-

New Trading Projection on Henry Hub Natural Gas

April 20, 2022, 9:30 AMAvailable to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

The Witchy Trio: Commodities Supercycle, Inflation, and… Recession?

April 18, 2022, 8:44 AMIf the current market phenomena were to star in a Shakespeare drama, they would be ideal candidates for the Three Witches. Can you guess who would play who?

Have you ever heard of Shakespeare’s mythological characters, the Three Witches? They are depicted as prophets who represent evil, darkness, chaos, and conflict.

If you look at the market today, you will find ideal candidates for these dark roles. However, while rising commodity prices and inflation have a casting win in their pocket, there is no certain actor to play the third witch. Would the recession stand a chance?

No Easter eggs today – instead, here is a story that may provide food for thought.

(Credit: Macbeth meets the three witches; scene from Shakespeare's 'Macbeth'. Wood engraving, 19th century. Wellcome Collection. Public Domain Mark)

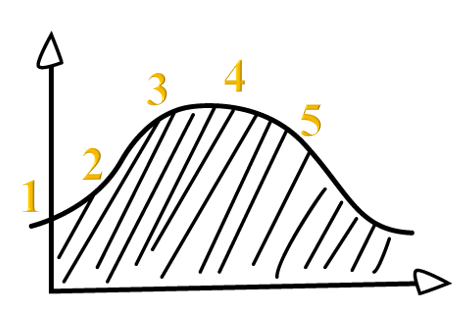

Let’s start by representing an economic cycle with its different phases:

Global commodity prices – in particular energy prices – surged at a fast pace following the COVID crisis. Notably, as major central banks responded to the economic slowdown by printing money, rising levels of inflation were observed as a result of accommodating monetary policy combined with accelerating oil and gas demand. The context was tight supply and high volatility triggered by (geo-)political unrest around the world (crises, wars, etc.).In fact, those inflationary periods of surged prices (foremost, fuel prices are often those pulling the trigger) are usually followed by a sudden drop in consumer confidence and, therefore, a sudden fall in demand, which may lead to a recession phase.

To predict those phases, some analysts tend to spot the inverted bond yield curves. In one of its articles, Investopedia explains The Impact of an Inverted Yield Curve as the following:

“The term yield curve refers to the relationship between the short- and long-term interest rates of fixed-income securities issued by the U.S. Treasury. An inverted yield curve occurs when short-term interest rates exceed long-term rates. Under normal circumstances, the yield curve is not inverted since debt with longer maturities typically carry higher interest rates than nearer-term ones.

From an economic perspective, an inverted yield curve is a noteworthy and uncommon event because it suggests that the near-term is riskier than the long term.”

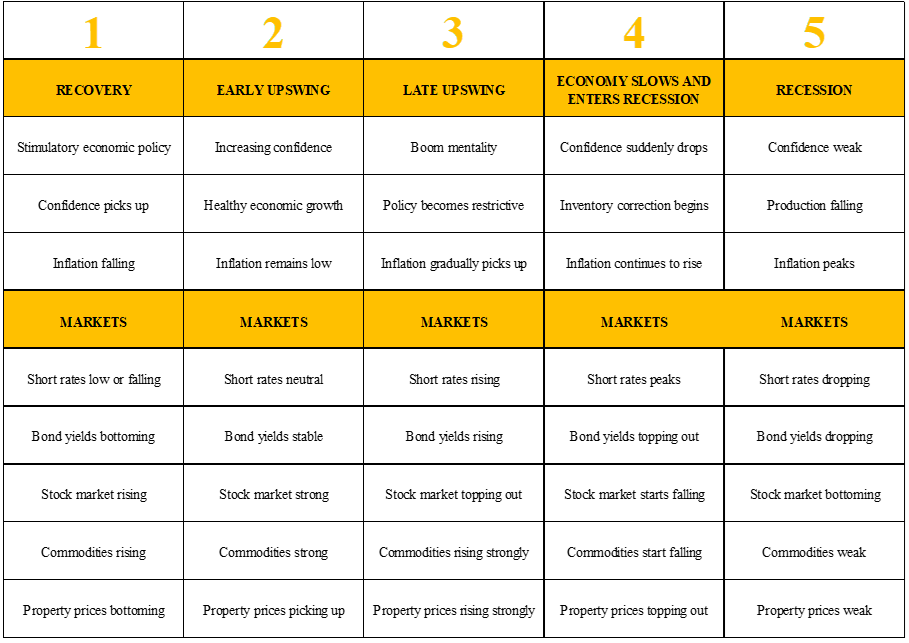

Now let’s have a look at the mystic US government yield curves over the past 30+ years:

- US 10 YR in Orange versus US 2 YR in Blue

- US 30 YR in Red versus US 5 YR in Indigo

The inversion of yield curves – typically with a two-year rate higher than the ten-year rate or even a five-year rate higher than the thirty-year rate – has occurred prior to each of the last US recessions. This phenomenon also briefly happened last week and lasted for almost two trading days.

(Credits: Small Exchange, Inc. Newsletter Apr 11, 2022)

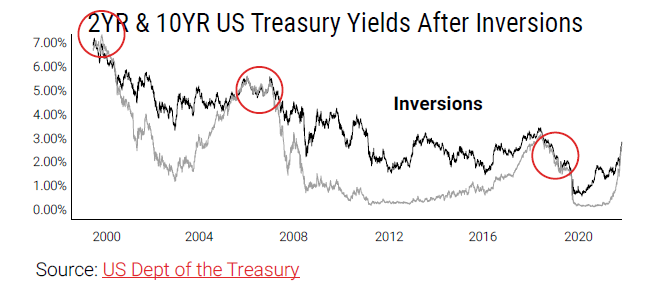

As you can see, the above charts demonstrate that US treasury yield curve inversions may sometimes be followed by a sudden drop in equity prices.

Alternatively, David Linton was also showing how big falls in bonds were preceding big falls in stocks in a recent tweet:

(Source: Twitter)

Okay, now let’s ask ourselves a few questions.

Do you think that the Federal Reserve (Fed) will be able to tighten its monetary policy as planned? Will stocks collapse? Will this trigger a recession? If so, when?

In what phase of the economic cycle do you think we are? 3, 4 or in between, maybe?

The first speculative scenario

Growth will continue for now, and so will demand... However, as soon as the Fed begins to tighten as planned, the S&P will plummet. So, the Fed will either be forced to stop to prevent a crashing stock market and falling risk sentiment from hitting growth, or just go ahead with tightening to keep inflation at bay and face the consequences. In the latter case, Powell loses his job...

The second speculative scenario

Following ongoing inflation, there could be a recession with a collapse in demand in about 6 months or so. On the energy side, despite the drop in demand, prices shouldn't drop too much as they might still be supported by limited supplies. Any ideas about a projected time horizon?

Regarding the Fed, I don't believe much in rate hikes. If they do so, they will plunge off their looming debt cliff. Maybe the Fed could keep communicating about future hikes if the markets are crashing. However, if they do any actual hikes, I bet they would probably be tiny ones, just to show some signals, but in the end, the actual rates wouldn't be much changed. J. Powell seems to be pretty much stuck.

(Source: Giphy)

Anyway, it is a moment of truth for central banks.

Let me know what you think in the comment section.

That’s all, folks, for today. I hope you’ve had a great Easter weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Crude Oil: Between Slowing Demand and Shrinking Supply

April 12, 2022, 10:10 AMCoronavirus in China, fights in Ukraine, sanctions against Russia – what else could raise concerns about oil supply in an already tense market?

An economic slowdown in China, which appears to have adopted a “zero-tolerance” epidemic policy, was weighing on oil prices as the country’s COVID case count rose.

Finally, some restrictions in Shanghai are being eased in certain neighborhoods following growing dissatisfaction with the very strict lockdown that has locked 25 million people in their homes. That lockdown has caused food shortages and forced thousands of citizens into isolation in specialized centers, consequently causing a food delivery surge and staff shortages.

In Ukraine, fears of fighting, which could intensify in the eastern region (around the Donbas), are also stirring the markets. Meanwhile, OPEC Secretary General HE Mohammad Sanusi Barkindo warned the European Union on Monday that the 7 million barrels a day of Russian exports, supposed to be lost due to sanctions, could not be fully replaced, reports the financial press.

Such concerns may again raise fears about the supply of black gold in an already tight market. It was added that the current and future sanctions on Russia could create one of the worst oil supply shocks ever and it would be impossible to replace those volumes, as OPEC signaled it would not pump more.

WTI Crude Oil (CLK22) Futures (May contract, daily chart)

Henry Hub Natural Gas (NGK22) Futures (May contract, daily chart)Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Will The Release of Emergency Oil Reserves Ease Fuel Prices?

April 8, 2022, 9:53 AMAvailable to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Oil: Are Sanctions on Russia Effective or Counterproductive?

April 5, 2022, 11:34 AMWhile Europe condemns Russia's actions, other countries take advantage of the turmoil and buy oil at a discount. Are any of the sanctions even effective?

Crude oil prices jumped over 3% on Monday, with investors worried about tighter supply in the market and even more nervous about the prospect of new European sanctions against Russia, which could affect Russian exports.

27 EU members failed to agree on an embargo as part of further penalties for Russia’s military deployment in Ukraine, with Germany warning of hasty moves that could plunge the economy into recession. Finally, on April 5, it was decided to introduce a total embargo, including for Russian coal, truck transport, and ports for Russian ships. However, the UE did not agree on the most important issues, i.e., the embargo on Russian oil and gas. Some countries, such as Hungary – where Prime Minister Viktor Orbán secured a new consecutive victory in the past weekend’s elections – opposed any prohibition.

Germany, however, aims to phase out Russian oil imports by the end of the year, officials said, as does Poland. Many buyers in Europe are voluntarily avoiding Russian crude oil in order not to damage their reputation or avoid possible legal difficulties.

Meanwhile, India and China, which refused to condemn Russia's actions, continue to buy Russian crude oil.

Lured by deep discounts following Western sanctions against Russian entities, India has bought at least 13 million barrels of Russian crude since late February, which is over 80% of the whole of 2021, according to some Reuters data.

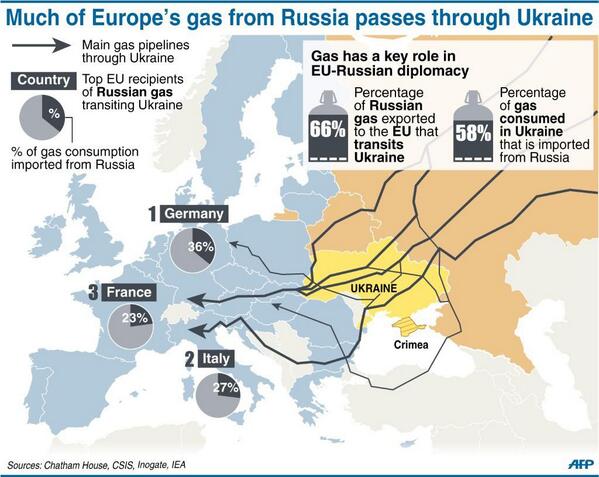

Until now, Russian energy imports provided Europe with 40% of its natural gas needs and another 30% of crude oil.

Switching to a new energy source is NOT that simple, and the refineries also need a certain adaptation period to be recalibrated to new imported sources as crude oil may have very different components depending on where it was extracted from.

This is what most politicians can’t even understand as they keep threatening supplies to their own country by pretending to be capable of just switching from one source to another as fast as an eye blink.

It is certainly not as simple as that, and the same goes with SWIFT and energy payments.

Many countries wanted to cut Moscow off from the SWIFT International Payment System. However, how will they pay for their gas after that?They will, in fact, have to make some exceptions with a few banks. Alternatively, they blocked or seized Russia’s currency reserves (both those in US dollars and euros), but now they are refusing to pay for their energy imports in roubles.

Has Russian energy become free then?

More seriously, given that the rouble is not widely available outside Russia, and that they will only accept payments in their domestic currency, there are only two options now for importing countries to pay Russia for their energy needs. As for the first option, they will have to pay for their imports with gold, which will surely be accepted. The second option, more indirectly, will use an intermediary bank that has not yet been disconnected from SWIFT, such as Gazprom Bank, where they will have to open a client account and then transfer the money in euros, so the bank will switch to foreign exchange operations (euro to ruble) and take a commission. The second option is indeed the most likely to be agreed between the different parties if the EU's most reliant on Russian gas does not want Russia to turn off the gas tap.

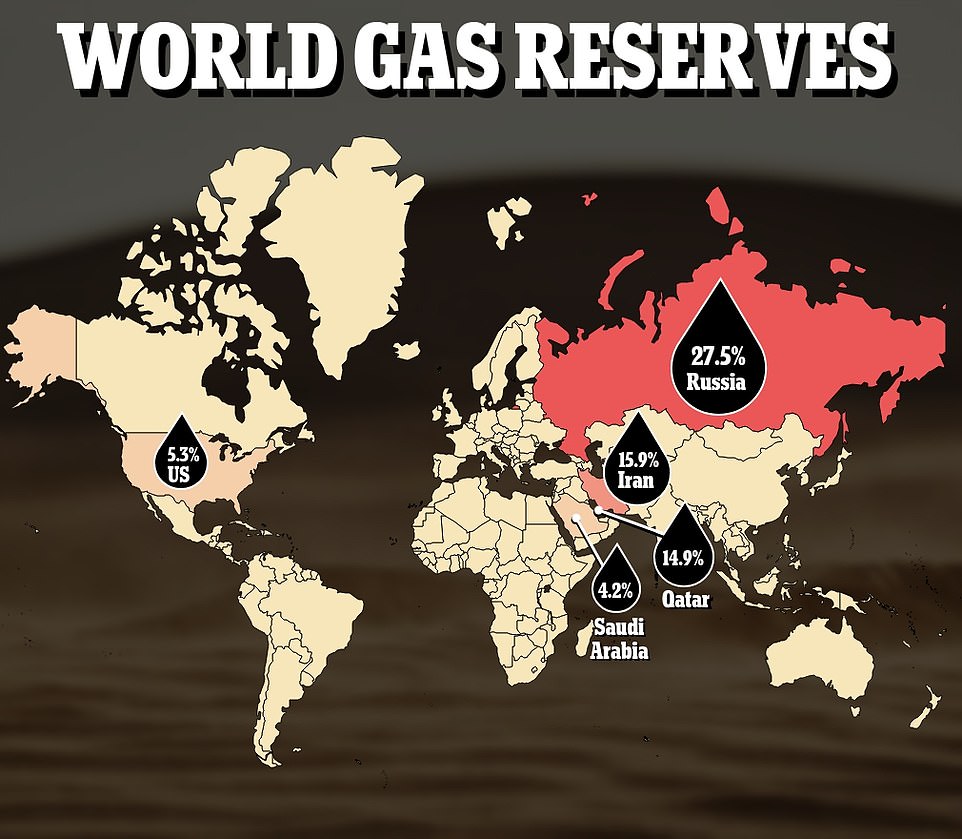

If you think that Europe’s gas supplies could easily be replaced if Putin cuts off its gas exports to the EU, just look at the world gas reserves below, take a deep breath, and think again:

Map of Europe showing EU-Russia gas pipelines (Source: Dailymail.co.uk)

WTI Crude Oil (CLK22) Futures (May contract, daily chart)

Henry Hub Natural Gas (NGK22) Futures (May contract, daily chart)

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM