-

Silver: What Happened in 2022, and What Could Happen in 2023?

December 30, 2022, 7:05 PMIt was an especially intense year, and silver held on tight. If 2023 is even more intense than 2022, silver won’t have a choice but to rally.

A lot has happened this year. Russia invaded Ukraine. North Korea fired off missile after missile. Latin America turned to the left. The United Kingdom lost a queen, gained a king, and saw three Prime Ministers in Downing Street. President Xi Jinping was re-elected for an unprecedented third term as the General Secretary of the Communist Party of China, cementing his grip on power. Protests have been raging across Iran. The world population crossed 8 billion. On a personal note, my favorite sportsman and probably the best tennis player in history, Roger Federer, ended his brilliant career.

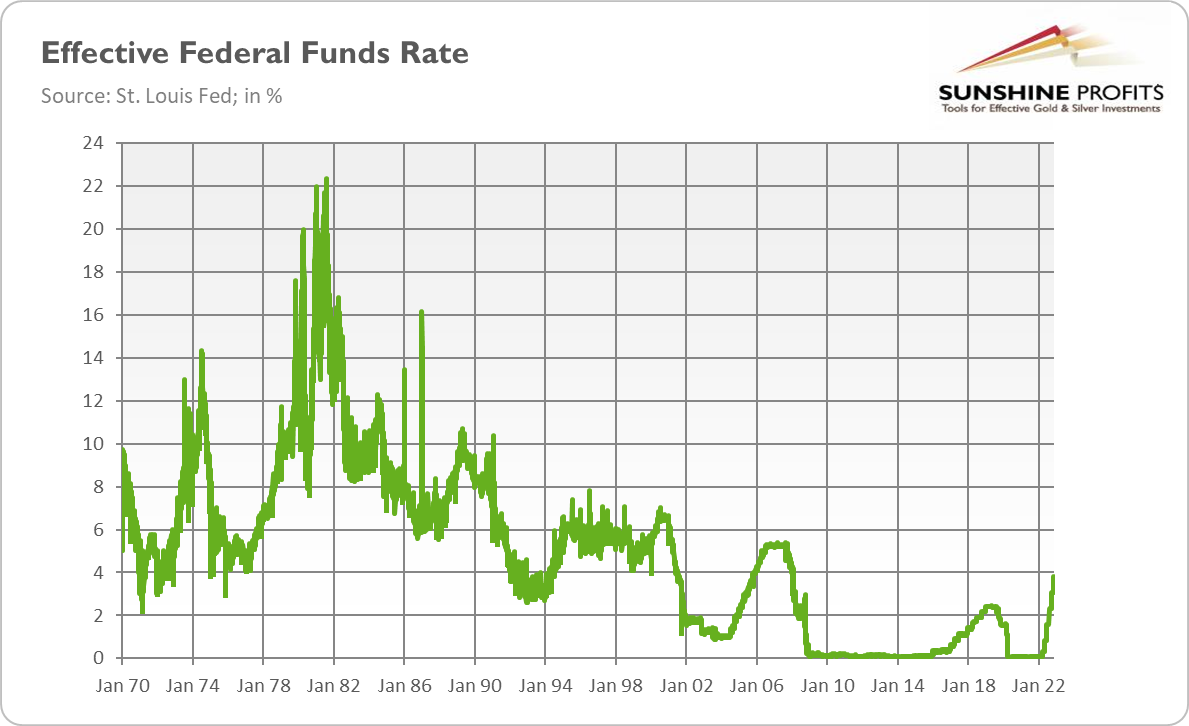

Focusing on economics, inflation soared to 9%, while the central bank hiked interest rates. Even the ECB joined the hawkish club. In particular, the Fed aggressively raised the federal funds rate by more than 4 percentage points to 4.52-4.50%. Consequently, the bond yields and the U.S. dollar soared, while the cryptocurrencies imploded. The American stock market entered a bear market. Oh, and Elon Musk bought Italy. Twitter, I mean Twitter!

2023 Could Be Even More Intense

Somewhere in 2023, we could see a recession. In October 2022, 27 states had negative growth in the state coincident indexes, which are used to assess recession-like conditions. According to the St. Louis Fed, the threshold to have reasonable confidence that the national economy entered a recession is 29 states. We are close. Anyways, the economy is going into stagnation with elevated inflation. Such a combination is called stagflation, and it should be beneficial for the precious metals. The next financial crisis is also possible, as some analysts have raised concerns about the sustainability of many private and public debts at the current, relatively high interest rates.

Implications for Silver

What does it all mean for the silver outlook for 2023? Well, I believe that the next year will be better for silver and gold than 2022. The reasoning is simple. Last year, the Fed’s tightening cycle created strong downward pressure on silver prices. But the metal managed to end the year with a modest gain, as the chart below shows!

Importantly, given the economic slowdown, the U.S. central bank won’t be as hawkish as in 2022. Actually, it could pivot and start to cut interest rates in 2023, especially since the American labor market is not as good as it seems at first glance.

I wish all of you – both bulls and bears – fulfillment of your dreams, successful transactions, and financial abundance in the new year of 2023!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Another Jumbo Rate Hike, Another Decline in Gold

November 3, 2022, 4:59 PMThe Fed delivered another 75-basis points hike. Gold didn’t like the FOMC meeting and declined further.

November’s FOMC gathering is behind us. It was quite boring. You know, another meeting, another 75-basis points hike…

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3 to -3-1/4 to 4 percent.

The Fed raised interest rates by that much for the fourth time in a row. It’s quite impressive, given that in the last tightening cycle, they increased the rates only in 25-basis point moves. As a result, the target range for the federal funds rate is now at 3.75-4.0%, the highest level since early 2008, as the chart below shows. Thus, we can say that the interest rates have finally normalized after the Great Recession!

Except for another hike, the statement on monetary policy was little change compared to September. The main alteration was adding the following sentence:

In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

In English, this sentence doesn’t mean anything special, as the FOMC didn’t say anything we wouldn’t have known about already. They didn’t reveal anything, apart from mentioning factors they take into account in their decisions. However, in Fedspeak, the sentence means that the Fed is going to decelerate the pace of the monetary policy tightening. The key part is “the cumulative tightening of monetary policy”, which signals the smaller moves in the interest rates to account for all the previous hikes, which affect the economy with an important lag. The decision hasn’t been yet made, but, as Powell admitted, “that time is coming, and it may come as soon as the next meeting or the one after that”. This dovish signal should support the price of gold. Actually, initially gold gained somewhat, but then hawkish Powell came and spoiled all the bullish fun.

Powell Says that Ultimate Rates Will Be Higher

The Fed Chairman admitted that financial conditions have tightened significantly and for the first time acknowledged that the Fed sees “the effects [of monetary policy tightening] on demand in the most interest-rate-sensitive sectors of the economy, such as housing.” He also admitted that the window for a soft landing has “narrowed” because of the monetary policy tightening. These were rather dovish remarks, but afterwards the hawkish tone began to dominate.

Most importantly, Powell stated that “the ultimate level of interest rates will be higher than previously expected”. As a reminder, at September’s meeting, the FOMC participants were seeing the peak in the federal funds rate between 4.5% and 4.75% next year. According to the CME FedWatch Tool, there are now about 72% odds of rates climbing to 5% or even higher by March 2023, an increase from about 22% one week ago. Higher expected rates implies lower gold prices.

Powell also reiterated the Fed’s commitment to remain restrictive in order to combat inflation: “the historical record cautions strongly against prematurely loosening policy. We will stay the course, until the job is done.”

And the job is clearly not done yet, so the Fed hasn’t over-tightened and it’s still not the time to think about a pause in rate hikes. But even “if we over-tightened, we have … our tools … [to] support economic activity. On the other hand, if you make a mistake in the other direction … then the risk really is that [inflation] has become entrenched in people’s thinking”, said Powell. Hence, the balance of risks is clear for the Fed: it would be better right now to have a too restrictive monetary policy rather than an easy one. That’s not what the gold bulls wanted to hear.

Implications for Gold

What does it all mean for the gold market? Well, the FOMC meeting was bearish for gold, as its price decreased again below $1,650, after an initial upward move to about $,1670. Today we see a continuation in declines, with the Comex price flirting with $1,620. All this implies that the downward trend that started in March this year (see the chart below) will remain untouched.

This is because there was no long-awaited pivot from the Fed. The FOMC members signaled the coming slowdown in the pace of the interest rates, but this dovish hint was more than neutralized by the hawkish message about a higher ultimate level of interest rates.

However, I believe that there is some room for very cautious optimism. What I mean here is that the Fed is entering a ‘fine-tuning’ phases instead of a ‘front-loading’ phase. The hikes will be continued, but we’re clearly approaching a peak in the level of the federal funds rate. According to the futures markets, we’ll see it as soon as in March 2023. And yesterday’s move by 75-basis points could be the last such big hike.

The implication for me is clear: gold will continue its downward move for some time, but next year should definitely be better for the yellow metal, as the Fed won’t be as aggressive as in 2022, and the chances of a hard landing, or a recession, are quite big – and even the central bank admits it.

Folks, on a personal note, this is the last edition of the Fundamental Gold Report, and it has been an honor and great fun to write these analyses for you throughout all these years. I’ll still be writing, and you’ll catch me soon, albeit with a different twist. I’m extremely grateful for this privilege and I wish you all lots of sun and big shiny profits!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

A Recession Is Coming, but Gold Feeds on Fear

October 27, 2022, 10:21 AMA recession is looming, but unless the Fed and people really fear it, gold won’t shine.

The famous House Stark’s words are “Winter is coming”. House Economists’ words are “recession is coming”.

I know that people can get fed up with recession warnings at some point, as they did with the boy who was constantly crying wolf. But there are more and more disturbing signals about black clouds gathering over the economy, despite the fact that the American GDP rose 2.6%, beating market expectations, in the third quarter.

First, America’s industrial engine is slowing down. The Philadelphia Fed Manufacturing Index for October came in at -8.7%, vs. -5% expected. The index remained in contraction territory for the second successive month. The Empire State Manufacturing Index also missed expectations. The index fell from -1.5% in September to -9.1%, while economists were looking for a decline to -4.3%.

Second, the Conference Board’s Leading Economic Index for the US decreased by 0.4 percent in September 2022 to 115.9, after remaining unchanged in August. The index is down 2.8 percent over the six-month period and this persistent downward trajectory suggests a recession is increasingly likely.

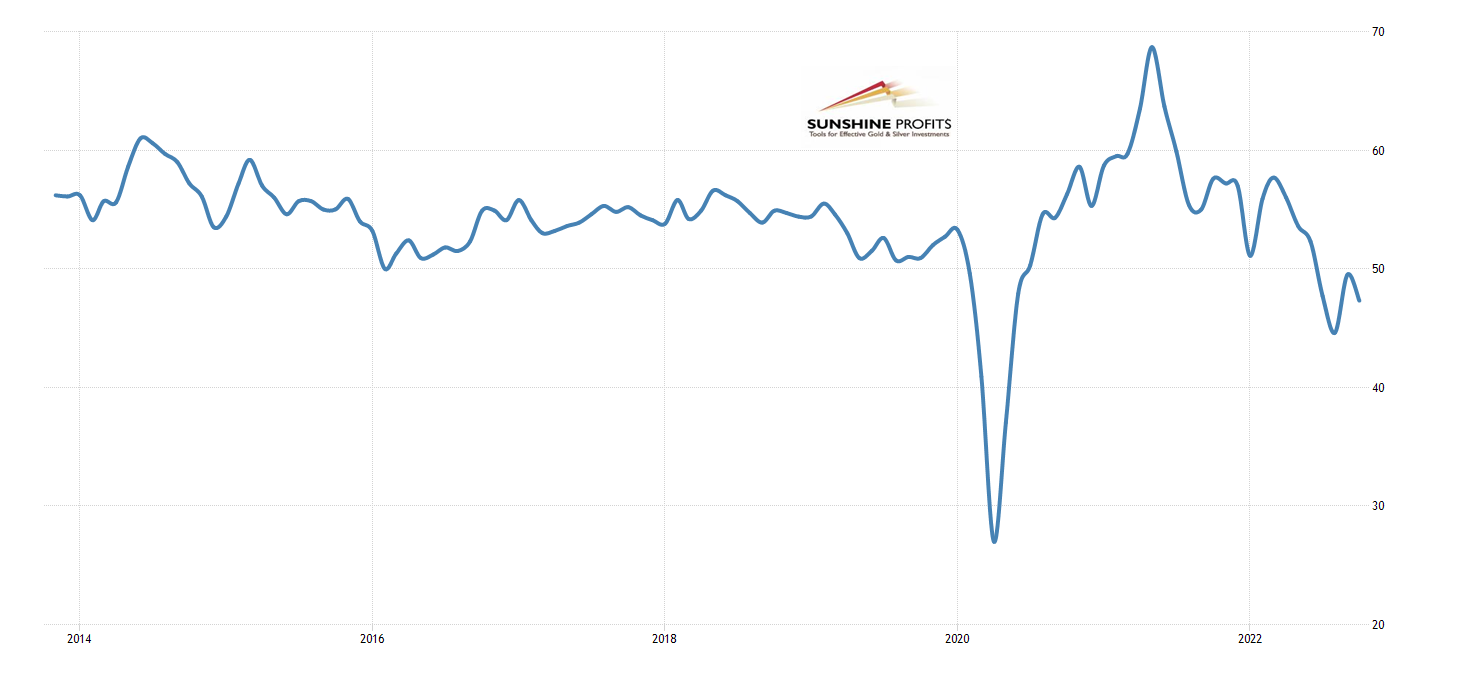

Third, according to the S&P Global Flash US Composite PMI, private sector firms in the US recorded a further downturn in output at the start of the fourth quarter. The index fell from 49.5 in September to 47.3 in October, as the chart below shows. The rate of decrease was the second-fastest since 2009 (with the exception of the early pandemic times).

The decline in business activity was driven by the solid fall in service sector output, as the S&P Global Flash US Services Business Activity Index posted a reading of 46.6 in October, down from 49.3 in September. As Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, commented on the report,

The US economic downturn gathered significant momentum in October, while confidence in the outlook also deteriorated sharply. The decline was led by a downward lurch in services activity, fuelled by the rising cost of living and tightening financial conditions (…) The surveys therefore present a picture of the economy at increased risk of contracting in the fourth quarter at the same time that inflationary pressures remain stubbornly high.

Oh, boy, we will get both contraction and inflation at the same time. What an offer! Two for the price of one! It will be so much fun, especially for the Fed, who will have to decide whether to stimulate the stagnating economy or fight inflation. What could possibly go wrong?

The Key Yield Curve Inverts

However, the most important recessionary signal is the inversion of the yield curve. The spread between 10 and 2-year Treasuries has been negative since June, but recently the difference between 10-year and 3-month has dived below zero, as the chart below shows.

This is actually breaking news, as this yield curve is believed to be the most reliable recessionary indicator in the economic history. It’s not perfect, but it’s the best we have – in the past fifty years, its inversion preceded all economic downturns, without giving any false alarms. You have been warned!

Implications for Gold

What does it all mean for the gold market? Well, the looming recession is fundamentally positive for the yellow metal, especially that it could arrive before inflation recedes. In this scenario, we will have a stagflation in which gold should shine. Other positive factors are the latest ECB’s hike in interest rates from 0.75 to 1.50%, which should strengthen the euro against the greenback, gold’s arch-enemy, and recent expectations for the Fed’s pivot (although they may be short-lived).

However, investors should remember that a recession is still a remote event. The inversion of the yield curve happens several months before the downturn. Additionally, fundamental factors don’t affect gold prices automatically or immediately. They exert their influence through shaping market stories and people’s narratives about the gold market, under whose influence they make decisions. What I have in mind here is that unless people are really afraid of the recession, it won’t affect positively the gold market. What the gold bulls need is either a market panic or the Fed’s pivot that would result in a decline in real interest rates.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

While Inflation Refuses to Go Away, Gold Refuses to Go Up

October 20, 2022, 10:36 AMThe recent CPI report shows that inflation remains high. It implies a hawkish Fed and bearish gold.

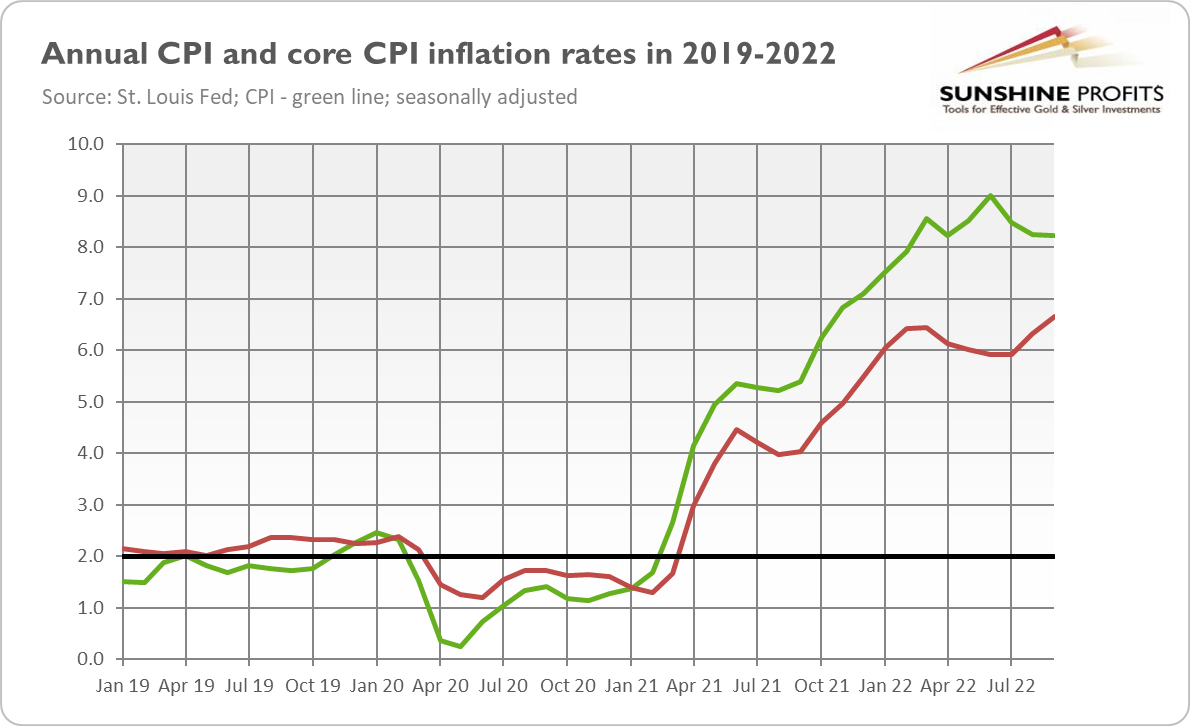

To paraphrase a famous Pink Floyd song, I wish you weren’t here, inflation! The CPI increased 0.4% in September, after rising 0.1% in August, according to the Bureau of Labor Statistics. The move was slightly higher than expected and occurred despite a 2.1% decline in the energy index. What’s really bad, especially for the poorest households, is that food prices continued to rise. The food index rose 0.8% for the month, the same as August, and was up 11.2% from a year ago.

Without plunging gas prices, inflation would be even higher. Indeed, the core CPI, which excludes food and energy prices, rose 0.6% last month, as it did in August. Increases in the prices of services (medical care, transportation, shelter) were the largest contributors to the increase in the core CPI monthly rate.

On an annual basis, the overall CPI increased 8.2% for the 12 months ending September, as the chart below shows. It’s a smaller number than the 8.3% rise in August but higher than expected (the market consensus was 8.1%). And the annual rate is still hovering near the highest levels since the early 1980s. The core CPI rose 6.6%, which means an acceleration from August, when it increased 6.3%. The rise was also above expectations. Although it seems that the overall index has peaked, at least for a while, the core CPI is once again on the rise, which doesn’t bode well for the inflationary outlook. Inflation simply refuses to go away.

Inflation Takes a Bite

What does stubbornly high inflation imply for the U.S. economy? So far, inflation has not had a significant impact on consumer spending. After all, it was caused by all the newly printed money that got into the hands of consumers, boosting their purchasing power. However, this is going to change, and inflation will eventually take its heavy toll, and we already see the first signs. Retail sales were flat in September, below market expectations. Meanwhile, the recession risk within a year rose from 65% to 100%, according to Bloomberg Economics. Yup, you read it correctly. The Bloomberg model says that there will be – for sure! – a recession by October 2023. So much for an economy “strong as hell,” Mr. Biden!

Recession will occur as a result of either inflation or the Fed's tightening cycle in response to price pressure. Bond yields rose following the release of the most recent CPI data, while the US dollar strengthened further. The odds of another 75-basis point interest rate hike at the FOMC meeting in November rose – right now, they are above 92%, compared to 60% one month ago, according to the CME FedWatch Tool.

Implications for Gold

What does it all mean for the gold market? Well, I don’t have good news. The fact that inflation remains absurdly high (and core inflation is even accelerating) implies that the Fed will stick to its hawkish monetary policy and continue to raise the federal funds rate. The tightening of monetary policy, which contributed to the rise in both interest rates and the greenback, is the main culprit behind the current bear market in gold. As the chart below shows, the price of the yellow metal declined this week to slightly above $1,630.

The problem is that as long as the Fed continues to raise interest rates, gold could continue to suffer. This week, Minneapolis Fed President Neel Kashkari said that “the Fed can’t pause its campaign of monetary policy tightening once its benchmark interest rate reaches 4.5% to 4.75% if ‘underlying’ inflation is still accelerating.” Traders are betting on another 75-basis points not only in November, but in December as well. It means that gold has, unfortunately, further room to go down this year.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

FOMC Minutes Don’t Offer Any Hope For Gold

October 13, 2022, 11:06 AMThe recent FOMC minutes confirm the Fed’s commitment to curb inflation and, apparently, gold prices.

For all those looking forward to the Fed’s pivot, I have bad news. The recently published FOMC minutes from the September meeting reveal strong concerns about “unacceptably high” inflation. The central bankers admitted that inflation is not falling as quickly as expected (is this surprising?).

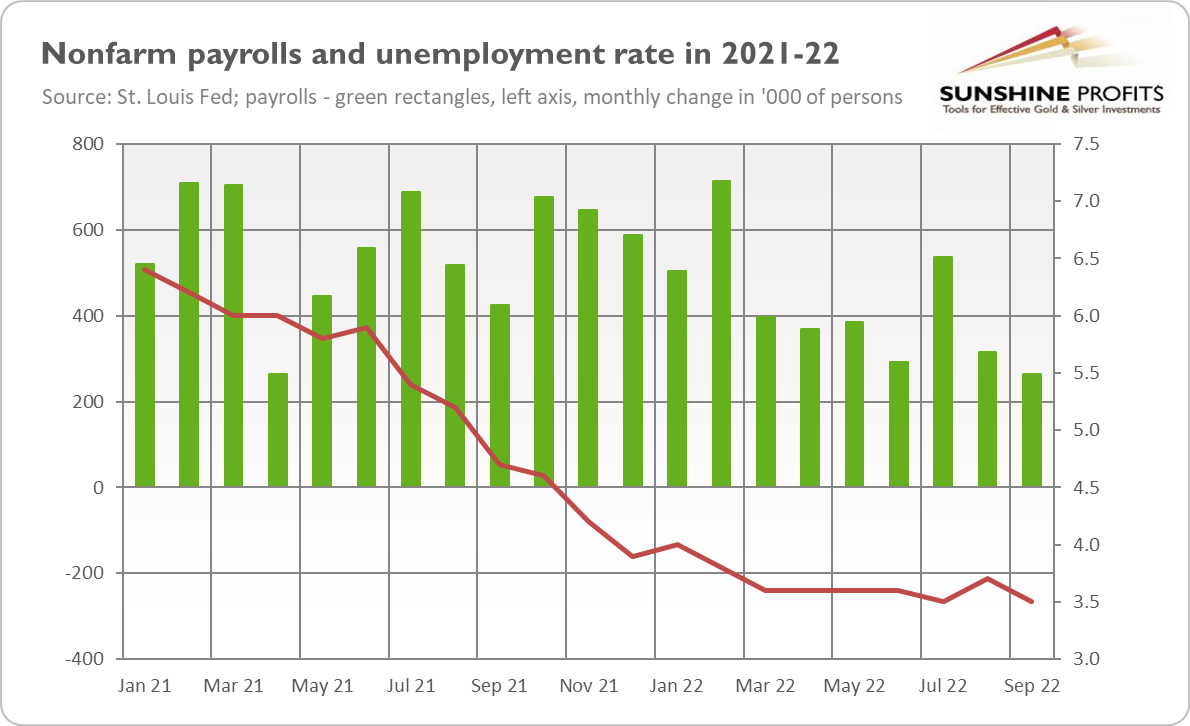

Well, if these economic geniuses hadn’t maintained for several months that inflation would be transitory and acted sooner, we wouldn’t have the current problem. Thus, Fed officials have to be very hawkish right now, simply because they let the inflationary genie get away. Hence, “participants reaffirmed their strong commitment to returning inflation to the Committee's 2 percent objective, with many stressing the importance of staying on this course even as the labor market slowed.” It means that the Fed is not likely to reverse its stance immediately when the unemployment rate increases. The softening of the labor market is expected or even desired by the FOMC participants, so they will react only to a surprisingly strong deterioration, which is bad news for the gold bulls.

The Labor Market Shows Resilience

The US labor market added 263,000 jobs in September, according to the BLS. The number was lower than in August (+315,000) and came slightly below expectations (275,000). However, job growth has averaged 420,000 per month this year and the U.S. labor market continues to show resilience during the Fed’s tightening cycle. What’s more, the unemployment rate declined from 3.7 to 3.5%, as the chart below shows. The drop was largely caused by a decline in labor participation, but the labor market remains relatively tight, allowing the Fed to hike the federal funds rate again. Hence, gold prices could remain under downward pressure.

Implications for Gold

What does it all mean for the gold market? Well, the recent FOMC minutes don’t offer any dovish hopes. Although participants acknowledged that "as the stance of monetary policy tightened further, it would become appropriate at some point to slow the pace of policy rate increases," this is still a matter of the distant rather than near future. Sure, we’re moving to the peak, but the Fed remains concerned about high inflation and seems really determined to lower it.

They see the labor market as very tight and inflation as broad-based and unacceptably high. Given such an outlook and the upside inflationary risk, FOMC members “continued to anticipate that ongoing increases in the target range for the federal funds rate would be appropriate to achieve the Committee’s objectives.” After all, the tightening so far hasn’t reduced inflation, which is staying at a higher level than expected:

Most participants remarked that, although some interest-sensitive categories of spending—such as housing and business fixed investment—had already started to respond to the tightening of financial conditions, a sizable portion of economic activity had yet to display much response. They noted also that inflation had not yet responded appreciably to policy tightening and that a significant reduction in inflation would likely lag that of aggregate demand.

What’s more, Fed officials believe that current aggressive monetary policy is the best strategy, even if the labor market softens, as it would be better to be too hawkish than too dovish right now. As perhaps the most important part of the FOMC minutes states,

In light of the broad-based and unacceptably high level of inflation, the intermeeting news of higher-than-expected inflation, and upside risks to the inflation outlook, participants remarked that purposefully moving to a restrictive policy stance in the near term was consistent with risk-management considerations. Many participants emphasized that the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action. Several participants underlined the need to maintain a restrictive stance for as long as necessary, with a couple of these participants stressing that historical experience demonstrated the danger of prematurely ending periods of tight monetary policy designed to bring down inflation.

As the chart below shows, gold was slightly moved by both the nonfarm payrolls and the FOMC minutes, and remains traded below $1,700. Although the minutes didn’t include any big surprises, they are hawkish and offer no clear hope for the gold bulls.

It means that the price of gold could go lower further in the near future. Gold will rebound one day, but it’s not likely to occur before the Fed pauses or reverses its stance amid an economic slowdown or outright recession. It’s going to arrive, but not right now. Winter is coming, but it won’t come before the fall is over.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM