-

WTI Crude Oil: How to Turn a Stop-Loss into a Stop-Win

April 1, 2022, 12:11 PMSometimes, we can get kicked off by the market from our trading positions. But does it have to prevent us from securing profits? Well, not this time!

No April Fool’s today – instead, here is a quick review of the trade entry provided in the pre-opening US session on Monday and its “stop-win” dragged upwards on Wednesday.

Film of a Trade (Trade Plan Explained)The dip took place as the oil market bottomed at $98.44 (facing a rejection from the bulls towards the $100 mark), triggering the suggested entry around $99.55-101.29, highlighted by the yellow band. It happened at the same time when the Kremlin announced a significant de-escalation around the Ukrainian capital of Kyiv and Chernihiv.

Thus, our subscribers got long around that pre-defined landing space (support). Not long afterwards, the first recommended target, projected at $113.90, was half-filled up. My recommended stop – initially placed just below the $92.20 level (March’s swing low) – could now be lifted:

- To new swing low ($98.44)

- To breakeven, or slightly above it

Personally, given the current volatility on the crude, I suggested dragging the stop up to $102.83 (Monday’s low - Mar. 28) and then lifting it again to $104.55 (Wednesday’s low - Mar. 30) once the prices break the $107.84 level (Tuesday’s high - Mar. 29).

Since black gold was at that time trading at $107.20 (we were getting very close to it while I was writing my Oil Trading Alert on Wednesday, as prices made a high at $107.70 that day), I suggested setting a price alert up there (at $107.84).

Monday (Mar. 28):

WTI Crude Oil (CLK22) Futures (May contract, daily chart)

WTI Crude Oil (CLK22) Futures (May contract, daily chart)Wednesday (Mar. 30):

WTI Crude Oil (CLK22) Futures (May contract, daily chart)Friday (Apr. 1):

WTI Crude Oil (CLK22) Futures (May contract, daily chart)

WTI Crude Oil (CLK22) Futures (May contract, daily chart)Update: as I was writing these few lines on Wednesday (Mar. 30), my alert finally got triggered, so our stop was therefore lifted to $104.55 according to our flying map (trade plan).

Wednesday (Mar. 30):

WTI Crude Oil (CLK22) Futures (May contract, 4H chart)

Here, I voluntarily removed the intermediate stop levels for better clarity, although you can look at them in the following chart:

WTI Crude Oil (CLK22) Futures (May contract, 4H chart)

Friday (Apr. 1):

As you can see, the level provided was optimum given its possible support function (that is, acting as a floor for rebounding prices).

On a side note, prices encountered some resistance as they were reaching the current month’s Volume Price of Control (VPoC). Therefore, exchanged volumes started accelerating around that level, and we wintessed a new accumulation cycle.

Suddenly, yesterday, the United States announced the largest ever release of crude oil barrels from the US Strategic Petroleum Reserves (SPR), as well as President Biden made a call on oil giants to increase drilling in order to boost oil supplies.

In response, the market retraced back to our support as prices recorded a 7% drop - at the end, we got stopped ideally still profiting from the market reversal (even though a retracement happened).

Who said a strict risk management framework got out a fashion? That’s exactly how important it is for succesful trading!

That’s all folks for today. Have a great weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

WTI Crude Oil: Let’s Review Our Just Triggered Trade Entry

March 30, 2022, 9:32 AMAvailable to premium subscribers only.

Today, let’s do a quick review of the trade entry provided in the pre-opening US session on Monday and then triggered yesterday.

-

Who Benefits Most From the Russia-Ukraine War?

March 28, 2022, 10:56 AMWith the unrest in the Black Sea basin, it appears that there are two more cross-trade wars in the world. These are about energy and currency.

Crude oil prices, down most of Friday, finally ended the week higher after a huge fire broke out at oil facilities in Jeddah, Saudi Arabia, following attacks by Yemeni rebels.

The great winner of the Russian-Ukrainian conflict is undoubtedly the United States, which now seems to be taking advantage of Europe’s moment of weakness.

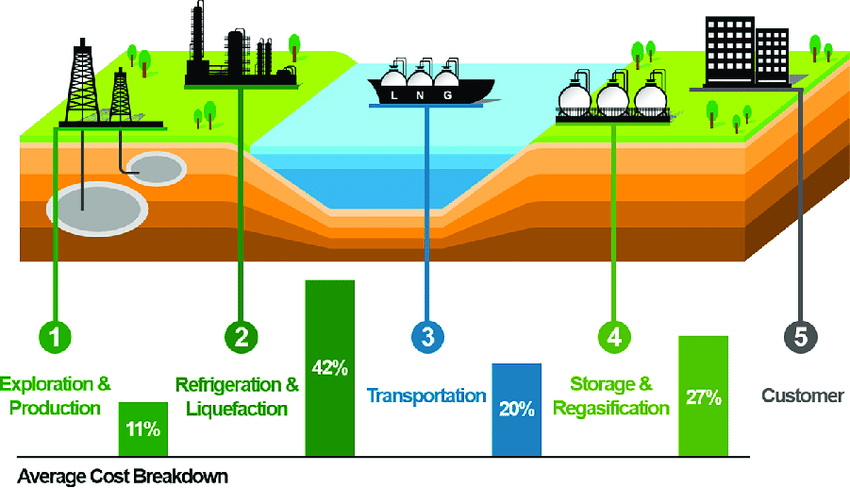

The latter is indeed currently switching its energy supplies from Russian natural gas (pipeline-transported) to the much more polluting and much more expensive US shale gas. The reasons are much higher extraction (fracking) and transportation costs since it requires additional processes such as liquefaction/degasification and the deployment of more port terminals that are able to provide such steps – also much more energy-consuming – linked to Liquefied Natural Gas (LNG) supplies.

(Source: ResearchGate.net)

By doing so, the European Union is going to increase its dependence on the US whilst a new and stronger block (including Asia) emerges on the east side.

As a result, we have already started to witness dedollarisation in international trade, with the petroyuan set to dethrone the heavily-printed petrodollar.

No wonder that the US dollar supply surge has ended up triggering uncontrollable and probably still underestimated inflation. As a result, this monetary virus is spreading through the global economy at a faster pace than any other variant!

WTI Crude Oil (CLK22) Futures (May contract, daily chart)

WTI Crude Oil (CLK22) Futures (May contract, daily chart) Henry Hub Natural Gas (NGK22) Futures (May contract, daily chart)

Henry Hub Natural Gas (NGK22) Futures (May contract, daily chart)“Inflation is like toothpaste. Once it's out, you can hardly get it back in again. So, the best thing is not to squeeze too hard on the tube.” – Dr Karl Otto Pöhl

That’s all folks for today. Happy trading!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Crude Oil Holds Its Breath Ahead of World Summits

March 24, 2022, 11:13 AMCurrent levels of oil and petroleum products are high. Given that, what can explain such a surprising drop in US crude inventories?

Energy Market Updates

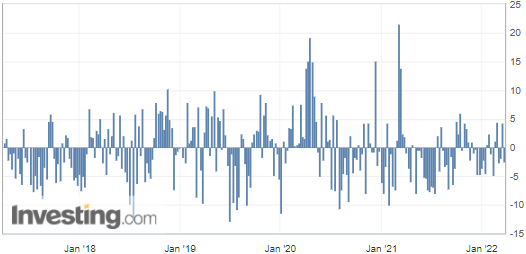

Commercial crude oil reserves in the United States fell much more than expected in the week ended March 18, according to figures released on Wednesday by the US Energy Information Administration (EIA).

US crude inventories have shrunk by more than 2.5 million barrels, which implies greater demand and is obviously another bullish factor for crude oil prices. Such a decline in inventories is particularly remarkable as the American strategic reserves have also recorded a significant drop. This is the 25th consecutive week of falling strategic reserves since the Biden administration started to make those adjustments in an attempt to relieve the market.

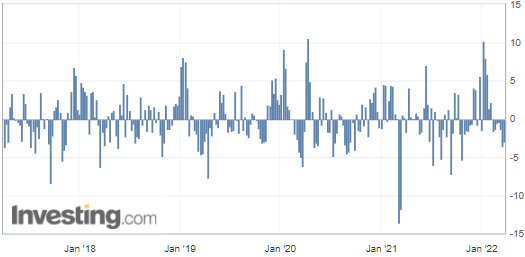

(Source: Investing.com)

WTI Crude Oil (CLK22) Futures (May contract, daily chart)

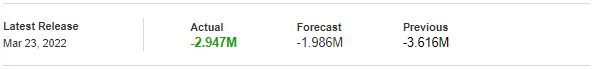

Furthermore, some additional figures extracted from the same EIA report were released and surprised the markets.

These are US Gasoline Reserves, which plunged by about 2.95 million barrels over a week, while the market was not even forecasting a two-million decline.

(Source: Investing.com)Thus, US exports jumped by more than 30% compared to the previous week, not only due to large flows to Europe to replace Russian barrels, but also marked by a significant rebound in Asian demand.

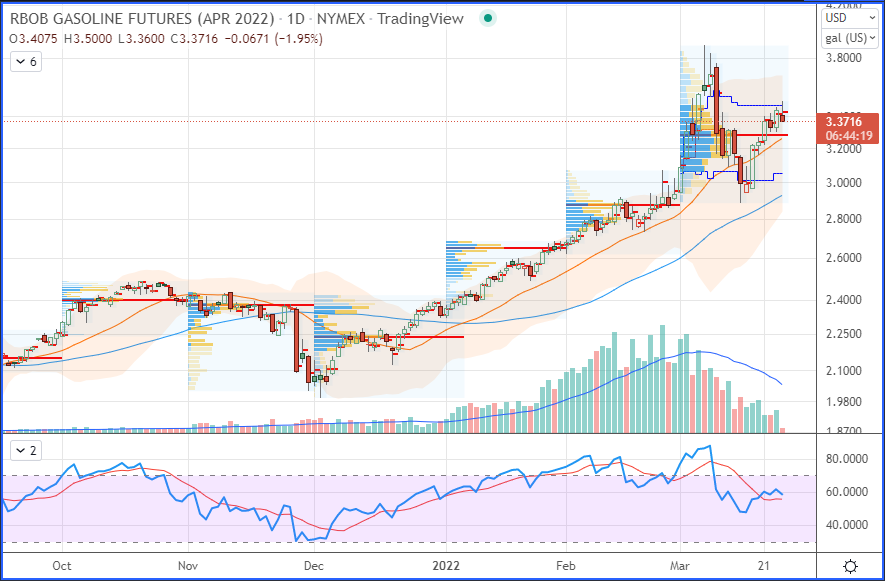

RBOB Gasoline (RBJ22) Futures (April contract, daily chart)

Beware that a NATO summit, a G7 summit, and a European Union summit are being held on Thursday, when the various countries could set a new round of sanctions against Moscow.

So, how will black gold progress from now on? Do you think that the on-going negotiations with Iran and Venezuela could flood the market with additional barrels? Let us know in the comments!

That’s all folks for today. Happy trading!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Crude Oil Projections: Patience Will Pay Off

March 22, 2022, 10:48 AMAvailable to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM