Trading position (short-term; our opinion): Short position with a stop-loss order at $65.46 and the initial downside target at $59.49 is justified from the risk/reward perspective.

Yesterday, we wrote the following:

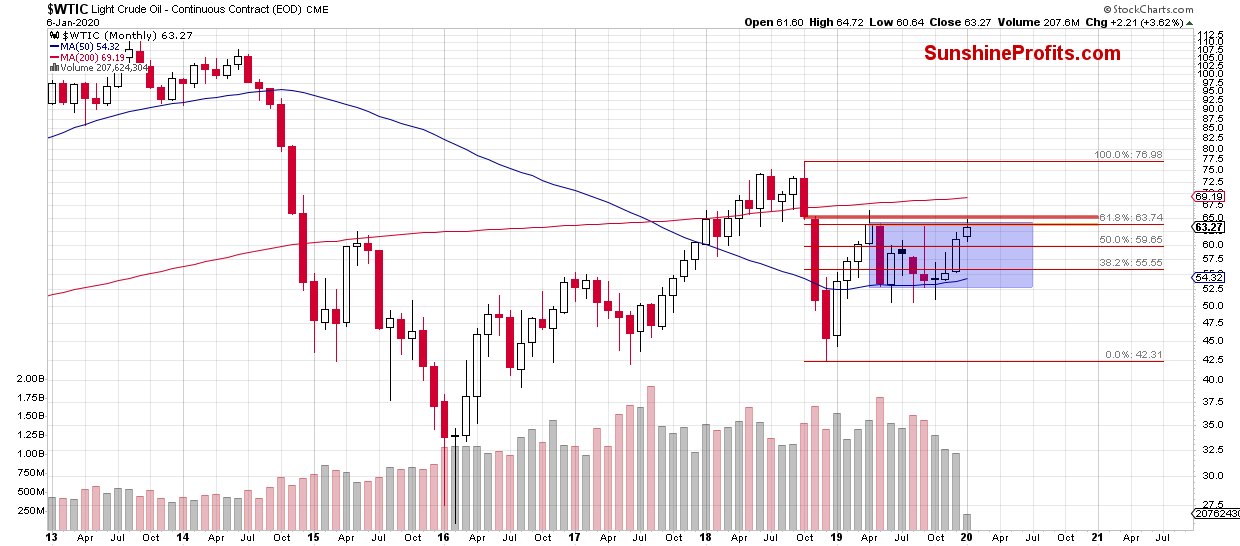

(...) crude oil is still trading inside the blue consolidation below three very important resistances (the red and orange bearish gaps and the 61.8% Fibonacci retracement), which form the key resistance zone for the coming week(s).

Additionally, the volume is decreasing on a monthly basis, which raises the probability of a reversal in the near future. Therefore, as long as there is no successful breakout above the mentioned consolidation and resistances, another move to the downside is very likely.

The above chart shows that recent increases took crude oil slightly above the orange gap and the 61.8% Fibonacci retracement. Despite this improvement, the bulls failed to push prices higher, and a pullback resulting in a drop below the above-mentioned levels followed.

This way, black gold invalidated the earlier tiny breakouts, which together with the proximity to the red gap increases the likelihood of further deterioration in the coming month.

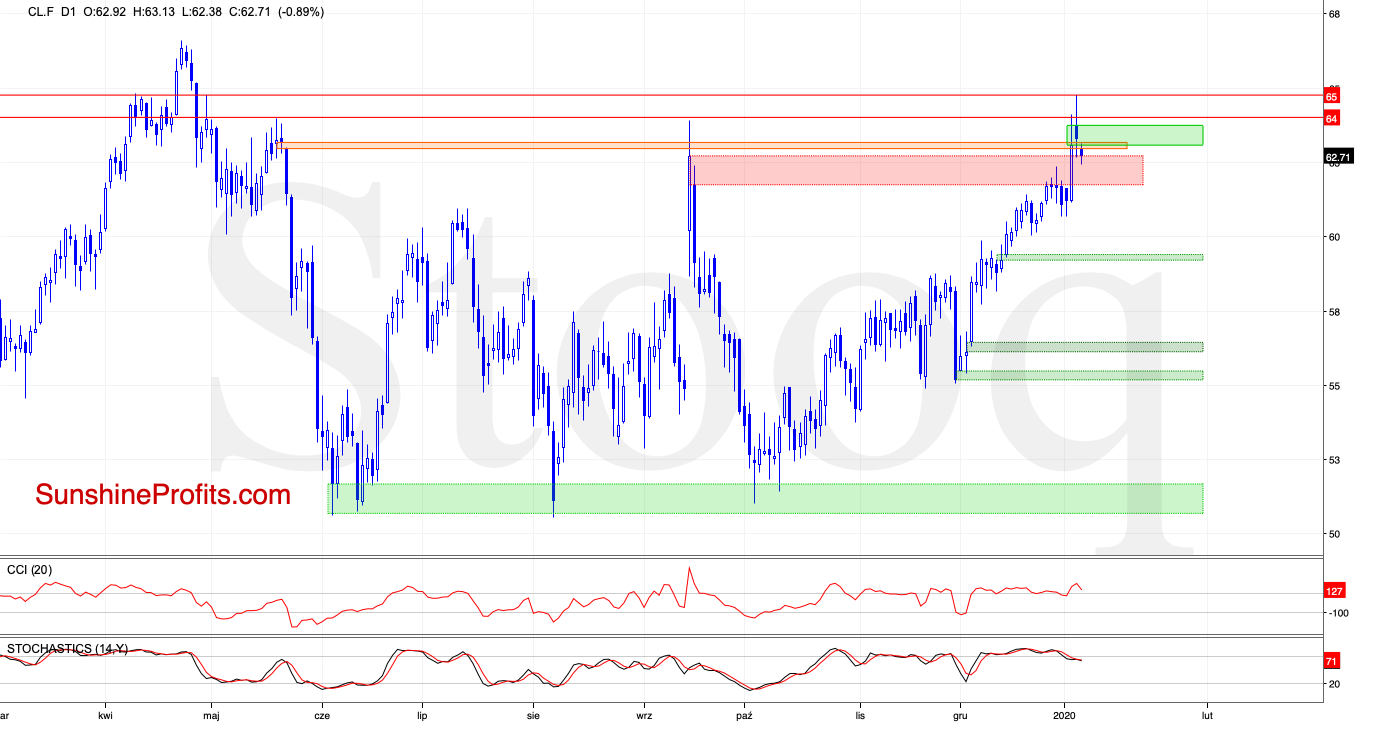

Additionally, when we factor in the current situation in the daily chart, the probability of lower prices seems to be even higher. Let's take a look at the chart below.

Friday's upswing resulted in closing two gaps, and has reached the horizontal resistance lines based on the late-April and May peaks. While these are bullish developments, the buyers didn't manage to go any higher, and a pullback followed yesterday.

As a result, the futures slipped below the previously-broken September high and Friday's peak during yesterday's session. This means invalidation of both breakouts, which is a bearish development.

It has encouraged the sellers to act, and the futures opened today with the red gap seen more clearly on the chart below.

On top of that, the current position of the indicators also favors the bears, suggesting that further declines are just around the corner.

Should it be the case and the futures extend losses from here, we'll likely see a decline to at least the nearest bullish green gap created in mid-December. This is where also the 38.2% Fibonacci retracement is, which together with the gap serves as the closest short-term support.

Taking all the above into account, opening short positions is justified from the risk/reward perspective. All details below.

Trading position (short-term; our opinion): Short position with a stop-loss order at $65.46 and the initial downside target at $59.49 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist