-

Is Crude Oil Attempting a Breakout Ahead of the OPEC+ Meeting?

May 5, 2022, 10:26 AMWhat decision could OPEC and its allies potentially make as we witness an economic slowdown in China, the world’s top importer of crude oil?

Energy Market Updates

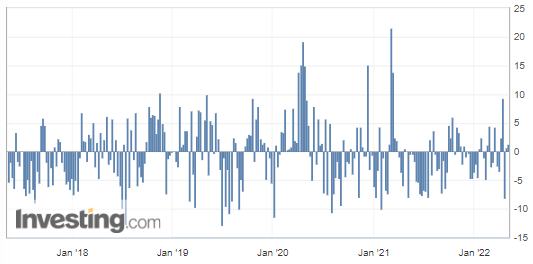

Commercial crude oil reserves in the United States unexpectedly rose in the week ended April 29, according to figures released Wednesday by the US Energy Information Administration (EIA).

US crude inventories have increased by more than 1.3 million barrels, which implies lower demand and could potentially count as a bearish factor for crude oil prices. This comes in addition to the US Federal Reserve’s rate hike. In normal times, theoretically, it tends to push commodities to the lower side, unless the markets have already priced more aggressive monetary policy adjustments by the Fed and thus were somehow disappointed that Powell ruled out a further 75bps in June.

(Source: Investing.com)

WTI Crude Oil (CLM22) Futures (June contract, daily chart)

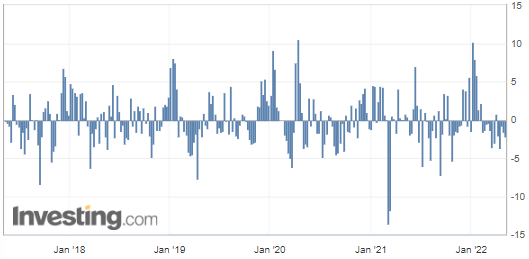

On the other hand, some additional figures, extracted from the same EIA report, were released and surprised the markets.

These are US Gasoline Reserves, which plunged by about 2.23 million barrels over a week, while the market was forecasting just a little more than half a million decline.

(Source: Investing.com)RBOB Gasoline (RBM22) Futures (June contract, daily chart)

The OPEC+ countries, which meet on Thursday, should once again agree on a marginal increase in their production of black gold, comforted by the risks that weigh on demand against the backdrop of anti-COVID restrictions in China. As explained in my last analysis, the market does not expect much more from this meeting, as the current targets of 400k barrels per day – or just a little bit more eventually – should be sustained, even though the cartel has been struggling to pump such volumes.

Notably, given the current political crisis in Libya – the producing country endowed with the most abundant reserves in Africa – which has seen its oil infrastructure blocked, where oil operations have been stopped since mid-April and with the likelihood of a “double-standardized” embargo on Russian oil and gas, it will certainly not help. In the end, some more dependent countries (such as Hungary and Slovakia) will still be allowed to buy Russian fossil fuels, and others might simply buy Russian hydrocarbons through a parallel market, since the opacity of some pipelines may sometimes turn some buyers blind when it comes to tracking oil and gas origins. However, everything is just a matter of communicating nowadays.

So, how do you think black gold will progress from now? Do you think it will break out of the triangle and accelerate further up by following the recent market development for gasoline? Or perhaps you believe that this attempt is a ruse designed to mislead buyers, causing crude to fall lower.

Let us know in the comments.

That’s all, folks, for today. Happy trading!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

China Faces Trouble as the EU Nears Embargo on Russian Oil

May 3, 2022, 11:01 AMChina is the world's second-largest consumer and the world’s top importer of crude oil. In the face of adversity, is its economy likely to slow down?

Crude oil prices ended slightly higher yesterday after a volatile session, caught between weakening demand in China and the prospect, closer than ever, of a European embargo on Russian oil imports.

In the economic capital of Shanghai, where more than 25 million inhabitants have been locked up for a month, anyone who tests positive for coronavirus is sent to a quarantine center, even if they are asymptomatic. Apparently, China is sticking to this “zero-covid” policy that, ironically, has even become a new standard of freedom as similar restrictive models that run counter to individual freedoms were followed by some countries, including Australia, Canada, and New Zealand not so long ago.

On the other hand, several countries, including Hungary, Denmark, France, the United States, and Britain, have recently announced they are moving their embassies back to Kyiv as the security situation in the Ukrainian capital improves.

As Hungary will not support sanctions on Russian oil and gas shipments, Slovakia says it will seek exemption from any EU embargo on Russian oil. Therefore, the EU executive committee could spare both Slovakia and Hungary an embargo on buying Russian oil, taking into account the dependence of both countries on Russian crude.

Speaking of Russian imports, it can also be noted that in 2021, Russia supplied Europeans with 30% of crude oil and 15% of petroleum products.

Meanwhile, the thirteen members of the Organization of the Petroleum Exporting Countries (OPEC), led by Riyadh, and their ten partners, led by Moscow (OPEC+), are going to meet on Thursday (May 5) by videoconference to make any adjustments to their production.

The market does not expect much from this meeting, as the current target of 400k barrels per day should be sustained. It’s despite the cartel’s struggling to pump such volumes, notably given the current political crisis in Libya – the producing country endowed with the most abundant reserves in Africa – which has seen its oil infrastructure blocked, where oil operations have been stopped since mid-April.

Regarding the US dollar, the safe-heaven currency – still the king of international trade – remains strong, with a dixie hovering around its highs in a range marked between 102.750 and 103.930.

The latter remains a strong resistance to break out before we see further moves towards the upside.

Charts

Figure 1 – US Dollar Currency Index (DXY) CFD (daily chart)

Figure 2 – WTI Crude Oil (CLM22) Futures (June 2022 contract, daily chart) Figure 3 – RBOB Gasoline (RBM22) Futures (June 2022 contract, daily chart)

Figure 3 – RBOB Gasoline (RBM22) Futures (June 2022 contract, daily chart) Figure 4 – Henry Hub Natural Gas (NGM22) Futures (June 2022 contract, daily chart)

Figure 4 – Henry Hub Natural Gas (NGM22) Futures (June 2022 contract, daily chart)That’s all, folks, for today. Happy trading!

As always, we’ll keep you, our subscribers, well informed.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Marine Shipping Stocks: Hot Ways to Diversify Your Portfolio

April 29, 2022, 11:33 AMIs it worth diversifying your portfolio with assets such as shipping logistics and transport-related areas? They can surely provide a bit of a sea breeze.

Today, let’s focus on stocks in another aspect of indirectly trading commodities (energy): sea freight, maritime shipping and logistics.

By the way, feel free to send us your questions or any topics that you would like us to write about in the forthcoming editions, and I will try my best to answer them!

Investment ideas and trading positions are available to our premium subscribers only.

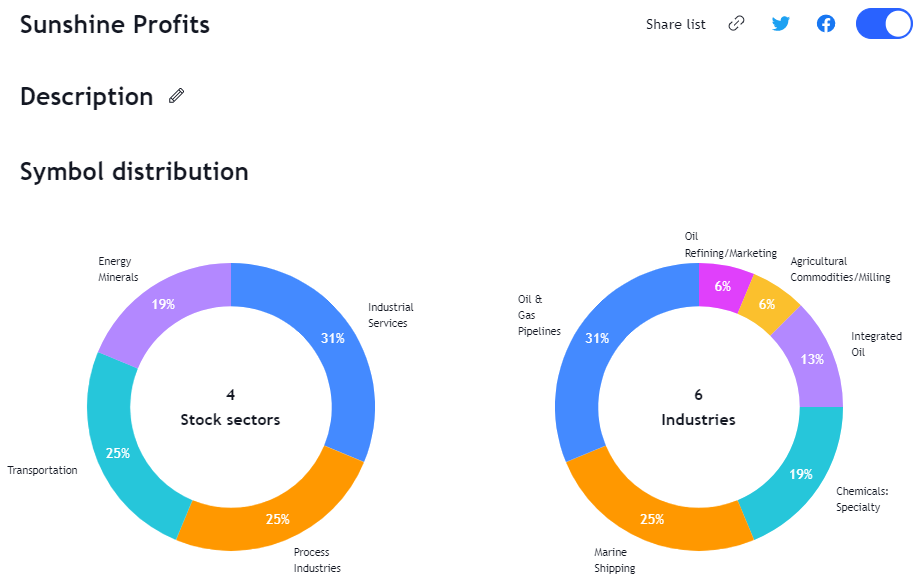

A good way to diversify the construction of your oil and gas investment portfolio is to use a variety of assets for a balanced exposure to the energy sector and its industrial components, such as the logistics and shipping industrial areas. Given that these are multinational corporations with their fleets of vessels spread all over the globe, across all the oceans, their shares would thus constitute a good way to give your portfolio some sea breeze.

Stock Watchlist

Last week, I presented a few key reasons to invest in the maritime shipping sector in the first article. Today, let’s watch some marine transportation stocks.

As usual, our stock-picks will be shared through that link to our dynamic watchlist, which will be updated from time to time, as we progress through this portfolio construction process.

See below for an example of some indicative metrics for our current portfolio:

In summary, this sector may present some benefits for diversifying your investment portfolio with a more balanced approach. So, what stocks do you guys’ trade?

As always, we’ll keep you, our subscribers, well informed.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Crude Oil Is Holding Its Breath As China Fears COVID Again

April 26, 2022, 10:22 AMWhile China plans to implement lockdowns for fear of an epidemic, concerns about the coronavirus are taking a toll on the oil market. Will it escalate?

Crude oil prices remained lower on Tuesday, after significant losses suffered the day before. They are still weighed down by fears of a general lockdown in Beijing, the capital of China, as well as in Shanghai, thus risking a demand reduction for black gold.

The concern also affects industrial metals, of which China is a major consumer. They recorded substantial price drops on the London Metal Exchange (LME) on Monday. As per the below chart, the LMEX, an index that incorporates the prices of aluminium, copper, lead, nickel, tin, and zinc traded on the LME, posted 4,864.9 points on Monday, erasing all its gains from March and April:

London Metal Exchange (LMEX), TradingEconomics.com

London Metal Exchange (LMEX), TradingEconomics.comThe implementation of China’s zero-COVID policy seems to be heavily affecting Chinese demand for crude, which is already down 1.2 million barrels per day due to the severe health restrictions (strict lockdowns) put in place in Shanghai. According to Bloomberg, Chinese demand for certain types of fuel (gasoline, diesel, and kerosene for aviation) has already fallen by 20% in April 2022 compared to a year earlier.

In addition, the rise of the US dollar represents another factor currently weighing on crude oil prices, since the greenback is at its 25-month high against the euro.

Dollar Currency Index (DXY), daily chart TradingView.com

Dollar Currency Index (DXY), daily chart TradingView.comOn the West Texas Intermediate (WTI) benchmark, we have switched to the new calendar month, which is the June maturity contract, CLM2022. On the Brent benchmark, we will look at the BRNM2022.

WTI Crude Oil (CLM22) Futures (June contract, daily chart)

WTI Crude Oil (CLM22) Futures (June contract, daily chart) Brent (BRNM22) Futures (June contract, daily chart, EOD data)

Brent (BRNM22) Futures (June contract, daily chart, EOD data)That’s all folks for today. Have a nice week ahead!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

With Lidl Becoming a Shipowner, Should We Invest in Shipping?

April 22, 2022, 10:50 AMWhile commodity prices soar, is it worthwhile to consider investing in the logistics, maritime, and shipping industrial sectors, or is it too risky?

One of Europe's largest discount retailers has set up its own company, Tailwind Shipping Lines, to respond to container shortages. With annual profits of nearly 3 billion euros, the group has plenty of the necessary capital. The objective is to ensure the smooth flow of delivery chains for the group's supermarkets. On the other hand, with sanctions on Russian oil and gas, we could see more tankers crossing the oceans, containing liquefied natural gas (LNG).

(Container Ship “Ever Given” stuck in the Suez Canal, Egypt March 24th, 2021, Creative Commons)Here are a few reasons to invest in that logistics-driven sector:

- container rates are still high, supported by energy prices and demand recovery;

- when demand is growing for goods, international trade through maritime routes tends to flourish;

- following the reduction of vessels in Shanghai due to China’s zero-COVID policy and thus forced lockdowns within one of its major economic centers, there was a slowdown that may give some opportunities to enter the transportation market.

The volatility in that market is high since shipping rates can be very variable, as can the shares of ship owners. Therefore, it is important to highlight that this market is a high-risk area that relies on many different and often unpredictable variables. Among the recent events that have marked the history of maritime transportation, there was the famous Evergreen’s carrier ship that got stuck in the Suez Canal. You probably all remember that, as it paralyzed the maritime flow for days and even provoked worldwide supply-chain disruptions.

So, in my next article to be published later next week, I have selected a list of products that I will provide with stocks that will help you diversify your portfolio and optimal entry levels to consider (for our subscribers).

That’s all, folks, for today. Have a nice weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM