Trading position (short-term; our opinion): Short position with a stop-loss order at $58.81 and the initial downside target at $53.28 is justified from the risk/reward perspective.

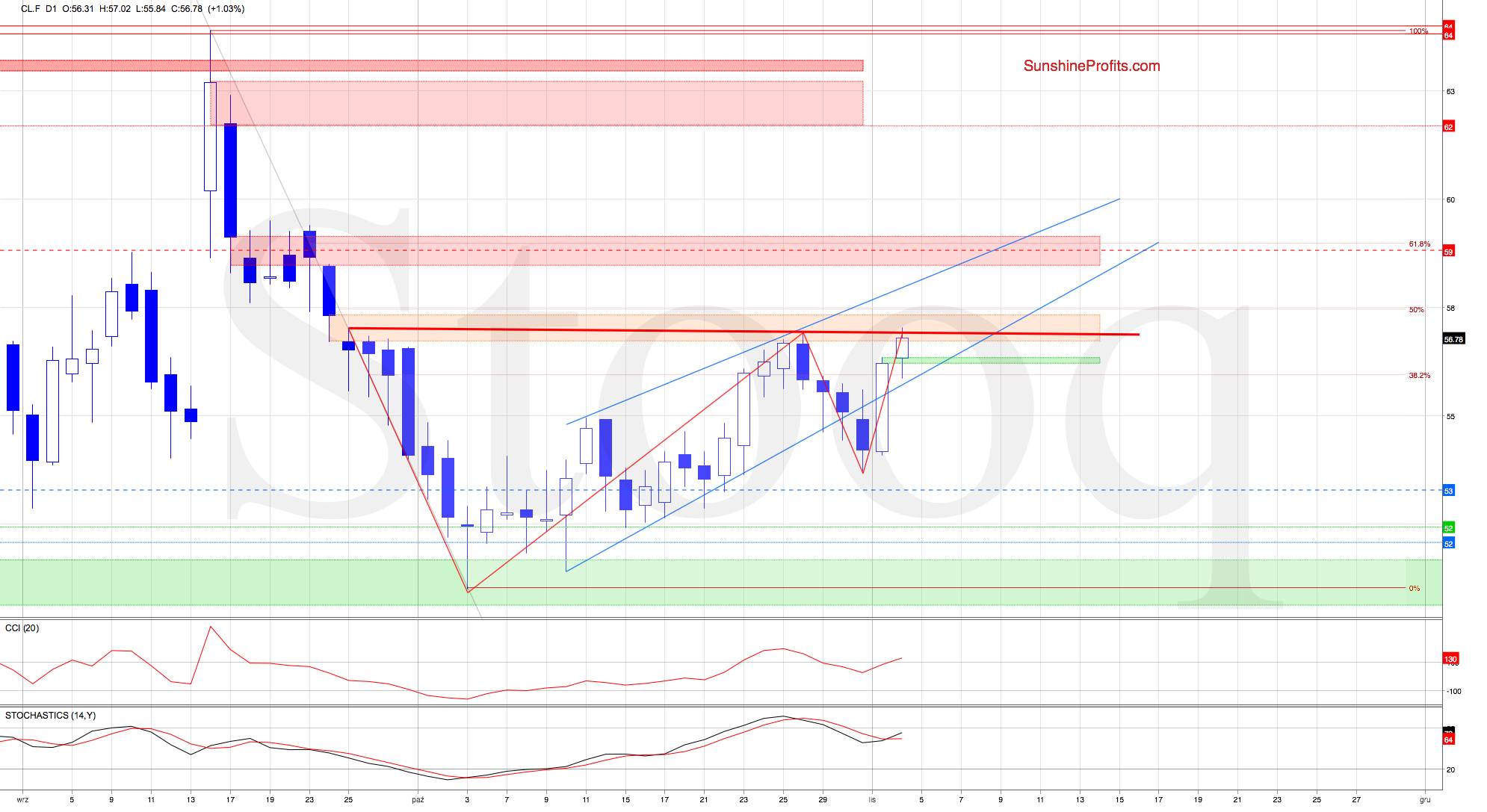

Let's get straight into the chart below (chart courtesy of www.stooq.com ) to find out where crude oil price is headed next.

The daily chart shows that crude oil futures reversed sharply to the upside on Friday. Today's open is marked by the green gap, which has sparked further bulls' gains. Prices have reached the red resistance line based on its previous peaks, and also the orange gap that has been open since the end of September.

Let's take a closer look at the chart: there's a potential cup and handle formation (marked with red lines for your convenience). Should crude oil futures move higher from here and close above the red line, the probability of further improvement would increase. Then, we would consider closing short positions.

Connecting the dots, we decided to move our stop-loss order a bit higher. But should we see further improvement and the orange gap likely to be closed, we'll consider closing our short position.

Summing up, Friday's oil reversal marks a potential cup and handle formation, and should black gold close above the red line and put the late-September orange gap into jeopardy, we'll consider closing our short positions. For now however, they remain justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.81 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist