-

Just How Much Progress Are Oil Bulls Making?

February 14, 2020, 9:15 AMAvailable to premium subscribers only.

-

Was Yesterday's Oil Upswing a Game Changer?

February 13, 2020, 6:45 AMAvailable to premium subscribers only.

-

Oil Price Action - Like a Coiled Spring Already?

February 12, 2020, 8:03 AMTrading slightly above the $50 mark, crude oil hasn't made a decisive move either way so far. Yesterday's bullish session has brought us new clues. Let's dive and examine the strength of the evolving oil move higher.

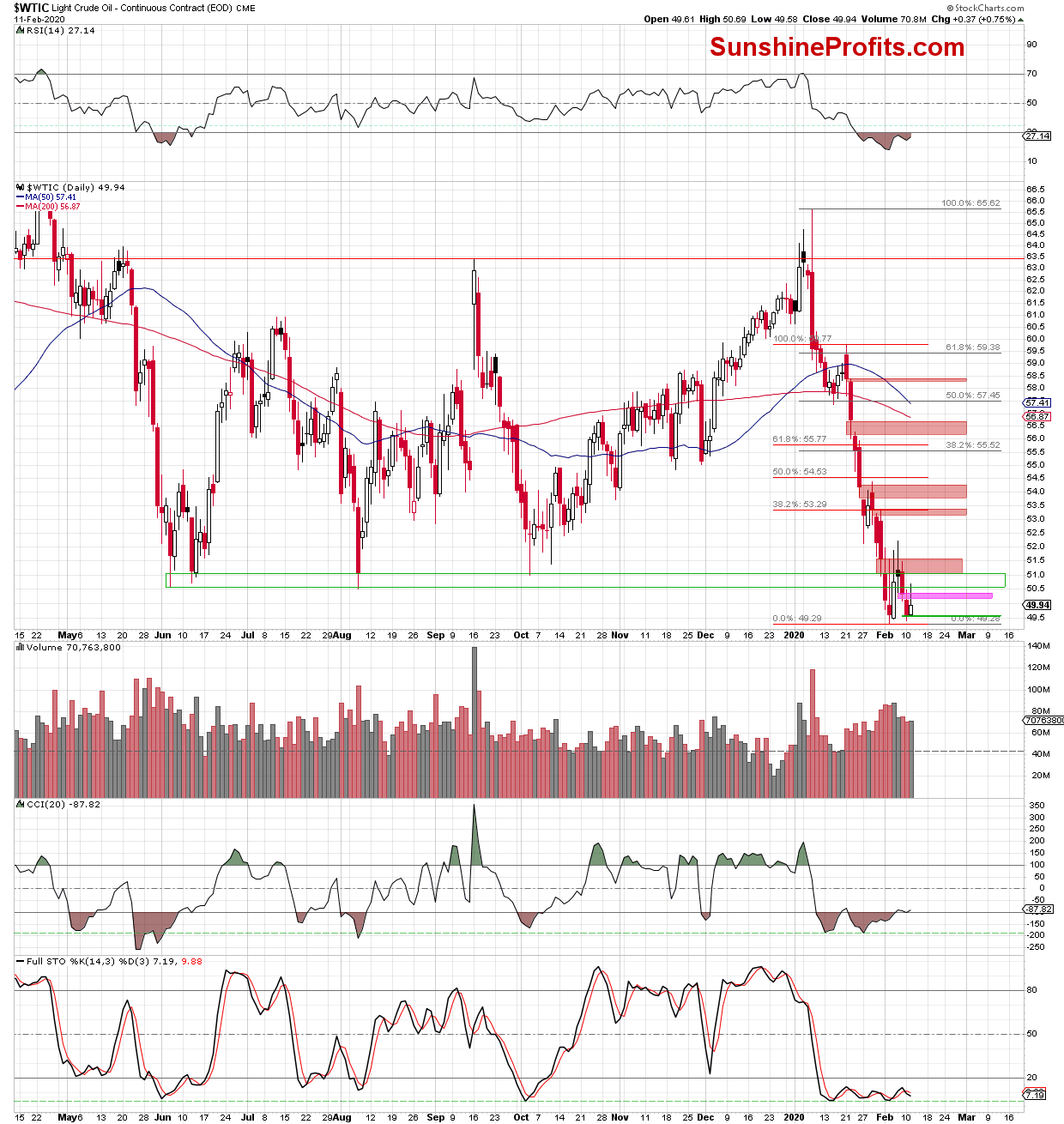

We'll start by taking a closer look at the daily chart (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

(...) the pink gap created yesterday remains in the cards, blocking the way to the north. Additionally, when we focus on the daily chart, we can see that similar price action took place on January 29. Back then, the futures (and also crude oil later in the day) also opened with a bullish gap, but the bearish gap created two days earlier stopped the bulls, triggering a decline in the following hours.

Will we see something similar this time as well?

In our opinion, as long as the pink gap remains open, the bulls and crude oil futures (and crude oil itself) are threatened by further declines. (...)

The situation has indeed developed in tune with the above, and crude oil pulled back after unsuccessfully attempting to close the pink gap, just like it did on January 29.

The bulls showed more strength this time, however. The green gap they created at the beginning of the day, remained out of the reach of the bears. It still serves as the nearest very short-term support.

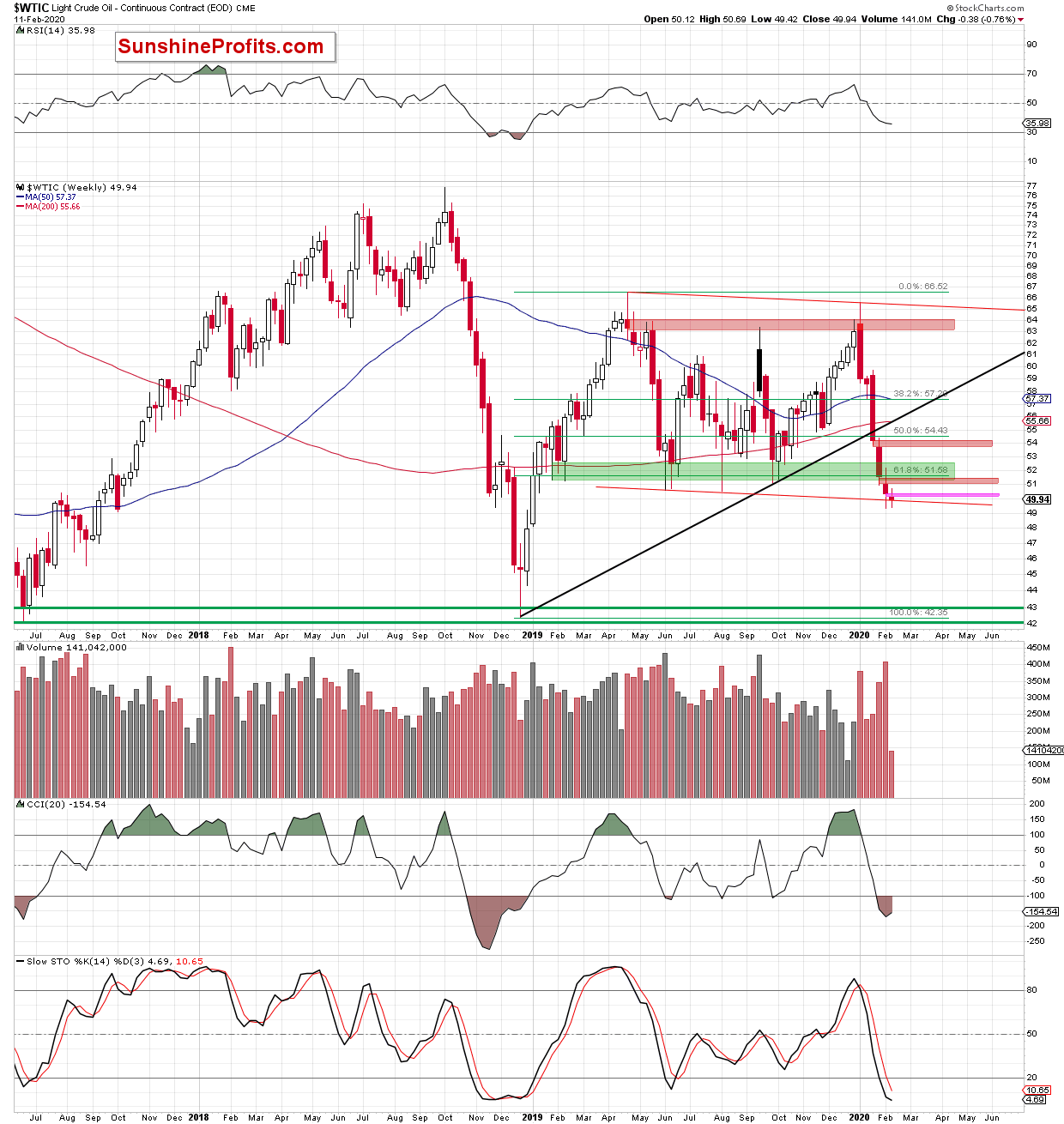

Additionally, yesterday's price action took the commodity back above the previously broken lower border of the declining red trend channel marked on the weekly chart below.

Let's check the reflection of these developments in today's premarket action.

Crude oil futures opened today with the yellow bullish gap, which triggered further improvement in the following hours.

This upswing is attempting to close the pink gap created on Monday. That's encouraging for the bulls, and suggests that we'll likely see the red gap created on February 3, 2020 tested later in the day.

This resistance was strong enough to stop the buyers five times in a row, which increases the probability that we could see another reversal and decline from here in the very near future. That could happen even later in the day after the EIA report. It's worth pointing out that the American Petroleum Institute showed yesterday that US crude oil inventories rose sharply last week (by 6 million barrels for the week ended Feb. 7). That doesn't bode well for higher oil prices - especially if today's EIA report confirms higher than expected increase in crude oil stockpiles.

This scenario is also reinforced by the green zone based on the previous lows and the upper border of the blue consolidation, which both work to reinforce this resistance zone. Additionally, another move to the downside and a fresh 2020 low would be in line with the Elliott Wave Theory.

Nevertheless, nothing in the market is 100% certain that is why we must also take into account the growth scenario, especially since that the price of black gold is in consolidation. Therefore, should the bulls manage to close the day above the above-mentioned resistances, we'll consider opening long positions.

Summing up, while oil bulls couldn't close the nearest bearish gap yesterday, and formidable resistances remain, we might see a break either way shortly. As for the bearish break, the fundamental expectations of high EIA stockpiles report and Elliott wave analysis support that. As for the bullish break, the very short-term gap analysis speaks in favor. It remains to be seen though whether the bulls manage to close today above the key resistances. If they do, we'll consider opening long positions.

Thank you for reading.

Sincerely,

Nadia Simmons

Day Trading and Oil Trading StrategistPrzemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

Untangling the Oil Story: Supports, Resistances and Gaps

February 11, 2020, 7:05 AMAvailable to premium subscribers only.

-

This Seems to Be the More Probable Oil Short-Term Move Now

February 10, 2020, 8:33 AMAvailable to premium subscribers only.

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM