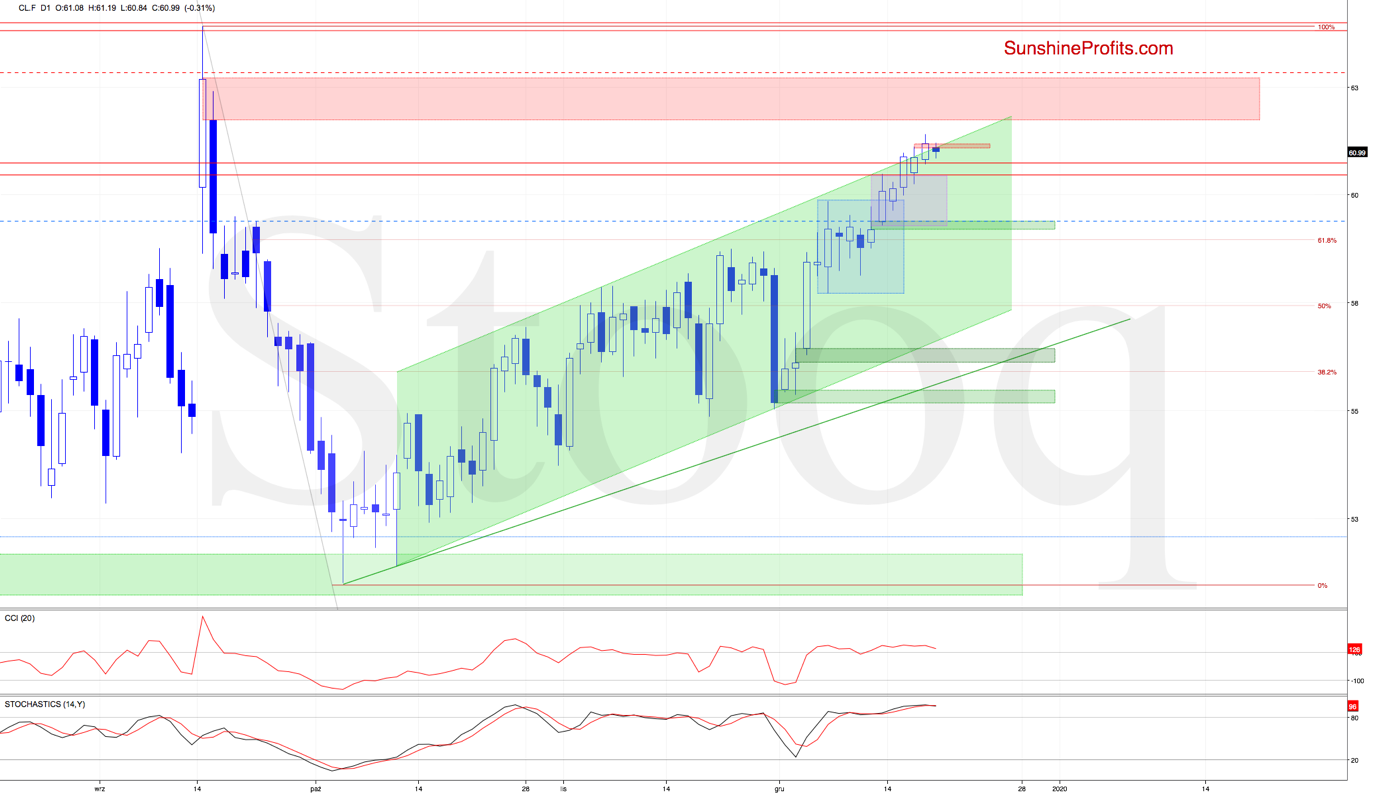

Trading position (short-term; our opinion): Short position with a stop-loss order at $62.82 and the initial downside target at $59.38 is justified from the risk/reward perspective.

Crude oil futures moved higher once again during yesterday's session, overcoming the upper border of the rising green trend channel for the third time in a row. While the futures finished the day above this resistance, the bulls didn't manage to hold gained ground in full.

Earlier today, the futures opened with the red gap. This bearish development means invalidation of yesterday's breakout, which doesn't bode well for the bulls.

The daily indicators are still very extended, also supporting the likelihood of upcoming resolution to the downside.

Should the futures extend losses from here, the initial downside target for the sellers will be the Friday's green gap.

Summing up, while the bulls broke above the upper border of the rising green trend channel yesterday, today's bearish opening doesn't support a bullish interpretation. The extended daily indicators support a downside reversal too. The short positions continues being justified from the risk-reward perspective.

Trading position (short-term; our opinion): Short position with a stop-loss order at $62.82 and the initial downside target at $59.38 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist