Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Yesterday's oil upswing was met with heavy selling not far above the $51 mark. Yet the bulls still closed with sizable gains, and attempted to build on them earlier today. Does it mean the downswing is over, or do the bears still hold some aces up their sleeves?

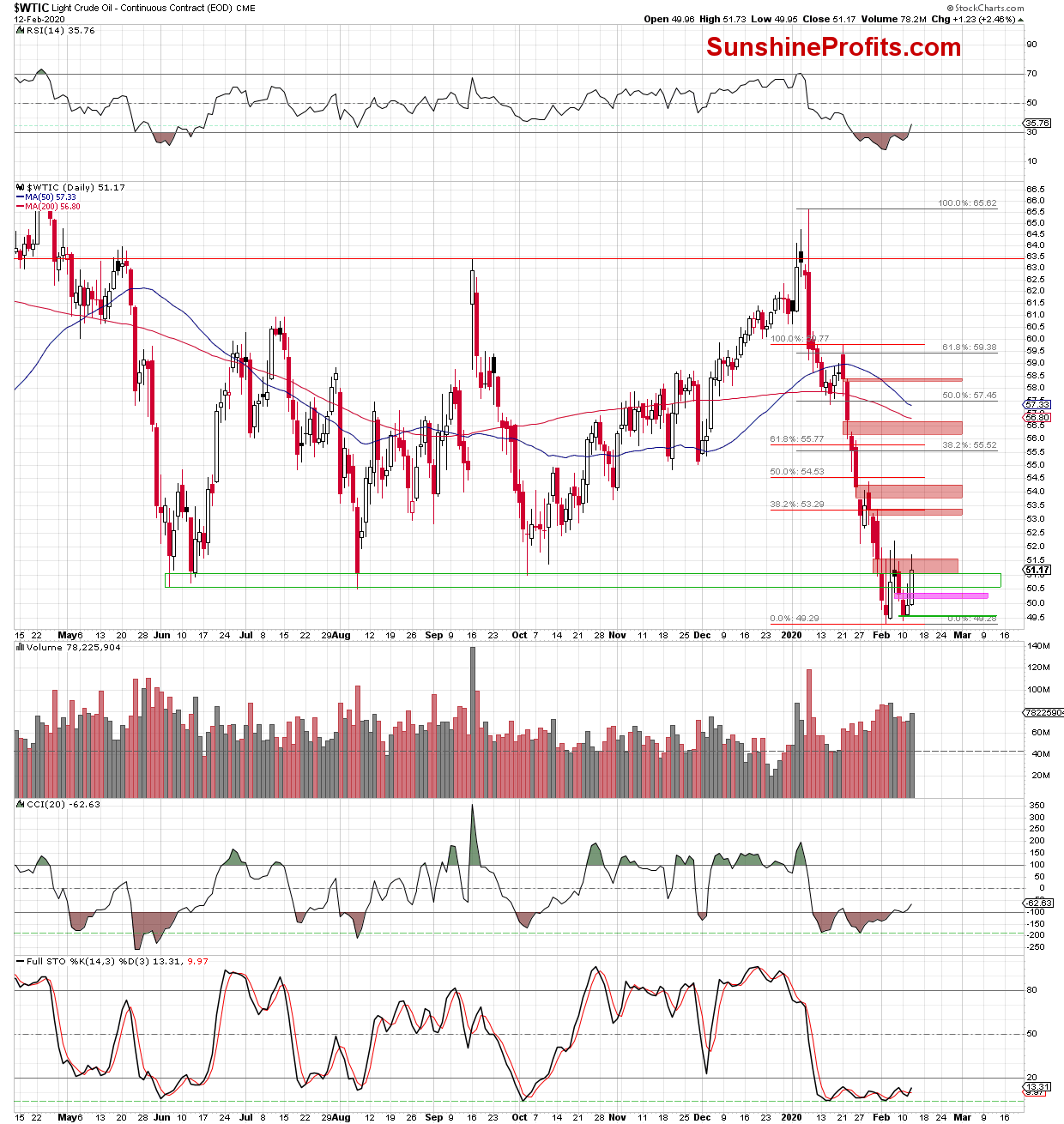

Let's check the daily chart below (charts courtesy of http://stockcharts.com and http://stooq.com ).

Let's recall our

yesterday's comments, and start with Wednesday's premarket action:

(...) Crude oil futures opened (...) with the yellow bullish gap, which triggered further improvement in the following hours.

This upswing is attempting to close the pink gap created on Monday. That's encouraging for the bulls, and suggests that we'll likely see the red gap created on February 3, 2020 tested later in the day.

This resistance was strong enough to stop the buyers five times in a row, which increases the probability that we could see another reversal and decline from here in the very near future. That could happen even later in the day after the EIA report. It's worth pointing out that the American Petroleum Institute showed yesterday that US crude oil inventories rose sharply last week (by 6 million barrels for the week ended Feb. 7). That doesn't bode well for higher oil prices - especially if today's EIA report confirms higher than expected increase in crude oil stockpiles.

This scenario is also reinforced by the green zone based on the previous lows and the upper border of the blue consolidation, which both work to reinforce this resistance zone. Additionally, another move to the downside and a fresh 2020 low would be in line with the Elliott Wave Theory.

The situation developed in tune with the above scenario and crude oil including its futures pulled back before the closing bell. This way, black gold invalidated the earlier tiny breakout above the red gap, providing encouragement to the sellers to act earlier today.

The second chart reveals that the futures opened today above yesterday's closing prices, thus creating a bullish gap. However, the buyers didn't manage to hold on to earlier gains, and a decline came in the following hours.

As a result, the bears closed the gap, and it remains closed at the moment of writing these words. This is similar to what we saw on January 29. Back then, such price action translated into further declines in the following days, which increases the likelihood that the history will repeat itself once again in the very near future and we'll see a fresh 2020 low in the coming day(s).

Summing up, oil bulls couldn't close the bearish gap just above $51 gap yesterday, and neither today's bullish open did the trick. The fundamental reality of high EIA stockpiles and Elliott wave analysis support a break lower. Should the January 29 lessons of closing the preceding bullish gap first and then move lower repeat today as well, it would increase the chances of seeing a renewed downswing that would challenge the 2020 lows.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager