-

Gold Plunged but Didn’t Knuckle Under to the Hawkish Fed

January 27, 2022, 7:48 AMThe FOMC set the stage for a March interest rate hike, which was an aggressive signal. Gold got it and fell – but hasn't capitulated yet.

The Battlecruiser Hawk is moving full steam ahead! The FOMC issued yesterday (January 26, 2022) its newest statement on monetary policy in which it strengthened its hawkish stance. First of all, the Fed admitted that it would start hiking interest rates “soon”:

With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate.

Previously, the US central bank conditioned its tightening cycle on the situation in the labor market. The relevant part of the statement was as follows in December:

With inflation having exceeded 2 percent for some time, the Committee expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment.

The alteration implies that, in the Fed’s view, the US economy has reached maximum employment and is ready to lift the federal funds rate. Indeed, Powell reaffirmed it, saying:

There’s quite a bit of room to raise interests without threatening the labor market. This is by so many measures a historically tight labor market — record levels of job openings, quits, wages are moving up at the highest pace they have in decades.

Powell also clarified the timing, stating that “the Committee is of the mind to raise the federal funds rate at the March meeting.” This is not completely unexpected, but does mark a significant hawkish change in the Fed’s communication, which is negative for gold.

Second, the FOMC reaffirmed its plan, announced in December, to end quantitative easing in early March. It means that in February, the Fed will buy only $20 billion of Treasuries and $10 billion of agency mortgage-backed securities, instead of the $40 and $20 purchased in January:

The Committee decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end in early March. Beginning in February, the Committee will increase its holdings of Treasury securities by at least $20 billion per month and of agency mortgage‑backed securities by at least $10 billion per month.

Third, the FOMC is preparing for quantitative tightening. Together with the statement on monetary policy, it published “Principles for Reducing the Size of the Federal Reserve's Balance Sheet”. The Fed hasn’t yet determined the timing and pace of reducing the size of its mammoth balance sheet. However, we know that it will happen after the first hike in interest rates, so probably as soon as May or June. After all, as Powell admitted during his press conference, “the balance sheet is substantially larger than it needs to be (...). There’s a substantial amount of shrinkage in the balance sheet to be done.”

Implications for Gold

What does the recent FOMC statement imply for the gold market? The end of QE, the start of the hiking cycle, and then of QT – all packed within just a few months – is a big hawkish wave that could sink the gold bulls. The Fed hasn’t been so aggressive for years.

Of course, maybe it’s just a great bluff, and the Fed will retreat to its traditional dovish stance soon when tightening monetary and financial conditions hit Wall Street and the real economy. However, with CPI inflation above 7%, mounting political pressure, and public outrage at costs of living, the US central bank has no choice but to tighten monetary policy, at least for the time being.

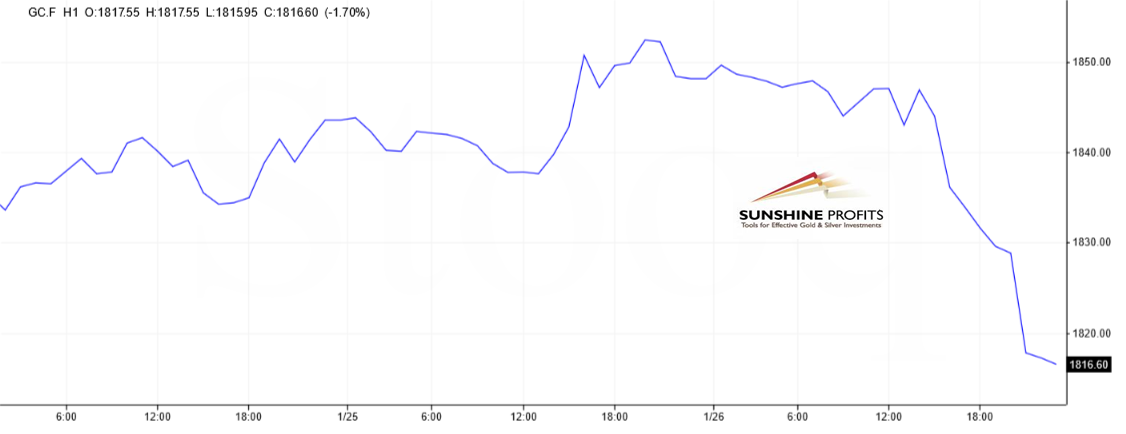

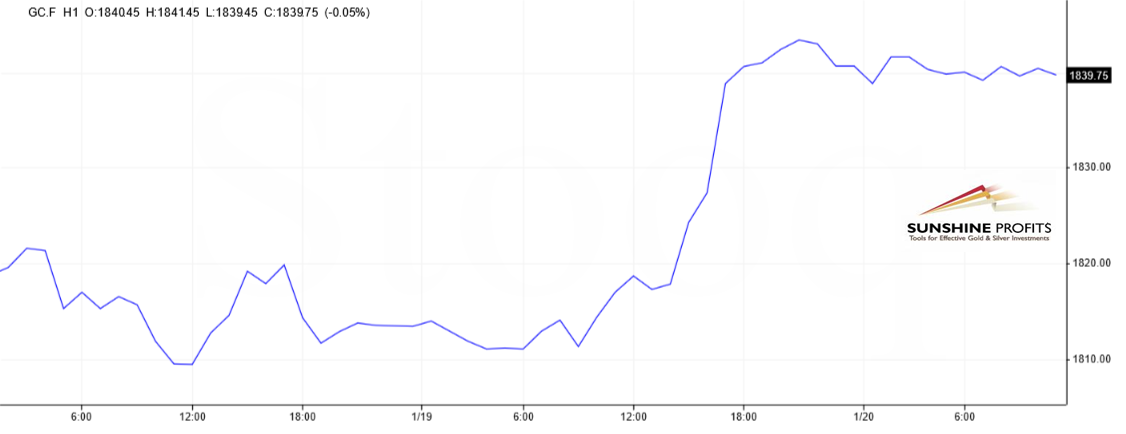

It seems that gold got the message. The price of the yellow metal plunged more than $30 yesterday, as the chart below shows. Interestingly, gold started its decline before the statement was published, which may indicate more structural weakness. What is also disturbing is that gold was hit even though the FOMC statement came largely as expected.

On the other hand, gold didn’t collapse, but it dropped only by thirty-some dollars, or about 1.6%. Given the importance and hawkishness of the FOMC meeting, it could have been worse. Yes, the hawkish message was expected, and some analysts even forecasted more aggressive actions, but gold clearly didn’t capitulate. Thus, there is hope (and turbulence in the stock market can also help here), although the upcoming weeks may be challenging for gold, which would have to deal with rising bond yields.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will 2022 Be the Groundhog Year for Gold?

January 25, 2022, 10:04 AMThe World Gold Council believes that gold may face similar dynamics in 2022 to those of last year. Well, I’m not so sure about it.

Have you ever had the feeling that all of this has already happened and you are in a time loop, repeating Groundhog Day? I have. For instance, I’m pretty sure that I have already written the Fundamental Gold Report with a reference to pop-culture before…

Anyway, I’m asking you this, because the World Gold Council warns us against the whole groundhog year for the gold market. In its “Gold Outlook 2022,” the gold industry organization writes that “gold may face similar dynamics in 2022 to those of last year.”

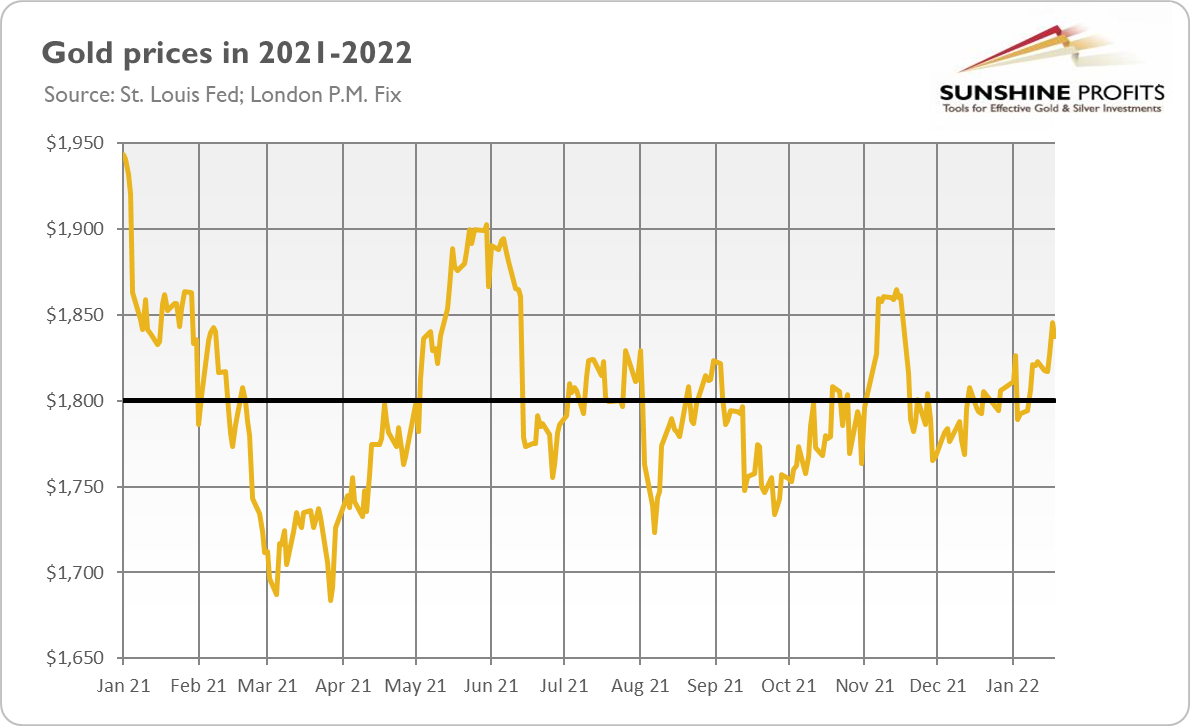

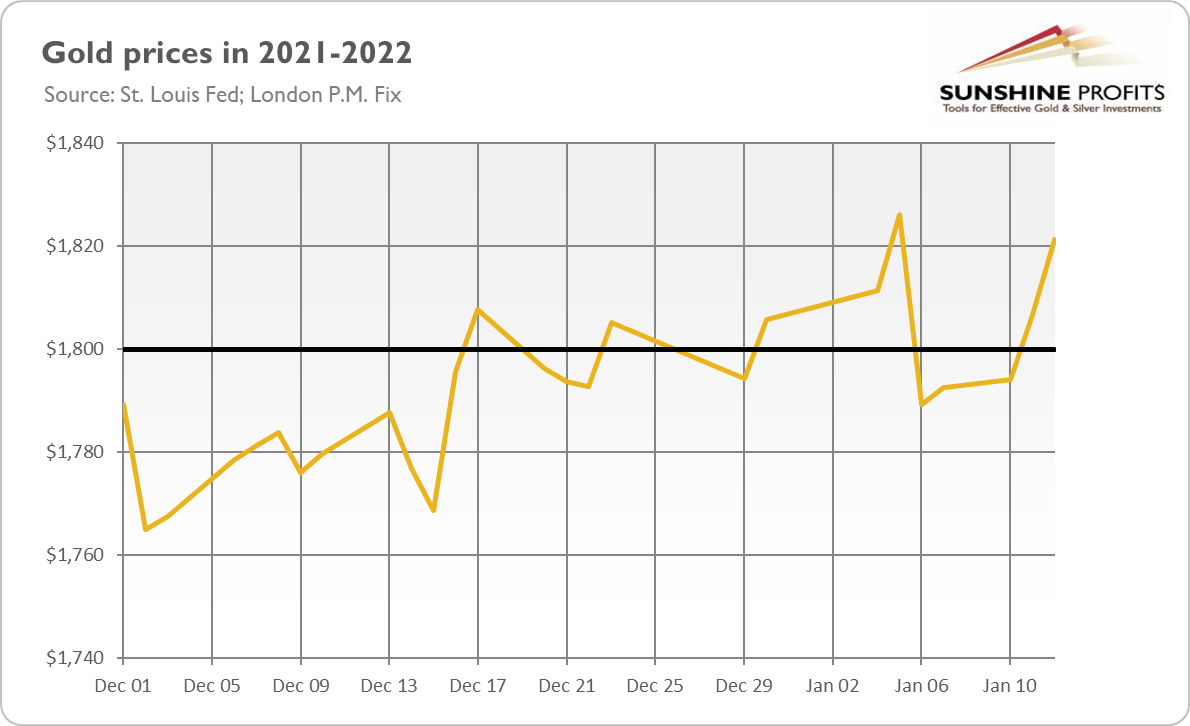

The reason is that in 2021, gold was under the influence of two competing forces. These factors were the increasing interest rates and rising inflation, especially strong in operation in the second half of the year, which resulted in the sideways trend in the gold market, as the chart below shows. The WGC sees a similar tug of war in 2022: the hikes in the federal funds rate could create downward pressure for gold, but at the same time, elevated inflation will likely create a tailwind for gold.

The WGC acknowledges that the ongoing tightening of monetary policy can be an important headwind for gold. However, it notes two important caveats. First, the Fed has a clear dovish bias and often overpromises when it comes to hawkish actions. For example, in the previous tightening cycle, “the Fed has tended not to tighten monetary policy as aggressively as members of the committee had initially expected.”

Second, financial market expectations are more important for gold prices than actual events. As a result, “gold has historically underperformed in the months leading up to a Fed tightening cycle, only to significantly outperform in the months following the first rate hike.”

I totally agree. I emphasized many times the Fed’s dovish bias and that the actual interest rate hikes could be actually better for gold than their prospects. After all, gold bottomed out in December 2015, when the Fed raised interest rates for the first time since the Great Recession.

I also concur with the WGC that inflation may linger this year. Expectations that inflation will quickly dissipate are clearly too optimistic. As China is trying right now to contain the spread of the Omicron variant of the coronavirus, supply chain disruptions may worsen, contributing to elevated inflation. However, although I expect inflation to remain high, I believe that it will cool down in 2022. If so, the real interest rates are likely to increase, creating a downward pressure on gold prices.

I also believe that the WGC is too optimistic when it comes to the real interest rates and their impact on the yellow metal. According to the report, despite the rate hikes, the real interest rates will stay low from a historical perspective, supporting gold prices. Although true, investors should remember that changes in economic variables are usually more important than their levels. Hence, the rebound in interest rates may still be harmful for the precious metals.

Implications for Gold

What should be expected for gold in 2022? Will this year be similar to 2021? Well, just like last year, gold will find itself caught between a hawkish Fed and high inflation. Hence, some similarities are possible.

However, in reality, we are not in a time loop and don’t have to report on Groundhog Day (phew, what a relief!). The arrow of time continues its inexorable movement into the future. Thus, market conditions evolve and history never repeats itself, but only rhymes. Thus, I bet that 2022 will be different than 2021 for gold, and we will see more volatility this year.

In our particular situation, the mere expectations of a more hawkish Fed are evolving into actual actions. This is good news for the gold market, although the likely peak in inflation and normalization of real interest rates could be an important headwind for gold this year. Tomorrow, we will get to know the FOMC’s first decision on monetary policy this year, which could shake the gold market but also provide more clues for the future. Stay tuned!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Russian Bear and Inflationary Hydra Sent Gold to $1,840

January 20, 2022, 10:57 AMGold soared as investors got scared by reports of an allegedly impending military conflict. Was it worth reacting sharply to geopolitical factors?

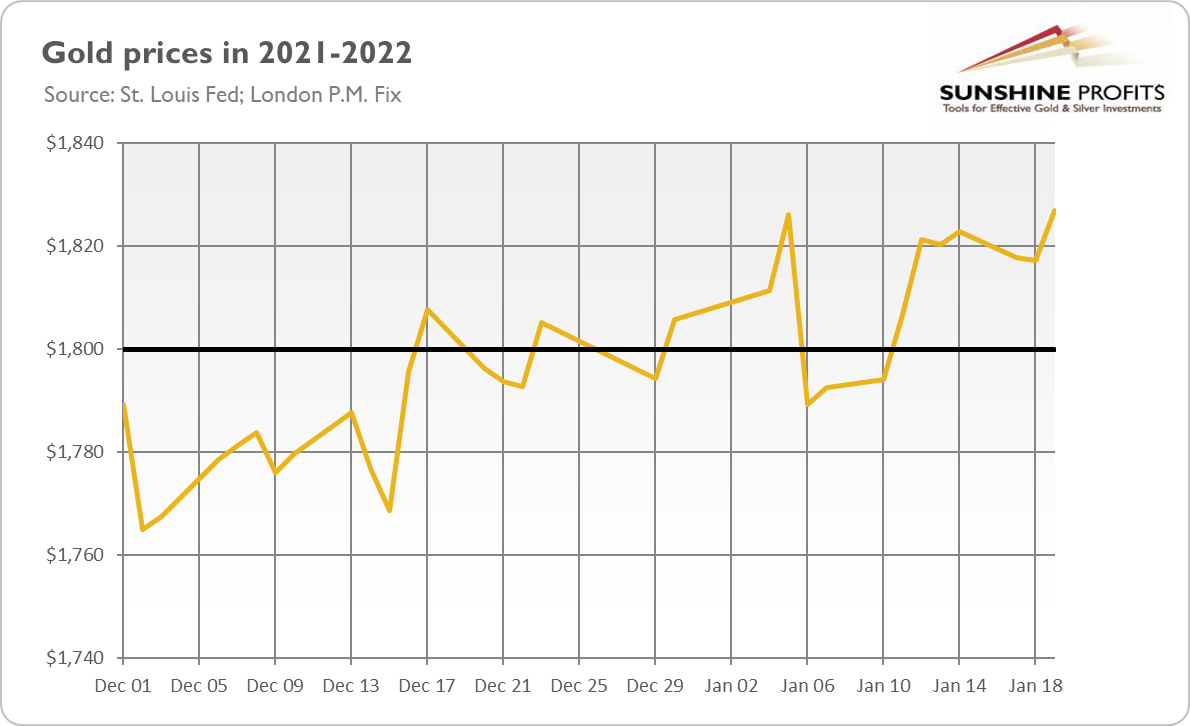

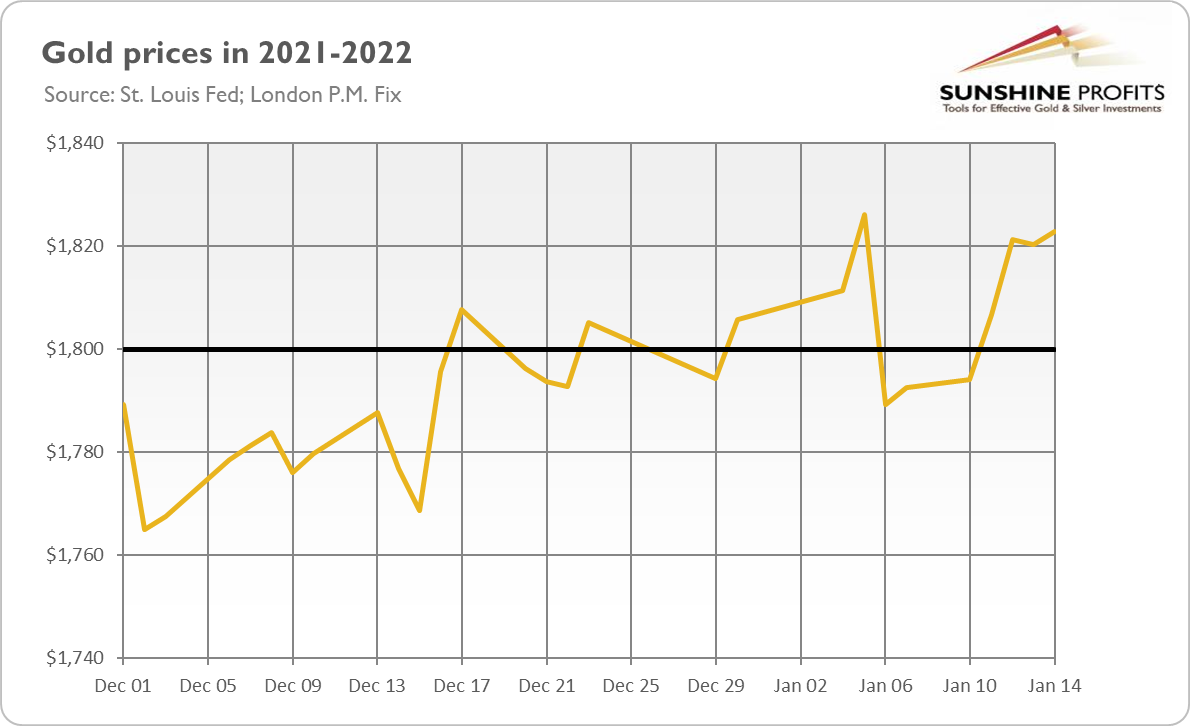

Gold has been performing quite nicely in January. As the chart below shows, its price increased from $1,806 at the end of December to around $1,820 this week, strengthening its position above $1,800.

Yesterday (January 19, 2022), gold prices went sharply higher, jumping above $1,840, as one can see in the chart below.

What happened? Investors got scared of the Russian bear and inflationary hydra. President Biden predicted that Russia would move into Ukraine. The threat of invasion and renewal of a conflict weakened risk appetite among investors. To complete the geopolitical picture, this week, North Korea fired missiles again (on Monday, the country conducted its fourth missile test of the year), while terrorists attacked the United Arab Emirates with drones. The heightened risk aversion could spur some demand for safe-haven assets such as gold. The yellow metal tends to benefit from greater uncertainty. However, investors should remember that geopolitical risks usually cause only a short-lived reaction.

Investors also recalled the ongoing global inflationary crisis. Some news helped them wake up. In the U.K., inflation surged 5.4% in December, the highest since March 1992. Meanwhile, in Canada, inflation jumped 4.8%, also the fastest pace in 30 years.

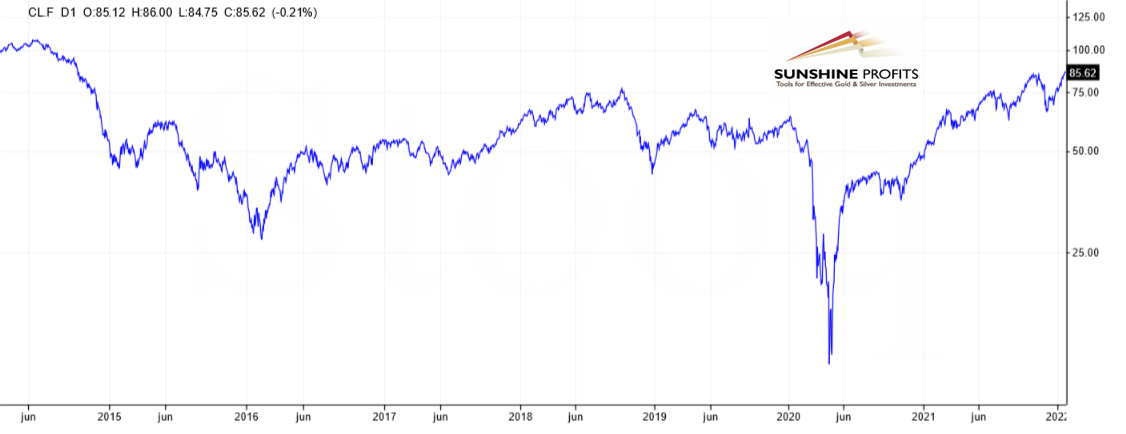

Additionally, crude oil prices have jumped to around $86.5 per barrel, the highest value since 2014, as the chart below shows. The timing couldn’t be worse, as inflation is already elevated, while higher oil implies higher CPI in the future. Gold should, therefore, welcome the rise in oil prices. On the other hand, it could prompt the Fed to react more forcefully and aggressively to tighten its monetary policy.

Implications for Gold

What does the recent mini-rally imply for the gold market? Well, it’s never a good idea to draw far-reaching conclusions from short-term moves, especially those caused by geopolitical factors. Risk-offs and risk-on sentiments come and go.

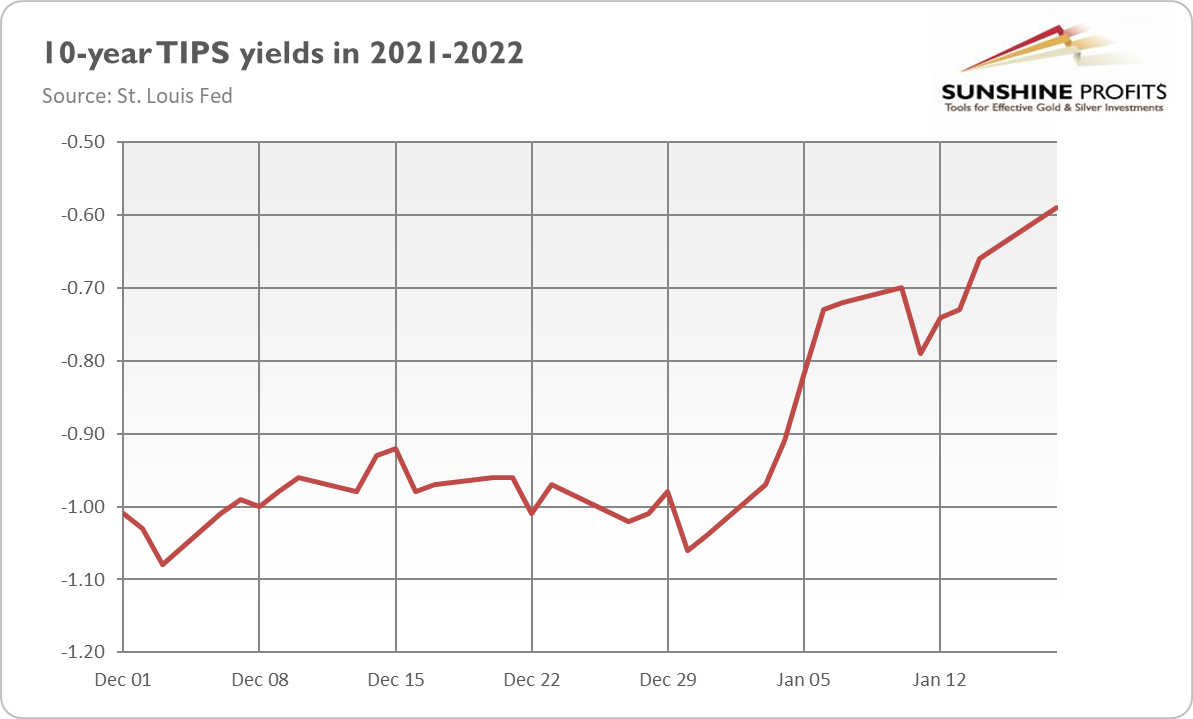

However, let’s do justice to gold. It hit a two-months high, more and more boldly settling in above $1,800. All this happened despite rising bond yields. As the chart below shows, the long-term real interest rates have increased from about -1.0% at the end of 2021 to about -0.6%. Gold’s resilience in the face of rising interest rates is praiseworthy.

Having said that, investors shouldn’t forget that 2022 will be a year of the Fed’s tightening cycle, rising interest rates, and also a certain moderation in inflation. All these factors could be important headwinds for gold this year.

However, investors may underestimate how the Fed’s monetary policy will impact market conditions. After all, the Fed’s hawkish stance also entails some risks for the financial markets and the overall economy. Practically, each tightening cycle in the past has led to an economic crisis. As a reminder, after four hikes in 2018, the Fed had to reverse its stance and cut them in 2019. The Fed signaled not only a few hikes this year, but also a reduction of its balance sheet. Given the enormous indebtedness of the economy and Wall Street’s addiction to easy money, it might be too much to swallow.

Importantly, when the Fed is focused on fighting inflation, its ability to help the markets will be limited. I thought that such worries would arise later this year, supporting gold, but maybe the gold market has already started to price in the possibility of economic turbulence triggered by the Fed’s tightening cycle. Anyway, next week, the FOMC will gather for the first time in 2022, and it could be an important, insightful event for the gold market. Stay tuned!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Neither Inflation nor the Fed Moves Gold

January 18, 2022, 9:32 AMInflation spiked 7.1% in December, and the Fed is likely to raise interest rates already in March. Still, gold remains uninterested.

“Inflation is too high,” admitted Lael Brainard during her nomination hearing in the Senate for the Vice Chair of the Fed. You don’t say, Governor Obvious! Indeed, the latest BLS report on inflation shows that consumer inflation rose 0.5% in December on a monthly basis, after rising 0.8% in the preceding month. The core CPI rate increased 0.6%, following a 0.6-percent increase in November.

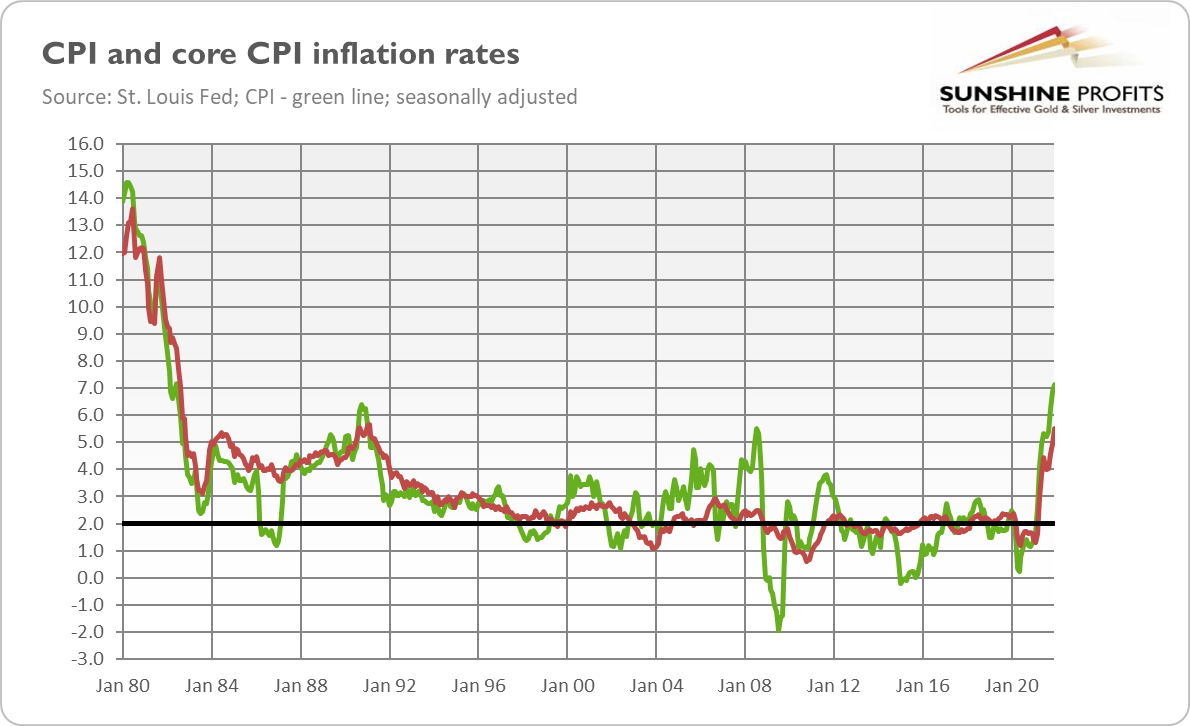

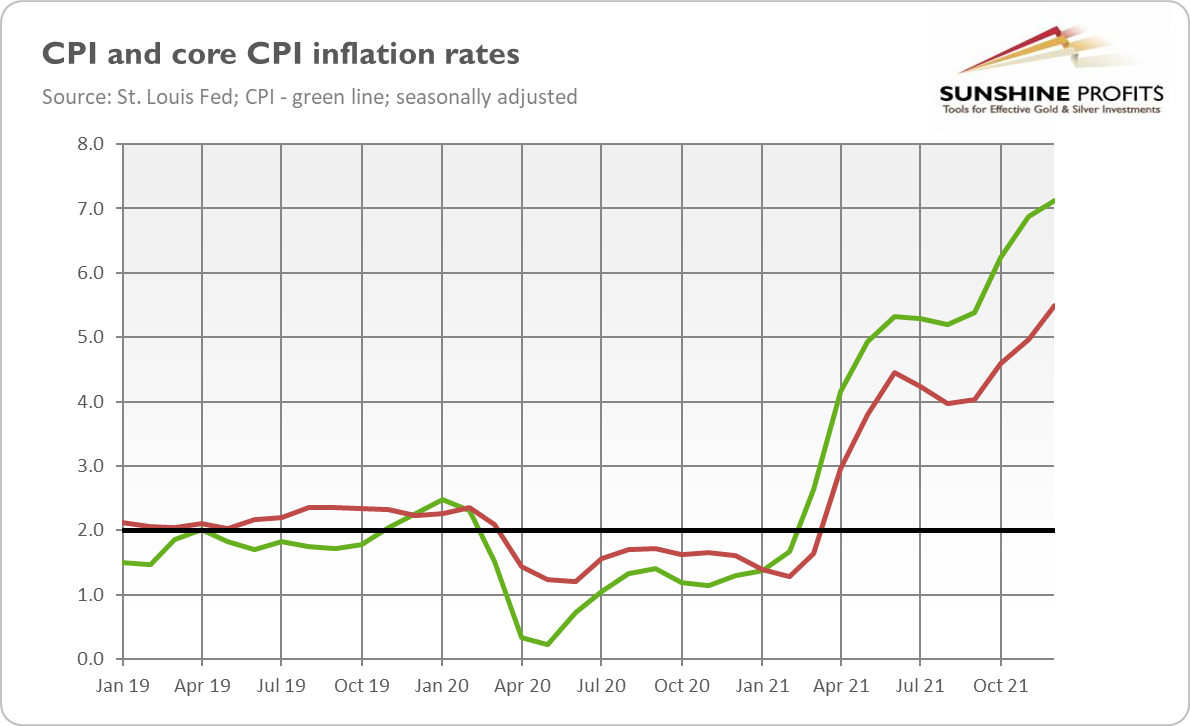

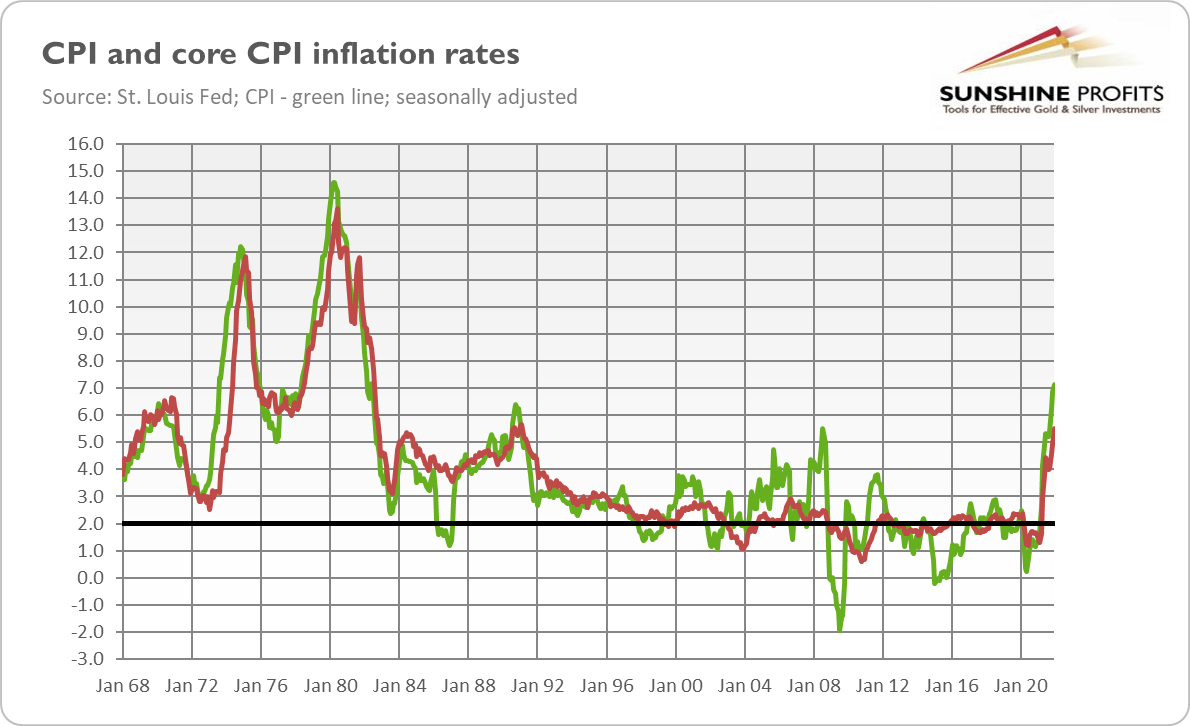

The situation is actually worse: inflation is not merely high – it’s high and still rising. As the chart below shows, the annual, seasonally adjusted CPI inflation rate spiked 7.1%, the highest move since February 1982.

However, 40 years ago, inflation was coming down, and now, it is still accelerating. Inflation has been in a clear upward trend since May 2020, and getting worse month after month since August 2021 (practically, since November 2020, when we skip a short moderation in summer 2021), as the chart below shows.

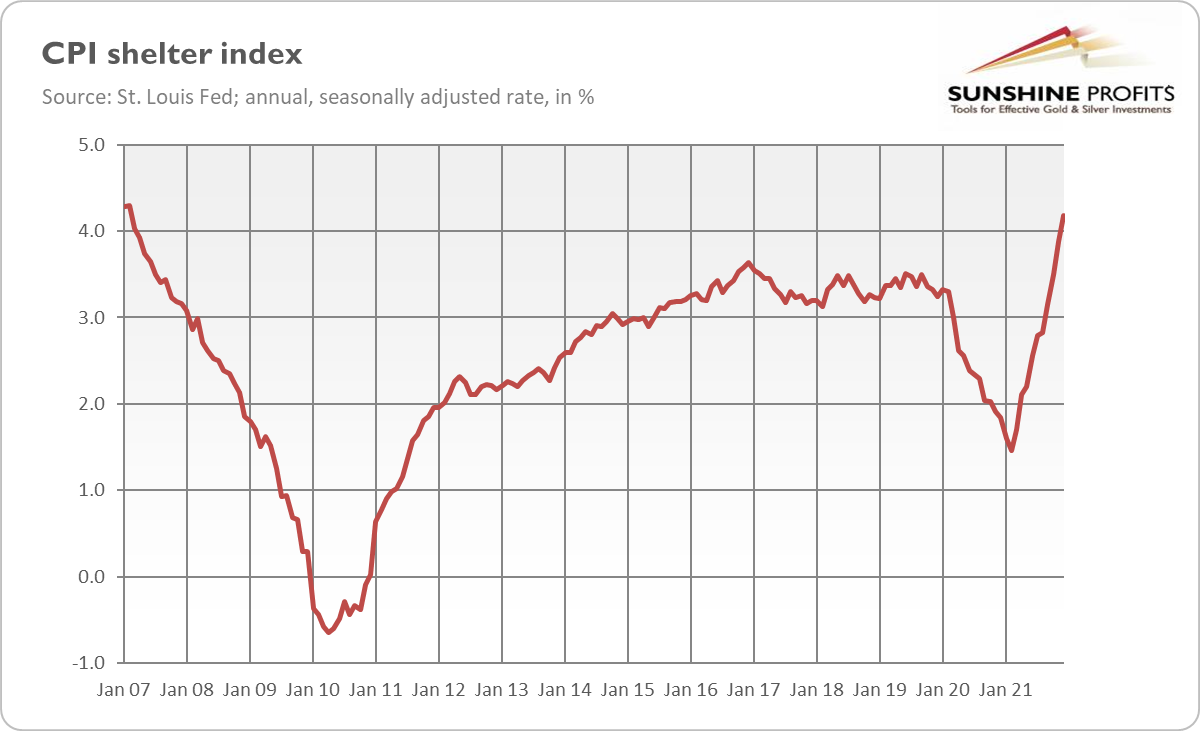

What is really disturbing is that core inflation, which excludes food and energy prices, spiked 5.5%, the highest since February 1991. It shows that inflation has moved deeply into the economy. It’s not a phenomenon caused merely by soaring energy prices – we are witnessing widespread, general inflation that covers practically all prices. For example, the shelter subindex, which is the biggest component of the CPI and is much less volatile than energy or food, rose 4.2% in December, the highest since February 2007, as the chart below shows.

Although inflation could calm down somewhat in the first quarter of 2022 or even peak amid the spread of Omicron and the recent peak in the Producer Price Index, it’s not likely to disappear quickly. Its negative impact on the economy is beginning to be felt more and more. For instance, retail sales plunged 1.9% in December, much worse than the forecasted decline of 0.1%. The drop was caused partially by surging prices that took a big bite out of spending.

Implications for Gold

What does rising inflation imply for the gold market? Well, theoretically, the yellow metal loves high and accelerating inflation, so it should shine under the current conditions. Last year, gold didn’t perform spectacularly, but it has recently managed to rise above $1,820, as the chart below shows. I wouldn’t draw too far-reaching conclusions on this basis, but at least that’s something.

Inflation has been accompanied by an expanding economy last year and, more recently, also by the Fed’s more hawkish rhetoric. For a shamefully long time, the Fed kept refusing to deal with inflation. However, Powell and his colleagues have finally awoken. They’ve already accelerated the pace of tapering asset purchases and signaled successfully to the markets that they’ll likely start raising interest rates as early as March. According to the CME FedWatch Tool, the odds of a hike in the federal funds rate have risen from 46.8% last month to above 90% now. Hence, the lift-off is almost certain.

The prospects of more hawkish monetary policy and the sooner start of a tightening cycle should be negative for the yellow metal, but gold didn’t care too much about a more aggressive Fed. This is encouraging, but the risk of normalization of real interest rates remains. It might also be the case that neither high inflation nor a hawkish Fed is able to shake gold out of the sideways trend right now. Let’s be patient – it might be just the silence before the storm.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Powell Sends a Smile to Gold

January 14, 2022, 10:01 AMPowell testified before the Senate. He didn’t say anything new, but gold rallied a bit.

“We have totally screwed up inflation and now we are in deep trouble,” admitted Jerome Powell during his appearance before the Senate. OK, he didn’t formulate it exactly that way, but it was the message of his testimony. Powell admitted that the Fed wrongly expected a faster easing of supply disruptions and thought that price pressures would be much lower by now. As a consequence, inflation was believed to be only ‘transitory’. Unfortunately, that’s not what happened.

“The supply-side constraints have been very durable. We are not seeing the kind of progress that all forecasters thought we’d be seeing by now. We did foresee a strong spike in demand. We didn’t know it would be so focused on goods,” said

Powell.As a result of the Fed’s inaction, inflation has risen 7% in 2021, the fastest pace since February 1982, as the chart below shows. After conducting very complicated calculations, Powell admitted that “inflation is running very far above target.” Bold deduction, Sherlock!

Such high inflation is indeed a troublesome and even central bankers realize that. This is why Powell stated that “the economy no longer needs or wants the very accommodative policies we have had in place,” and that “we will use our tools to support the economy and a strong labor market and to prevent higher inflation from becoming entrenched.”

However, there is a problem here. The main tool the Fed has to fight inflation is raising the federal funds rate, but hiking interest rates may hamper economic expansion and even trigger the next financial crisis. As Powell admitted, “if inflation does become too persistent, that will lead to much tighter monetary policy and that could lead to a recession.” Thus, the central bank is between a rock and a hard place, between high inflation and the risk of slowing economic expansion or even of an economic crisis.

Implications for Gold

What does Powell’s testimony imply for the gold market? Well, theoretically not much, as it didn’t include any major surprises. However, Powell sounded quite hawkish. For example, he downplayed the economic consequences of the current surge in coronavirus cases, and said that it’s likely not changing the Fed’s plans to tighten its monetary policy this year. These plans are relatively bold for this year: “We are going to end asset purchases in March. We will raise rates. And at some point this year will let the balance sheet runoff,” Powell said.

However, it seems that Powell sounded less hawkish than investors were afraid of. Given such worries, the lack of any surprises could be dovish. This is at least what gold’s performance suggests. As the chart below shows, Powell’s testimony triggered a small rally and revived optimism in the gold market.

That’s for sure encouraging. After all, gold jumped above a key level of $1,800, catching some breath, but it’s too early to call a major reversal in the gold market. The yellow metal would have to sustain itself above $1,820 and then surpass $1,850, or even higher levels, to trumpet a bullish breakout.

There are still several headwinds for gold. First of all, the monetary hawks haven’t struck yet. They are growing in strength, as several regional bank presidents have recently called for a rate hike as soon as in March. Such calls may strengthen the expectations of rate increases, boosting bond yields, and creating downward pressure for gold prices. We’ll find out soon whether it will happen or not, as the January FOMC meeting is in two weeks, and it could be a groundbreaking event in the gold market.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM