-

Crude Oil Returns to Its Diving Lessons. CPI Hits New High!

July 13, 2022, 9:48 AMWhat are the main price drivers in crude oil to observe this week?

Oil tumbled on Tuesday, caught in a climate of anxiety over the possibility of a global recession, which would stifle demand, even if many signals continue to predict a tight market for a long time.

Central Banks’ Monetary Policies vs Recession Fears

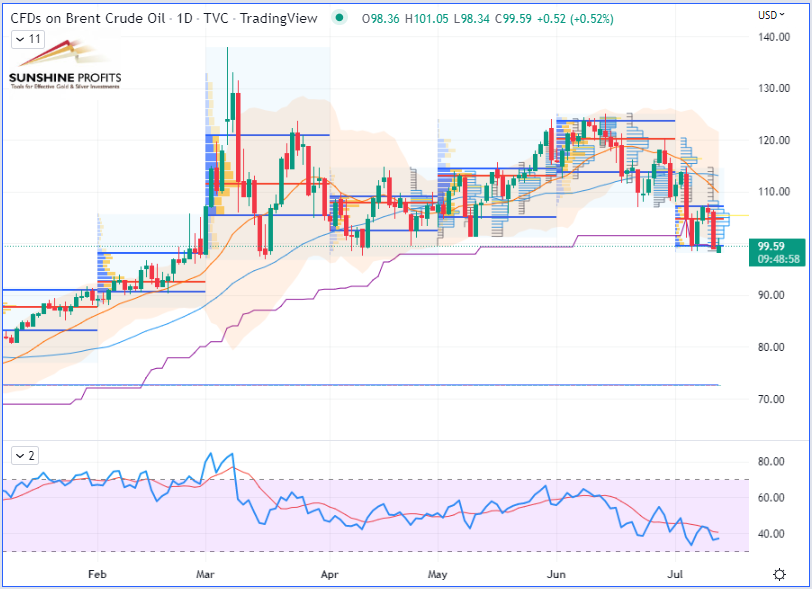

The European Brent benchmark settled below $100 a barrel for the first time since April 2022 on a strengthening dollar. In a market that remains unbalanced, struggling for oil despite threats to demand, and as volatility grows in energy markets, there is a consensus among analysts to report the darkening outlook for the global economy. In the West, the combination of high energy prices and rising interest rates is fueling fears of a recession, which would have a serious impact on the black gold market.

About the Chinese Panda

A new wave of health restrictions in China is also worrying investors, raising fears of further shutdowns. There is a slowdown in demand from the world's largest crude oil importer and fears over what Friday's second quarter growth figures will reveal. The Chinese authorities seem once again to prefer sacrificing their economy in pursuit of draconian public health goals.

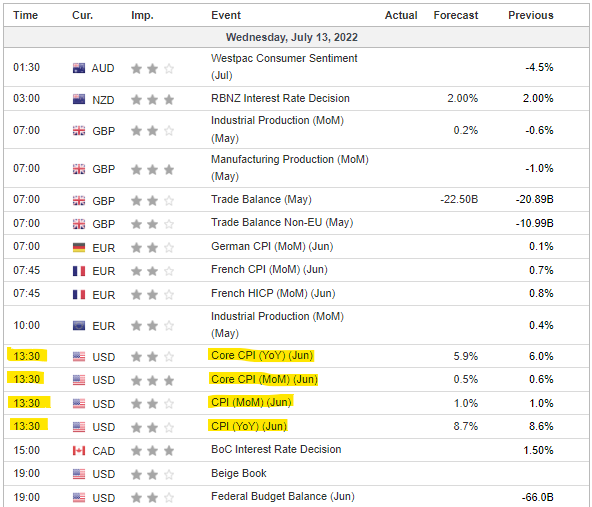

US Consumer Price Index (CPI) data

As highlighted in my last article published last week, here is a quick reminder that the US Consumer Price Index (CPI) data for the month of June will be released on Wednesday. What will it be in comparison to May figures? Traders will observe whether the peak of inflation is behind, or not yet. If it is lower, then we could see a certain sense of relief (a rather positive sentiment). This could possibly mean that the US Federal Reserve (Fed) may decide to not hike much. If not, then the volatility may increase on negative sentiment, with another peak on the Volatility (aka “Fear”) Index (VIX) causing a drop for markets (particularly equities) much lower, and consequently, the Fed may have to consider hiking rates further, etc.

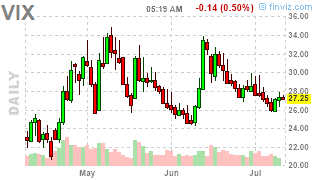

VIX chart (before CPI data):

(Source: Futures Charts – Finviz.com)

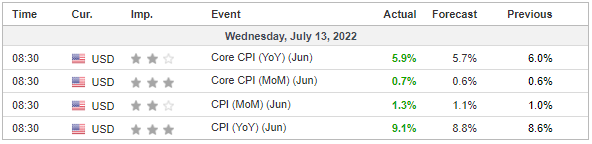

As I am writing these lines, the CPI figures just came up through the following table:

(Source: Economic Calendar – Investing.com)

As we can see, the actual numbers are all surpassing the expectations, and for most of them, they are even higher than the previously released data (except for the Core CPI (YoY), which is slightly lower than the previous release. U.S. inflation is thus intensifying by hitting a new 4-decade high of 9.1% in June! Therefore, we may start seeing volatility increase again.

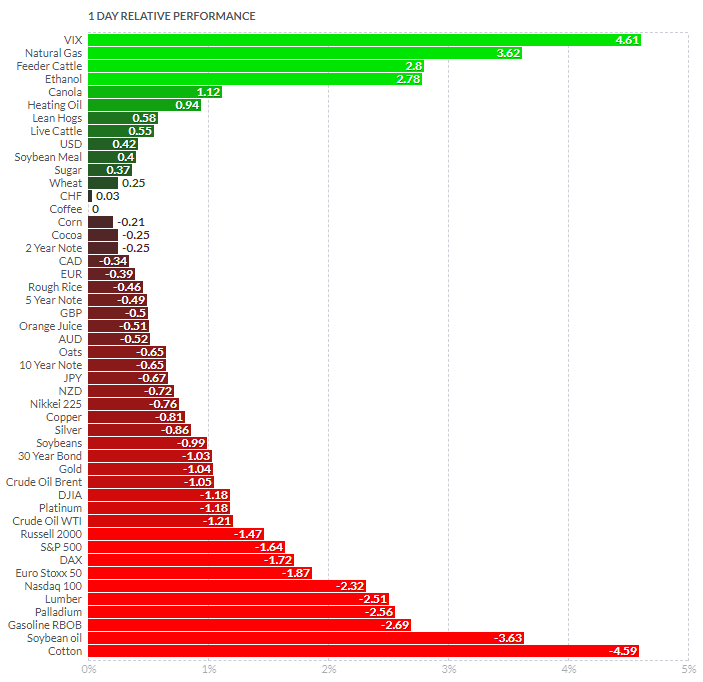

(Source: Futures – Finviz.com)

VIX chart (less than 30min after CPI release):

(Source: Futures Charts – Finviz.com)

Fundamental Analysis

On Tuesday, the American Petroleum Institute (API) released their weekly oil stock figures.

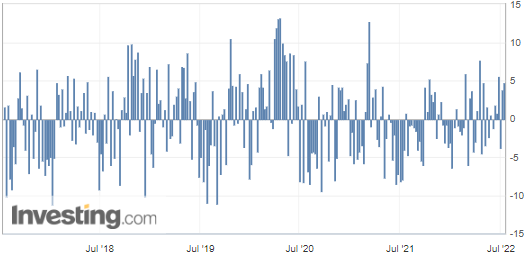

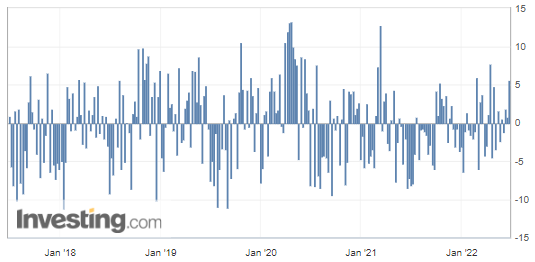

U.S. API Weekly Crude Oil Stock

Once again, the weekly commercial crude oil reserves in the United States rose to +4.762M barrels while the forecasted figure was just about -1.933M), according to figures released yesterday by the US American Petroleum Institute (API) (direct link under following chart).

US crude inventories have thus increased by another 4.762 million-barrels, which firmly confirms slowing demand and could still be considered a bearish factor for crude oil prices. This figure may also signal a drop in fuel consumption, which could potentially be explained by some changes in consumer behavior, but also by the artificial and temporary Strategic Petroleum Reserve (SPR) release, as one reader brought to my attention through the comment section.

(Source: Investing.com)

We will see whether those figures will be confirmed by the U.S. Stocks of Crude Oil and Petroleum Products published later on by the Energy Information Administration (EIA).

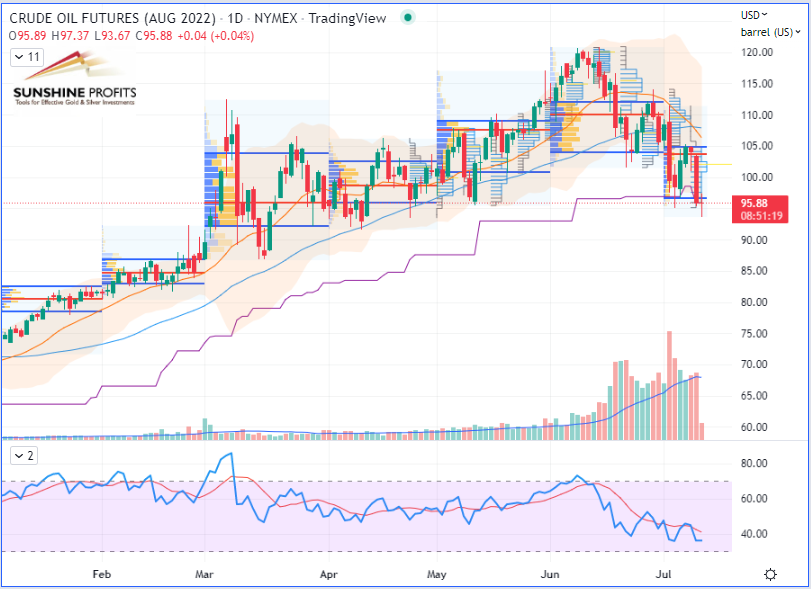

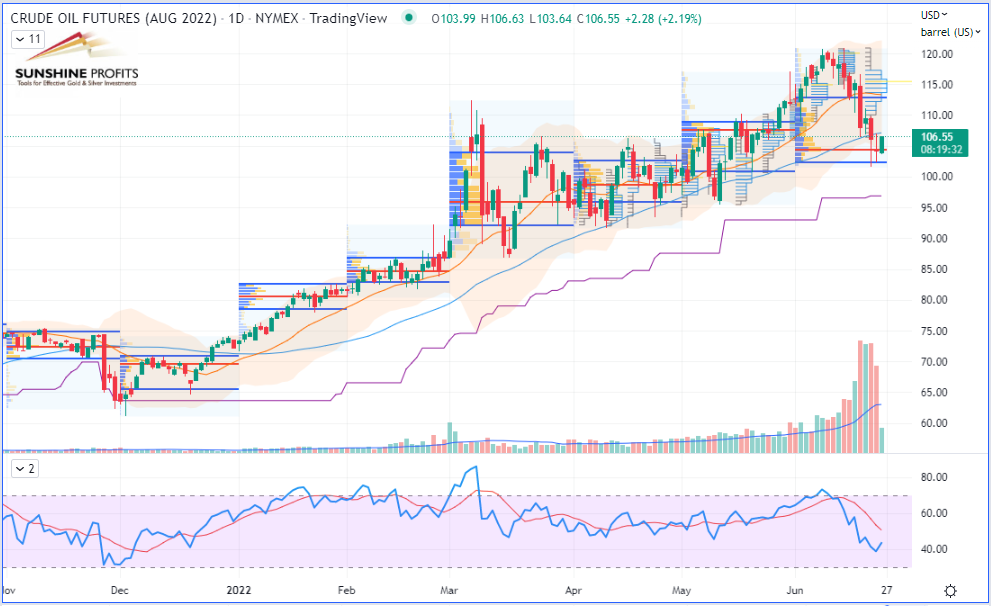

WTI Crude Oil (CLQ22) Futures (August contract, daily chart)

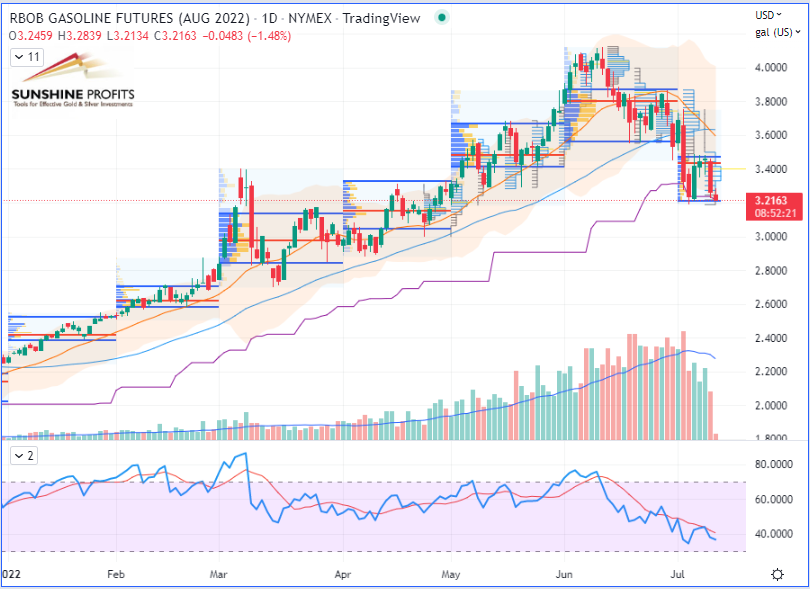

RBOB Gasoline (RBQ22) Futures (August contract, daily chart)

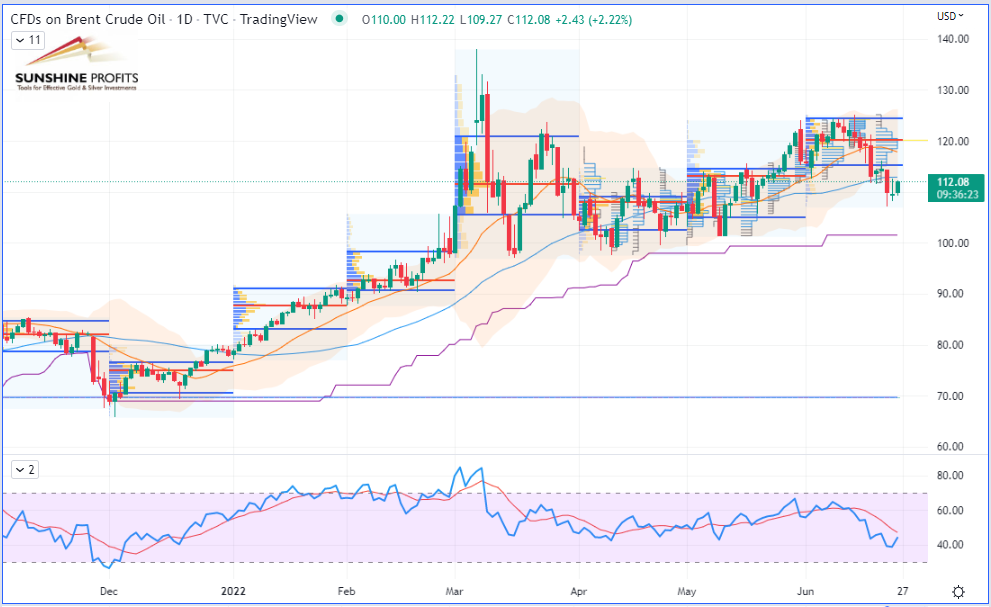

Brent Crude Oil (BRNQ22) Futures (August contract, daily chart) – Represented by its Contract for Difference (CFD) UKOIL

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Crude Oil Is Caught Between Recession Fears and Supply Cuts

July 7, 2022, 9:43 AMOil prices fluctuated on fears of a recession and a contraction in demand. What are the main figures to observe in this critical month?

Crude oil prices hovered between red and green on Thursday after two days of steep losses this week, still plagued by fears of a global economic recession that could threaten demand but also supply cuts in a tight market.

New Lockdown and Restrictions for the Chinese Panda

On the Asian continent, several million people may again suffer from strict restrictions because of China’s “zero-Covid policy” because of this epidemic rebound, which raises fears of the return of restrictions in Shanghai a month after the lifting of a long and grueling lockdown.

JP Morgan Sees a Stratospheric Rise To $380 Per Barrel of Brent

In the most pessimistic scenario imagined by JP Morgan, Russia could slash its crude oil production by 5 million barrels per day in retaliation to a price cap being considered by the G7, according to an article published by Reuters on Monday.

Inflation + Recession = Stagflation? Economic Indicators to Be Followed Next…

As we have seen volatility increasing, here are the main concerns that the markets will be facing within the next few weeks.

Technically, if we take the strict definition of recession, the United States has already entered a recession since last week, on the 1st of July, since they have just had two consecutive quarters of negative gross domestic product (GDP).On the other hand, I personally believe that central banks’ tools are indeed very limited given the context of supply-driven inflation. On the European side, the cost of debt for Southern European countries would become unbearable with higher interest rates – which could eventually trigger a fragmentation of the Eurozone, which is why I can understand that Lagarde is not feeling very comfortable in her shoes right now.

There are some figures to look at this month – as July could be a critical month – so it could shape what the next 6 months are going to be like:

- Watching earnings estimate costs could give us an indication of the earnings season (15 Jul-31 Aug) for Q2 and, therefore, how badly companies are going to be impacted.

- Important date: 13 of July – 1:30 PM London Time / 8:30 AM New York Time – US Consumer Price Index (CPI) data for the month of June to be released. Will it be larger than May figures? No doubt, traders will carefully observe whether the peak of inflation is behind, or simply not yet… If it is lower, then there will be sense of relief (a rather positive sentiment), the US Fed then wouldn’t have to hike much. If not, then the volatility would increase on negative sentiment, with another peak on the Volatility (or Fear) Index (VIX) causing a drop for markets (in particular, the stock exchange) much lower, and consequently the Fed would have to hike further, etc.

Anyway, it is likely that the second half of 2022 will not be bullish, and central banks are not going to come to the rescue of investors with an easing monetary policy anytime soon.

Fundamental Analysis

On Wednesday, the American Petroleum Institute (API) released their weekly oil stock figures.

U.S. API Weekly Crude Oil Stock

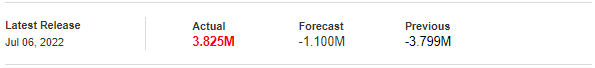

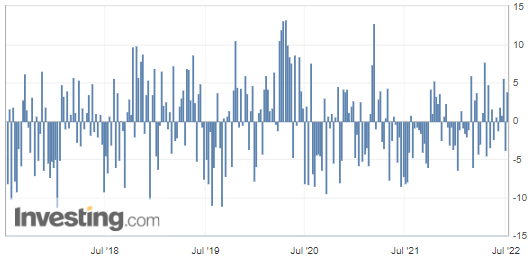

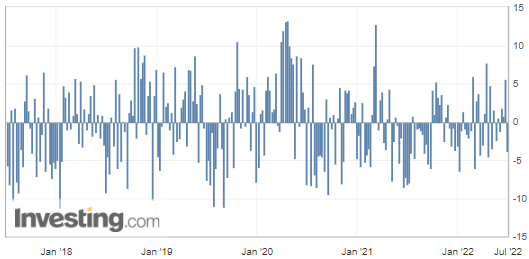

The weekly commercial crude oil reserves in the United States rose to +3.825M barrels while the forecasted figure was just about -1.100M, according to figures released yesterday by the US American Petroleum Institute (API).

US crude inventories have thus increased by over 3.825 million barrels, which firmly shows a slowing demand and could be considered a strong bearish factor for crude oil prices. This figure could also signal a drop in fuel consumption. As a result, demand is now dropping as well despite the ongoing context of energy supply cuts.

(Source: Investing.com)

WTI Crude Oil (CLQ22) Futures (August contract, daily chart)

RBOB Gasoline (RBQ22) Futures (August contract, daily chart)

Brent Crude Oil (BRNQ22) Futures (August contract, daily chart) – Represented by its Contract for Difference (CFD) UKOIL

That’s all, folks. Happy trading!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Crude Oil Sails Between Tight Supply and a Drop in Demand

July 1, 2022, 9:51 AMCrude oil prices ended lower, marking their first monthly decline since November, in a market concerned about the deteriorating health of the economy.

Available to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Rebounding Crude Oil Gets Far Away from the Bearish Side

June 29, 2022, 10:03 AMDemand for crude oil is accelerating – a bullish sign for its prices. What may the current energy market environment say about the black gold’s outlook?

A Chinese Panda’s Appetite

On the Asian continent, the lifting of health restrictions in China could signal resuming oil demand for the world’s top consumer. Given the context of tight supply, this has partially triggered a rebound in crude while driving prices higher.

Geopolitical Scene

The Libyan National Oil Company (NOC) warned that they could declare a state of "force majeure" on the facilities in the Gulf of Sirte – blocked due to the political crisis that has been hitting the country for months.

In Ecuador as well, the spectre of a halt in oil production is becoming clearer following the blockades and demonstrations initiated by a movement protesting the rise in the cost of living.

OPEC+ Struggles to Increase Volumes

The United Arab Emirates assured that they were at maximum capacity, while Saudi Arabia stated it could pump an additional 150,000 barrels per day. It is important to note that these two producing countries are indeed the two OPEC+ members perceived to have the most spare oil production capacity. The 23 members of OPEC+ are just starting a series of two-day e-meetings on Wednesday (they should also meet on Thursday by videoconference) to decide on a new adjustment to their total volume of production of black gold. However, analysts expect the status quo despite numerous calls for action.

Fed’s Recession Denial?

The US economy is slowing down, but not to the point of falling into recession, the president of the New York branch of the Federal Reserve (Fed) said to CNBC Tuesday. The mighty Federal Reserve has raised rates three times since March. The latter are now in a range between 1.50% and 1.75% after remaining close to zero during the COVID-19 pandemic.

Fundamental Analysis

On Tuesday, the American Petroleum Institute (API) released their weekly oil stock figures.

U.S. API Weekly Crude Oil Stock

The weekly commercial crude oil reserves in the United States dropped to -3.8M barrels while the forecasted figure was just about -0.110M, according to figures released on Tuesday by the US American Petroleum Institute (API).

US crude inventories have thus decreased by over 3.799 million barrels, which firmly shows accelerating demand and could be considered a strong bullish factor for crude oil prices. This figure would indeed signal a rise in fuel consumption. As a result, demand is now holding up well as the peak of the summer driving season approaches with many trips.

(Source: Investing.com)

WTI Crude Oil (CLQ22) Futures (August contract, daily chart)

RBOB Gasoline (RBQ22) Futures (August contract, daily chart)

Brent Crude Oil (BRNQ22) Futures (August contract, daily chart) – here it is represented by its Contract for Difference (CFD) UKOIL

That’s all, folks! Happy trading!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Is Crude Oil About to Pivot into Bearish Territory?

June 24, 2022, 10:16 AMWhat outcome or outlook for crude oil should we expect when looking at the current (macro-)economic environment?

Recession Fears

Oil prices were up slightly during the European session on Friday as fears of insufficient crude oil supply to meet demand during the summer took precedence over those of a recession amid runaway inflation. Markets fear that the slowdown in economic activity will lead to lower global demand. In addition, growth in economic activity in the Eurozone slowed sharply in June – notably in the private sector – to its lowest level in 16 months due to inflation, according to the composite PMI index published on Thursday by S&P Global. It must also be said that comments by Federal Reserve Chairman Jerome Powell have fueled fears of a global slowdown since J. Powell has not ruled out the risk of recession in the United States.

Indeed, the head of the US Federal Reserve, who was heard Thursday by the Finance Committee of the House of Representatives, repeated that his priority remained the fight against inflation. “We’re going to want to see evidence that it really is coming down before we declare ‘mission accomplished," said Jerome Powell. Finally, whilst addressing an audience’s question as to whether war was responsible for inflation, Powell answered: “No, inflation was high before – certainly before the war in Ukraine broke out.”

Here is an interesting article just published on FXStreet that summarizes some of Powell’s remarks in Congressional testimony.

In addition, according to several media, Joe Biden's proposal to temporarily lift the federal tax on gasoline and diesel did not have sufficient support to be adopted in Congress (a mandatory step).

Fundamental Analysis

In a rare occurrence, plagued by technical issues, the US Energy Information Agency (EIA) has announced that it will not release weekly US oil inventory and oil inventory figures this week. So, let’s look at the figures from the American Petroleum Institute.

U.S. API Weekly Crude Oil Stock

The weekly commercial crude oil reserves in the United States increased by over 5.607M barrels while the forecasted figure was expected to be in negative territory (-1.433M), according to figures released on Wednesday by the US American Petroleum Institute (API).

US crude inventories have increased by over 5.607 million barrels, which firmly confirms slowing demand and could be considered a strong bearish factor for crude oil prices. This figure would indeed signal a drop in Americans' appetite – at least at the current fuel prices – for petroleum products.

(Source: Investing.com)

WTI Crude Oil (CLQ22) Futures (August contract, daily chart

Brent Crude Oil (BRNQ22) Futures (August contract, daily chart) – Here it is represented by its Contract for Difference (CFD) UKOIL

To conclude, is it even worth pointing out that in the event of a recession, the demand for petroleum products would fall, the current astronomical refinery margins would collapse, and therefore, a key bullish factor for crude oil would certainly vanish?

Have a nice weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM