Trading position (short-term; our opinion): Short position with a stop-loss order at $57.86 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Let's dive right into the chart below (chart courtesy of www.stooq.com ) and assess where crude oil price is most likely to go next.

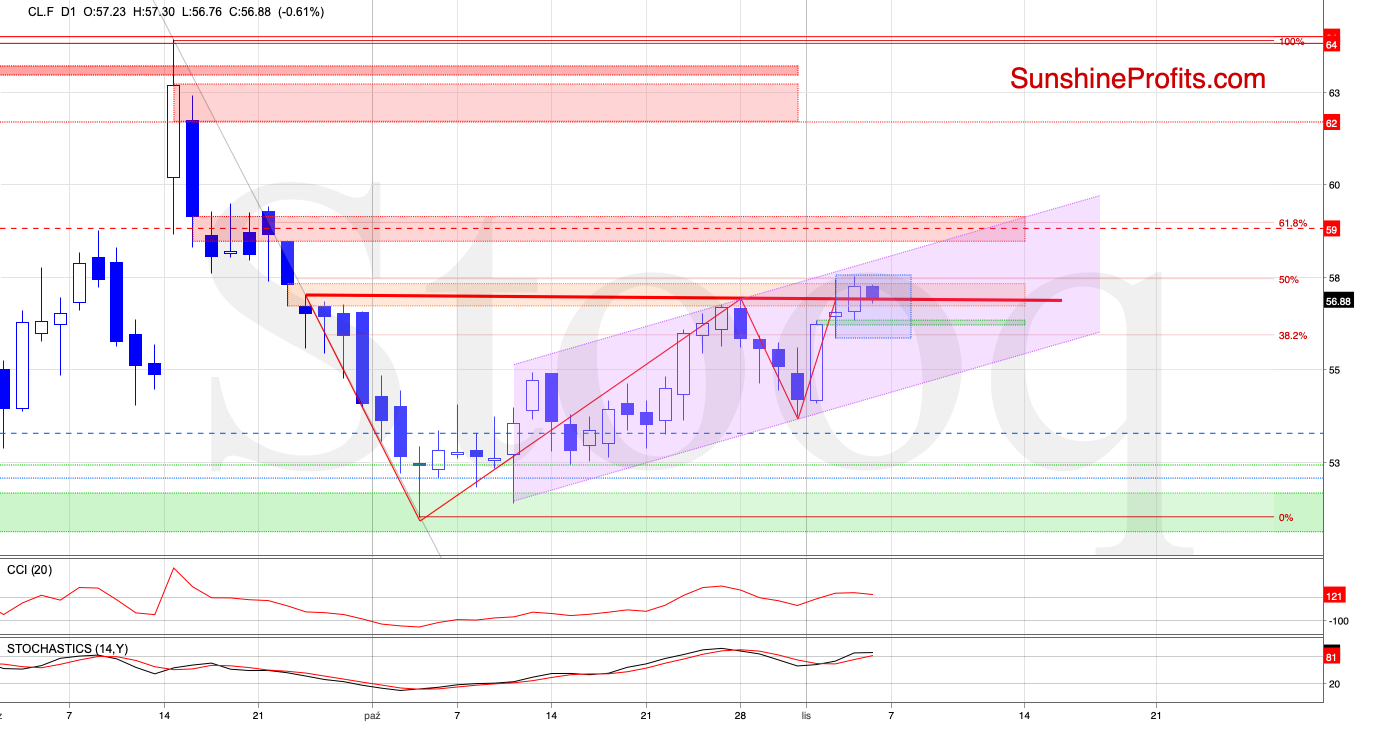

Yesterday, crude oil futures moved higher, closing the day above the red resistance. That would lend some support to the bulls in their further efforts. However, they haven't managed to close the orange gap for the second time in a row, and they also couldn't overcome the 50% Fibonacci retracement.

That could be interpreted as a sign of weakness. Nearby, there's also the upper border of the rising purple trend channel, serving as an additional resistance. Please note that as the futures hit a fresh peak, we deleted the blue rising wedge and replaced it with the rising purple trend channel.

Earlier today, the sellers triggered a pullback up to the red resistance line. While this can be a verification of yesterday's breakout, it could equally well turn out to be an invalidation of yesterday's breakout, which would open open the way to at least the lower border of the recent blue consolidation.

Taking into account yesterday's data from the American Petroleum Institute showing that U.S. crude inventories tripled the forecast of an increase of 1.5 million barrels, rising by 4.3 million barrels in the week ended Nov. 1 to 440.5 million barrels, it seems that lower values of crude oil are just around the corner. Especially so if today's EIA report shows a bigger than expected increase in crude oil stockpiles.

Connecting the dots, we think that a reversal and lower values of the commodity are still ahead of us, and short position continues to be justified.

Summing up, while crude oil moved higher yesterday, the bulls didn't end up on a high note. They couldn't overcome the orange resistance zone or the 50% Fibonacci retracement. Prices have pulled back earlier today. If today's EIA report shows a bigger than expected stockpiles increase, it could mark a catalyst for renewed downside. Such an outcome would be supported by yesterday's American Petroleum Institute data. Therefore, our short position remains justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $57.86 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist