Trading position (short-term; our opinion): Short position with a stop-loss order at $57.86 and the initial downside target at $53.28 is justified from the risk/reward perspective.

The overall situation in the very short term deteriorated after crude oil futures closed Wednesday below the upper border of the short-term trend channel. Earlier today, this show of weakness triggered further deterioration, and futures dropped below $55, making our short positions even more profitable. Taking the above into account and combining it with the sell signals generated by the daily indicators, the probability of further deterioration has increased. Therefore, what we wrote yesterday, is up to date also today.

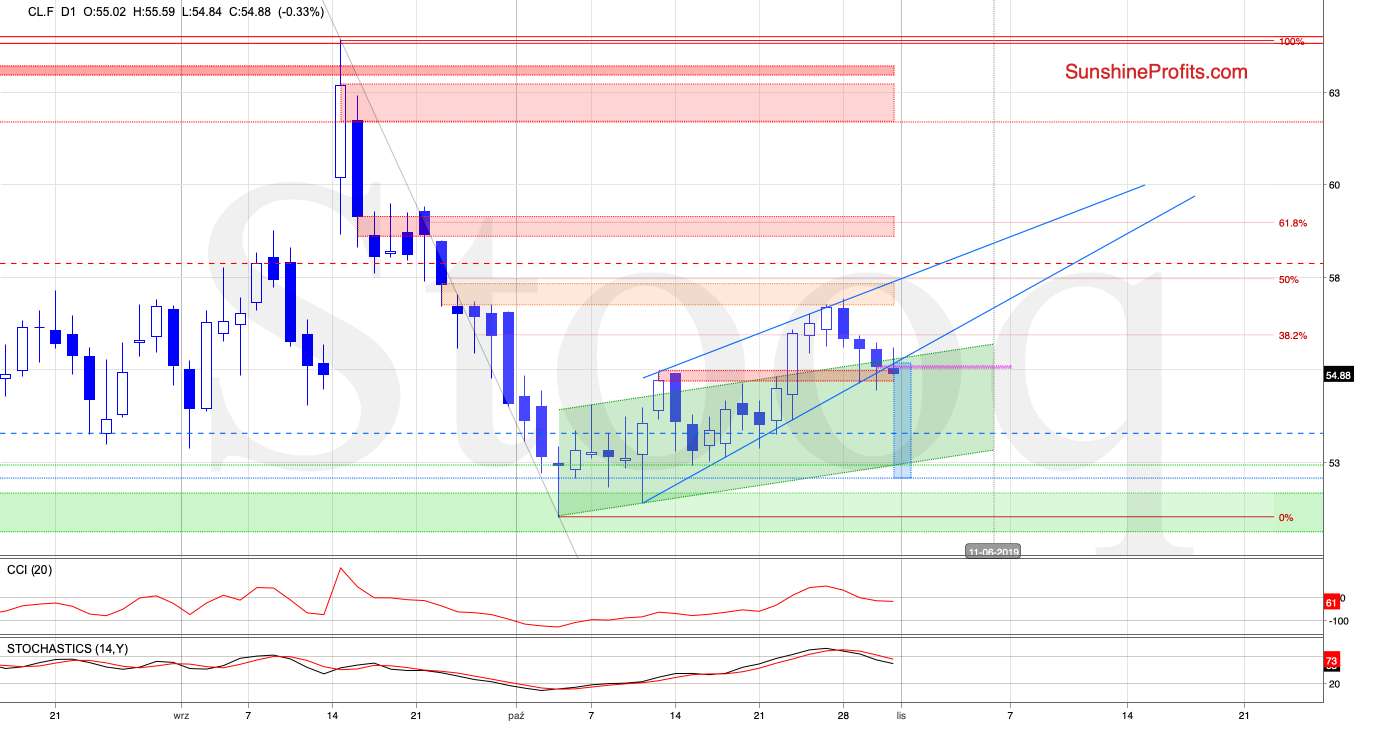

Let's take a closer look at the chart below.

In our yesterday's Oil Trading Alert, we wrote These are our yesterday's words:

(...) What could happen if the futures extend declines from here?

In our opinion, we'll see not only a test of the lower border of the very short-term rising blue trend channel, but maybe even a drop to the lower border of the green channel in the following days - yes, that's below our initial downside target.

Closer look at the above chart reveals that although crude oil futures bounced off the red area that continues to serve as the nearest support now, the bulls didn't manage to close the day above the upper border of the rising green trend channel.

Thanks to their weakness, the futures closed the day inside the channel, invalidating the earlier breakout above the formation. This negative development triggered another downswing earlier today, which resulted in a drop below the lower border of the blue rising wedge. In our previous Alert, you could see a very short-term blue rising trend channel in this area - adjusting for recent price action however, we corrected the upper border of the formation, receiving the rising wedge instead of the channel.

This is a bearish factor, which would be even more reliable if crude oil futures close today's session below the blue formation. At this point, it is worth noting that the futures opened on Thursday with another gap (marked on the above chart with pink), increasing the probability of further deterioration in the very near future.

Before summarizing today's Alert, we would like to add that if the situation develops in tune with our assumptions (a daily close below the rising wedge), we could see a decline not only to the lower line of the rising green trend channel, but even to around $52.10, which is where the size of the downward move would correspond to the height of the blue formation.

Summing up, short position continues to be justified from the risk/reward perspective as crude oil futures moved lower and invalidated of the earlier breakout above the upper border of the green rising trend channel. This increases the likelihood of further declines - especially if the sellers are strong enough to finish today below the lower border of the blue rising wedge.

Trading position (short-term; our opinion): Short position with a stop-loss order at $57.86 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Before signing off, please note that there won't be a regular Alert issued tomorrow - the service will resume again on Monday. Thank you for your patience and understanding.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist