Please note that due to the market volatility, some of the key levels may have already been reached and scenarios played out.

Risk Management: an idea here could be to enter on some potential dips (price getting back to support levels) by allocating one quarter (1/4th) of the position, then averaging down to lower supports with successively one third (1/3rd) and two fifth (2/5th) in case of further dips and depending on the volatility of each chosen security…

If you want to set a stop-loss, I suggest that you place it according to your risk appetite:

- Below the previous swing low (depending on your timeframe/time horizon).

- Or just use some Average True Range (ATR) multiplicator.

Investing entries (medium to long-term; my opinion; support levels for stocks): long.

|

Shipping stocks |

|

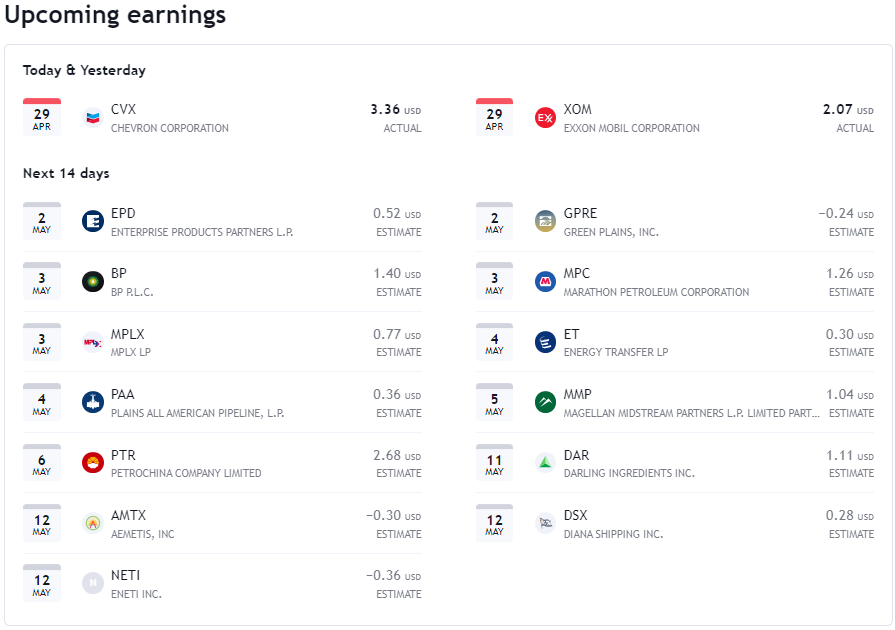

DSX, 3.45-3.83 |

|

NETI, 4.99-6.33 |

|

SB, 3.51-3.99 |

|

TNK, 12.50-13.77 |

Today, let’s focus on stocks in another aspect of indirectly trading commodities (energy): sea freight, maritime shipping and logistics.

By the way, feel free to send us your questions or any topics that you would like us to write about in the forthcoming editions, and I will try my best to answer them!

Investment ideas and trading positions are available to our premium subscribers only.

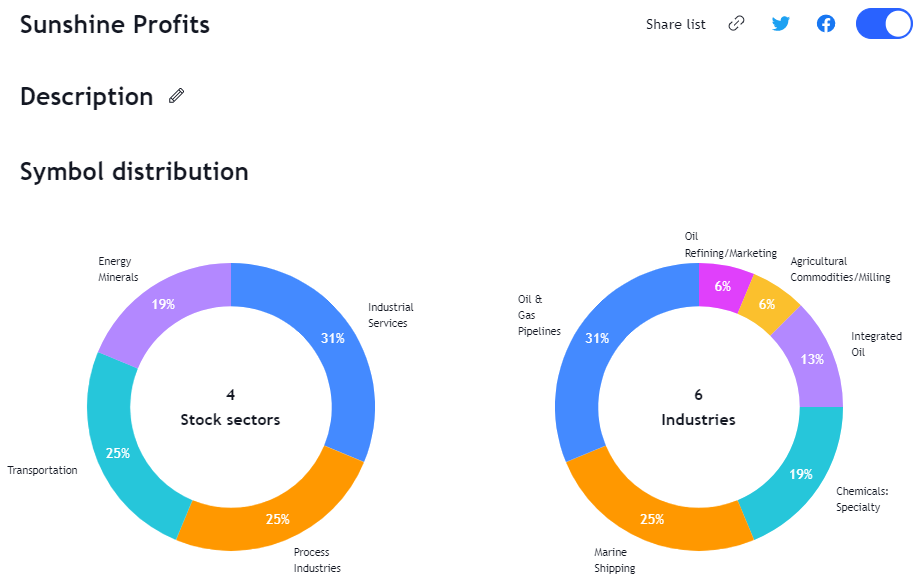

A good way to diversify the construction of your oil and gas investment portfolio is to use a variety of assets for a balanced exposure to the energy sector and its industrial components, such as the logistics and shipping industrial areas. Given that these are multinational corporations with their fleets of vessels spread all over the globe, across all the oceans, their shares would thus constitute a good way to give your portfolio some sea breeze.

Stock Watchlist

Last week, I presented a few key reasons to invest in the maritime shipping sector in the first article. Today, let’s watch some marine transportation stocks.

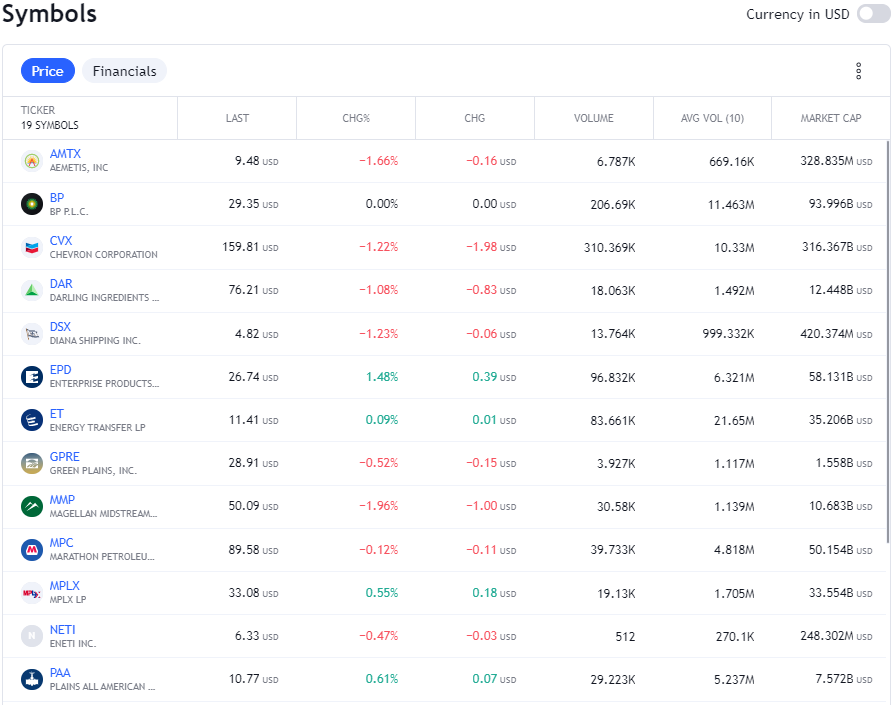

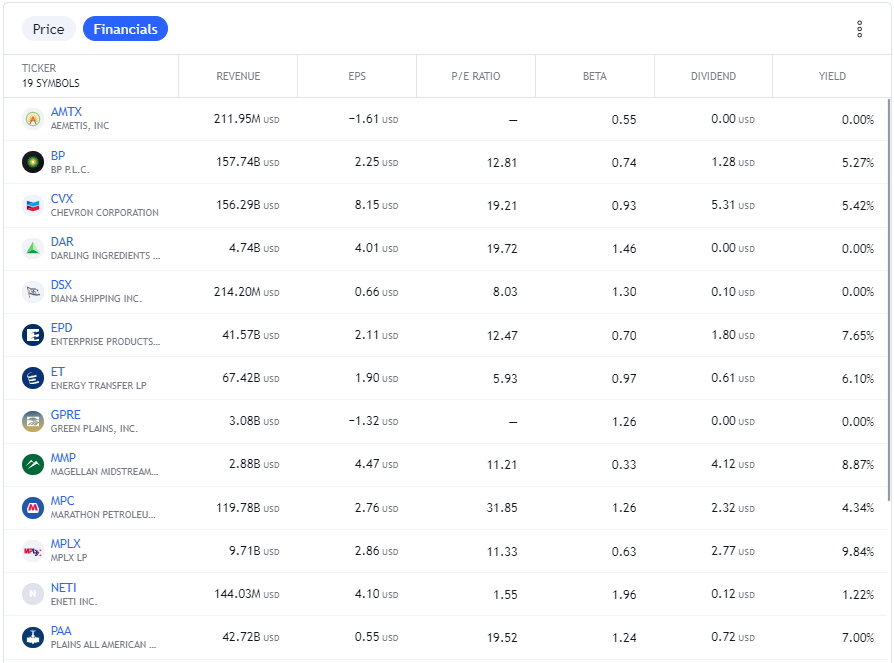

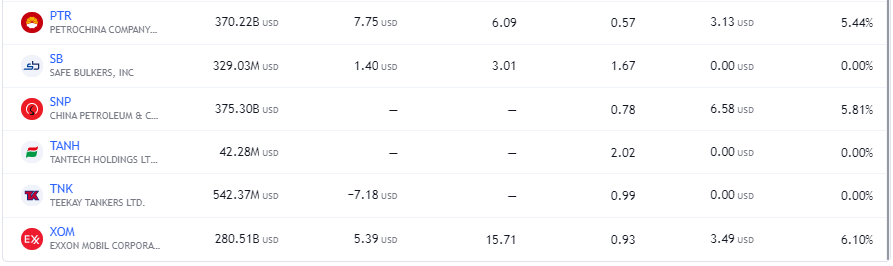

As usual, our stock-picks will be shared through that link to our dynamic watchlist, which will be updated from time to time, as we progress through this portfolio construction process.

See below for an example of some indicative metrics for our current portfolio:

Stocks Charts

Figure 1 – Diana Shipping (DSX) Stock (weekly chart)

Figure 2 – Eneti (NETI) Stock (weekly chart)

Figure 3 – Safe Bulkers (SB) Stock (weekly chart)

Figure 4 – Teekay Tankers (TNK) Stock (weekly chart)

In summary, this sector may present some benefits for diversifying your investment portfolio with a more balanced approach. So, what stocks do you guys’ trade?

Have a nice weekend!

As always, we’ll keep you, our subscribers, well informed.