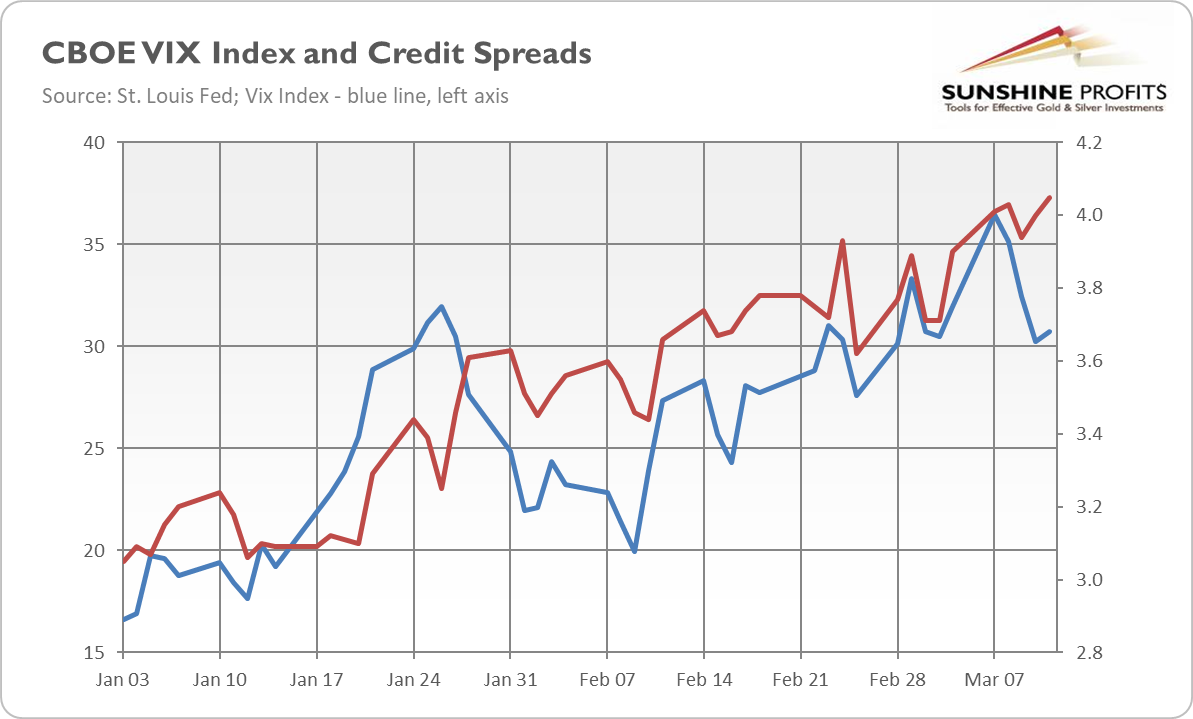

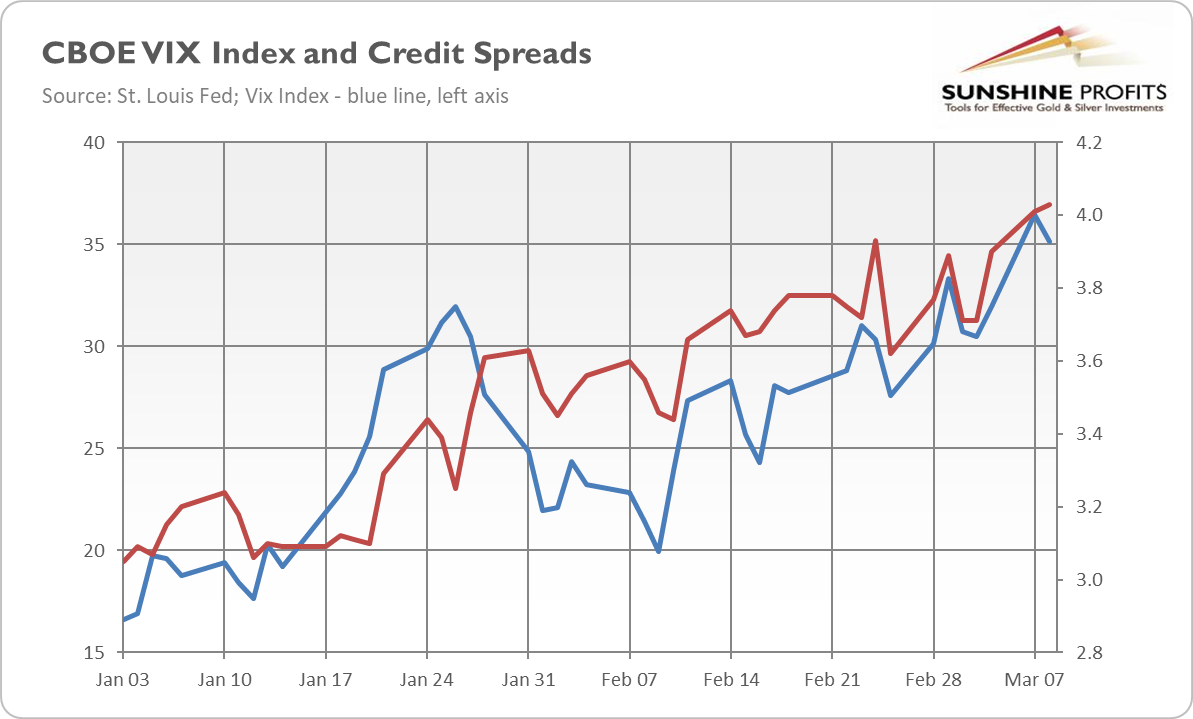

However, the reason for the decline is simple. It seems that the uncertainty reached its peak last week and has eased since then. As the chart below shows, the CBOE volatility index, also called a fear index, has retreated from its recent peak. The Russian troops have made almost no progress, the most severe response of the West is probably behind us, and the world hasn’t sunk into nuclear war. Meanwhile, the negotiations between Russia and Ukraine are taking place, offering some hope for a relatively quick end to the war. As I wrote last week, “there might be periods of consolidation and even corrections if the conflict de-escalates or ends.” The anticipation of tomorrow’s FOMC meeting could also contribute to the slide in gold prices.

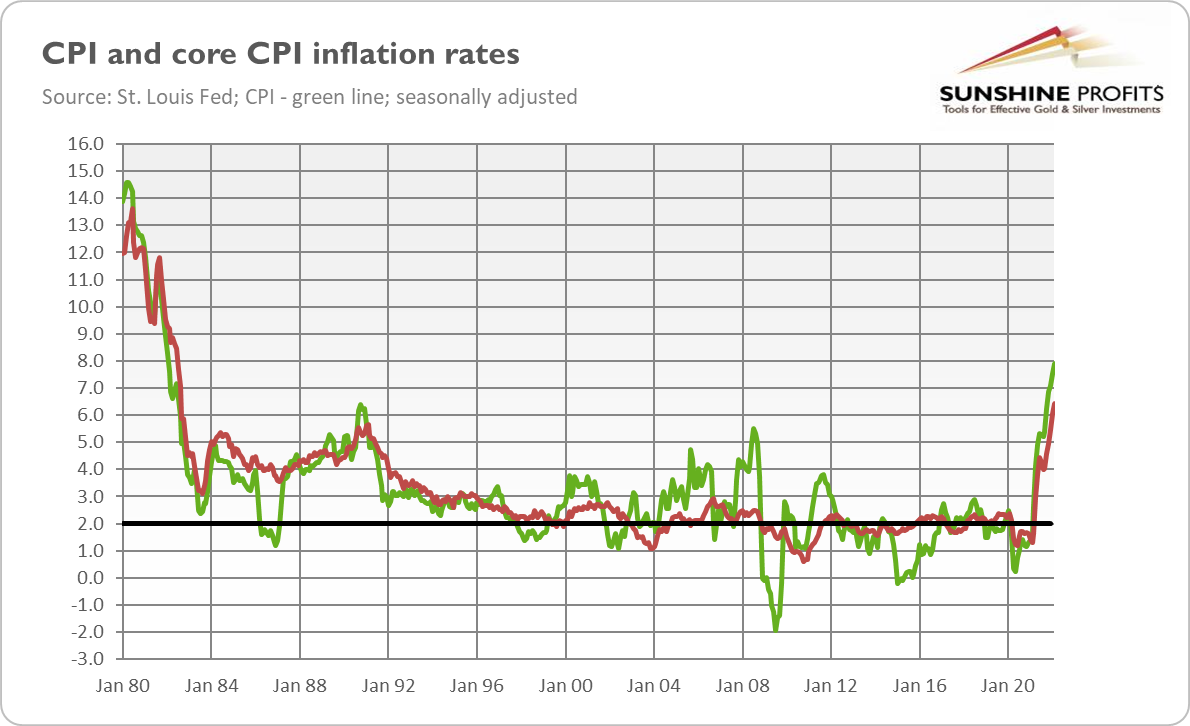

However, the chart above also shows that credit spreads, another measure of risk perception, have continued to widen in recent days. Other fundamental factors also remain supportive of gold prices. Let’s take, for instance, inflation. As the chart below shows, the annual CPI rate has soared from 7.5% in January to 7.9% in February, the largest move since January 1982. Meanwhile, the core CPI, which excludes food and energy prices, surged from 6.0% to 6.4% last month, also the highest reading in forty years.

The war in Ukraine can only add to the inflationary pressure. Prices of oil and other commodities have already soared. The supply chains got another blow. The US Congress is expanding its spending again to help Ukraine. Thus, the inflation peak would likely occur later than previously thought. High inflation may become more embedded, which increases the odds of stagflation. All these factors seem to be fundamentally positive for gold prices.

There is one “but”. The continuous surge in inflation could prompt monetary hawks to take more decisive actions. Tomorrow, the FOMC will announce its decision on interest rates, and it will probably hike the federal funds rate by 25 basis points. The hawkish Fed could be bearish for gold prices. Having said that, historically, the Fed’s tightening cycle has been beneficial to the yellow metal when accompanied by high inflation. Last time, the price of gold bottomed out around the liftoff. Another issue is that, because of the war in Ukraine, the Fed could adopt a more dovish stance and lift interest rates in a more gradual way, which could be supportive of gold prices.

The military situation in Ukraine and tomorrow’s FOMC meeting could be crucial for gold’s path in the near future. The hike in interest rates is already priced in, but the fresh dot-plot and Powell’s press conference could bring us some unexpected changes in US monetary policy. Stay tuned!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

The War Is on for Two Weeks. How Does It Affect Gold?

March 10, 2022, 10:55 AMWith each day of the Russian invasion, gold confirms its status as the safe-haven asset. Its long-term outlook has become more bullish than before the war.

Two weeks have passed since the Russian attack on Ukraine. Two weeks of the first full-scale war in Europe in the 21th century, something I still can’t believe is happening. Two weeks of completely senseless conflict between close Slavic nations, unleashed without any reasonable justification and only for the sake of Putin’s imperial dreams and his vision of Soviet Reunion. Two weeks of destruction, terror, and death that captured the souls of thousands of soldiers and hundreds of civilians, including dozens of children.

Just yesterday, Russian forces bombed a maternity hospital in southern Ukraine. I used to be a fan of Russian literature and classic music (who doesn’t like Tolstoy or Tchaikovsky?), but the systematic bombing of civilian areas (and the use of thermobaric missiles) makes me doubt whether the Russians really belong to the family of civilized nations.

Now, for the warzone report. The country’s capital and largest cities remain in the hands of the Ukrainians. Russian forces are drawing reserves, deploying conscript troops to Ukraine to replace great losses. They are still trying to encircle Kyiv. They are also strengthening their presence around the city of Mykolaiv in southern Ukraine. However, the Ukrainian army heroically holds back enemy attacks in all directions. The defense is so effective that the large Russian column north-west of Kyiv has made little progress in over a week, while Russian air activity has significantly decreased in recent days.

Implications for Gold

How has the war, that has been going on for already two weeks, affected the gold market so far? Well, as the chart below shows, the military conflict was generally positive for the yellow metal, boosting its price from $1,905 to $1989, or about 4.4%. Please note that initially the price of gold jumped, only to decline after a while, and only then rallied, reaching almost $2,040 on Tuesday (March 8, 2022).

However, the price has retreated since then, below the key level of $2,000. This is partially a normal correction after an impressive upward move. It’s also possible that the markets are starting to smell the end of the war. You see, Russian forces can’t break through the Ukrainian defense. They can continue besieging cities, but the continuation of the invasion entails significant costs, and Russia’s economy is already sinking. Hence, they can either escalate the conflict in a desperate attempt to conquer Kyiv – according to the White House, Russia could conduct a chemical or biological weapon attack in Ukraine – or try to negotiate the ceasefire. In recent days, the President of Ukraine, Volodymyr Zelensky, said he was open to a compromise with Russia. Today, the Russian and Ukrainian foreign ministers met in Turkey for the first time since the horror started (unfortunately, without any agreement).

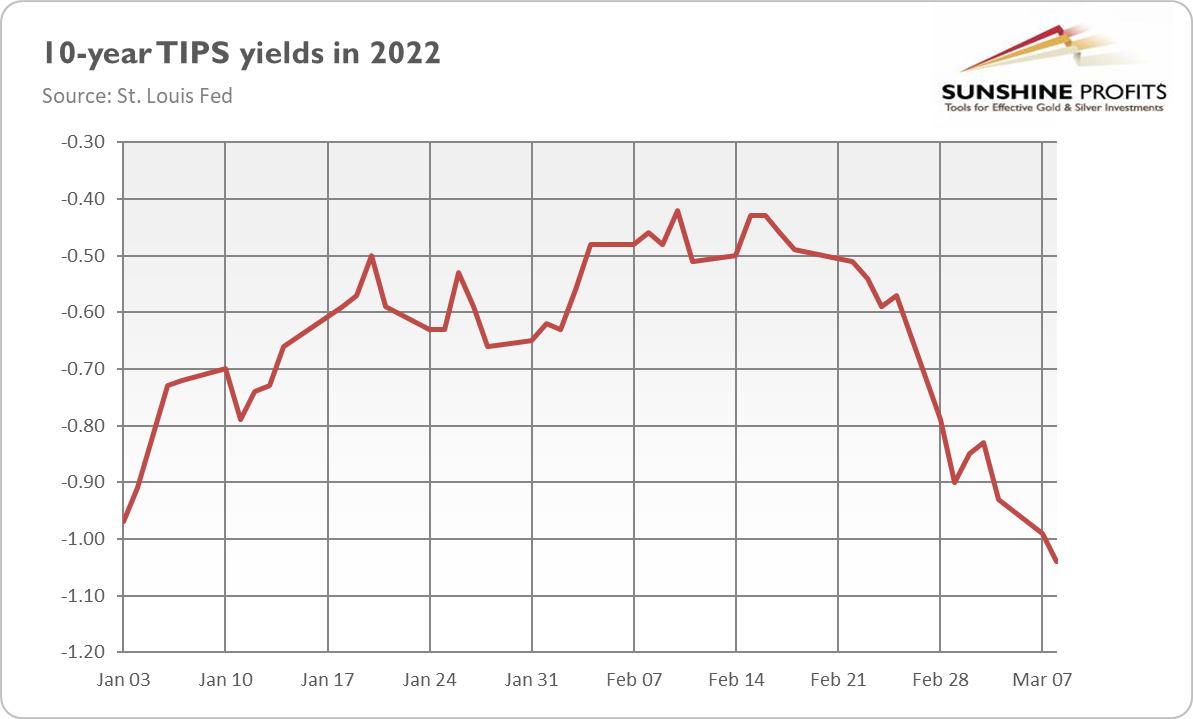

However, although gold prices may consolidate for a while or even fall if the prospects of the de-escalation increase, the long-term fundamentals have turned more bullish. As you can see in the chart below, the real interest rates decreased amid the prospects of higher inflation and slower economic growth. Russia and Ukraine are key exporters of many commodities, including oil, which would increase the production costs and bring us closer to stagflation.

What’s next, risk aversion increased significantly, which is supportive of safe-haven assets such as gold. After all, Putin’s decision to invade Ukraine is a turning point in modern history, which ends a period of civilized relations with Russia and relative safety in the world. Although Russia’s army discredited itself in Ukraine, the country still has nuclear weapons able to destroy the globe. As you can see in the chart below, both the credit spreads (represented here by the ICE BofA US High Yield Index Option-Adjusted Spread) and the CBOE volatility index (also called “the fear index”) rose considerably in the last two weeks.

Hence, the long-term outlook for gold is more bullish than before the invasion. The short-term future is more uncertain, as there might be periods of consolidation and even corrections if the conflict de-escalates or ends. However, given the lack of any decisions during today’s talks between Ukrainian and Russian foreign ministers and the continuation of the military actions, gold may rally further.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Ukraine’s Defense Shines ‒ and So Does Gold

March 8, 2022, 11:11 AMRussian forces have made minimal progress against Ukraine in recent days. Unlike the invader, gold rallied very quickly and achieved its long-awaited target - $2000!Nobody expected the Russian inquisition! Nobody expected such a fierce Ukrainian defense, either. Of course, the situation is still very dramatic. Russian troops continued their offensive and – although the pace slowed down considerably – they managed to make some progress, especially in southern Ukraine, by bolstering air defense and supplies. The invaders are probably preparing for the decisive assault on Kyiv. Where Russian soldiers can’t break the defense, they bomb civilian infrastructure and attack ordinary people, including targeting evacuation corridors, to spread terror. Several Ukrainian cities are besieged and their inhabitants lack basic necessities. The humanitarian crisis intensifies.

However, Russian forces made minimal ground advances over recent days, and it’s highly unlikely that Russia has successfully achieved its planned objectives to date. According to the Pentagon, nearly all of the Russian troops that were amassed on Ukraine’s border are already fighting inside the country. Meanwhile, the international legion was formed and started its fight for Ukraine. Moreover, Western countries have recently supplied Ukraine with many hi-tech military arms and equipment, including helicopters, anti-tank weapons, and anti-aircraft missiles, which could be crucial in boosting the Ukrainian defense.

Implications for Gold

What does the war in Ukraine imply for the precious metals? Well, gold is shining almost as brightly as the Ukrainian defense. As the chart below shows, the price of the yellow metal has surged above $1,980 on Monday (March 7, 2022), the highest level since August 2020.

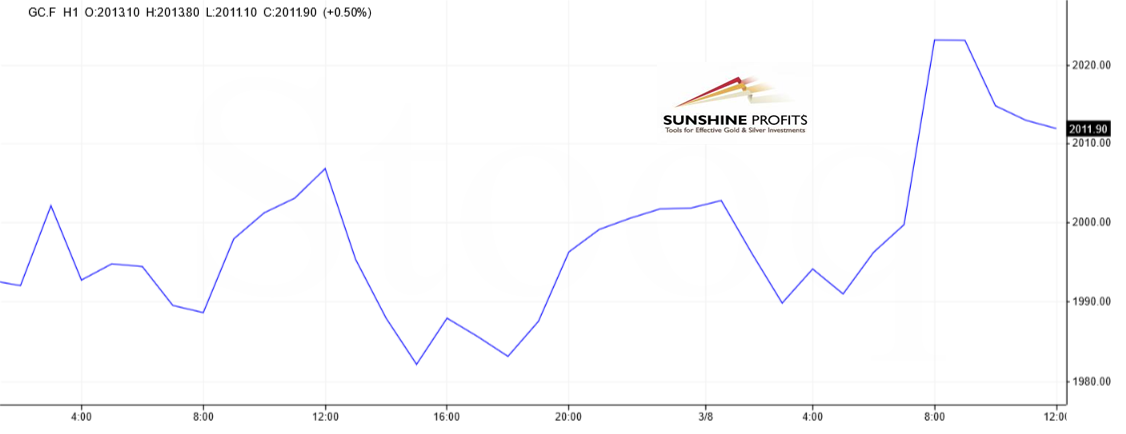

What’s more, as the next chart shows, during today’s early trading, gold has soared above $2,020 for a while, reaching almost an all-time high.

In my most recent report, I wrote: “as long as the war continues, the yellow metal may shine (…). The continuation or escalation of Russia’s military actions could provide support for gold prices.” This is exactly what we’ve been observing.

This is not surprising. The war has increased the safe-haven demand for gold, while investors have become more risk-averse and have continued selling equities. As you can see in the chart below, the S&P 500 Index has plunged more than 12% since its peak in early January. Some of the released funds went to the gold market.

What’s more, the credit spreads have widened, while the real interest rates have declined. Both these trends are fundamentally positive for the yellow metal. Another bullish driver of gold prices is inflation. It’s already high, and the war in Ukraine will only add to the upward pressure. The oil price has jumped above $120 per barrel, almost reaching a record peak. Higher energy prices would translate into higher CPI readings in the near future. Other commodities are also surging. For example, the Food Price Index calculated by the Food and Agriculture Organization of the United Nations has soared above 140 in February, which is a new all-time high, as the chart below shows. Higher commodity prices could lead to social unrest, as was the case with the Arab Spring or recent protests in Kazakhstan.

Higher energy prices and inflation imply slower real GDP growth and more stagflationary conditions. As a reminder, in 2008 we saw rapidly rising commodities, which probably contributed to the Great Recession. In such an environment, it’s far from clear that the Fed will be very hawkish. It will probably hike the federal funds rate in March, as expected, but it may soften its stance later amid the conflict between Ukraine and the West with Russia and elevated geopolitical risks. The more dovish Fed should also be supportive of gold prices.

However, when the fighting cools off, the fear will subside, and we could see a correction in the gold market. Both sides are exhausted by the conflict and don’t want to continue it forever. The Russian side has already softened its stance a bit during the most recent round of negotiations, as it probably realized that a military breakthrough was unlikely. Hence, when the conflict ends, gold’s current tailwind could turn into a headwind.

Having said that, the impact of the conflict may not be as short-lived this time. I'm referring to the relatively harsh sanctions and high energy prices that may last for some time after the war is over. . The same applies to a more hawkish stance toward Russia and European governments’ actions to become less dependent on Russian gas and oil. A lot depends on how the conflict will be resolved, and whether it brings us Cold War 2.0. However, two things are certain: the world has already changed geopolitically, and at the beginning of this new era, the fundamental outlook for gold has turned more bullish than before the war.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM