-

Trade Projections for Brent & WTI: A Sharp Drop Avoided!

June 22, 2022, 8:53 AMAvailable to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Trade Projections for Brent & WTI: Both Entries Triggered!

June 21, 2022, 9:31 AMAvailable to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Are Interest Rate Hikes Bearish or Bullish for Oil Prices?

June 17, 2022, 10:13 AMSince most currencies take all their importance from the price of energy and oil, let’s have a look at the other side of the coin: monetary policies.

So, What’s the Story with Central Banks?

Oil prices were choppy on Thursday. They ended up slightly higher in a fearful environment for markets in general, after a Fed rate hike the day before and a sharp fall in the US dollar.

Faced with galloping inflation – after the Federal Reserve (the Fed) announced the largest rate hike since 1994 on Wednesday – the Swiss National Bank (SNB) unexpectedly raised interest rates on Thursday, a rare occurrence that deserves to be noted.

Meanwhile, the Bank of England (BoE) has also promised to act forcefully as it anticipates an inflation rate of 11% in the UK.

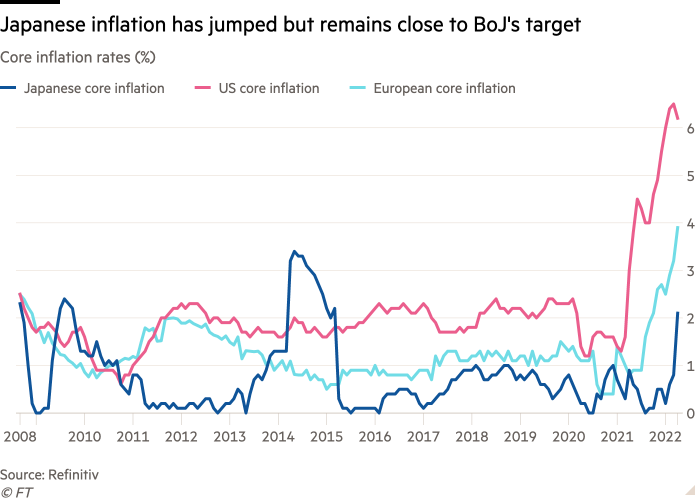

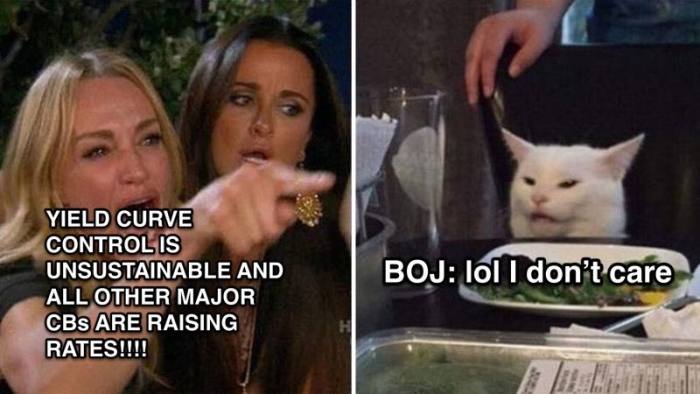

In the Asia-Pacific region, the Bank of Japan (BoJ) sticks to ultra-loose monetary policy, as Governor Haruhiko Kuroda said on Friday that he would not raise interest rates even with a weakening Japanese yen.

Therefore, the latter just hit a 24-year low against the US dollar following the central bank’s decision.

(Source: FT.com)

(Source: FT.com)According to Deutsche Bank reporting to the Financial Times, “the BoJ has spent $72bn buying bonds just this week, almost what the Fed and ECB were doing in an entire month last year. Adjusted for the different sizes of their respective economies, the pace of Japanese QE this week is more than 20 times the pace of the Fed’s in 2021.” (FT.com)

In short, if all the central banks around the world raised interest rates, the dollar wouldn’t fare any better and commodity prices would likely recoup their losses.

Fundamental Analysis & U.S. Crude Oil Inventories

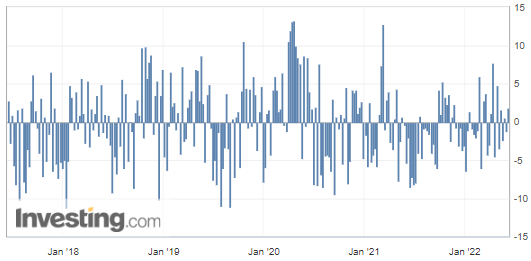

The weekly crude inventories were released on Wednesday. They confirmed the American Petroleum Institute (API) figures presented in my previous analysis, with an increase of over 1.956M barrels in US oil stocks, while the forecasted figure was expected to be negative (-1.314M barrels).

US crude inventories have increased by over 1.956 million barrels, which confirms slowing demand and is considered a bearish factor for crude oil prices.

Like the API’s release, the difference with the forecasted figure is almost the opposite, so it entails a wide miss from the analysts’ expectations.

Therefore, I still think that the black gold is set for a further corrective wave, possibly back to previous support levels, which I projected for a couple of new trades on both Brent and WTI (see our member section) despite persistent crude supply problems.

(Source: Investing.com)

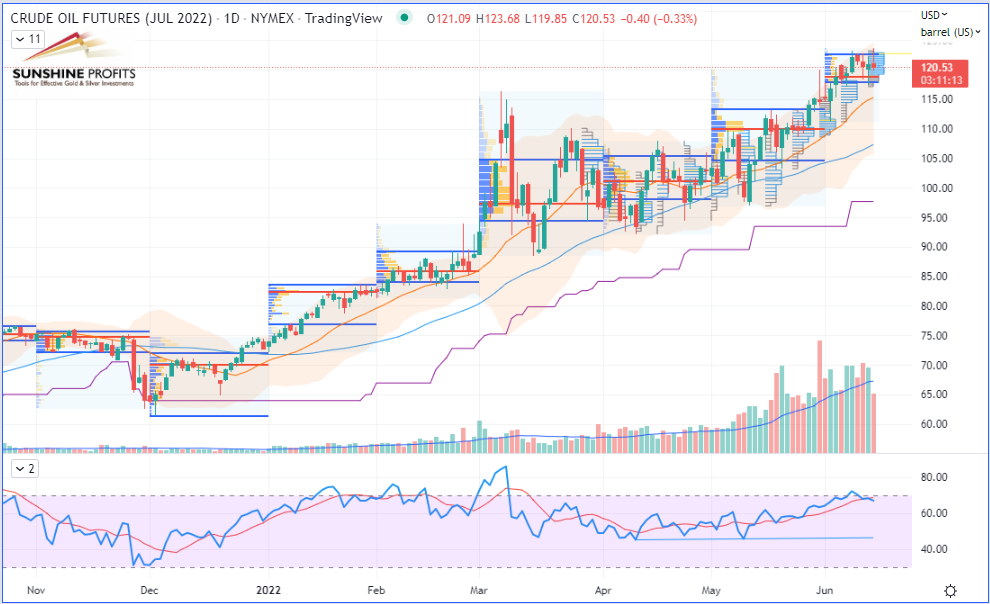

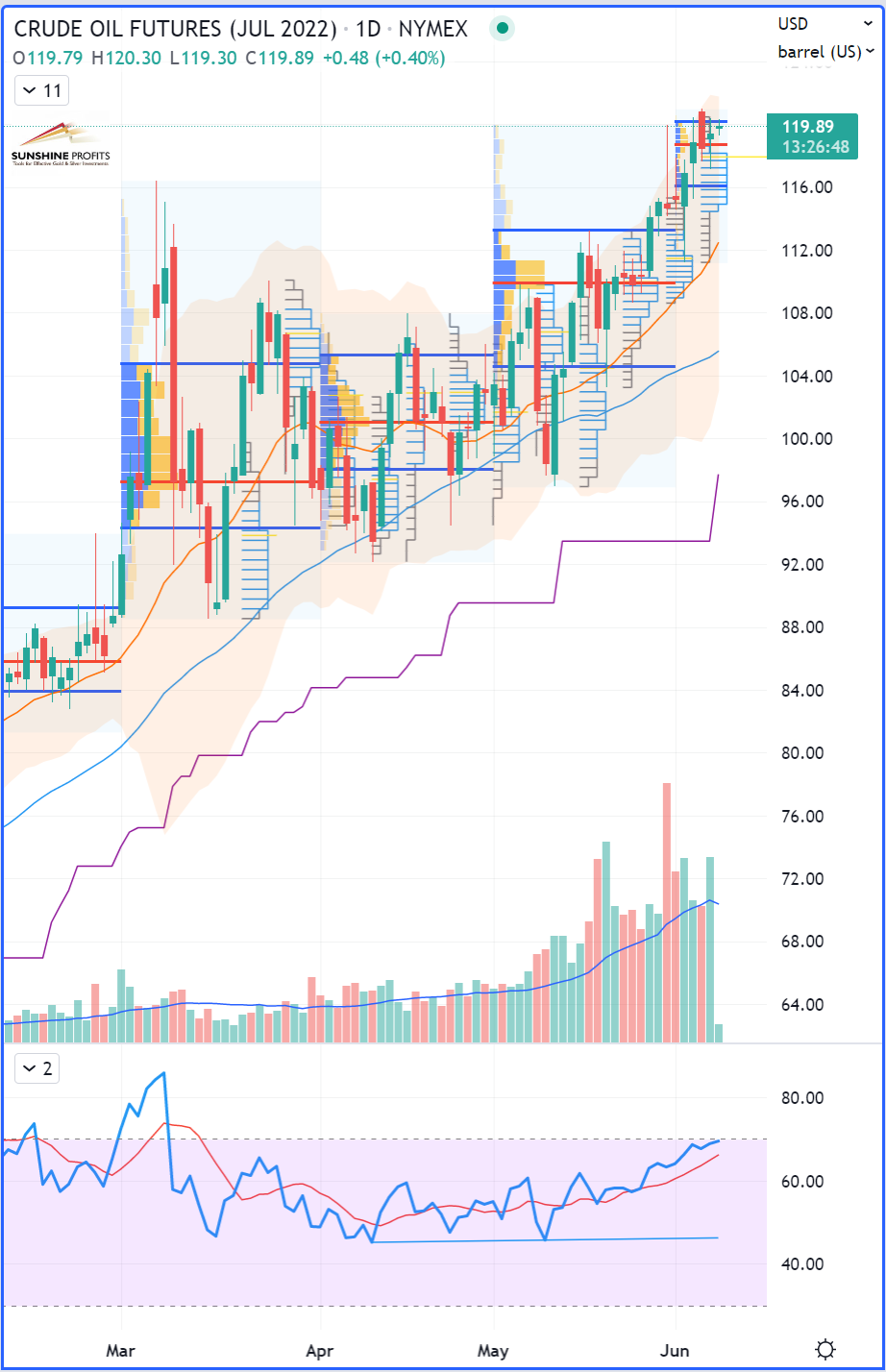

WTI Crude Oil (CLM22) Futures (June contract, daily chart)

Brent Crude Oil (BRNQ22) Futures (August contract, daily chart)

That’s all for today, folks. Have a nice weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Global Oil Demand Is Expected to Slow in 2023

June 15, 2022, 7:41 AMWhat scenario for crude oil can we expect based on the geopolitical scene, OPEC forecasts, and oil stocks released by the US Petroleum Institute?

Geopolitical Scene

Crude oil prices were resilient on Tuesday, as fears about supply outweighed those about demand. That was due to the near total shutdown of production in Libya, in the grip of a major political crisis, where two politicians are vying for the post of Prime Minister: interim PM Abdul Hamid Dbeibeh and eastern-affiliated Fathi Bashagha.

Libya is currently missing its oil production at a rate of 1.1 million barrels a day, Libyan Oil Minister Mohammed Aoun said, adding that almost all oil fields in the country have been closed.

Fundamental Analysis

The world economy this year, still largely dependent on fossil fuels, remains full of uncertainties, OPEC estimates in an article devoted to the outlook for the second half of the year. The first quarter of the year showed a weakening trend in growth in the context of sharply rising commodity prices and a booming Omicron wave, which dampened economic momentum, particularly in developed countries and China.

Growth in global oil demand should slow in 2023, according to OPEC delegates and industry sources, as soaring crude and fuel prices help drive up inflation and dampen the global economy. OPEC is expected to release its first demand forecast for 2023 in its monthly report later, on July 12.

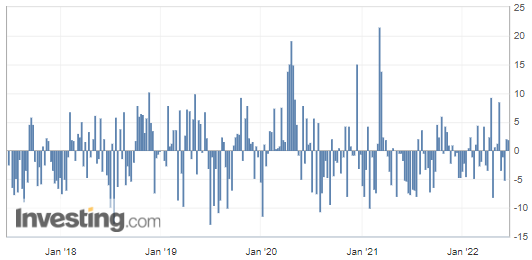

U.S. API Weekly Crude Oil Stock

The weekly commercial crude oil reserves in the United States increased by over 1.845M barrels while the forecasted figure was expected to be in negative territory (-1.8M barrels), according to figures released on Tuesday by the American Petroleum Institute (API).

US crude inventories have increased by over 1.845 million barrels, which implies slowing demand and is considered a bearish factor for crude oil prices.

Here, the difference with the forecasted figure is quite the opposite, so let us see whether the figure will be confirmed by the Energy Information Administration's (EIA) on Wednesday.

If that scenario is confirmed by the EIA’s figures later today, then the black gold may be set for a corrective wave, possibly back to previous support levels, which I projected for a couple new trades on both Brent and WTI (see our member section).

(Source: Investing.com)

WTI Crude Oil (CLM22) Futures (June contract, daily chart)

Brent Crude Oil (BRNQ22) Futures (August contract, daily chart)

In conclusion, after floating above $120, the U.S. WTI benchmark might eventually retrace back to its long-term mean to get some fresh air and breathe for a bit. We already defined the next support, so get ready to get in if all the signals are turning green again!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

How Will Rising Crude Oil Prices Affect Demand and Gasoline?

June 8, 2022, 5:38 AMWhat are the new fundamentals for crude oil to look at this week? Could Asian demand be slowed down by Saudi Arabia raising its prices?

Crude oil prices soared earlier this week after Saudi Arabia said on Sunday it would raise crude oil prices for most regions except the United States. Just days after opening the floodgates a little wider (as announced last week following an OPEC+ meeting), Saudi Arabia wasted no time in raising its official selling price for Asia, its main market. It is worth noting that the country is one of the few OPEC members that has spare oil capacity. Thus, this decision to raise prices happens just when demand, especially in Asia, is increasing.

In the prediction contest, Goldman Sachs raised its forecast for the price of a barrel of Brent to $135 by the end of the year.

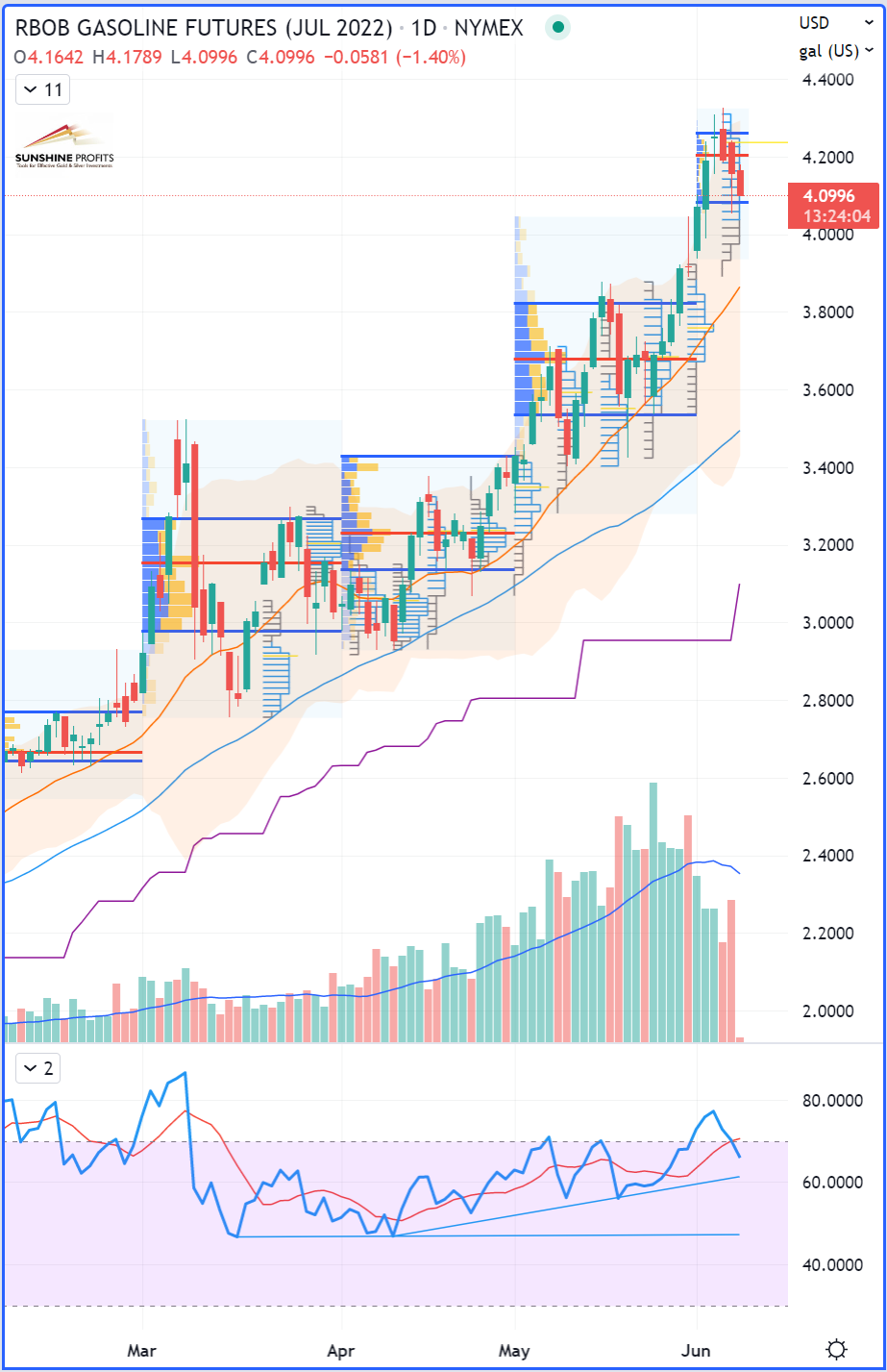

Looking at the impact of oil prices on gasoline, we are also starting to see changes in consumer behavior. As we head into the summer, people are likely going to think twice before making long trips by car during their vacation.

As a result, the “crack spread” is clearly narrowing, as you can see in the third following chart.

WTI Crude Oil (CLN22) Futures (July contract, daily chart)

RBOB Gasoline (RBN22) Futures (July contract, daily chart)

42 x RBOB Gasoline (RBN22) - WTI Crude Oil (CLN22) “Crack Spread” Futures (July contracts, daily chart)

42 x RBOB Gasoline (RBN22) - WTI Crude Oil (CLN22) “Crack Spread” Futures (July contracts, daily chart)Question: Is RBOB gasoline taking the lead now to pull crude oil prices back lower with it, or will the RB-CL spread find a rebounding floor around the $50 price mark, acting as support?

Write back and let me know.

That’s all for today, folks. Happy trading!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM