Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Crude oil still hasn't made much headway in the current back-and-forth trading. But as the previous week is over, let's check what kind of insightful details we can learn from across several time horizons.

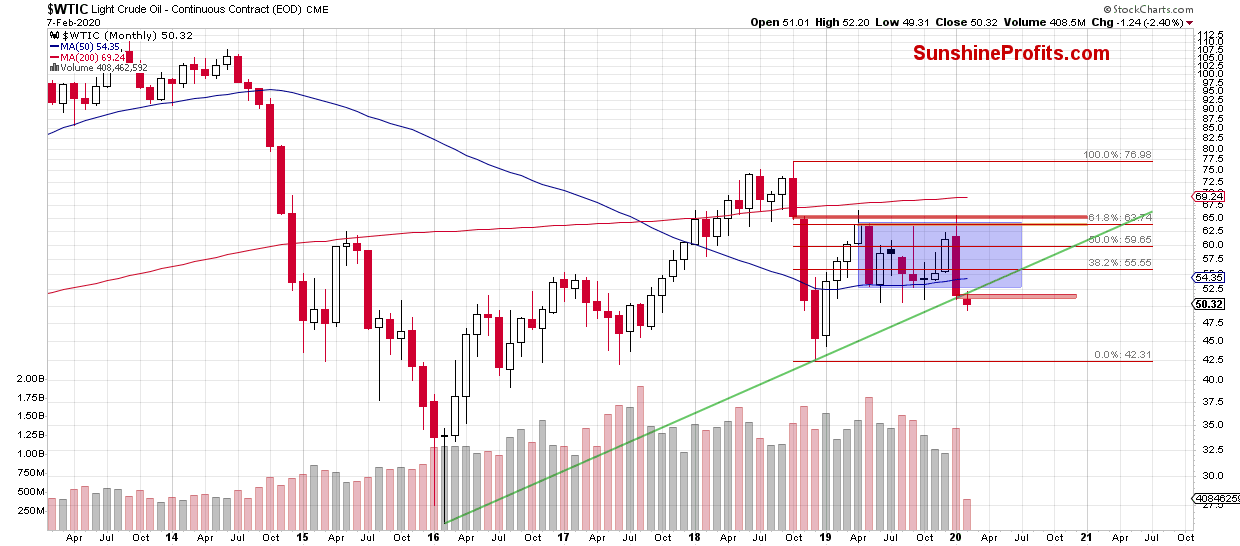

Let's take a closer look at the monthly chart below (charts courtesy of http://stockcharts.com).

The major resistances are the previously broken long-term green line, the red gap and the lower border of the blue consolidation. They continue to keep gains in check, which means that the overall situation in the long term remains unchanged.

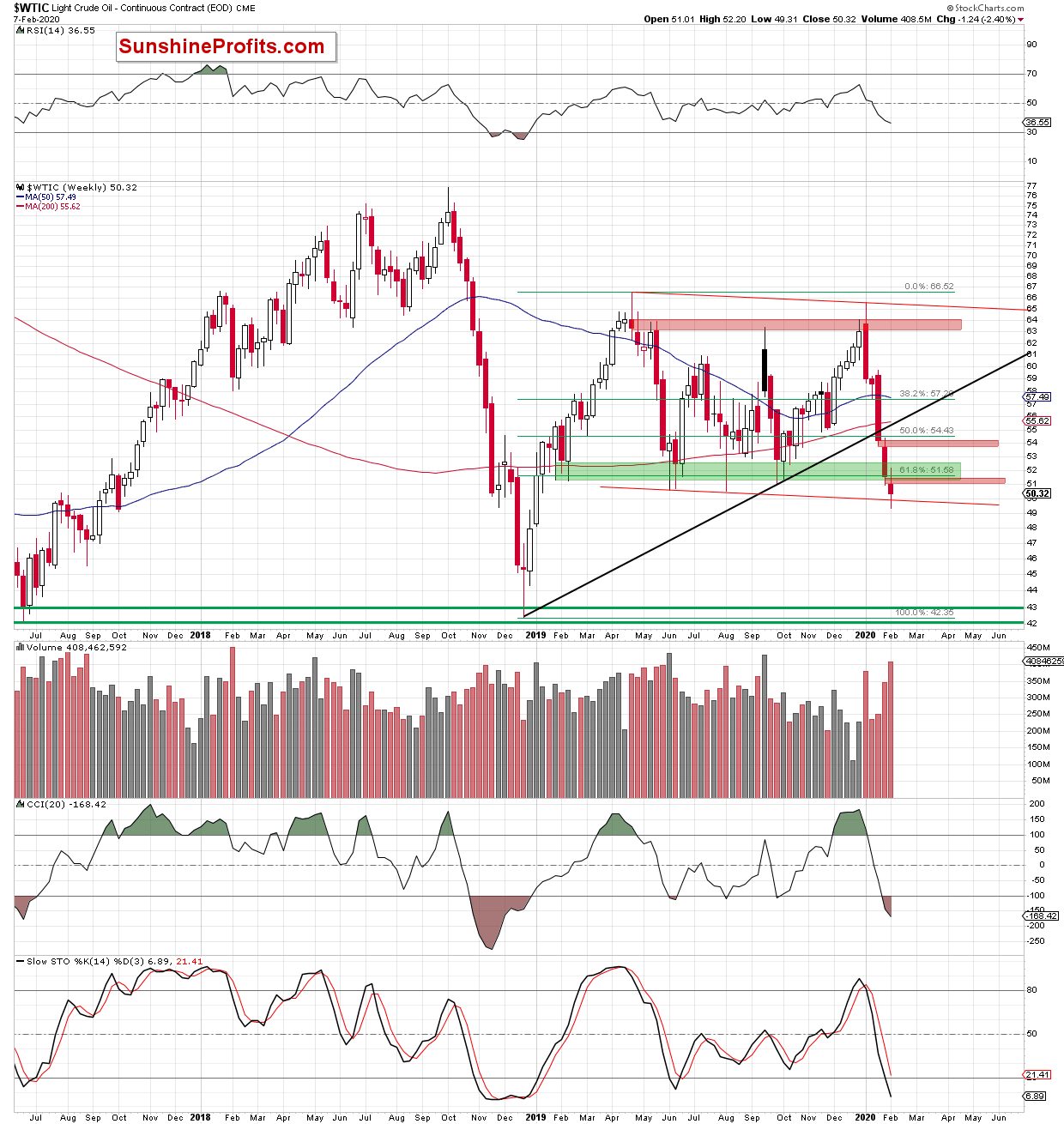

Has anything important changed on the medium-term chart?

Yes, but only at first glance. What do we mean by that? As you can see on the above chart, crude oil closed the previous week above the previously broken lower border of the red declining trend channel, invalidating the earlier breakdown.

Although this is a bullish development, the price of black gold is still trading below the green zone. Also, the red gap remains open, and it serves as a major short-term resistance. Finally, the sell signals generated by the weekly indicators are still in play, suggesting that one more attempt to move lower can't be ruled out - especially when we factor in the current short-term situation.

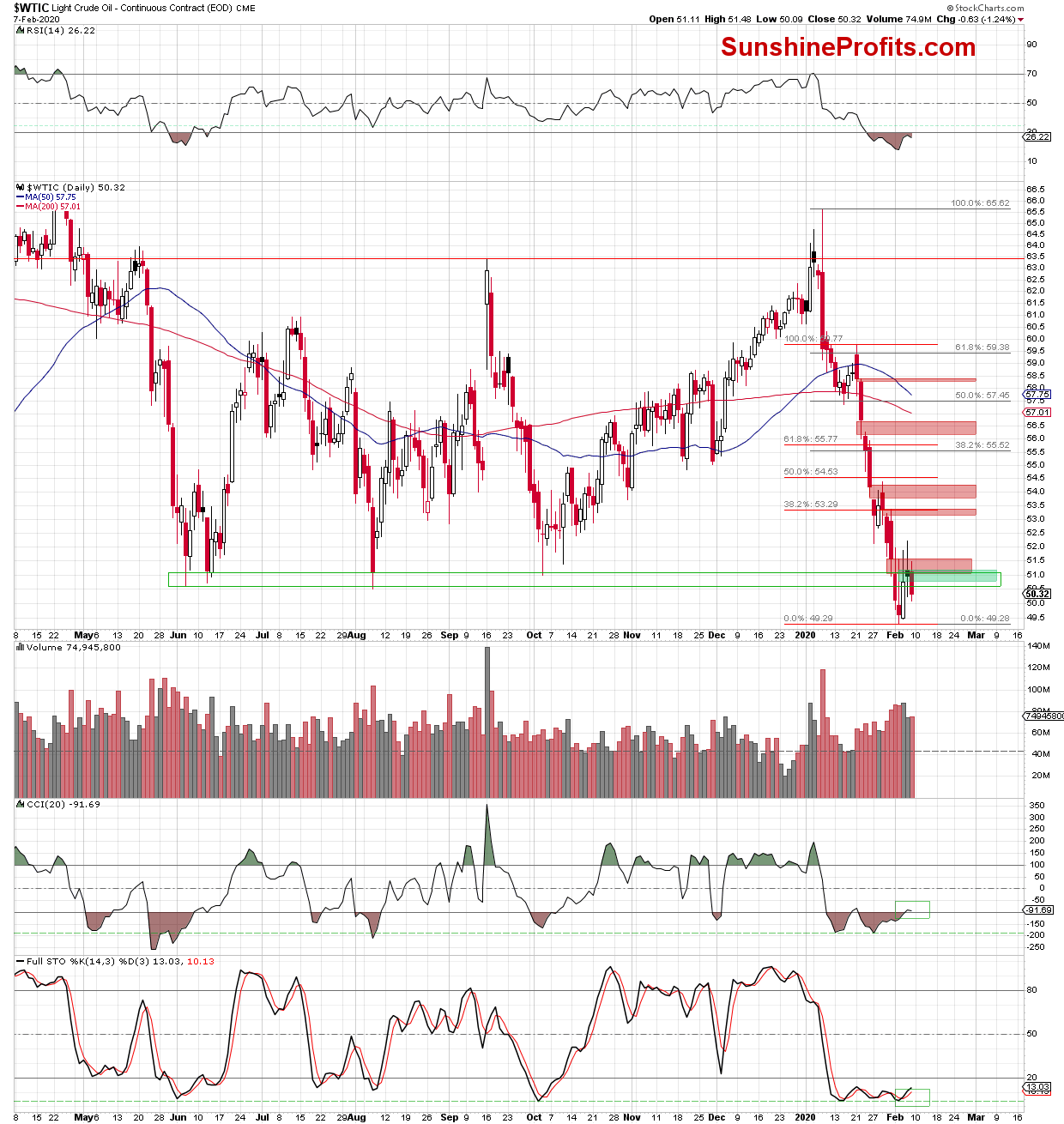

Let's take a look at the daily chart to find out what we mean.

From this perspective, we see that although the buyers took the commodity a bit higher after the market's open, the red gap stopped them for the third time in a row. That just shows how the bears are committed to defending this resistance.

As a result, black gold reversed and declined, which translated into the green gap created at the beginning of Thursday getting closed. Additionally, light crude finished the day below the green zone created by the previous lows, which doesn't bode well for the bulls, regardless of the extended position of the daily indicators.

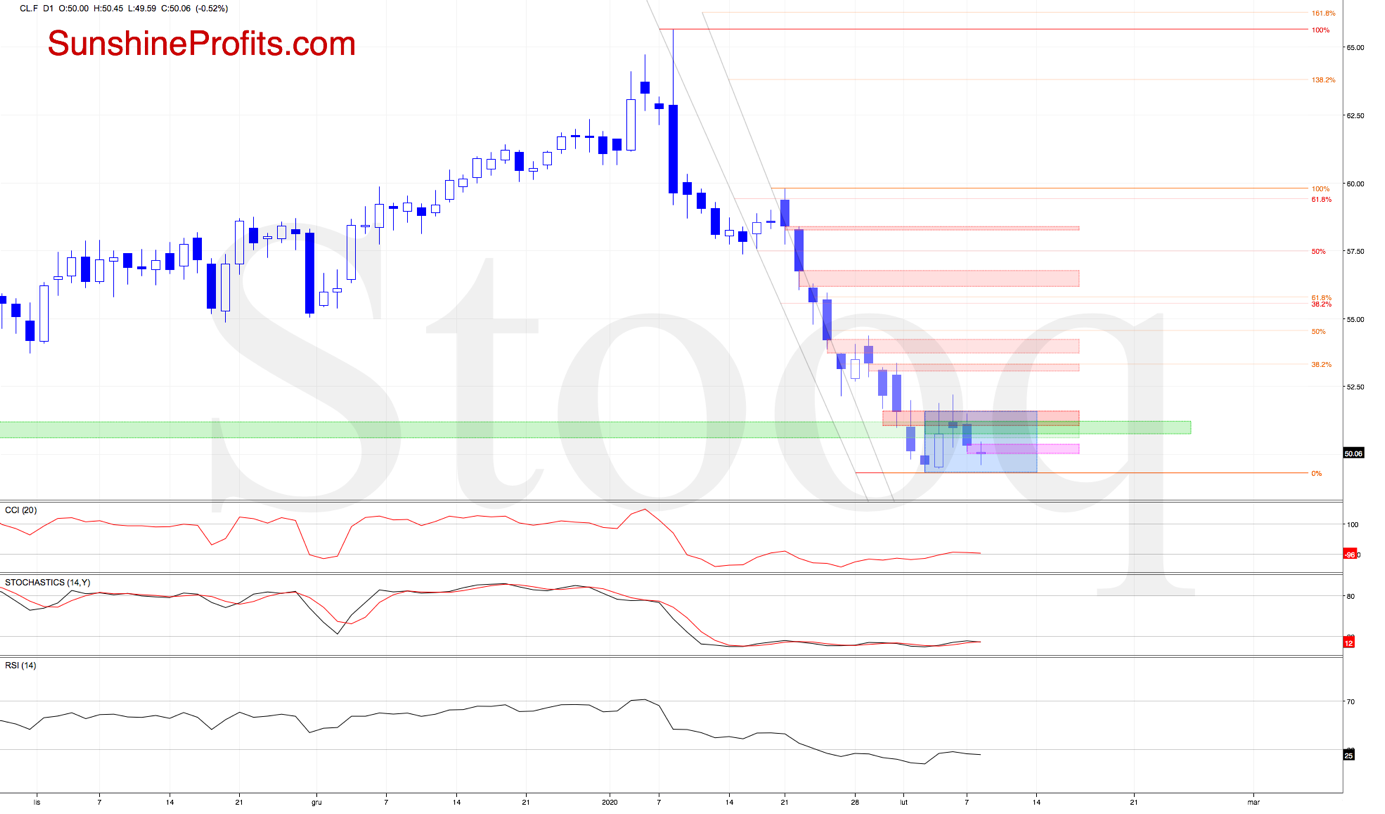

How Friday events influenced the mood of market participants before today's opening? Let's focus on the crude oil futures action.

Bulls' weakness on Friday translated into another bearish open today, and you can see the gap marked with pink on the above chart. Although the buyers tried to close it earlier today, they failed. Thus, the gap still remains open at the moment of writing these words. It increases the probability of another downswing in the very near future.

Should it be the case and crude oil futures move lower from here, further deterioration in crude oil after the market's open and a test of the lower border of the mentioned red declining trend channel (seen more clearly on the weekly chart), the last week's low or even a fresh 2020 low, is very likely.

Summing up,

the situation in crude oil is currently too unclear to justify opening any trading positions, but the multitude of bearish factors suggests a solid probability of another downswing in the near future. These are the following facts: black gold is still trading below the green zone on the weekly chart, the weekly red gap remains open, and the weekly indicators' sell signals are still in play.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager