Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Despite the bearish shape of yesterday's candle, the bulls scored daily gains and repelled another downswing. Does it mean that the outlook has turned bullish now?

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com).

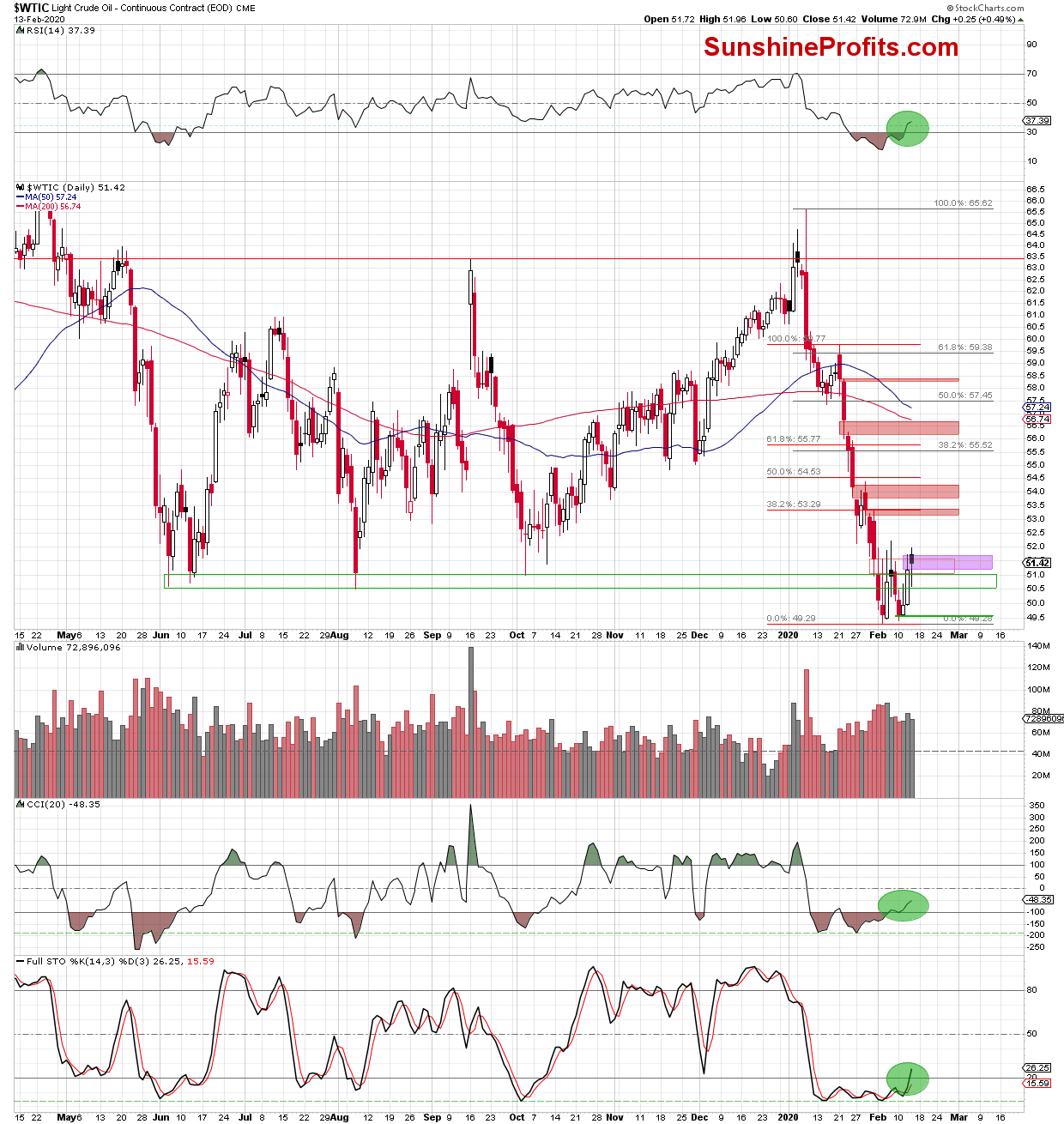

The first thing that catches the eye on the daily chart is the pink gap created at the beginning of yesterday's session. This bullish development encouraged the buyers to push the commodity higher after the market's open.

As a result, the price of light crude moved above the upper border of the red gap and approached early-February peaks. Despite such a bullish move, the buyers failed in the end. Black gold pulled back before the end of the day, and closed below the upper border of the red gap.

But let's keep in mind that despite yesterday's decline well below $51, the commodity reversed and rebounded from its intraday lows of $50.60. As a result, it has erased most of the earlier drop, which looks quite encouraging.

Additionally, all daily indicators generated their buy signals, giving the bulls even more reasons to act.

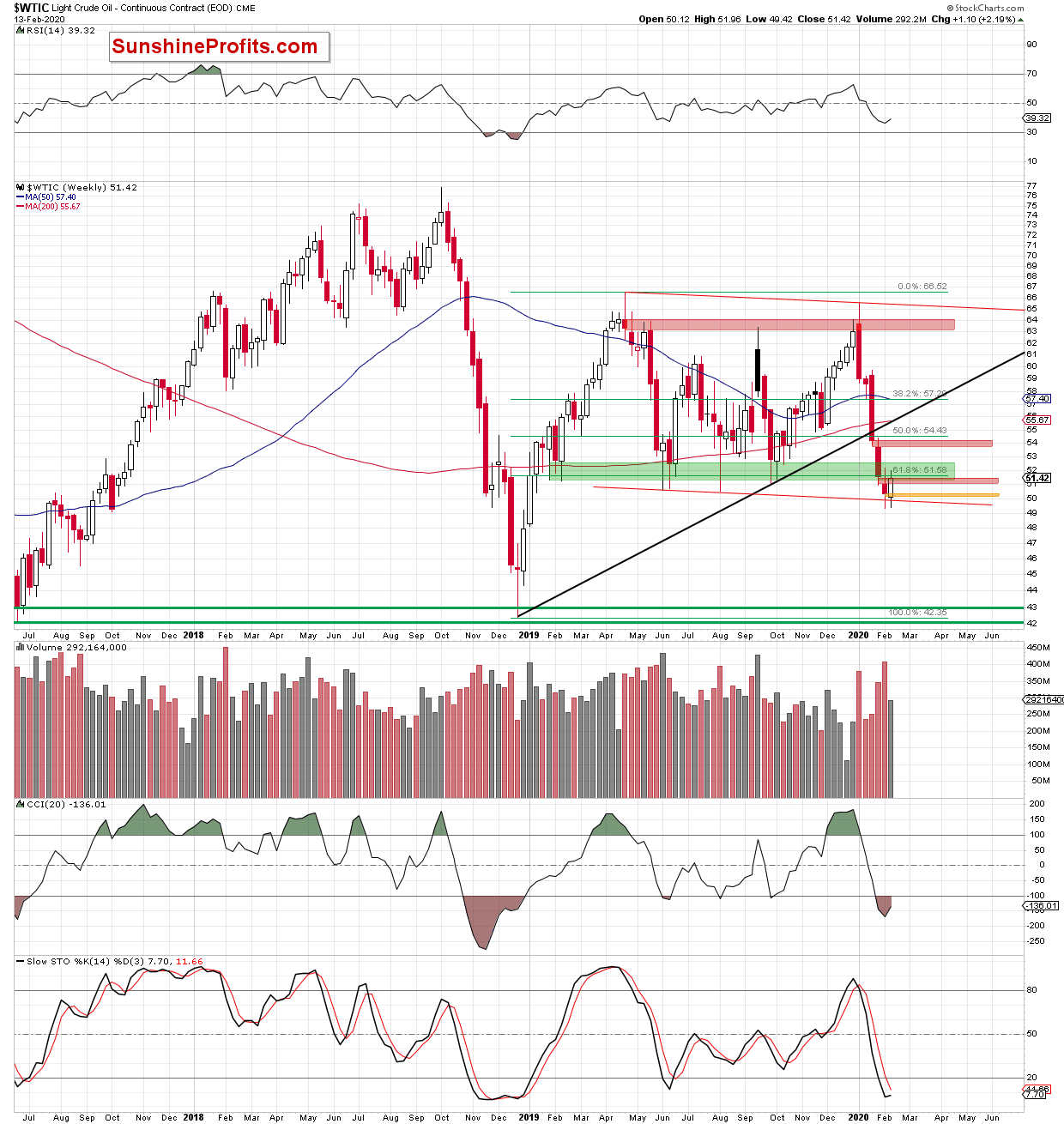

On top of that, when we zoom out our picture, we'll see that yesterday's increase positively affected the medium-term picture.

It reveals that the commodity not only invalidated the earlier breakdown below the lower border of the declining red trend channel earlier this week, but the orange gap created at the beginning of the week was also closed.

Thanks to recent increases, the bulls are very close to closing the gap created at the beginning of the month. If that happens, it would be a very positive development for the bulls.

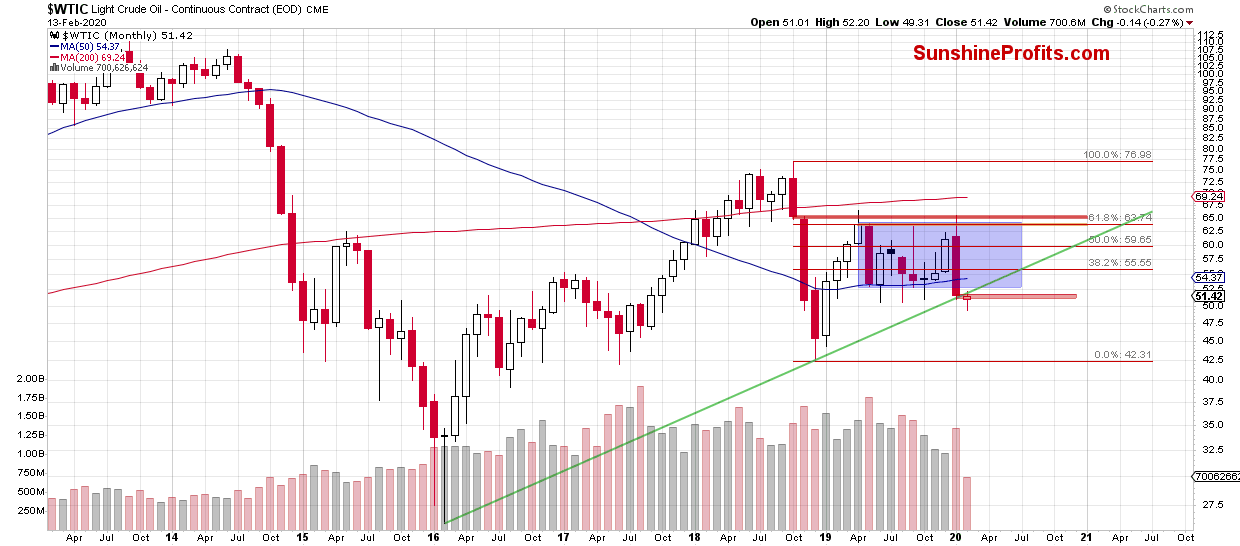

Is there anything that can stand in the way of higher prices? Let's take a look at the long-term chart below.

The monthly chart shows that despite the bulls pushing higher for almost the entire week, the price of black gold remains below the previously broken long-term green support line based on the previous lows.

What does it mean for the commodity?

Unfortunately, until the price rises above the previously-broken support line, the whole rebound can only be a verification of the earlier breakdown below it.

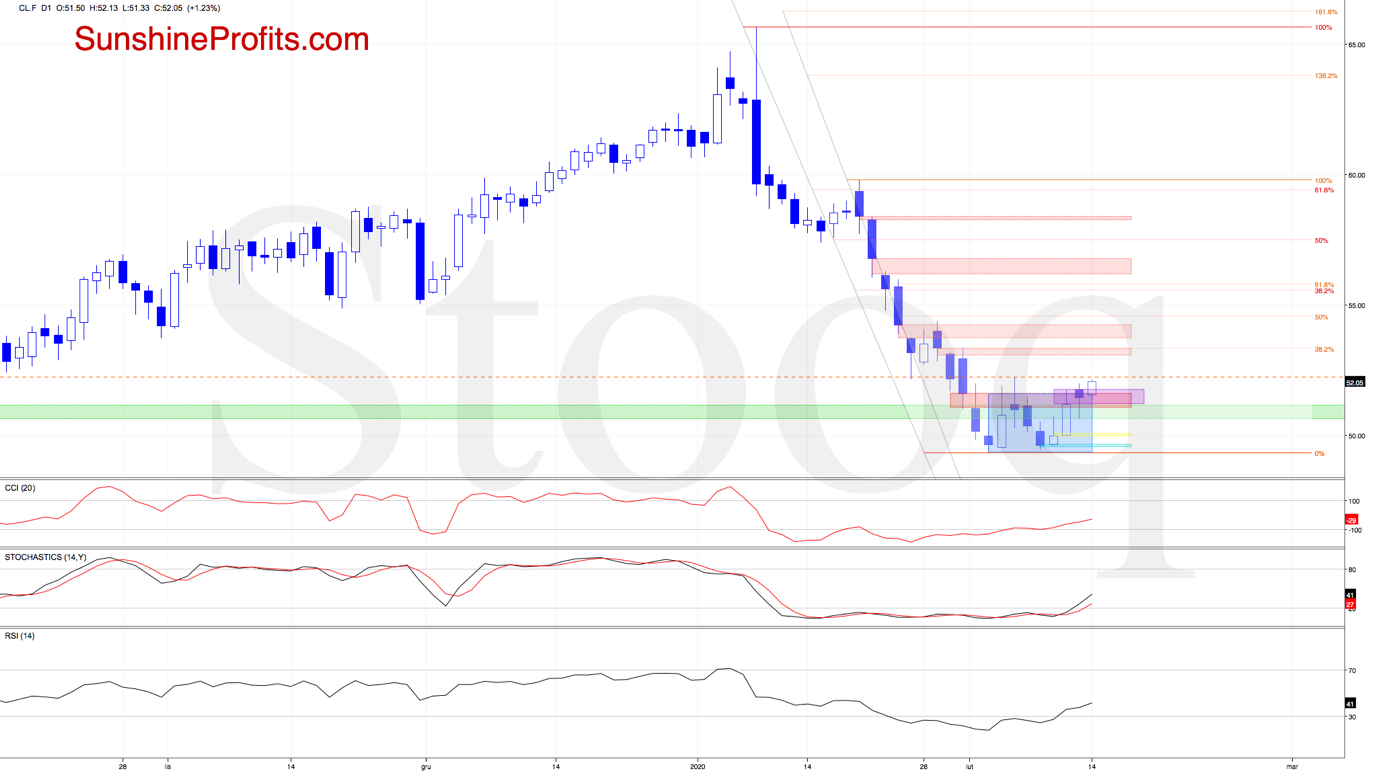

How does it reflect upon the buyers in today's premarket futures session? Let's examine the daily chart of crude oil futures to find out.

Looking at the daily chart, we can see that the buyers aren't giving up and bulls are fighting fiercely to close the gap. Such a bullish development would be noticeable also on the weekly chart.

Earlier today, crude oil futures moved not only above the red gap, but also above the upper border of the blue consolidation and yesterday's peak, which triggered an increase to the orange horizontal resistance line based on last week's high.

What's next for the futures and crude oil?

In our opinion, today's price action looks very encouraging for the bulls. Unfortunately for them though, we are still of the opinion that as long as there is no confirmed daily close above the red gap, above the upper border of the blue consolidation that's marked on the futures chart, and above the long-term green resistance line, opening long positions is not yet justified from the risk/reward perspective.

Nevertheless, if the bulls show strength later in the day and manage to finish Friday's session above the mentioned levels, we'll likely open long positions on Monday. As always, we'll keep you - our subscribers - informed.

Summing up, the daily chart's outlook is gradually turning bullish, and it's encouraging to see the buyers take on one bearish obstacle on the weekly chart after another. Unless they also move back above the previously broken rising support line on the monthly chart, this week's effort could be nothing more than verification of the breakdown below it. Today's price action is encouraging, and should the bulls show strength however, and close above the mentioned levels, we'll strongly consider opening long positions on Monday.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager