-

Oil Trading Alert Update Postponed

March 4, 2022, 9:58 AMAvailable to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Nymex Natural Gas: How to Trade In Conflict-Marked Conditions?

March 2, 2022, 9:19 AMNew trade projections on Henry Hub Natural Gas Futures, April 2022 contract.

Available to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Little Hope that OPEC+ Will Reduce Energy Fears

February 28, 2022, 10:16 AMThe Russian invasion of Ukraine has produced a climate of anxiety around global supply disruptions. Don’t expect it to abate just yet.

After witnessing crude oil prices slipping on Friday (Feb. 25) – as some major players sold off their positions before the weekend, which was still marked by a context of uncertainty regarding the evolution of the current Ukraine-Russia conflict – lots of concerns remain over potential global supply disruptions from a strengtening set of sanctions on major crude exporting country Russia.

The sanction that is likely to impact the Russian bear the most in the long term was taken by Taiwan in the weekend (under rising pressure from the West) to block the sales of electronic microchips to the Russian Federation.

OPEC+ will meet this Wednesday (Mar. 2) during a surge in the two black gold benchmarks, with little hope, however, that their action will dissipate the feverishness of the energy markets.

British oil giant BP’s shares fell by nearly 7% this morning on the London Stock Exchange, the day after the announcement of its divestiture from the Russian giant Rosneft, in which it held a 19.75% stake.

Technically, the sturdiest support seems to be located around the $93.36-95.01 area for Brent and around the $89.54-90.45 area for the West Texas Intermediate (WTI), as we recently saw some bulls entering long trades around those levels. We could see prices rebounding onto these support zones one more time as volatility stays high.

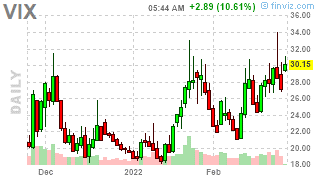

Figure 1 - VIX "Fear Index"

The VIX (aka “Fear Index”) – currently trading around 30 – could spike again depending on how the situation progresses.

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, please read this article on how to secure profits.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Oil Trading Alert Update: Markets Volatility in the Face of War

February 25, 2022, 9:25 AMAvailable to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Final Target Hit on NYMEX Natural Gas!

February 23, 2022, 10:14 AMThe Natural Gas flight just landed after hitting its second and last target yesterday. The perfect trade does not exist, but this one has been developing pretty well following our flying map.

In today’s edition, I will provide a trade review for Natural Gas futures (NGH22) following my last projections published on Friday Feb-11, for which the stop was also updated last Wednesday and trailed again last Thursday.

Trade Plan

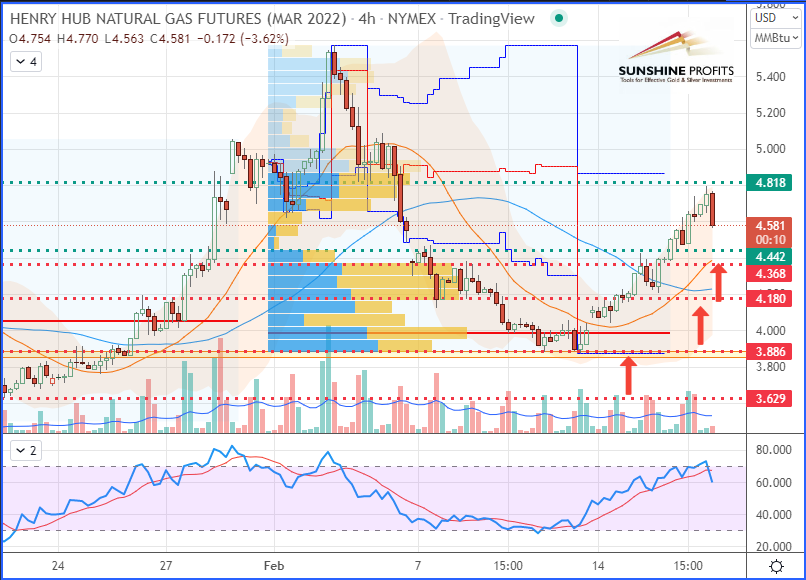

Just to remember, our initial plan was relying on a gas market having to cope with stronger demand to fuel and increasing industrial activity after being surprised by the warming mid-February weather forecast. Hence, the projected rebounding floor (or support level) provided, which was ideal for the Henry Hub given the unyielding global demand for US Liquefied Natural Gas (LNG), providing a catapulting upward momentum. Then, it took a few days for the first suggested objective at $4.442 to be passed, and a few extra days for the second target located at the $4.818 level to be hit (as it was yesterday). Meanwhile, as I explained in more detail in my last risk-management-related article to secure profits, our subscribers were kindly and promptly invited to place their initial stop just below the $3.629 level (below one-month previous swing low), before receiving a couple of trading alerts suggesting they manually trail it up around the $3.886 level (around breakeven), then one more time up towards 4.180 (which corresponds to the 50% distance between initial entry and target 1), and finally to be lifted up to 4.368 optimally.

Consequently, after a reconnaissance mission got close enough to target number 2, the Nat-Gas flight started running out of kerosene after passing through the first target like a fighter jet would break the sound barrier. Therefore, after getting refueled at a lower altitude (just above our highest elevation trailing stop) by a refuelling aircraft, the jet was finally ready to point and lock its last target before striking it.

Here is a picture-by-picture record of that trade.

First step: flight preparation on carrier ship

Henry Hub Natural Gas (NGH22) Futures (March contract, daily chart)Second step: prices catapulted and stop lifted at breakeven once the mid-point target was reached

Henry Hub Natural Gas (NGH22) Futures (March contract, daily chart)

Third step: target one hit and stop dragged up

Henry Hub Natural Gas (NGH22) Futures (March contract, daily chart)Zoom to target one (4H chart):

Henry Hub Natural Gas (NGH22) Futures (March contract, 4H chart)Fourth step: mission reconnaissance to target two and refueling aircraft en route to refill the jet tank (stop trailing again)

Henry Hub Natural Gas (NGH22) Futures (March contract, daily chart)Zoom to lock final target (4H chart):

Henry Hub Natural Gas (NGH22) Futures (March contract, 4H chart)Fifth step: final strike to target two

Henry Hub Natural Gas (NGH22) Futures (March contract, daily chart)

Now, let’s zoom one more time into the 4H chart to observe the recent price action all around the abovementioned steps of our flying map:

Henry Hub Natural Gas (NGH22) Futures (March contract, 4H chart)As you may observe, target one is now serving as a new landing space (support) for a new ranging market cycle.

That’s all, folks for today. I hope that you enjoyed the flight with our company!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM